- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

2025 Latest Study Abroad Remittance Methods and Bank Service Updates

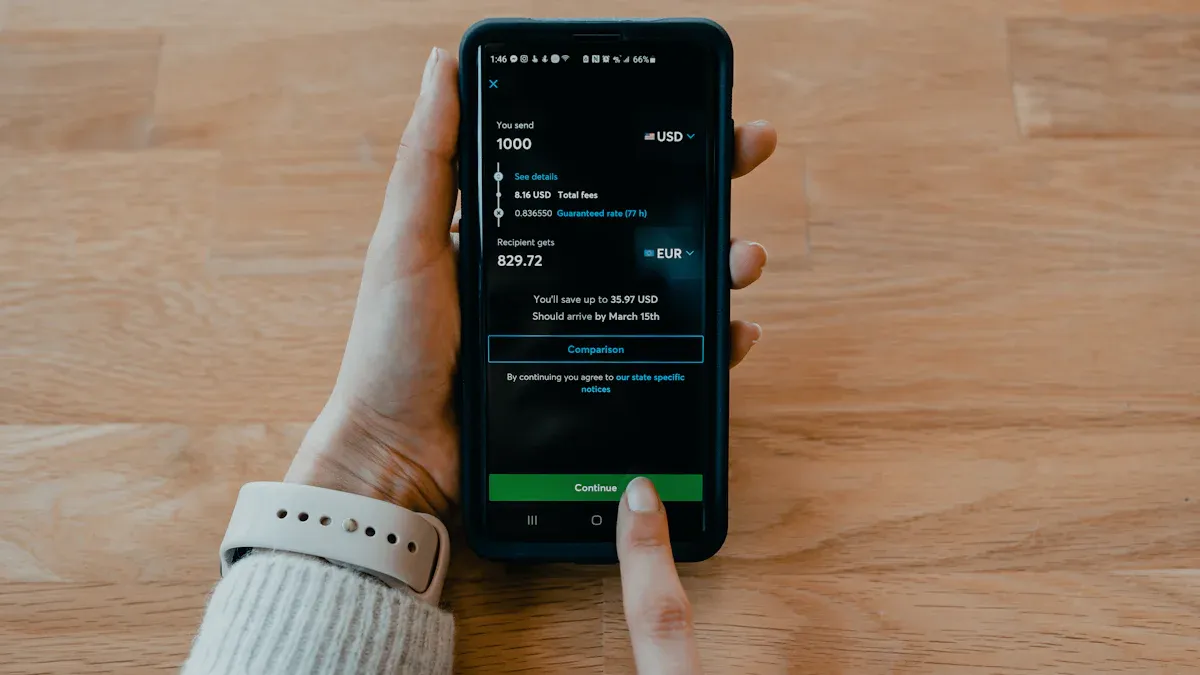

Image Source: unsplash

In 2025, study abroad remittance methods have undergone significant changes. Domestic remittance tools such as banks, Alipay, and WeChat allow you to easily control fund flows. Overseas remittances have become more convenient, with direct transfers to school accounts, reducing cross-border fees and complexity. At the same time, bank services continue to upgrade, providing a more efficient transaction experience. When choosing the best remittance method for studying abroad, you need to focus on cost, speed, and security to ensure funds reach their destination on time.

Latest Changes in Study Abroad Remittance Methods

Image Source: unsplash

Technological Upgrades in Traditional Bank Remittances

In recent years, traditional banks have made significant progress in technological upgrades. You may have noticed that many banks have introduced smarter cross-border remittance services. These services, by integrating blockchain technology and artificial intelligence algorithms, have significantly improved remittance speed and accuracy.

For example, some banks now offer real-time exchange rate locking functions. This feature helps you mitigate the risks caused by exchange rate fluctuations, ensuring the maximum value of funds upon arrival.

Additionally, banks have optimized user experience. Through mobile banking applications, you can complete remittance operations anytime, anywhere, without visiting a bank branch in person. For families of international students, this convenience undoubtedly saves a significant amount of time and effort.

- Since 2015, the scale of China’s outbound study abroad market has gradually expanded.

- In 2020, due to the impact of the pandemic, the number of outbound students decreased, but the long-term growth trend remains unchanged.

- The behavioral characteristics of outbound students in financial planning and cross-border remittances have changed, with more people inclined to choose technologically advanced bank services.

Convenience of Third-Party Payment Platforms

The rise of third-party payment platforms has provided more options for study abroad remittances. These platforms attract a large number of users with their simple operations and fast fund arrivals. You can complete cross-border remittances through platforms like Alipay and WeChat Pay, even without opening a foreign currency account.

Another advantage of these platforms is that they offer more competitive exchange rates. Compared to traditional banks, third-party payment platforms generally charge lower handling fees and support real-time exchange rate queries, making you feel more transparent and reassured during remittances.

The following are key manifestations of the convenience of third-party payment platforms:

- The popularity of digital tools has prompted businesses and individuals to shift to online payment platforms.

- Platforms provide real-time exchange rate locking services to help you mitigate exchange rate fluctuation risks.

- The operational processes of third-party payment platforms are simple, suitable for scenarios like studying abroad and immigration.

For example, Shopee’s payment gateway integrates multiple payment methods, including ShopeePay and other third-party payment tools. This diverse range of payment methods not only enhances security but also optimizes user experience.

Cross-Border Applications of Digital Currencies

The rise of digital currencies has brought new possibilities for cross-border remittances. If you have some knowledge of blockchain technology, you will find that the application of digital currencies in cross-border payments is becoming increasingly widespread. It not only eliminates intermediary bank fees but also significantly shortens fund arrival times.

Using digital currencies for remittances, you can directly transfer funds from one wallet to another without going through complex bank processes. This method is particularly suitable for urgent situations requiring fast fund arrivals.

Moreover, the decentralized nature of digital currencies enhances transaction transparency and security. For families of international students, this emerging method may become one of the mainstream choices in the future.

- Large multinational enterprises have begun adopting localized account solutions to avoid intermediary bank fees.

- The popularity of digital currencies provides more flexibility and options for individual remittances.

- In some countries, the use of digital currencies has been integrated into mainstream payment systems.

As technology continues to advance, the cross-border applications of digital currencies will further expand. If you are looking for an efficient and secure remittance method, consider keeping an eye on the latest developments in this field.

Analysis of Different Bank Service Features

Updates to Domestic Bank Services

Chinese banks have shown outstanding performance in service updates in recent years. You will find that many banks have enhanced customer experience and service efficiency through new technologies. Self-service and intelligent applications have become major highlights. For example, many banks have introduced Intelligent Teller Machines (ITMs), allowing you to complete complex transactions outside business hours.

Data shows that customer acceptance and satisfaction with these new services are continuously increasing. This trend indicates that bank technology upgrades are meeting users’ actual needs.

The following are key manifestations of Chinese bank service updates:

- Intelligent applications: Providing 24-hour service support through mobile banking and online customer service.

- Self-service: Significant increase in the coverage of Intelligent Teller Machines and self-service terminals.

- User experience optimization: Offering personalized financial solutions through big data analysis.

These updates not only make services more efficient but also provide you with greater convenience, especially in cross-border remittances and study abroad fund management.

Advantages of International Bank Services

International banks have significant advantages in cross-border services. If you choose to use international bank services, you can enjoy a global network and efficient fund management. The following is a set of data showcasing the performance of international banks in cross-border services:

| Cross-Border Service Advantages | Data Performance |

|---|---|

| Number of Covered Markets | Over 90 markets |

| Customer Range | Over 200 cross-border investors |

| Global Custody Network | Services provided through overseas branches and global custody network |

| Professional Team Size | Over 1,000 dedicated employees |

| Industry Standard Leadership | Leading organization of the China Banking Association’s Custody Business Professional Committee |

For example, Hong Kong banks, through their global custody network and overseas branches, provide customers with a one-stop seamless service experience. This service combines financial technology and industry data to ensure fund security and efficiency.

If you need to transfer funds between multiple countries, international bank services can help you save time and costs while providing higher transparency.

Study Abroad Exclusive Services of Innovative Banks

Innovative banks are offering exclusive services for international students. These banks typically focus on digitalization, addressing the pain points of families with international students. For example, some banks have introduced study abroad exclusive accounts, allowing you to easily manage tuition and living expenses.

The following are features of innovative bank services:

- Quick Account Opening: Through online applications, you can complete account opening in minutes.

- Transparent Fees: Provide clear fee structures to avoid hidden charges.

- Multi-Currency Support: Support multiple foreign currency accounts, convenient for use in different countries.

Additionally, some banks offer study abroad loans and scholarship management services. For example, some innovative banks in Hong Kong have launched exclusive tuition installment payment plans to help you alleviate financial pressure.

By choosing innovative bank services, you can not only enjoy a convenient digital experience but also access financial solutions tailored to study abroad needs.

How to Choose the Best Study Abroad Remittance Method

Image Source: pexels

Based on the Needs of the Study Abroad Country

When choosing a study abroad remittance method, the policies and financial environment of the study abroad country are important considerations. Different countries have varying regulatory requirements for cross-border remittances and acceptance of payment methods. For example, universities in the United States and the United Kingdom typically accept bank wire transfers and credit card payments, while some European countries may prefer SEPA transfers.

You need to understand the mainstream payment methods and related fees in the target country. For example, in the United States, bank wire transfers are common but have higher fees; in Australia, some schools support paying tuition through third-party payment platforms, which is more convenient and cost-effective.

Tip: Before choosing a remittance method, confirm the payment methods accepted by the school and check for additional fees or exchange rate differences.

Additionally, the currency policies of the study abroad country will affect your choice. If the target country’s currency fluctuates significantly, choosing a remittance method that supports real-time exchange rate locking can help you mitigate risks and ensure fund stability.

Comprehensive Evaluation of Cost and Efficiency

When choosing the best study abroad remittance method, cost and efficiency are two key metrics. You need to comprehensively consider handling fees, exchange rate differences, and fund arrival times. The following is a comparison of the cost and efficiency of different remittance methods:

| Remittance Method | Total Cost (Yuan) | Efficiency (%) | Cost Efficiency (Yuan) |

|---|---|---|---|

| ESM | 4,868.55 | 55.24 | 8,813.45 |

| MPM | 7,122.12 | 9.89 | 72,013.35 |

From the table, it can be seen that the ESM method has lower total costs and higher efficiency, making it suitable for scenarios requiring fast fund arrivals. The MPM method, while less efficient, may be suitable for specific high-security demand scenarios.

Tip: If you want to reduce costs, choose third-party payment platforms with lower handling fees; if you prioritize efficiency, consider bank services that support real-time fund arrivals.

Additionally, the following data further illustrates the cost-effectiveness ratio and incremental costs of different methods:

| Remittance Method | Cost-Effectiveness Ratio (Yuan) | Incremental Cost (Yuan) | Incremental Effect (%) | ICER (Yuan) |

|---|---|---|---|---|

| ESM | 7,938.28 | 2,253.57 | 17.46 | 12,907.04 |

| MPM | 9,039.37 | - | - | - |

Through these data, you can more intuitively evaluate the cost-effectiveness of different remittance methods and choose the most suitable option.

Considerations for Security and Compliance

Security and compliance are critical factors when choosing a study abroad remittance method. You need to ensure the selected method complies with international and target country financial regulatory requirements while protecting fund security.

Bank wire transfers are generally considered the safest method, as they are subject to strict regulation and provide detailed transaction records. However, they have higher fees and longer arrival times. In contrast, third-party payment platforms are convenient but may face risks of data breaches and fraud. Therefore, choosing reputable platforms and enabling two-factor authentication is crucial.

Note: When using digital currencies for cross-border remittances, pay special attention to the target country’s regulatory policies on digital currencies. Some countries may impose restrictions or completely prohibit digital currency transactions.

Additionally, compliance is key. Ensure your remittance method complies with foreign exchange regulations to avoid fund freezes or delays due to non-compliant operations. For example, China’s Foreign Exchange Administration has clear limits on individual annual foreign exchange purchases, and exceeding these limits may require additional approval processes.

By comprehensively considering security and compliance, you can better protect your funds and avoid unnecessary risks.

In 2025, study abroad remittance methods show a technology-driven trend. Traditional banks have improved efficiency through intelligent upgrades, third-party payment platforms have gained favor with their convenience, and digital currencies offer new options for cross-border payments. Bank service updates allow you to enjoy more efficient and secure fund management experiences.

When choosing the best study abroad remittance method, consider the policies of the study abroad country, cost and efficiency, and security factors. Understanding the school’s payment requirements in advance and selecting the appropriate remittance tool can make fund management easier.

Tip: Pay attention to real-time exchange rate locking functions to mitigate exchange rate fluctuation risks and ensure maximum fund value.

FAQ

1. How to Avoid Exchange Rate Losses During Study Abroad Remittances?

Use remittance methods that support real-time exchange rate locking. You can lock the exchange rate in advance to avoid fund losses due to exchange rate fluctuations. Many banks and third-party payment platforms offer this function to ensure maximum fund value.

2. Is Digital Currency Remittance Safe?

Digital currency remittances are relatively secure but require choosing reliable wallets and platforms. You also need to understand the target country’s regulatory policies to ensure transaction legality. Enabling two-factor authentication can further protect funds.

3. Which Countries Support Third-Party Payment Platform Remittances?

Countries like the United States, the United Kingdom, and Australia widely accept third-party payment platform remittances. You can use Alipay or WeChat Pay to transfer tuition and living expenses. Confirm in advance whether the school supports these payment methods.

4. How to Choose the Right Bank Service for You?

Choose bank services based on the needs of the study abroad country. Prioritize banks offering multi-currency accounts, real-time fund arrivals, and low handling fees. Study abroad exclusive services from innovative banks are also worth considering.

5. What Compliance Issues Should Be Noted During Remittances?

Ensure the remittance amount is within foreign exchange regulation limits. Understand the target country’s foreign exchange policies to avoid fund freezes due to non-compliant operations. Choosing regulated banks or platforms can reduce risks.

High fees, exchange rate fluctuations, delayed transfers, and compliance risks often burden students and parents with international remittances. BiyaPay delivers a seamless cross-border payment solution! Exchange over 30 fiat currencies and 200+ cryptocurrencies with transparent real-time rates, and benefit from transfer fees as low as 0.5% across 190+ countries, with same-day initiated, same-day delivered transfers. Sign up for BiyaPay in just one minute to effortlessly manage tuition payments, living expenses, and US/HK stock investments without complex processes. Plus, grow idle funds with a 5.48% annualized yield on flexible savings. BiyaPay leverages blockchain technology to ensure fund security, backed by U.S. MSB and SEC licenses for compliance. Start now—join BiyaPay to simplify your study abroad finances with efficiency and peace of mind!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.