- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Comprehensive Analysis of Study Abroad Remittance Methods and Tax Handling Guide

Image Source: pexels

For international students, choosing the right remittance method is crucial. Different remittance channels have distinct characteristics in terms of fees, security, and arrival time, which directly affect your choice:

- Bank remittance fees vary by bank, for example, Hong Kong banks charge higher fees for expedited remittances, suitable for large transfers.

- Digital payment platforms like Alipay have lower handling fees but smaller single-transaction limits, making them more suitable for small remittances.

- Remittance companies charge higher fees, with specific costs depending on the company’s calculation method, but arrival times are generally faster.

- Emerging methods like Bitcoin have low fees but carry significant price volatility risks.

When choosing, you need to weigh these factors based on your needs to ensure fund safety and compliance with relevant study abroad remittance tax policies.

Analysis of Common Remittance Methods and Their Advantages and Disadvantages

Image Source: pexels

Bank Wire Transfers: Suitable for Large-Amount Remittances

Bank wire transfers are a traditional remittance method chosen by many, especially suitable for large-amount transfers. You can directly transfer funds to a designated account through a bank, with simple operations and high security. Hong Kong banks’ wire transfer services are particularly notable, offering expedited remittance options suitable for urgent large-amount transfer needs.

Advantages:

- High security, with strict bank systems protecting funds.

- Suitable for large remittances, with higher single-transaction limits.

- Option for expedited services to shorten arrival time.

Disadvantages:

- Higher handling fees, especially for cross-border remittances.

- Longer arrival times, with regular wire transfers potentially taking several business days.

If you need to remit large amounts and have high security requirements, bank wire transfers are a worthwhile option.

Remittance Companies: Lower Fees with Faster Arrival Times

Remittance companies offer an efficient and cost-effective remittance method, particularly suitable for small to medium-amount transfers. You can quickly complete international remittances through these companies while saving on fees. TransferMate is a typical example, covering over 200 countries and regions and supporting 141 currencies.

Features:

- Low cost: TransferMate is committed to providing cost-effective transfer services.

- Fast arrival: Generally faster than bank wire transfers.

- Global coverage: Supports multiple currencies and countries/regions.

Applicable Scenarios:

- If you need to quickly remit funds to an overseas account.

- If you want to save on handling fees.

When choosing a remittance company, you can compare based on your needs and the service coverage in the target country.

Digital Payment Platforms: Combining Convenience and Security

Digital payment platforms have gained increasing popularity in recent years. They are simple to operate, suitable for small remittances, and offer certain security guarantees. The following are convenience and security ratings for some common platforms:

| Payment Platform | Convenience Score | Security Score |

|---|---|---|

| WeChat Pay | Leading | Users have security concerns |

| Alipay | Second | Users have security concerns |

| UnionPay QuickPass | Growing | Users have security concerns |

Advantages:

- Convenient operation, suitable for daily small remittances.

- Low handling fees, high cost-effectiveness.

Disadvantages:

- Lower single-transaction limits, unsuitable for large transfers.

- Security may vary by platform, requiring careful selection.

If you need to quickly complete small remittances, digital payment platforms are an efficient choice. However, when using them, you need to pay attention to the platform’s security and choose reputable service providers.

Other Methods: Flexibility of Credit Card Transfers and Third-Party Services

In addition to bank wire transfers and digital payment platforms, credit card transfers and third-party services are also commonly used by international students. These methods are favored for their flexibility and convenience, especially for scenarios requiring quick fund processing.

Features of Credit Card Transfers

Credit card transfers are an efficient remittance method, particularly suitable for urgent payment needs in the short term. Through a credit card, you can directly transfer funds to a target account without needing to open an additional bank account.

Advantages:

- Quick and Convenient: Credit card transfers are usually instant, suitable for urgent payment needs.

- Globally Accepted: Most credit cards support international payments with wide coverage.

- High Flexibility: Credit cards allow repayment after spending, easing short-term financial pressure.

Disadvantages:

- Higher Fees: Some credit card companies charge high cross-border payment fees.

- Opaque Exchange Rates: Credit card companies may use unfavorable exchange rates for settlement.

If you need to quickly complete payments, credit card transfers are a worthwhile option. However, before using them, you need to understand the relevant fees and exchange rate policies to avoid unnecessary costs.

Flexibility of Third-Party Services

Third-party payment services provide more fund management options, especially suitable for users needing multi-currency accounts or flexible fund operations. For example, platforms like Payoneer and Wise offer convenient cross-border payment solutions.

Advantages of Third-Party Services:

- Provide multi-currency accounts, facilitating the management of different currencies.

- Flexible fund management, suitable for global sellers or users needing frequent transfers.

- Handling fees are generally lower than traditional bank transfers.

Comparison with Credit Card Transfers:

- Third-party payment platforms are more suitable for users needing long-term fund management, while credit card transfers are better for short-term payment needs.

- Third-party services support multi-currency accounts, while credit cards mainly settle in a single currency.

The following is a comparison of their flexibility:

| Feature | Credit Card Transfer | Third-Party Service |

|---|---|---|

| Applicable Scenarios | Short-term payment needs | Long-term fund management |

| Fee Transparency | Lower, may have hidden fees | Higher, fees are clear and transparent |

| Multi-Currency Support | Not supported | Supports multi-currency accounts |

How to Choose the Right Method?

Choosing between credit card transfers and third-party services depends on your specific needs. If you need to quickly pay tuition or living expenses, credit card transfers are an efficient choice. If you need to manage multi-currency accounts or frequently conduct cross-border payments, third-party services are more suitable.

Tip: Before using any remittance method, be sure to understand the relevant fees and policies to ensure fund safety and avoid unnecessary costs.

By reasonably choosing a remittance method, you can manage funds more efficiently while meeting the needs of different scenarios.

Remittance Operation Guide

Specific Steps for Bank Wire Transfers

Bank wire transfers are a remittance method chosen by many international students. You can complete wire transfer operations through the following steps:

- Prepare Necessary Information: Ensure you have the recipient’s bank account information, including account name, account number, bank name, and SWIFT code.

- Visit Bank Branch or Online Platform: You can choose to handle it in person at a bank branch or complete the operation through the bank’s online platform.

- Fill Out Remittance Form: Enter the recipient’s detailed information and remittance amount. Ensure the information is accurate to avoid remittance failures.

- Pay Handling Fees: Banks usually charge a handling fee. Hong Kong banks’ fees may be higher, especially for cross-border remittances.

- Confirm Remittance: After submitting the remittance application, the bank will provide a confirmation receipt. Keep this receipt for future reference.

Although bank wire transfers are more traditional, they offer high security. If you need to remit large amounts, this method is very suitable.

Process for Using Remittance Companies

Remittance companies provide convenient international remittance services. The following is the basic process for using remittance companies:

- Choose a Suitable Remittance Company: Select a reputable remittance company, such as TransferMate, based on the target country and remittance amount.

- Register an Account: Visit the remittance company’s website or download its app to complete account registration.

- Fill Out Remittance Information: Enter the recipient’s detailed information, including name, account number, and bank information.

- Pay Remittance Fees: Pay the corresponding handling fee based on the remittance amount and target country.

- Confirm Remittance: After submitting the remittance application, you can track the remittance status in real-time through the platform.

Although remittance companies are convenient, some user feedback indicates areas for improvement. The following is a survey of user satisfaction with remittance companies:

| Feedback Aspect | Proportion of Users Who Believe Improvement Is Needed | Main Issue Description |

|---|---|---|

| Feedback Timeliness | 21.6% | Slow response speed, unable to receive feedback promptly |

| Operation Convenience | 16.1% | Too much repetitive filling and excessive dropdown menus |

| Interface Friendliness | 12.7% | Similar icons with different content, text and images affect readability |

When choosing a remittance company, you can refer to these data and select a platform with convenient operations and timely feedback.

Operation Method for Digital Payment Platforms

Digital payment platforms are popular for their convenience and low handling fees. The following are the basic steps for using digital payment platforms:

- Download the App: Choose a commonly used digital payment platform, such as Alipay or UnionPay QuickPass, and download its official app.

- Register an Account: Use your phone number or email to register an account and complete real-name authentication.

- Link a Bank Card: Link your bank card to the digital payment platform for fund operations.

- Fill Out Remittance Information: Enter the recipient’s account information and remittance amount. Some platforms may require verification of the recipient’s identity.

- Confirm Payment: Verify the remittance information and confirm the payment. The platform will provide transaction records for future reference.

Digital payment platforms are suitable for small remittances. If you need to quickly complete daily transfers, this method is highly efficient. However, you need to pay attention to the platform’s security and choose reputable service providers.

Precautions: How to Ensure Remittance Safety and Avoid Failures

When conducting remittances, ensuring fund safety and avoiding failures are key concerns for every international student. The following are practical suggestions to help you reduce risks and increase success rates during remittances:

1. Verify Recipient Information

When filling out remittance information, carefully verify the recipient’s name, account number, bank name, and SWIFT code. Any error may lead to remittance failure or funds being returned.

Tip: If you use Hong Kong banks for wire transfers, confirm the accuracy of the recipient’s account information with them in advance.

2. Choose Reputable Remittance Channels

Prioritize well-known banks or regulated remittance companies. Avoid using unknown third-party services to prevent fund theft or delayed arrivals.

- Bank Wire Transfers: Suitable for large remittances with high security.

- Digital Payment Platforms: Suitable for small remittances but require choosing reputable platforms like Alipay or UnionPay QuickPass.

3. Avoid Public Network Operations

Performing remittance operations on public Wi-Fi may increase the risk of information leaks. Use private networks or mobile data for transactions.

Note: When entering bank card information, ensure your device has antivirus software installed to prevent malware from stealing data.

4. Understand Remittance Restrictions and Policies

Different countries have varying restrictions on cross-border remittances. For example, China has clear regulations on individual annual foreign exchange limits. If you need to remit large amounts, understand the relevant policies in advance and prepare necessary documents.

5. Keep Transaction Records

After completing a remittance, save transaction receipts or screenshots. These records can help you quickly contact the bank or remittance company for inquiries if issues arise.

| Common Issue | Solution |

|---|---|

| Remittance Failure | Verify information and resubmit |

| Delayed Arrival | Contact the bank or remittance company to check progress |

| High Handling Fees | Compare different channels and choose cost-effective options |

Through these measures, you can effectively reduce remittance risks and ensure funds reach their destination safely. Keep these precautions in mind, and each remittance will be smoother and more secure.

Study Abroad Remittance Tax Policies and Handling Guide

Image Source: pexels

Do Remittances Require Tax Declarations?

When conducting study abroad remittances, whether tax declarations are required depends on the remittance amount and the target country’s tax policies. In China, the annual foreign exchange limit for individuals is USD 50,000. If your remittance amount exceeds this limit, the bank may require you to provide relevant supporting documents and declare to the tax authorities.

In the United States, if the remittance amount exceeds a certain threshold, the recipient may need to pay gift tax. According to U.S. tax law, the annual tax-exempt gift limit is USD 17,000. If your remittance amount exceeds this limit, the recipient needs to declare taxes and pay the corresponding tax.

Tip: Before remitting, consult a professional tax advisor or bank customer service to understand the specific tax policies of the target country and avoid fines or legal issues due to non-declared taxes.

How to Avoid Tax Risks?

To avoid tax risks, you need to take the following measures:

- Understand the Target Country’s Tax Policies

Each country has different tax requirements for cross-border remittances. For example, China has clear regulations on individual annual foreign exchange limits, while the U.S. has strict gift tax restrictions. Understanding these policies in advance can help you avoid non-compliant operations. - Plan Remittance Amounts Reasonably

If your remittance amount is large, consider splitting remittances to avoid exceeding the annual limit or triggering tax declaration requirements. - Keep Remittance Records

Regardless of the remittance method chosen, save transaction records. These records can serve as evidence for tax declarations, helping you prove the source and purpose of funds. - Choose Compliant Remittance Channels

Use regulated banks or remittance companies for transfers. Hong Kong banks’ wire transfer services are highly secure and suitable for large remittances. Avoid using unknown third-party services to prevent fund theft or tax issues.

Note: When conducting study abroad remittances, ensure all operations comply with the target country’s tax policies. Any non-compliant behavior may lead to fines or legal liability.

Tax Regulations and Compliance Suggestions for Different Countries

Different countries have varying tax regulations for study abroad remittances. The following are tax policies and compliance suggestions for some common countries:

| Country | Tax Policy | Compliance Suggestions |

|---|---|---|

| China | Annual foreign exchange limit of USD 50,000 | Split remittances, provide proof of fund sources |

| United States | Annual tax-exempt gift limit of USD 17,000 | Avoid exceeding the limit, consult a tax advisor |

| United Kingdom | Remittance amounts exceeding the threshold require income tax | Declare taxes in advance, keep remittance records |

| Australia | Large remittances require proof of fund sources | Use regulated remittance channels, ensure compliance |

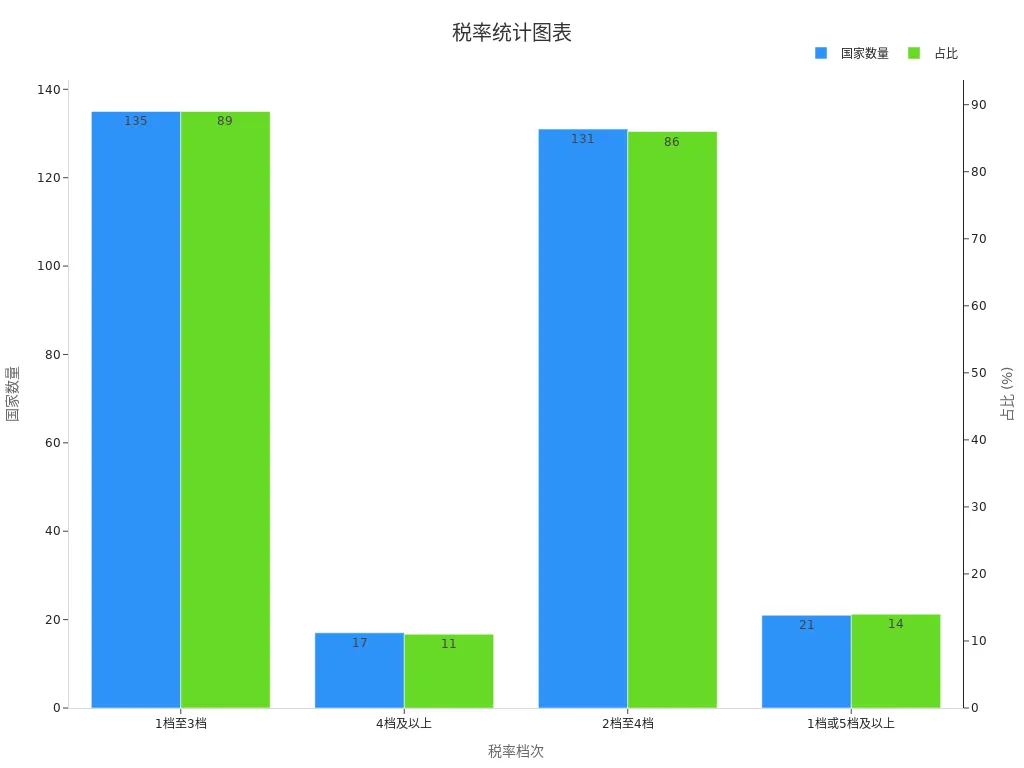

Additionally, according to global tax rate tier statistics, the distribution of tax rates across countries is as follows:

| Tax Rate Tier | Number of Countries | Proportion |

|---|---|---|

| Tier 1 to Tier 3 | 135 | 89% |

| Tier 4 and Above | 17 | 11% |

| Tier 2 to Tier 4 | 131 | 86% |

| Tier 1 or Tier 5 and Above | 21 | 14% |

Suggestion: When choosing remittance methods and amounts, fully consider the target country’s tax rate tiers and tax policies. Through reasonable planning and compliant operations, you can effectively reduce tax risks.

Handling Special Situations

Requirements for Proof of Family Relationship

In some cases, banks or remittance companies may require you to provide proof of family relationship. This requirement typically arises during large remittances or cross-border transfers to prevent money laundering or other illegal activities. You can prepare relevant documents through the following methods:

- Household Register or Birth Certificate: These documents can directly prove your family relationship with the recipient.

- Notarized Documents: If you are abroad, you can obtain proof of family relationship through local notarization agencies.

- Other Documents Required by Banks: Some banks may require additional documents, such as ID copies or the recipient’s passport information.

Tip: When conducting large remittances through Hong Kong banks, consult bank customer service in advance to understand specific document requirements. This can avoid delays due to incomplete materials.

Precautions for Large Remittance Amounts

Large remittances require special attention to the legality and compliance of fund sources. Banks and remittance companies typically conduct strict reviews of large transfers. The following are practical suggestions:

- Prepare Proof of Fund Sources: Provide pay stubs, tax returns, or other legal income proof documents.

- Split Remittances: If possible, split large amounts into multiple remittances to reduce the risk of scrutiny.

- Choose Compliant Channels: Prioritize regulated banks or remittance companies, such as Hong Kong banks’ wire transfer services.

In practice, incorrect remittances can occur. The following is a common case and solution:

| Case Type | Solution |

|---|---|

| Incorrect remittance to a bank deposit account | Seek relief through the unjust enrichment system; if the recipient is bankrupt, stronger protection can be sought under bankruptcy law. |

Note: When filling out remittance information, carefully verify the recipient’s account information to avoid fund losses due to incorrect operations.

Special Regulations in Different Countries

Different countries have significant differences in regulatory policies for cross-border remittances. Understanding these regulations can help you avoid unnecessary troubles. The following are special requirements for some major countries:

- The EU restricts data outflows through the General Data Protection Regulation, establishing a data protection committee.

- The U.S. advocates for free data flows, emphasizing market leadership, and maintains data control rights through the Clarifying Lawful Overseas Use of Data Act.

- Russia implements strict data localization policies, prohibiting data transfers abroad.

- China’s regulation relies on data localization, but related laws have not yet formed a systematic framework.

Suggestion: Before conducting cross-border remittances, understand the specific regulations of the target country. Choose compliant remittance methods and keep all transaction records for future reference.

By mastering these methods for handling special situations, you can complete remittance operations more efficiently while avoiding unnecessary risks.

Choosing the right remittance method can make your study abroad life easier. Bank wire transfers are suitable for large fund transfers with high security; remittance companies offer low fees and fast arrivals; digital payment platforms are convenient for small remittances; and credit card transfers and third-party services provide flexible options. You need to choose the most suitable method based on remittance amount, arrival time, and security needs.

When remitting, pay close attention to the target country’s tax policies, especially study abroad remittance tax policies. Plan remittance amounts reasonably, keep transaction records, and ensure compliant operations. Through these measures, you can effectively avoid tax risks and ensure fund safety.

FAQ

1. Will Funds Be Returned If a Remittance Fails?

Yes, funds are usually returned to your account. However, this may take a few days, depending on the processing speed of the bank or remittance company. You can contact the bank or remittance company customer service and provide transaction records to expedite processing.

Tip: Ensure the recipient’s information is accurate to reduce the likelihood of failure.

2. Why Are Bank Wire Transfer Fees High?

Bank wire transfer fees are high due to intermediary bank fees and exchange rate margins involved in cross-border transactions. Institutions like Hong Kong banks typically charge fixed fees or percentage-based fees based on the remittance amount and destination.

Suggestion: Before remitting, compare the fee structures of different banks and choose a cost-effective service.

3. Is It Safe to Remit Using Digital Payment Platforms?

The safety of digital payment platforms depends on the platform’s technology and regulation. For example, Alipay and UnionPay QuickPass use encryption to protect user information. However, avoid operating in public network environments.

Note: Choose well-known platforms and enable two-factor authentication to further enhance account security.

4. Do Remittances to the U.S. Require Tax Payments?

If the remittance amount exceeds the U.S. annual tax-exempt gift limit (USD 17,000), the recipient may need to declare taxes and pay gift tax. The specific situation depends on the latest U.S. tax regulations.

Tip: Before remitting, consult a tax advisor or bank customer service to understand the latest policies.

5. How to Track Remittance Progress?

You can track remittance status through the online platforms of banks or remittance companies. Some platforms offer real-time tracking, such as TransferMate and Hong Kong banks’ wire transfer services.

Suggestion: Keep transaction receipts and contact customer service with the transaction number if needed for assistance.

In 2025, study abroad remittances grapple with high fees (bank wires costing hundreds), delayed arrivals (3-7 days for standard transfers), complex tax compliance, and risks of errors causing transfer failures. BiyaPay delivers a streamlined solution for students! Exchange over 30 fiat currencies and 200+ cryptocurrencies with real-time rate tracking to dodge volatility, enjoy fees as low as 0.5% across 190+ countries, and benefit from same-day initiated, same-day delivered transfers. Sign up for BiyaPay in just one minute to effortlessly handle tuition, living expenses, and US/HK stock investments while simplifying compliance. Earn a 5.48% annualized yield on flexible savings to grow idle funds. Secured by blockchain technology and backed by U.S. MSB and SEC licenses, BiyaPay ensures transparent, compliant transactions with minimal failure risks. Start today—join BiyaPay for a fast, cost-effective remittance experience!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.