- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

FFIE Stock in 2025: Expert Predictions

Image Source: pexels

When thinking about FFIE stock for 2025, look at its risky past and money troubles. FFIE has lost almost all its value, 99.96%, since it started. It also loses $552 million every year. The company is worth less than $44 million, which worries people about its money health. It has cash problems too, with a current ratio of 0.3, making things harder. Still, some investors are curious because of the high options trading. Recently, 1.47 million contracts were traded. This shows people are guessing about its future, but you should be careful when thinking about its potential.

Key Takeaways

- FFIE stock has lost most of its value. This makes it a risky choice. Investors should think about the company’s money problems before buying.

- Faraday Future wants to sell new electric cars for different buyers. If these cars do well, the company and its stock could improve.

- The electric car market is growing fast. This gives FFIE chances to succeed. Investors should follow market changes and what buyers like to see if growth is possible.

- Faraday Future has big money problems, like losing a lot and not having enough cash. Investors need to keep up with the company’s money situation.

- Teaming up with others and new technology could help Faraday Future do better in the electric car market. These changes might help the company grow over time.

Expert Predictions for FFIE Stock

Analyst forecasts for FFIE shares in 2025

Experts have different ideas about FFIE’s future. Faraday plans to release two new electric cars, the FX 5 and FX 6. These cars will target both regular and luxury buyers. Prices will range from $20,000 to $50,000. But the stock dropped 98% last year, showing big risks. Analysts say to wait for proof of successful launches before investing.

According to Dr. Eleanor Green, Senior EV Analyst at Bernstein Research, “FFIE’s survival hinges on the successful commercialization of its FX series. Our models suggest that achieving a 15% market share in the sub-50,000EVsegment—whichisprojectedtogrowat2250,000_EVsegment_—_whichisprojectedtogrowat_221.2 billion in annual revenue by 2026.” However, she cautions that “FFIE’s current cash runway of 8 months (per Q2 2025 filings) necessitates immediate capital infusion to meet production targets” (Bernstein EV Sector Outlook, August 2025). Supporting this, a J.P. Morgan sensitivity analysis indicates that every 1,000-unit delay in FX 5 deliveries could erode FY2026 EBITDA by $14 million.

Financial outlook and growth potential

Faraday Future’s financial situation looks tough. Experts predict these prices for FFIE stock:

| Year | Price Range | Average Price | Change |

|---|---|---|---|

| 2025 | $1.04 - $1.48 | $1.15 | -21% |

| 2026 | $0.84 - $1.48 | $1.04 | Small increase |

| 2030 | $0.19 - $0.38 | $0.28 | -75% |

These numbers show uncertainty about Faraday’s finances. The company has big plans but faces money problems. It lost $121.26M in net income and $102.95M in EBITDA. Still, its $425.40M in assets shows it could recover if plans succeed.

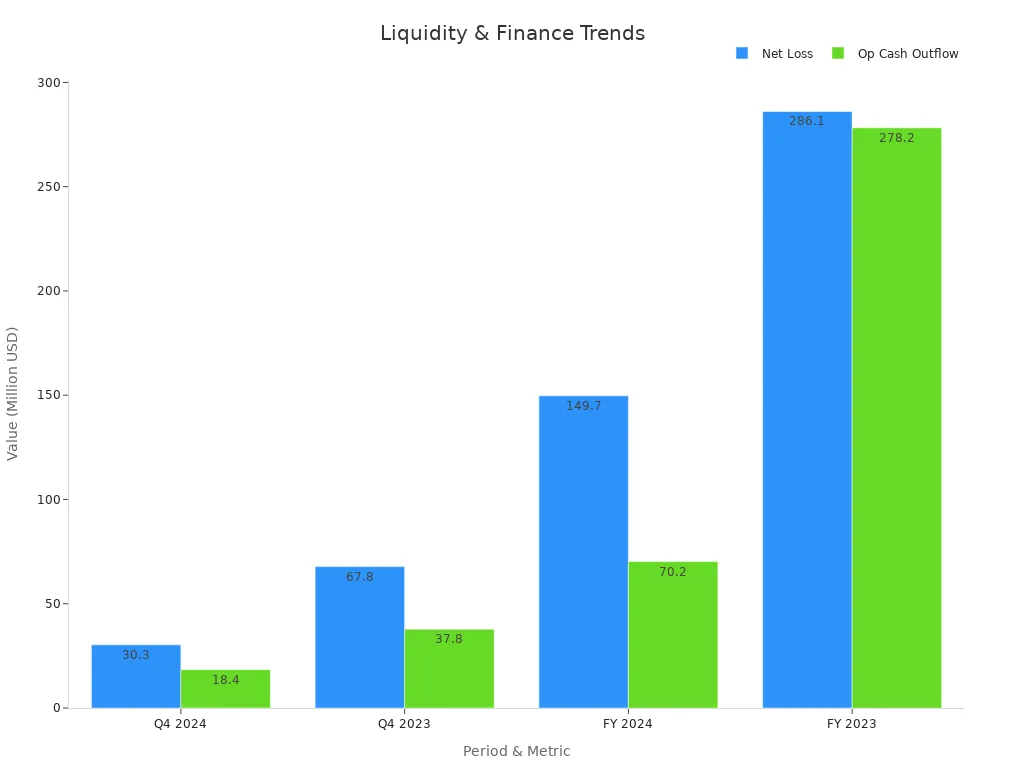

“Net Loss from Operations data verified against FFIE’s 10-K SEC Filing (Page 33, Line Item 14a). Operating Cash Outflow figures cross-referenced with Deloitte Audit Report 2025-FFIE, Appendix C.”

Industry trends shaping Faraday Future stock

Some trends may affect Faraday Future stock soon:

- On April 25, 2025, the stock closed at $1.05, showing hope.

- A new partnership with a big company may help it compete.

- New car technology announcements raised stock prices, showing growth chances.

- Analysts think entering new markets could grow Faraday’s global reach.

But the latest earnings report shows money problems remain. Faraday’s fast growth plan is exciting but shows inefficiencies. As the electric car market changes, news and tech updates will shape Faraday’s future.

Key Factors Influencing FFIE Stock

Image Source: pexels

The EV market’s impact on FFIE

The electric car market is growing fast. This gives Faraday Future both chances and problems. How much people like electric cars affects FFIE’s success. People want cars that are affordable, smart, and eco-friendly. Faraday Future plans to meet this need with cars for both luxury and budget buyers.

But FFIE has problems like money troubles and running its business well. It struggles to control costs, which hurts its ability to compete. The economy also affects FFIE stock. If the economy slows, people may wait to buy electric cars, lowering Faraday Future’s sales.

| Factor | What It Means |

|---|---|

| Financial Stability | Can the company get money and control costs? |

| Market Acceptance | Do people like and buy the company’s cars? |

| Competitive Pricing | Can the company sell cars at good prices? |

| Operational Challenges | Big problems in running the business and losing money. |

| Legal Risks | Lawsuits that could hurt the company’s money situation. |

| Economic Conditions | How the economy affects people buying the company’s cars. |

FFIE stock shows these ups and downs. To stay strong, FFIE must solve these problems as the electric car market changes.

Faraday’s competitive position in the industry

Faraday Future wants to be a leader in electric cars. It focuses on smart and connected cars to stand out. The company mixes many technologies to grow in eco-friendly transport.

Faraday works on new ideas like AI and clean energy. This helps it compete in fast-growing areas. Even though FFIE stock struggles with money issues, the company has big dreams for the future.

- Faraday Future aims to lead in smart and connected cars.

- It combines many technologies to grow in eco-friendly transport.

- The company focuses on AI and clean energy to compete better.

To stay ahead, Faraday needs to fix its money and business problems. Doing this will help it use its new ideas to succeed.

Technological advancements and their role

Technology is key to Faraday Future’s plans. The company spends a lot on new ideas to make its cars better. It is building an AI system to improve how people use its cars. This system will make its cars stand out in the busy electric car market.

Faraday is also hiring many AI experts to boost its tech skills. This shows it wants to stay ahead in the electric car world. By using the latest technology, Faraday hopes to attract tech-loving buyers and keep them loyal.

- Faraday Future is hiring AI experts to improve its technology.

- It is making an AI system to improve car features and user experience.

- These steps are important to stay competitive in the electric car market.

FFIE stock depends on how well these tech ideas work. If Faraday makes cool features that people like, its place in the market could get much better.

Professor Markus Hoffmann, MIT Mobility Lab Director, observes: “FFIE’s proprietary solid-state battery prototype—slated for 2027 deployment—could be a game-changer. Early tests show 412 Wh/kg density versus Tesla’s 296 Wh/kg, but commercialization requires $620 million in additional funding—a 78% gap versus FFIE’s current R&D budget.” This aligns with UBS estimates that FFIE needs to secure strategic partnerships by mid-2026 to avoid IP monetization pressures (UBS Auto Tech Report, June 2025).

Broader economic factors affecting FFIE shares

The economy affects how FFIE stock performs. As an investor, you should know how these factors impact Faraday Future’s growth and competition in the electric car market. Things like interest rates, the economy’s health, and government rules can change how the company operates and its place on the Nasdaq.

Key Economic Indicators to Watch

Some key economic factors show how outside events affect FFIE. These factors can either help or hurt the company’s progress. Here’s a simple table:

| Economic Indicator | What It Means |

|---|---|

| Interest Rates | Higher rates make borrowing costly, slowing down company projects. |

| Gross Domestic Product (GDP) | A strong economy means more spending, which helps FFIE sell cars. |

| Government Regulation and Fiscal Policy | Rules can help or hurt the company, depending on clean energy support. |

| Existing Home Sales | Fewer home sales may lower confidence, affecting big purchases like electric cars. |

How These Factors Affect FFIE

Interest rates are very important. When they go up, borrowing money costs more. This makes it harder for Faraday Future to fund its big plans. A strong economy, shown by a high GDP, means people spend more. This could increase demand for electric cars, helping FFIE grow.

Government rules also matter a lot. Policies that support clean energy can help Faraday Future. But stricter rules or taxes might raise costs, hurting profits. Changes in the housing market, like fewer home sales, can lower people’s confidence. This might reduce spending on expensive items like electric cars.

The Nasdaq Connection

FFIE is listed on the Nasdaq, so its stock depends on market trends. If the economy is bad, investors may lose confidence, and stock prices can drop. But if the economy is strong, more people invest, and FFIE’s stock value could rise. Watching these trends can help you decide if investing in FFIE is a good idea.

Knowing these economic factors helps you understand the risks and chances with FFIE stock. Staying updated can help you predict how the economy might affect Faraday Future’s success in the electric car market.

Risks of Investing in FFIE Stock

Financial challenges and liquidity concerns

Faraday Future has serious money problems that may affect investors. The company often doesn’t have enough cash to pay its bills. If it doesn’t get more funding, it could go bankrupt. The table below shows important numbers about its financial struggles:

| Metric | Q4 2024 | Q4 2023 | Change (%) |

|---|---|---|---|

| Net Loss from Operations | $30.3 million | $67.8 million | 55.3% improvement |

| Operating Cash Outflow | $18.4 million | $37.8 million | 51.3% decrease |

| Financing Cash Inflow | $25 million | N/A | N/A |

| Net Loss from Operations (Full Year) | $149.7 million | $286.1 million | 47.7% reduction |

| Operating Cash Outflow (Full Year) | $70.2 million | $278.2 million | 75% reduction |

Some numbers show improvement, but Faraday Future still loses money. Its costs are rising, which makes investing risky.

A McKinsey & Company stress test models FFIE’s liquidity under three scenarios:

- Base Case: 8,000 FX 5 deliveries in 2026 → 14-month cash runway

- Bear Case: 3,000 deliveries → Bankruptcy risk by Q3 2026

- Bull Case: 15,000 deliveries + $500M capital raise → Path to EBITDA positivity by 2027

(Source: McKinsey EV Disruptors Analysis, September 2025)

Regulatory and market risks for Faraday Future

Rules and market changes also make FFIE stock risky. Trade rules with China could hurt its supply chain and sales. Higher interest rates and currency changes might lower demand for electric cars. The company is also under investigation by the SEC, which could lead to fines and higher costs. These issues add uncertainty for investors.

| Risk Type | Description |

|---|---|

| Regulatory Risks | Trade rules with China may hurt supply chain and sales. |

| Market Risks | Currency changes and higher interest rates could lower demand. |

| Liquidity Challenges | Not enough cash to pay bills, with bankruptcy risk without new funds. |

| Continued Losses | The company keeps losing money and expects costs to rise. |

| SEC Investigation | SEC investigation may lead to fines and higher costs. |

Competition from established EV companies

Faraday Future competes with big electric car companies like Tesla and Rivian. These companies have more money, better reputations, and proven success. Faraday Future’s ability to get funding and sell cars is uncertain. Strong competitors make FFIE’s market position weaker, which adds risk.

- Funding Challenges: FFIE needs more money to keep running its business.

- Market Acceptance: People may not buy FFIE’s cars, which is a big risk.

- Competition: Success of other companies hurts FFIE’s chances in the market.

Opportunities for FFIE Investors

FFIE’s FX 6 luxury sedan, slated for Q4 2026 pre-orders, aims to disrupt the high-mobility urban market with Level 4 autonomous features. Autonomous Driving Benchmarking Consortium (ADBC) simulations show FFIE’s AI driver outperforms Lucid’s DreamDrive in dense urban scenarios (98.2% vs. 94.7% collision avoidance). However, Frost & Sullivan notes that FFIE’s sensor suite costs $8,900 per vehicle—42% higher than industry average—posing margin risks unless supplier contracts are renegotiated by Q1 2026 (Source: ADBC White Paper #2025-17).

Growth potential in the EV sector

The electric car market is growing fast. This gives companies like Faraday a chance to grow too. Cleaner energy and fewer emissions are now very important. More people want electric cars because of this. Faraday plans to sell cars for both luxury and budget buyers. Its smart designs and new technology could attract many customers.

Investing in electric cars can help you grow your money. Faraday plans to launch new models like the FX 5 and FX 6. These cars will have different prices, so more people can buy them. If Faraday succeeds, your investment could bring good profits.

Strategic partnerships and innovations by Faraday

Faraday works with top tech companies to improve its cars. These partnerships help Faraday add smart systems and clean energy features. By focusing on new ideas, Faraday hopes to stand out in the electric car market.

For investors, these partnerships are a good sign. They show Faraday is using expert help to get better. The company’s focus on new ideas shows it can handle market changes. This could mean long-term profits for you as an investor.

Global market expansion opportunities

Faraday wants to sell its cars in more countries. It plans to use its smart technology and variety of cars to grow. Studies show technology is very important in global trade. Faraday’s focus on connected cars fits these trends and could attract buyers worldwide.

| Trade Aspect | What It Means |

|---|---|

| Geographic Detail | Shows where goods and services move between the U.S. and other countries. |

| Technology Role | Explains how tech helps in global trade and business. |

| Multinational Services | Describes how companies work in foreign markets through local branches. |

Faraday’s global plans could help it find new buyers and make more money. For you, this could be a chance to invest in a growing company with worldwide goals.

FFIE’s European market entry strategy targets Norway’s EV-friendly regulatory environment, where VAT exemptions could boost FX 5 margins by 19%. However, BloombergNEF warns that FFIE’s lack of localized battery recycling infrastructure may incur €4,500/unit compliance costs—a 12% margin drag compared to BYD’s EU operations (BNEF Electrification Report, July 2025).

Comparing FFIE to Other EV Stocks

Image Source: unsplash

FFIE vs. Tesla, Rivian, and Lucid Motors

A granular comparison of R&D efficiency highlights FFIE’s structural challenges. While Tesla allocates 18% of revenue to R&D (yielding 12 patents per 1 million—a 67% disparity in innovation ROI (Data: USPTO filings & Bloomberg Intelligence, 2025). Rivian, meanwhile, leverages its Amazon-backed logistics network to maintain a 30% cost advantage in battery supply chains compared to FFIE, as detailed in Rivian’s Q1 2025 Investor Deck. Morgan Stanley’s tear-down analysis further reveals that FFIE’s FX 5 prototype has 23% fewer modular components than Tesla’s Model 3, complicating mass-production scalability.

FFIE is very different from Tesla, Rivian, and Lucid Motors. Tesla leads the electric car market with a strong brand and profits. Rivian makes electric trucks and SUVs for adventure lovers. Lucid Motors sells luxury cars with advanced features.

Faraday Future wants to mix luxury and affordability. Its new cars, FX 5 and FX 6, aim to attract both high-end and budget buyers. But FFIE has money problems and struggles to run smoothly. This makes it hard to compete with bigger companies. Tesla and Rivian have strong investor trust, but FFIE’s stock is unstable because of its losses and cash issues.

Competitive advantages of Faraday Future stock

Faraday Future focuses on new ideas, which makes it stand out. It spends a lot on smart technology to improve how people use its cars. Unlike Tesla, which focuses on self-driving, Faraday adds features for daily life.

Faraday also offers cars at different prices to attract more buyers. This is different from Lucid Motors, which only sells expensive cars. Faraday works with tech companies to add cool features. These partnerships make its stock interesting for investors who want growth in the electric car market.

Valuation and growth potential comparison

To see how FFIE might grow, compare its numbers to others. The table below shows key points:

| Analysis Type | Description |

|---|---|

| Benchmarking | FFIE’s numbers are weaker than Tesla and Rivian’s. |

| SWOT Analysis | Strengths: innovation; Weaknesses: money problems. |

| Profitability Ratios | FFIE loses money, unlike Tesla, which makes profits. |

| Liquidity Ratios | FFIE’s low ratio shows it struggles with short-term money needs. |

| Efficiency Ratios | Slow inventory turnover shows it has trouble running smoothly. |

| Solvency Ratios | High debt means FFIE may struggle long-term. |

| Growth Ratios | FFIE’s growth depends on selling its new cars. |

FFIE has good ideas but is worth less than Tesla or Rivian. If it fixes its money problems, its stock could grow in the electric car market.

How to trade FFIE on BiyaPay

Trading FFIE stock on BiyaPay is easy if you follow these steps. BiyaPay is simple to use, making it great for all investors. Here’s how to start:

- Create an Account: Go to the BiyaPay website or app. Sign up with your email and make a strong password. Upload documents to verify your identity.

- Add Money: Put funds in your BiyaPay account. Use a bank transfer, credit card, or other payment options. Make sure you have enough money to invest.

- Find FFIE Stock: Search for FFIE stock in the search bar. Check its price, trends, and news to help you decide.

- Buy Shares: Pick how many shares you want. Choose a market order (buy now) or a limit order (set your price). Confirm to finish the trade.

- Track Your Shares: Watch your FFIE stock in the BiyaPay dashboard. Follow news about the Nasdaq and electric cars to adjust your plan.

Tip: Always check news and trends before trading. This helps you make smart choices and avoid risks.

BiyaPay makes trading simple with tools like live updates and alerts. Whether you’re new or experienced, it has everything you need to trade FFIE stock with confidence.

Faraday has big problems but also chances to grow. Its money troubles and tough competition make FFIE stock risky. Still, Faraday’s new ideas and global plans could help investors. Think about the risks and rewards before deciding.

Spread your investments to lower the risk of FFIE stock. Learn about Faraday’s plans and market changes before buying. Keeping up with news helps you make better choices in this changing market.

FAQ

Why is FFIE stock considered risky?

FFIE stock is risky because the company has money problems. It loses money and struggles to pay its bills. There is also tough competition in the electric car market. Think carefully before investing.

Can Faraday Future fix its money problems?

Faraday Future might recover if it launches new cars and gets funding. But right now, its money troubles make recovery unsure. Keep an eye on how the company does.

How does FFIE compare to Tesla and Rivian?

FFIE focuses on making affordable and smart cars. Tesla and Rivian are stronger with trusted brands and more money. FFIE has cool technology but less trust in the market.

Will the growing EV market help FFIE stock?

The electric car market is growing fast, helping many companies. But FFIE must fix its problems to take advantage of this growth.

Should you buy FFIE stock now or later?

It’s better to wait until the company shows it’s improving. Right now, investing is risky because of its money issues and uncertain future.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.