- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Tips for Choosing Japan Study Abroad Remittance Methods and Analysis of Advantages and Disadvantages

Image Source: pexels

When studying abroad in Japan, choosing the right remittance method is crucial for your fund management. Different remittance methods, such as traditional bank remittances, virtual banks, WeChat Pay, wire transfers, and Western Union remittances, each have their own characteristics. By comparing the advantages and disadvantages of these methods, you can find a solution that is both safe and fast. The complexity of the remittance process also affects your choice, and ensuring funds arrive at their destination on time is particularly important. Understanding the Japan study abroad remittance process and mastering techniques can help you better plan and manage financial needs during your study abroad life.

Key Factors in the Japan Study Abroad Remittance Process

When choosing a suitable remittance method, you need to focus on several key factors. These factors directly affect your fund costs, arrival efficiency, and user experience. The following will analyze in detail from three aspects: handling fees, exchange rates, and arrival time.

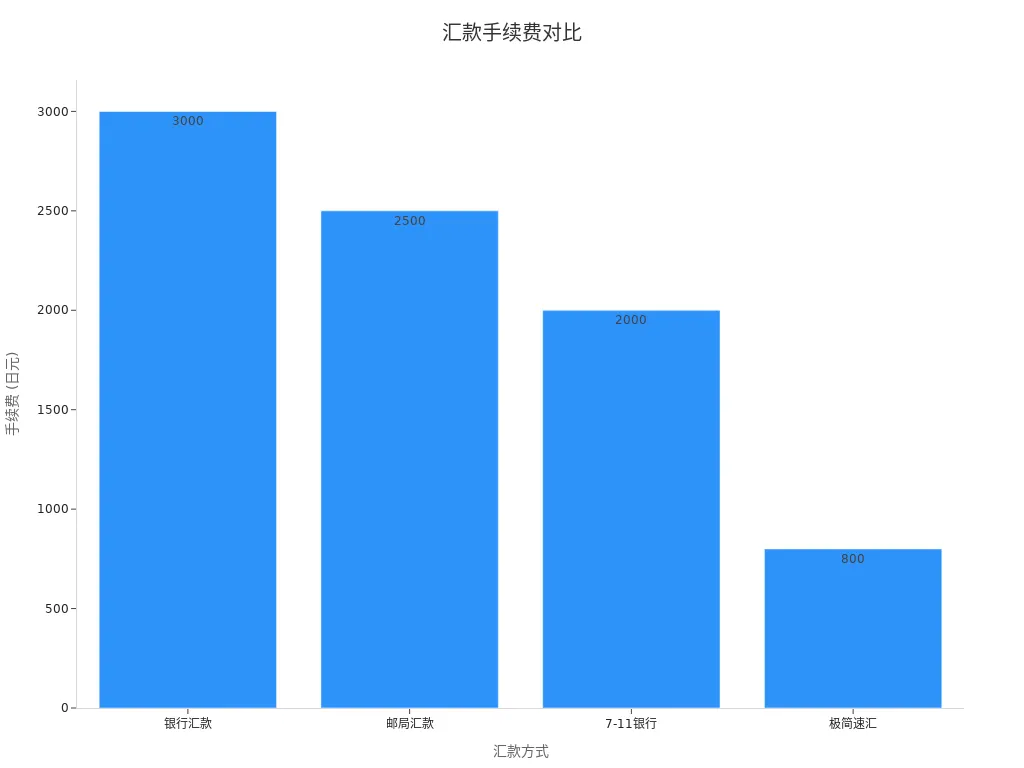

Handling Fee Comparison

Handling fees are an important consideration when choosing a remittance method. The fee differences between channels are significant, and applicable scenarios vary. The following are the handling fee characteristics of common remittance methods:

| Remittance Channel | Handling Fee Characteristics |

|---|---|

| Bank Remittance | Generally higher fees, suitable for large remittances. |

| Third-Party Payment Platform | Lower fees, fast processing speed. |

| International Remittance Company | Moderate fees, relatively fast remittance speed. |

Additionally, the specific handling fee amounts for different remittance methods also show clear differences. The following table compares the handling fees of several common methods:

| Remittance Method | Handling Fee (JPY) |

|---|---|

| Bank Remittance | 3000 |

| Post Office Remittance | 2500 |

| 7-11 Bank | 2000 |

| Simple Speed Remittance | 800 |

From the table and chart above, it is evident that bank remittances have higher handling fees but are suitable for secure transfers of large funds. For small remittances, methods like Simple Speed Remittance offer a cost advantage.

Exchange Rate Impact

Exchange rate fluctuations directly affect the cost of your study abroad funds. Paying attention to exchange rate trends when choosing a remittance method can help you save expenses. The following points need special attention:

- Historical exchange rate data reveal the direct impact of exchange rate fluctuations on study abroad fund costs.

- When the RMB exchange rate fluctuates significantly, the cost of study abroad funds changes noticeably.

- Choosing a time with lower exchange rates for currency conversion can effectively reduce losses.

For example, when the RMB to JPY exchange rate declines, you need to pay more RMB to exchange for the same amount of JPY. Therefore, regularly monitoring exchange rate changes and choosing the right remittance timing are particularly important.

Arrival Time

Arrival time determines whether funds can meet your needs in a timely manner. The arrival speed varies significantly across different remittance methods:

- Bank Remittance: Typically takes 2-5 business days, suitable for non-urgent fund transfers.

- Third-Party Payment Platform: Faster arrival, usually completed within 1-2 business days.

- International Remittance Company: Some companies offer instant arrival services, but fees may be higher.

If you need to urgently pay tuition or living expenses, choosing a method with a shorter arrival time is more appropriate. For non-urgent funds, you can opt for methods with lower fees but slightly longer arrival times.

Security

Security is one of the most important considerations when choosing a remittance method. You need to ensure that funds are not stolen or lost during the transfer process. The following is a security analysis of several common remittance methods:

- Traditional Bank Remittance

Bank remittances offer high security. Banks typically use multiple encryption technologies and strict identity verification processes to ensure fund safety. However, the bank remittance process is relatively complex, requiring multiple forms, and errors may occur if not handled carefully. - Third-Party Payment Platform

Third-party payment platforms (such as Alipay, WeChat Pay) provide convenient transfer services, but security depends on the platform’s technical safeguards. You need to protect your account password and avoid operations in public network environments. - Cross-Border Remittance Company

Cross-border remittance companies often provide real-time tracking functions, allowing you to monitor fund transfer status at any time. This method has high security, but you need to choose reputable companies and avoid unknown small institutions. - Virtual Bank

The security of virtual banks depends on their technical architecture and regulatory policies. Many virtual banks offer two-factor authentication and real-time notifications to help you detect unusual activities promptly.

Tip: Regardless of the method chosen, regularly checking account balances and transaction records is key to protecting fund security.

User Convenience

User convenience directly affects your remittance experience. You need to choose methods that are easy to operate and have clear processes, especially in emergencies. The following is a comparison of the convenience of several remittance methods:

- Traditional Bank Remittance

The bank remittance process is relatively cumbersome. You may need to visit a bank branch in person, fill out multiple forms, and provide detailed recipient information. This method is suitable for non-urgent situations. - Third-Party Payment Platform

Third-party payment platforms are highly convenient. You can complete transfers via mobile apps, with the entire process typically taking just a few minutes. This method is ideal for small remittances or daily living expense payments. - Cross-Border Remittance Company

Cross-border remittance companies offer convenience between that of banks and third-party payment platforms. You can submit remittance requests through their websites or mobile apps, but identity verification documents may be required. - Virtual Bank

Virtual banks provide multi-currency accounts and one-stop services. You can complete remittances anytime, anywhere via mobile apps, suitable for students needing frequent transfers.

Note: When choosing a remittance method, prioritize methods that are simple to operate and support real-time arrival to address sudden fund needs.

Traditional Bank Remittance

Image Source: pexels

Security and Stability

Traditional bank remittances are renowned for their high security and stability. Banks typically employ multi-layered encryption technologies and strict identity verification processes to ensure funds are not tampered with or stolen during transfers. For example, Hong Kong banks offer real-time tracking for cross-border remittances, allowing you to monitor fund transfer status at any time. Additionally, banks have robust regulatory systems to effectively prevent fraud.

If you choose bank remittances, carefully verify recipient information to avoid delays or returns due to errors. While the bank remittance process is complex, its security and stability make it the preferred choice for large fund transfers.

Tip: When using bank remittances, retaining remittance vouchers is crucial. This not only aids in tracking funds but also provides necessary proof if issues arise.

Handling Fees and Exchange Rates

Bank remittance handling fees are generally higher, especially for cross-border transfers. For example, international remittances through Hong Kong banks may cost up to 3000 JPY or more. Additionally, bank exchange rates are typically less favorable than those of third-party payment platforms or cross-border remittance companies.

Nevertheless, bank remittance fee structures are transparent, suitable for users needing stable exchange rates and clear costs. If you plan to remit large amounts, the high security and stability of bank remittances can offset the disadvantages of higher fees and less favorable exchange rates.

| Remittance Amount Range | Handling Fee (JPY) | Exchange Rate Advantage |

|---|---|---|

| Small Amount (≤100,000) | 3000 | Lower |

| Large Amount (>100,000) | 3000+ | Stable |

Applicable Scenario Analysis

Bank remittances are suitable for scenarios requiring large fund transfers or high security. For example, when paying tuition, deposits, or other significant expenses, bank remittances are a reliable choice.

For small remittances or daily living expense payments, bank remittances may not be cost-effective. In such cases, consider third-party payment platforms or cross-border remittance companies with lower fees and faster arrivals.

Note: When choosing bank remittances, understand the handling fee and exchange rate policies in advance to avoid increased financial burdens due to high costs.

Third-Party Payment Platforms

Operational Convenience

Third-party payment platforms are known for their simplicity and speed. You can complete transfers via mobile apps or websites without complex procedures. For example, Alipay and WeChat Pay offer intuitive interfaces, allowing remittances to be completed in minutes.

These platforms typically support multiple payment methods, including linked bank cards and balance payments. You can operate anytime, anywhere without visiting a bank or filling out cumbersome forms. For students, this convenience saves time and effort, especially in emergencies.

Tip: When using third-party payment platforms, ensure your account has completed real-name authentication to avoid transfer failures or delays.

Handling Fees and Amount Limits

Third-party payment platforms generally have lower handling fees, suitable for small remittances. For example, Alipay’s cross-border remittance fees may be as low as 0.5%-1%. Compared to traditional banks, this method offers a cost advantage. However, these platforms may have limits on single transaction amounts. For instance, WeChat Pay’s single transaction limit is typically 50,000 RMB.

The following is a comparison table of handling fees and amount limits for common third-party payment platforms:

| Platform Name | Handling Fee Rate | Single Transaction Limit (RMB) |

|---|---|---|

| Alipay | 0.5%-1% | 50,000 |

| WeChat Pay | 0.6%-1% | 50,000 |

| PayPal | 1%-2% | No explicit limit |

Note: When choosing a platform, understand the handling fee and limit policies to avoid transaction failures due to exceeding limits.

Applicable Scenario Analysis

Third-party payment platforms are ideal for small remittances or daily living expense payments. For example, you can use them to pay rent, tuition, or purchase daily necessities. This method has fast arrival times, typically completed within 1-2 business days, making it suitable for urgent fund needs.

However, for large remittances or scenarios requiring high security, third-party payment platforms may not be ideal. In such cases, consider traditional banks or cross-border remittance companies.

Suggestion: Flexibly choose the most suitable payment method based on remittance amount and arrival time needs.

Cross-Border Remittance Companies

Exchange Rate Transparency

Cross-border remittance companies excel in exchange rate transparency. You can easily check real-time exchange rates to understand the exact cost of fund conversion. Compared to traditional banks, cross-border remittance companies typically offer clearer exchange rate policies, helping you avoid hidden fees. The following are the main advantages of cross-border remittance companies in exchange rate transparency:

- Significant progress in RMB exchange rate marketization reform, with enhanced exchange rate flexibility and two-way fluctuations becoming the norm.

- Clear and transparent exchange rate policy stance, with regular publication of relevant data, improving policy transparency.

- Continuous deepening of the foreign exchange market, enriching product systems to meet diverse foreign exchange needs.

These features give you more confidence when choosing remittances, especially during significant exchange rate fluctuations. By selecting companies with transparent exchange rates, you can better control the cost of study abroad funds.

Arrival Speed

Cross-border remittance companies typically offer fast arrival times, suitable for urgent transfers. Many companies provide instant arrival services, with some completing transfers in minutes. In contrast, traditional bank remittances may take 2-5 business days. The fast arrival advantage allows you to pay tuition, rent, or other urgent expenses on time.

For example, some cross-border remittance companies use advanced payment networks to optimize fund flow efficiency. You can track remittance progress in real-time via mobile apps, ensuring funds safely reach their destination. This efficient service is highly suitable for students’ daily needs.

Tip: When choosing a cross-border remittance company, prioritize those with fast arrival times and stable services to avoid delays in critical payments.

Privacy and Security

Privacy and security are significant advantages of cross-border remittance companies. Many companies use advanced encryption technologies to protect your personal information and fund safety. For example, two-factor authentication and real-time transaction notifications can effectively prevent account theft.

Additionally, reputable cross-border remittance companies are typically subject to strict financial regulation, ensuring the legality and transparency of fund flows. You can use these services with confidence without worrying about privacy leaks or fund losses.

Note: When choosing a cross-border remittance company, verify its qualifications and user reviews to avoid using unknown small institutions.

Virtual Banks

Image Source: pexels

Multi-Currency Account Advantages

Virtual banks’ multi-currency accounts offer great convenience for students. You can manage multiple currencies in a single account without frequent foreign exchange conversions. This feature saves time and helps avoid additional fees due to exchange rate fluctuations. For example, when paying tuition in JPY, you can directly deduct from the JPY balance in your account without extra conversions.

Additionally, multi-currency accounts typically support real-time exchange rate updates. You can check exchange rate changes for different currencies at any time and choose the optimal timing for conversions. This transparency allows you to better plan fund usage and reduce unnecessary expenses.

Tip: When opening a multi-currency account, prioritize virtual banks supporting major currencies (such as RMB, JPY, USD) to meet daily needs.

Service Fees and Applicable Scope

Virtual banks’ service fees are relatively low, especially for cross-border transfers. Many virtual banks offer free or low-fee transfer services, suitable for small remittances or frequent transfers. For example, some virtual banks waive fees for the first few transfers each month, which is highly practical for students.

The applicable scope of virtual banks is also expanding. With the development of mobile internet, virtual banks are increasingly involved in cross-border credit card payments. The rapid growth of cross-border e-commerce provides new market opportunities for virtual banks, especially in online credit card payments. You can use virtual bank services to pay tuition, settle online purchases, and more.

| Service Type | Fee Characteristics | Applicable Scope |

|---|---|---|

| Cross-Border Transfer | Low or no fees | Small remittances, daily living expense payments |

| Credit Card Payment | Lower fees | Cross-border e-commerce, tuition payments |

| Multi-Currency Account Management | Free or low-cost | Multi-currency management needs for study abroad life |

Applicable Scenario Analysis

Virtual banks are highly suitable for students needing frequent transfers or managing multiple currencies. For example, you can use virtual banks to pay rent, tuition, or purchase daily necessities. This method is simple to operate and has fast arrival times, meeting most daily needs.

Additionally, virtual banks have significant potential in cross-border e-commerce. The growth of online credit card payments provides more opportunities for virtual banks. You can complete cross-border shopping with virtual banks, enjoying a convenient payment experience.

Suggestion: If you need frequent small remittances or cross-border payments, virtual banks are a worthwhile choice. Their low costs and high efficiency significantly enhance your fund management experience.

Choosing the Optimal Remittance Method Based on Needs

Remittance Amount and Frequency

When choosing a remittance method, the remittance amount and frequency are two important considerations. Different remittance methods have significant differences in handling fees and applicable scenarios. You need to choose the most cost-effective method based on your fund needs.

- Small Remittances: If your remittance amounts are small and frequent, third-party payment platforms or virtual banks are good choices. These methods have low fees and fast arrivals, suitable for paying daily living expenses or small purchases.

- Large Remittances: For one-time payments like tuition or deposits, traditional bank remittances or cross-border remittance companies are more reliable. These methods offer high security, suitable for handling large fund transfers.

The following is a comparison of the applicability of different remittance methods based on amount and frequency:

| Remittance Method | Suitable Amount Range | Applicable Frequency |

|---|---|---|

| Third-Party Payment Platform | Small (≤50,000 RMB) | High (multiple times per month) |

| Virtual Bank | Small to Medium (≤100,000 RMB) | Medium (1-2 times per month) |

| Traditional Bank Remittance | Large (>100,000 RMB) | Low (1-2 times per year) |

| Cross-Border Remittance Company | Medium to Large (≥50,000 RMB) | Medium (once per month) |

Tip: When choosing a remittance method, plan the remittance amount and frequency in advance to avoid impacts on fund usage due to high fees or amount restrictions.

Arrival Time Needs

Arrival time directly affects your fund usage efficiency. You need to choose a suitable remittance method based on the urgency of the funds.

- Urgent Needs: If you need to pay tuition or rent immediately, choosing a method with a short arrival time is crucial. Third-party payment platforms and some cross-border remittance companies can complete transfers within 1-2 business days, with some offering instant arrival services.

- Non-Urgent Needs: For non-urgent fund transfers, such as monthly living expense subsidies, you can choose methods with slightly longer arrival times but lower fees, such as traditional bank remittances.

The following is a comparison of arrival times for common remittance methods:

| Remittance Method | Arrival Time | Applicable Scenario |

|---|---|---|

| Third-Party Payment Platform | 1-2 business days | Urgent payments for living expenses, rent |

| Virtual Bank | Instant or 1 business day | Frequent small transfers |

| Traditional Bank Remittance | 2-5 business days | Tuition, deposit, and other large payments |

| Cross-Border Remittance Company | Instant or 1-3 days | Urgent payments or medium-amount transfers |

Suggestion: When choosing a remittance method, clarify arrival time needs. If funds are urgently needed, prioritize methods with fast arrivals.

Security and Privacy Protection

Fund security and privacy protection are critical factors when choosing a remittance method. You need to ensure funds are not stolen or personal information leaked during transfers.

- Traditional Bank Remittance: Banks offer the highest security, suitable for large fund transfers. They use multi-layered encryption and strict identity verification to prevent fraud effectively.

- Third-Party Payment Platform: Security depends on technical safeguards. You need to protect account passwords and avoid operations in public network environments.

- Cross-Border Remittance Company: Reputable companies are subject to strict regulation and offer real-time tracking to ensure fund safety.

- Virtual Bank: Virtual banks use two-factor authentication and real-time notifications to help detect unusual activities promptly.

The following is a comparison of security and privacy protection for different remittance methods:

| Remittance Method | Security Features | Privacy Protection Measures |

|---|---|---|

| Traditional Bank Remittance | High security, strict regulation | Multi-layered encryption, identity verification |

| Third-Party Payment Platform | Moderate security, depends on technical safeguards | Account password protection, real-time notifications |

| Cross-Border Remittance Company | High security, offers real-time tracking | Strict regulation, clear privacy policies |

| Virtual Bank | High security, advanced technology | Two-factor authentication, real-time transaction notifications |

Note: Regardless of the method chosen, regularly checking account balances and transaction records is key to protecting fund security.

Practical Suggestions and Tips

When choosing a Japan study abroad remittance method, mastering practical tips can help you save time and costs while improving fund management efficiency. The following are key suggestions for your reference:

1. Regularly Monitor Exchange Rate Changes

Exchange rate fluctuations directly affect remittance costs. You can use exchange rate alert functions from banks or third-party platforms to stay updated on rate trends. Remitting when exchange rates are lower can effectively reduce fund losses. For example, when the RMB to JPY exchange rate declines, you need more RMB to exchange for the same amount of JPY. Choosing the right remittance timing can significantly lower costs.

Tip: Avoid large remittances during periods of sharp exchange rate fluctuations; choose stable rate periods for better results.

2. Choose the Right Method Based on Amount

Different remittance methods suit different amount ranges. For small remittances, prioritize third-party payment platforms or virtual banks, which have low fees and fast arrivals. For large remittances, such as tuition or deposits, use traditional banks or cross-border remittance companies for higher security.

| Remittance Amount Range | Recommended Method | Advantages |

|---|---|---|

| Small (≤50,000 RMB) | Third-Party Payment Platform, Virtual Bank | Low fees, fast arrival |

| Large (>50,000 RMB) | Traditional Bank, Cross-Border Remittance Company | High security, suitable for large transfers |

3. Optimize Remittance Frequency

Frequent small remittances may lead to accumulated fees, increasing fund costs. You can reduce remittance frequency by planning fund needs in advance. For example, combining monthly living expenses and tuition into a single remittance can effectively lower fees. Additionally, some virtual banks offer fee waivers for the first few transfers each month, and leveraging these promotions can further save costs.

4. Use User Feedback to Optimize Choices

User feedback data provides valuable insights. For example, data shows significant growth potential in cross-border payment services, with many users preferring low-fee, fast-arrival methods. Banks and payment platforms have introduced differentiated services tailored to user needs, such as exclusive discounts and value-added services. These measures enhance customer experience and brand loyalty.

- User feedback indicates significant growth potential in cross-border payment services.

- Differentiated services tailored to user needs improve remittance efficiency.

- Exclusive discounts and value-added services meet the needs of cross-border shoppers.

5. Pay Attention to Privacy and Security

Ensuring fund security is the top priority for remittances. Choose reputable platforms or institutions and avoid unknown small companies. Regularly check account balances and transaction records to detect anomalies promptly. Using two-factor authentication and real-time notifications can further enhance account security.

Note: When operating in public network environments, avoid entering sensitive information to ensure account password safety.

6. Understand the Japan Study Abroad Remittance Process

Familiarizing yourself with the Japan study abroad remittance process can help you complete fund transfers more efficiently. Prepare necessary information, such as recipient details and bank account information, in advance to avoid remittance failures due to incomplete data. Choosing methods with real-time arrivals can quickly address urgent fund needs.

Through these suggestions, you can better plan remittance methods, reduce costs, and improve fund management efficiency.

Different remittance methods have their own advantages and disadvantages, and you need to make a comprehensive choice based on personal needs. For small remittances, third-party payment platforms offer a cost advantage with convenient operations and fast arrivals. For large remittances, traditional banks or cross-border remittance companies are recommended for their high security, suitable for handling significant fund transfers.

Tip: Regularly monitor exchange rate and handling fee changes, and choose lower-rate timings for remittances. Flexibly adjusting remittance methods can effectively reduce costs and improve fund management efficiency.

Through reasonable planning, you can better meet the financial needs of your study abroad life.

FAQ

1. How to Choose the Most Suitable Remittance Method?

You need to choose based on remittance amount, arrival time, and security needs. For small remittances, prioritize third-party payment platforms or virtual banks. For large remittances, use traditional banks or cross-border remittance companies. Planning fund needs in advance can help save costs and improve efficiency.

Tip: Regularly monitor exchange rate changes and choose lower-fee timings for remittances.

2. What Information Needs to Be Prepared for Remittances?

You need to provide the recipient’s name, bank account information, and remittance amount. If using third-party payment platforms, you also need to link a bank card or top up the account balance. Ensure information is accurate to avoid remittance failures or delays due to errors.

Note: Verify recipient information in advance to avoid fund returns or losses.

3. What to Do If a Remittance Fails?

If a remittance fails, first check the account balance and verify the entered information. Contact the remittance platform or bank customer service, providing transaction records and vouchers to assist in resolving the issue. In most cases, funds will be returned to your account within a few days.

Suggestion: Retain remittance vouchers to facilitate tracking fund flows.

4. Which Method Is Best for Urgent Remittances?

Third-party payment platforms and some cross-border remittance companies offer instant arrival services, suitable for urgent payments like tuition or rent. Virtual banks also support fast transfers, typically completed within 1 business day. Traditional bank remittances have longer arrival times and are unsuitable for urgent needs.

Tip: Choose methods with fast arrivals to ensure funds are available on time.

5. How to Ensure Fund Safety During Remittances?

Choose reputable platforms or banks and avoid unknown small institutions. Enable two-factor authentication to protect account safety. Regularly check transaction records to detect anomalies promptly. Avoid operations in public network environments to prevent information leaks.

Note: Security is the primary consideration for remittances; never overlook it.

In 2025, Japan study abroad remittances face high fees, delayed arrivals, exchange rate volatility, and security risks, with bank transfers costing up to 3000 yen and taking 2-5 days to arrive. BiyaPay offers a seamless, cost-effective solution for students! Exchange over 30 fiat currencies and 200+ cryptocurrencies with real-time rate tracking to minimize volatility, enjoy fees as low as 0.5% across 190+ countries, and benefit from same-day initiated, same-day delivered transfers. Sign up for BiyaPay in just one minute to effortlessly manage tuition, rent, or living expenses. Earn a 5.48% annualized yield on flexible savings to grow idle funds. Secured by blockchain technology and backed by U.S. MSB and New Zealand FSP licenses, BiyaPay ensures transparent, compliant transactions with minimal risks. Start today—join BiyaPay for a secure, efficient Japan remittance experience!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.