- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Top Tools for Comparing Exchange Rates and Converting Currencies

When traveling abroad, doing business internationally, or simply converting currency for personal use, understanding and comparing exchange rates is critical. The exchange rate is the price of one currency in terms of another and it fluctuates regularly based on global economic conditions, market demand, and various geopolitical factors. To make informed decisions and get the best value when converting money, using exchange rate tools can help you quickly compare rates and find the best deals for currency exchanges. In this post, we’ll explore the importance of exchange rates, guide you on using an exchange rate calculator, introduce top currency exchange rate converters, and highlight how BiyaPay simplifies currency exchanges for users globally.

What is the Exchange Rate?

The exchange rate is the value of one currency in relation to another. It determines how much of one currency you need to exchange to get another. For example, if the exchange rate between the USD (U.S. Dollar) and the EUR (Euro) is 1 USD = 0.85 EUR, this means that for every dollar you exchange, you will receive 0.85 Euros. These rates fluctuate continuously based on various factors including market demand, inflation rates, interest rates, and economic stability.

According to the Bank for International Settlements (BIS), the average daily turnover in the global foreign exchange market reached $7.5 trillion in 2022, reflecting the massive volume and volatility of currency trading worldwide. This makes it essential for consumers and businesses alike to monitor exchange rates closely to avoid losing money on conversions.

Studies show that consumers and businesses can save between 2% to 5% per transaction by comparing rates before converting currencies (OECD, 2023). This can translate into substantial savings, especially for frequent travelers or companies handling large cross-border payments.

How to Use an Exchange Rate Calculator

Using an exchange rate calculator is an easy and convenient way to compare currency exchange rates and perform money conversions. Here’s a step-by-step guide to help you get the most accurate and up-to-date conversions:

- Choose Your Currencies: Start by selecting the currency exchange rate of the two currencies you want to convert. For example, if you are traveling from the U.S. to Europe, you would select USD and EUR.

- Enter the Amount: Input the amount of money you want to convert. The currency exchange rate calculator will automatically calculate the equivalent value of the other currency based on the current rate.

- Real-Time Updates: Most currency exchange rate calculators offer real-time updates, ensuring that you get the most current exchange rate. This feature is especially useful for international business transactions where rates can change rapidly.

- Conversion Accuracy: Ensure that the calculator provides accurate rates by using a trusted platform. Reliable calculators, like the ones found on financial news sites or apps like BiyaPay, offer precise conversions, including the latest market data.

- Check Fees: Some calculators also show the fees associated with the exchange, helping you determine the best option. For businesses and travelers, comparing exchange fees is essential to avoid paying hidden costs.

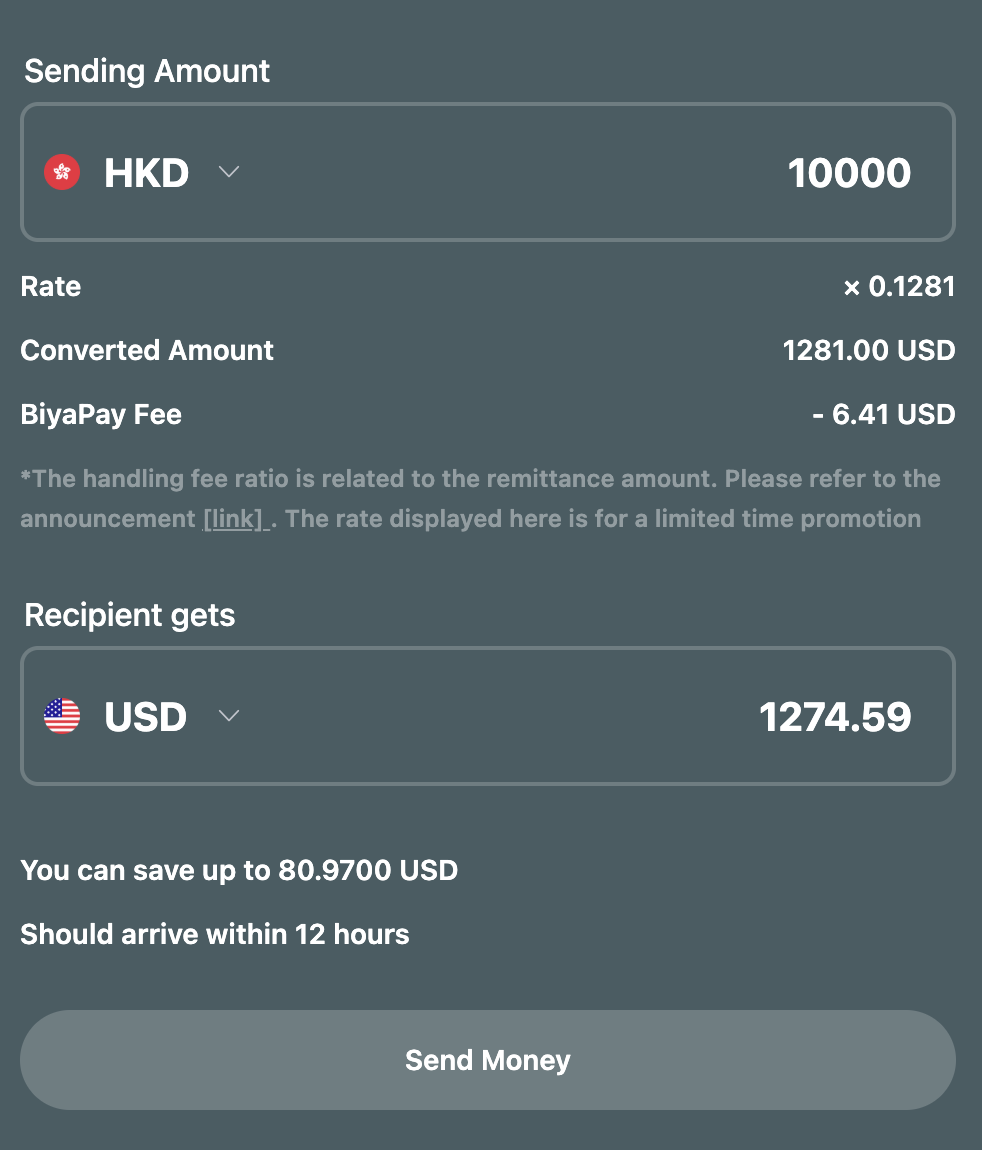

By using currency exchange rate calculators, individuals and businesses can accurately convert their funds and save money by getting the best available rate. If you’re looking to convert HKD to USD, for example, you can easily use this HKD-USD Converter from BiyaPay to get an instant and accurate result.

Top Exchange Rate Tools for 2025

Several exchange rate tools are available today, helping individuals and businesses compare foreign exchange rates and find the best deals. Here are some of the most trusted and widely used options:

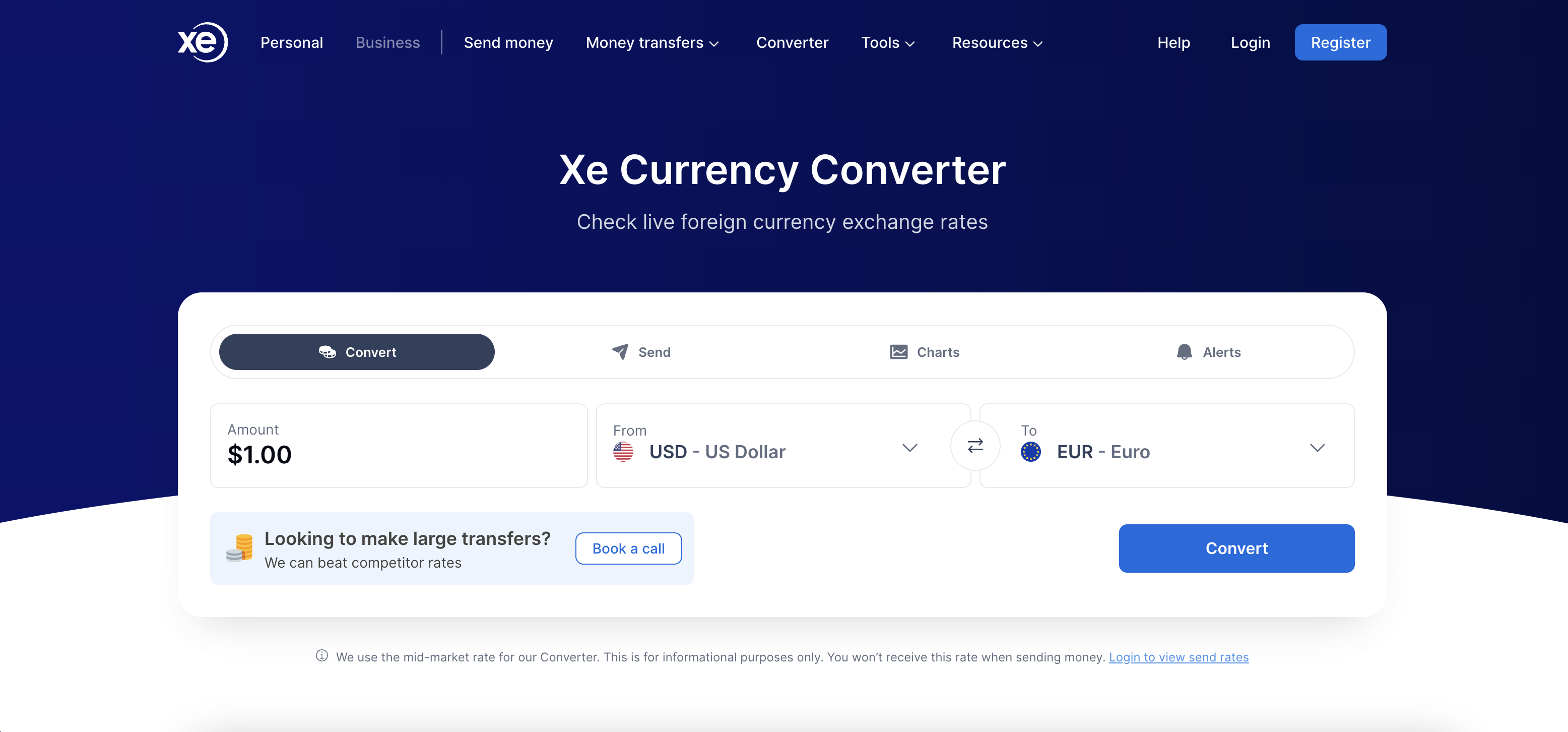

XE Currency Converter

One of the most popular tools for checking live exchange rates, XE Currency Converter offers real-time data on over 180 currencies. XE is trusted globally and provides an easy-to-use platform for both travelers and businesses.

Key Features:

- Live exchange rates for 180+ currencies

- Currency charts and historical data

- Supports multiple currencies for global conversions

- Available on mobile and desktop platforms

Pros:

- Free to use

- Real-time updates for accuracy

- Easy-to-navigate interface

Cons:

- Limited to currency exchange (doesn’t support international payments)

User Case: Sarah, a frequent traveler, shares, “XE helps me track currency fluctuations before trips. The charts are very helpful to decide when to convert my money.”

Choosing Advice: Ideal for travelers and casual users who want quick, reliable exchange rates without the need for sending money internationally.

OANDA

OANDA offers comprehensive historical data, live currency exchange rates, and market insights, making it an excellent resource for businesses and financial analysts. It provides users with a currency exchange rate calculator and powerful tools for tracking trends.

Key Features:

- Access to real-time foreign exchange rate data

- Historical exchange rates and data analysis

- Integration with other trading tools

- Provides forex trading platform

Pros:

- Detailed financial data and analytics

- Reliable historical data for better decision-making

- Excellent for businesses

Cons:

- Best suited for more experienced traders

- The platform can be complex for casual users

User Case: Michael, a forex trader, notes, “OANDA’s detailed data and fast updates are crucial for my trading strategy, especially the historical trend analysis.”

Choosing Advice: Perfect for businesses and traders needing in-depth forex data and analytical tools.

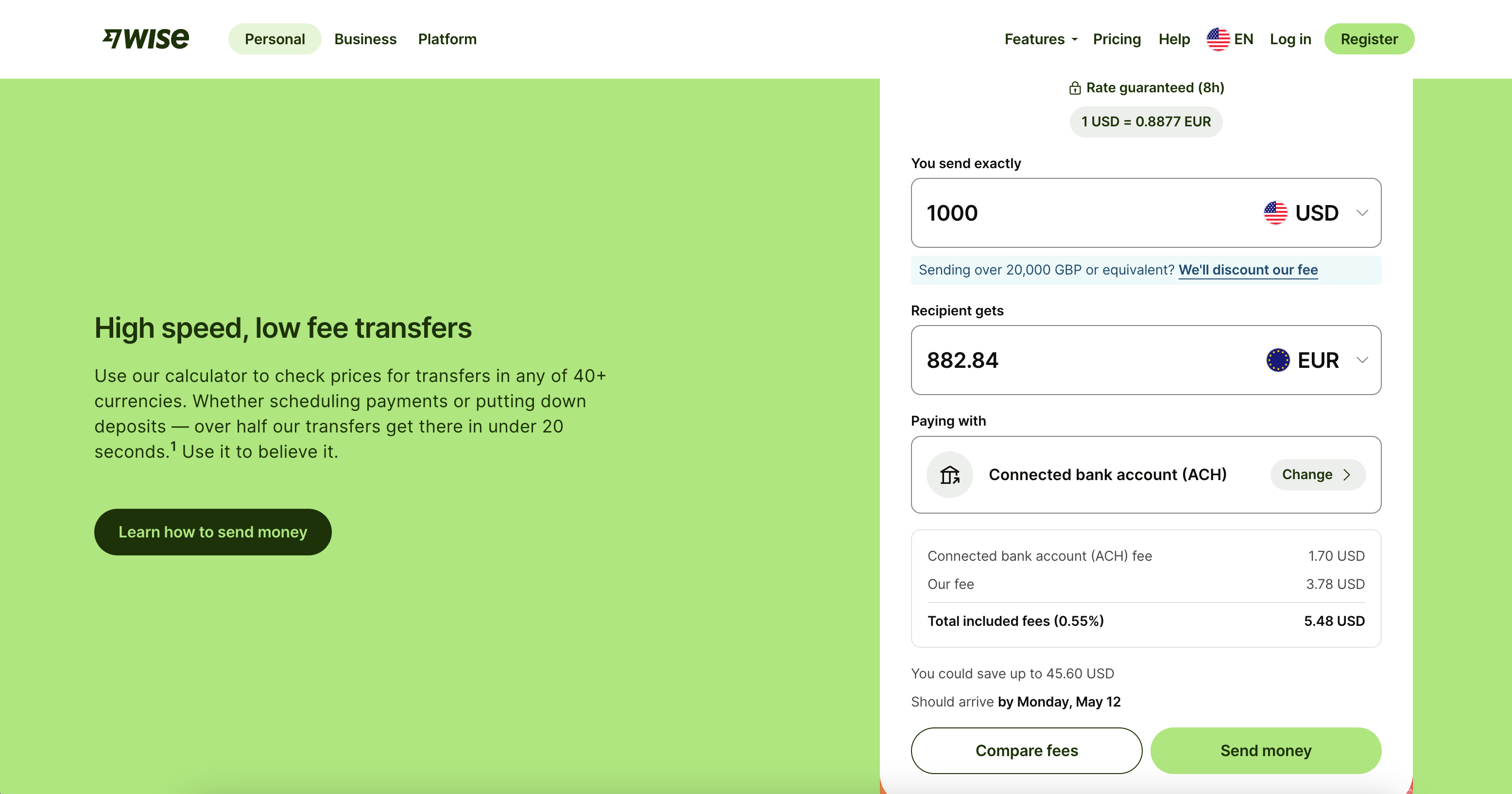

Wise

Wise is a currency exchange rate converter that offers real-time data and allows users to send money internationally with low fees. Wise guarantees that users get the best live exchange rates without any hidden costs.

Key Features:

- Real-time exchange rates for international money transfers

- Transparent fees with no hidden charges

- Multi-currency support

- Quick international money transfers

Pros:

- Low-cost money transfers

- Real-time rate tracking

- Easy-to-use mobile app

Cons:

- Limited coverage in some countries

- Fees may apply for certain transactions

User Case: Raj, a freelancer working with clients overseas, says, “Wise saved me hundreds in fees and gave me confidence with real-time exchange rate updates.”

Choosing Advice: Great for individuals and businesses needing affordable and transparent international transfers.

Google Currency Converter

For quick conversions, Google provides a simple currency exchange rate calculator directly in search results. Just type in the currency pair, such as “USD to EUR,” and get an instant conversion.

Key Features:

- Quick and easy currency conversions

- Real-time data sourced from financial markets

- Accessible directly through Google search

Pros:

- Fast and easy to use

- Free of charge

- No need to download apps or use external websites

Cons:

- Basic functionality

- Limited to basic conversions without additional data or charts

User Case: Linda, a small business owner, shares, “Google Currency Converter is my go-to for quick currency checks when invoicing clients globally.”

Choosing Advice: Best for users needing simple and fast exchange rate lookups without advanced features.

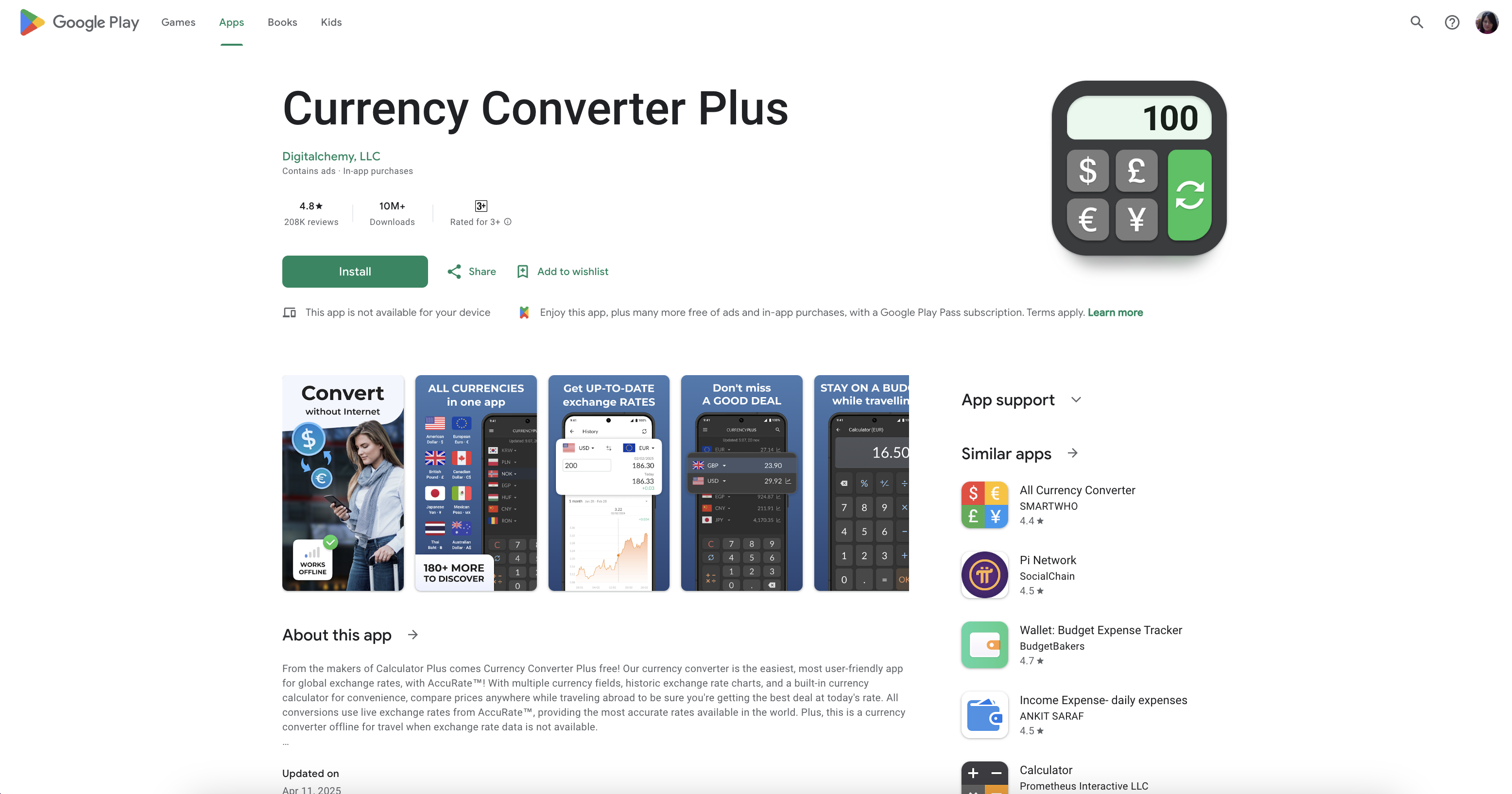

Currency Converter Plus

Currency Converter Plus is a mobile app available on both Android and iOS that provides exchange rates and includes a built-in currency exchange rate calculator. This app allows users to track rates and perform conversions on-the-go.

Key Features:

- Real-time currency exchange rates

- Multiple currency support

- Historical data and charts

- Offline conversion mode

Pros:

- Easy to use on mobile devices

- Supports a wide range of currencies

- No internet required for basic conversions

Cons:

- Limited features in the free version

- Ads in the free app

User Case: Tom, an international student, says, “Currency Converter Plus helps me manage my budget by tracking exchange rates, even when I’m offline.”

Choosing Advice: Ideal for users frequently traveling or needing mobile access with offline capabilities.

Currency Exchange Rate Converters: What to Look For

When choosing a currency exchange rate converter, there are several key features to consider that will help ensure you get the best value and make informed decisions. Here’s what to look for:

- Real-Time Data: Choose a tool that provides live stock market ticker updates or real-time exchange rates, especially if you are trading or need to track rapid price changes.

- Multiple Currencies: A good currency exchange rate converter should support a wide range of currencies, making it ideal for global transactions and international trade.

- Historical Data: Having access to historical trends can be useful for tracking market behavior and making predictions for future exchanges.

- Ease of Use: The platform should be user-friendly, allowing you to quickly find the rates you need and convert currencies efficiently.

- Accuracy: Always use a tool that guarantees accurate and reliable data, as inaccurate exchange rates can lead to significant financial losses.

Using an accurate currency exchange rate converter is particularly important when making money exchange for international travel or business dealings. It ensures that you are getting the best deal and helps save on conversion fees.

Bonus: BiyaPay: Your Trusted Solution for Currency Exchange and Payments

BiyaPay is not just a secure money transfer platform, it also offers a comprehensive solution for currency exchange. With real-time tracking of exchange rates, BiyaPay ensures that you always get competitive rates with low fees for your global transactions. Whether you’re sending money to a friend overseas or paying for international goods and services, BiyaPay helps you convert currencies instantly and securely.

BiyaPay offers several key advantages:

- Competitive exchange rates and low transaction fees

- Real-time rate tracking, ensuring you get the best possible value for your money

- Multi-currency support for global transactions, making it ideal for both personal and business use

- Secure and fast payments, giving you peace of mind when sending funds internationally

By integrating currency exchange and money transfer into one platform, BiyaPay simplifies the process of sending money across borders while ensuring that you get the best rates available.

Steps to Using Biyapay money transfer platform

Step 1: Download and Install the BiyaPay App

Download the BiyaPay app from the app store or website and install it on your device.

Step 2: Sign Up and Verify Your Identity

Create an account by registering with your email. Complete the identity verification process by adding your bank card and personal details for added security.

Step 3: Fund Your Account

Navigate to the Deposit section, select your preferred method, and deposit the desired currency (e.g., USDT, USD) into your BiyaPay account.

Step 4: Make a Payment or Transfer

Go to the Transfer page, choose the recipient’s account, enter the amount, and confirm the transfer using the required verification (email or Biya Authenticator).

User Case Studies for BiyaPay

Case Study 1: Raj, Remote Software Developer Raj works with clients in the US, Europe, and Asia, receiving payments in different currencies. Using BiyaPay, he effortlessly converts USD, EUR, and SGD to his local currency with minimal fees and real-time rate alerts. This has helped Raj increase his net income by avoiding unfavorable exchange rates and reducing transfer delays that he faced with traditional banks.

Case Study 2: Global NGO Facilitating Aid Payments A non-governmental organization (NGO) uses BiyaPay to disburse funds to field workers and beneficiaries in remote regions. BiyaPay’s multi-currency support and secure, instant transfers ensure timely aid delivery with full transparency and reduced overhead costs compared to traditional banking channels.

Case Study 3: Carlos, E-commerce Entrepreneur Carlos runs an e-commerce store selling products internationally. BiyaPay enables him to accept payments in various currencies and convert revenues instantly with low fees. This flexibility helps Carlos optimize cash flow and offer competitive pricing by avoiding hefty conversion charges.

Conclusion

Exchange rate tools are essential for anyone involved in international transactions, whether for personal, travel, or business purposes. By using currency exchange rate converters and live stock tickers, you can easily compare and convert currencies to get the best value. Services like BiyaPay offer real-time exchange rates, low fees, and fast transactions, making it easier to handle currency exchanges globally. Whether you’re a traveler, investor, or business owner, having access to reliable exchange rate tools ensures that you make the best financial decisions.

Explore BiyaPay for your next money exchange transaction and take advantage of competitive rates and seamless international payments.

FAQs

Q1. What factors affect currency exchange rates? Currency exchange rates are influenced by factors such as inflation rates, interest rates, political stability, and market demand.

Q2. How accurate are exchange rate calculators? Exchange rate calculators that pull data from trusted sources like financial news platforms or official exchange systems, such as BiyaPay, are highly accurate and provide real-time data.

Q3. What’s the best way to compare foreign exchange rates? Use a reliable exchange rate calculator to compare rates, or check live currency exchange rate displays from trusted platforms like BiyaPay or XE Currency Converter.

Q4. How does BiyaPay offer better exchange rates for international payments? BiyaPay offers real-time exchange rate tracking and low fees for global transactions, making it a more cost-effective option than traditional currency exchange services.

Q5. Are exchange rates the same across different platforms? No, exchange rates can differ slightly between platforms due to fees, market fluctuations, and the spread between buy and sell rates.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.