- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Analysis of Fees and Legal Restrictions for U.S. Study Abroad Remittances

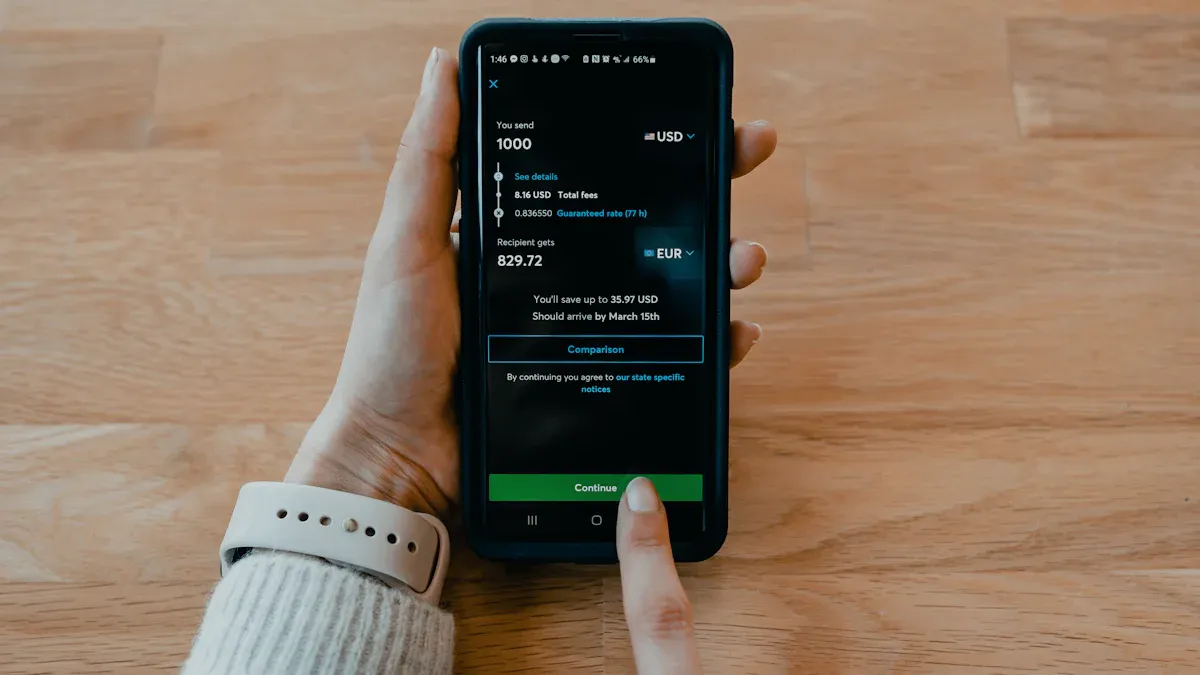

Image Source: pexels

U.S. study abroad remittances involve multiple complex aspects, with fees being a significant component. The fee structure includes fixed charges from banks or payment platforms, additional costs for transfers through intermediary institutions, and losses due to exchange rate differences across channels. Choosing the right remittance method directly impacts costs.

At the same time, laws and regulations impose strict requirements on remittance amounts and fund sources. According to U.S. anti-money laundering laws, students must provide proof of fund sources for large remittances and comply with tax regulations. Failure to comply may result in additional fees or even legal risks.

To balance cost and compliance, understanding U.S. study abroad remittance strategies is crucial. Selecting low-fee channels, planning remittance frequency, and monitoring exchange rate fluctuations can effectively reduce costs while ensuring compliance with relevant laws and regulations.

Analysis of U.S. Study Abroad Remittance Fees

Image Source: unsplash

Fee Composition

The fees for U.S. study abroad remittances consist of multiple components. First, banks or payment platforms charge fixed fees. These fees are typically unrelated to the transfer amount, but the fee standards may vary across institutions. Second, additional fees from intermediary institutions may be incurred during the remittance process. For example, when completing a transfer through a third-party payment platform, fees may be lower. One student converted 100,000 RMB to USD through a third-party platform, paying only about 200 RMB in fees. Additionally, exchange rate differences also affect actual expenses. Choosing channels with better exchange rates can effectively reduce costs.

To avoid exceeding your budget, you need to calculate total expenses in advance, including tuition, accommodation fees, and more. After completing the transfer, regularly check the status to ensure funds arrive on time, avoiding issues caused by delays.

Fee Calculation Methods

Fee calculation methods vary by remittance channel. Bank wire transfers typically charge a fixed fee plus a percentage of the transfer amount. For example, Hong Kong banks’ wire transfer fees may include a fixed fee and 0.1%-0.3% of the remittance amount. Online payment platforms have more flexible fee structures, with some charging fixed fees and others calculating based on a percentage of the amount.

You can use comparison websites to find the best remittance method. Pay attention to real-time market trends and choose the channel with the lowest fees. For example, some platforms offer preferential exchange rates, effectively reducing fees.

Factors Affecting Fees

Factors affecting fees mainly include remittance amount, remittance method, and exchange rate fluctuations. Larger amounts may result in higher fees, but some platforms offer discounts for large remittances. The choice of remittance method is also critical. Bank wire transfers generally have higher fees, while online payment platforms and third-party service providers may offer cost advantages.

Additionally, exchange rate fluctuations directly impact actual expenses. Real-time exchange rate changes may increase or decrease fees. It is recommended to monitor exchange rate trends before remitting and choose the right timing to complete the transfer.

By understanding these factors, you can better plan your remittance strategy. Combining U.S. study abroad remittance strategies, choosing low-fee channels and appropriate methods can save costs while ensuring fund safety.

Legal Restrictions on U.S. Study Abroad Remittances

Image Source: unsplash

Remittance Amount Restrictions

The U.S. imposes strict restrictions on international remittance amounts, particularly for large remittances. According to the U.S. Anti-Money Laundering Law (AML), financial institutions must monitor and report suspicious fund flows to prevent money laundering. When remitting, you need to be aware that single or cumulative amounts exceeding a certain threshold may trigger bank review procedures. For example, remittances exceeding USD 10,000 typically require detailed proof of fund sources.

To avoid unnecessary trouble, you can split large amounts into multiple transfers. At the same time, understand the bank’s specific requirements in advance to ensure each remittance complies with regulations. This can effectively reduce the risk of review and ensure funds arrive smoothly.

Legality of Fund Sources

The legality of fund sources is a key issue in U.S. study abroad remittances. Banks and relevant institutions require you to provide supporting documents to ensure funds are legally sourced and compliant. The following are common supporting documents:

- Bank-issued deposit certificates, showing account balances and fund transaction records.

- Financial statements of enterprises for the past three years, proving the stability and legality of funds.

- Contracts or agreements related to funds, such as internal enterprise fund transfer agreements.

- Tax payment certificates issued by tax authorities, showing that funds have been legally taxed.

- Audit reports issued by accounting firms, confirming the legality and compliance of funds.

If you cannot provide these documents, it may lead to remittance delays or rejections. Therefore, preparing relevant materials before remitting is crucial. Through these documents, you can prove the legality of funds and avoid unnecessary legal risks.

Tax Compliance Requirements

U.S. tax regulations also have clear requirements for international remittances. Under the Foreign Account Tax Compliance Act (FATCA), overseas financial institutions must report account information of U.S. asset holders to the U.S. Internal Revenue Service (IRS). If your U.S. account receives large remittances, you may need to declare them to the tax authorities.

Additionally, the U.S. Consumer Financial Protection Bureau (CFPB) oversees consumer rights protection in financial markets. When remitting, you need to ensure all transaction records are clear and retain relevant vouchers for verification. Complying with tax requirements not only avoids fines but also ensures the safety of your study abroad funds.

To better address tax compliance issues, you can consult professional tax advisors or accountants. They can help you understand the latest tax policies and provide personalized advice. Through reasonable planning, you can comply with the law while minimizing tax costs.

U.S. Study Abroad Remittance Strategies: Comparison of Remittance Methods

Bank Wire Transfers

Bank wire transfers are one of the traditional remittance methods, suitable for large fund transfers. You can complete operations through bank counters or online banking. However, this method may have higher costs and longer processing times. Wire transfers involve multiple institutions, including the sending bank, central bank, correspondent banks, and receiving bank. These steps increase processing time and fees. Additionally, each institution has independent accounting and clearing systems, leading to lower cross-border payment efficiency. Transactions also require fund clearing and reconciliation, increasing payment risks.

Nevertheless, bank wire transfers excel in security. Banks conduct strict reviews of each transaction to ensure the legality of fund sources. For those needing stable and secure remittance methods, bank wire transfers are a priority option.

Online Payment Platforms

Online payment platforms have become a popular choice for study abroad remittances in recent years. They are favored for fast arrival times and low fees. Data shows that in 2018, Chinese third-party payment institutions processed cross-border internet transactions exceeding 490 billion RMB, a 55% increase from 2017. This growth reflects the market’s demand for online payment platforms.

The advantages of online payment platforms also include flexible fee structures. Industry fees have gradually decreased from 2% to 0.5%, with some platforms even introducing “zero-fee” policies. This fee advantage is particularly suitable for small, high-frequency remittance needs. If you want to complete remittances quickly and save costs, online payment platforms are a good choice.

Third-Party Service Providers

Third-party service providers offer more options for international students. These providers typically collaborate with banks or payment platforms, offering lower fees and better exchange rate discounts. For example, some service providers launch exclusive remittance packages for students, helping you save costs.

Additionally, third-party service providers offer more personalized services. They provide tailored remittance solutions based on your needs, along with real-time exchange rate queries and fee calculation tools. This flexibility makes third-party service providers a preferred choice for many students.

When choosing third-party service providers, you need to verify their qualifications and reputation. Selecting reputable providers ensures fund safety and reduces risks.

By comparing bank wire transfers, online payment platforms, and third-party service providers, you can choose the most suitable remittance method based on your needs. The core of U.S. study abroad remittance strategies lies in balancing cost and efficiency while ensuring fund safety.

Suggestions for Reducing Fees and Risks

Choosing Low-Fee Channels

Choosing low-fee remittance channels can significantly reduce costs. High-traffic platforms typically offer lower fee rates. For example, third-party payment channels like Alipay and WeChat have fees generally below 0.3%. In contrast, individual merchants or small platforms may charge fees as high as 0.6%.

To save costs, you can prioritize payment channels with low fees and high stability. The following are specific suggestions:

- Use well-known third-party payment platforms to ensure low fees and reliable services.

- Avoid small platforms with high fee rates to reduce unnecessary expenses.

- Before remitting, compare fee rates across channels to choose the optimal solution.

Through these methods, you can maximize fee savings while ensuring fund safety.

Planning Remittance Frequency Reasonably

Planning remittance frequency is an important strategy for controlling costs. Frequent small remittances may lead to accumulated fee increases, while one-time large remittances may trigger bank reviews. You need to find a suitable remittance frequency based on actual needs.

For example, if tuition and living expenses can be budgeted in advance, you can choose to remit once per semester or quarter. This approach not only reduces fees but also avoids the hassle of frequent operations. Additionally, understanding the discount policies of banks or payment platforms is crucial. Some platforms may offer fee waivers or exchange rate discounts for large remittances.

Through reasonable planning, you can reduce costs while ensuring funds arrive on time.

Monitoring Exchange Rate Fluctuations

Exchange rate fluctuations directly affect remittance costs. Since the 2005 RMB exchange rate reform, the nominal effective exchange rate has appreciated by 19.71%, and the real effective exchange rate has appreciated by 25.06%. Despite RMB appreciation, China’s trade surplus continues to grow. This indicates that exchange rate changes significantly impact economic activities.

To reduce risks from exchange rate fluctuations, you can take the following measures:

- Monitor exchange rate trends and choose times with lower rates for remittances.

- Use payment platforms offering real-time exchange rate queries to secure the best rates.

- If possible, opt for rate-locking services to avoid additional costs due to fluctuations.

By monitoring exchange rate changes, you can better control remittance costs and maximize fund efficiency.

U.S. study abroad remittances involve multiple critical aspects. You need to focus on fee composition and calculation methods, understand legal restrictions on remittance amounts and fund sources, and compare the advantages and disadvantages of different remittance methods. Choosing a suitable remittance plan can effectively reduce costs.

Compliance and cost control are crucial for remittance decisions. The following data and cases illustrate their practical impact:

- In 2017, ICBC researched blockchain technology applications, improving account opening efficiency.

- In 2018, ICBC applied artificial intelligence to cross-border payment clearing, reducing labor costs.

Select the optimal remittance plan based on your needs to save costs and ensure fund safety. Through reasonable planning, you can easily address the challenges of study abroad remittances.

FAQ

1. What Documents Are Required for Remittances?

You need to prepare proof of fund sources, such as bank deposit certificates, tax payment certificates, or contracts. These documents help prove the legality of funds and avoid remittance delays or rejections.

2. What Happens If a Remittance Exceeds USD 10,000?

Remittances exceeding USD 10,000 may trigger bank review procedures. You need to provide detailed proof of fund sources and ensure all transaction records are clear to avoid legal risks.

3. Which Remittance Method Is Best for Small Fund Transfers?

Online payment platforms are the best choice for small fund transfers. They have low fees and fast arrival times, suitable for frequent small remittances. For example, Alipay and WeChat offer flexible fee structures.

4. How to Choose the Right Remittance Timing to Reduce Exchange Rate Losses?

Monitor exchange rate trends and remit when rates are lower. Use real-time exchange rate query tools to secure the best rates. Additionally, rate-locking services can help avoid extra costs due to fluctuations.

5. What to Do If a Remittance Is Delayed?

First, contact the remittance channel’s customer service to inquire about the delay reason. Then, check if complete supporting documents were provided. If the issue persists, consult professionals or legal advisors to ensure fund safety.

In 2025, US study abroad remittances encounter high fees, delayed arrivals, strict legal restrictions, and costs inflated by exchange rate volatility, with bank wires charging fixed fees plus 0.1%-0.3%, taking 3-7 days, and requiring proof of funds for transfers over $10,000 under AML regulations. BiyaPay delivers a streamlined, cost-effective solution for students! Exchange over 30 fiat currencies and 200+ cryptocurrencies with real-time rate tracking to minimize volatility, enjoy fees as low as 0.5% across 190+ countries, and benefit from same-day initiated, same-day delivered transfers. Sign up for BiyaPay in just one minute to seamlessly manage tuition, living expenses, and US/HK stock investments.

Earn a 5.48% annualized yield on flexible savings to grow idle funds. Secured by blockchain technology and backed by U.S. MSB and New Zealand FSP licenses, BiyaPay ensures transparent, compliant transactions with minimal risks. Start today—join BiyaPay for a secure, efficient US remittance experience!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.