- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Comparison of Hong Kong ADRs and Local Closing Prices with Investment Insights

Image Source: pexels

Hong Kong American Depositary Receipts (ADRs) and local closing prices often show price differences. These differences mainly stem from exchange rate fluctuations, non-overlapping trading sessions, changes in market supply and demand, and recent news. For example, exchange rate movements can cause significant changes in stock price trends and capital flows; during peak trading periods, trading volume surges, leading to immediate price fluctuations. Investors should pay attention to these phenomena and understand their importance to daily investment decisions.

Key Points

- Hong Kong American Depositary Receipts (ADRs) are traded in U.S. dollars in the U.S., representing Hong Kong stocks, facilitating international investors’ participation in the Hong Kong market.

- Price differences mainly arise from exchange rate fluctuations, non-overlapping trading sessions, market supply and demand, and news impacts, requiring investors to closely monitor these factors.

- Both Hong Kong ADRs and local closing prices have high trading volumes and good liquidity, providing investors with diverse trading options.

- Investors can use price differences between the two markets to predict the next day’s Hong Kong stock trends but must cautiously assess exchange rate and news risks, avoiding blindly chasing short-term profits.

- Professional investors use arbitrage strategies to lock in risk-free profits, while ordinary investors should rationally formulate investment strategies based on their risk tolerance.

Hong Kong ADRs and Closing Prices

Image Source: pexels

Definition

Hong Kong American Depositary Receipts (ADRs) are securities traded in the U.S. market. They represent shares of Hong Kong-listed companies. Investors can buy and sell these securities on U.S. stock exchanges without directly participating in the Hong Kong market. ADRs make it more convenient for U.S. and global investors to invest in Hong Kong companies.

Local closing prices refer to the stock prices at the close of the Hong Kong Stock Exchange each day. This price reflects the day’s supply and demand and news in the Hong Kong market. The main difference between the two lies in the trading venue and participants. ADRs primarily circulate in the U.S. market, while local closing prices are dominated by Hong Kong local investors.

Pricing Method

The price of Hong Kong ADRs is calculated in U.S. dollars. Their price is adjusted based on the closing price of the related Hong Kong stock, exchange rates, and market supply and demand. Each ADR typically represents a certain number of Hong Kong stock shares. For example, one ADR may equal five or ten shares of a Hong Kong-listed company.

Local closing prices are calculated in Hong Kong dollars. The trading sessions of the Hong Kong and U.S. markets differ, leading to occasional price differences between the two markets. Exchange rate fluctuations also affect the conversion results between ADRs and local closing prices.

Investors can use ADRs to participate in Hong Kong companies without directly exchanging Hong Kong dollars or opening a Hong Kong securities account. This method enhances capital liquidity and makes it easier for Hong Kong companies to attract international capital.

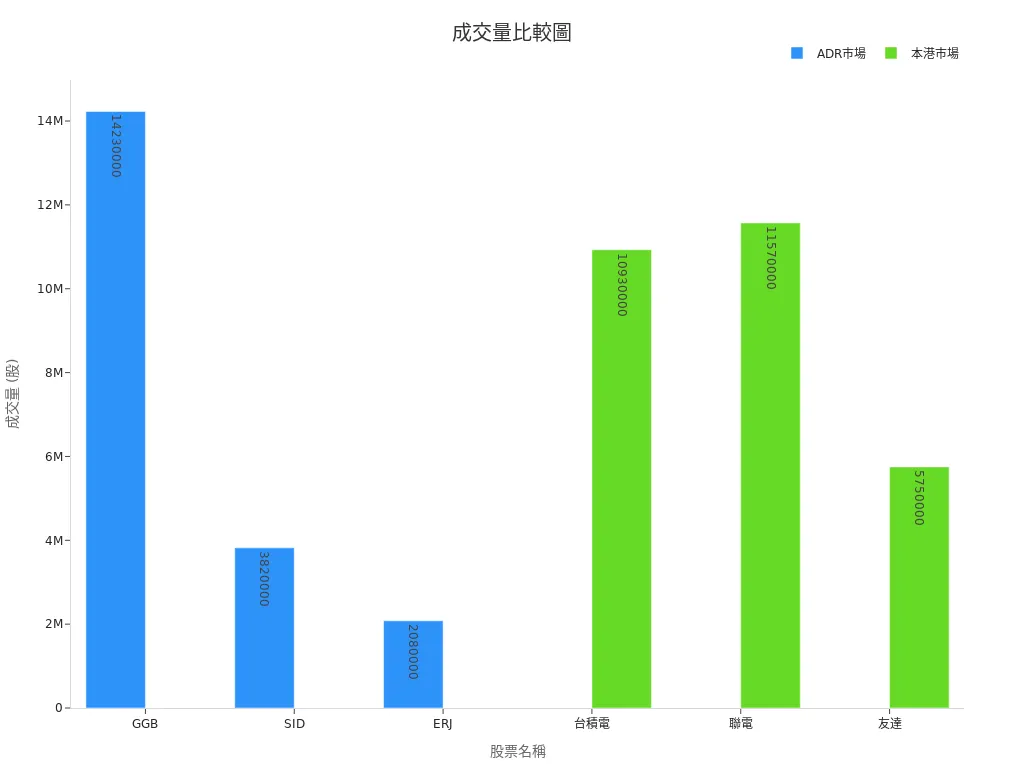

Trading Volume Comparison

The table below shows the trading volume of some ADR markets compared to the Hong Kong market, reflecting the activity levels of both markets:

| Stock Category | Stock Name | Trading Volume (Shares) |

|---|---|---|

| ADR Market | GGB (Gerdau SA) | Approx. 14.23 million |

| ADR Market | SID (Companhia Siderurgica Nacional) | Approx. 3.82 million |

| ADR Market | ERJ (Embraer) | Approx. 2.08 million |

| Hong Kong Market | TSMC | Approx. 10.93 million |

| Hong Kong Market | UMC | Approx. 11.57 million |

| Hong Kong Market | AU Optronics | Approx. 5.75 million |

From the table and chart, it is evident that the trading volume of some Hong Kong ADRs is comparable to that of the Hong Kong market, indicating significant capital participation in both markets. This situation helps enhance stock liquidity and provides investors with more trading options.

Factors Contributing to Price Differences

Exchange Rate Impact

Exchange rate fluctuations are one of the main reasons for the price differences between Hong Kong ADRs and local closing prices. Hong Kong ADRs are priced in U.S. dollars, while local stocks are priced in Hong Kong dollars. When the USD/HKD exchange rate or other currency pairs fluctuate, price differences between the two markets emerge instantly. For example, when the U.S. dollar appreciates, the price of Hong Kong ADRs may exceed the local closing price, and vice versa, leading to a discount. Exchange rate fluctuations not only affect investment returns but also increase currency conversion costs. The table below shows the exchange rate fluctuation ranges and bid-ask spreads for different currencies against the USD, reflecting the actual impact of exchange rates on price differences:

| Currency Pair | 1-Year Exchange Rate Fluctuation Range | 3-Year Exchange Rate Fluctuation Range | Bid-Ask Spread Percentage |

|---|---|---|---|

| TWD/USD | Approx. 4.0% | Approx. 10.7% | Approx. 0.3% |

| TWD/EUR | Approx. 5.0% | Approx. 12.4% | Approx. 1.16% |

| TWD/AUD | Approx. 8.1% | Approx. 15.1% | Approx. 1.08% |

| TWD/CNY | Approx. 5.0% | Approx. 8.6% | Approx. 1.14% |

| TWD/ZAR | Approx. 14.8% | Approx. 26.0% | Approx. 3~4% |

When converting currencies, investors also need to consider the bid-ask spreads of banks. For example, in Hong Kong banks, the price difference between buying and selling U.S. dollars directly affects the final investment cost. If an investor uses TWD to purchase a USD 10,000 fund and the exchange rate shifts from 1:30 to 1:32, the final TWD amount redeemed will vary due to exchange rate changes, directly impacting investment returns.

Trading Sessions

The trading sessions of the U.S. and Hong Kong markets do not overlap. The Hong Kong market opens from 9:30 AM to 4:00 PM, while the U.S. market trades from 9:30 PM to 4:00 AM the next day Hong Kong time. This time difference means that Hong Kong ADRs trading in the U.S. market often reflect news or international market changes after the Hong Kong market closes. When the U.S. market opens, significant international news or sharp U.S. market fluctuations can prompt immediate adjustments in Hong Kong ADR prices. These changes are only reflected in the local closing price when the Hong Kong market opens the next day. Therefore, the two markets often exhibit temporary price differences, which investors can use to predict the next day’s Hong Kong stock trends.

Market Demand

Market demand directly affects the premium or discount of Hong Kong ADRs relative to local closing prices. When investor demand for a particular stock or ETF is strong, the price often exceeds the net asset value, resulting in a premium. Conversely, if market sentiment is pessimistic and investors rush to sell, the price may fall below the net asset value, leading to a discount. The following are common scenarios of market demand changes and price differences:

- When market demand is strong, investors are willing to buy ETFs at higher prices, causing the market price to exceed the net value, forming a premium.

- When market sentiment deteriorates, investors urgently sell ETFs, and the price may fall below the net value, resulting in a discount.

- In April 2020, after a sharp decline in oil prices, oil ETFs saw significant premiums due to a surge in market demand, demonstrating the direct impact of demand changes on prices.

- Investors can check historical premium/discount data on platforms like Yuanta Securities’ website, U.S. issuers’ websites, Morningstar, and MoneyDJ.

- Overall, imbalances in market supply and demand are the primary reasons for premiums or discounts, supported by multiple data query channels.

News Impact

News-related factors also contribute to differences between Hong Kong ADRs and local closing prices. When significant news is announced in international markets or by the company itself, Hong Kong ADR prices reflect this information first. For example, U.S. economic data releases, changes in international political and economic situations, corporate earnings reports, or sudden events can cause immediate fluctuations in Hong Kong ADR prices in the U.S. market. Since the Hong Kong market is already closed, these news events cannot be immediately reflected in the local closing price. The next day, when the Hong Kong market opens, the relevant stock prices adjust based on the latest news. Thus, news-related factors often cause temporary significant price gaps between the two markets.

Case Studies

Image Source: pexels

Financial Stocks

Financial stocks are active in the Hong Kong ADR market. HSBC Holdings and AIA Group are often focal points for investors. HSBC’s ADR sometimes trades at a premium to the local closing price in the U.S. market. This premium typically occurs when the USD/HKD exchange rate rises or when confidence in the financial sector strengthens in the U.S. market. AIA’s ADR prices are relatively stable but may exhibit temporary premiums or discounts following significant earnings reports or policy news. Market sentiment and international capital flows directly influence the ADR prices of these financial stocks.

Technology Stocks

Technology stocks exhibit significant price volatility in the Hong Kong ADR market. The ADRs of Tencent and Alibaba often reflect the overall trends of U.S. technology stocks. When the U.S. tech sector rises, Tencent and Alibaba’s ADR prices tend to show premiums. If negative news hits the U.S. market, ADR prices may fall below the local closing price. Tech stocks are highly sensitive to news, and international investors’ expectations for future growth also drive ADR price movements. These factors occasionally widen the gap between tech stock ADRs and local closing prices.

Other Popular Stocks

Some popular stocks show even more pronounced price differences between their ADRs and the Hong Kong market. Taking TSMC (2330) and Dukang-DR as examples, their premium magnitudes vary significantly across periods. The table below presents relevant data:

| Stock Name | Premium Magnitude | Explanation |

|---|---|---|

| TSMC (2330) | Approx. 8.25% (September 25, 2020) | ADR premiums within 10% are normal, indicating price linkage with a premium phenomenon |

| Dukang-DR | Up to 3,178% | Extremely high premium, showing significant differences between ADR and underlying stock prices |

These data indicate significant variations in the correlation between Hong Kong ADRs and local market prices for different popular stocks. Investors should closely monitor premium magnitudes and analyze underlying market supply, demand, and news factors to make more informed investment decisions.

Investment Insights

Exploiting Price Differences

Investors often use the price difference between Hong Kong ADRs and local closing prices to predict the opening trend of Hong Kong stocks the next day. After the U.S. market closes, if Hong Kong ADR prices are significantly higher than the local closing price, the market generally expects Hong Kong stocks to open higher the next day. This phenomenon provides a reference for short-term traders. Some investors design entry and exit strategies based on historical data, such as using a weekly breakout above the six-month moving average as a buy signal and selling when it falls below. These strategies, tested through algorithmic trading, can effectively validate their profitability. Backtesting results show that some strategies underperform expectations over the long term or even experience significant declines, reminding investors to choose cautiously.

Risk Warning

While price differences offer opportunities, risks also exist. Exchange rate fluctuations and inconsistencies in news between the U.S. and Hong Kong markets can cause temporary divergences between Hong Kong ADR prices and local closing prices. Investors relying solely on signals from a single market risk losses due to sudden news or shifts in market sentiment. Additionally, while backtested strategies provide historical references, future market conditions may change, and past performance does not guarantee future results. Ordinary investors need to assess their risk tolerance and avoid blindly chasing short-term profits.

Arbitrage Opportunities

Arbitrage opportunities attract many professional investors. When significant premiums or discounts appear between Hong Kong ADRs and local closing prices, some hedge funds simultaneously buy and sell in both markets to lock in risk-free profits. Books and data analyses show that hedge funds achieve higher risk-adjusted returns than typical portfolios, effectively reducing volatility. Professional managers adjust strategies based on market conditions to enhance overall returns. While arbitrage is supported by theory and evidence, ordinary investors face challenges in executing cross-market trades instantly and must consider related costs and technical barriers.

Strategy Recommendations

Investors should select appropriate strategies based on their capital size, risk tolerance, and investment goals. It is recommended to periodically review and backtest existing strategies, avoiding untested methods blindly. Hong Kong ADR prices can serve as an auxiliary indicator for predicting the next day’s Hong Kong stock trends but should not be the sole basis. Long-term investors may consider diversified investments to reduce single-market volatility risks. Short-term traders need to closely monitor exchange rates, market news, and trading volume changes, adjusting operations flexibly. Most importantly, investments should be data-driven, with rational analysis to avoid emotional decisions.

Investors should clearly distinguish the differences between Hong Kong ADRs and local closing prices. Price changes mainly stem from exchange rates, trading sessions, market demand, and news. Wise investors adjust strategies based on these factors to enhance decision-making quality. They need to stay attuned to market dynamics and maintain risk awareness. Continuous learning and practice help improve investment capabilities.

FAQ

What is the difference between Hong Kong ADRs and local stocks?

Hong Kong ADRs are traded in U.S. dollars in the U.S. market, while local stocks are traded in Hong Kong dollars in the Hong Kong market. The two differ in trading sessions, participants, and pricing currencies.

Do I need a Hong Kong securities account to invest in ADRs?

Investors do not need a Hong Kong securities account. They can buy and sell ADRs directly on U.S. brokerage platforms, with funds settled in U.S. dollars.

Can ADR prices predict the next day’s Hong Kong stock trends?

ADR prices often reflect the latest news at the U.S. market close. Investors can use ADR prices to predict the opening direction of Hong Kong stocks the next day but should note exchange rate and news differences.

How do exchange rate changes affect ADRs and local closing prices?

When the USD/HKD exchange rate rises, ADR prices may exceed local closing prices. When the exchange rate falls, ADR prices may show a discount.

Do Hong Kong ADRs have liquidity risks?

Some ADRs have low trading volumes, with limited liquidity. Investors should check trading volume data and choose ADRs with higher liquidity for trading.

In 2025, price disparities between Hong Kong ADRs and local closing prices offer opportunities, but high transaction fees and complex cross-market fund management often deter investors. BiyaPay delivers a seamless solution to capitalize on these dynamics. No need for additional overseas accounts—BiyaPay enables trading in both U.S. and Hong Kong stocks with a single account. Start now at BiyaPay!

BiyaPay supports real-time conversions across multiple fiat and digital currencies with transparent rate queries, ensuring cost clarity. With remittance fees as low as 0.5%, it minimizes transfer costs. Regulated by international financial authorities, BiyaPay ensures secure transactions, empowering you to leverage ADR price differences strategically. Visit BiyaPay today to streamline your investment strategy!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.