- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Complete Guide for Beginners on Avoiding Pitfalls in Tencent ADR Investing

Image Source: unsplash

You want to buy Tencent ADR, but are worried about falling into traps? You might ask: “Is the liquidity sufficient? Will exchange rates cause losses? What are the regulatory risks? Are the fees high?” In fact, these are common questions for beginners. If you don’t want to stumble into pitfalls from the start, this article can help you break down each key point, making your investment more confident.

Key Points

- Tencent ADR is traded in USD on the US OTC market with low liquidity; pay attention to trading volume and spreads to avoid trading difficulties or losses.

- Investing in Tencent ADR requires attention to exchange rate risks, as USD to HKD fluctuations affect actual returns; regularly monitor exchange rate trends and exchange in batches.

- Changes in US regulatory policies may impact Tencent ADR prices; investors should actively track related news and manage risks effectively.

- Before trading Tencent ADR, compare HK stock prices and exchange rates to avoid buying high or selling low due to premiums or discounts, maintaining rational judgment.

- Choosing a suitable broker and understanding fees and tax details helps control costs and improve returns; don’t overlook these hidden expenses.

Tencent ADR Introduction

Image Source: pexels

Basic Concept

You may have heard of ADR but may not know how it works. ADR (American Depositary Receipt) is issued by a US depositary bank, representing shares of a foreign company. Tencent ADR represents Tencent Holdings’ shares, allowing you to trade in USD on the US market. In fact, Tencent ADR is an unsponsored ADR, meaning it is not directly issued by Tencent and can only be traded on the US over-the-counter (OTC) market. You should note that ADRs have three levels, and Tencent ADR is Level 1, with the lowest regulation and lower liquidity. According to market statistics, ADR trading volume is usually less than local stocks, so you need to be extra cautious about liquidity and price volatility when trading.

Differences from HK Stocks

What’s the difference between buying Tencent ADR and buying HK stocks? The biggest differences are the trading venue, currency, and rights. When you buy HK stocks, you directly own company shares with voting rights; but with ADR, you only hold a receipt representing shares, without voting rights. However, you can still receive dividends. Tencent ADR is traded in USD, while HK stocks are in HKD. Thus, when investing in ADR, you need to consider exchange rate risks, which HK stocks don’t have. Also, ADR has a minimum purchase of one share, while HK stocks typically require one lot, making the entry cost higher. In recent years, the US has tightened regulations on Chinese ADRs, with some facing delisting risks, leading to greater volatility.

Pros and Cons

If you want to invest in Tencent ADR, it’s best to understand its advantages and disadvantages first. The advantage is that you can trade directly in USD without converting to HKD, convenient for US investors. Trading hours align with the US market, suitable for nighttime trading. The disadvantages are low liquidity, with potentially large bid-ask spreads. You need to bear exchange rate fluctuations and pay attention to changes in US regulatory policies. Tencent ADR is not directly issued by the company, and information disclosure may not be as comprehensive as HK stocks. You need to do more research before investing and not just focus on price.

Common Pitfalls

Liquidity

When trading Tencent ADR, the easiest thing to overlook is liquidity. The US OTC market has much lower trading volume than the main board. You may find that when you want to buy, there’s no seller, or when you want to sell, there’s no buyer. This can widen bid-ask spreads or even require a long wait to complete a trade. Beginners often assume the US market is always active, but Tencent ADR has limited daily trading volume, making it prone to liquidity traps.

Premiums and Discounts

Have you noticed that Tencent ADR prices sometimes differ from HK stocks? This is the premium or discount issue. Due to exchange rates, trading hours, and supply-demand factors, Tencent ADR prices may be higher or lower than HK stocks. Beginners often only look at US market quotes, ignoring premiums or discounts, resulting in buying high or selling low. If you don’t compare prices in both markets, it’s easy to fall into a trap.

Exchange Rate Risk

You trade Tencent ADR in USD, but the company’s actual revenue is in HKD. There are exchange rate fluctuations between USD and HKD. You may profit from a price increase, but if USD depreciates against HKD, you could lose part of your profit due to exchange rates. Beginners often overlook exchange rate risks, focusing only on price movements, and find that actual returns differ from expectations.

Regulatory Policies

The US is increasingly strict in regulating Chinese companies. When investing in Tencent ADR, you face changes in US Securities and Exchange Commission (SEC) policies. If the US requires Chinese companies to disclose more information or faces delisting risks, Tencent ADR prices may fluctuate significantly. Beginners sometimes only focus on company performance, ignoring regulatory policies, and are caught off guard by policy news.

Information Asymmetry

When trading Tencent ADR, you may encounter information asymmetry issues. The US OTC market has lower disclosure requirements, and news may not be as comprehensive as HK stocks. You may struggle to access the latest announcements or company updates instantly. In fact, many scholars have studied the impact of information asymmetry on stock markets. You can refer to the following platforms and research reports:

- Airiti Library has numerous studies on information asymmetry, including empirical analyses of Taiwan’s stock market, correlations between corporate social responsibility and information asymmetry, etc.

- Google Scholar can find more international scholars’ papers, such as Balakrishnan and Cohen (2014) exploring product market competition and financial accounting misstatements.

- Other studies, like Huang and Liu (1995), used VAR models to analyze trading information asymmetry in Taiwan’s stock market, providing theoretical and data support.

If you rely solely on US market platform information, you may miss critical updates, increasing investment risks.

Fees and Taxes

When trading Tencent ADR, fees and taxes cannot be ignored. US brokers have different fee structures; some charge fixed fees, others charge based on transaction amounts. You also need to note that the US imposes withholding tax, deducting a portion of dividends. Beginners often only calculate price differences, ignoring fees and taxes, resulting in lower actual returns than expected.

Ways to Avoid Pitfalls

Judging Liquidity

When trading Tencent ADR, liquidity is the primary consideration. You can first check the daily trading volume on the US OTC market, observing the average traded shares over the past week. If daily volume is below 10,000 shares, you may face large spreads or difficulty executing trades instantly. You can:

- Use the broker’s real-time quote function to observe bid-ask depth.

- Place orders during the opening or closing periods of the US market, when trading is more active.

- Avoid placing large orders at once; buy or sell in batches.

Tip: Don’t assume all US stocks are highly active; OTC market liquidity is far lower than the main board, so check trading volume first!

Handling Premiums and Discounts

Tencent ADR prices sometimes show premiums or discounts compared to HK stocks. You can reduce the risk of buying high or selling low with these methods:

- Use a calculator to convert HK stock prices to USD (based on real-time exchange rates) and compare with ADR prices.

- Refer to real-time quotes in both markets, noting price differences.

- When premiums or discounts are too large, consider delaying trades until the gap narrows.

Common Mistake: Only looking at US market quotes without comparing HK stocks, resulting in buying high.

Exchange Rate Management

When trading Tencent ADR in USD, exchange rate fluctuations directly affect returns. You can:

- Regularly monitor USD to HKD exchange rate trends.

- If you expect USD depreciation, consider exchanging in batches to reduce single-point risk.

- Some Hong Kong banks offer real-time exchange services; compare rates across banks to choose the best timing.

Tip: Don’t just focus on price movements; exchange rate changes also affect your final profit or loss.

Regulatory Attention

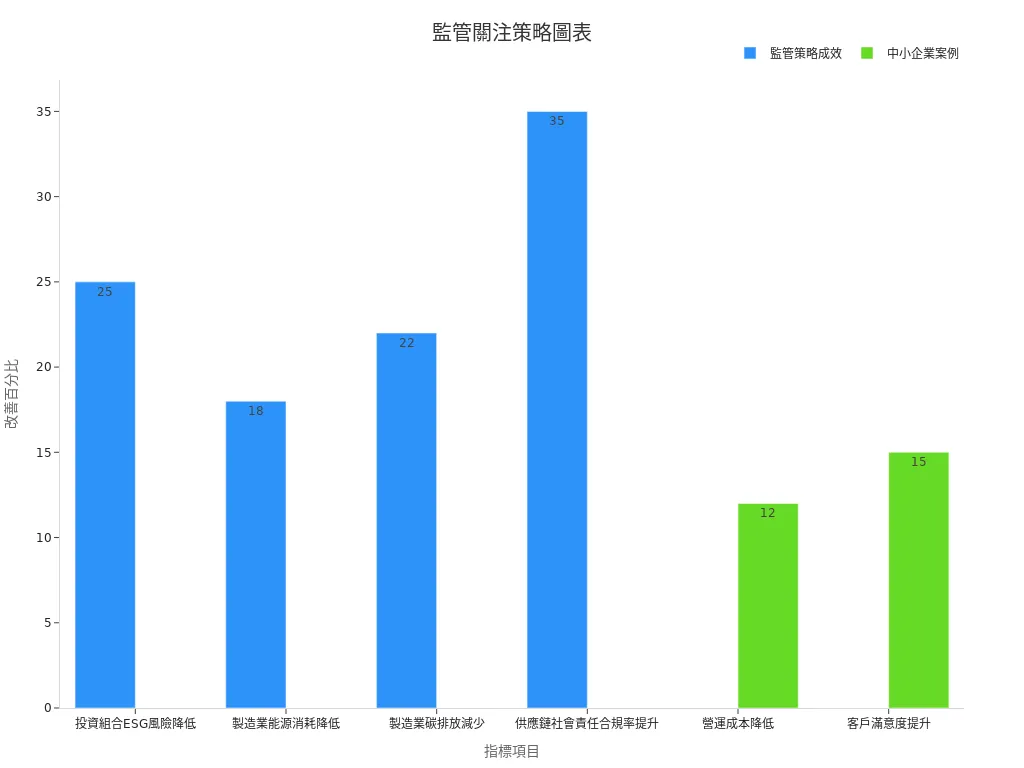

Changes in US regulatory policies on Chinese companies can impact Tencent ADR. You can proactively track related news and regularly check SEC announcements. In recent years, many investors have emphasized ESG (Environmental, Social, Governance) strategies, which help reduce investment risks. According to market data, after companies adopt ESG system integration, portfolio ESG risks decrease by an average of 25%, supply chain social responsibility compliance improves by 35%, ESG ratings rise by two levels, gaining high investor recognition.

| Indicator Item | Data/Impact Description |

|---|---|

| Portfolio ESG Risk Reduction | 25% |

| Manufacturing Energy Consumption Reduction | 18% |

| Manufacturing Carbon Emissions Reduction | 22% |

| Supply Chain Social Responsibility Compliance Improvement | 35% |

| ESG Report Preparation Time Shortened | From 8 weeks to 2 weeks |

| ESG Rating Improvement | Up two levels, highly recognized by investors |

You can refer to these practices:

- Adopt modular design to support phased implementation and flexible adjustments.

- Establish a unified ESG data platform to centralize data collection and analysis.

- Use automation and AI to improve data processing efficiency.

- Fully consult internal and external stakeholders to ensure the system meets needs.

- Focus on change management and user training to ensure effective system adoption.

- Establish ongoing evaluation mechanisms to monitor integration effects and optimize solutions.

These methods can help you address regulatory risks more effectively, enhancing investment confidence.

Information Verification

When investing in Tencent ADR, verifying information is crucial. You can use third-party platforms to check company announcements, financial reports, and historical data. In Taiwan, there’s an online stock strategy backtesting platform called “Strategy Cloud” that provides 1–3 years or longer historical data to validate investment advice. This platform can:

- Backtest historical performance of different investment strategies.

- Offer long/short strategy options, product, and backtest period settings.

- Download detailed entry/exit records for individual stocks to track strategy performance.

- Receive regular entry/exit notifications for individual stocks.

Tip: Don’t trust a single information source; cross-verify across multiple platforms to reduce information asymmetry risks.

Fee Planning

When trading Tencent ADR, fees and taxes directly affect returns. You can:

- Compare commission structures of different brokers; some charge fixed fees, others charge based on transaction amounts.

- Note US withholding tax policies, as a portion of dividends will be deducted.

- Calculate all related costs, including exchange fees, broker commissions, and platform fees, and prepare a cost budget in advance.

Common Mistake: Only calculating price differences, ignoring fees and taxes, resulting in significantly lower actual returns.

Tencent ADR Trading Process

Image Source: pexels

Broker Selection

To trade Tencent ADR, the first step is to choose a suitable US stock broker. You can consider these key points:

- Compare trading fees across brokers; for example, Firstrade clearly lists fees per trade, making cost calculations easier.

- Check user reviews and feedback, which reflect the broker’s service quality.

- Understand each broker’s pros and cons; some platforms offer Chinese customer support, while others focus on low commissions.

- Refer to online comparisons and recommendations to comprehensively evaluate brokers’ services and fees.

Tip: Choosing a low-commission, stable-service broker can save significant trading costs.

Account Opening and Funding

After selecting a broker, you need to open an account and fund it. Most US brokers support online account opening; you only need to prepare identity and address proof. After opening, transfer funds to the broker’s account. Remember:

- You need to exchange to USD, using Hong Kong banks’ online exchange services, and note real-time rates.

- Some brokers support direct wire transfers from Hong Kong banks; check fees and processing times in advance.

- When funding, transfer sufficient funds at once to reduce multiple transfer fees.

Placing Orders

Once funds are credited, you can start placing orders to trade Tencent ADR. You can:

- Enter the stock ticker (TCEHY) on the broker’s platform and choose a market or limit order.

- Note the US OTC market trading hours, typically from 9:30 PM to 4:00 AM (Hong Kong time).

- When placing orders, buy in batches to avoid paying high prices due to low liquidity.

Reminder: Check real-time HK stock and ADR prices before placing orders to avoid excessive premiums or discounts.

Asset Management

After buying Tencent ADR, regularly manage and review your assets. You can:

- Check the broker’s asset reports to ensure transaction data is accurate.

- Save transaction records after each trade for future reference.

- Use the broker’s risk management system to track position changes and price fluctuations.

- Periodically use statistical methods (e.g., backtesting) to evaluate asset allocation performance, checking for gaps between actual and expected returns.

- Conduct sensitivity analysis to understand how your assets respond to different market risks.

Tip: Regularly reviewing asset reports and transaction records helps detect issues early, ensuring investment safety.

Common Beginner Mistakes

Ignoring Trading Hours

Have you ever tried buying Tencent ADR at night only to find the market closed? In fact, Tencent ADR can only be traded on the US OTC market, with trading hours from 9:30 PM to 4:00 AM (Hong Kong time). If you’re used to daytime trading, you may miss the best trading opportunities. You should:

- Check US OTC market opening hours in advance.

- Set reminders to avoid missing key periods.

- Place orders during high-liquidity periods.

Note: Don’t assume trading is available anytime; align with US market hours!

Focusing Only on Price

Many beginners only look at Tencent ADR’s real-time price, ignoring HK stock prices and exchange rates. In fact, ADR prices are affected by USD to HKD exchange rates. If you only check US quotes, you may buy high. You should:

- Use a calculator to convert HK stock prices to USD (based on real-time rates).

- Compare prices in both markets to check for premiums or discounts.

- Avoid traps due to insufficient information.

Tip: Before each order, check the price gap between HK stocks and ADR!

Overlooking Taxes

When receiving Tencent ADR dividends, the US imposes withholding tax. Many beginners only calculate price differences, neglecting taxes, resulting in lower returns than expected. You should:

- Check the US withholding tax rate (generally 30%).

- Calculate actual income after taxes.

- Note exchange fees charged by Hong Kong banks.

| Item | Description |

|---|---|

| Withholding Tax Rate | Approx. 30% |

| Exchange Fees | Varies by Hong Kong bank |

| Actual Amount Received | Dividends after taxes and fees |

Note: Don’t overlook taxes, or returns will be significantly reduced!

Chasing Highs and Selling Lows

When Tencent ADR rises sharply, do you feel tempted to jump in? Or sell in a panic during a market drop? In fact, chasing highs and selling lows is a common beginner mistake. You should:

- Set investment goals and avoid changing strategies due to short-term fluctuations.

- Use batch buying or selling to reduce risk.

- Regularly review holdings and stay calm.

Reminder: Market volatility is normal; don’t let temporary emotions affect judgment!

When investing in Tencent ADR, proceed cautiously and don’t rush. Do your homework and use reliable platforms like MarketSenseAI, which uses long-term data tracking and diversified analysis to validate strategies. For further learning, consider these books:

- Short-Term Trading Secrets

- Trading: Creating Your Own Holy Grail

- Confessions of a Trader’s Losses

- Schwager on Futures: Technical Analysis (Vol. 1 & 2)

- The 3 Most Important Questions in Investing

- He’s a Gambler, but Also a Stock Market Guru

Study steadily, invest rationally, and you’ll avoid beginner traps.

FAQ

What’s the minimum number of Tencent ADR shares I can buy?

You can buy at least one Tencent ADR share. Unlike HK stocks’ lot requirement, ADR has no minimum lot size, allowing flexible adjustments based on your funds.

What currency is used to trade Tencent ADR?

You must trade Tencent ADR in USD. Remember to exchange to USD first, using Hong Kong banks’ online exchange services, and note real-time rates.

Does Tencent ADR pay dividends? How are they received?

Yes, Tencent ADR pays dividends. Dividends are automatically converted to USD and deposited into your broker account. However, the US withholds tax, reducing the actual amount received.

Can I trade Tencent ADR anytime?

You can only trade during US OTC market hours (9:30 PM to 4:00 AM Hong Kong time). Orders placed outside these hours won’t execute immediately.

What fees are involved in trading Tencent ADR?

Fees vary by broker. Some charge fixed fees, others base fees on transaction amounts. Also, account for exchange fees and compare rates across Hong Kong banks.

In 2025, investing in Tencent ADR (TCEHY) requires careful navigation of low liquidity, exchange rate fluctuations, and U.S. regulatory risks, especially for beginners prone to pitfalls like information asymmetry or premium/discount issues. BiyaPay offers a seamless digital financial solution, enabling Hong Kong and U.S. stock trading with a single account and a wealth management product offering up to 5.48% annualized return, accessible anytime with flexible withdrawals—no additional overseas accounts needed. Start now at BiyaPay!

BiyaPay supports real-time conversions across multiple fiat and digital currencies with transparent rate queries, minimizing costs with remittance fees as low as 0.5%, streamlining your investment process for Tencent ADR. Regulated by international financial authorities, it ensures secure, reliable transactions. Visit BiyaPay today to seize financial opportunities!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.