- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Think Buying ETFs is a Sure Win? Here are 6 "Hidden Rules" You MUST Know!

Image Source: pexels

Does buying ETFs guarantee profits? You may have heard this claim, but the reality is far more complex. ETF investing does not guarantee profits, and you need to understand the risks and pitfalls involved. Many investors often misunderstand that ETFs are riskier than mutual funds or assume ETFs are unsuitable for long-term holding. The reality is as follows:

- The risk of ETFs depends on their underlying assets, and there is no fundamental difference compared to mutual funds.

- ETFs are not only suitable for short-term trading but also for long-term investment goals.

- Expense ratios are not the only cost; trading fees and bid-ask spreads are equally important.

Only by recognizing these truths can you avoid investment traps and improve your success rate.

Key Takeaways

- ETF investing does not guarantee profits; understanding risks and misconceptions is key to success.

- When choosing ETFs, focus on their underlying assets and fee structures to avoid blindly following trends.

- Diversified investing can reduce risk, but it does not mean complete safety.

- Market volatility affects ETF performance, and maintaining rationality and patience is an important investment strategy.

- Develop a clear investment strategy, regularly monitor and adjust your portfolio to enhance long-term returns.

Does Buying ETFs Guarantee Profits?

Misconception Analysis

You might think that buying ETFs guarantees profits, but the reality is far from that. Many investors fall into several common misconceptions when selecting ETFs:

- Chasing hot assets and ignoring risk management. If you only look at an ETF’s recent performance, you’re likely to buy at market peaks, increasing the probability of losses.

- Expecting ETFs to consistently outperform the market. In reality, most ETFs track indices and struggle to outperform the overall market in the long term.

- Not checking the ETF’s internal components and weightings. Some ETFs are heavily concentrated in a few large tech companies, which can lead to instability during market downturns.

- Assuming diversified investing eliminates all risks. Diversification does not equal safety; ETFs can still decline when industries or sectors underperform.

You should carefully examine the composition of an ETF before investing, understanding its investment objectives and asset types. Industry- or sector-specific ETFs have higher volatility and greater risk.

Risk Warning

The claim that buying ETFs guarantees profits ignores investment risks. ETF investing involves the possibility of principal loss, and market volatility directly affects your asset value. The table below outlines the main risks ETF investing may face:

| Risk Type | Description |

|---|---|

| Market Risk | The value of ETF securities may decline |

| Tracking Error | Differences between ETF returns and benchmark returns |

| Liquidity Issues | Difficulty buying or selling ETFs in the market |

| Systemic Risk | ETF structure and trading may trigger systemic risks |

Historical data shows that ETFs can experience significant losses in extreme market conditions. For example, during the 2018 U.S. market “Volmageddon” event, the VIX index surged from 18 to 37 in a single day, causing massive losses for inverse ETF strategies. You need to recognize that investing in ETFs does not guarantee profits, and changes in market and economic conditions can impact your investment outcomes.

When choosing ETFs, you should consider your risk tolerance and avoid blindly following trends. Only through rational analysis can you improve your long-term investment success rate.

The Nature of ETFs

Basic Concepts

You often hear the term ETF in investing. ETF, or Exchange-Traded Fund, is an investment vehicle traded on exchanges. You can buy or sell ETFs in real-time, just like stocks. ETFs differ significantly from mutual funds and individual stocks. See the table below:

| Feature | ETF | Mutual Fund | Individual Stock |

|---|---|---|---|

| Trading Method | Traded on exchanges with real-time pricing | Purchased through fund companies, typically traded at net asset value at the end of the trading day | Traded on exchanges with real-time pricing |

| Portfolio Transparency | Holdings disclosed daily | Holdings disclosed periodically | Not transparent |

| Management Style | Mostly passive, tracking indices | Can be active or passive | Individual selection |

| Risk | Diversified investments, lower risk | Diversified investments, lower risk | Higher risk |

You can see that ETFs combine the diversification benefits of mutual funds with the trading flexibility of individual stocks. ETF prices fluctuate throughout the trading day, allowing investors to participate in the market at any time.

Investment Logic

When choosing ETFs, you should focus on their investment logic. ETFs reduce the risk of individual securities by diversifying investments across multiple assets. You can achieve a diversified portfolio at a lower cost. ETFs typically have lower expense ratios, helping you retain more returns. You can buy or sell ETFs anytime during market hours, making trading highly convenient. Diversification is crucial in ETF investing. By investing in ETFs that cover different industries, regions, and asset classes, you can reduce the impact of poor performance in a single industry or company. This makes your overall portfolio more stable and risks more manageable.

To avoid the misconception that “buying ETFs guarantees profits,” you must understand the nature and investment logic of ETFs. ETFs are not a guaranteed profit tool but a vehicle to diversify risk and improve investment efficiency. Only by understanding the structure and advantages of ETFs can you make more rational investment decisions.

Risk Management

Image Source: unsplash

Market Risk

When investing in ETFs, you must understand market risks. ETF performance is influenced by various factors. Historical data shows that the following market risks have the greatest impact on ETFs:

- Market Risk: When you invest in stock, bond, or real estate ETFs, fluctuations in the underlying asset prices directly affect your investment returns.

- Tracking Error: ETFs may not fully replicate the performance of the tracked index, leading to returns below expectations.

- Liquidity: When buying or selling ETFs in the market, insufficient liquidity may prevent transactions at ideal prices.

- Industry Concentration: Some ETFs are heavily concentrated in a single industry, and industry volatility amplifies overall risk.

- Single Stock Concentration: Certain ETFs hold a few large stocks, and fluctuations in a single stock can affect the ETF’s overall performance.

You can refer to the table below to understand the risk characteristics of different ETF types:

| ETF Type | Risk Characteristics | Description |

|---|---|---|

| Equity ETF | High market volatility | Tracks stock indices, heavily influenced by market sentiment |

| Bond ETF | Sensitive to interest rates, lower volatility | Affected by interest rate changes, typically more stable during market volatility |

| Commodity ETF | High price volatility | Tracks physical asset prices, influenced by inflation and supply-demand, higher risk |

When choosing ETFs, you cannot focus solely on historical returns. Market risks can emerge at any time, and the notion that buying ETFs guarantees profits is unfounded.

Individual ETF Risks

You also need to pay attention to the specific risks of individual ETFs. Certain ETFs, such as leveraged ETFs and sector-specific ETFs, carry higher risks. Key risks include:

- Speculative Market Risk: Leveraged ETFs amplify market gains and losses, resulting in greater profits or losses.

- Unsuitable for Long-Term Holding: Leveraged ETFs are only suitable for short-term trading, and long-term holding may lead to significant losses due to compounding effects.

- High Fees: Leveraged ETFs have higher management fees than standard ETFs, reducing your net returns over the long term.

- Compounding and Volatility Exposure: During periods of high market volatility, compounding effects can lead to catastrophic losses.

- Catastrophic Losses: In a major U.S. market downturn, triple-leveraged ETFs may cause investors to lose their entire principal.

Before investing, you should carefully read the ETF prospectus to understand its structure and risk characteristics. Only then can you effectively manage risks and improve your investment success rate.

Liquidity

Liquidity Impact

When investing in ETFs, liquidity is a critical factor you cannot ignore. ETF liquidity depends not only on trading volume but also on the creation and redemption mechanism and the role of authorized participants. You can buy or sell ETFs anytime during the trading day, just like stocks, allowing you to flexibly adjust your portfolio. In contrast, the liquidity of individual stocks depends primarily on trading volume and bid-ask spreads, while mutual funds have lower liquidity due to trading only at net asset value (NAV) at the end of the day.

ETF liquidity is influenced by multiple factors. See the table below:

| Influencing Factor | Description |

|---|---|

| Underlying Security Liquidity | ETF liquidity is affected by the liquidity of its underlying securities; a liquid underlying market supports secondary market liquidity |

| Role of Authorized Participants | Authorized participants adjust market supply and demand by creating or redeeming ETF shares, impacting ETF liquidity |

| Market Volatility | During market volatility, liquidity becomes critical, and you need to monitor ETF liquidity configurations |

| Trading Volume and Spread | Observing average trading volume and bid-ask spreads helps assess ETF liquidity in different market environments |

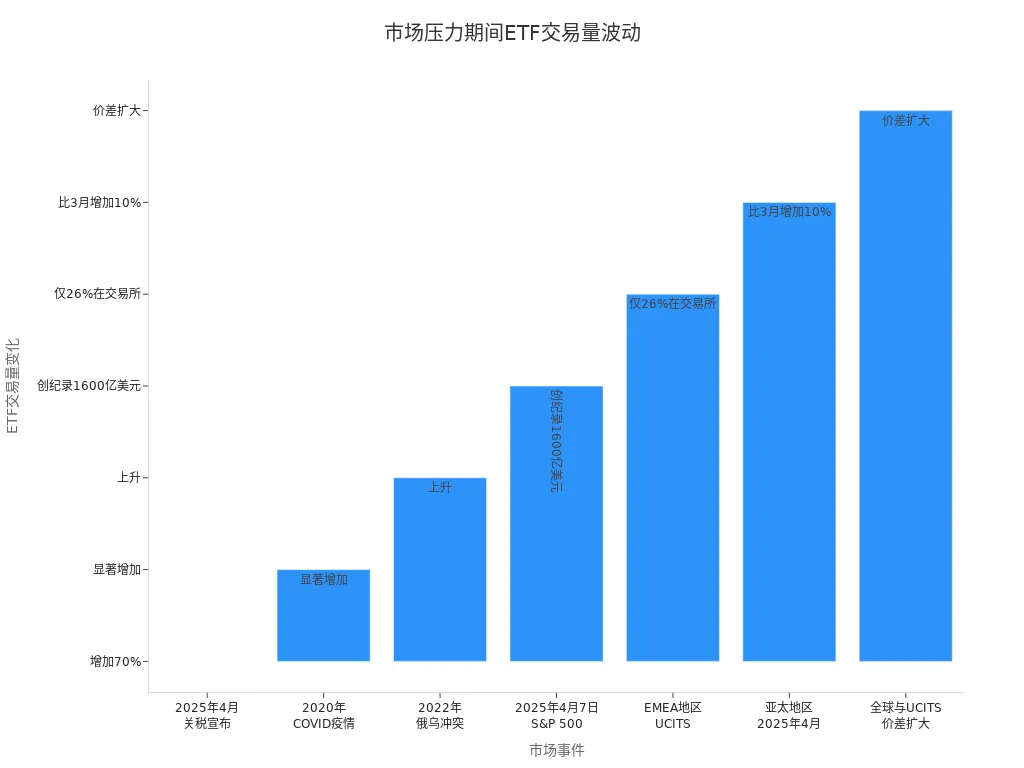

You will notice that ETF trading volume significantly increases during periods of market stress. For example, in the U.S. market, ETF trading volume surged during the 2020 COVID pandemic and the 2022 geopolitical conflicts, reflecting investors’ preference for ETF liquidity. The chart below illustrates changes in ETF trading volume during different market stress events:

You should note that insufficient liquidity in underlying assets can lead to ETF tracking errors and pricing issues, which may also affect arbitrage activities.

Liquidity has become a key component of analyzing the total cost of ETF ownership. When choosing ETFs, you must pay attention to their liquidity performance, especially during periods of heightened market volatility.

Bid-Ask Spread

When buying or selling ETFs, you will encounter the bid-ask spread. The bid-ask spread is the difference between the buying price and the selling price. ETF bid-ask spreads are influenced by multiple factors, including trading volume, market maker competition, the nature of underlying assets, and market conditions. Higher trading volume and market competition typically narrow bid-ask spreads, while low activity may widen them. The liquidity of underlying assets and market hours also affect bid-ask spreads.

During periods of heightened market volatility, ETF bid-ask spreads tend to widen. You’ve observed in the U.S. market that S&P 500 ETF bid-ask spreads significantly increase during periods of sharp market fluctuations. The average bid-ask spread for emerging market ETFs is 11.6 basis points, down 25% from previous levels. Developed market ETFs typically have lower bid-ask spreads and better liquidity.

- The smaller the ETF bid-ask spread, the lower your trading costs, ensuring better long-term investment returns.

- When choosing ETFs, you should prioritize products with high trading volume and narrow bid-ask spreads.

If you ignore bid-ask spreads, you may incur higher costs during frequent trading. Liquidity and bid-ask spreads together determine the actual investment experience of ETFs.

Commissions and Fees

Fee Types

When investing in ETFs, you must pay attention to various fee types. The main ETF fees include trading commissions, management expense ratios, and hidden costs. Major U.S. brokerage platforms have widely eliminated ETF trading commissions. You can refer to the table below to understand commissions and account minimums for various platforms:

| Brokerage Platform | Trading Commission | Minimum Account Balance |

|---|---|---|

| Fidelity | $0 | $0 |

| Vanguard | $0 | $0 |

| E-Trade | $0 | $0 |

| Firstrade | $0 | $0 |

| Merrill Edge | $0 | $0 |

| Ally Invest | $0 | $0 |

When choosing a platform, zero commissions can effectively reduce trading costs. In addition to trading commissions, ETFs charge management expense ratios, which are typically lower than those of actively managed mutual funds. You also need to be aware of bid-ask spreads and potential hidden fees, as these can affect your actual returns.

ETFs with low expense ratios can improve the overall returns of your portfolio. Studies show that ETFs’ low trading costs and expense ratios make them outperform high-fee investment vehicles in the long term.

Long-Term Impact

When investing in ETFs for the long term, the fee structure has a significant impact on your final returns. Annual fees reduce your investment amount and future returns, with compounding effects amplifying these losses. You can refer to the table below to understand the fee budget proportions for ETFs versus actively managed mutual funds:

| Investment Vehicle | Asset Proportion | Fee Budget Proportion |

|---|---|---|

| ETFs | 63% | 33% |

| Actively Managed Mutual Funds | N/A | 67% |

If you ignore expense ratios, your actual returns can significantly decline. For example, if an ETF’s total return is 7% and the expense ratio is 0.25%, your actual return is only 6.75%. Over the long term, the impact of fees becomes even more pronounced. A portfolio with no management fees could grow to $6,167,647, while one with fees might reach only $4,848,200, resulting in a potential wealth loss of $1,319,447.

- Low-fee ETFs can more effectively capitalize on market inefficiencies, thereby improving investment returns.

- When choosing ETFs, you must focus on the fee structure and prioritize low-fee products to maximize long-term returns.

Only by fully understanding and controlling investment costs can you achieve higher compounding returns in long-term investing.

Investment Strategies

Developing Strategies

When investing in ETFs, you should first develop a clear investment strategy. Financial advisors suggest you follow these steps:

- Clarify investment goals. You need to determine your risk tolerance and investment time horizon.

- Conduct thorough research. You can evaluate different ETFs and select products that align with your goals and risk profile.

- Embrace diversification. You can reduce the risks from fluctuations in a single market or industry by combining ETFs with different underlying assets.

- Supplement existing holdings. ETFs can help you fill gaps in your portfolio to optimize asset allocation.

- Consider cost efficiency. You should focus on ETFs’ expense ratios, as low-fee products offer an advantage in the long term.

- Understand tracking error. You need to monitor the performance difference between an ETF and its benchmark index to avoid return impacts from tracking errors.

- Monitor liquidity. You can choose ETFs with high trading volume to ensure ease of buying and selling.

- Consider tax implications. You should understand the tax efficiency of ETFs and their potential impact.

- Stay informed. You can regularly monitor market changes and new ETF launches.

- Combine active and passive management. You can integrate actively managed funds with passive ETFs to create a balanced portfolio.

- Implement a disciplined rebalancing strategy. You should periodically review and adjust your portfolio to stay aligned with your goals.

- Assess risk tolerance. You need to evaluate how different ETFs fit your risk preferences.

Only by developing a scientific investment strategy can you maintain stable returns in complex market environments.

Emotional Management

When investing in ETFs, emotional management is equally important. Behavioral finance studies show that emotional decisions significantly affect investment returns. The table below presents relevant research findings:

| Research Topic | Result Description |

|---|---|

| Investor Behavior and Market Returns | Over the past 20 years, the average U.S. equity investor achieved about 6% annual returns, while the S&P 500 returned nearly 9%. The gap is mainly due to poor timing decisions. |

| Behavioral Penalty | Emotional decisions can reduce investor returns by 1-2% annually, with significant long-term impacts. |

| Loss Aversion Bias | The pain of losses is about twice as intense as the pleasure of equivalent gains, leading investors to lock in losses through stop-loss actions. |

During the investment process, you are prone to the following emotional biases:

- Loss Aversion: You may sell due to fear during market volatility, leading to realized losses.

- Overconfidence: You might overestimate your judgment, ignoring potential risks.

- Regret Aversion: You may regret holding or selling, impacting your decisions.

- Anchoring Effect: You may overly rely on early information, missing better opportunities.

- Cognitive Dissonance: You might ignore new information, sticking to existing views.

- Conservatism: You tend to hold onto old views, ignoring recent market changes.

- Confirmation Bias: You only accept information supporting your beliefs, ignoring contrary evidence.

You can reduce the negative impact of emotional decisions by developing a disciplined investment plan and regularly rebalancing your portfolio. Maintaining rationality and patience is key to improving your ETF investment success rate.

Market Volatility

Image Source: pexels

Emotional Impact

During ETF investing, you’ll find that market volatility significantly affects your emotions. Financial research indicates that the main reasons for ETF price volatility include:

- Passive investment strategies and ETF fund inflows can lead to non-fundamental volatility in underlying securities.

- Higher ETF liquidity and constituent stock proportions result in more pronounced volatility spillover effects.

- Deviations between ETF prices and net asset values amplify market volatility.

- Leveraged and inverse ETFs amplify asset price volatility during market stress.

When ETF prices fluctuate sharply, your emotions are easily affected. Psychological studies show that investors have stronger emotional reactions during market downturns, often reducing risk-taking. You may exhibit the following behaviors:

| Emotional Response | Investment Behavior Change |

|---|---|

| Increased Emotional Arousal | Reduced financial risk-taking |

| Emotional Response During Declines | Stronger than during upswings |

You may also follow others’ buying or selling, become overconfident, feel more pain from losses, or focus only on recent events. These emotional responses can affect your investment decisions, increasing the risk of irrational actions.

Volatility Management

When facing market volatility, you should proactively adopt risk management measures. The following methods can help improve your portfolio’s stability:

- Adopt active low-volatility strategies focusing on quality, stability, and price to mitigate downside risk while capturing upside opportunities.

- Consider using low-volatility ETFs in the U.S. market, such as AB U.S. Low Volatility Equity ETF (NYSE: LOWV) and AB International Low Volatility Equity ETF (NYSE: ILOW), to gain exposure to different markets.

- Educate yourself not to sell impulsively during market volatility to avoid missing rebound opportunities.

- Maintain a stable asset allocation to reduce overall risk.

- Adopt a target allocation model to enhance portfolio resilience.

You can also use the following tools to manage market downturns:

- Inverse ETFs: Protect your portfolio during U.S. market declines.

- Diversification: Spread risk across different asset classes.

- Tax-Loss Harvesting: Manage tax implications while maintaining market exposure.

Only by rationally analyzing market volatility and combining scientific risk management tools can you reduce losses in ETF investing and improve long-term success rates.

When investing in ETFs, you must remain rational. The claim that buying ETFs guarantees profits is inaccurate. Only by mastering and avoiding these 6 hidden rules can you improve your long-term success rate. See the table below; rational decision-making and diversified strategies help achieve financial goals:

| Evidence Point | Description |

|---|---|

| Evidence-Based Investing | Relying on empirical data, reducing emotional biases, and following diversified, low-cost strategies increase the likelihood of achieving financial goals. |

| Diversification | Diversifying across different asset classes reduces exposure to volatility from a single investment, increasing the likelihood of stable long-term returns. |

| Long-Term Perspective | Emphasizes holding diversified portfolios rather than frequently trading assets due to short-term market volatility. |

If you continue learning about ETFs and make cautious decisions, you can better manage risks. Studies show that investors who understand ETF advantages are more confident in achieving financial goals. You should avoid blindly following trends and focus on long-term growth.

FAQ

How do ETFs differ from mutual funds?

You can trade ETFs like stocks anytime during the day. Mutual funds can only be traded at net asset value after the market closes daily. ETFs typically have lower fees and higher transparency.

Is there a minimum investment amount for ETFs?

When opening an account with major U.S. brokers, there is usually no minimum investment requirement. You can start investing in ETFs with a small amount of USD, offering high flexibility.

How are ETF dividends distributed?

When holding ETFs, some ETFs periodically pay dividends. You can choose to automatically reinvest or receive USD dividends directly, depending on the broker’s settings.

Are leveraged ETFs suitable for long-term holding?

You should not hold leveraged ETFs for the long term. Leveraged ETFs are highly volatile, and long-term holding may lead to principal losses. You should carefully assess the risks.

What are the main fees for ETF investing?

You need to pay attention to management expense ratios, bid-ask spreads, and potential trading commissions. Major U.S. platforms offer ETF trading commissions at USD 0, with management expense ratios varying by product.

The key to successful ETF investing lies not in the “guaranteed profit” myth, but in disciplined execution and cost control. The “6 secrets” reveal that fees (expense ratio, spread) and liquidity are powerful hidden variables that erode returns. When you need to rebalance your portfolio or react quickly to a market shock, slow cross-border funding and high transaction costs become the true enemies of your long-term success.

To ensure your passive investment strategy is backed by proactive financial efficiency, integrate BiyaPay. We offer zero commission for contract limit orders, a crucial advantage that minimizes the drag from frequent trading necessary for disciplined portfolio management (like dollar-cost averaging or rebalancing). Furthermore, our platform facilitates the swift, mutual conversion between fiat and digital assets like USDT, providing you with the fastest, most reliable pathway to fund your brokerage accounts and meet urgent market needs. You can register in just 3 minutes without requiring an overseas bank account, gaining immediate access to US and Hong Kong Stocks. Leverage our real-time exchange rate checks to maintain transparent control over your funding. Open your BiyaPay account today to conquer the hidden costs and liquidity challenges of ETF investing.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.