- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Top Multi-Currency Accounts for Global Transactions

What is a Multi-currency account?

A multi-currency account is a type of account that allows users to hold, manage, and transact in multiple currencies simultaneously. These accounts are becoming increasingly popular with businesses that operate internationally, as well as individuals who travel or shop across borders. Unlike traditional single-currency bank accounts, multi-currency accounts offer the flexibility of dealing with a wide range of currencies without the need for separate accounts for each one.

For businesses and freelancers, multi-currency payment processing becomes a convenient way to handle transactions in various currencies. Similarly, for individuals, having a multi-currency wallet or a multi-currency card means they can manage different currencies effortlessly, especially when traveling or making international purchases.

Compared to traditional accounts, which require users to convert their funds each time they make an international transfer, a multi-currency account simplifies the entire process, saving both time and money. Whether you are an entrepreneur managing cross-border payments or an individual making international purchases, a multi-currency bank account can streamline the entire process.

How does a multi-currency account work?

A multi-currency account works by allowing you to hold balances in various currencies. For example, you could have an account that holds USD, EUR, GBP, and other currencies. Instead of having multiple bank accounts for each currency, you can manage them all within one account.

These accounts work by allowing users to deposit, withdraw, and exchange funds across multiple currencies. Some multi-currency wallets or multi-currency bank accounts also enable users to perform currency conversions within the account itself, often at competitive exchange rates. This eliminates the need to use a third-party service to handle currency conversion, saving on fees and time.

The exchange rates and fees associated with multi-currency accounts can vary based on the platform you use. While many services offer competitive rates, it’s important to review the terms and conditions to ensure you’re getting the best deal on currency conversion.

Additionally, multi-currency accounts provide the convenience of making payments in the local currency of the recipient, reducing the need for frequent conversions and avoiding unfavorable exchange rates offered by traditional banks.

Benefits of a multi-currency account

Cost efficiency

One of the primary benefits of a multi-currency account is its cost efficiency. With traditional bank accounts, each time you make an international payment, you may be charged a conversion fee, which can add up quickly. Multi-currency payment processing eliminates the need for frequent currency exchanges, saving on these fees. Instead, you can hold the currency you need and make payments without the hassle or cost of conversions.

Convenience

Another advantage of a multi-currency account is the convenience it offers, especially for frequent travelers and international businesses. Rather than having to convert money every time you cross borders or do business with international clients, you can hold various currencies in one account. This eliminates the need to manage multiple bank accounts and accounts for different currencies.

For businesses, this means less hassle in handling international payments. For personal users, this can make international travel or online shopping much more straightforward.

Real-time currency exchange

A multi-currency account allows users to convert currencies at real-time exchange rates. Traditional banks often provide less favorable rates and may charge additional fees. Multi-currency wallets or cards can offer real-time, market-based exchange rates, enabling users to convert currencies at competitive rates without waiting for long processing times or dealing with hidden charges.

Financial flexibility

With a multi-currency account, you have the ability to make payments directly in the local currency of the country you’re transacting with. This eliminates the need to convert currencies or make multiple transfers between accounts. Whether you are making international business payments or simply spending time while traveling, a multi-currency bank account allows you to pay in local currencies with ease.

Types of multi-currency accounts

Multi-currency bank accounts

Traditional multi-currency bank accounts are offered by various banks that allow users to hold and manage multiple currencies in a single account. These accounts are ideal for businesses or individuals who require frequent international transactions. Many multi-currency bank accounts provide online banking and mobile app access, making it easier to monitor your balances and exchange currencies as needed.

Multi-currency wallets

Multi-currency wallets like PayPal, Revolut, or TransferWise offer users the ability to hold multiple currencies within a digital wallet. These wallets are often used for online purchases or managing funds for international payments. Many digital wallets provide features like currency conversion, enabling users to spend in different currencies without needing a traditional bank account.

Multi-currency payment cards

A multi-currency card is a prepaid or debit card that allows users to hold multiple currencies on a single card. These cards are especially useful for travelers or individuals who need to make online purchases in different currencies. Popular providers like Revolut offer multi-currency cards with low conversion fees and additional features like cryptocurrency support.

Personal vs. Business Accounts

While both personal multi-currency account****s and business multi-currency account****s offer similar functionalities, the main difference lies in their use cases. Personal accounts are often used for travel, online shopping, or personal savings in multiple currencies. In contrast, business multi-currency accounts cater to businesses with international clients, offering features like payment processing, invoicing, and integration with accounting systems.

How to choose the best multi-currency account

Choosing the best multi-currency account depends on several factors, including your specific needs, whether you are an individual or a business, and the services you require. Here are key considerations to keep in mind when selecting the right account:

- Fees: Look for accounts with low or no transaction fees for currency exchanges and international transfers. Many providers offer free multi-currency bank accounts, but some may charge additional fees for specific transactions.

- Supported Currencies: Ensure the account supports the currencies you frequently use or deal with. Some multi-currency accounts offer dozens of currencies, while others may be limited to just a few.

- Ease of Use: Choose an account with a user-friendly interface, especially if you’re managing multiple currencies. Some platforms, like Wise multi-currency account****s, offer an intuitive app to help users easily manage their funds.

- Integration with Payment Systems: If you’re a business, look for an account that integrates easily with your payment systems (e.g., PayPal, Stripe), making it easier to process payments and manage finances.

- Security: Choose an account that offers robust security features like encryption and two-factor authentication to protect your funds and personal information.

Best multi-currency accounts for 2025

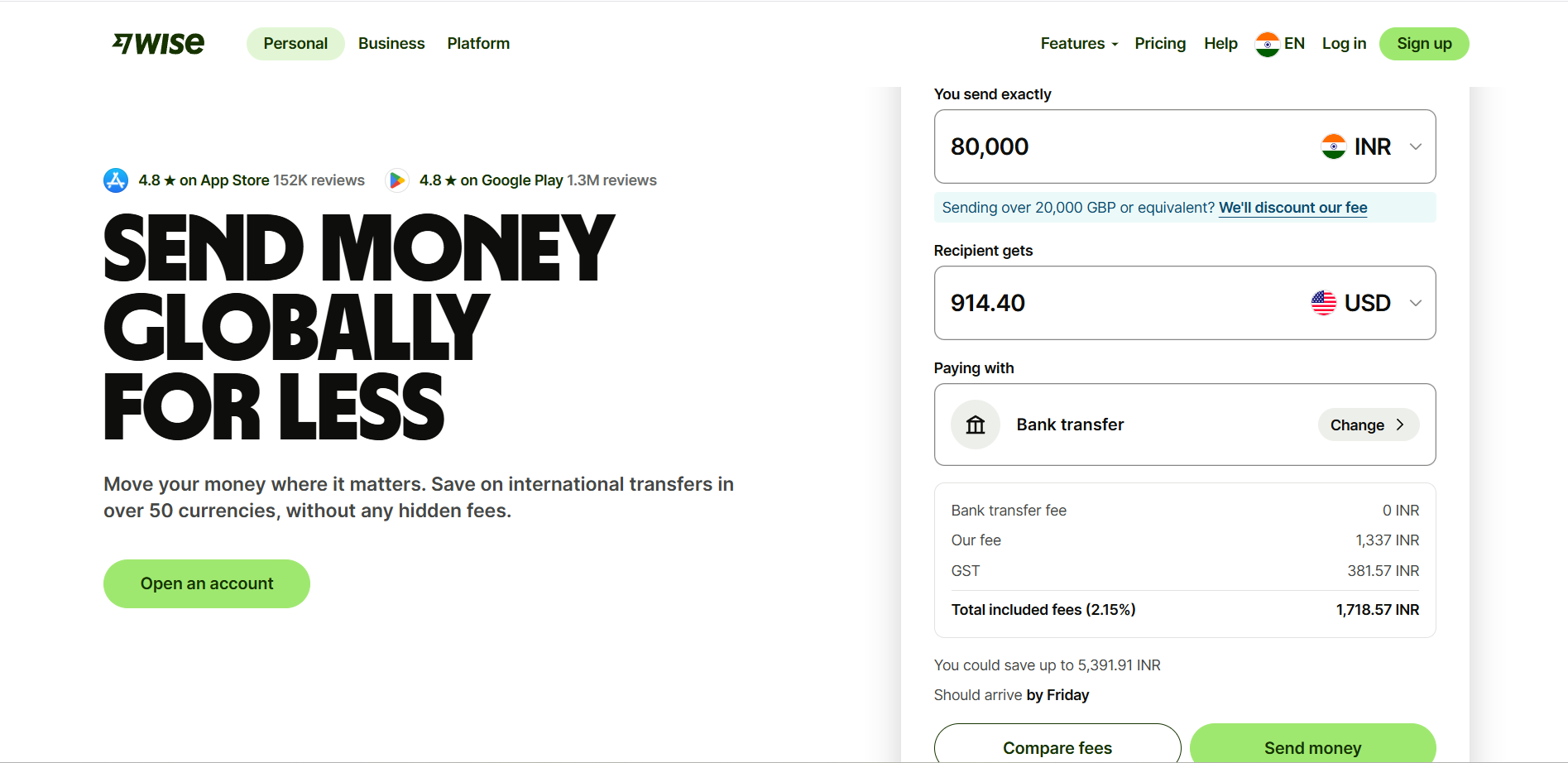

1. Wise (formerly TransferWise)

Wise is a popular choice for individuals and businesses due to its low fees, real-time exchange rates, and ability to hold multiple currencies in one account. It offers both personal and business accounts, making it a versatile choice for managing cross-border transactions.

2. Revolut

Revolut is a versatile multi-currency wallet and card provider that offers a range of additional financial services, including cryptocurrency support. It’s ideal for individuals who need a multi-currency card for travel or online purchases and businesses that deal with international clients.

3. Payoneer

Payoneer is a multi-currency account solution perfect for freelancers and businesses. It offers global payment services, allowing users to hold and manage multiple currencies. Payoneer is especially useful for those who need to receive payments from international clients.

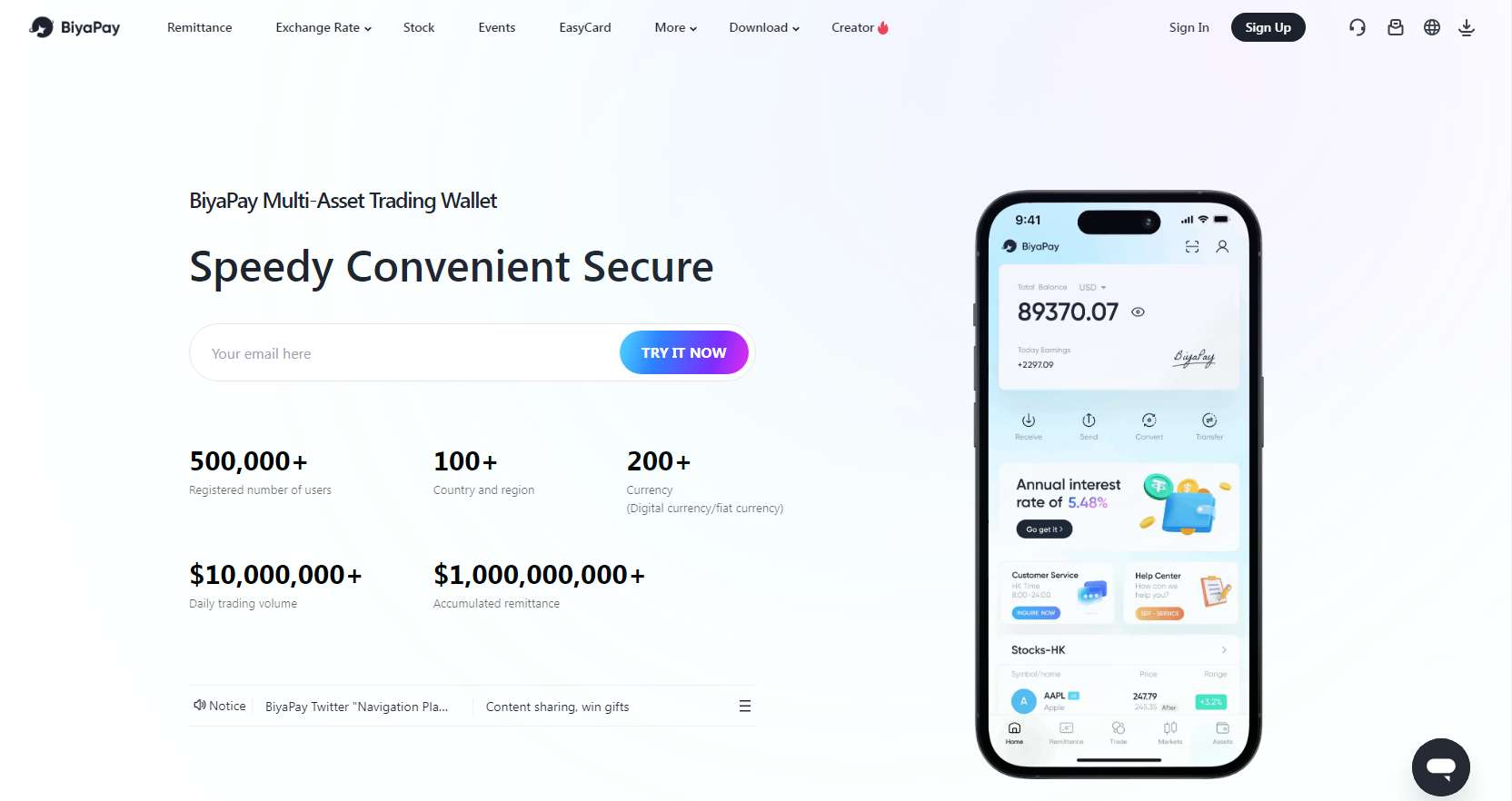

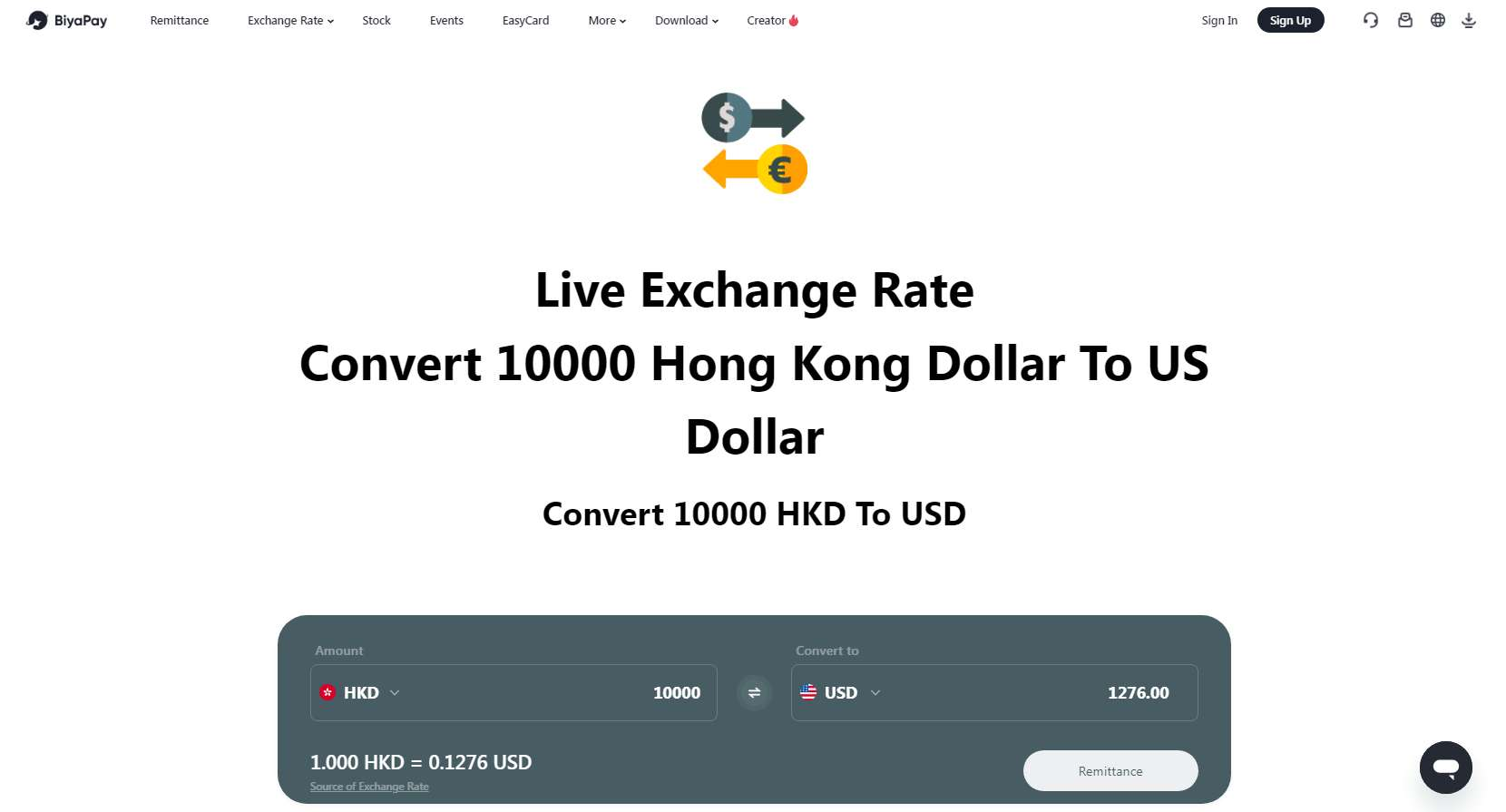

4. BiyaPay

BiyaPay provides a comprehensive solution for managing multi-currency payments and international transactions. It allows businesses and individuals to hold, exchange, and transact in multiple currencies at competitive rates. BiyaPay also integrates easily with various payment systems, making it a great option for businesses seeking seamless cross-border transactions.

BiyaPay: Simplifying multi-currency management for businesses and individuals

Managing money across borders used to mean juggling banks, apps, and hidden fees. Not anymore. BiyaPay rewrites the rulebook for multi-currency payments, giving both individuals and businesses a single, streamlined platform to move money without madness.

Simple steps to master multi-currency payments with BiyaPay

Step 1: Sign up and set up your account Download the BiyaPay app or visit the website, then register in minutes with basic details. Choose between personal or business use.

Step 2: Add and hold multiple currencies Load your wallet with various currencies like USD, EUR, GBP, INR, and more—all in one account. There is no need for multiple bank setups.

Step 3: Instantly convert and transfer funds Use BiyaPay’s real-time exchange feature to swap currencies instantly at competitive rates. Send or receive money globally with minimal fees.

Step 4: Track, manage, and accept payments Use the intuitive dashboard to monitor balances, track transactions, and for businesses—accept payments in multiple currencies seamlessly.

Whether you’re a global freelancer, an e-commerce brand scaling across continents, or just someone sending money abroad—BiyaPay lets you hold, exchange, and send funds in multiple currencies at rates that don’t feel like daylight robbery. No need for third-party middlemen or endless conversion hoops.

Why does BiyaPay work for everyone?

- Secure, encrypted transactions—because peace of mind should be the default.

- Ultra-low fees that put traditional banks to shame.

- Real-time currency conversion at competitive FX rates.

- User-friendly dashboard for tracking balances, rates, and transfers in seconds.

The integration of BiyaPay with payment processing systems, allowing businesses to accept payments in multiple currencies and manage funds seamlessly as:

- Plug-and-play magic: BiyaPay doesn’t just integrate—it melds with your payment stack, making multi-currency acceptance feel frictionless and freakishly fast.

- Let the world pay their way: USD, EUR, INR, JPY—you name it. Your customers pay in their currency, your dashboard handles chaos like a pro.

- One dashboard to rule them all: Real-time tracking, currency sorting, instant conversions—BiyaPay turns financial clutter into surgical clarity.

- Smash the conversion trap: Say goodbye to double-dips and shady FX fees. With BiyaPay, you hold and convert on your terms.

- No more “pending” purgatory: Lightning-speed settlements get your money moving faster than traditional banks can even log in.

- Fortress-level security: BiyaPay doesn’t mess around—every transaction is armored with encryption and AI monitoring.

- Scales like a beast: Whether you’re a side-hustler or a borderless biz, BiyaPay scales without breaking a sweat—or your backend.

Multi-currency payment processing for businesses

Gone are the days when a business could thrive with just one currency in its toolbox. Today, multi-currency payment processing is not just a convenience—it’s a competitive edge. Whether you’re running a global e-commerce empire or freelancing from a beach in Bali, the ability to accept payments in multiple currencies is a game-changer.

So, how does it work? Instead of forcing your international clients to convert their money into your local currency (and potentially bounce due to bad exchange rates), multi-currency processors let them pay in their currency of choice—yen, euros, dollars, rupees—you name it. Behind the scenes, your payment platform handles the conversion, deposits the funds in your account, and logs the transaction, all without you lifting more than a click.

For online stores, this means fewer abandoned carts. For freelancers, it means faster payments. For businesses with global clientele, it means simplified bookkeeping and less revenue lost to sketchy exchange fees. Plus, you get the bonus of cleaner accounting, since your reports are currency-aware right from the source.

And yes, platforms like BiyaPay are jumping ahead by offering built-in currency conversion, real-time rate alerts, and multi-currency wallets, making cross-border payment chaos a thing of the past.

Free multi-currency bank accounts: Are they worth it?

In a world that moves faster than FX charts can update, free multi-currency bank accounts promise financial freedom across borders—without burning a hole in your wallet. But do they truly deliver, or is there fine print lurking beneath the “free” label?

What makes them different? Unlike premium or paid accounts, free multi-currency accounts often give you the essentials: the ability to hold and convert between major currencies (like USD, EUR, GBP) and send/receive internationally. But while the front-facing features seem generous, backend limitations can tell a different story—think lower transfer limits, fewer supported currencies, and delayed processing times.

Pros

- Zero monthly fees: Ideal for casual travelers, digital nomads, or side-hustlers dipping into international waters.

- Multi-currency access: Store, send, and spend in multiple currencies without constantly converting.

- Easy setup: Most free plans skip the paperwork and credit checks—sign up, verify, and go.

- Great for testing the waters: A no-risk way to explore cross-border finance before committing to a paid plan.

Cons

- Hidden costs: “Free” doesn’t always mean zero fees—watch for marked-up exchange rates or withdrawal charges.

- Fewer currency options: Exotic or less-traded currencies may be locked behind premium tiers.

- Transfer limits: Monthly caps on how much you can send or convert.

- Reduced customer support: Free users might wait longer for help—or get only automated responses.

Examples of platforms offering free multi-currency account****s

- Revolut: Revolut’s free Standard plan gives you access to a multi-currency account supporting 30+ currencies. You can exchange and spend globally at interbank rates (up to a certain limit), make free ATM withdrawals, and track spending in-app. Perfect for digital nomads and travelers, but watch for weekend exchange markups and monthly conversion caps.

- BiyaPay: BiyaPay offers a free multi-currency wallet designed for global citizens, freelancers, and investors. You can hold, convert, and transfer funds in several major currencies with real-time exchange rates and no hidden fees. The platform also integrates with stock trading apps and supports seamless international payments. Ideal if you’re looking to combine everyday spending, investing, and cross-border business with one app.

- Wise (formerly TransferWise): Wise’s free multi-currency account lets you hold 50+ currencies, receive money with local bank details (including IBANs), and convert at mid-market rates with low, transparent fees. There’s no monthly charge, and it’s especially popular among freelancers, remote workers, and small businesses who need to get paid internationally.

Conclusion:

In conclusion, unlocking a multi-currency account is a game-changer for anyone navigating global payments—whether you’re a business scaling across borders or an individual sending money abroad. It offers real-time control, eliminates unnecessary conversion fees, and allows seamless transactions in multiple currencies without the hassle of juggling multiple bank accounts or providers.

BiyaPay takes this a step further by offering a secure, intuitive platform where you can hold, exchange, and transfer funds at competitive rates—all in one place. With features like real-time FX monitoring, ultra-low fees, and direct integration with payment systems, BiyaPay simplifies cross-border finance for both personal and business users. If you’re ready to ditch the outdated financial maze and embrace effortless global transactions, BiyaPay is your launchpad for a smarter, borderless money experience.

FAQs:

- Can I hold multiple currencies in a single multi-currency account**?** Absolutely. You can store USD, EUR, GBP, INR, and more—all under one roof. BiyaPay gives you a unified wallet that behaves like a vault for global currencies, eliminating the need for juggling separate accounts or apps.

- How do I exchange currencies in a multi-currency account**?** Currency swaps are instant and intuitive. With BiyaPay, just a tap or click converts your funds at real-time, competitive rates—no waiting, no hidden FX traps, no third-party detours. Total control, zero hassle.

- Is a multi-currency account suitable for online shopping? Yes—and it’s a game-changer. Shop globally without worrying about currency mismatches or nasty surprises at checkout. BiyaPay’s card and wallet options auto-adjust to the local currency so you always pay like a local.

- What are the fees associated with multi-currency account****s? Fees vary by provider, but BiyaPay is built to be brutally transparent. Expect ultra-low conversion fees, zero monthly charges on basic plans, and no surprise deductions—just honest pricing that respects your wallet.

- How can businesses benefit from multi-currency payment processing**?** Big time. With BiyaPay, businesses can accept global payments in local currencies, auto-convert earnings, and manage everything from one sleek dashboard. It simplifies accounting, slashes FX costs, and expands your customer base without borders.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.