- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Can Forex Be Transferred? Comparing Traditional Banks and New Platforms

Image Source: unsplash

Can forex be transferred? The answer is yes. Through specific channels, you can easily complete international transfers of foreign exchange. Currently, traditional banks and emerging transfer platforms are the two main options. Each method has its unique advantages, and you should choose the channel that best fits your needs. Understanding the characteristics of different transfer methods will help you manage funds more efficiently.

Key Points

- Forex transfer is feasible; choosing the right channel can improve efficiency and reduce costs.

- Traditional banks suit large transfers, offering high security and broad service coverage, but with longer processing times.

- Emerging transfer platforms like Wise and BiyaPay offer advantages in fees and speed, ideal for small and fast transfers.

- Knowing the pros and cons of different transfer methods helps you choose the best solution based on your needs.

- When making international transfers, pay attention to exchange rate fluctuations and fees, choosing transparent platforms to minimize costs.

International Transfer Services of Traditional Banks

Image Source: pexels

Transfer Process

The international transfer process of traditional banks is relatively complex but standardized. You need to go to a bank counter or submit a transfer application via online banking. The bank will require detailed beneficiary information, including name, account number, and the receiving bank’s SWIFT code. Then, the bank reviews your request and transfers funds via wire transfer or other methods.

The processing time for international bank transfers varies by bank and region. Below is a summary of processing times for selected banks across different countries and regions:

| Region/Country | Bank Name | Processing Time |

|---|---|---|

| Mainland China | Bank of China (BOC) | 5-7 business days |

| Hong Kong | HSBC | 3-5 business days |

| Singapore | DBS Bank | 2-4 business days |

| United States | Bank of America | 3-5 business days |

Key Points:

- Processing Time: International transfers typically take 2-7 business days. Wire transfers (SWIFT) generally arrive within 3-5 business days, depending on the bank’s efficiency and public holidays. Transfers initiated between Tuesday and Thursday may arrive faster, with some cases as early as Monday.

- Considerations:

Fees: Transfers incur fees and exchange rate spreads. Compare bank policies for cost details.

Recommendation: Opt for efficient banks (e.g., DBS in Singapore) or digital platforms (e.g., Wise) for faster processing.

Transfer Fees

Traditional bank international transfer fees comprise multiple parts, including service fees, telegraph fees, cash-to-telegraphic transfer spreads, etc. The breakdown is:

| Fee Type | Amount or Rate |

|---|---|

| Service Fee | Usually calculated at 0.1% of amount |

| Telegraph Fee | It is USD 10-20 per transaction (or in local currency) |

| Cash-to-Telegraphic Transfer Spread | Fees for converting cash to telegraphic transfer rate |

| Correspondent Bank Fees | Varies by agreement and transfer amount |

| Exchange Rate Spread | Cost borne by the user due to rate differences |

Note that service fees and telegraph fees are fixed costs, while exchange rate spreads and correspondent fees vary based on amount and destination.

Transfer Speed

Traditional bank international transfers are slow, typically requiring 3 to 5 business days. Counter-initiated cross-border transfers may be faster; for example, Bank of China’s counter remittances usually arrive within 1 to 2 business days. However, arrival time depends on the destination bank’s processing efficiency and time zone differences.

If you need quick forex transfer, traditional banks might not be the best choice. Emerging platforms offer speed advantages.

Pros and Cons of Traditional Banks

When choosing an international transfer channel, consider traditional banks’ services. Here are their main advantages and disadvantages to help assess suitability.

Advantages

- High Security: Banks have comprehensive regulatory frameworks and strict fund management, ensuring fund safety.

- Wide Coverage: Most banks support global transfers, suitable for users sending money to multiple countries.

- High Trust: As established financial institutions, banks have strong reputations and long-term customer trust.

- Multiple Services: Banks offer additional services like forex exchange, account management, and financial consulting, allowing one-stop solutions.

Disadvantages

- High Fees: Service fees, telegraph fees, and exchange rate spreads tend to be costly, especially for small transfers where these fees are proportionally large.

- Slower Speed: International transfers typically take 3 to 5 business days or longer, not ideal for urgent needs.

- Complex Procedures: Multiple forms and possible in-person visits make the process time-consuming and cumbersome.

- Limited Flexibility: Bank service hours restrict operations, and transfers to certain countries may have limitations.

Tip: If you prioritize security and stability, traditional banks are reliable. But if speed and cost matter more, consider other options.

Understanding these pros and cons helps clarify if traditional banks meet your forex transfer needs.

International Transfer Services of New Platforms

Image Source: unsplash

In recent years, new platforms for international transfers have rapidly risen as strong competitors to traditional banks. Below are features and advantages of three major emerging platforms — Wise, Pandaremit, and BiyaPay — to help you choose suitable tools.

Features and Advantages of Wise

Wise is renowned for low costs and transparent fees. Both individuals and businesses can enjoy near wholesale bank exchange rates. Fee structure details:

| Payment Method | Fee Formula | Fee for Sending 1000 USD |

|---|---|---|

| Bank Debit (ACH) | 0.94 USD + 1.22% | 13.03 USD |

| Wire Transfer | 4.46 USD + 1.02% | 14.54 USD |

| Using Wise Multi-Currency Balance | 0.6 USD + 0.98% | 10.32 USD |

Wise’s other major strength is speed. Most transfers complete within 1-2 business days; some even offer instant arrival. For fast forex transfers, Wise is an efficient choice.

Features and Advantages of Pandaremit

Pandaremit focuses on efficient international transfers for cross-border e-commerce and SMEs. Its main features include:

- One-Stop Forex Settlement: Real-time online forex settlement commands enable same-day fund arrival, greatly enhancing turnover efficiency.

- Compliance and Tax Support: Tracks settlement totals to ensure compliance, offers export tax refund services to reduce tax risks.

- Transparent and Favorable Exchange Rates: Provides near-bank wholesale rates; flexible settlement timing helps optimize margins.

Pandaremit’s services are ideal for frequent global settlement business users. Its streamlined process and flexible rates enhance competitiveness.

Features and Advantages of BiyaPay

BiyaPay, a multi-asset trading wallet, integrates remittance, asset management, and investment. Wherever you are, BiyaPay enables fast international transfers. Key advantages:

- Multi-Currency Support: Supports over 30 fiat currencies and 200 digital currencies, catering to diverse asset management needs.

- Fast Arrival: Transfers and receipts often complete same day, greatly improving transaction efficiency.

- Extensive User Base: Covers 100+ countries/regions with over 500,000 users and cumulative transfers exceeding $1 billion.

Additionally, BiyaPay plans collaboration with VISA cards, enhancing payment convenience. Future integration with Apple Pay, Google Pay, etc., will provide more options.

Tip: If you want a fast, secure, and feature-rich platform, BiyaPay is a trustworthy choice.

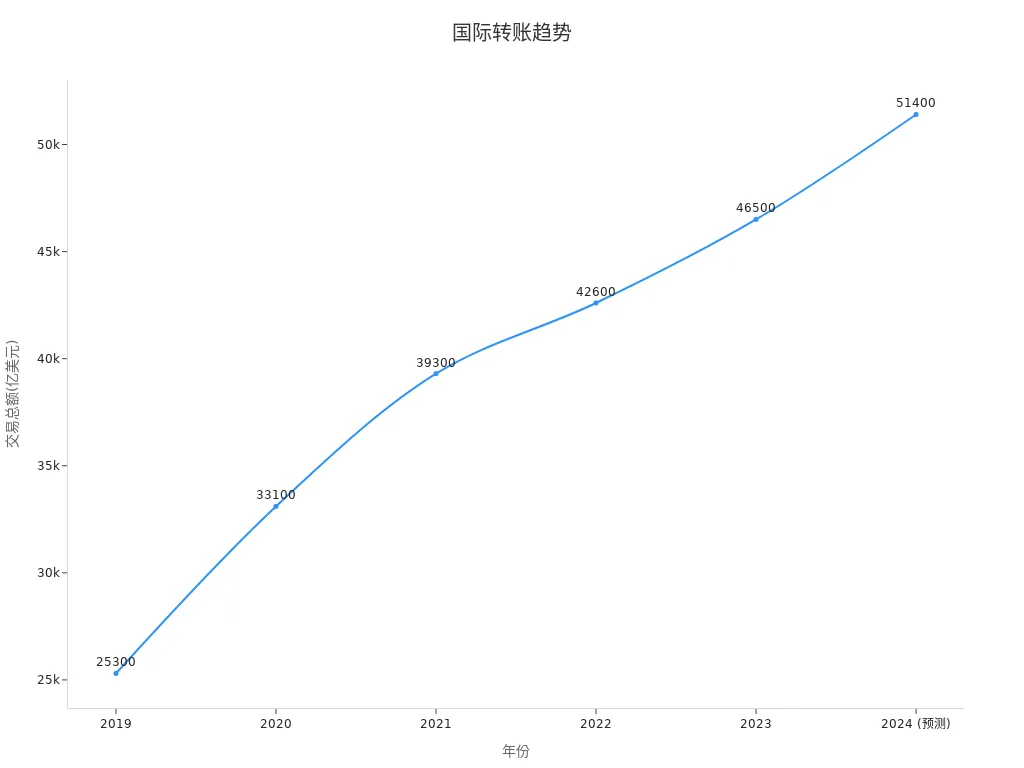

With global economic openness and accelerating digitization, new platform markets continue expanding. In 2023, transaction volumes reached 4.65 trillion USD, with global e-commerce projected to exceed 8 trillion USD by 2027. This trend underscores the growing importance of new platforms.

Suitable Scenarios for New Platforms

Emerging platforms’ efficiency and convenience suit multiple scenarios. Whether individual or corporate users, choose platforms per your needs.

1. Cross-Border E-Commerce and Corporate Settlement

If you’re a cross-border e-commerce seller or SME owner, new platforms simplify financial processes. For example, many sellers use WorldFirst for payments and forex services, improving fund management efficiency. Antom platform offers global acquiring, helping SMEs access online payments rapidly. These flexible and efficient services suit frequent international settlements.

2. Personal Cross-Border Consumption

Frequent travelers or shoppers benefit from new platforms’ convenience. For example, Chinese tourists pay in RMB using Alipay+ in Southeast Asia without pre-exchanging currency, saving time and avoiding exchange rate risks.

3. Cross-Border Financing and Data Verification

For cross-border financing or data verification, new platforms provide support. For instance, WeBank’s blockchain-based “Yuexinrong” service addresses information asymmetry, enabling successful overseas financing. It has covered over 20 financial institutions, becoming a key cross-border data flow tool.

4. Digital Currency and Multi-Currency Management

Users managing multiple currencies find strong support in new platforms like BiyaPay. One platform manages fiat and digital currencies, facilitating globalized asset management.

Tip: For enterprises and individuals alike, new platforms offer flexible, efficient solutions for various international transfer needs.

Comparative Analysis of Traditional Banks and New Platforms

Fee Comparison

Fees are key when selecting international transfer channels. Traditional banks’ fees are complex, typically including service fees, telegraph fees, and exchange rate spreads. Service fees are often 0.1% of transfer amount;Telecommunication fees are between USD 10 and 20 (or subject to local currency conditions). Exchange rate spreads add hidden costs. For small transfers, these fees can be disproportionately high.

In contrast, new platforms offer more transparent and lower fees. For example, Wise charges fixed plus percentage fees with clear breakdowns. Pandaremit and BiyaPay offer near-wholesale exchange rates, reducing extra costs from rate spreads. For cost-conscious users, new platforms are clearly more attractive.

Tip: To save transfer costs, especially for small amounts, new platforms are more economical.

Speed Comparison

Transfer speed directly affects fund usability. Traditional banks typically take 3 to 5 business days or longer. Comparison:

| Service Type | Processing Speed |

|---|---|

| Traditional Banks | 3 to 5 business days |

| New Platforms | Instant or next-day arrival |

New platforms have clear speed advantages. With BiyaPay, transfers and receipts complete same day. Wise and Pandaremit also offer instant or next-day arrival. This efficiency suits users needing rapid forex transfers.

Tip: If you need quick arrival, new platforms’ instant transfer saves time.

User Experience Comparison

User experience is vital for service quality. Traditional banks’ transfer processes are complex, requiring multiple form fields and possibly in-person visits. This adds time and psychological burden for unfamiliar users.

New platforms focus on user experience. BiyaPay provides intuitive interfaces; transfers can be done easily via mobile or desktop. Wise and Pandaremit support multiple payment methods like credit cards and e-wallets, enhancing convenience. Real-time exchange rate and fee calculators inform users upfront.

Tip: For convenient and efficient experience, new platforms are preferable.

Suitable Scenario Comparison

Choosing a transfer channel depends on scenarios. Different methods perform differently depending on needs. Here is a comparative analysis:

1. Large Amount Transfers

For large sums, traditional banks are more reliable due to strict regulation and fund management. Advantages:

- High Fund Security: Regulated by national authorities; low fund risk.

- Multi-Currency Support: Handles diverse fiat currency transfers.

New platforms are improving large transfer capabilities. For instance, BiyaPay supports 30+ fiat currencies and 200+ digital currencies with fast speed. If fast large transfers matter, consider BiyaPay.

Tip: For highest security, traditional banks are top choice; for speed and convenience, new platforms suffice.

2. Small Amount Transfers

New platforms excel in small transfers. Traditional banks’ fixed fees and telegraph charges can make small transfers costly. Features of new platforms:

- Low Fees: Wise and Pandaremit have transparent, much lower fees.

- Convenient Operations: Mobile or desktop transfers anytime, no bank visits.

Using BiyaPay, small remittances can complete same day with transparent rates, avoiding hidden costs.

Tip: For frequent small transfers, new platforms are more cost-effective and efficient.

3. Cross-Border E-Commerce and Corporate Settlement

Cross-border e-commerce and enterprises often require frequent international settlements. Traditional banks’ slow and complex processes may hamper cash flow. New platforms offer flexibility:

- Real-Time Settlement: Pandaremit supports same-day arrival, boosting liquidity.

- Tax Support: Offers export tax refund services.

- Multi-Currency Management: BiyaPay supports fiat and digital currencies for global asset management.

For e-commerce sellers or SMEs, new platforms streamline finances and boost competitiveness.

Tip: For frequent settlement, new platforms’ flexibility and speed appeal more.

4. Personal Cross-Border Consumption

Personal users seek convenience and low cost in cross-border spending. Traditional banks are cumbersome and expensive. New platforms offer:

- Instant Payments: BiyaPay enables quick payment without pre-exchanging currency.

- Multiple Payment Methods: Support credit cards, Apple Pay, soon Google Pay.

Tip: Frequent travelers benefit from new platforms’ convenience and cost savings.

5. Digital Currency Trading and Asset Management

Users managing digital assets get strong support from new platforms like BiyaPay. One platform covers fiat and digital currency trading, enabling globalized asset management. Advantages:

- Multi-Currency Support: BiyaPay supports 30+ fiat and 200+ digital currencies.

- High Security: Employs advanced encryption for safe transactions.

For crypto investors or multi-currency managers, new platforms provide better solutions.

Tip: For crypto trading and asset management, new platforms offer superior functions and security.

This comparison helps you pick the most suitable transfer method based on needs. Both traditional banks and new platforms have unique scenarios. Choosing the right tool aids efficient international transfers.

Choosing the Best Transfer Method Based on Needs

Recommendations for Small Transfers

For small transfers, focus on fees and efficiency. Traditional banks’ fees may be prohibitive. Emerging platforms offer cost-effective solutions. For example, BiyaPay and Wise use transparent fee models, lowering costs.

Suggestions:

- Choose low-cost platforms: Prefer platforms with low fees and transparent rates like BiyaPay and Wise, suitable for small transfers.

- Use real-time forex settlement: Platforms like XTransfer provide online auto-settlement for quick currency conversion.

- Support multi-currency accounts: Hold multiple currency accounts to meet market demands, avoiding frequent exchanges.

For example, XTransfer’s innovative cross-border payment offers SMEs efficient and secure transfers with near-wholesale rates and smart risk controls, saving fees and improving speed.

Proper platform choice saves costs and boosts efficiency in small transfers.

Recommendations for Large Transfers

For large transfers, security and stability matter most. Traditional banks are advantageous, being highly regulated with sound fund management.

Suggestions:

- Prioritize traditional banks: If fund security is paramount, banks are reliable, supporting multiple fiat currencies.

- Monitor exchange rate volatility: Large transfers are sensitive to rate changes; use services offering real-time rate checks to transfer at optimal times.

- Consider efficient new platforms: For fast large transfers, BiyaPay supports many currencies with rapid speed.

Tip: Both traditional banks’ security and new platforms’ speed have benefits. Choose based on needs.

Recommendations for Frequent Transfers

For frequent transfers, focus on cost saving and ease of operation. Traditional banks’ multi-layer intermediaries raise fees and complicate processes. New platforms offer better solutions.

Suggestions:

- Choose real-time payment systems: Platforms like BiyaPay and Pandaremit provide fast arrival, improving fund use.

- Reduce transaction costs: Use bank-enterprise direct-connect systems to cut intermediaries, lowering fees and rate spreads.

- Enhance financial transparency: Select platforms with real-time fund tracking for clear transaction visibility.

Comparison of channels for frequent transfers:

| Advantages | Bank-Enterprise Direct Connect | Traditional Cross-Border Payment |

|---|---|---|

| Lower Transaction Costs | Direct bank connection, fewer intermediaries | Multiple intermediaries, higher fees |

| Higher Payment Efficiency | Real-time payments, quick arrivals | Requires bank processing time |

| Enhanced Transparency | Real-time fund tracking | Lower transparency |

| Multi-Currency Support | Supports multiple currencies | Limited currency support |

| Security Assurance | Advanced security tech | Lower security |

| Convenient Online Operation | Pay anytime anywhere | Requires bank |

counter visits |

Choosing efficient and transparent platforms saves time and cost, enhancing fund management for frequent transfers.

Recommendations for Specific Destination Transfers

Destination countries affect transfer methods and costs due to local financial policies and payment systems. Here are recommendations:

1. Transfers to Europe and America

Financial systems are mature with extensive interbank networks. Options:

- Traditional Banks: For large amounts, secure choice with SWIFT transfers.

- New Platforms: For small or fast transfers, BiyaPay and Wise offer transparent fees and near-real-time arrivals.

Tip: Choose channels supporting USD or EUR; check exchange rates for best timing.

2. Transfers to Southeast Asia

Cross-border payments grow rapidly here; new platforms excel.

- Local Platforms: Pandaremit offers low fees and fast arrivals in multiple local currencies.

- Multi-Currency Wallets: BiyaPay supports easy currency conversion and transfers (e.g., HKD to USD, GBP).

| Platform | Suitable Scenario | Main Advantages |

|---|---|---|

| Pandaremit | Small transfers, corporate settlement | Low cost, fast arrival |

| BiyaPay | Multi-currency management, personal use | Multi-currency support, real-time arrival |

Tip: Southeast Asia currency volatility is high; prefer platforms with real-time rate checking.

3. Transfers to Africa

Financial infrastructure is less developed, but mobile payments and crypto grow fast.

- Digital Currency Transfers: BiyaPay’s digital currency support is ideal for bypassing traditional banking.

- Mobile Payment Platforms: Local preferences like M-Pesa accept funds via new platforms.

Tip: Ensure beneficiaries have compatible local accounts or wallets.

4. Transfers to Middle East

Strict financial regulations and forex rules apply.

- Compliant Platforms: BiyaPay supports multi-currency trades, meeting local compliance.

- Fee Awareness: Banks may charge high intermediary fees; transparent platforms like Wise help reduce costs.

Tip: Research local forex policies to ensure smooth transfers.

5. Transfers to South America

Currencies fluctuate strongly; some financial systems unstable.

- Use New Platforms: BiyaPay handles multiple South American currencies with fast transfers and reduced forex risk.

- Platforms Supporting Local Currencies: Wise and Pandaremit offer near-wholesale rates for small amounts.

Tip: Use platforms supporting real-time rate locking to control costs.

With these recommendations, select transfer methods fitting destination features. Both traditional and emerging options have unique advantages. Flexibly choosing channels based on needs and locations improves international transfer efficiency.

Forex can be transferred; choosing the right channel is crucial. Traditional banks suit large, stable transfers with high security and broad coverage. New platforms better serve small, fast, and convenient transfers with cost and speed advantages. Consider your needs, fees, speed, and scenarios to pick the optimal method for efficient fund management.

FAQ

1. What information is needed for forex transfers?

You need beneficiary name, bank account number, receiving bank’s SWIFT code, and transfer amount. Some platforms may require additional info like beneficiary address. Ensure accuracy to avoid failures.

2. How to select the best exchange rate when transferring?

Use new platforms to check real-time rates (e.g., BiyaPay offers transparent rates). Transfer during stable rate periods to reduce costs. Monitor markets to avoid peak volatility fees.

3. What to do if a transfer fails?

First, verify info accuracy. Then contact the transfer platform or bank customer service with transaction ID for investigation. Most platforms resolve issues within 24 hours ensuring fund safety.

4. Is transferring via new platforms safe?

New platforms use advanced encryption and multi-factor authentication to secure funds and data. For example, BiyaPay employs strict risk control protecting user assets. Choose reputable platforms for peace of mind.

5. What should be noted when transferring to different countries?

Local financial policies and currencies affect transfer methods. Check forex regulations before transferring. Choose platforms supporting local currencies, e.g., BiyaPay supports 30+ fiat currencies for diverse needs.

Tip: Verify info and policies beforehand to ensure smooth transfers.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.