- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

More Stable Than Stocks, More Flexible Than Bonds: Why Smart Money Is Buying Convertible Bonds

Image Source: pexels

When investing, you often want your principal to be safe while not missing out on growth opportunities. Convertible bonds perfectly meet your needs. They are more stable than stocks because, even during market fluctuations, you can still retain the bond’s principal. In 2023, investment in Chinese convertible bonds saw significant growth, with many large tech companies using convertible bonds to finance business expansion. You will find that low issuance rates and strong issuing companies have led more industries to adopt this flexible financing method.

Key Points

- Convertible bonds provide principal safety and regular interest payments, ensuring stable cash flow.

- During market fluctuations, convertible bonds perform more robustly, protecting investors’ principal.

- Convertible bonds offer high flexibility, allowing investors to adjust strategies based on market changes.

- Investing in convertible bonds provides diversified returns, including fixed interest and capital appreciation.

- They are suitable for investors seeking both safety and growth, especially in uncertain market environments.

Core Advantages

Image Source: unsplash

Principal Safety

When investing, your primary concern is whether your principal is safe. Convertible bonds provide you with dual protection.

- Like traditional bonds, convertible bonds pay interest periodically and return the principal at maturity. You can enjoy stable cash flow.

- If the issuing company’s stock price rises, you can choose to convert the bonds into stocks for higher returns.

- The valuation of convertible bonds is heavily influenced by company news, but the bond’s baseline provides downside protection. Even during market fluctuations, you can still retain the bond’s minimum value.

- Traditional bonds are mainly affected by the economic environment, with lower risk but limited growth potential. Convertible bonds combine safety and growth potential.

Convertible bonds allow you to enjoy the safety of bonds while seizing the growth opportunities of stocks. You don’t have to worry about significant principal loss, which is one of the key reasons they are more stable than stocks.

More Stable Than Stocks

You may worry about the risks brought by stock market volatility. Convertible bonds perform more robustly during significant market fluctuations.

The table below shows the performance of convertible bonds compared to stocks in different market environments:

| Market Environment | Convertible Bonds Performance | Stocks Performance |

|---|---|---|

| High Volatility | Strong downside protection, lower volatility | High volatility, high risk |

| Low Volatility | Slightly underperforms stocks | Performs well |

| Market Decline | Bond baseline protects principal | Principal may suffer significant losses |

| Market Rise | Participates in stock gains | Directly benefits from rising prices |

You can see that as market volatility increases, the equity option value of convertible bonds rises, attracting many institutional and individual investors.

From 2019 to 2022, U.S. market volatility continued to rise. Many investors chose convertible bonds because they are more stable than stocks, helping you navigate market corrections and risks.

Low issuance rates are another advantage of convertible bonds. When large companies issue convertible bonds, the interest rates are typically lower than those of regular bonds, reducing your holding costs.

If you want to protect your principal in uncertain market environments while not missing out on growth opportunities, convertible bonds are an ideal choice, being more stable than stocks.

Flexibility

When investing, you need to flexibly adapt to market changes. Convertible bonds offer you multiple options:

- You can receive stable interest income, enjoying predictable cash flow like traditional bonds.

- If the company’s stock performs well, you can convert the bonds into stocks for capital appreciation.

- Convertible bonds carry lower risk than directly buying stocks because the bond component provides a buffer.

- You can set conversion triggers based on future valuations or company performance, flexibly adjusting your investment strategy.

- Modern convertible bonds allow issuers to deliver a combination of cash and stocks upon conversion, helping you manage cash flow and balance risk and reward.

- In the event of company bankruptcy or liquidation, you, as a creditor, have priority claim rights, further protecting your interests.

- Convertible bonds add diversification to your portfolio, with performance characteristics different from traditional bonds and stocks, reducing overall volatility.

The flexibility of convertible bonds allows you to adjust your investment strategy based on market and company developments, which is why they are more stable than stocks and more flexible than bonds.

Institutional Strategies

Image Source: pexels

Arbitrage

When investing in convertible bonds, you may notice that institutional investors often use arbitrage strategies. These strategies typically rely on market pricing errors and volatility changes.

- You can leverage the positive convexity of convertible bonds to profit from market segmentation or unexpected volatility.

- Institutions analyze the issuer’s credit quality and expected stock volatility to identify undervalued convertible bonds.

- You can hedge against stock price fluctuations, interest rate changes, and credit risks to reduce overall risk.

- Convertible bond arbitrage is a relative value strategy with low stock beta and low correlation with stocks and interest rates.

- You can invest based on factors such as volatility, risk-free rates, credit quality, and time to maturity to achieve profits.

Return Sources

When investing in convertible bonds, your return sources are highly diversified.

- You can earn coupon income from fixed-income securities, enjoying stable cash flow.

- You can achieve short-term returns by shorting stocks.

- Volatility trading and arbitrage trading can also bring additional returns.

- When you exercise the conversion right to convert bonds into stocks, you can achieve capital appreciation.

- Coupon payments and capital gains together constitute the total return of convertible bonds.

The table below shows the average returns of convertible bond arbitrage strategies in the U.S. market in recent years:

| Year | Return |

|---|---|

| 2023 | +10.1% |

| 2024 | Double-digit |

| 2025 | +4% (as of May) |

You can see that, in the long term, convertible bond arbitrage strategies perform steadily, are more stable than stocks, and carry lower risk.

Case Studies

You can refer to real-world cases in the U.S. market. A Hong Kong-licensed bank, when participating in a U.S. convertible bond issuance, adopted flexible redemption exit options.

| Key Innovation | Details |

|---|---|

| Redemption Exit Option | Investors can choose to redeem part or all shares after 7 years, at a redemption price of the higher of a 15% annual return or fair market value. |

| Valuation | Total financing of $500,000, with a pre-money valuation of $2 million. |

| Legal Structure | Structured similarly to the U.S. “seed” preferred stock investment model. |

You can also see that Strategy Company issued convertible bonds due in 2030 with a 0% interest rate and a principal of $2 billion, allowing investors to convert debt into equity when stock prices rise. This structure helps institutions obtain low-cost capital while avoiding immediate dilution of shareholder equity.

When analyzing these cases, you should focus on credit quality and terms design, rationally allocating convertible bonds to improve investment efficiency and return potential.

Comparative Analysis

Risk and Return

When choosing investment products, your primary concern is risk and return. Convertible bonds combine the stability of bonds and the growth potential of stocks. You can earn bond-like interest income while enjoying capital appreciation from stock price increases. Historical data shows that convertible bonds in the U.S. market perform more like stocks because they can be converted into the issuer’s shares. Over the past 20 years, the returns of convertible bonds have been comparable to U.S. large-cap stocks, but during market downturns, they typically bear only 50% of the downside risk of stocks while capturing 80% of bull market returns.

- Convertible Bonds: Bond income + stock growth potential, strong defensiveness

- Stocks: High volatility, high returns, high risk

- Regular Bonds: Stable interest, low risk, limited growth potential

The table below shows the historical performance of the three asset classes (in USD):

| Asset Class | Average Return | Standard Deviation | Minimum | Maximum |

|---|---|---|---|---|

| Convertible Bonds | 0.024% | 0.508% | -2.839% | 3.756% |

| Stocks | 0.005% | 1.247% | -7.063% | 9.523% |

| Regular Bonds | 0.023% | 0.364% | -1.864% | 2.857% |

You can see that convertible bonds strike a balance between risk and return, being more stable than stocks and more flexible than regular bonds.

Investment Threshold

When considering investment thresholds, you need to focus on capital requirements and liquidity. In the U.S. market, convertible bonds are typically issued by large companies, enhancing their market appeal.

- Convertible bonds have a moderate investment threshold, with many products open to both institutional and individual investors.

- Stock investment thresholds are low, with high liquidity but significant volatility.

- Regular bond thresholds vary depending on the issuer; government bonds have high liquidity, while corporate bonds require attention to the issuer’s credit.

- When large companies issue convertible bonds, they can negotiate more favorable terms, making stability and growth potential more attractive to investors.

- The liquidity of convertible bonds depends on the market and investor interest in conversion potential, generally better than small-cap corporate bonds.

The table below compares the key parameters of the three products:

| Parameter | Convertible Bonds | Corporate Bonds | Government Bonds |

|---|---|---|---|

| Interest Rate | Lower | Higher | Lowest |

| Risk | Moderate | Higher | Lowest |

| Return | Moderate, with growth potential | Higher, credit-dependent | Stable, limited growth |

| Liquidity | Moderate | Varies significantly | High |

| Issuer | Mainly large companies | Various companies | Government |

Suitable Investors

When choosing investment products, you should base your decision on your risk preferences and goals. Convertible bonds are suitable for the following types of investors:

- If you seek a balance between equity participation and downside protection, convertible bonds are an ideal choice.

- If you are cautious about market timing and prefer long-term holding, convertible bonds can help you achieve stable growth.

- If you have active management capabilities and can monitor market dynamics and terms changes, convertible bonds offer more opportunities.

- Regular bonds are suitable for risk-averse investors prioritizing safety and stable income.

- Stocks are better suited for investors with high risk tolerance seeking high returns.

In the U.S. market, major investment banks like Morgan Stanley and Goldman Sachs actively participate in convertible bond activities, driving product innovation and market development. You can explore more investment opportunities through these institutions and choose products that suit you.

Individual Investor Participation

Suitable Investors

If you want to balance growth and safety in your investments, convertible bonds are a good choice. The following types of investors are typically more suitable for convertible bonds:

- You seek growth potential and aim to profit from stock market rises.

- You need stable income sources and value fixed income.

- You want to diversify your portfolio to reduce overall volatility.

The hybrid nature of convertible bonds allows you to flexibly adjust strategies in different market environments. You can enjoy capital appreciation from stock price increases while earning bond interest income.

Threshold

When considering investment thresholds, you need to focus on capital requirements and market liquidity. In the U.S. market, convertible bonds issued by large companies are typically open to institutional and individual investors, with moderate investment thresholds. You can purchase them through brokerage platforms, with minimum investment amounts generally starting at 1,000 USD or higher. Compared to regular corporate bonds and stocks, convertible bonds have better liquidity but require attention to their smaller market size and high specialization. Market conditions change rapidly, and price fluctuations can be significant. You should understand product terms and choose reputable issuers before investing.

Considerations

When investing in convertible bonds, you need to pay attention to the following points:

- The convertible bond market is small and specialized, with rapidly changing market conditions.

- Credit risk is higher, especially for bonds issued by smaller companies with less capital.

- Market volatility and high-interest-rate environments may affect convertible bond prices.

- Issuer-specific risks increase during market instability.

- The risk characteristics of convertible bonds are influenced by the conversion price, categorized as in-the-money, at-the-money, or out-of-the-money.

You can adopt various risk management strategies. For example, global convertible bond strategies allow you to participate in stock market growth while managing downside risk through fixed income. Active management strategies optimize risk and return by adjusting the portfolio’s delta value. You can also focus on the total return of the entire portfolio rather than a single benchmark.

The table below summarizes common risk management strategies:

| Strategy | Description |

|---|---|

| Global Convertible Bond Strategy | Leverages the risk/reward characteristics of convertible bonds to participate in stock market growth while managing downside risk. |

| Active Management | Actively adjusts delta to achieve optimal risk/reward positioning. |

| Total Return Focus | Focuses on the overall portfolio return rather than strictly tracking a benchmark. |

Before investing, you should thoroughly understand product terms and market conditions, allocate assets rationally, reduce risks, and enhance return potential.

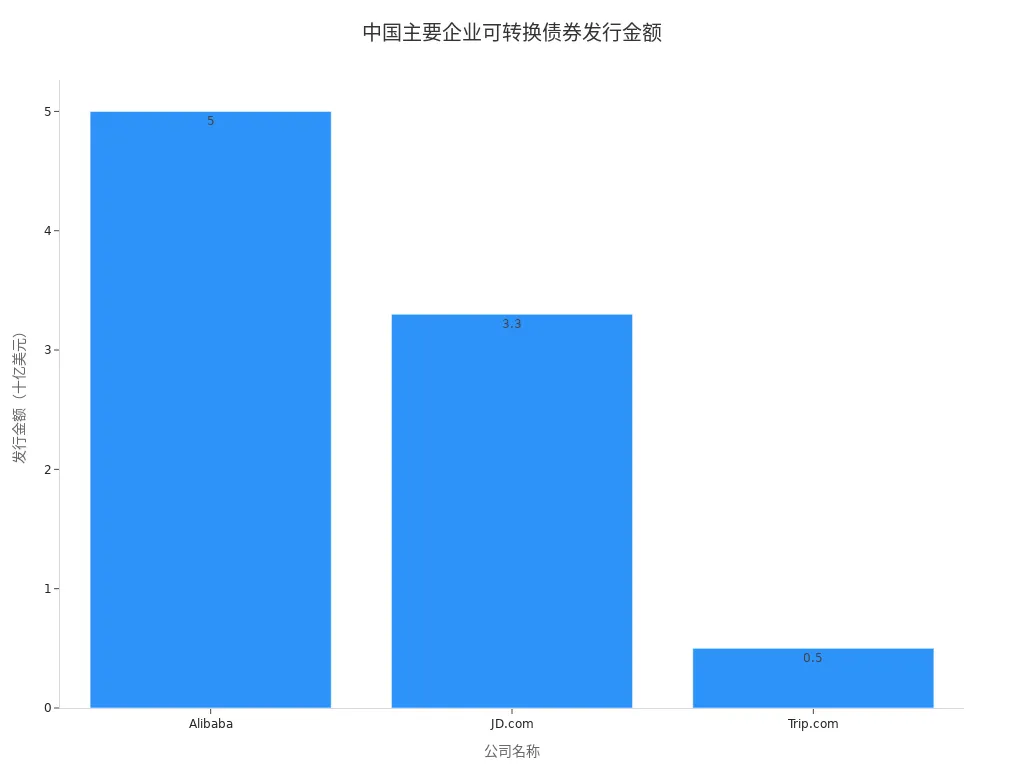

You can see that convertible bonds, with their “more stable than stocks, more flexible than bonds” characteristics, have become the top choice for smart money. Large companies like Alibaba, JD.com, and Trip.com in mainland China have issued convertible bonds totaling $8.3 billion, indicating sustained market demand growth.

| Company | Issuance Amount | Notes |

|---|---|---|

| Alibaba | $5 billion | Asia’s largest issuance since 2008 |

| JD.com | $3.3 billion | One of the major recent issuers |

| Trip.com | $0.5 billion | Notable issuer |

| Total | $8.3 billion | Reflects growing market demand for convertible bonds |

When investing, you should pay attention to the following market changes:

- Geopolitical tensions

- Difficulties in traditional stock market financing

- Increased demand from hedge funds

Hedge funds actively participate in the convertible bond market, leveraging price and volatility differences between bonds and stocks for arbitrage, boosting market activity. When choosing convertible bonds, you can prioritize products with low issuance rates issued by large companies. You should allocate assets rationally, focus on risk management strategies, and participate in investments rationally.

FAQ

What is the difference between convertible bonds and regular bonds?

You can convert convertible bonds into the issuing company’s stocks. Regular bonds only provide fixed interest and cannot participate in company growth.

Are the investment risks of convertible bonds high?

You bear lower risks than with stocks. The bond baseline protects your principal. During market fluctuations, you can choose not to convert and retain the bond’s value.

How to purchase convertible bonds?

You can purchase them through U.S. brokerage platforms. The minimum investment amount is generally 1,000 USD. You need to pay attention to the issuing company’s credit and terms.

What are the return sources for convertible bonds?

You can earn fixed interest income. When the company’s stock price rises, you can convert to stocks for capital appreciation. Arbitrage trading can also bring additional returns.

Why are issuance rates lower?

You find that when large companies issue convertible bonds, the interest rates are typically lower than regular bonds. Companies finance at lower costs, and investors gain growth

opportunities.

Convertible bonds appeal to sophisticated investors because they offer downside protection (via the bond floor and fixed interest) with equity upside potential (via the conversion option). This hybrid nature makes them more stable than stocks and more flexible than traditional bonds. To capitalize on the nuances of this asset class globally—whether for hedging, arbitrage, or direct investment—you need an operational platform that supports low-cost, high-speed cross-border execution and funding.

To ensure your investment in convertible bonds translates into maximized net returns, integrate the financial agility of BiyaPay. We offer zero commission for contract limit orders, a crucial advantage that drastically minimizes the cost of acquiring, selling, or hedging these complex instruments. Furthermore, our platform supports the swift, mutual conversion between fiat and digital assets like USDT, providing you with the fastest, most reliable pathway to fund your brokerage accounts for time-sensitive global investment. You can register quickly—in just 3 minutes without requiring an overseas bank account—and gain immediate access to US and Hong Kong Stocks. Leverage our real-time exchange rate checks to maintain transparent control over your funding costs. Open your BiyaPay account today and secure the operational advantage your versatile investment strategy deserves.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.