- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Choosing Remittance Methods for Studying in Germany and Their Differences from Regular Remittances

Image Source: pexels

Remittances for studying in Germany differ significantly from regular remittances in several aspects. Study remittances are primarily used to pay tuition and living expenses, typically requiring documents such as school admission letters and tuition invoices. Regular remittances, on the other hand, have a wide range of uses and only require recipient information to complete. When remitting to Germany, handling fees and exchange rate fluctuations are important considerations. Different methods, such as wire transfers or Western Union, involve fee deductions and currency conversions. Additionally, study remittances may benefit from preferential exchange rates and fee reductions, but regulatory compliance requirements are stricter to ensure funds are used for legitimate educational purposes.

Tip: Understanding precautions for Germany study remittances can help you avoid common issues in the process.

Choosing Remittance Methods for Studying in Germany

Image Source: pexels

Common Remittance Methods and Their Features

When choosing a remittance method, you will find multiple options, each with its unique features. Below are several common remittance methods:

- Bank Wire Transfer

Bank wire transfer is the most traditional method. You can transfer funds directly to a German bank account through Chinese banks such as Bank of China, China Construction Bank, or Industrial and Commercial Bank of China. This method is highly secure but has higher fees, with arrival times typically ranging from 3 to 7 business days. - International Remittance Services

International remittance services like Western Union and MoneyGram offer fast fund transfers. You only need to provide recipient information, and funds can arrive within minutes. However, these services generally have higher fees. - Online Remittance Platforms

Online platforms like Panda Remit have gained popularity in recent years. These platforms are easy to use, often offer more favorable exchange rates, and have very fast arrival times, making them suitable for urgent remittances. - Hong Kong Bank Account Transfer

If you have a Hong Kong bank account, you can transfer funds through a Hong Kong bank. This method may have lower fees but requires opening an account in advance.

Tip: When choosing a remittance method, be sure to understand the fees and arrival times of each option to make the best choice.

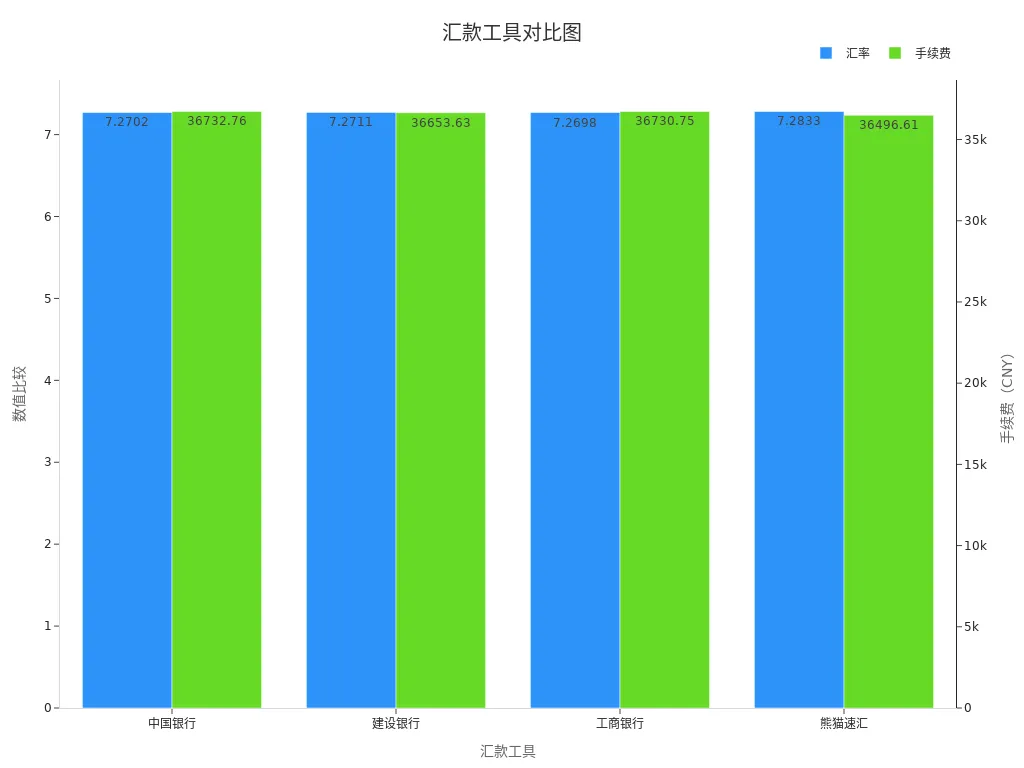

Comparison of Fees, Exchange Rates, and Speed Across Methods

Different remittance methods vary significantly in fees, exchange rates, and arrival times. Below is a comparison of data for several common methods:

| Remittance Tool | Exchange Rate | Total Cost for Remitting 5,000 USD Including Fees | Arrival Time |

|---|---|---|---|

| Bank of China | 1 USD = 7.2702 CNY | 36,732.76 CNY | 3 to 7 business days |

| China Construction Bank | 1 USD = 7.2711 CNY | 36,653.63 CNY | 3 to 7 business days |

| Industrial and Commercial Bank | 1 USD = 7.2698 CNY | 36,730.75 CNY | 3 to 7 business days |

| Panda Remit | 1 USD = 7.2833 CNY | 36,496.61 CNY | As fast as minutes |

From the table, it can be seen that Panda Remit offers the best exchange rate and fastest arrival time but has higher fees. In contrast, bank wire transfers have lower fees but longer arrival times.

Analysis: If you prioritize arrival speed, Panda Remit is a good choice. If you want to save on fees, bank wire transfers may be more suitable.

How to Choose the Most Suitable Method Based on Personal Needs

When choosing a remittance method, you need to weigh your needs:

- Prioritize Arrival Speed

If you need to urgently pay tuition or living expenses, fast-arrival methods like Panda Remit or Western Union are more appropriate. - Focus on Fees and Exchange Rates

If you want to save costs, bank wire transfers are a good option. Although arrival times are longer, fees and exchange rates are more advantageous. - Consider Security

Bank wire transfers and Hong Kong bank account transfers offer high security, suitable for large fund transfers. - Need for Flexibility

Online remittance platforms are easy to operate, ideal for users unfamiliar with bank processes.

Suggestion: Before choosing a remittance method, clarify your priorities, such as speed, cost, or security. Then, select the most suitable option based on your situation.

Precautions for Germany Study Remittances

Documents Needed Before Remitting

Before making a Germany study remittance, you need to prepare relevant documents in advance. These documents not only ensure the remittance is completed smoothly but also prevent delays due to incomplete information. Below is a common preparation checklist:

- Personal Identification: Including copies of your passport or ID card for identity verification.

- Recipient Information: Including the recipient’s name, bank account number, bank name, and address. Ensure the information is accurate.

- School-Related Documents: Such as admission letters or tuition invoices. These documents help prove the purpose of the remittance, especially for tuition payments.

- Budget for Remittance Amount: Calculate the amount to be remitted in advance, considering the impact of exchange rate fluctuations on the final amount.

Preparing these documents in advance can make your remittance process more efficient and reduce unnecessary trouble.

How to Ensure the Security of the Remittance Process

Remittance security is a critical aspect of Germany study remittance precautions. You can ensure fund safety through the following methods:

- Choose Reliable Remittance Channels: Prioritize reputable banks or online remittance platforms, such as Hong Kong banks or Panda Remit. These channels typically have robust security measures.

- Verify Information: Before submitting a remittance application, carefully check recipient information and amounts to avoid losses due to errors.

- Enable Two-Factor Authentication: Many banks and platforms offer two-factor authentication, such as SMS verification codes or dynamic passwords. These features can effectively prevent account theft.

- Retain Remittance Records: After completing the remittance, keep relevant receipts and records for future inquiries or dispute resolution.

Through these measures, you can minimize remittance risks and ensure funds safely reach their destination.

Avoiding Common Mistakes in Remittances

During the Germany study remittance process, many people make common mistakes. These errors not only increase costs but may also lead to remittance failures. Below are common mistakes and improvement suggestions:

- Ignoring Exchange Rate Fluctuations: Many people fail to monitor exchange rate changes during remittances, leading to higher costs. It’s recommended to track exchange rate trends and remit when rates are favorable.

- Improper Currency Exchange Methods: Some people exchange currency at airports or unofficial channels, which often incur high fees. It’s better to exchange through banks or online platforms to save money.

- Incorrect Information Entry: Errors in recipient information can cause remittance failures or fund delays. It’s advised to carefully verify all information for accuracy.

Avoiding these mistakes can make your remittance process smoother while saving time and costs.

Differences Between Germany Study Remittances and Regular Remittances

Image Source: pexels

Differences in Purpose and Use Cases

The primary purpose of Germany study remittances is to pay tuition and living expenses. These remittances typically require providing school admission letters or tuition invoices, with clear and regulated fund purposes. You can transfer funds directly to a German school or personal account through bank wire transfers or online platforms. This remittance method ensures funds are used for education-related legitimate purposes.

Regular remittances have a broader range of use cases. They can be used for fund transfers between family members, business transactions, or personal consumption. Regular remittances generally do not require additional supporting documents, only needing the recipient’s account information to complete. Due to their diverse purposes, regular remittances face relatively relaxed regulatory requirements.

Tip: If your remittance is for tuition or living expenses, choosing a study remittance method is more appropriate. Regular remittances are suitable for other types of fund transfers.

Differences in Process and Required Documents

The process for Germany study remittances is more complex. You need to prepare relevant documents in advance, including passport copies, school admission letters, tuition invoices, and recipient bank information. These documents help prove the fund’s purpose and ensure compliance with regulatory requirements. During the remittance, you need to fill out detailed application forms and may require assistance from bank staff.

The process for regular remittances is relatively simple. You only need to provide the recipient’s name, bank account number, and bank address to complete the remittance. No additional supporting documents are required, making the process faster. Online remittance platforms like Panda Remit can even be operated via mobile phones, further simplifying the process.

Suggestion: For study remittances, preparing all necessary documents in advance can save time. Regular remittances are suitable for quick fund transfers.

Comparison of Fees and Exchange Rates

Germany study remittances and regular remittances differ significantly in fees and exchange rates. Below is a specific fee comparison for the two remittance types:

| Remittance Method | Handling Fee | Telegraph Fee | Remarks |

|---|---|---|---|

| Wire Transfer | 0.1% handling fee + 150 RMB | 150 RMB | Fast, arrives in 2-3 business days |

| Draft | Same as wire transfer | No telegraph fee | Cheaper, slower arrival |

From the table, wire transfers are faster but have higher handling and telegraph fees. Drafts are cheaper but take longer to arrive. If you need to urgently pay tuition, wire transfers may be a better choice.

Exchange rate fluctuations also significantly impact remittance costs. Below is the specific impact of EUR/USD exchange rate changes on converted amounts:

| Time Point | EUR/USD Exchange Rate | Converted Amount (USD) | Fee Difference (USD) |

|---|---|---|---|

| March 14 | 1.3478 | 10,782 | |

| Recent | 1.2 | 9,600 | 1,182 |

As shown in the table, a drop in exchange rates significantly reduces the converted amount. If you remit when rates are low, you may need to pay more. Therefore, monitoring exchange rate trends and choosing the right remittance timing can effectively reduce costs.

Analysis: To save costs, consider drafts and exchange when rates are favorable. For urgent remittances, wire transfers are faster despite higher fees.

Differences in Regulation and Compliance Requirements

Germany study remittances and regular remittances differ significantly in regulation and compliance requirements. Understanding these differences can help you avoid unnecessary trouble and ensure funds reach their destination smoothly.

Regulatory Requirements for Germany Study Remittances

Germany study remittances are typically subject to strict regulation. During remittances, you need to provide detailed supporting documents. These documents include school admission letters, tuition invoices, and passport copies. These files prove that the funds are for legitimate educational expenses.

Banks and remittance platforms will review your remittance. The review aims to ensure the funds’ source is legitimate and complies with German financial regulations. For example, Hong Kong banks, when processing study remittances, require you to fill out detailed remittance application forms and verify the accuracy of all information.

Additionally, German financial institutions may require recipients to provide extra supporting documents. For example, school account information or tuition receipts. These requirements ensure funds are used for education-related legitimate purposes.

Tip: Preparing all necessary documents in advance can speed up the review process and avoid delays due to missing materials.

Compliance Requirements for Regular Remittances

Regular remittances have relatively relaxed regulatory requirements. You only need to provide the recipient’s name, bank account number, and bank address to complete the remittance. No additional supporting documents are required, making the process simpler.

However, regular remittances must still comply with basic financial regulations. For example, when remittance amounts exceed certain limits, banks may require proof of fund sources. This is to prevent money laundering or other illegal activities.

Some online remittance platforms, like Panda Remit, use advanced security technologies to protect your funds. For example, two-factor authentication prevents account theft. These platforms typically conduct additional reviews for large remittances to ensure the legitimacy of fund sources and purposes.

Note: Even with fewer requirements, you must ensure the information provided is accurate to avoid remittance failures or fund delays.

Key Differences Between the Two

Below are the main differences in regulation and compliance requirements between Germany study remittances and regular remittances:

| Item | Germany Study Remittance | Regular Remittance |

|---|---|---|

| Required Documents | School admission letter, tuition invoice, passport copy | Recipient name, bank account number, bank address |

| Review Strictness | High, requires proof of fund purpose | Lower, typically no additional proof needed |

| Fund Use Restrictions | Limited to education-related expenses | Wide-ranging, no specific restrictions |

| Additional Requirements | May need school account info or tuition receipts | Large remittances may require proof of fund source |

As shown in the table, Germany study remittances have stricter regulatory requirements and more complex document preparation. If your remittance is for tuition or living expenses, choosing a study remittance method is more appropriate. Regular remittances are suitable for other types of fund transfers.

Analysis: Choosing the right remittance method based on fund purpose and amount can avoid unnecessary trouble while ensuring fund safety.

Practical Suggestions

How to Reduce Remittance Fees

Reducing remittance fees can help you save on study costs. Below are several effective methods:

- Choose the Right Bank: Fees and intermediary bank charges vary significantly across banks. It’s recommended to compare fee standards of multiple banks and choose the most cost-effective one.

- Clarify Fee Responsibilities: Sign an agreement with the recipient to have them bear the fees. This can reduce your fee expenses.

- Use Multi-Country Accounts: Receive funds through local accounts in multiple countries to avoid extra fees from multi-party fund flows.

- Choose Promotional Periods: Some banks or platforms offer fee discounts during specific times; seizing these opportunities can further reduce costs.

| Measure Category | Specific Effect Description |

|---|---|

| Tax Burden | Annual tax reduction of over 500 billion RMB, full implementation of the VAT reform pilot. |

| Financing Costs | Gradual reduction in corporate loan and bond interest burdens, reasonable reduction in financing intermediary fees. |

| Institutional Transaction Costs | Implementation of streamlining administration and optimizing service reforms, significant reduction in pre-approval intermediary services for administrative approvals. |

Through these methods, you can effectively reduce remittance fees and optimize fund usage.

How to Ensure Fund Safety

Ensuring fund safety is a key aspect of Germany study remittance precautions. The following strategies can help protect your funds:

- Choose Secure Platforms: Prioritize reputable banks or online remittance platforms, such as Hong Kong banks or Panda Remit. These platforms typically use advanced technologies to ensure transfer safety.

- Enable Multi-Factor Authentication: Use two-factor or biometric authentication to prevent unauthorized access.

- Protect Personal Information: Avoid remitting on public networks to prevent personal information leaks.

- Monitor Transaction Records: Regularly check remittance records and contact the bank promptly if anomalies are detected.

| Security Measure | Description |

|---|---|

| Advanced Technology | Use cutting-edge technology to ensure transfer safety. |

| Strict Security Measures | Implement strict security protocols to ensure the safety of each transaction. |

| Identity Verification | Use multi-factor and biometric authentication to prevent unauthorized access. |

| Data Privacy Protection | Comply with regulations like GDPR and CCPA to ensure secure handling and protection of user data. |

Through these measures, you can minimize fund risks and ensure a secure remittance process.

Precautions During Remittance

When remitting, paying attention to the following points can avoid common issues:

- Verify Information: Ensure the recipient’s name, bank account number, and bank address are accurate. Incorrect information may lead to remittance failures or fund delays.

- Monitor Exchange Rate Fluctuations: Exchange rate changes directly affect remittance costs. It’s recommended to remit when rates are favorable to save costs.

- Retain Receipts: After completing the remittance, keep relevant receipts and records. These documents are crucial for future inquiries or dispute resolution.

- Avoid Peak Periods: Bank peak periods may lead to longer processing times. Remitting during off-peak times can improve efficiency.

Through these precautions, you can make the remittance process smoother and avoid unnecessary trouble.

Choosing the right remittance method for studying in Germany requires you to consider personal needs, fees, and arrival times comprehensively. Compared to regular remittances, study remittances emphasize compliance and clarity of fund purpose. Through proper planning, you can effectively reduce costs and ensure fund safety.

- Systematic budget management functions can help you compare budgets with actual expenses, identifying discrepancies and adjusting plans in time.

- Real-time monitoring of expense spending optimizes approval processes, reducing unnecessary delays and costs.

- Data analysis provides insights into spending trends, helping you identify potential savings opportunities.

Tip: Choosing the right remittance method and paying attention to fee details can make your study abroad experience easier and worry-free.

FAQ

1. What Information Should I Pay Attention to During Remittance?

When remitting, ensure the recipient’s name, bank account number, and bank address are accurate. Incorrect information may lead to fund delays or remittance failures. It’s recommended to carefully verify all entered information and retain remittance receipts for future inquiries.

Tip: Using two-factor authentication can further ensure remittance safety.

2. Are There Limits on Remittance Amounts?

Remittance amounts typically have upper limits, depending on the remittance method and bank policies. For example, Hong Kong banks may set limits on single remittances. It’s advised to consult bank or platform customer service in advance to understand specific limits and plan remittance amounts.

Note: Large remittances may require additional proof of fund sources.

3. How to Choose the Optimal Remittance Timing?

When choosing remittance timing, monitor exchange rate trends. Remitting when rates are high can save costs. Additionally, avoiding bank peak periods can improve processing efficiency. It’s recommended to use online platforms to track exchange rate changes in real time.

Analysis: Exchange rate fluctuations directly affect remittance amounts; planning in advance can effectively reduce costs.

4. What to Do If a Remittance Fails?

If a remittance fails, contact bank or platform customer service to investigate the reason. Common causes include incorrect information or insufficient funds. Providing remittance records and receipts can help customer service quickly identify and resolve the issue.

Suggestion: Retain all remittance receipts for future processing.

5. Which Remittance Methods Are Suitable for Emergencies?

In emergencies, choose Panda Remit or Western Union. These methods have fast arrival times, typically completing within minutes. Although fees are higher, they meet urgent payment needs.

| Method | Arrival Time | Fees |

|---|---|---|

| Panda Remit | Minutes | Higher |

| Western Union | Minutes | Higher |

Quick Choice: Prioritize arrival speed to ensure funds arrive on time.

In 2025, Germany study abroad remittances face challenges from strict compliance requirements, high fees, and exchange rate volatility, while general remittances offer simpler processes but lack tailored benefits. BiyaPay delivers a streamlined, cost-effective solution for student transfers! Exchange over 30 fiat currencies and 200+ cryptocurrencies with transparent real-time rates, and benefit from transfer fees as low as 0.5% across 190+ countries, with same-day initiated, same-day delivered transfers. Sign up for BiyaPay in just one minute to effortlessly manage tuition payments, living expenses, and US/HK stock investments, bypassing complex documentation and audits. Plus, grow idle funds with a 5.48% annualized yield on flexible savings. BiyaPay leverages blockchain technology for secure transactions, backed by U.S. MSB and SEC licenses to meet Germany’s regulatory standards. Start now—join BiyaPay to simplify your study abroad finances with ease and confidence!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.