- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Complete Guide to U.S. Stock Pre-Market Trading Hours and Recommended High-Rated Broker Platforms

Image Source: unsplash

If you want to flexibly grasp U.S. stock market trends, you must understand the pre-market trading hours. Below is a comparison of Eastern Time (ET) and Hong Kong Time (HKT):

| Trading Session | Eastern Time (ET) | Hong Kong Time (HKT) |

|---|---|---|

| Pre-Market Trading | 04:00-09:30 | 16:00-21:30 |

Pre-market trading allows you to buy and sell before the official market opening, enabling quick responses to the latest news. You can use this period to adjust positions or seize market opportunities.

Key Points

- U.S. stock pre-market trading hours are from 04:00 to 09:30 ET, corresponding to 16:00-21:30 HKT during daylight saving time or 17:00-22:30 HKT during standard time, allowing you to flexibly adjust investment strategies before the official market opens.

- Pre-market trading only accepts limit orders, with lower trading volume and higher price volatility. Investors should be aware of liquidity risks and higher fees, suitable for professional or short-term investors who need to react quickly to market news.

- When choosing a broker, compare trading costs, pre-market trading hours, and features. Futu Securities and HSBC support 5x24-hour trading, while uSMART and Webull focus on commission-free trading, catering to different investor needs.

- Beginners are recommended to choose user-friendly, commission-free platforms like uSMART or Webull, while advanced users may consider feature-rich platforms like Futu Securities or Interactive Brokers, selecting a suitable broker based on investment goals and risk tolerance.

- The account opening process is simple and fast; prepare identity and address proof for online applications. Multiple funding methods are available, including bank transfers, FPS, and third-party payments. Ensure recipient account details are verified to avoid errors.

U.S. Stock Pre-Market Trading Hours

Image Source: unsplash

Trading Session Comparison

To flexibly participate in the U.S. stock market, you must master the pre-market trading hours. This period allows you to adjust investment strategies based on the latest news before the official market opens. The pre-market trading hours in Eastern Time and Hong Kong Time are as follows:

| Trading Session | U.S. Time (ET) | Hong Kong Time (Daylight Saving) | Hong Kong Time (Standard) |

|---|---|---|---|

| Pre-Market Trading | 04:00-09:30 | 16:00-21:30 | 17:00-22:30 |

| Regular Trading | 09:30-16:00 | 21:30-04:00 | 22:30-05:00 |

| After-Hours Trading | 16:00-20:00 | 04:00-08:00 | 05:00-09:00 |

Tip: Hong Kong time is the same as Taiwan time. Daylight saving time typically runs from mid-March to mid-November, and standard time from mid-November to mid-March. You can easily convert U.S. pre-market trading hours based on the time difference.

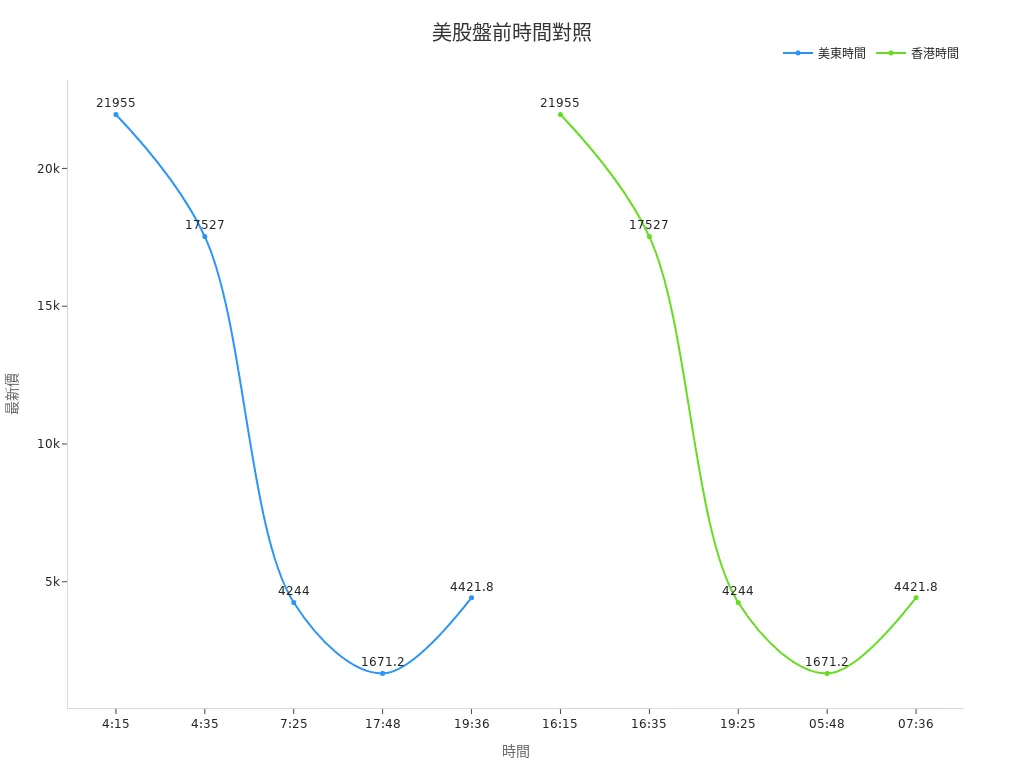

You can refer to the chart below to understand the comparison of pre-market price movements in Eastern Time and Hong Kong Time:

Major Exchange Trading Hours

The two major U.S. exchanges—New York Stock Exchange (NYSE) and NASDAQ—both support pre-market trading. You can trade during the pre-market session of these exchanges to capture market opportunities early.

- NYSE Pre-Market Trading Hours: 04:00-09:30 (ET)

- NASDAQ Pre-Market Trading Hours: 04:00-09:30 (ET)

The pre-market trading hours of these two exchanges are identical. You can place orders during this period, but only limit orders are accepted. Pre-market trading typically has lower volume and higher price volatility. You need to pay special attention to liquidity and price gap risks.

According to market data, many investors adjust positions during U.S. pre-market trading hours based on major news or earnings reports. For example, on April 4, 2024, Bitcoin rose 2.6% in the four hours before the U.S. market opened. This reflects the activity and market responsiveness of the pre-market trading session.

You can refer to the table below for the latest prices and volatility of various indices during the pre-market session:

| Time (ET) | Index Name | Exchange | Latest Price | Change | % Change | Open | High | Low | Volume | Open Interest |

|---|---|---|---|---|---|---|---|---|---|---|

| 4:35 | Dow Jones Futures Manual | CBOT | 17527 | 215 | 1.24% | 17527 | 17527 | 17527 | 0 | 0 |

| 7:25 | NASDAQ 100 Futures Manual | CME | 4244 | 55.75 | 0.00% | 4244 | 4244 | 4244 | 0 | 0 |

| 19:36 | S&P 500 Futures Manual | CME | 4421.8 | -42.4 | -0.95% | 4421.8 | 4421.8 | 4421.8 | 6 | 110 |

| 4:15 | Nikkei 225 Futures | CME | 21955 | 35 | 0.16% | 21955 | 21955 | 21955 | 9314 | 15578 |

| 17:48 | Russell 2000 Futures | CME | 1671.2 | -7 | -0.42% | 1676.8 | 1681.1 | 1660 | 3755 | 10790 |

You can see that during the pre-market session, index prices fluctuate rapidly based on market news. This period is crucial for investors who need to react instantly.

Note: The pre-market session has lower trading volume, and prices are prone to gaps. When placing orders, pay special attention to price volatility and liquidity risks.

Pre-Market Trading Concept

Definition and Process

You can engage in pre-market trading before the U.S. stock market officially opens. This period allows you to adjust investment strategies based on the latest news. Pre-market trading only accepts limit orders. You need to place orders on a broker’s platform, and the system will match them based on your set price. Most brokers automatically display tradable stocks during the pre-market session. You simply select the stock, enter the quantity and price, and submit the order. The broker will attempt to match your order during the pre-market session. If no match is found, the order will be automatically canceled at the end of the pre-market session.

Tip: You can use pre-market trading to quickly react to U.S. company earnings, international news, or sudden events.

Advantages and Risks

Pre-market trading offers several advantages. You can enter the market early to capitalize on major news. You can also adjust positions during market volatility to reduce risks. However, pre-market trading carries higher risks. Trading volume is typically lower, and prices are prone to significant fluctuations. You may encounter insufficient liquidity, leading to wider bid-ask spreads. Some brokers charge higher fees, approximately USD 0.005-0.01 per trade (1 USD ≈ 7.8 HKD). You need to pay special attention to trading costs.

Suitable Audience

Pre-market trading is suitable for those who need to flexibly adjust their investment portfolios. If you frequently follow U.S. stock market news or need to react quickly to earnings reports or policy news, pre-market trading can be very helpful. Professional investors, short-term traders, and those needing immediate risk hedging often use pre-market trading. If you’re a beginner, it’s recommended to first familiarize yourself with pre-market trading rules and risks before gradually participating.

Broker Recommendations

Image Source: pexels

Platform List

When choosing a U.S. stock broker, you should first understand the high-rated platforms available in the market. Below are the mainstream brokers that currently support U.S. stock pre-market trading hours:

- Futu Securities (Futu)

- uSMART Securities (uSMART)

- Valuable Capital

- Interactive Brokers

- Fidelity

- Webull Securities (Webull)

- Charles Schwab

- HSBC

- SogoTrade

- Firstrade

These platforms generally support web, mobile app, and desktop software. You can choose a broker based on your operating preferences.

U.S. Stock Pre-Market Trading Hours Support

Different brokers offer varying levels of support for U.S. stock pre-market trading hours. You need to pay attention to each platform’s pre-market trading hours, whether they support full-session trading, and if there are additional fees. Below is a summary of pre-market trading hours for major brokers:

| Broker Name | Pre-Market Hours (ET) | Pre-Market Hours (HKT) | Trading Method | Feature Description |

|---|---|---|---|---|

| Futu Securities | 04:00-09:30 | 16:00-21:30 | Limit Order | 5x24-hour U.S. stock trading, high flexibility |

| uSMART Securities | 04:00-09:30 | 16:00-21:30 | Limit Order | Commission-free, suitable for beginners |

| Valuable Capital | 04:00-09:30 | 16:00-21:30 | Limit Order | Low commission, multi-market support |

| Interactive Brokers | 04:00-09:30 | 16:00-21:30 | Limit Order | International platform, strong professional features |

| Fidelity | 04:00-09:30 | 16:00-21:30 | Limit Order | Major U.S. broker |

| Webull Securities | 04:00-09:30 | 16:00-21:30 | Limit Order | Commission-free, user-friendly interface |

| Charles Schwab | 07:00-09:30 | 19:00-21:30 | Limit Order | Shorter pre-market session |

| HSBC | 5x24 hours | 5x24 hours | Limit Order | 5x24-hour trading, high flexibility |

| SogoTrade | 07:00-09:30 | 19:00-21:30 | Limit Order | Low commission, suitable for long-term investing |

| Firstrade | 08:00-09:30 | 20:00-21:30 | Limit Order | Commission-free, shorter pre-market session |

Tip: Futu Securities and HSBC support 5x24-hour U.S. stock trading, allowing you to seize market opportunities anytime. uSMART and Webull focus on commission-free trading, ideal for cost-conscious investors.

Main Feature Comparison

When choosing a broker, in addition to focusing on U.S. stock pre-market trading hours, you should also compare platforms’ fees, features, and user experience. The table and chart below help you quickly understand the differences:

| Broker Name | Commission (Per Trade) | Pre-Market Hours (ET) | 5x24-Hour Trading | Trading Interface | Technical Analysis Tools | Supported Languages | Minimum Deposit |

|---|---|---|---|---|---|---|---|

| Futu Securities | USD 0.0049 | 04:00-09:30 | Yes | User-Friendly | Strong | Chinese/English | USD 0 |

| uSMART Securities | Commission-Free | 04:00-09:30 | No | User-Friendly | Moderate | Chinese/English | USD 0 |

| Valuable Capital | As low as USD 0.003 | 04:00-09:30 | No | User-Friendly | Moderate | Chinese/English | USD 0 |

| Interactive Brokers | USD 0.005 | 04:00-09:30 | No | Professional | Strong | Multilingual | USD 0 |

| Fidelity | USD 0 | 04:00-09:30 | No | Standard | Moderate | English | USD 0 |

| Webull Securities | Commission-Free | 04:00-09:30 | No | User-Friendly | Moderate | Chinese/English | USD 0 |

| Charles Schwab | USD 0 | 07:00-09:30 | No | Standard | Moderate | English | USD 0 |

| HSBC | Varies by product | 5x24 hours | Yes | User-Friendly | Moderate | Chinese/English | USD 0 |

| SogoTrade | USD 2.88 | 07:00-09:30 | No | Standard | Basic | English | USD 0 |

| Firstrade | Commission-Free | 08:00-09:30 | No | Standard | Basic | Chinese/English | USD 0 |

You can see that Futu Securities and HSBC’s 5x24-hour trading feature allows you to place orders flexibly outside regular pre-market hours. uSMART, Webull, and Firstrade focus on commission-free trading, suitable for cost-conscious investors. Valuable Capital’s commission as low as USD 0.003 is highly attractive for high-frequency traders.

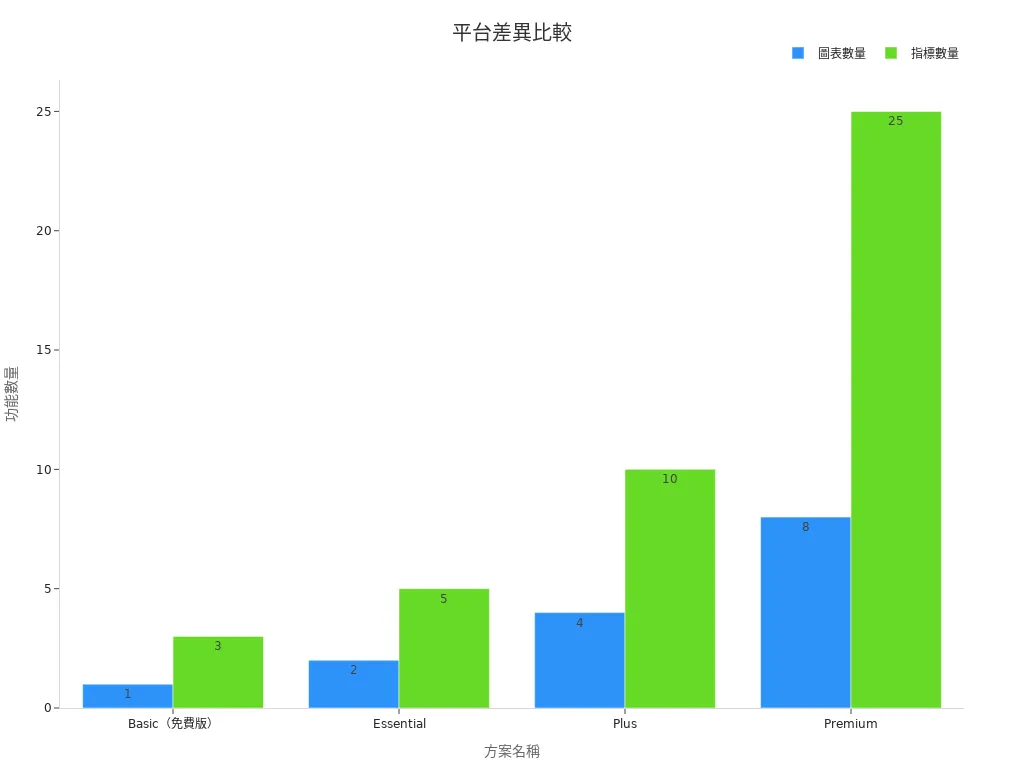

You can also refer to the chart below for a visual comparison of platform features and fees:

Note: Some platforms like TradingView offer various technical analysis tools and customizable charting features. You can choose a broker that supports multiple charts, technical indicators, and timeline adjustments based on your analysis needs. Free versions typically have limited features, while paid versions support more charts and indicators, suitable for advanced users.

When choosing a broker, you should consider the platform’s pre-market trading hours, fees, and features based on your trading habits, cost budget, and technical analysis needs. This allows you to flexibly seize market opportunities during U.S. stock pre-market trading hours.

Platform Selection Advice

Selection Focus

When choosing a U.S. stock broker platform, you should compare from multiple perspectives. Market research shows that data-driven analysis and user experience are the two most critical factors. You can refer to the following points:

- You should use competitive analysis to compare trading costs, features, and services of different platforms. This helps you identify each platform’s strengths and weaknesses.

- You can combine online and offline user reviews to form a concrete selection plan. This reduces selection risks and improves investment efficiency.

- Survey data suggests that questions should remain neutral to avoid bias, ensuring objective and reliable analysis results.

You can refer to the table below to compare trading costs and key features of different platforms:

| Platform Name | Trading Cost (Per Trade) | Key Features |

|---|---|---|

| Futu Securities | USD 0.0049 | 5x24-hour trading, Chinese interface |

| uSMART Securities | Commission-Free | Commission-free, beginner-friendly |

| Valuable Capital | USD 0.003 | Multi-market support, low commission |

| Interactive Brokers | USD 0.005 | Professional features, internationalized |

| HSBC | Varies by product | 5x24-hour trading, trusted Hong Kong bank |

Tip: Choose a platform based on your trading frequency and technical analysis needs. Low-cost platforms are suitable for high-frequency trading, while platforms with good user experience are ideal for long-term investing.

Advice for Beginners and Advanced Users

When choosing a platform, you should make decisions based on your experience and needs. Below are specific recommendations:

- If you’re a beginner, opt for user-friendly, commission-free platforms like uSMART or Webull. These platforms are easy to use and help you get started quickly.

- If you have some experience, consider feature-rich platforms with strong technical analysis tools, such as Futu Securities or Interactive Brokers. These platforms offer various technical indicators and charts, suitable for advanced users conducting in-depth analysis.

- If you value flexible trading hours, consider Futu Securities or HSBC, which support 5x24-hour trading, allowing you to seize market opportunities anytime.

Remember: Choose the most suitable broker platform based on your investment goals and risk tolerance. Comparing options before deciding can effectively enhance your investment outcomes.

Account Opening and Funding

Account Opening Steps

To open a U.S. stock broker account, you can follow these steps:

- Choose a suitable broker platform, such as Futu Securities, uSMART, or HSBC.

- Prepare identity proof (e.g., Hong Kong ID or passport) and address proof (e.g., bank statement).

- Visit the broker’s official website or app and click “Open Account.”

- Fill in personal details as prompted, including name, contact information, and investment experience.

- Upload identity and address proof documents.

- Wait for the broker’s review, typically taking 1 to 3 business days.

- Upon approval, you’ll receive an account opening confirmation and can log into the platform.

Tip: You can opt for online account opening, which is simple and fast, without needing to visit a branch.

Funding Methods

After opening an account, you need to deposit funds into your broker account. You can choose from the following common funding methods:

- Bank Transfer: You can transfer funds through Hong Kong banks (e.g., HSBC, Bank of China Hong Kong) via local or international wire transfers. Be aware of bank fees, typically around USD 10-30 per transfer (1 USD ≈ 7.8 HKD).

- FPS (Fast Payment System): Some brokers support FPS, with instant fund crediting, convenient and fast.

- Third-Party Payment: Some platforms support PayPal or Wise, but be mindful of additional fees.

| Funding Method | Crediting Time | Fees (Approx.) | Applicable Platforms |

|---|---|---|---|

| Bank Transfer | 1-3 business days | USD 10-30 | Most brokers |

| FPS | Instant | As low as USD 0 | Futu, uSMART, etc. |

| Third-Party Payment | 1-2 business days | Varies by platform | Some international brokers |

Note: When funding, verify the broker’s recipient account details to avoid transferring to the wrong account.

Common Questions

You may encounter the following questions during account opening and funding:

- Q: Can I use a Chinese bank account to fund a U.S. stock broker account?

A: You can use a Hong Kong bank account to fund. Some brokers support Bank of China (Hong Kong) accounts, but confirm whether they support RMB conversion and related fees. - Q: Is there a minimum funding amount?

A: Most brokers have a minimum funding requirement of USD 0, but some international brokers may require USD 100 or more. - Q: How soon can I start trading after funding?

A: Once funds are credited, you can start trading. FPS is instant, while bank transfers typically take 1-3 business days.

Tip: If you have questions, contact the broker’s customer service for immediate assistance.

By mastering U.S. stock pre-market trading hours, you can more flexibly seize market opportunities. When choosing a high-rated broker platform, compare trading costs, features, and user experience. The table below shows how data-driven strategies enhance competitive advantages:

| Case Type | Specific Data Metrics | Competitive Advantage Description |

|---|---|---|

| SaaS Enterprise Gamified Subscription Strategy | Churn rate reduced from 60% to 25%; LTV increased 3.2x; Marketing ROI reached 420% | Using data analytics to improve user retention and investment returns |

Be mindful of the lower liquidity and higher price volatility in pre-market trading. Choosing a suitable platform allows you to make informed decisions during U.S. stock pre-market trading hours.

FAQ

Is there a Minimum Funding Requirement for U.S. Stock Pre-Market Trading?

Most brokers have no minimum funding requirement. You can start with USD 0. However, some international brokers may require a minimum of USD 100. Check the platform’s rules.

Can You Use Market Orders for Pre-Market Trading?

You can only use limit orders for pre-market trading. Market orders are not applicable during the pre-market session. This reduces risks from price gaps.

Are Pre-Market Trading Fees Higher?

Some brokers charge higher fees for pre-market trading. Check the platform’s fee schedule. Fees are typically around USD 0.005-0.01 per trade (1 USD ≈ 7.8 HKD).

What Are the Risks of Pre-Market Trading?

Pre-market trading has lower volume and higher price volatility. You may face insufficient liquidity and wider bid-ask spreads. Place orders carefully to avoid losses.

Can I Use a Hong Kong Bank Account to Fund a U.S. Stock Broker?

You can use a Hong Kong bank account to fund. Most brokers support Hong Kong bank transfers. Verify recipient account details to avoid errors.

Pre-market trading (Hong Kong time 16:00-21:30) offers flexibility to seize market opportunities, but high cross-border remittance costs, complex currency exchanges, and time-consuming overseas account setups hinder efficiency. BiyaPay provides an all-in-one financial platform for seamless US stock trading! Users can trade US and HK stocks in real-time without an overseas bank account, managing global markets with one account. Remittance fees are as low as 0.5%, covering 190+ countries with same-day fund transfers. The flexible savings product yields a 5.48% annualized return, with daily interest credited automatically. It supports real-time conversion of 30+ fiat currencies and 200+ cryptocurrencies, secured by KYC verification.

Try BiyaPay now to start your global investment journey! Pair it with top brokers and join BiyaPay today at BiyaPay for efficient trading and steady returns!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.