- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Simplifying Global Payments with Best Mobile Remittance Transfer Solutions

Understanding Mobile Money Transfer

A Brief History

Mobile money transfer began in 2007 with Kenya’s M-Pesa, a text message-based system that allowed users to send money via basic phones. By 2023, mobile transactions reached $1.3 trillion globally (GSMA, 2023), proving its role in financial inclusion. Today, apps like Biyapay combine AI, blockchain, and biometrics to simplify international transfers.

Key Trends

- Cost Reduction: Mobile transfers are 50–70% cheaper than traditional banks (World Bank, 2023).

- Speed: 80% of transactions complete within 24 hours, versus 3–5 days for banks.

- Accessibility: Over 1.4 billion unbanked adults now use mobile wallets (Global Findex, 2023).

Case Study: M-Pesa in Kenya M-Pesa transformed Kenya’s economy by enabling farmers and small businesses to send money via SMS. By 2023, 96% of Kenyan households used mobile money, reducing poverty by 2% (IMF Report).

How Mobile Money Transfer Apps Work

Mobile cash transfer apps make sending and receiving money simple and efficient by leveraging technology for quick, secure transactions. Here’s a look at how these apps function to ensure a smooth experience for users worldwide.

Step 1: Registration & Security Checks

- Users sign up with a phone number or email.

- Security: Apps like Biyapay require ID verification (e.g., passport scans) and two-factor authentication (2FA) to prevent fraud.

Step 2: Sending Money

- Enter recipient details (phone number, email, or bank account).

- Choose a payment method:

- Debit/Credit Cards: Instant but higher fees (3–5%).

- Bank Transfers: Cheaper (1–2%) but slower (1–3 days).

- Mobile Wallets: Ideal for recipients without bank accounts.

Step 3: Tracking & Receiving Funds

- Real-time alerts update senders and recipients.

- Funds arrive via bank deposit, mobile wallet, or cash pickup (e.g., Western Union’s 500,000+ locations).

Security Features

- Encryption: Biyapay uses AES-256 encryption to protect data.

- Biometric Logins: Fingerprint or face scans add extra security.

- Fraud Detection: AI monitors transactions for suspicious activity.

Common Questions

“What if I enter the wrong details?” Most apps allow cancellations within 30 minutes.

“Are transfers safe during network issues?” Transactions resume automatically once connectivity is restored.

Top Mobile Money Transfer Applications

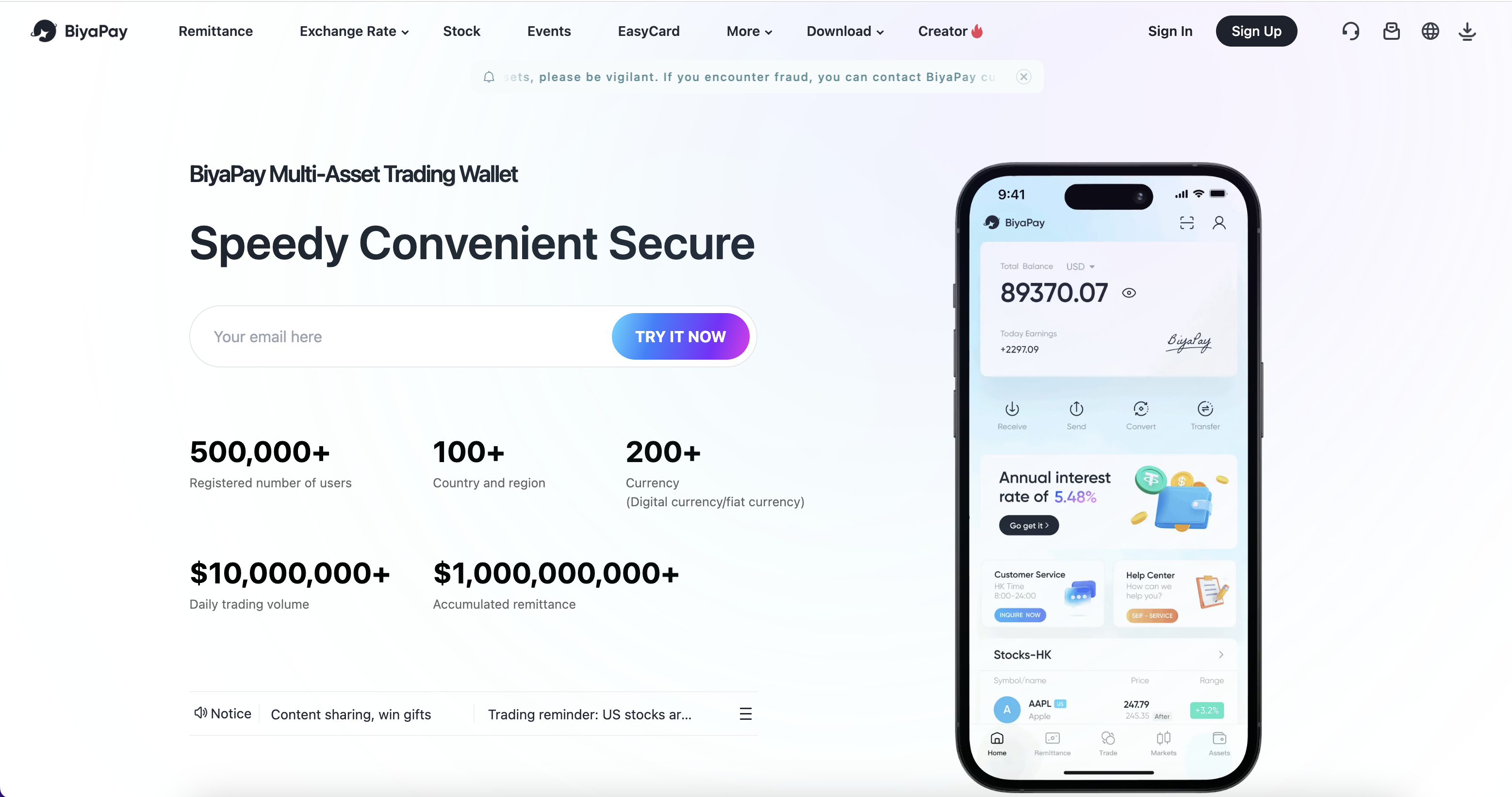

BiyaPay (Best for low-cost, multi-currency transfers)

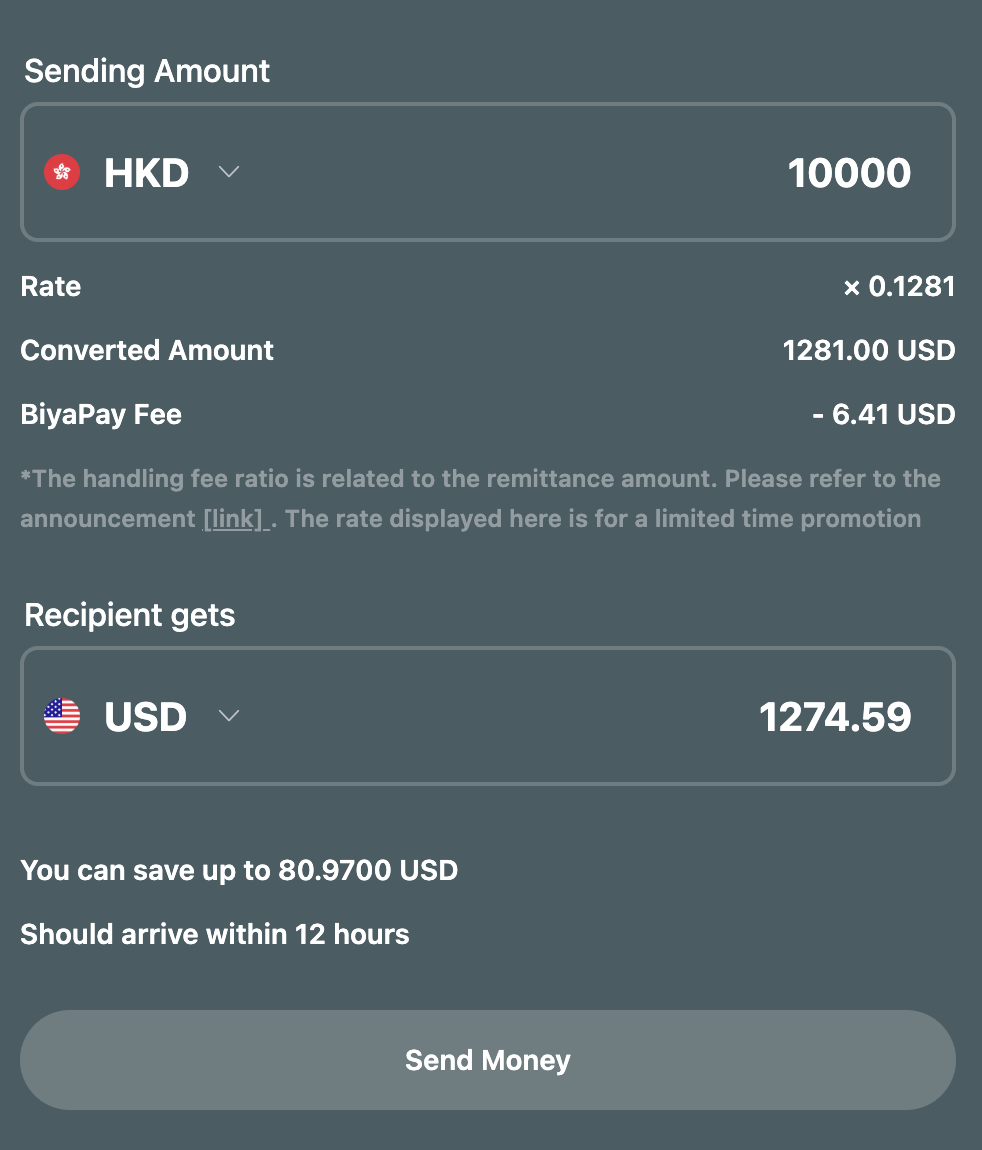

Biyapay is a popular mobile money transfer application that enables users to send money internationally with ease. Known for its simplicity and competitive rates, Biyapay is favored for both personal and business transactions. It supports multiple currencies and offers fast transfer times to various countries, making it a top choice for global remittances. As an example, you can send 10,000 HKD from Hong Kong to the USA using this international mobile money transfer service.

Key Features:

- 50+ Currency Support: Send USD, EUR, JPY, and even digital currencies like USDT.

- Real-Time Tracking: Monitor transfers via a user-friendly mobile money transfer app with instant notifications.

- PCI DSS & GDPR Compliance: Bank-level security with 2FA and biometric logins.

- Investment Integration: Trade stocks and digital assets within the same platform.

Stepwise guide to transferring money using BiyaPay

Step 1: Download the BiyaPay app Download the BiyaPay app on your smartphone. It’s available for both Android and iOS devices.

Step 2: Register and verify your identity Launch the app and sign up using your email address. Complete the identity verification process, add your bank card, and fill out your user profile to activate all features securely.

Step 3: Add USDT to your wallet From the home screen, select Deposit, choose On-chain deposit, and transfer USDT into your BiyaPay wallet to fund your account for sending money.

Step 4: Send Fiat currency remittances Go to the Transfer section, select to send USDT (equivalent to USD transfers), pick the recipient’s account, then verify the transaction using the email verification code or Biya Authenticator code to finalize the transfer safely.

User Reviews:

“Biyapay is my favorite app for sending money to other countries,” said one user. The rates are reasonable, and the move is always done the next day.

“I really enjoy how simple it is to use Biyapay. Every month, I send money to my family living abroad, and it’s always easy.”

“The app works well, but it’s only available in some countries.” I hope they soon offer more services.

PayPal (Best for global e-commerce & freelancers)

PayPal stands out as a leading mobile money transfer app, providing a trustworthy platform for transferring money both locally and globally. This platform is popular for making online payments, offering features that allow users to send money to friends, family, or businesses around the world.

Key Features:

- 200+ Country Coverage: Widely accepted by 70M+ merchants for online mobile money transfers.

- Instant Transfers: Send money between PayPal accounts in seconds.

- Purchase Protection: Refunds eligible transactions within 180 days.

- Multi-Currency Wallet: Hold balances in 25+ currencies for flexible spending.

- Debit Card Integration: Link cards for instant withdrawals to bank accounts.

User Reviews:

“I’ve used PayPal for years to send money to family living abroad,” said one user. The fees are too high, even though it’s handy.

“PayPal is great for international payments, but I wish they had lower fees for transfers.”

“I like how fast PayPal is, but sometimes the exchange rates can be a little unfavorable.”

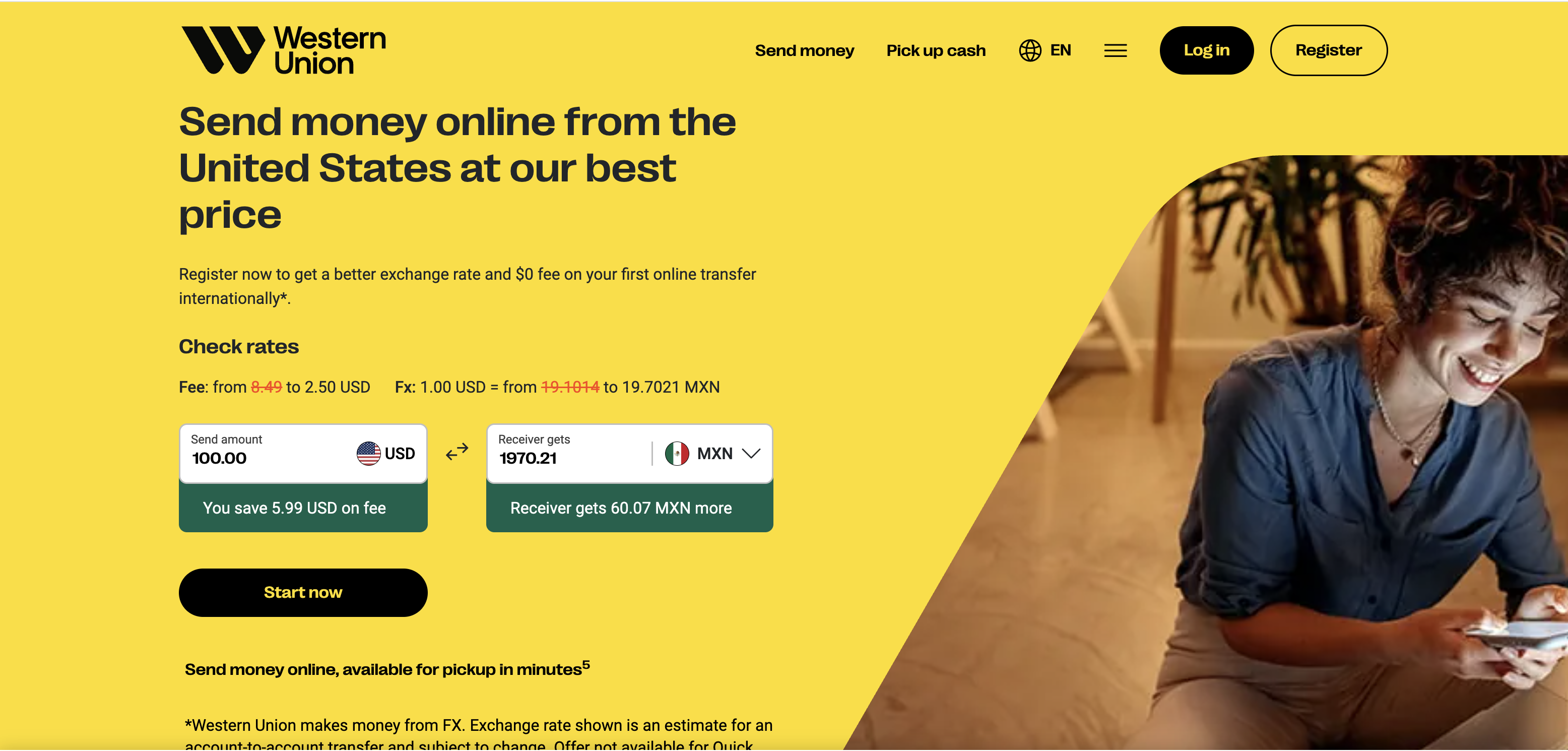

Western Union (Best for cash pickups in remote areas)

For quite some time, Western Union has stood out as a frontrunner in the global money transfer scene. There’s an app available that enables users to transfer money to nearly any location across the globe. It provides numerous options to collect cash, thanks to its extensive network of agents and locations globally.

Key Features:

- 500,000+ Agent Locations: Largest global network for mobile cash transfers to rural regions.

- Cash Delivery in Minutes: Emergency funds arrive fast via 200+ country partners.

- Multiple Payment Options: Pay via bank transfer, card, or in-person cash deposits.

- Brand Recognition: Trusted for 150+ years in cross-border remittances.

- SMS Tracking: Receive updates via text for cash pickup readiness.

User Reviews:

“Western Union is reliable and I can send money to my family almost anywhere, but the fees are quite high.”

“I like Western Union better because I can pick up my cash at a lot of different places.” It costs a lot, but it works well.

“Their app is easy to use, but I’ve noticed that their exchange rates are not always the best compared to other services.”

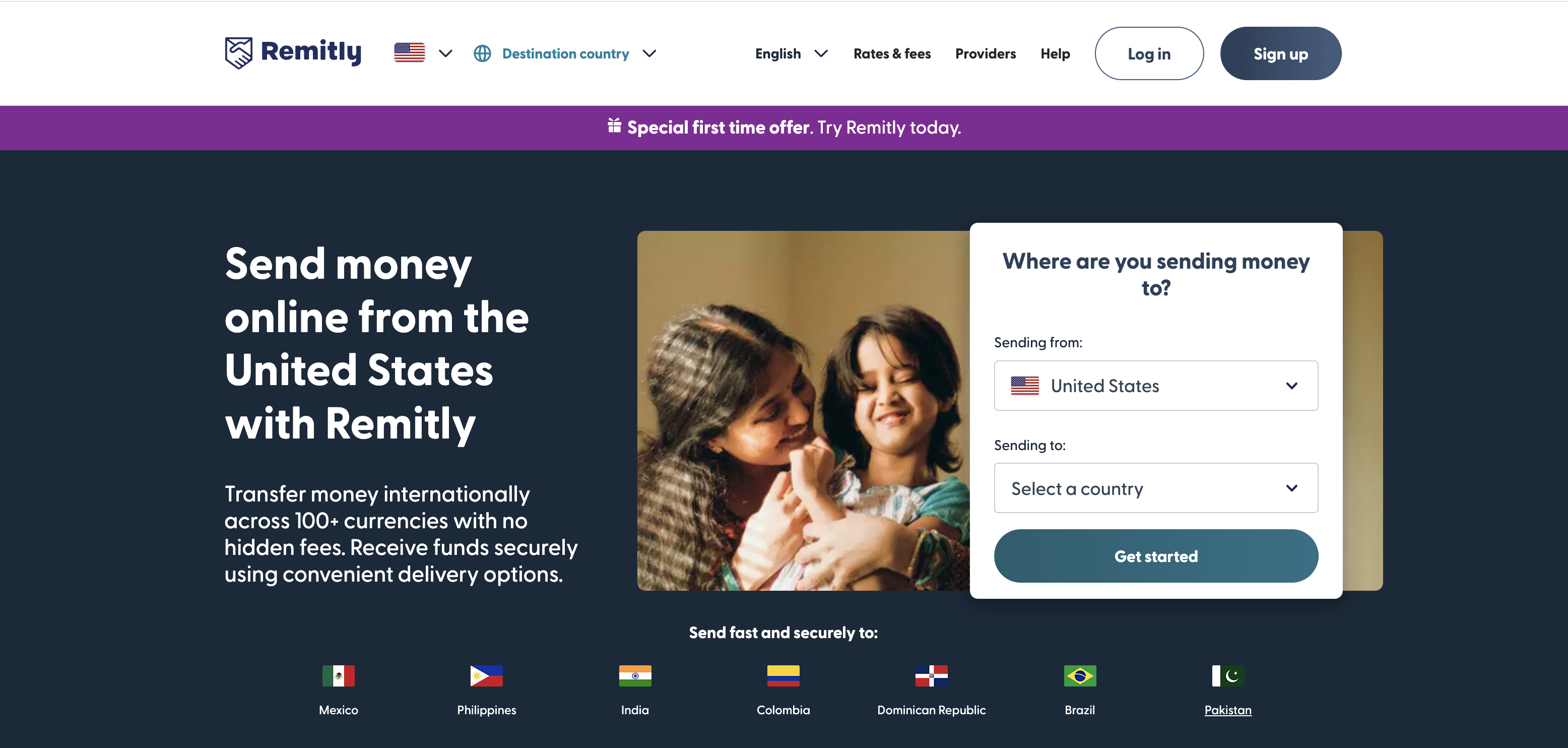

Remitly (Best for affordable family remittances)

The purpose of Remitly is to facilitate the sending of money across international borders in a quick and cost-effective manner, with a particular emphasis on sending money to families of immigrants. In order to cater to a variety of requirements regarding speed and cost, it provides two options: Economy and Express.

Key Features:

- Economy & Express Options: Choose speed (3–5 days vs. <10 minutes) for mobile remittance transfers.

- Mobile Wallet Compatibility: Deliver funds to GCash, Paytm, or bank accounts.

- Fee Transparency: No hidden charges; exchange rates match mid-market averages.

- Biometric Security: Fingerprint/Face ID login and AI fraud detection.

User Reviews:

“I use Remitly for all of my international transfers,” said one user. I can use either a credit card or a bank account to pay. The exchange rate is good.

“The Economy option is great for saving money, but the Express service is perfect when I need to send money quickly.”

“Remitly is simple to use, but it could offer more transfer options in more countries.”

Security and Privacy in Mobile Transfers

Financial apps handle sensitive personal and financial data, making them prime targets for cybercriminals. In 2023 alone, $10 billion was lost to payment fraud (Juniper Research), with attacks ranging from phishing scams to sophisticated malware. Mobile money transfers are especially vulnerable due to their global reach and the high volume of cross-border transactions. For instance, hackers often exploit weak authentication methods or unsecured networks to intercept transfers, steal credentials, or redirect funds.

How Apps Protect You

To combat these risks, leading mobile money transfer apps implement multi-layered security frameworks:

- End-to-End Encryption (E2EE)

How It Works: Data is scrambled into unreadable code during transmission, ensuring only the sender and recipient can decode it.

- Example: Biyapay uses AES-256 encryption (the same standard as banks and militaries) to secure transactions.

- Impact: Even if hackers intercept data, they cannot decipher it without the encryption key.

- Regulatory Compliance

- GDPR (EU): Requires apps to obtain explicit user consent for data collection and allows users to request data deletion.

- Example: Biyapay anonymizes user data for analytics, preventing linkage to individual identities.

- PSD2 (EU): Mandates Strong Customer Authentication (SCA), such as two-factor authentication (2FA) or biometric scans, for transactions over €30.

- Example: Remitly uses fingerprint/Face ID logins to meet this standard.

- Privacy Policies

- Data Minimization: Apps collect only essential information (e.g., name, phone number) to reduce exposure.

- No Third-Party Sales: Reputable apps like Biyapay and Wise prohibit selling user data to advertisers or external companies.

- Transparency: Users can review how their data is stored, used, or shared via in-app privacy dashboards.

- AI-Powered Fraud Detection

- How It Works: Algorithms analyze transaction patterns (e.g., sudden large transfers, new recipients) to flag suspicious activity.

- Example: In 2022, Remitly blocked 12,000 fraud attempts by identifying anomalies like rapid repeated transfers to high-risk regions.

- Impact: Machine learning adapts to emerging threats faster than manual monitoring.

- Secure Infrastructure

- Independent Custody: Funds are held in segregated bank accounts (e.g., Biyapay’s partnerships with licensed custodians) to prevent misuse.

- Penetration Testing: Regular audits simulate cyberattacks to identify vulnerabilities before hackers exploit them.

How to Choose the Best Mobile Money Transfer Service

Choosing the right mobile money transfer service is crucial to ensure that your international transactions are fast, secure, and affordable. Here are the key factors to consider when selecting the best service for your needs.

- Key Factors to Consider: It is important to compare transaction fees between platforms when choosing a mobile money transfer service, as they can be very different. To make sure you’re getting the best deal on transfers, check the exchange rates as well. Transfer or shipping limits may apply to some services, so make sure the one you pick can meet your needs, especially if you need to send large amounts of money. Based on where the recipient lives, delivery choices like bank deposit, cash pickup, or mobile wallet transfer can also be important things to think about.

- Customer Service and Support: It’s important to have reliable customer service, especially if there are problems with your move. Make sure the service has easy-to-use, quick-response help channels, like chat, email, or the phone. Also, most mobile transfer services let you track your transfer in real time, so you can see it from the beginning to the end and fix any problems right away.

- Platform Compatibility: Check to see if the mobile transfer service has a web-based platform or a specialized app for your phone that you can use while you’re on the go. Some services work better on phones, while others give you more options through web-based tools. Also, make sure that the service works in both the country of the sender and the country of the receiver.

- Transfer Speed and Reliability: Speed of transfer is crucial for those who need to send money urgently. Some services offer instant transfers, while others may take a few days. Look for services that provide fast and reliable transfers, especially for emergency situations.

- Security Features: When moving money abroad, security is very important. To make sure your transactions are safe, look for services that offer encryption, two-factor authentication, and safety against fraud. You can feel safe knowing that your money is safe during the transfer process if the service you use has strong security features.

The Future of Mobile Money Transfers

The mobile money transfer industry is evolving rapidly, driven by technological innovation, changing regulations, and growing demand for fast, affordable cross-border payments. As digital finance becomes more accessible worldwide, mobile money apps are transforming how people send and receive funds—especially in regions with limited banking infrastructure.

Key trends shaping the future include:

- Blockchain & Crypto Integration: Technologies like Ripple’s XRP are reducing transfer costs to pennies per transaction, while stablecoins offer a bridge between traditional and digital finance.

- Central Bank Digital Currencies (CBDCs): Countries like Nigeria (eNaira) and China (digital yuan) are piloting CBDCs to enable instant, low-cost remittances and improve financial inclusion.

- AI & Fraud Prevention: Machine learning is helping apps detect scams in real time, making transactions safer for users.

- Regulatory Challenges: Governments are working to balance innovation with consumer protection, leading to new compliance rules that impact global money flows.

- Currency Volatility: Exchange rate fluctuations remain a hurdle, pushing apps to adopt smarter hedging strategies.

The future of mobile money is borderless, instant, and secure—with fintech companies and traditional banks racing to meet the needs of a digitally connected world. Whether through blockchain, CBDCs, or AI-powered security, the goal remains the same: making global payments as easy as sending a text message.

Conclusion

This article talks about how online mobile money transfer apps have changed the way people pay for things around the world by making it easy, quick, and cheap. People and businesses can send and receive money abroad with Biyapay and other services that offer low fees and quick transfer times. Secure deals, real-time tracking, and easy access to funds, especially for people in remote areas, are some of the best things about mobile remittance apps. It’s also easier for businesses to pay their workers, contractors, and customers in other countries. Check out Biyapay, the best mobile money transfer service, to make sending money across borders easier right now!

FAQs

Q1. What is the difference between mobile remittance and mobile money transfer?

Mobile remittance specifically refers to sending money across borders, typically for international transactions, while mobile money transfer can be used for both domestic and international transactions. Biyapay is an excellent choice for both types, offering seamless international remittance services with competitive rates.

Q2. Which mobile money transfer apps are the fastest and most reliable?

The fastest and most reliable mobile money transfer apps offer instant or near-instant transfers with minimal delays. Biyapay is known for its quick transfer speeds and reliability, allowing users to send money internationally without the usual waiting times.

Q3. How secure is sending money internationally via mobile apps?

Mobile apps that send money use encryption and two-factor security to make sure that your transactions are safe. Biyapay puts security first, which is why they offer these strong protections for your personal info and international transfers.

Q4. Can I use a mobile remittance app to send money to anyone, anywhere?

Many mobile remittance apps allow you to send money to recipients in multiple countries. With Biyapay, you can send money to a wide range of destinations, making it easy to transfer funds to anyone, anywhere.

Q5. What are the transaction fees associated with mobile remittance?

Fees for sending money through a mobile phone can be different based on the service and the amount being sent. Biyapay’s fees are fair and easy to understand, so you can be sure you’re getting the best deal on your foreign transfers.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.