- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Remit Money to Bangladesh When in the United States: User Experience Summary

Image Source: unsplash

For small to medium transfers from the US to Bangladesh, I highly recommend Remitly.

Remitly offers great deals for new users. Its exchange rates are competitive, and it supports multiple receiving methods like bKash, making it very convenient.

Like me, many people in the US need to regularly send money to family and friends in Bangladesh. This experience summary is your guide to avoiding pitfalls.

Key Points

- When choosing a transfer platform, consider fees, exchange rates, speed, and user experience.

- Remitly is suitable for new users and those needing bKash as a receiving method.

- Wise offers transparent exchange rates, ideal for large transfers.

- Paysend has fixed low fees, perfect for frequent small transfers.

- Avoid illegal Hundi channels to ensure fund safety.

Comparison of Mainstream Online Transfer Platforms

Image Source: unsplash

There are numerous transfer platforms on the market, each with its own strengths. To help you find the best one for you, I’ll break down several mainstream platforms based on fees, exchange rates, speed, and user experience.

Remitly

As mentioned earlier, Remitly is my go-to platform, especially for those new to sending money from the US to Bangladesh.

- Fees and Exchange Rates: Remitly’s biggest draw is its attractive offers for new users, often “zero fees” or highly competitive promotional exchange rates. It offers two services:

- Economy: Lower fees but slower delivery.

- Express: Slightly higher fees but near-instant delivery.

- Transfer Speed: Express service typically delivers funds to the recipient within minutes, ideal for emergencies. Economy service takes 3-5 business days, suitable for non-urgent transfers.

- Ease of Use: Its mobile app and website are very intuitive with clear guidance. You can complete transfer setup in just a few steps, making it very beginner-friendly.

- User Experience Highlights/Drawbacks:

- Highlights: Generous discounts for new users and support for bKash mobile wallet, which aligns well with local habits in Bangladesh.

- Drawbacks: After the promotional period, regular exchange rates lose competitiveness. Its features are relatively limited, unlike Wise, which offers multi-currency account management.

Wise (formerly TransferWise)

If you value maximum transparency and fair exchange rates, Wise is your top choice. It’s renowned for using the “real market exchange rate.”

-

Fees and Exchange Rates: Wise’s core advantage is transparency. It uses the “mid-market exchange rate,” the real-time rate you’d find on Google, without hidden markups. Its fees are fully transparent, consisting of a fixed fee and a percentage-based fee.

What is the mid-market exchange rate? It’s the midpoint between the buy and sell prices in the global currency market, considered the most “fair” rate. Many banks and services add a markup to profit, but Wise doesn’t.

To illustrate the difference, here’s an example of sending $1,000 USD:Platform Exchange Rate (1 USD to BDT) Fees Recipient Receives Wise 122.525 (mid-market rate) $15.17 (transparent fees) 120,666.30 BDT Other Platforms May be lower than mid-market rate May advertise low fees but hide costs in exchange rate Amount uncertain -

Transfer Speed: Speed depends on payment method. Debit or credit card payments are usually fast, arriving within hours. Bank account transfers (ACH) may take 1-2 business days.

-

Ease of Use: Wise offers a robust multi-currency account, allowing you to hold and manage over 50 currencies, extremely convenient for users with cross-border payment needs.

-

User Experience Highlights/Drawbacks:

- Highlights: Fully transparent rates and fees with no hidden costs. Ideal for large transfers, as transparent rates save significant money.

- Drawbacks: For small transfers of a few hundred dollars, its fees may not be as competitive as other platforms’ promotions.

Paysend

Paysend stands out with its straightforward fixed-fee model.

- Fees and Exchange Rates: This is Paysend’s most attractive feature. Regardless of the amount, transfers from the US typically incur a fixed fee of $2. Even better, when transferring directly to a Bangladesh bank account, Paysend often offers zero-fee promotions.

Feature Paysend Wise Fee Type Fixed Fee Percentage Fee Fixed Fee Amount Usually $2 Not applicable Bank Account Transfer Often fee-free promotions Percentage-based fees - Transfer Speed: Transfers to bank cards (Visa or Mastercard) are very fast, typically completed within minutes.

- Ease of Use: The interface is highly simplified, focusing solely on the core transfer function without unnecessary complexity.

- User Experience Highlights/Drawbacks:

- Highlights: Simple and transparent fee structure, ideal for frequent, small transfers with highly predictable costs.

- Drawbacks:

- Exchange rates are often less competitive than Wise or Remitly’s promotional rates.

- Large transfers may trigger additional identity verification, making the process more complex than for small amounts.

- Thus, it’s better suited for smaller amounts (e.g., under $1,000).

WorldRemit

If your recipient in Bangladesh doesn’t have a bank account or prefers picking up cash in person, WorldRemit is an excellent choice.

- Fees and Exchange Rates: Fees and rates are mid-tier, neither the cheapest nor the most expensive. You need to compare based on the day’s specific rates.

- Transfer Speed: Depends on the receiving method. Mobile wallet top-ups and cash pickups are nearly instant.

- Ease of Use: The app is smooth, and the process of selecting a receiving method is very clear.

- User Experience Highlights/Drawbacks:

- Highlights: Offers highly flexible receiving methods, including bank transfers, mobile wallet top-ups (bKash, Nagad, etc.), and cash pickups. Its cash pickup network is extensive, such as:

- Dutch-Bangla Bank branches

- Other partner banks and financial institutions

- Drawbacks: Fees and exchange rate competitiveness are not top-tier; its main advantage lies in flexible receiving options.

- Highlights: Offers highly flexible receiving methods, including bank transfers, mobile wallet top-ups (bKash, Nagad, etc.), and cash pickups. Its cash pickup network is extensive, such as:

Xoom (owned by PayPal)

When you need to send money to family as quickly as possible and aren’t too concerned about costs, Xoom is your “emergency responder.”

- Fees and Exchange Rates: Xoom is positioned as a premium, fast service, so its fees are typically the highest, and its exchange rates are often the least cost-effective among these platforms. You pay a premium for its speed.

- Transfer Speed: This is Xoom’s trump card. Most transactions are completed within minutes, whether to a bank account or mobile wallet, with astonishing speed.

- Ease of Use: If you’re already a PayPal user, Xoom is very convenient, seamlessly integrating with your PayPal account for payments. The process is designed to be as fast as possible.

- User Experience Highlights/Drawbacks:

- Highlights: Unmatched speed. For people in the US facing urgent family needs in Bangladesh, Xoom’s reliability is invaluable.

- Drawbacks: High costs make it unsuitable for regular transfers, as you’ll spend significantly more over time.

Traditional Bank Wire Transfer

In addition to convenient online platforms, bank wire transfers are another option. This is a very traditional method, like the “veteran” of the transfer world. While it lags behind newer platforms in speed and cost, it remains an irreplaceable choice in certain scenarios.

Pros and Cons of Bank Wire Transfers

You need to clearly understand the advantages and disadvantages of bank wire transfers to decide if they’re right for you.

-

Advantages:

- High Security: Banks are heavily regulated and experienced in handling large funds, making your large transfers more secure.

- High Transfer Limits: Compared to online platforms’ limits of a few thousand or ten thousand dollars per transfer, bank wire transfer limits are much higher, suitable for transactions of hundreds of thousands or even millions of dollars.

-

Disadvantages:

- High Fees: This is the biggest drawback of bank wire transfers. Fees typically range from $35 to $50, not including potential intermediary bank fees and less favorable exchange rates. Here’s an example with two major US banks:

Bank Wire Type Fee Bank of America Online International Wire (USD) $45 Chase International Wire (USD) $45 - Slow Speed: An international wire transfer typically takes 3-5 business days, unable to meet urgent needs.

Scenarios Suitable for Bank Wire Transfers

Given these characteristics, bank wire transfers are best for large, non-urgent transfers. For example, transferring funds back to Bangladesh after selling property in the US or making large overseas investments.

For such large transactions, banks will require detailed proof of the source of funds to comply with anti-money laundering (AML) regulations.

What’s Needed for Large Transfers? You should know that US banks may require additional transfer information. For transfers exceeding $10,000, banks must report to the IRS. Preparing the necessary documents will make the process smoother.

Transfer Purpose Possible Required Documents Property Sale Sales contract, attorney letter, bank statement showing receipt Salary Income Recent pay stubs, employer verification letter, tax returns Inheritance Will copy, court documents, attorney letter

Thus, when you need to transfer a large sum and prioritize security and compliance, choosing a trusted bank for a wire transfer is the safest option.

Step-by-Step Guide to Completing an Online Transfer

Image Source: unsplash

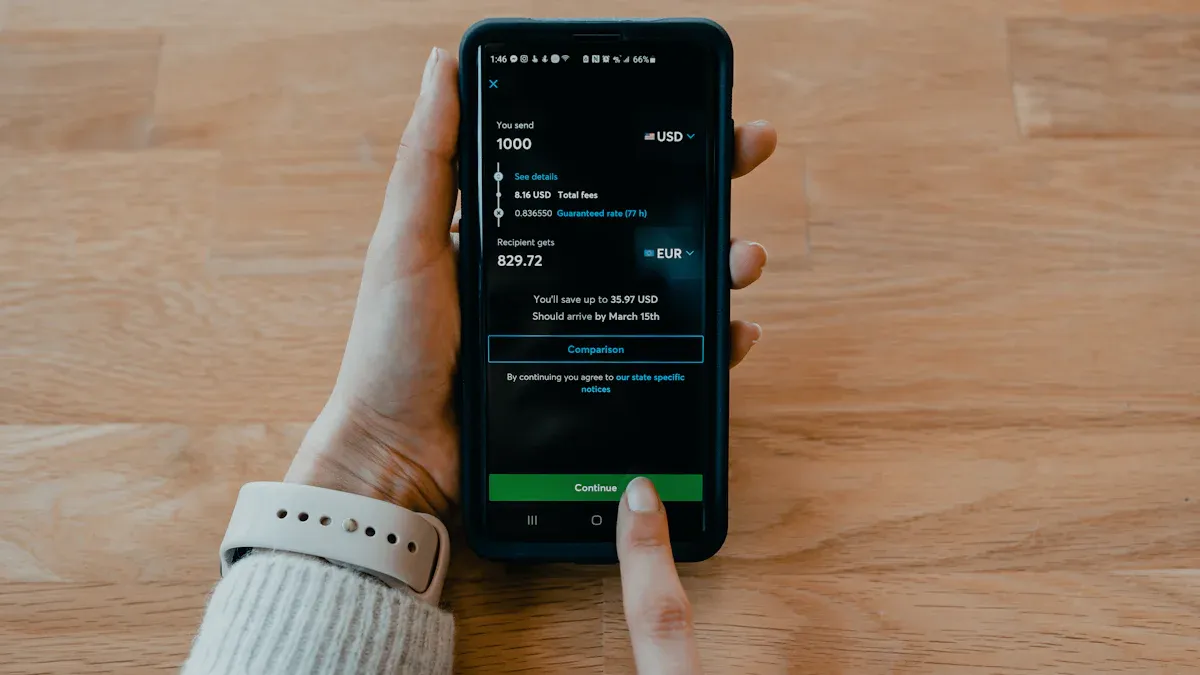

Having understood the pros and cons of each platform, let’s look at how to actually operate a transfer. The process for online transfers is largely similar and very simple. Below, I’ll use Remitly as an example to walk you through the complete process.

Step 1: Registration and Identity Verification

First, download the Remitly app on your phone or visit its website and create an account with your email. To ensure fund security and comply with regulations, the platform will require identity verification. Prepare your identification documents.

| Accepted Identification Documents (US) |

|---|

| Passport |

| Driver’s License |

| Other government-issued photo ID |

Additional Note: Address Proof For larger transfers or when using platforms like Wise, you may need to provide address proof. Typically, platforms accept utility bills, bank statements, or lease agreements from the past three months. Ensure the name and address match those used to register your account.

Step 2: Create Transfer and Lock Exchange Rate

After logging in, click “Start Transfer.” Enter the USD amount you want to send (e.g., $1,000) and select Bangladesh as the recipient country. The system will automatically display the current exchange rate, fees, and the final amount the recipient will receive in Bangladeshi Taka (BDT). Confirm to lock in the rate.

Step 3: Enter Recipient Information

Next, accurately enter the recipient’s information, including:

- Recipient’s full name (ensure it matches their ID)

- Address and contact phone number

- Receiving method: Depending on your choice, provide the corresponding bank account, bKash mobile wallet number, or designated cash pickup point information.

Step 4: Choose Payment Method and Pay

This is the final step: select your payment method for the transfer. As someone in the US, you typically have the following options, which differ in fees and speed:

| Payment Method | Fee Characteristics | Speed |

|---|---|---|

| Debit Card | Lower fees | Fast (suitable for Express service) |

| Credit Card | Highest fees (usually ~3% extra) | Fast (suitable for Express service) |

| Bank Account (ACH) | Lowest fees, often no extra cost | Slow (typically 3-5 business days) |

Payment Tip If you choose bank account (ACH) payment, you’ll need to provide your US bank’s routing number and account number. While slower, this is the most cost-effective option. For speed, a debit card offers the best balance.

Step 5: Track Transfer Status

Once payment is successful, you’re done! The platform will notify you of each step of the transfer’s progress via email or app, from “processing” to “delivered,” keeping you reassured throughout.

Must-Know for People in the US Sending Money: Key Issues and Pitfall Avoidance Guide

Successfully sending money isn’t just about clicking “send.” You need to understand key issues to ensure funds arrive safely and efficiently.

Choosing a Receiving Method in Bangladesh

bKash is a very popular mobile wallet in Bangladesh. It’s convenient for receiving funds, but you need to be aware of its receiving limits to avoid transfer failures.

bKash International Transfer Receiving Limits

Limit Type Amount (BDT) Per Transaction Limit 10,000 Daily Limit 25,000 Monthly Limit 150,000

How to Get the Best Exchange Rate

To ensure the recipient gets more money, focus on exchange rates.

- Compare with the Mid-Market Rate: The rate you find on Google or XE.com is the “mid-market rate.” Use it as a benchmark to evaluate if a platform’s rate is cost-effective. Remitly and WorldRemit add markups, while Wise uses this rate directly.

- Set Rate Alerts: Some tools help you monitor exchange rates.

- Wise: You can set a target rate and get notified when it’s reached.

- Xe: Also offers rate alert features to help you transfer at the best time.

Understanding Transfer Limits and Policies

Each platform has its own transfer limits, such as Remitly’s maximum limit of $100,000. More importantly, as someone in the US, you need to understand US federal policies.

Beware of Illegal Channels (Hundi)

You may hear about an underground transfer method called “Hundi.” Avoid it at all costs.

- Completely Illegal: Hundi transactions are unrecorded and unprotected by law, risking total loss of funds.

- Enables Crime: It’s often used for money laundering and funding illegal activities.

- Harms National Interests: This method prevents foreign exchange from entering Bangladesh’s formal system.

What to Do if a Transfer Fails or Is Delayed

If you encounter issues, don’t panic. Follow these steps:

- Verify Information: First, check if the recipient’s name, account number, and other details are completely correct.

- Contact Customer Service: Immediately contact the customer service team of the platform you used and explain the situation.

- Provide Transaction Number: Have your transfer transaction number or reference number ready to help customer service locate your transaction quickly.

There’s no “one-size-fits-all” best transfer method, only the one most suitable for you. To help you decide quickly, I’ve summarized the key recommendations below:

| Platform | Fee Structure | Average Speed | Recommended Scenarios |

|---|---|---|---|

| Remitly | Low during promotions, normal afterward | Minutes to days | Seeking new user discounts or needing bKash |

| Wise | Transparent percentage fees | Hours to two days | Large transfers, prioritizing rate transparency |

| Paysend | Fixed low fee (~$2) | Minutes | Frequent, small transfers |

| Xoom | Higher fees | Minutes | Emergencies, prioritizing speed |

| Bank Wire | High fixed fees ($35+) | 3-5 business days | Very large transfers, prioritizing safety |

I hope this summary helps people in the US like you ensure every transfer reaches family smoothly.

FAQ

How Should I Choose Between Remitly and Wise?

Selection Tip Your choice depends on your needs. If you want new user discounts and convenience for small transfers, choose Remitly. For large transfers and full rate transparency, Wise is better.

Can I Pay for Transfers with a Credit Card?

Yes. You can use a credit card, and transfers are typically fast. However, platforms may charge an additional ~3% fee, increasing your total cost. This is better suited for emergencies.

What If I Entered Incorrect Recipient Information?

- Contact Customer Service Immediately: If you spot an error, contact the transfer platform’s customer service team right away.

- Provide Transaction Number: Have your transfer transaction number or reference number ready to help customer service locate and assist with modifying or canceling the transfer.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.