- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Exchanging US Dollars for Canadian Dollars: How to Choose the Right Remittance Service and Secure the Best Exchange Rate

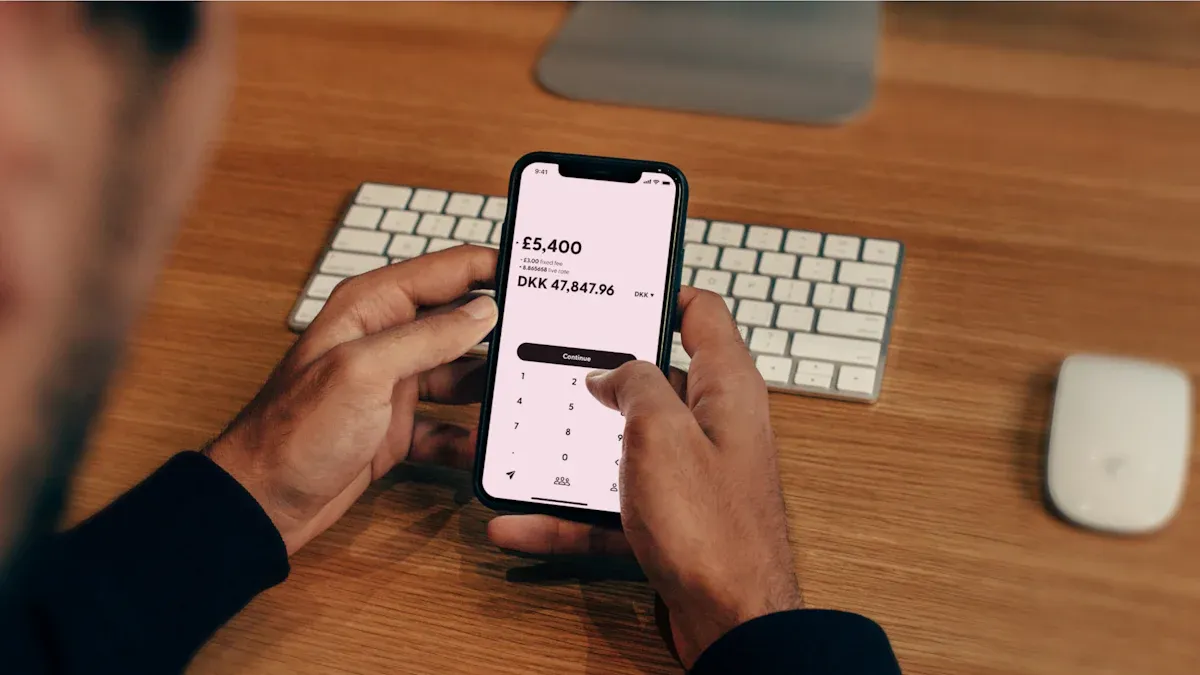

Image Source: unsplash

Are you looking for a way to exchange USD to CAD? To choose the best remittance method, you need to comprehensively consider the total cost, speed, and security.

Key Tip: In most cases, online remittance services are a more cost-effective choice. They usually offer exchange rates close to the mid-market rate and lower fees, helping you get better value.

Your remittance amount and speed requirements will determine which service is most suitable for you. Finding the best exchange rate is a key step.

Key Points

- Online remittance services usually provide better exchange rates and lower fees, making them the best choice in most cases.

- When choosing a remittance service, pay attention to the exchange rate, handling fees, and speed to avoid hidden fees.

- For large remittances, the exchange rate is more important than fixed handling fees; choose services that offer rates close to the mid-market rate.

- Using exchange rate tools and setting rate alerts can help you exchange at the most favorable rate.

- When carrying cash into Canada, amounts over 10,000 CAD must be declared, and do not exchange currency at the airport.

The Three Core Elements for Evaluating Remittance Services

When choosing a remittance service, you need to scrutinize three key aspects like a detective. This can help you avoid unnecessary losses and ensure your funds arrive safely and efficiently at their destination.

Exchange Rate: Understanding the Mid-Market Rate

The exchange rate directly determines how many CAD your USD can be exchanged for. The exchange rate you find online is usually the mid-market exchange rate. This rate is the midpoint between the global currency buy and sell prices, which can be seen as the most “real” and fair rate at the moment.

However, most traditional banks do not offer you this rate. They add a “markup” to the mid-market rate, usually between 4% and 6%, as their profit. This means the actual rate you get will be worse than the market standard you see. Finding a service that offers a rate close to the mid-market rate is the first step to getting the best exchange rate.

Handling Fees: Transparency and Hidden Costs

Handling fees are another important factor affecting the total cost. Some services may attract you with “zero fee” advertising, but they often hide the fees in poorer exchange rates. This exchange rate markup itself is a hidden fee.

In addition, when conducting international wire transfers through banks, you may encounter “correspondent bank fees”. If your remittance needs to pass through multiple banks, each one may charge a processing fee, making the final cost unpredictable.

Key Tip: A trustworthy service will provide complete fee transparency. Before you confirm the transfer, it will clearly list all fees, the exchange rate used, and the exact amount the recipient will receive.

Speed, Convenience, and Customer Support

How long does it take for your funds to arrive? This is also an important consideration.

- Traditional bank wire transfers: Usually take 1 to 5 business days to complete.

- Online remittance services: Many modern online services are faster, with some remittances arriving in a few hours or even minutes.

At the same time, you should also consider the convenience of operation. Online platforms allow you to initiate remittances anytime, anywhere, without visiting a physical branch. Reliable customer support is also crucial to get timely help when you encounter problems.

Comparison of Mainstream USD to CAD Remittance Channels

Image Source: unsplash

Understanding different remittance channels is key to finding the best solution. Each channel has its unique advantages and disadvantages, suitable for different needs. Below, we will deeply compare the three most mainstream types of services.

Online Remittance Services (Wise, WorldRemit)

In recent years, online remittance services have been favored for their high efficiency and low cost. They are usually the first choice for getting the best exchange rate.

The biggest advantage of such services is transparency. Most of them use the mid-market exchange rate and only charge a clear, small service fee. You can know all costs and the recipient’s amount exactly before transferring.

Take Wise as an example:

Wise is a typical representative of such services. It is known for its fair exchange rates and low fees.

| Advantages | Disadvantages |

|---|---|

| ✅ Uses the real mid-market exchange rate | ❌ Does not support cash or check payments |

| ✅ Fees are completely transparent, no hidden markups | ❌ Not all countries support the service |

| ✅ Fast remittance speed, usually arrives within a few hours | |

| ✅ Convenient operation, completed entirely online |

Cost Calculation: Remitting $1,000 USD to Canada Suppose you remit $1,000 USD to Canada from the US via Wise:

- Total Fees: Approximately $8.50 - $10.15 USD (depending on your payment method)

- Exchange Rate: Wise uses the mid-market exchange rate (e.g., 1 USD = 1.37 CAD)

- Recipient Receives: After deducting fees, your recipient will receive about $1,358 CAD.

Note: The above are estimated values; the actual amount is subject to what Wise displays during your operation.

Convenience Tip: If you are a user of Canada’s EQ Bank, you can directly use Wise for international remittances within your banking App. EQ Bank has integrated Wise’s services, allowing you to enjoy low-cost remittances without leaving the bank interface.

WorldRemit is another option, especially suitable for scenarios requiring cash pickup.

- Advantages: Offers multiple receipt methods, including bank transfer, mobile wallet, and cash pickup. For emergencies, cash pickup can be almost instant.

- Disadvantages: Its fee structure includes exchange rate markups, and the total cost is usually higher than Wise. You need to carefully compare the final receipt amount to ensure it meets your expectations.

Traditional Bank International Wire Transfers

Conducting international wire transfers through banks is the most traditional method. Many people feel safe and reassured because it is directly linked to their bank accounts.

However, this sense of security often comes with high costs.

| Advantages | Disadvantages |

|---|---|

| ✅ Feels safe and reliable, processed directly through the bank | ❌ Poor exchange rates, banks add 2%-5% markup to the rate |

| ✅ Suitable for transferring very large amounts of funds | ❌ High handling fees, usually with charges from both sending and receiving banks |

| ✅ Wide global coverage | ❌ Slow speed, usually takes 1-5 business days |

| ❌ Possible correspondent bank fees, total cost unpredictable |

The main problem with banks is hidden costs. They not only charge a fixed wire transfer fee (usually $25-$50 USD) but also add significant profit to the exchange rate. This means that even if advertised as “low fees,” you are still paying a lot of hidden fees through poor rates.

Warning: When using bank wire transfers, the exchange rate you see is not the real mid-market rate. This difference is the bank’s profit, and the larger the amount, the more you lose.

For individuals seeking cost-effectiveness, bank wire transfers are usually not the ideal choice.

Other Methods (PayPal, Western Union)

In addition to mainstream online services and banks, there are some other tools available, but they are usually only suitable for specific scenarios.

PayPal

You may already be using PayPal for online shopping or receiving payments. It can also be used for international transfers, but the cost is very high.

- Advantages: Very convenient for users who already have PayPal accounts, with almost instant transfers.

- Disadvantages: Extremely poor exchange rates. PayPal charges up to 4.00% currency conversion fee on the rate, far higher than other services. In addition, depending on your payment method, there may be additional fixed and percentage fees.

Therefore, PayPal is only recommended for instant, small transfers of a few dozen dollars between friends, and should never be used for large currency exchanges.

Western Union

Western Union is synonymous with emergency cash remittances. Its global network of outlets is very extensive.

- Advantages: Recipients can quickly pick up cash at hundreds of thousands of agent locations worldwide without a bank account.

- Disadvantages: The total cost is the highest among all methods. Its exchange rates are very unfavorable, and handling fees are quite high.

You should only consider using Western Union in extreme emergencies (e.g., the recipient urgently needs cash and has no bank account).

How to Actively Track and Lock in the Best Exchange Rate

Image Source: pexels

Exchange rates fluctuate daily. Instead of passively accepting the current rate, take the initiative to exchange when the rate is most favorable. You can use some simple tools to track market dynamics and lock in the best rate.

Using Exchange Rate Converter Apps

Exchange rate converter Apps are great helpers for tracking real-time rates. An excellent App should not only tell you the current rate but also have the following features to help you make wiser decisions:

- Real-time Updates: Exchange rate data should refresh in real time, keeping you updated on the latest situation.

- Historical Charts: Provide clear charts showing rate trends over the past day, week, or month.

- Simple Interface: Operation should be straightforward, allowing you to quickly input amounts and view conversion results.

By observing historical trends, you can get a general idea of rate highs and lows, helping you judge whether the current time is good for exchanging.

Setting Exchange Rate Alerts

If you don’t have time to check rates daily, setting rate alerts is a more efficient method. This is a “set it and forget it” strategy that helps you seize the best opportunity.

Many online services (such as Wise, Xe, or OFX) offer free rate alert functions. You can set a desired target rate, for example, when 1 USD can exchange for more than 1.38 CAD, the system will notify you via email or mobile App.

Core Advantage: Rate alerts can help you save time and effort. You don’t need to constantly monitor the market; the system automatically tracks for you. When the ideal rate appears, you get notified immediately, avoiding remittances at unfavorable times and maximizing fund value.

This simple tool can effectively reduce your decision-making pressure and help you complete remittances at a more ideal cost.

Best Remittance Solutions for Different Amounts

Your remittance amount is the core factor in determining the best solution. The impact of fees and rates varies completely with different amounts. Below, we analyze the best choices for different scenarios.

Small Remittances (Below $1,000 USD)

For small remittances below $1,000 USD, your primary goal is to find services with low fixed fees and transparent rates. In this case, online remittance services are usually the most cost-effective choice.

Core Recommendation: For small remittances, Wise (formerly TransferWise) usually has the lowest cost due to its near-market rates and low fees. Remitly and WorldRemit are also good alternatives, especially when you prioritize extreme speed.

Let’s take remitting $100 USD as an example to intuitively compare the costs of different services:

| Service Name | Fees (Sending $100) | Exchange Rate (USD to CAD) | Estimated Arrival Time |

|---|---|---|---|

| Wise | $0.84 USD | 1.363 | Seconds to 2 days |

| Remitly | $1.99 USD | 1.359 | Minutes to 3-5 days |

| Xoom (PayPal service) | $4.99 USD | 1.359 | Minutes to 2 days |

| WorldRemit | $3.99 USD | 1.359 | Minutes to 2 days |

| OFX | $0 USD | 1.359 | 1-2 business days |

| Western Union | $5.00 USD | 1.359 | Minutes to 5 business days |

| MoneyGram | $10.00 USD | 1.359 | Minutes to hours |

Note: The above table data are examples; actual fees and rates are subject to the time of operation.

You may notice that PayPal seems to have low fees, but its real cost is hidden in the rate. PayPal adds 3% to 4% currency conversion fee to the rate. In contrast, Wise uses the real mid-market rate and only charges a transparent service fee.

| Amount and Currency | PayPal Recipient Receives | Wise Recipient Receives | Which is Cheaper? |

|---|---|---|---|

| Send 1,000 USD to EUR | 892.05 EUR | 919.48 EUR | Wise |

| Send 1,000 USD to GBP | 747.49 GBP | 769.67 GBP | Wise |

This comparison clearly shows that due to rate differences, using Wise allows your recipient to receive more money.

Medium to Large Remittances ($1,000+ USD)

When your remittance amount exceeds $1,000 USD, the importance of the exchange rate far exceeds fixed handling fees. At this point, you should firmly avoid using traditional bank wire transfers.

Why? Because even a 1% small difference in the rate will be amplified in large transactions.

For example: You remit $10,000 USD.

- Service A (like Wise) offers a 1.37 rate, recipient receives 13,700 CAD.

- Service B (like a bank) offers a 1.34 rate (including about 2% markup), recipient only receives 13,400 CAD.

Just the rate difference causes you to lose 300 CAD. The larger the amount, the greater the loss.

Therefore, for medium to large remittances, you need to find professional online services that offer the best rates.

- Wise: For remittances from a few thousand to tens of thousands of USD, Wise remains a strong contender, with its transparent fee structure and real rates saving you significant costs.

- OFX or CurrencyTransfer: These services also focus on providing competitive rates. They reduce intermediate links through a vast global bank account network, thereby lowering costs. For large transfers over tens of thousands of USD, you can even contact their customer service directly for a chance at more personalized preferential rates.

At this point, your goal is clear: Choose an online platform that uses the mid-market rate and has transparent fees to maximize your fund value.

Carrying Cash into the Country

If you are traveling to Canada in person, carrying cash is also an option. But this method has strict legal regulations and is only suitable for personal travel.

First, you must understand Canada’s customs declaration rules.

Important Regulation: According to the Canada Border Services Agency (CBSA), any individual or group entering or leaving Canada carrying cash and financial instruments (such as stocks, bonds, checks) totaling 10,000 CAD or equivalent in foreign currency must declare to customs.

- This is not illegal: Carrying over 10,000 CAD is legal.

- But must declare: Failure to declare is illegal and may result in fines or confiscation of funds.

If you need to declare, you can complete it in the following ways:

- Complete at the airport’s automatic border inspection kiosk.

- Declare verbally directly to a border services officer.

After successfully entering, the next question is how to exchange USD cash for CAD. Remember a golden rule: Never exchange at the airport.

Airport and hotel exchange counters have high rents, and they pass these costs on to you, offering very poor rates. The correct approach is:

- Exchange only a small amount of cash at the airport for emergencies (e.g., paying taxi fares).

- After arriving in the city, look for professional currency exchange stores (Currency Exchange Store). These shops are usually located in shopping centers or downtown, with rates far better than airports.

In this way, you can ensure that the cash you carry also gets a relatively ideal price.

In summary, when you need to exchange USD for CAD, choosing an online service that uses the mid-market rate is the best solution to balance cost, speed, and convenience.

Your Next Action: Before remitting, actively use exchange Rt tools to track prices and choose services based on the amount recommendations in this article. This ensures every penny maximizes its value.

FAQ

Is the cheapest remittance method always the best?

Not necessarily. You need to balance total cost, speed, and convenience. A service may have the lowest fees but very slow arrival times. Choose the comprehensive solution that best fits your urgency and personal needs.

How can I confirm I got a fair exchange rate?

Quick Tip: Before confirming the remittance, compare the rate provided by the service provider with the “mid-market rate” on Google. The closer they are, the fairer the rate. A trustworthy service will proactively show this comparison.

Are online remittance services safe?

Yes, reputable online services are safe. They are regulated by financial institutions similar to banks and use encryption technology to protect your funds and personal information. You can check their official website for regulatory license information to ensure safety.

Why not just use my bank’s wire transfer?

The main disadvantage of bank wire transfers is high cost. They usually charge higher handling fees and hide profits (markups) in the exchange rate. This results in fewer CAD received compared to using online services.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.