- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Future Trends in Transnational Economic Support Viewed Through Immigrant Remittance Taxes

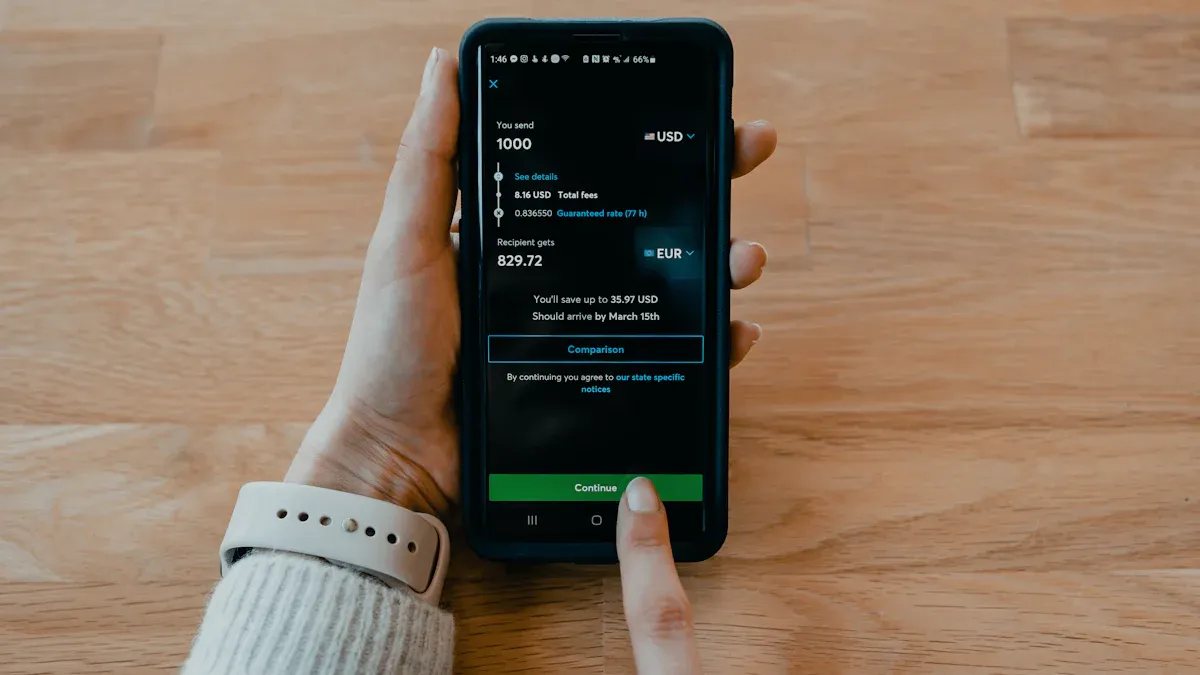

Image Source: pexels

Immigrant remittance tax policies directly affect your family’s economy. If you regularly send money to family, the recent bill imposing a 5% remittance tax may cause you stress. For example, every $10,000 sent incurs an additional $500 tax, especially since there is no minimum threshold, meaning small remittances are also taxed. This policy increases remittance costs, limiting the flexible use of funds. You need to understand the long-term impact of these changes on your family’s economy while paying attention to potential policies offering immigrant remittance tax incentives to better address future challenges.

Core Points

- Immigrant remittance tax policies increase remittance costs, potentially affecting family economic conditions. Every $10,000 sent incurs an additional $500 in taxes, requiring families to replan budgets.

- Understand the differences in global remittance tax policies and choose suitable remittance methods. Some countries offer low-cost services, which may be more conducive to fund flows.

- Pay attention to potential policy changes regarding immigrant remittance tax incentives. Timely adjustments to remittance plans may allow you to benefit from exemptions, easing economic burdens.

- Optimize remittance methods by choosing platforms with low fees. Diversifying economic support methods, such as directly purchasing goods, can reduce tax costs.

- Discuss economic support priorities with family to ensure basic needs are met. Proper planning can help families better cope with policy changes.

Origins and Purposes of Immigrant Remittance Tax Policies

Historical Background of the Policy

The introduction of immigrant remittance tax policies was not accidental. Republicans in the U.S. Congress were the first to propose a 5% tax on overseas remittances by non-citizens. This means an additional $5 tax for every $100 sent. This policy affects not only lawful permanent residents but also temporary visa holders and other non-residents. The policy is expected to be voted on and take effect by May 26, 2025. Its introduction has sparked widespread controversy, with many arguing it constitutes double taxation for non-U.S. residents.

The historical background of this tax policy can be traced to discussions on global economic imbalances. Some countries believe immigrant remittances benefit the economies of origin countries but contribute little to the remitting country’s economy. By increasing taxes, policymakers aim to balance this economic relationship. However, whether this approach is fair remains a question worth exploring.

Main Objectives of the Policy

The core objectives of immigrant remittance tax policies are to increase tax revenue while restricting the free flow of funds. According to statistics, this proposal will affect approximately 40 million people across the U.S.. An additional $500 tax per $10,000 sent represents a significant burden for many families. Small remittances are no exception, further limiting the flexibility of fund usage.

Additionally, the policy may prompt remittance platforms to strengthen identity verification. Such changes could lead to more cumbersome procedures and longer arrival times. Policymakers hope these measures will reduce illegal fund flows while increasing national tax revenue. However, achieving these goals may profoundly impact the economic support models of transnational families.

Differences in Global Remittance Tax Policies

There are significant differences in remittance tax policies worldwide. Some countries adopt lenient policies on immigrant remittances, encouraging fund inflows to support origin country economies. For example, China’s remittance tax policies are relatively flexible, with many Hong Kong banks offering low-cost remittance services. Other countries impose strict tax policies, aiming to protect domestic economies by restricting remittances.

These differences reflect varying national attitudes toward immigrant remittances. Lenient policies typically aim to promote economic cooperation, while strict policies focus more on domestic economic interests. You need to understand these policy differences to choose the most suitable remittance method during transnational transfers while paying attention to potential changes in immigrant remittance tax incentive policies.

Economic Impact of Immigrant Remittance Taxes on Transnational Families

Image Source: unsplash

Increased Remittance Costs

Immigrant remittance tax policies directly increase the cost of transnational remittances. You may have noticed that each remittance now requires paying additional taxes, which is a significant expense for many families. Taking Nicaragua as an example, overseas remittances account for 29.4% of its GDP. If immigrant remittance tax policies are fully implemented, the country is expected to lose over $200 million. This situation affects not only Nicaragua but also Honduras, El Salvador, and Guatemala. Below is the relevant data:

| Country | Proportion of Overseas Remittances to GDP | Estimated Loss Amount (USD) |

|---|---|---|

| Nicaragua | 29.4% | Over 200 million |

| Honduras | 28% | At least 500 million |

| El Salvador | 24% | N/A |

| Guatemala | 20% | N/A |

You can see that these countries’ economies heavily rely on overseas remittances. The increase in remittance taxes not only affects remitters but also threatens the economic stability of origin countries.

Changes in Family Economic Burdens

Immigrant remittance tax policies increase the economic burdens on many families. You may need to replan your family budget to cope with rising remittance costs. For example, if you send $1,000 monthly, a 5% tax rate means an additional $600 annually. This cost may force you to reduce remittance amounts, affecting your family’s quality of life.

Furthermore, remittance tax policies may lead to changes in fund allocation priorities. You may need to make tough choices between education, healthcare, and daily expenses. This economic pressure affects not only individuals but may also have a profound impact on the long-term planning of entire families.

Adjustments in Fund Liquidity and Economic Support Models

Immigrant remittance tax policies alter fund liquidity. You may find that remittance platforms have more complex procedures and longer arrival times. These changes may push you to seek more efficient remittance methods, such as low-cost services offered by Hong Kong banks.

At the same time, the policy may prompt you to reassess your family’s economic support model. You may need to explore alternative support methods, such as directly purchasing goods or services instead of remitting funds. Such adjustments affect not only fund usage but may also change economic interaction patterns among family members.

The potential introduction of immigrant remittance tax incentive policies may provide some relief. Staying informed about policy changes and adjusting strategies promptly can help you better address future challenges.

Potential Global Economic and Social Impacts

Impact on Origin Country Economies

Immigrant remittance tax policies have a direct impact on the economies of immigrants’ origin countries. You may not realize that many developing countries’ economies heavily depend on overseas remittances. For example, the Philippines receives overseas remittances accounting for nearly 10% of its GDP annually. These funds support critical areas such as household consumption, education, and healthcare. If remittance taxes increase, families in origin countries may reduce consumption, leading to slower economic growth.

Moreover, reduced remittances may affect origin countries’ foreign exchange reserves. Insufficient reserves make these countries less able to cope with international trade and financial crises. You can imagine that this chain reaction may make origin countries’ economies more vulnerable.

Role of Policy in Social Stability

Immigrant remittance tax policies affect not only economies but may also have profound impacts on social stability. You may have noticed that many immigrant families rely on remittances to maintain basic livelihoods. If remittances decrease, family members may face greater economic pressure. This pressure could lead to increased social issues, such as rising poverty rates and reduced educational opportunities.

At the same time, the policy may spark discontent within immigrant communities. You may see that dissatisfaction with the policy could translate into protests or other forms of social action. Such situations may exacerbate social tensions, affecting community harmony and stability.

Indirect Impact on International Relations

Immigrant remittance tax policies may also indirectly affect international relations. You may not realize that remittances are an important link in economic cooperation between many countries. If policies lead to reduced remittances, origin countries may develop resentment toward the policy-imposing country. This resentment could affect diplomatic relations between the two countries.

Additionally, the policy may prompt origin countries to seek other economic partners. For example, some countries may strengthen economic cooperation with China to offset losses from reduced remittances. Such changes could reshape the global economic landscape and influence the long-term development of international relations.

You need to pay attention to potential policy changes regarding immigrant remittance tax incentives. These changes may provide more economic support while mitigating the negative impacts of the policy.

Immigrant Remittance Tax Incentives and Future Trends

Image Source: unsplash

Possibility of Tax Incentive Policies

You may wonder whether immigrant remittance tax policies will offer tax incentives. In fact, some countries have already started exploring this direction. For example, the Mexican government once proposed exempting remittances below a certain amount from taxes to ease the economic burden on low-income families. This approach not only relieves family pressures but also encourages more funds to flow into origin countries, promoting economic development.

In the future, policymakers may consider similar tax incentive measures. For example, setting a minimum threshold or offering exemptions for remittances used for education or healthcare. These measures can increase tax revenue while reducing negative impacts on family economies. You need to closely monitor policy changes and adjust remittance plans promptly to benefit from potential incentive policies.

Tip: If you frequently send money to family, it’s recommended to stay informed about tax policy developments in your country. Understanding whether there are proposals or discussions regarding immigrant remittance tax incentives can help you better plan future economic support.

Policy Evolution Directions and Globalization Trends

The evolution direction of immigrant remittance tax policies is closely related to your life. As globalization deepens, transnational economic cooperation becomes more interconnected. Many countries may adjust remittance tax policies to adapt to this trend. For example, some countries may lower tax rates or simplify procedures to attract more fund inflows.

Meanwhile, the widespread adoption of digital technologies is transforming remittance methods. You may have noticed that more remittance platforms offer low-cost or even free transnational transfer services. These technological advancements may prompt policymakers to reassess traditional tax models and seek more efficient solutions.

Globalization trends may also drive international policy coordination. For example, the International Monetary Fund (IMF) and World Bank may recommend that countries standardize remittance tax policies to reduce barriers to transnational fund flows. Such coordination could provide you with more convenience while reducing policy uncertainties.

Coping Strategies for Transnational Families

In response to changes in immigrant remittance tax policies, you need to develop effective coping strategies. Below are some suggestions:

- Optimize Remittance Methods: Choose platforms with low fees, such as low-cost services offered by Hong Kong banks.

- Diversify Economic Support Methods: In addition to direct remittances, consider supporting family by purchasing goods or services. This can reduce tax costs while meeting family needs.

- Stay Informed About Policy Changes: Regularly check information on immigrant remittance tax incentives. If new incentive policies are introduced, adjust your plans promptly.

- Seek Professional Advice: If you’re unsure about the specific impacts of policies, consult tax experts or financial advisors. They can provide tailored solutions.

Suggestion: Discuss economic support priorities with your family, such as prioritizing education and healthcare expenses, to ensure basic family needs are met.

Through these strategies, you can better cope with policy changes, reduce impacts on family economies, and prepare for future economic support.

Immigrant remittance tax policies have long-term impacts on your family and the global economy. These policies may increase family economic pressures while altering fund flow patterns. You need to stay informed about policy changes and adjust strategies promptly to mitigate negative impacts.

The sustainability of transnational economic support is crucial for global economic stability. You can address challenges by optimizing remittance methods and diversifying economic support. Policymakers also need to find a balance between taxation and economic support, ensuring policies increase tax revenue without excessively impacting family economies.

Suggestion: Stay engaged in policy discussions and participate in related activities to voice your opinions. This not only helps protect your family’s interests but also promotes fairer policymaking.

FAQ

Will Immigrant Remittance Tax Policies Affect All Remittances?

Not all remittances are affected. Policies typically target transnational remittances, especially funds sent to specific countries. You need to understand the specific regulations in your country to ensure your remittances comply with policy requirements.

How to Reduce Economic Pressure from Immigrant Remittance Taxes?

You can choose platforms with lower fees, such as services offered by Hong Kong banks. Diversifying economic support methods, such as directly purchasing goods, can also reduce tax costs. Stay informed about changes in immigrant remittance tax incentive policies and adjust strategies promptly.

Will Remittance Tax Policies Change Remittance Methods?

Policies may prompt remittance platforms to strengthen identity verification, making procedures more complex. You can choose digital remittance methods, such as low-cost online platforms. These methods improve efficiency while reducing tax costs.

How Do Immigrant Remittance Tax Policies Affect Origin Country Economies?

Policies may reduce remittance amounts, impacting household consumption and economic growth in origin countries. Insufficient foreign exchange reserves may make origin countries less able to cope with international trade and financial crises. You need to monitor policy changes and adjust remittance plans promptly.

Is It Possible for More Tax Incentive Policies to Be Introduced?

Some countries have explored tax incentives, such as exempting remittances below certain amounts. In the future, more similar measures may emerge, such as exemptions for remittances used for education or healthcare. You need to closely follow policy developments to benefit from potential incentives.

In 2025, the new remittance tax imposes significant financial strain on cross-border families, with a 5% tax adding $500 per $10,000 sent, impacting household budgets and liquidity. BiyaPay offers a cost-effective, streamlined solution for international transfers! Exchange over 30 fiat currencies and 200+ cryptocurrencies with transparent real-time rates, and enjoy transfer fees as low as 0.5% across 190+ countries, with same-day initiated, same-day delivered transfers. Sign up for BiyaPay in just one minute to effortlessly support family, investments, or other financial needs while navigating complex verification and tax policies. Plus, grow idle funds with a 5.48% annualized yield on flexible savings. BiyaPay leverages blockchain technology for secure transactions, backed by U.S. MSB and SEC licenses to ensure compliance. Start now—join BiyaPay to minimize tax burdens and enhance your cross-border financial support with confidence!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.