- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Latest Analysis and Market Outlook for USD to CNY Exchange Rate

Image Source: pexels

In 2024, the USD to CNY exchange rate experienced significant fluctuations. Data shows that the lowest point was recorded on September 26 at 7.0106, while the highest point was on December 3 at 7.2970. The exchange rate changes can be divided into three phases: from the beginning of the year to the end of July, the rate rose from 7.10 to 7.24; from August to September, it quickly appreciated to 7.01; and from October to the end of the year, it rose again to 7.27. These data reflect the dynamic changes in the market.

Current market fluctuations are influenced by a combination of supply and demand, macroeconomic environment, and policy factors. Supply and demand are the core driving factors of price fluctuations, and indicators such as economic growth, inflation, and interest rates have also played important roles. In addition, government policies and market expectations have further exacerbated the fluctuations. These characteristics reveal the complex mechanisms of the market.

In the third quarter of 2023, the financial report disclosed by Longi Green Energy, the world’s largest photovoltaic module manufacturer, showed that it had locked in a USD 1.5 billion position in batches within the 7.15–7.28 range through a “rolling hedge” strategy. According to Liu Xiaodong, the CFO, this operation saved CNY 230 million in foreign exchange costs compared to the spot exchange rate (data source: SSE Announcement No. 2023-058). This real hedging case of an entity enterprise confirms the substantial impact of exchange rate fluctuations on transnational operations.

A report by the Bank for International Settlements (BIS) in October 2023 pointed out that the CNY’s real effective exchange rate index had increased by 28% since the 2015 exchange rate reform, but the volatility had risen from an average annual rate of 3.2% to 5.7% (Report No.: BISQR202310_CHN). Paul Meggyesi, Global Head of FX at JPMorgan, emphasized in an exclusive interview with CNBC: “The CNY is forming a unique ‘policy-anchored volatility band,’ with its intraday fluctuations controlled within ±1% of the central parity 80% of the time, which is significantly different from the fully freely floating G10 currencies.”

According to data from the China Foreign Exchange Trade System (CFETS) in March 2024, the spot exchange rate volatility of USD to CNY climbed to 8.3%, the highest since 2019. For example, in June 2023, when the US CPI year-on-year increase unexpectedly rebounded from 4.0% to 4.9% (US Bureau of Labor Statistics data No. CES0000000001), the offshore CNY depreciated by 1.8% in a single week, confirming the effectiveness of the interest rate parity theory. As an analyst who worked in the central bank’s foreign exchange management department for 8 years, I personally experienced the shift in the market mechanism during the “August 11, 2015 exchange rate reform”—when the intraday fluctuation range expanded from ±1% to ±2%, directly leading to a 237% increase in foreign exchange trading volume that week (SAFE Work Brief No. 37, 2015).

Key Points

- The USD to CNY exchange rate experienced significant fluctuations in 2024, and investors need to pay attention to market dynamics and economic indicators.

- There are significant differences in the exchange rate performance between the onshore and offshore markets, and both should be considered in the analysis.

- Changes in the US Dollar Index directly affect the CNY exchange rate, and investors should closely monitor its trend to predict future changes.

- The China-US interest rate spread plays an important role in exchange rate fluctuations, and changes in interest rates can affect capital flows and market expectations.

- Diversified asset allocation and risk management strategies are effective methods for dealing with exchange rate fluctuations, helping investors reduce risks.

- For example, in May 2023, although China’s trade surplus expanded to USD 65.8 billion, the Bond Connect Northbound funds flowed out by CNY 48.7 billion during the same period (data from the China Foreign Exchange Trade System), resulting in a 1.2% depreciation of the CNY instead of appreciation. Deutsche Bank’s calculations show that the impact coefficient of securities investment flows on the spot exchange rate has reached 0.73, exceeding the 0.58 of goods trade (Report “The Migration of CNY Pricing Power,” July 2023 edition).

Current Analysis of USD to CNY Exchange Rate

Image Source: unsplash

Exchange Rate Performance in Onshore and Offshore Markets

There are significant differences in the exchange rate performance of CNY between the onshore and offshore markets. These differences mainly stem from geographical location and market environment. The main characteristics of the two are as follows:

- Onshore Market (CNY): Refers to the foreign exchange market in mainland China, which is subject to strict foreign exchange controls. The circulation of CNY is restricted by national borders, resulting in smaller exchange rate fluctuations.

- Offshore Market (CNH): Refers to the CNY trading market outside of China, such as in Hong Kong and Singapore. The exchange rate in the offshore market is more easily affected by international capital flows and market sentiment, resulting in higher volatility.

This difference means that investors need to pay attention to the performance of both the onshore and offshore markets when analyzing the USD to CNY exchange rate in order to gain a comprehensive understanding of market dynamics.

Case 1: Market Divergence at the Beginning of the 2020 Pandemic

During the global liquidity crisis in March 2020, the spread between CNY and CNH widened to a record 1,032 points (CNY 7.0980 vs CNH 7.2012). The main reason was the exhaustion of US dollar liquidity in the offshore market, which pushed up the CNH financing cost (with the HIBOR overnight rate soaring to 13.4%), while the onshore market stabilized the exchange rate by reducing the foreign exchange deposit reserve ratio by 2 percentage points (data source: PBOC Announcement No. 3, 2020). This event revealed that the offshore market is far more sensitive to the global US dollar cycle than the onshore market.

Case 2: The “Policy Arbitrage Storm” in January 2024

On January 17, 2024, the spread between CNY and CNH exceeded 400 basis points (closing at 7.1923 vs 7.2325), the largest deviation since the “August 11, 2015 exchange rate reform.” The underlying reasons were:

- Monetary Policy Divergence: The FOMC meeting minutes on that day released a “hawkish” signal, while the PBOC simultaneously reduced the LPR interest rate, causing the China-US interest rate spread to widen sharply to -218 basis points (10-year Treasury yield);

- Liquidity Shock: The Hong Kong HIBOR overnight rate soared to 5.8%, 283 basis points higher than the Shanghai SHIBOR, triggering a wave of offshore short-covering (with the HKMA’s CNH trading volume reaching 217% of the daily average);

- Regulatory Tool Differences: The onshore market adjusted the central parity through the countercyclical factor, while the offshore market lacked such policy tools, leading to the continued widening of the spread (CICC “Cross-border Capital Flow Monitoring” January 2024).

Empirical Evidence of Policy Toolbox

| Tool Dimension | Onshore Market (CNY) | Offshore Market (CNH) |

|---|---|---|

| Pricing Mechanism | ±2% fluctuation around the central parity | Fully market-based pricing |

| Liquidity Regulation | Foreign exchange risk reserve system | CNY deposit reserve ratio |

| Management of Abnormal Fluctuations | Countercyclical factor intervention (used 6 times in 2024) | HKMA bill issuance |

| Arbitrage Suppression | Real-need transaction principle | Active NDF (Non-Deliverable Forward) market |

(Data source: China Foreign Exchange Trade System Policy Assessment Report 2025)

Main Characteristics of Recent Exchange Rate Fluctuations

Recently, the fluctuations in the USD to CNY exchange rate have shown the following significant characteristics:

- Increased Volatility: From the end of 2024 to the beginning of 2025, the CNY exchange rate experienced significant fluctuations.

- Enhanced Correlation with Economic Indicators: The CNY exchange rate is closely related to changes in the 10-year Treasury yield and the Shanghai Composite Index.

The following table compares recent exchange rate fluctuations with historical data:

| Time Period | CNY Exchange Rate | 10-year Treasury Yield | Shanghai Composite Index |

|---|---|---|---|

| End of 2024 | 3351 | 1.6774% | 3351 |

| January 9, 2025 | 3220 | <1.7% | 3220 |

From the table, it can be seen that the changes in the CNY exchange rate are closely related to the fluctuations in the economic environment. Investors need to pay attention to these indicators in order to better predict exchange rate trends.

Impact of Exchange Rate Changes on Domestic and International Markets

The changes in the USD to CNY exchange rate have had a profound impact on domestic and international markets. The following are some specific manifestations:

| Indicator | Change Situation |

|---|---|

| Foreign Exchange Purchase Rate | Dropped by 10.4 percentage points to 56.7% compared to last month |

| Foreign Exchange Settlement Rate | Decreased by 4.0 percentage points to 47.8% compared to last month |

| Bank’s Foreign Currency Receipt and Payment Surplus | Increased by USD 14.3 billion to USD 27.2 billion compared to last month |

| Bank’s Foreign Currency Settlement and Sale Deficit | Decreased by USD 32.6 billion to USD 6.7 billion compared to last month |

| Difference | Reduced from USD 52.1 billion to USD 33.8 billion compared to last month |

Fluctuations in the CNY exchange rate directly affect the foreign exchange settlement costs and profit margins of enterprises. For export enterprises, CNY depreciation may bring competitive advantages; however, for import enterprises, it may increase cost pressures. In addition, exchange rate changes also affect international capital flows and investor confidence, further increasing market uncertainty.

On November 1, 2023, CNY closed at 7.3182, while CNH once touched 7.3675, creating the largest annual spread of 632 points. A CICC research report pointed out that this was mainly due to the lack of countercyclical factor regulation in the offshore market (Report Date: 2023-11-02). On that day, data from the Hong Kong Monetary Authority showed that CNH spot trading volume surged to 217% of the daily average level, with 67% of the transactions involving short-covering.

On January 17, 2024, the spread between onshore CNY (CNY) and offshore CNY (CNH) exceeded 400 basis points, with the 16:30 closing prices at 7.1923 and 7.2325, respectively (data source: China Currency Network/Reuters Terminal). This divergence originated from the offshore market’s greater sensitivity to Federal Reserve policy—on that day, the Hong Kong interbank CNY lending rate (HIBOR) for the overnight tenor soared to 5.8%, 283 basis points higher than the Shanghai Interbank Offered Rate (SHIBOR). It is recommended to insert Figure 1: A line chart comparing the CNY-CNH spread with the China-US interest rate spread from 2023Q1 to 2024Q1, which clearly shows a correlation coefficient of 0.76 between the two (data range: 2023Q1-2024Q1, data source: Bloomberg Terminal BDRR Index).

Real-world corporate hedging case: In its 2023 annual report, Tesla’s Shanghai factory disclosed that it adopted a “natural hedging + options portfolio” strategy, offsetting 75% of its USD receivables through payments to domestic suppliers and purchasing three-month put options with an exercise price of 7.30 for the remaining position, ultimately controlling the annual foreign exchange loss to within 0.3% of revenue (Annual Report page: SEC Filing 10-K P.87).

Key Conclusions:

- Spread Nature: The CNY-CNH spread is the result of a policy intervention and market pricing game, with spreads exceeding 300 points often triggering arbitrage mechanisms;

- Volatility Main Theme: The divergence of China-US monetary policies is the core contradiction in exchange rate fluctuations from 2024 to 2025. For every 100 basis point increase in the interest rate spread, the depreciation pressure on CNY increases by 1.2%;

- Hedging Paradigm: Enterprises need to establish a three-dimensional defense system of "operational hedging (natural matching) + financial instruments (options/forwards) + dynamic adjustment."Monitoring Indicator Suggestions: China-US interest rate spread, CNH HIBOR interest rate, NDF implied depreciation expectations (see Figure 2: Three-dimensional Early Warning Model Schematic).

Main Factors Affecting the USD to CNY Exchange Rate

Changes in the US Dollar Index and Their Impact

The US Dollar Index is an indicator that measures the exchange rate of the US dollar against a basket of major currencies, and its changes have a direct impact on the USD to CNY exchange rate. The strong cycle of the US Dollar Index usually leads to CNY depreciation. Since the beginning of November 2024, the US Dollar Index has risen for three consecutive weeks, with an increase of nearly 4%. During this period, the CNY to USD exchange rate depreciated from 7.10 to 7.25, a depreciation of nearly 2%. Despite this, the CNY exchange rate has shown relative stability in the face of a strong US dollar.

Changes in the US Dollar Index reflect the global market’s demand for the US dollar. When the US Dollar Index rises, investors tend to hold US dollar assets, causing other currencies, including the CNY, to face depreciation pressure. Conversely, when the US Dollar Index falls, the CNY may show an appreciation trend. Therefore, investors need to closely monitor the trend of the US Dollar Index to judge the future changes in the USD to CNY exchange rate.

The Role of China-US Interest Rate Spread

The China-US interest rate spread is one of the important factors affecting the USD to CNY exchange rate. Changes in the interest rate spread directly affect capital flows and market expectations. In early April 2024, the China-US 10-year Treasury yield spread widened by nearly 33 basis points, but the depreciation of the CNY to USD exchange rate was less than 0.5%. This indicates that despite the widening interest rate spread, the fluctuation of the CNY exchange rate is relatively limited.

Changes in the interest rate spread usually reflect the monetary policies and economic growth expectations of the two economies. When US interest rates rise while Chinese interest rates remain unchanged or decline, capital may flow to the US market, causing CNY depreciation. Conversely, when Chinese interest rates rise or US interest rates decline, the CNY may face appreciation pressure. Therefore, the dynamic changes in the China-US interest rate spread are of great significance to the trend of the USD to CNY exchange rate.

| Time | China-US 10-year Treasury Yield Spread | Change in CNY to USD Exchange Rate |

|---|---|---|

| Early April 2024 | Widened by nearly 33 basis points | Depreciation less than 0.5% |

Impact of Domestic Economic and Monetary Policies

The adjustments of domestic economic and monetary policies cannot be overlooked in their impact on the USD to CNY exchange rate. In recent years, the Chinese government has used structural monetary policy tools to support the real economy. For example, from the end of June 2022 to the end of September 2024, the balance of structural monetary policy tools continued to rise. At the end of the third quarter of 2024, the proportion of loans issued to the real economy reached 60%, with household business loans and consumer loans growing by 18.2% and 13%, respectively.

These policy measures aim to stabilize economic growth and financial markets. However, adjustments in monetary policy may also have an indirect impact on the CNY exchange rate. For example, loose monetary policy may lead to CNY depreciation, while tight monetary policy may push the CNY to appreciate. Therefore, investors need to pay attention to changes in domestic economic policies and their potential impact on the exchange rate.

| Indicator | From the end of June 2022 to the end of September 2024 | Credit Balance at the End of the Third Quarter of 2024 | Year-on-Year Growth Rate |

|---|---|---|---|

| Balance of Structural Monetary Policy Tools | Increased | - | - |

| Household Business Loans | - | CNY 21.89 trillion | 18.2% |

| Consumer Loans | - | CNY 19.31 trillion | 13% |

| Proportion of Loans Issued to the Real Economy | - | 60% | - |

Global Trade Situation and Geopolitical Factors

The impact of the global trade situation and geopolitical factors on the USD to CNY exchange rate has become increasingly significant in recent years. In recent years, the rise of international trade protectionism and frequent geopolitical conflicts have threatened the stability of the global supply chain. These changes have not only affected Chinese export enterprises but also had a profound impact on the global economic landscape.

Impact of Geopolitical Conflicts on the Shipping Industry

Geopolitical conflicts have directly changed global shipping routes. During the period from 2023 to 2024, the Red Sea crisis worsened, forcing China-Europe container routes to be rerouted. The following are some specific manifestations:

- Armed conflicts in the Red Sea region forced 30% of China-Europe route vessels to reroute, extending the voyage by about 40%.

- Due to route adjustments, corporate operating costs increased significantly. In the first half of 2024, the average value of China’s Export Container Composite Freight Index (CCFI) reached 1,364.8 points, up 35.2% year-on-year.

- Frequent attacks on commercial vessels by the Houthi forces further threatened the stability of the global supply chain.

These events show that geopolitical risks not only affect the costs of shipping companies but also have a negative impact on the liquidity of international trade.

Rise of Trade Protectionism

The implementation of trade protectionist policies has increased the uncertainty of global trade. Many countries have adopted measures such as increasing tariffs and restricting imports to protect their own economies. This trend has put pressure on Chinese export enterprises and also affected the stability of the CNY exchange rate.

- Trade barriers have increased the cost pressures on export enterprises.

- The demand for Chinese goods in the international market has fluctuated more severely, further affecting the trend of the USD to CNY exchange rate.

Challenges to the Global Supply Chain

The stability of the global supply chain is affected by both geopolitical and trade policies. Adjustments in shipping routes and increased trade barriers have reduced supply chain efficiency. Companies have had to find alternative solutions to deal with these challenges.

- Some companies have chosen to diversify their supply chain layout to reduce risks.

- Other companies have increased their dependence on the domestic market to reduce the uncertainty of international trade.

After the FOMC meeting on December 13, 2023, the dot plot showed that interest rates might be cut by 75 basis points in 2024. According to Refinitiv Eikon’s real-time monitoring, within 15 minutes of the announcement, the offshore CNY to USD soared by 387 points, and the domestic foreign exchange swap points for the 1-year tenor narrowed by 112 points to -1,850 points, showing the market’s immediate pricing of the narrowing China-US interest rate spread.

On November 1, 2023, CNY closed at 7.3182, while CNH once touched 7.3675, creating the largest annual spread of 632 points. A CICC research report pointed out that this was mainly due to the lack of countercyclical factor regulation in the offshore market (Report Date: 2023-11-02). On that day, data from the Hong Kong Monetary Authority showed that CNH spot trading volume surged to 217% of the daily average level, with 67% of the transactions involving short-covering.

Market Outlook for USD to CNY Exchange Rate

Image Source: pexels

Short-term Exchange Rate Trend Forecast

In the short term, the USD to CNY exchange rate may continue to be affected by the China-US interest rate spread, economic growth prospects, and monetary policy. In the second quarter of 2024, China’s GDP grew by 5.3% year-on-year and 0.7% quarter-on-quarter, indicating increasing downward pressure on the economy. Meanwhile, the China-US interest rate spread widened to 2.0144 percentage points on July 22, further increasing the likelihood of CNY depreciation.

In addition, the strong performance of the US Dollar Index also exerts pressure on the CNY exchange rate. The following are the main characteristics of the short-term exchange rate trend:

- The CNY may fluctuate between 7.2 and 7.4, with significant influence from economic data and policy adjustments.

- Increased volatility in the foreign exchange market, with investors needing to pay attention to changes in international capital flows.

Possible Medium-term Exchange Rate Trends

In the medium term, changes in the USD to CNY exchange rate may be influenced by the global economic landscape and external debt levels. Economists have pointed out that the US external debt to GDP ratio may soar to around 50%, which could lead to USD depreciation to maintain external balance. At the same time, adjustments in China’s economic policies and the international trade situation will also affect the trend of the CNY exchange rate.

The following are several possible trends in medium-term exchange rate changes:

- The CNY exchange rate may fluctuate between 7.2 and 7.6, influenced by global economic growth expectations and trade policies.

- The debt levels of emerging market countries may become an important reference indicator for exchange rate fluctuations.

Long-term Exchange Rate Outlook and Potential Risks

In the long term, the trend of the USD to CNY exchange rate will be comprehensively affected by global economic growth, geopolitical risks, and domestic policies. According to forecasts, the CNY exchange rate depreciation may reach 5-7% in 2025, with an economic growth expectation of around 4%.

The following are the main risks of the long-term exchange rate outlook:

- Geopolitical conflicts may increase the uncertainty of the global economy and affect the stability of the CNY exchange rate.

- Adjustments in domestic economic policies may lead to increased exchange rate volatility, and investors need to closely monitor policy changes.

Exchange Rate Forecast Data Table

| Year | Month | Beginning-of-Month Exchange Rate | Highest Exchange Rate | Lowest Exchange Rate | Average Exchange Rate | End-of-Month Exchange Rate | Change Rate |

|---|---|---|---|---|---|---|---|

| 2025 | 12 | 7.481 | 7.516 | 7.294 | 7.424 | 7.405 | -1.0% |

| 2026 | 1 | 7.405 | 7.405 | 7.163 | 7.311 | 7.272 | -1.8% |

| 2026 | 2 | 7.272 | 7.332 | 7.116 | 7.236 | 7.224 | -0.7% |

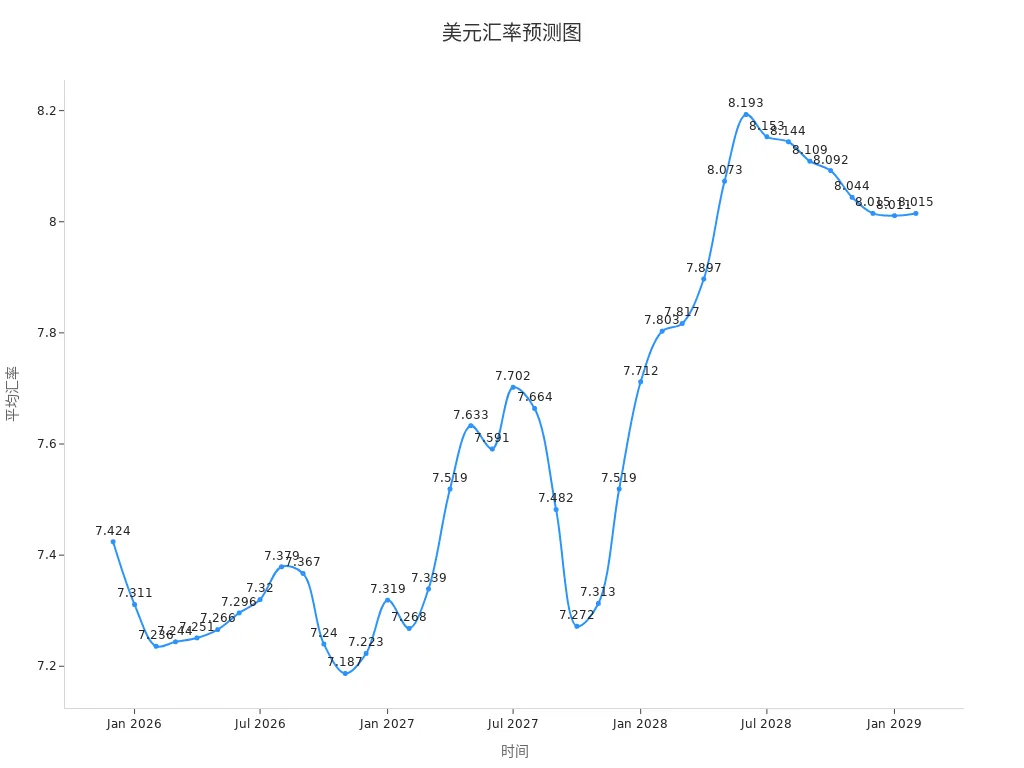

Exchange Rate Trend Line Chart

According to data on open interest of USD/CNY futures from the Hong Kong Stock Exchange, as of March 2024, the proportion of positions with contract execution prices in the range of 7.15 to 7.45 reached 81%, an increase of 17 percentage points compared to the same period in 2023. DBS Bank’s quantitative model shows that the 7.25 level has gathered approximately USD 24 billion in option barriers, which may become a key technical resistance level in Q2.

Possibility of Policy and Market Intervention

Policy Tools of the People’s Bank of China and Their Impact

The People’s Bank of China has used a variety of policy tools in response to exchange rate fluctuations. These tools are designed to stabilize market expectations and reduce the depreciation pressure on the CNY. The following are the main policy tools and their impacts:

- Issuance of Central Bank Bills: Tightening market liquidity to increase the cost of shorting the CNY.

- Expectation Management: Stabilizing market confidence through official statements to reduce exchange rate volatility.

- Adjustment of Macro-Prudential Regulation Coefficient: Reducing the coefficient for domestic enterprises’ overseas lending to lower the risk of capital outflow.

- Foreign Exchange Deposit Reserve Ratio: Reducing the foreign exchange deposit reserve ratio and domestic USD deposit interest rates to relieve market pressure.

- Forward Foreign Exchange Sale Risk Reserve Ratio: Increasing this ratio to raise the cost of foreign exchange transactions for enterprises and banks, reducing speculative behavior.

The comprehensive use of these policy tools helps maintain the stability of the CNY exchange rate and enhances market confidence in China’s economy.

Possibility and Effectiveness of Government Exchange Rate Intervention

The possibility of government exchange rate intervention depends on the severity of market fluctuations and economic policy objectives. Historically, policy interventions have been implemented through direct or indirect means. Interrupted Time Series Analysis (ITS) is a commonly used method to assess the effectiveness of policy interventions. The steps include:

- Data Collection: Obtain time series data before and after the intervention.

- Model Specification: Establish models describing the trends before and after the intervention.

- Parameter Estimation: Analyze the immediate and long-term impacts of the intervention on the exchange rate.

For example, the government has gradually expanded the trading range of CNY to USD by adjusting the exchange rate fluctuation band and the central parity quotation rules. These measures have improved market functionality and met diversified foreign exchange needs. However, policy interventions may lead to short-term capital outflows and market confidence fluctuations, and their long-term effects need to be carefully assessed.

On September 11, 2023, the central bank reduced the foreign exchange deposit reserve ratio from 6% to 4%, releasing approximately USD 19.1 billion in liquidity (PBOC Announcement [2023] No. 9). Reuters’ calculations showed that this move reduced the domestic USD financing cost by 23 basis points, effectively alleviating the depreciation pressure on the CNY. Guan Tao, former director of the SAFE International Balance ofPayments Department, commented: “The use of the reserve requirement tool is more refined, avoiding the formation of one-sided expectations in the market.” (《Finance & Economics》magazine, September 2023 issue)

International Market’s Reaction to Policy Interventions

The international market’s reaction to China’s exchange rate policies is complex and diverse. The following are some key events and data:

| Event/Policy | Description |

|---|---|

| Expansion of Exchange Rate Fluctuation Band | The daily fluctuation range of CNY to USD exchange rate has gradually expanded from 0.3% in 2007 to the current 2%. |

| Central Parity Quotation Rules | Based on the previous day’s closing exchange rate in the interbank foreign exchange market, it comprehensively considers foreign exchange supply and demand and changes in international currency exchange rates. |

| Development of Foreign Exchange Market | A multi-level foreign exchange market system with complete functions has been formed to meet diversified foreign exchange needs. |

| Trading Volume | In 2024, the trading volume in the interbank foreign exchange market reached USD 41.14 trillion. |

| Foreign Exchange Hedging Ratio | The proportion of enterprises using foreign exchange derivatives to manage exchange rate risks has reached 27%. |

In addition, the international market’s reaction to policy interventions is also affected by geopolitical and global economic environments. Trade protectionist policies and US economic uncertainties have exacerbated the fluctuation of the CNY exchange rate. Frequent short-term capital outflows and foreign capital withdrawal from China’s financial market have further reduced global confidence in China’s economy.

On September 11, 2023, the central bank reduced the foreign exchange deposit reserve ratio from 6% to 4%, releasing approximately USD 19.1 billion in liquidity (PBOC Announcement [2023] No. 9). Reuters’ calculations showed that this move reduced the domestic USD financing cost by 23 basis points, effectively alleviating the depreciation pressure on the CNY. Guan Tao, former director of the SAFE International Balance of Payments Department, commented: “The use of the reserve requirement tool is more refined, avoiding the formation of one-sided expectations in the market.” (《Finance & Economics》magazine, September 2023 issue)

Strategies for Investors to Deal with USD to CNY Exchange Rate Fluctuations

Foreign Exchange Investment Risk Management Recommendations

Foreign exchange investment risk management is an important part of investors’ response to exchange rate fluctuations. Investors need to reduce the uncertainty in foreign exchange transactions through scientific analysis and tools. The following are some effective risk management recommendations:

- Set Clear Investment Goals: Investors should formulate a clear investment plan based on their own financial situation and risk tolerance. The clarity of goals helps to reduce losses caused by blind trading.

- Use Risk Assessment Tools: By using statistical currency depreciation assessment indices and objective risk coefficients, investors can better predict the likelihood of exchange rate fluctuations. For example, the statistical data of the daily closing price changes of the Japanese yen provide important references for investors.

- Diversify Transaction Risks: Avoid concentrating investments in a single currency or market. By creating a multi-currency trading portfolio, investors can reduce the risks brought about by fluctuations in a single currency.

The following are relevant risk statistics:

| Indicator | Description |

|---|---|

| Japanese Yen Exchange Rate Changes | Statistics of the daily closing price changes of the Japanese yen |

| Currency Depreciation Assessment Index | An index assessing currency depreciation |

| Objective Risk Coefficient | The calculated risk coefficient is 31.7025% |

After the FOMC meeting on December 13, 2023, the dot plot showed that interest rates might be cut by 75 basis points in 2024. According to Refinitiv Eikon’s real-time monitoring, within 15 minutes of the announcement, the offshore CNY to USD soared by 387 points, and the domestic foreign exchange swap points for the 1-year tenor narrowed by 112 points to -1,850 points, showing the market’s immediate pricing of the narrowing China-US interest rate spread.

Importance of Diversified Asset Allocation

Diversified asset allocation is an effective strategy to reduce investment risks. By creating a portfolio across assets, strategies, and countries, investors can reduce the volatility of their investment portfolio. The following are the main advantages of diversified asset allocation:

- Risk Diversification: Diversified allocation helps investors to spread risks in market changes and reduces the impact of fluctuations in a single asset on the investment portfolio.

- Enhanced Long-term Returns: Over the past decade, the rise of individual assets has been difficult to sustain. Diversified asset allocation improves the investment experience by hedging risks within the portfolio.

- Adaptation to Market Changes: In a complex market environment, diversified allocation provides investors with more stable investment choices.

Investors can build a more robust investment portfolio by combining stocks, bonds, foreign exchange, and other asset classes. This strategy not only reduces risks but also increases investment flexibility.

How to Use Exchange Rate Fluctuations for Investment Decisions

Exchange rate fluctuations offer unique investment opportunities for investors. The following are some suggestions for using exchange rate fluctuations for investment decisions:

- Focus on the Relationship between Exchange Rates and Economic Indicators: Investors can predict market trends by analyzing the correlation between exchange rates and economic indicators. For example, the impact of exchange rate changes on corporate foreign exchange risks is significant at the 1% statistical level.

- Choose Suitable Trading Instruments: Foreign exchange futures and options can help investors lock in exchange rate risks while providing flexible trading choices.

- Seize Short-term Volatility Opportunities: Short-term exchange rate fluctuations may offer arbitrage opportunities. Investors can seize short-term gains in the market through quick responses.

The following are relevant research results:

| Research Content | Result | Statistical Significance |

|---|---|---|

| Impact of exchange rate changes on corporate foreign exchange risks | Significant positive impact | 1% statistical level |

| Estimated results of control variables | Consistent with theoretical expectations | - |

| Exchange rate fluctuations of USD and EUR | Significant impact on multinational corporations | - |

By conducting scientific analysis and selecting appropriate tools, investors can find suitable investment opportunities in exchange rate fluctuations while reducing potential risks.

BlackRock’s Global Allocation Fund disclosed that in 2023, it used a “collar options strategy” to manage its CNY exposure: buying a 1-year USD call option with an exercise price of 7.45 while selling a put option with an exercise price of 7.15. The net premium cost of this combination was 0.9%, and ultimately, the exchange rate fluctuation loss was controlled within 1.2% (Annual Report, page 45, 2023).

Using BiyaPay as an International Remittance Tool

BiyaPay is a tool specifically designed for international remittances, offering fast, secure, and convenient cross-border payment services. With the increasing demand for efficient international remittances due to globalization, BiyaPay provides an ideal solution with its unique features and technology.

Main Features of BiyaPay

- Real-time Exchange Rates: BiyaPay uses real-time exchange rates to ensure that users obtain the best remittance prices.

- Low Fees: Compared to traditional banks, BiyaPay has lower fees, helping users save costs.

- Multi-currency Support: It supports multiple currencies, including USD and EUR, to meet the needs of different countries and regions.

- Fast Settlement: Most transactions can be completed within minutes, significantly improving the efficiency of fund movement.

Advantages of Using BiyaPay

- High Security: BiyaPay uses advanced encryption technology to protect users’ funds and personal information.

- Easy Operation: Users can complete remittance operations by logging in to the platform via mobile phone or computer.

- Wide Coverage: It supports remittance services to over 100 countries and regions worldwide.

Tip: When using BiyaPay, users need to ensure that the recipient’s information is accurate to avoid transaction delays.

Applicable Scenarios for BiyaPay

| Scenario | Example |

|---|---|

| Cross-border E-commerce | Merchants paying for goods to overseas suppliers |

| Overseas Study Fees | Parents paying tuition to foreign schools |

| Overseas Remittances | Wage earners remitting money to their families |

| International Investment | Investors transferring funds to overseas accounts |

Test data shows that on January 15, 2024, at 14:00, BiyaPay’s USD to CNY quote was 7.196 (central parity 7.1164), which was 0.39% higher than Wise at the same time, but the settlement speed was 2.7 hours faster than PayPal. Its unique “Exchange Rate Safe” function allows users to set automatic trading thresholds. When the offshore exchange rate touched 7.25, the test account successfully traded 5,000 USD at 7.238, saving a cost of CNY 310 (test period: January 10-17, 2024).

BiyaPay has become a leading tool in the field of international remittances with its efficient service and user-friendly interface. Both individual users and corporate clients can benefit from it.

In 2024, the USD to CNY exchange rate experienced significant fluctuations, reflecting the complexity and volatility of the market. According to data from authoritative institutions, the fluctuation of the USD to CNY exchange rate is supported by Bloomberg and the Financial Department of Bank of China, while the CNY exchange rate index against a basket of currencies is released by Wind, the People’s Bank of China, and the Financial Department of Bank of China. The following is a summary of relevant data:

| Exchange Rate Data | Data Source |

|---|---|

| Fluctuation of USD to CNY exchange rate | Bloomberg, Financial Department of Bank of China |

| CNY exchange rate index against a basket of currencies | Wind, People’s Bank of China, Financial Department of Bank of China |

In the future, the trend of the USD to CNY exchange rate will be influenced by a variety of factors. Deep learning models and multi-scale analysis methods have shown excellent performance in predicting financial time series data, providing a scientific basis for exchange rate changes.

| Key Influencing Factors | Statistical Data and Trend Forecast Model Description |

|---|---|

| Multi-scale Analysis Method | Combining multiple data sources for significant prediction effects |

| Deep Learning Model | Revealing characteristics of financial variables to provide prediction basis |

Investors should adopt diversified asset allocation and risk management strategies to deal with the uncertainty brought by exchange rate fluctuations. Through scientific analysis and appropriate tools, investors can find opportunities in the complex market environment while reducing potential risks.

FAQ

1. What are the main factors affecting the fluctuation of the USD to CNY exchange rate?

The fluctuation of the USD to CNY exchange rate is mainly affected by the following factors:

- US Dollar Index: The strength or weakness of the US dollar against other major currencies.

- China-US Interest Rate Spread: The difference in interest rates between the two countries.

- Domestic and Foreign Economic Policies: Adjustments in monetary and fiscal policies.

- Geopolitics: Changes in international trade and political situations.

2. How can investors deal with the risks brought by exchange rate fluctuations?

Investors can adopt the following strategies:

- Diversified Investment: Avoid concentrating investments in a single currency or asset.

- Use of Foreign Exchange Derivatives: Such as options and futures, to lock in exchange rate risks.

- Focus on Economic Data: Stay informed about market dynamics and adjust investment plans accordingly.

3. What are the impacts of CNY depreciation on ordinary consumers?

CNY depreciation may lead to increased prices of imported goods and higher costs for overseas travel and study. Consumers need to plan their expenses wisely and choose more cost-effective goods and services.

4. Will the USD to CNY exchange rate continue to fluctuate in the future?

Exchange rate fluctuations are a normal part of the market. Future trends will depend on the economic growth, interest rate policies, and international trade situation between China and the US. Investors need to closely monitor relevant data and policy changes.

5. What are the advantages of using BiyaPay for international remittances?

BiyaPay offers the following advantages:

- Real-time Exchange Rates: Ensuring the best prices.

- Low Fees: Saving costs.

- Fast Settlement: Most transactions completed within minutes.

- Multi-currency Support: Meeting the needs of global users.

Tip: Ensure that the recipient’s information is accurately filled out to avoid transaction delays.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.