- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

A Comprehensive Guide to Purchasing International Travel Insurance: From Coverage to Claims Process

Image Source: pexels

International travel is full of the unknown and adventure, but it also comes with significant risks. Sudden illness or unexpected accidents may lead to high medical expenses, with some countries charging tens of thousands of dollars for treatment. In addition, luggage loss is a prominent issue—data from 2024 shows that Europe has the highest luggage loss compensation rate, with single claim limits often exceeding thousands of dollars. Faced with these risks, the right insurance policy not only provides financial protection but also peace of mind. Choosing insurance is essentially buying peace of mind for yourself and your loved ones.

Main Coverage of International Travel Insurance

Image Source: pexels

Medical Coverage: Covers Sudden Illness or Accidental Medical Expenses Abroad

During international travel, sudden illness or accidental injury can catch you off guard. Medical expenses in many countries—especially in Europe and the U.S.—are extremely high. Even a simple emergency visit may cost thousands of dollars. With insurance, you won’t have to worry about the financial burden in such cases.

Tip: When selecting insurance, ensure that the medical coverage is broad enough to include hospitalization, outpatient services, and medication.

Some plans also provide emergency medical rescue services, such as arranging medical transportation or helping you contact local hospitals. These services are critical during emergencies and can provide timely assistance.

Accidental Injury Coverage: Compensation for Accidents During Travel

Accidents are often unpredictable during trips. High-risk activities like skiing or diving can lead to injuries, and even routine traffic accidents are possible. Accidental injury coverage provides compensation for medical costs and potential income loss due to injury.

When purchasing insurance, check whether high-risk activities are included. If you plan to engage in adventure activities, choose a policy specifically designed to cover such risks.

Trip Cancellation or Delay Coverage: Changes Caused by Uncontrollable Factors

Flight delays, natural disasters, or sudden events can disrupt your travel plans. Trip cancellation or delay coverage offers compensation for extra costs like accommodation, transportation, or rebooking fees caused by changes.

Note: Claims usually require proof, such as flight delay notices or cancellation confirmations. Read the policy terms in advance to ensure you meet the requirements.

When selecting insurance, pay attention to the compensation limits and conditions for trip coverage to avoid unexpected out-of-pocket expenses.

Baggage and Property Coverage: Compensation for Lost, Damaged, or Stolen Luggage

Luggage loss or damage is common during trips. Whether it’s due to airline mishandling or theft in public places, it can cause inconvenience and financial loss. Travel insurance can effectively reduce these risks and provide monetary compensation.

Baggage coverage typically includes:

- Delayed Checked Baggage: If your baggage is delayed, the insurer may compensate for necessary purchases.

- Lost or Damaged Checked Baggage: Loss or damage during transit is reimbursed based on the severity.

- Stolen Personal Items: Valuable items such as phones or cameras are partially covered if stolen.

Here is the coverage and claim limit of a typical comprehensive plan:

| Product Name | Coverage | Compensation Limit | Premium |

|---|---|---|---|

| Comprehensive Plan (Domestic & International) | Delayed Checked Baggage | Compensation of ¥1,000 after 6+ hours, up to ¥1,000 | ¥35/segment |

| Lost Baggage | ¥600 | ||

| Lost Documents | ¥1,000 |

Tip: When selecting insurance, ensure that compensation limits meet your needs, especially for high-value items.

Other Optional Coverages: Legal Assistance, Emergency Services, etc.

Beyond basic coverage, many insurance plans offer additional services to enhance your travel safety. Common add-ons include:

- Legal Assistance: Provides legal consultation or helps contact a lawyer if you encounter legal issues abroad.

- Emergency Rescue Services: Includes medical evacuation and repatriation of remains.

- Travel Assistance: Helps replace lost passports, contact embassies, and more.

These extras can be critical during emergencies. For instance, emergency rescue services can arrange medical transport and reduce the impact of language or cultural barriers.

Recommendation: If you’re traveling to areas with limited medical resources or complex legal environments, choose a plan with these added protections.

How to Choose the Right Insurance

Choose Based on Destination: Medical Costs and Risk Levels Vary by Country

When selecting insurance, your destination is a key factor. Medical expenses and risks vary significantly across countries, so it’s important to choose a product suited to your travel location. Here are some key points:

- Medical costs in the U.S. are much higher than in China, and cancer survival rates also differ.

- The availability of medical equipment and diagnostic models varies by country.

- The quality of service experience differs across healthcare systems.

If you’re traveling to Europe or North America, it’s advisable to choose a plan with higher medical coverage. For areas with limited medical resources, emergency medical rescue services become particularly crucial.

Tip: Research the local healthcare system and potential risks at your destination before purchasing insurance to ensure the policy covers what you may need.

Choose Based on Travel Type: Independent Travel, Group Tours, Adventure Trips

Your style of travel directly influences your insurance needs. Different travel types come with different risks, and your plan should match your itinerary.

- Independent Travel: Requires broader coverage including trip cancellation, lost luggage, and medical emergencies.

- Group Tours: Lower risks but still need accident and trip delay coverage.

- Adventure Travel: Activities like skiing, diving, or mountaineering are high-risk, so choose insurance designed for extreme sports.

For example, Allianz’s “Globetrotter” plan includes humanitarian aid for scenarios like cave exploration, making it ideal for adventure travelers.

Recommendation: When planning your trip, list your activities and choose an insurance product that fully covers them.

Choose Based on Personal Needs: Age, Health Status, Budget

Everyone has different needs, so your age, health condition, and budget should influence your insurance choice. Here are common factors to consider:

- Age: Older travelers may require higher medical limits; younger travelers might prioritize cost-effective basic coverage.

- Health Status: If you have chronic conditions, ensure coverage includes those needs.

- Budget: Select a plan that meets your needs without overspending.

Here’s a comparison of popular insurance plans to help you decide:

| Insurance Provider | Core Product | Key Advantages |

|---|---|---|

| Ping An Insurance | LeYou Global, Voyager | Visa rejection compensation ¥900, kidnapping coverage ¥12,000, 24/7 global support |

| Allianz Insurance | Globetrotter, Schengen King | In-house rescue team, fast response, coverage for extreme sports, top share in Schengen insurance |

| AIG Travel Guard | Universal Travel Plan | Medical coverage up to ¥1 million, compensates for any external flight delay |

| AXA Insurance | Global Comfort | ¥100,000 for self-driving accidents, up to ¥1 million for liability, global hospital access |

| JD Allianz | Light Travel Global | Covers up to 365 days per trip, ideal for long-term travelers |

Tip: Evaluate both coverage scope and value for money to ensure the plan fits your specific needs.

Be Aware of Exclusions and Claim Restrictions: Avoid Common Pitfalls

Many people overlook exclusions and claim limitations when buying travel insurance, which leads to trouble when filing a claim. Understanding these terms helps you avoid misunderstandings and ensures timely compensation.

1. Compensation Limits: Know Your Coverage Cap

Insurance plans often cap the maximum payout. For example, some pet liability policies limit property damage claims to ¥1,000 per incident, with a ¥500 minimum. Travel insurance often imposes similar limits on baggage loss or delays.

Tip: Read the compensation terms carefully to ensure they match your needs. Choose higher limits for valuables or high-risk activities.

2. Exclusions: What Isn’t Covered

Exclusion clauses specify conditions not covered. These often include emotional distress, indirect losses, or specific high-risk activities. Make sure your chosen plan includes any planned activities like skiing or diving.

Case Study: A traveler was denied reimbursement for accommodation after a flight delay because they failed to submit proof of the delay. This highlights the need for both understanding exclusions and preparing documentation.

3. Special Requirements: Extra Rules for Specific Situations

Some plans have stricter rules for certain groups, such as elderly travelers or those with pre-existing conditions. Know these limits before purchasing.

Recommendation: Always confirm special case coverage with the insurer to avoid surprises during claims.

4. Claim Documentation: Ensure Complete Records

Incomplete documentation is a leading cause of denied claims. Insurers typically require medical proof, receipts, itineraries, and other evidence.

Tip: Understand required claim materials before your trip and keep all original documents safe. Scanning or photographing them is a good backup.

By understanding exclusions and limits, you can better match your needs to a policy. Whether it’s medical, trip cancellations, or lost baggage, being informed helps ensure your protection.

Complete Guide to the International Travel Insurance Claims Process

Image Source: pexels

Required Documents for Claims: Medical Records, Receipts, Itinerary, etc.

Unexpected events during travel can be stressful, but preparing the right claim documents is the key to receiving compensation. Insurers typically require the following:

- Medical Certification: Includes doctor’s diagnosis and treatment records proving your medical needs.

- Expense Receipts: Official invoices for all medical costs, accommodation, or related expenses.

- Itinerary: Flight or hotel bookings to verify your travel plans.

- Additional Proofs: Such as flight delay notices or luggage loss reports, depending on the claim type.

Statistics show that 97.5% of claims are for acute illness or accidental medical issues, with total payouts reaching ¥21.85 million. For example, a 79-year-old traveler received ¥300,000 for a fracture in the U.S., while a 75-year-old was compensated ¥830,000 after a fracture in Switzerland. These cases show that proper documentation significantly improves your chances of a successful claim.

Tip: Keep all documents safe during travel, especially original receipts. Taking photos as backups is a good habit in case of loss.

Claims Process: Step-by-Step From Reporting to Submission

Though it may seem complex, the claims process is manageable if you follow the steps:

- Step 1: Report Immediately

Contact your insurer’s 24-hour hotline as soon as an incident occurs. Provide details and get a claim reference number. - Step 2: Prepare Documents

Gather all required documents based on insurer instructions. Ensure they are complete—for example, medical documents must be stamped by a hospital. - Step 3: Submit Materials

Send all materials via the designated channels (online or at a physical branch). Keep a copy or receipt of your submission. - Step 4: Wait for Review

The insurer will assess your claim, usually within 5–10 business days. Once approved, funds will be transferred to your account.

Note: If the insurer requests additional information, provide it promptly to avoid delays.

Following these steps will ensure a smooth process. Whether it’s for medical costs or baggage loss, timely reporting and complete documentation are crucial.

Claims Tips: Avoid Denials Due to Incomplete or Late Submissions

Many claims are denied due to common mistakes. Keep these in mind:

- Complete Documents: Missing items slow down or block your claim. Ensure medical reports have signatures and stamps; invoices must be official.

- Timely Submission: Most insurers require claims within 30 days of the incident. Missing the deadline may void your eligibility.

- Explain Special Cases: If you can’t submit on time due to specific reasons, inform the insurer early and request an extension.

Here are examples of high-success claims regions and case types:

| Claim Type | Statistics |

|---|---|

| Medical Risk | 97.5% of claims for acute illness/injury |

| Total Payout | ¥21.85 million |

| Case Sample | ¥300,000 for 79-year-old’s fracture (U.S.) |

| ¥830,000 for 75-year-old’s fracture (CH) | |

| Key Regions | Japan, U.S., Malaysia, Thailand, Singapore |

Recommendation: Before travel, read policy terms carefully, know the claim deadlines and requirements. Keep your policy and emergency contact info easily accessible during your trip.

With thoughtful preparation and early planning, you can avoid common pitfalls in the claims process. Whether for medical needs, delayed trips, or lost items, thorough readiness ensures full protection when you need it most.

Recommended International Travel Insurance Products

Comparison of Major Insurance Providers: Coverage, Price, Services

Understanding the differences between major insurance companies is crucial when choosing international travel insurance. Below is a comparison based on claim rates, market share, profitability, etc.:

| Insurance Company | Claim Rate Rank | Market Share Rank | Profitability Rank | Reserve Sufficiency Rank | Liquidity Rank | Stability Rank |

|---|---|---|---|---|---|---|

| China Life Insurance Co., Ltd. | 1 | 1 | 1 | 1 | 4 | 7 |

| China Pacific Life Insurance Co. | 3 | N/A | N/A | N/A | N/A | N/A |

As shown, China Life performs exceptionally in claim rate, market share, and profitability—ideal for users seeking high efficiency in payouts. China Pacific also holds competitive advantages in some niche areas. Choose products that match your individual needs.

Major insurers also offer diverse coverage options such as medical reimbursement, high-risk activity protection, and emergency assistance. Some companies even provide intelligent product recommendations and innovative services to improve user experience.

Product Pros and Cons: Matching Different User Needs

Each insurance product has its pros and cons and suits different user types. Below is an analysis:

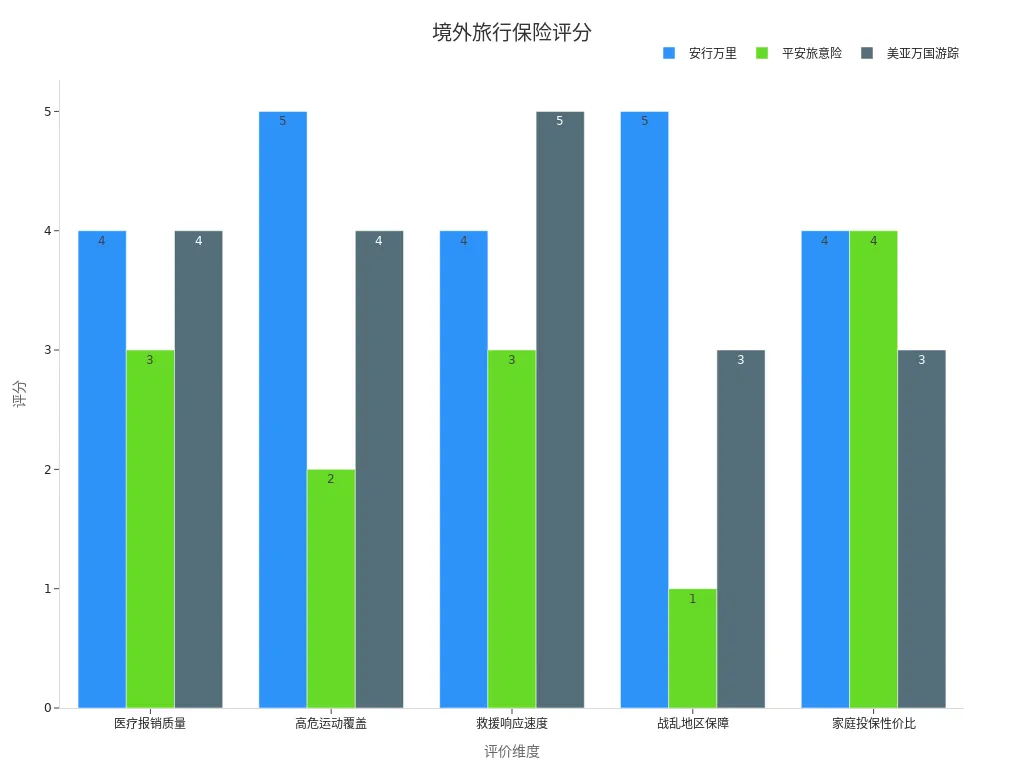

- Anxing Wanli: Excellent coverage for high-risk activities and conflict zones—ideal for adventure travelers.

- Ping An Travel Insurance: High cost-effectiveness for families, but average response time for emergencies.

- AIG Travel Guard: High medical reimbursement and fast emergency response, but less suitable for families due to pricing.

User surveys indicate that over 80% of consumers read product reviews before purchasing insurance. Diverse feedback helps you make better decisions by understanding strengths and weaknesses from real experiences.

User Reviews and Reputation: Choose High-Value Plans

User ratings are a valuable reference when selecting insurance. Below is a score breakdown for popular products:

| Dimension | Anxing Wanli | Ping An Travel | AIG Travel Guard |

|---|---|---|---|

| Medical Reimbursement | ★★★★☆ | ★★★☆☆ | ★★★★☆ |

| High-Risk Activity | ★★★★★ | ★★☆☆☆ | ★★★★☆ |

| Emergency Response | ★★★★☆ | ★★★☆☆ | ★★★★★ |

| Conflict Zone Coverage | ★★★★★ | ★☆☆☆☆ | ★★★☆☆ |

| Family Suitability | ★★★★☆ | ★★★★☆ | ★★★☆☆ |

From these ratings, Anxing Wanli stands out in high-risk and conflict coverage. Ping An is better for families, while AIG Travel Guard leads in emergency response. Choose the product that best aligns with your travel style and budget.

By analyzing coverage, user reviews, and value, you can confidently select the right travel insurance and enjoy worry-free trips.

Best Timing and Channels to Purchase Travel Insurance

When to Buy: How Far in Advance is Best

The best time to buy travel insurance is as early as possible. Early planning ensures your coverage starts before departure and provides access to better choices and prices. Here are the main benefits of early purchase:

- Covers visa denial-related losses if bought early.

- Reimburses non-refundable bookings in case of cancellations.

- Allows time to read terms carefully and avoid rushed decisions.

- Secures better pricing before last-minute price increases.

Tip: Once your trip is confirmed, buy your insurance—especially important during peak travel seasons.

Online vs Offline Purchase: Pros and Cons

Each method of buying insurance has its own advantages. Choose based on your preference:

- Online Purchase Pros:

- Saves time: No need to queue—buy from your phone anytime.

- Flexible: 24/7 availability for urgent needs.

- Digital policy: Sent to your email instantly, easy to store and access.

- Offline Purchase Pros:

- Ask questions in person: Get face-to-face advice to understand policy terms clearly.

- More reassurance: Expert suggestions provide confidence in high-value coverage.

- Paper policy in hand: No worries about phone battery or internet issues.

Recommendation: If you’re comfortable reading terms, go online. If you need expert help or are buying high-coverage policies, offline is safer.

Notes on Buying from Travel Agencies or Third-Party Platforms

If buying through a travel agency or third-party site, keep these points in mind:

- Verify Insurer Credentials: Ensure the insurance provider is reputable and licensed.

- Review Coverage Carefully: Agency-recommended plans might not fully match your needs.

- Check for Extra Fees: Some platforms charge service fees—ask upfront.

- Keep Purchase Proof: Whether digital or paper, store your policy securely for future claims.

Tip: Use well-known platforms when buying through agents to protect your rights and avoid hidden risks.

Travel insurance is your safety net during international trips. It reimburses medical expenses, compensates for lost or delayed luggage, and covers trip cancellations. It also reduces financial stress when emergencies happen.

Choose the right product based on your destination, travel type, and budget. Plan ahead, read the terms, and save all claim documents to ensure full protection.

To simplify the process, BiyaPay offers an all-in-one payment solution. With its platform, you can convert currencies and make international payments quickly and securely. As holiday demand for travel insurance grows, BiyaPay makes insurance purchases easier and safer—giving you peace of mind on every journey.

FAQ

1. Is international travel insurance mandatory?

Not always, but it’s highly recommended. It protects you from high medical bills, trip cancellations, and other risks. Especially in countries with expensive healthcare, it’s your most reliable safeguard.

2. How do I choose the right insurance?

Match your plan to your destination, trip type, and personal needs. Adventure travel requires high-risk activity coverage, while family trips focus on medical and itinerary protection.

Tip: Choose insurance with emergency rescue services for more complete protection.

3. Does insurance cover all countries?

Most plans offer global coverage, but some exclude high-risk regions. Confirm whether your destination is covered—conflict zones or pandemic hotspots are often excluded.

4. What costs are covered if I cancel my trip?

Trip cancellation coverage usually includes non-refundable expenses like flights and hotels. You must provide supporting documents, such as airline or medical cancellation notices.

5. How should I store my travel insurance policy?

Digital copies are the most convenient. Save them to your phone or cloud, and print a paper backup in case of low battery or no internet.

Recommendation: Save your insurer’s emergency contact info in your phone before you travel.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.