- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Complete Guide to Remitting Funds Back to China with a U.S. Green Card

Image Source: pexels

Living in the United States, you may need to remit funds back to China. How can you ensure the remittance process is legal, safe, and efficient? According to the latest cross-border remittance policies, personal bank accounts can accept remittances from foreign companies. The CNY has become China’s second-largest cross-border payment method, providing greater convenience for fund flows. Foreign exchange regulations limit remittances to China to USD 50,000 per person per year, with amounts exceeding this limit requiring reporting and proof of legal income. These policies not only ensure the legality of funds but also enhance remittance safety. Understanding these rules allows you to complete U.S. green card remittances to China with greater peace of mind.

Key Points

- Before remitting, ensure personal information and documents are complete, including identity proof and bank account details.

- The annual remittance limit is USD 50,000, with amounts exceeding this requiring reporting and proof of legal income.

- Choose an appropriate remittance method, considering fees, arrival time, and security.

- When filling out remittance information, ensure recipient details and remittance purpose are accurate to avoid delays.

- Comply with tax and foreign exchange regulations to ensure legal and compliant remittances, reducing legal risks.

Basic Requirements for Remitting Funds Back to China with a U.S. Green Card

Personal Information and Document Preparation

Before conducting a U.S. green card remittance to China, you need to prepare relevant personal information and documents. These documents include valid identity proof (such as a passport or green card), bank account information, and detailed information about the remittance recipient. Ensure all information is accurate to avoid remittance failures due to errors. Additionally, the remittance purpose must be clearly stated, such as family support, education expenses, or medical costs. According to regulations, all cross-border remittances require declaration, including recipient information, remittance amount, and purpose.

Remittance Amount Restrictions and Regulations

U.S. green card holders must comply with amount restrictions when remitting funds to China. The annual remittance limit to foreign countries per person must not exceed USD 50,000. If this limit is exceeded, you must wait until the next year to continue foreign exchange settlement. Additionally, the use of funds is strictly restricted. Individuals can use funds for legal purposes such as travel, business trips, or study abroad, but they are prohibited from using funds for purchasing property abroad or buying life insurance. Complying with these regulations not only ensures the legality of remittances but also avoids unnecessary legal risks.

Basic Bank Account Requirements

Choosing an appropriate bank account is a crucial step in completing a U.S. green card remittance to China. You need to ensure your account supports international remittance functions and that the account information matches your personal identity information. Many Hong Kong banks offer convenient cross-border remittance services with relatively low fees, suitable for users needing frequent remittances. Additionally, the recipient’s bank account must support foreign exchange receipt functions. Confirming the account’s relevant requirements with the bank in advance can avoid unnecessary issues during the remittance process.

Specific Operation Process for Remitting Funds Back to China with a U.S. Green Card

Choosing an Appropriate Remittance Method

Choosing an appropriate remittance method is a key step in completing a U.S. green card remittance to China. Different remittance methods have their own advantages and disadvantages, and you need to choose based on your needs. The following are several common remittance methods:

- Bank Wire Transfer: Suitable for large remittances, high security, but higher fees, with processing typically taking 3-5 business days.

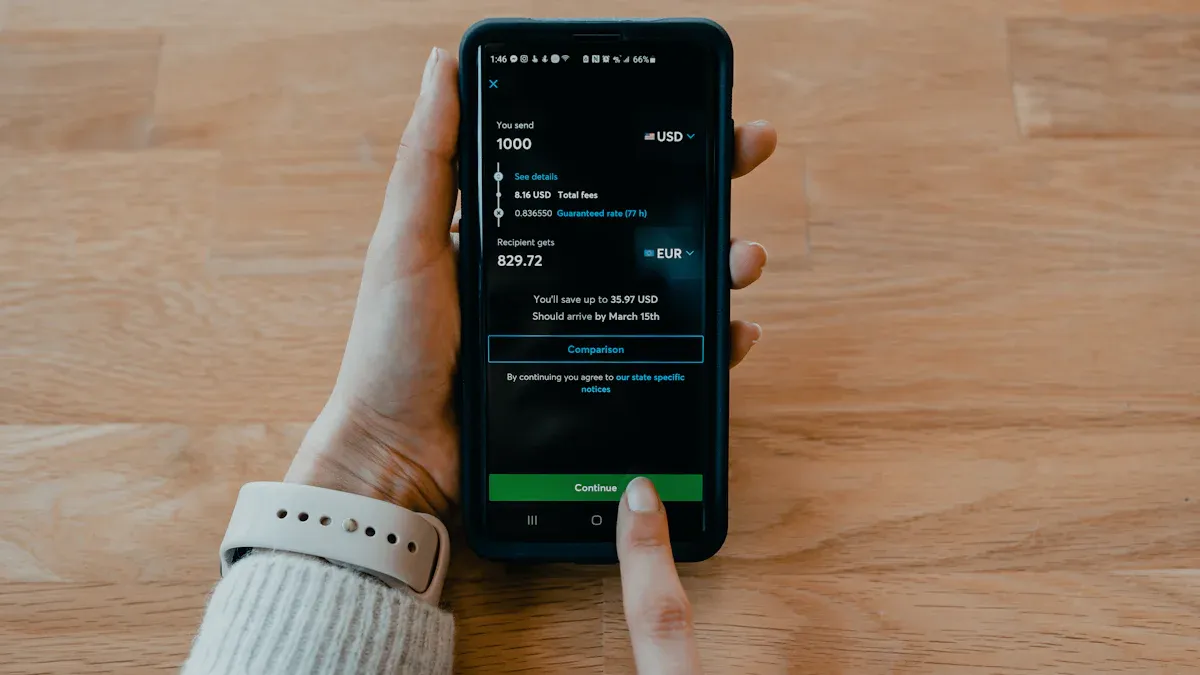

- Third-Party Payment Platforms: Such as PayPal or Wise, suitable for small remittances, lower fees, faster remittance speed, but may require additional account verification.

- Professional Remittance Services: Such as Western Union or MoneyGram, suitable for urgent remittances, fast speed, but fees may be higher.

Tip: If you need frequent remittances, choose platforms with lower fees; for one-time large remittances, bank wire transfers may be safer.

When choosing a remittance method, consider factors such as exchange rates, fees, and arrival time. Understanding this information in advance can help you save costs and improve efficiency.

Key Points for Filling Out Remittance Information

Accuracy is crucial when filling out remittance information. Any errors may lead to remittance failure or delays. The following are key points to note when filling out information:

- Recipient Information: Ensure the recipient’s name, bank account number, and bank details are accurate. The recipient’s name must exactly match the name registered with the bank account.

- Remittance Amount: Clearly specify the remittance amount and ensure it is within the regulated limits.

- Remittance Purpose: Truthfully state the remittance purpose, such as “family support” or “education expenses.” Avoid using vague or unclear descriptions.

- Bank Codes: If using a bank wire transfer, provide the recipient bank’s SWIFT code or IBAN number.

Note: Before submitting remittance information, carefully verify all details to avoid funds failing to arrive due to minor errors.

Confirming Remittance and Tracking Progress

After completing the information, you need to confirm the remittance and track its progress. The following are specific steps:

- Confirm Remittance: After submitting the remittance application, the bank or platform will provide a confirmation receipt. Carefully check the information on the receipt to ensure accuracy before making the payment.

- Save Vouchers: After completing the payment, save the remittance voucher. This is an important basis for querying remittance status or resolving issues.

- Track Progress: Most banks and platforms offer online tracking services. You can check the remittance status in real-time using the transaction number or reference number.

Suggestion: If the remittance does not arrive within the expected time, promptly contact the bank or platform’s customer service and provide relevant vouchers for inquiry.

Through these steps, you can smoothly complete the U.S. green card remittance to China. Regardless of the chosen method, ensuring accurate information and legal compliance is the most important.

Commonly Used Remittance Tools and Platforms

Image Source: pexels

Bank Wire Transfer

Bank wire transfer is one of the most traditional cross-border remittance methods, suitable for users needing to send large amounts. Through a bank wire transfer, you can directly transfer funds from a U.S. account to a Chinese bank account. Wire transfers offer high security but may have higher fees and longer processing times. The following is a comparison of cross-border remittance fees for several common banks:

| Bank | Same-Bank Remittance Fee | Cross-Bank Remittance Fee |

|---|---|---|

| Bank of China | No fee for local, 10 CNY for non-local | 4 CNY for same city, 12 CNY for non-local |

| ICBC | No fee for local, 1% for non-local (min. 1 CNY, max. 50 CNY) | 4 CNY for same city, 1% for non-local (min. 1 CNY, max. 50 CNY) + 4 CNY labor fee |

| China Construction Bank | No fee for local, 1% for non-local (min. 2 CNY, max. 100 CNY) | 4 CNY for same city, 1% for non-local (min. 2 CNY, no upper limit) + 2 CNY labor fee |

| Agricultural Bank of China | No fee for local, 1% for non-local (min. 1 CNY, no upper limit) | 4 CNY for same city, 1% for non-local (min. 1 CNY, no upper limit) + 2 CNY labor fee |

Tip: If you choose a bank wire transfer, consult the bank’s specific fee standards and processing times in advance to better plan your remittance.

Third-Party Payment Platforms (e.g., PayPal, Wise)

Third-party payment platforms have become increasingly popular for remittances in recent years. These platforms are easy to operate and have transparent fees, suitable for small remittances or frequent transfers. The following are the main features of PayPal and Wise:

| Platform | Monthly Transaction Volume | Main Features |

|---|---|---|

| PayPal | Over 4 billion transactions | Multiple encryption technologies ensure fund safety, supports over 200 countries and regions |

| Wise | N/A | Transparent fee structure, real-time exchange rate conversion, supports multi-currency accounts |

PayPal is renowned for its global coverage and security, suitable for users needing transfers between multiple countries. Wise attracts many users with its low fees and real-time exchange rate conversion, especially for those requiring frequent cross-border transactions.

Note: When using third-party payment platforms, ensure account information is accurate and comply with the platform’s usage rules to avoid unnecessary trouble.

Professional Remittance Services (e.g., Western Union, MoneyGram)

Western Union and MoneyGram are well-known professional remittance service providers, suitable for users needing fast remittances. These services typically do not require a bank account, and recipients can collect cash directly at designated locations. Although fees are higher, the remittance speed is very fast, often completed within minutes.

Suggestion: If you need urgent remittances, choose these professional services. However, understand the fees and exchange rates in advance to avoid unnecessary costs.

Through these tools and platforms, you can choose the most suitable remittance method based on your needs. Whether it’s bank wire transfers, third-party payment platforms, or professional remittance services, each method has unique advantages and applicable scenarios. Ensuring accurate information and legal compliance is key to completing U.S. green card remittances to China.

Tax and Legal Compliance for U.S. Green Card Remittances to China

Image Source: unsplash

U.S. Tax Declaration Requirements

As a U.S. green card holder, you need to understand U.S. tax declaration requirements. According to U.S. tax law, your worldwide income must be reported to the U.S. Internal Revenue Service (IRS) and subject to federal income tax. This includes wages, investment income, and other forms of income. Even if you remit funds to China, these incomes must still be included in the declaration scope.

Additionally, declaring overseas assets is crucial. If you hold assets overseas exceeding USD 50,000, you must declare them under the Foreign Account Tax Compliance Act (FATCA). Individuals failing to declare as required may face hefty fines or even legal action. To avoid these issues, you need to complete tax declarations by April 15 each year. If unable to declare on time, you can apply for an extension to August 15 or October 15.

Tip: If you have paid relevant taxes in China, you can apply for a deduction under the U.S.-China tax treaty. This effectively reduces the burden of double taxation.

China’s Foreign Exchange Regulations

In China, foreign exchange regulations have clear requirements for cross-border remittances. The annual foreign exchange settlement limit per person is USD 50,000. If you need to remit funds exceeding this limit to China, you must provide proof of legal income and report to the relevant authorities. The State Administration of Foreign Exchange of China also imposes strict restrictions on fund usage, prohibiting foreign exchange for illegal activities or non-compliant investment projects.

To ensure smooth remittances, you need to understand the foreign exchange receipt policies of the recipient bank in advance. Some banks may require additional documents, such as remittance purpose statements or proof of fund sources. Complying with these regulations not only ensures the legality of funds but also avoids penalties for non-compliant operations.

Note: The CNY has become China’s second-largest cross-border payment method. If you choose to remit in CNY, you can enjoy more convenient fund flow services.

Suggestions for Avoiding Legal Risks

To avoid violating laws during the remittance process, you need to take the following measures:

- Ensure Tax Compliance: Declare worldwide income and overseas assets on time to avoid penalties for underreporting or misreporting.

- Comply with Foreign Exchange Regulations: Strictly follow China’s foreign exchange policies to ensure legal fund usage.

- Enhance Data Protection: Choose secure and reliable platforms for cross-border remittances to prevent personal information leaks.

- Consult Professionals: If unsure about tax or legal issues, seek assistance from tax advisors or lawyers.

Through these measures, you can effectively reduce legal risks and ensure a safe and smooth remittance process.

Suggestion: Develop good financial record-keeping habits and regularly check remittance and tax declaration statuses. This not only improves fund management efficiency but also supports future financial planning.

Practical Suggestions and Common Questions Answered

How to Reduce Remittance Fees

Reducing remittance fees can help you save costs, especially for frequent cross-border remittances. The following are practical methods:

- Choose Banks or Platforms with Lower Fees: Fee standards vary significantly across banks and platforms. The following is a fee comparison for several banks:

Bank Name Fee Rate Minimum Fee Maximum Fee ICBC 0.10% 50 CNY 260 CNY Bank of China 0.10% 50 CNY 260 CNY Agricultural Bank of China 0.10% 20 CNY 200 CNY China Construction Bank 0.10% 20 CNY 300 CNY - Choose Appropriate Remittance Methods: Bank wire transfers are suitable for large remittances, while third-party payment platforms like Wise are better for small remittances with lower fees.

- Pay Attention to Promotional Offers: Some banks or platforms periodically offer fee waivers, and understanding these in advance can save more costs.

Tip: Before remitting, consult the latest fee policies of banks or platforms to avoid unnecessary expenses.

Impact of Exchange Rate Fluctuations and Coping Strategies

Exchange rate fluctuations directly affect remittance costs. Especially in unstable exchange rate conditions, remittance fees may increase significantly. The following are coping strategies:

- Flexibly Use Financial Tools: Through hedging or forward foreign exchange transactions, you can lock in exchange rates to reduce risks from fluctuations.

- Choose Appropriate Remittance Timing: Remit when exchange rates are lower to save costs.

- Monitor Foreign Exchange Market Trends: Understand exchange rate trends to avoid extra fees due to market fluctuations.

Exchange rate fluctuations have a particularly significant impact on small-country currencies, and administrative barriers and foreign exchange controls may also increase remittance costs. Through reasonable planning and financial tools, you can effectively reduce risks.

Solutions for Encountered Issues

During the remittance process, you may encounter issues such as incorrect information or delayed fund arrivals. The following are common issues and solutions:

- Incorrect Information: If you find an error, immediately contact the bank or platform’s customer service, provide correct information for correction.

- Delayed Fund Arrival: Check the remittance status using the transaction number or reference number. If unresolved, provide remittance vouchers and request an investigation.

- System Integration or Functionality Issues: Common user feedback includes difficult system integration and incompatible functions. Areas for improvement include optimizing process compatibility and enhancing training support.

Issue Type Solution Incorrect Information Contact customer service to correct information Delayed Fund Arrival Check status and request investigation Incompatible System Functions Customize functions and enhance training support

Suggestion: Save all remittance vouchers, regularly check remittance status, and promptly communicate with relevant institutions when issues arise.

Through these suggestions, you can complete remittance operations more efficiently while reducing costs and risks.

To complete a U.S. green card remittance to China, you need to keep several core steps in mind: prepare complete personal information and documents, choose an appropriate remittance method, accurately fill out remittance information, and ensure tax and legal compliance. Each step is crucial and directly affects the efficiency and safety of the remittance.

The following are key data to help you better understand the importance of compliance:

| Evidence Type | Specific Content |

|---|---|

| Tax Credits | Individuals residing overseas long-term can enjoy over USD 90,000 in foreign income tax exemptions, with couples jointly reaching USD 180,000. |

| Double Taxation Agreement | Taxes paid in China do not need to be paid again in the U.S., avoiding double taxation. |

| Tax-Exempt Limits | Individuals have a lifetime tax-exempt limit of USD 5 million and an annual foreign income exemption of USD 92,900. |

Legal compliance not only protects your fund safety but also avoids unnecessary legal risks. Based on your needs, choose the most suitable remittance method to ensure the entire process is efficient and smooth.

FAQ

1. How Long Does It Take to Remit Funds Back to China?

Remittance time depends on the chosen method. Bank wire transfers typically take 3-5 business days, third-party payment platforms like Wise may take 1-2 days, and professional services like Western Union can arrive in minutes.

Tip: Before choosing a method, consult the platform’s processing time to avoid delays.

2. What to Do If a Remittance Fails?

If a remittance fails, immediately contact the bank or platform’s customer service. Provide the transaction number and remittance vouchers, explaining the issue in detail. Customer service will assist in identifying the cause and resolving the issue.

Suggestion: Before submitting, carefully verify all information to avoid failures due to errors.

3. How to Ensure the Remittance Process Is Secure?

Choose reputable banks or platforms with encryption technology to protect funds and information safety. Avoid using public Wi-Fi for operations.

Note: Save transaction receipts, regularly check account status, and contact relevant institutions promptly if abnormalities are detected.

4. What Fees Are Paid During Remittances?

Fees include handling fees and exchange rate margins. Bank wire transfers are expensive, while third-party payment platforms have lower fees. Some platforms may charge additional account verification fees.

Tip: Understand fee standards in advance and choose cost-effective methods to save costs.

5. Are There Limits on Remittance Amounts?

Yes, the annual foreign exchange settlement limit per person is USD 50,000. Exceeding this limit requires proof of legal income and reporting.

Suggestion: Reasonably plan remittance amounts to avoid exceeding limits and ensure compliance.

In 2025, US green card holders remitting to China face high fees, delayed arrivals, strict legal restrictions, and costs driven by exchange rate volatility, with bank wires incurring high fees and taking 3-5 days, China’s $50,000 annual limit requiring compliance, and FATCA mandating reporting of foreign assets. BiyaPay offers a seamless, cost-effective solution! Exchange over 30 fiat currencies and 200+ cryptocurrencies with real-time rate tracking to minimize volatility, enjoy fees as low as 0.5% across 190+ countries, and benefit from same-day initiated, same-day delivered transfers. Sign up for BiyaPay in just one minute to effortlessly manage family support, education payments, or investment transfers. Earn a 5.48% annualized yield on flexible savings to grow idle funds. Secured by blockchain technology and backed by U.S. MSB and New Zealand FSP licenses, BiyaPay ensures transparent, compliant transactions with minimal risks. Start today—join BiyaPay for a secure, efficient remittance experience!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.