- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Introduction to Options: Bear Call Spread Strategy, Easy for Beginners!

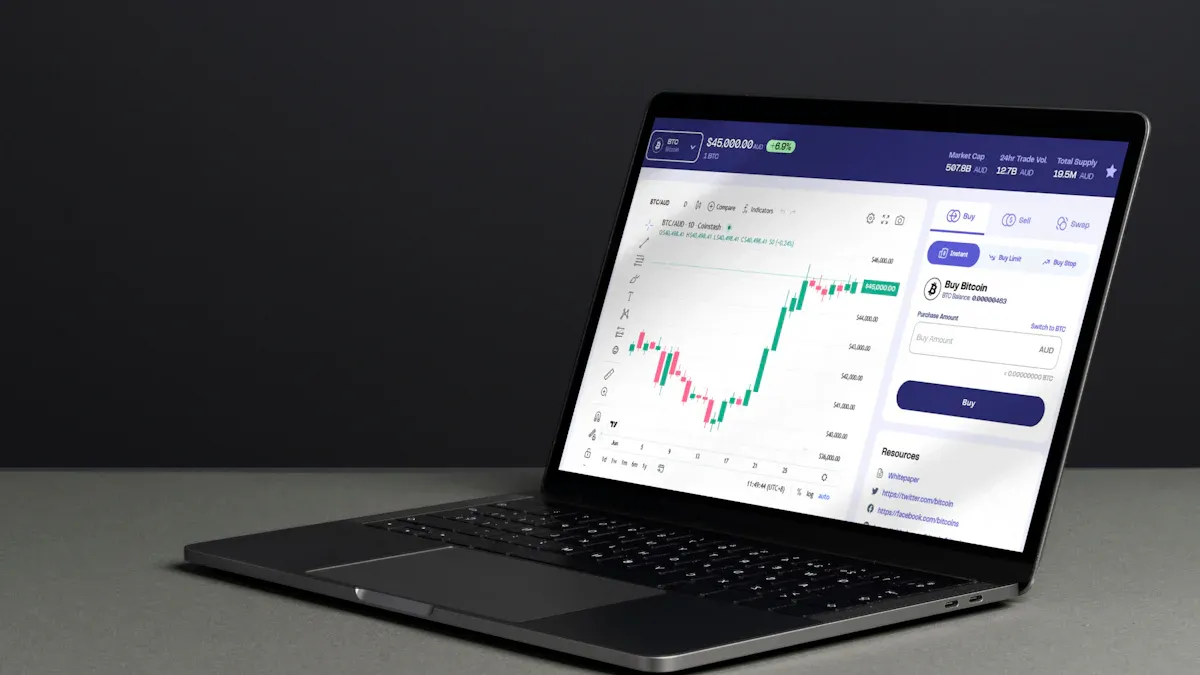

Image Source: unsplash

Are you just starting with options trading and looking for a simple and safe strategy? The Bull Call Spread Strategy can help you achieve risk-controlled investment goals in the U.S. stock market:

- This strategy involves combining call options on the same underlying asset with the same expiration date but different strike prices.

- Many beginners like using this method because it is easy to understand, has limited risk, and offers moderate returns.

| Advantage | Description |

|---|---|

| Limited Risk | Losses are limited to the net premium paid, with the maximum loss known in advance. |

| Lower Upfront Capital | You only need to invest less capital compared to buying a single call option. |

| Suitable for Moderate Bullish Expectations | If you believe the stock price will rise moderately, this strategy is ideal for you. |

Core Points

- The Bull Call Spread Strategy is suitable for beginners, with limited risk, moderate returns, and easy to understand.

- By buying a call option with a lower strike price and selling a call option with a higher strike price, investors can participate in market upside at a lower cost.

- The maximum loss is equal to the net premium paid, allowing investors to know the risk in advance and avoid uncertainty.

- Choosing highly liquid options and appropriate expiration dates can improve the strategy’s execution efficiency.

- Flexibly adjusting the strategy to adapt to different market conditions ensures controlled risk and enhances profitability.

Options Introduction and Bull Call Spread

Strategy Definition

During the early stages of options trading, you often encounter various complex strategies. The Bull Call Spread is a simple, limited-risk combination strategy. You only need to buy a call option with a lower strike price and simultaneously sell a call option with a higher strike price on the same underlying asset. This allows you to gain opportunities for moderate upside with lower costs.

| Component | Description |

|---|---|

| Long Call Option | Buy a call option with a lower strike price. |

| Short Call Option | Sell a call option with a higher strike price. |

| Cost | Establish the strategy with a net debit (net cost). |

| Profit Potential | Profit when the stock price rises, with maximum profit limited by the sold call option’s strike price. |

| Risk | Maximum risk equals the cost of the spread. |

| Ideal Market Expectation | Suitable for markets where moderate stock price increases are expected. |

You can see that this strategy has a clear structure, with all potential outcomes predictable in advance, making it very suitable for those in the early stages of options trading.

Applicable Scenarios

The Bull Call Spread Strategy is most suitable for use in the following market conditions:

- You believe the underlying stock price will rise moderately but with limited upside, possibly approaching a resistance level.

- You want to participate in the U.S. stock market’s upside opportunities at a lower cost instead of directly buying stocks or a single option.

- You want to control risk by selling a call option to offset part of the cost of the purchased option.

Many beginners choose the Bull Call Spread because it has limited risk and reward, with a clear structure. You don’t need to worry about significant losses from sharp market fluctuations. Time decay works in your favor, and as long as the stock price rises to the appropriate range by expiration, you can achieve maximum returns.

Through this strategy, you can seize limited upside opportunities in the U.S. stock market with lower costs and risks. This is why many investors new to options trading prioritize learning and trying the Bull Call Spread.

Strategy Mechanism

Image Source: pexels

The core of the Bull Call Spread Strategy lies in how you combine two call options with different strike prices. You can follow these steps to easily build this strategy and achieve risk-controlled investment goals.

Buying a Lower Strike Price Call Option

You first need to buy a call option with a lower strike price. This step is the foundation of the strategy, as it gives you the right to buy the underlying asset at a lower price in the future. The premium you pay is your initial investment cost.

Here’s a practical example to help you understand:

| Step | Description |

|---|---|

| 1 | Buy a call option with a lower strike price. For example, buy a call option on a U.S. stock with a $45 strike price. |

| 2 | Simultaneously sell a call option with a higher strike price. For example, sell a call option with a $50 strike price. |

| 3 | Calculate the initial cash outlay, typically the price of the lower strike call option minus the price of the higher strike call option. Assume you pay $236. |

| 4 | Calculate the profit and loss, including maximum profit, maximum loss, and break-even point. |

By buying a lower strike price call option, you gain upside potential. This is one of the most common practices in the early stages of options trading. You can clearly know that the maximum loss is the premium you paid.

Selling a Higher Strike Price Call Option

Your next step is to sell a call option with a higher strike price. This action helps you reduce the overall cost while capping the maximum profit. The premium you receive offsets part of the cost of the purchased option.

| Risk/Reward | Description |

|---|---|

| Maximum Loss | Limited to the net premium paid when establishing the spread. For example, the maximum loss is $236. |

| Maximum Profit | Limited by the difference between the two strike prices minus the net premium. For example, the maximum profit is $264. |

| Market Conditions | Particularly advantageous in moderately bullish market conditions. |

By selling a higher strike price call option, you clearly define the boundaries of risk and reward. You don’t have to worry about significant losses from extreme market conditions. This combination allows you to grasp investment outcomes clearly during the early stages of options trading.

You can refer to the following practical example to further understand the strategy’s profit and loss structure:

| Scenario | Description | Profit/Loss |

|---|---|---|

| Maximum Loss | When the underlying asset price is below $45, both options expire worthless, and the loss is the initial cost of $236. | -$236 |

| Maximum Profit | When the underlying asset price is above $50, the profit is $500, minus the initial cost of $236, resulting in a net profit of $264. | +$264 |

| Between the Two Strike Prices | When the underlying asset price is between $45 and $50, the profit varies depending on the underlying asset price. | Gradually increases, up to $31. |

You can see that the Bull Call Spread Strategy strictly limits both risk and reward. In the early stages of options trading, you can know the maximum loss and maximum profit in advance, avoiding uncertainty.

Combination Method and Risk Reduction Principle

By buying a lower strike price call option, you gain upside opportunities. By selling a higher strike price call option, you reduce the overall cost and risk.

The table below illustrates the mathematical principle:

| Transaction Type | Result Explanation | Notes |

|---|---|---|

| Buy Call Option | Purchase a $100 call option, paying a $5.00 premium. | Maximum loss is -$500. |

| Sell Call Option | Sell a $105 call option, receiving a $1.00 credit. | Maximum profit is capped at $100. |

| Risk Reduction | Selling the higher strike call option reduces the overall cost of the original position and lowers the break-even point. | Break-even point reduced by $1.00. |

You can use this combination method to achieve risk-controlled investments in the U.S. market. You don’t need to invest large amounts of capital or worry about significant losses from extreme market conditions.

If you’re in the early stages of options trading, the Bull Call Spread Strategy is an ideal choice for learning risk management and profit structures.

- The strategy’s profit cap is determined by the difference between the two strike prices.

- Downside risk is also limited, allowing investors to know the maximum profit and loss in advance.

- Suitable for traders who want clearly defined risk/reward parameters.

Through the above steps and principles, you can flexibly apply the Bull Call Spread Strategy in practice, enhancing your options trading skills.

Profit and Loss Analysis

Image Source: pexels

When implementing the Bull Call Spread Strategy, your primary concern is the profit and loss structure. Through specific numbers and tables, you can clearly see the risk and reward at each step. Below, I’ll guide you through analyzing the maximum profit point, maximum loss point, and break-even point.

Maximum Profit Point

You can calculate the maximum profit as follows:

| Calculation Step | Explanation |

|---|---|

| Option Strike Price Difference | $55.00 - $52.50 = $250 |

| Net Premium Paid | $42 |

| Maximum Profit | $250 - $42 = $208 |

| Condition for Maximum Profit | Stock price reaches or exceeds $55.00 at expiration. |

By buying a lower strike price call option and selling a higher strike price call option, you can achieve the maximum profit as long as the stock price reaches or exceeds the higher strike price (e.g., $55.00) at expiration. The maximum profit equals the difference between the two strike prices minus the net premium paid.

You can remember: The maximum profit occurs when the stock price exceeds the strike price of the short call option. At this point, the profit is locked and will not increase further.

Maximum Loss Point

When establishing the Bull Call Spread Strategy, the maximum loss is the net premium you paid to enter the trade. No matter how the market fluctuates, your loss will not exceed this amount.

| Transaction Cost | Maximum Loss | Stock Price at Expiration |

|---|---|---|

| $7.76 | $776 | $135 or below |

If the stock price at expiration is below the lower strike price you bought (e.g., $135), both options will expire worthless. Your loss is the initial net premium paid. For example, if you paid a $7.76 premium, the maximum loss is $776.

You can know the risk in advance and won’t suffer greater losses due to sharp market declines. This is one of the most important risk control advantages in the early stages of options trading.

Break-Even Point

When implementing the Bull Call Spread Strategy, the break-even point is a key price to focus on. As long as the stock price reaches this point at expiration, you won’t incur a loss.

You can calculate the break-even point with these steps:

- Determine the strike prices: You buy a call option with a lower strike price and sell a call option with a higher strike price.

- Calculate the net debit: Subtract the premium of the sold option from the premium of the bought option to get the net cost.

- Add the net debit to the lower strike price: This gives you the break-even point.

For example, if you buy a call option with a $52.50 strike price and the net debit is $42, the break-even point is $52.50 + $42 = $52.92.

| Item | Explanation |

|---|---|

| Maximum Profit | Strike price difference minus net premium |

| Maximum Loss | Net premium paid to enter the trade |

| Break-Even Point | Strike price of the long call option plus the net premium |

| Transaction Structure | Buy a lower strike price call option + sell a higher strike price call option |

You can use the break-even point to assess whether the strategy is worth executing. If you believe the stock price has a chance to exceed the break-even point, the Bull Call Spread Strategy is a risk-controlled choice.

In the early stages of options trading, mastering profit and loss analysis can help you better evaluate the risk and reward of each trade.

Operational Guide

Strike Price Selection

When choosing strike prices, you need to consider several key factors:

- Choose in-the-money, at-the-money, or out-of-the-money strike prices, based on your market expectations.

- Prioritize highly liquid options to ensure smoother order placement and execution.

- Select expiration dates of 30–60 days to balance sufficient time for market movement and minimize time decay impact.

- Pay attention to implied volatility, as higher volatility makes options more expensive.

- Combine technical analysis, such as support and resistance levels, to optimize strike price selection.

- Control position size to avoid over-investing in a single trade.

You can use these methods to improve execution efficiency and reduce transaction costs.

Order Placement Process

When implementing the Bull Call Spread in the U.S. market, you can follow these steps:

- First, complete the options agreement and obtain trading approval.

- Select the underlying asset, such as XYZ stock, and determine the strike prices for the two call options.

- Buy a call option with a lower strike price (e.g., October $35) and simultaneously sell a call option with a higher strike price (e.g., October $40).

- Calculate the total cost and maximum profit to ensure the risk is within a controllable range.

- Monitor changes in the underlying asset’s price and be ready to adjust or close the position.

- Use a multi-leg order function to close both positions simultaneously.

By following these steps, you can execute the strategy more efficiently.

Position Management

In the early stages of options trading, position management is particularly important. The maximum loss of the Bull Call Spread is the net premium you paid. You can:

- Set a maximum loss limit for each trade to avoid exceeding your risk tolerance.

- Use smaller position sizes to reduce overall risk and complexity.

- Conduct scenario testing regularly to evaluate the strategy’s performance under different market conditions.

- Monitor time decay and implied volatility changes to adjust positions promptly.

This way, you can effectively control risk and enhance trading stability.

Exit Strategy

You need to exit flexibly based on market signals. Common exit signals include:

| Indicator Type | Indicator Name | Explanation |

|---|---|---|

| Technical Indicators | Support/Resistance Levels | When the price approaches a resistance level, it may be a good time to close the position. |

| Trend Lines | Consider exiting when the price breaks below an uptrend line. | |

| Momentum Indicators | Exit to lock in profits when the trend weakens. | |

| Fundamental Indicators | Earnings Reports | Consider closing after positive news is realized. |

| Economic Indicators | Exit when economic data weakens. | |

| News Events | Stop losses promptly when significant negative news emerges. |

You can combine these signals to develop a clear exit plan, avoid emotional trading, and ensure each trade is completed within a controllable range.

Practical Applications

When Market Expectations Are Bearish

When you observe a weak overall trend in the U.S. stock market and expect the stock price to decline but with limited downside, the Bull Call Spread Strategy can still be effective. You can select an underlying stock, buy a call option with a lower strike price, and sell a call option with a higher strike price. This allows you to participate in limited upside opportunities at a lower cost while locking the maximum loss at the initial net debit.

If you believe the stock price won’t rebound significantly and will only fluctuate within a small range, the Bull Call Spread Strategy can help you control risk. You don’t need to invest large amounts of capital or worry about significant losses from sharp market declines.

You can refer to this scenario: Assume XYZ stock is currently priced at USD 45. You buy a call option with a $45 strike price and sell a call option with a $50 strike price. As long as the stock price doesn’t drop significantly by expiration and even rises slightly, you can achieve limited profits.

Adjustments in Different Environments

You can flexibly adjust the Bull Call Spread Strategy in different market environments. The strategy’s performance varies with market volatility.

- In high volatility periods, using the Bull Call Spread Strategy allows you to benefit from the price increase of short-term options and the decay of time value.

- When expecting moderate upside, you can choose a narrower strike price spread to reduce costs and lock in risk.

- If you expect significant price movements, a debit spread strategy is more advantageous, especially when volatility rises, as option premiums increase, offering higher potential returns.

| Market Environment | Strategy Adjustment Suggestions | Expected Outcome |

|---|---|---|

| High Volatility | Shorten expiration time, choose narrow spread | Reduce risk, achieve quick profits |

| Moderate Upside | Widen spread, extend expiration time | Increase maximum profit potential |

| Significant Movement | Increase position size, monitor premium changes | Enhance profit potential |

You can adjust strike prices, expiration dates, and position sizes based on market conditions. This way, you can maintain risk control in the U.S. stock market while improving the strategy’s adaptability and profitability.

Strategy Comparison

Difference from Bear Put Spread

When learning options strategies, you often encounter the Bull Call Spread and Bear Put Spread. While both are spread strategies, their market views and profit/loss structures differ significantly. You can quickly understand their core differences through the table below:

| Bull Call Spread | Bear Put Spread | |

|---|---|---|

| Market View | You expect the underlying asset price to rise moderately. | You expect the underlying asset price to fall moderately. |

| Risk | Maximum loss is the net premium, limited risk. | Maximum loss is the net premium, limited risk. |

| Reward | Maximum profit equals the strike price difference minus the net premium, achieved when the price is above the higher strike price. | Maximum profit equals the strike price difference minus the net premium, achieved when the price is below the lower strike price. |

When implementing the Bull Call Spread, it’s suitable for expecting moderate market upside. The Bear Put Spread is suitable when you expect a moderate market decline. Both allow you to lock in maximum risk and reward in advance, making them suitable for investors with lower risk tolerance.

Tip: You can flexibly choose a strategy based on your market judgment. If you believe the U.S. stock market will rebound in the short term, the Bull Call Spread is more appropriate. If you expect a slight pullback, the Bear Put Spread is more advantageous.

Difference from Single Option

When choosing an options strategy, you may struggle between using the Bull Call Spread or directly buying a single call option. The two differ significantly in cost, risk, and reward structure. You can refer to the table below:

| Aspect | Bull Call Spread | Single Call Option |

|---|---|---|

| Cost | Lower cost, about 75% of a single call option. | Higher cost. |

| Break-Even Price | Lower break-even point. | Higher break-even point. |

| Delta | For every $1 price increase, value increases by about $0.08. | For every $1 price increase, value increases by about $0.75. |

| Theta | Less affected by time decay. | More affected by time decay. |

| Vega | Less affected by volatility changes. | More affected by volatility changes. |

| Maximum Reward | Limited reward, capped by the strike price difference. | Theoretically unlimited reward. |

By choosing the Bull Call Spread, you can participate in market upside at a lower cost while locking in the maximum loss. A single call option offers unlimited profit potential but comes with higher costs, faster time value decay, and greater volatility risk. For beginners in options trading, the Bull Call Spread is easier to manage risk and is more suitable for practicing risk management.

You can choose a strategy based on your risk tolerance and market judgment. If you seek stable returns, prioritize the Bull Call Spread.

The Bull Call Spread Strategy offers a low-cost, limited-risk investment approach, making it particularly suitable for options beginners. You can refer to the table below to quickly understand its main advantages:

| Advantage | Explanation |

|---|---|

| Lower Transaction Costs | Requires only a small initial investment. |

| Limited Risk | Maximum loss is predictable in advance. |

| Suitable for Beginners | Simple structure, easy to get started. |

You can continue to improve by:

- Taking options courses to systematically learn basics and strategies.

- Recording each trade to analyze and improve methods.

- Reading related books to enhance market understanding.

Continuous learning and practice will help you better apply options strategies in the U.S. market.

FAQ

What type of investors is the Bull Call Spread Strategy suitable for?

If you’re just starting to learn options and want to control risk, this strategy is suitable. You don’t need a lot of capital or worry about excessive losses.

Can I close the position early?

You can close the position at any time during market trading hours. This allows you to lock in existing profits or reduce potential losses.

Will the strategy automatically exercise at expiration?

If there’s a profit at expiration, the broker will automatically exercise the options for you. You can also choose to close the position early to avoid the complexity of exercising.

What risks should I watch for?

You need to monitor underlying price fluctuations and time value decay. The maximum loss is the net premium you initially paid.

How is this strategy different from directly buying a call option?

With the Bull Call Spread Strategy, the cost is lower, and the risk is limited. Buying a single call option has higher costs, unlimited reward potential, but also greater risk.

The Bull Call Spread is the ideal strategy for your option trading entry: it offers a simple, limited-risk structure that allows you to capitalize on moderate upward price movement while precisely capping your maximum loss (the net premium paid). However, the real challenge in US option trading lies in the high per-contract fees and the friction of cross-border funding, which can significantly eat into the capped profits of this strategy.

To ensure your sophisticated option strategy translates into maximized net profit, integrate the financial precision of BiyaPay. We offer zero commission for contract limit orders, a crucial advantage that drastically minimizes the cost of spread construction, closing, and risk management. This means you can execute your strategy with the lowest possible friction, maximizing your potential return. Furthermore, our platform supports the swift, mutual conversion between fiat and digital assets like USDT, providing you with the fastest, most reliable pathway to fund your brokerage accounts for time-sensitive global investment. You can register quickly—in just 3 minutes without requiring an overseas bank account—and gain immediate access to US and Hong Kong Stocks. Leverage our real-time exchange rate checks to maintain transparent control over your funding costs. Open your BiyaPay account today and secure the operational advantage your risk-defined option strategy deserves.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.