- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

What You Need to Know About Withdrawing Funds from PayPal via MoneyGram

Image Source: unsplash

You might wonder if PayPal lets you get cash at MoneyGram. Good news—PayPal users in the U.S. can start withdrawing funds at MoneyGram locations. Just use your PayPal account, transfer the funds, and pick up your money at a nearby MoneyGram. Many people choose PayPal because it makes managing funds simple. If you need quick access, MoneyGram offers a way to turn PayPal funds into cash. When you want your funds fast, this option works well. Withdrawing funds from PayPal through MoneyGram puts your money in your hands.

Key Takeaways

- You can withdraw PayPal funds as cash at MoneyGram locations in the U.S. by enrolling online and linking your accounts.

- To use this service, you must be 18 or older, have a U.S. PayPal account, a valid photo ID, and complete the MoneyGram enrollment.

- Follow the step-by-step process to transfer money from PayPal to MoneyGram, then pick up your cash with your ID and reference number.

- Be aware of fees and a $500 daily withdrawal limit; multiple transactions may increase costs but give you quick access to cash.

- Check your PayPal and MoneyGram account details carefully to avoid common issues like name mismatches or missing reference numbers.

Withdrawing Funds: PayPal to MoneyGram

Image Source: unsplash

Is Withdrawing Money from PayPal via MoneyGram Possible?

You might ask if withdrawing money from PayPal at MoneyGram is something you can do. The answer is yes. PayPal and MoneyGram have a partnership that lets you withdraw your PayPal funds at MoneyGram locations in the U.S. This service gives you a way to turn your digital funds into cash quickly. If you want to transfer funds from PayPal and pick up cash, you can do it at thousands of MoneyGram spots.

You cannot use this service to transfer funds internationally. The PayPal-to-MoneyGram withdrawal only works inside the U.S. If you live outside the U.S., you will need to look for other ways to send money online or access your PayPal funds.

Note: You must enroll in the MoneyGram withdrawal service online before you can start withdrawing money from PayPal. This step is important. Without enrollment, you cannot use the PayPal-to-MoneyGram withdrawal option.

Who Can Use This Service?

You can use the PayPal-to-MoneyGram withdrawal service if you have a PayPal account registered in the U.S. and you are at least 18 years old. You also need a valid photo ID to pick up your funds at a MoneyGram location. If you meet these requirements, you can transfer your funds from PayPal to MoneyGram and withdraw cash.

Here is a quick checklist to see if you qualify:

- You have a PayPal account in the U.S.

- You are 18 or older.

- You have a valid photo ID.

- You enroll in the MoneyGram withdrawal service online.

If you check all these boxes, you can start withdrawing money from PayPal at MoneyGram. This process makes it easy to transfer your funds and get cash when you need it. Many people find this option helpful when they want fast access to their PayPal funds.

How to Withdraw Money from PayPal

Withdrawing money from PayPal at MoneyGram is simple if you follow the right steps. You can turn your PayPal funds into cash quickly. Let’s walk through the process so you know exactly what to do.

Enrolling and Linking Accounts

Before you start withdrawing money from PayPal, you need to enroll in the MoneyGram withdrawal service. This step connects your PayPal account with MoneyGram and sets you up for future withdrawals. Here’s how you do it:

- Visit the co-branded MoneyGram-PayPal website.

- Log into your PayPal account using your credentials.

- Choose a MoneyGram location where you want to pick up your funds.

- Enter the amount you want to withdraw from your PayPal account.

- The website will give you a reference number. Keep this number safe.

You also need to create a MoneyGram account if you don’t have one. Linking your PayPal account to your MoneyGram account lets you transfer funds easily. Make sure your personal information matches on both accounts. This helps avoid problems when you pick up your cash.

Tip: Double-check your name and details on both your PayPal and MoneyGram accounts. If they don’t match, you might have trouble picking up your funds.

Withdrawing Money from PayPal Account

Once you have enrolled and linked your accounts, you can start withdrawing money from PayPal. The withdrawal process is straightforward. Here’s what you need to do:

- Log in to your PayPal account and go to the “Withdraw” option under the “My Wallet” tab.

- Select your MoneyGram account as the withdrawal destination.

- Enter the amount you want to transfer from your PayPal account.

- Review the fees and confirm the withdrawal details.

- Click “Continue” and then “Transfer” to start the withdrawal process.

- Log in to your MoneyGram account and go to the “Receive” section.

- Link your PayPal account by choosing PayPal as the payment method and entering your PayPal email address.

- Verify your identity with MoneyGram by providing your personal identification.

- Confirm the transfer and wait for the funds to be processed.

- You will get notifications from both PayPal and MoneyGram when your funds are ready for pickup.

If you want to withdraw money from a PayPal business account, you follow the same steps. Make sure your business information matches your identification documents.

Note: You cannot cancel the withdrawal once you start the process. Always double-check the amount and details before you confirm.

Picking Up Cash at MoneyGram

After you finish the withdrawal process, you can pick up your cash at the MoneyGram location you selected. Here’s what you need to bring and do:

- Bring your government-issued photo ID. The name on your ID must match the name on your PayPal account and the transfer details.

- Have your 8-digit reference number ready. You get this number from the MoneyGram-PayPal website or by email.

- In some cases, you might need to show proof of address, like a recent utility bill or bank statement, if your ID does not have your address.

- Go to the MoneyGram location within 30 days. If you wait too long, the funds will return to your PayPal account, minus any processing fees.

Important: Without your reference number and valid photo ID, you cannot pick up your funds. Always check your email or the MoneyGram website for your reference number before you go.

If you run into any issues while withdrawing funds, you can visit the PayPal Resolution Center. There, you can report problems, select the transaction, and provide details. PayPal will review your case and let you know the next steps. If you have trouble at MoneyGram, contact their customer service and keep records of your communication.

Withdrawing money from PayPal at MoneyGram gives you fast access to your funds. Just follow these steps, keep your documents ready, and you’ll have your cash in no time.

Fees, Limits, and Processing Time

Image Source: unsplash

Withdrawal Fees

When you use PayPal and MoneyGram to withdraw your funds, you pay several types of fees. You see a flat fee for each withdrawal, plus possible extra charges. Here’s a simple table to help you understand the costs:

| Fee Type | Amount / Range | Notes |

|---|---|---|

| Flat fee for withdrawal | $2.99 | Charged regardless of withdrawal amount |

| Additional country fees | 1-3% of withdrawal amount | Varies by recipient’s country |

| MoneyGram transaction fee | $1.99 to $49.99 | Depends on withdrawal amount |

| Currency conversion fees | Variable | Based on exchange rate at transaction time |

| Daily withdrawal limit | $500 | May require multiple transactions for larger amounts, increasing fees |

You pay a $2.99 flat fee every time you withdraw funds from PayPal using MoneyGram. If you transfer a large amount, MoneyGram may charge up to $49.99. Currency conversion fees also apply if you need a different currency. These fees can add up quickly, especially if you withdraw funds often.

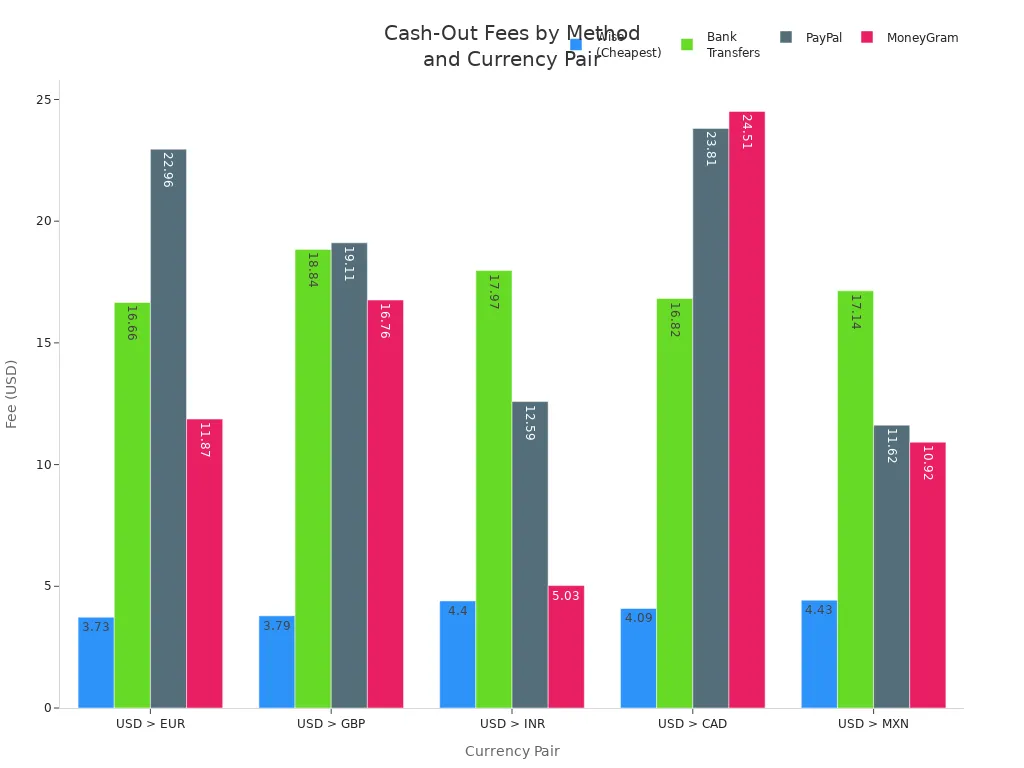

Compared to alternative methods for withdrawing money, PayPal and MoneyGram fees are usually higher. For example, bank transfers or ATM withdrawals often cost less, especially if you use banks with low fees. The table below shows how PayPal and MoneyGram compare to other services when sending $500 abroad:

| Currency Pair | Wise (Cheapest) | Bank Transfers (e.g., Bank of America, Chase, Wells Fargo) | PayPal | MoneyGram |

|---|---|---|---|---|

| USD > EUR | ~$3.73 | $13.63 - $19.69 | $22.96 | $11.87 |

| USD > GBP | ~$3.79 | $17.69 - $19.99 | $19.11 | $16.76 |

| USD > INR | ~$4.40 | $15.50 - $20.44 | $12.59 | $5.03 |

| USD > CAD | ~$4.09 | $13.74 - $19.89 | $23.81 | $24.51 |

| USD > MXN | ~$4.43 | $14.26 - $20.01 | $11.62 | $10.92 |

You see that PayPal and MoneyGram fees are higher than some alternative methods for withdrawing money. If you want to save money, you might want to look at other options.

Daily Limits

PayPal and MoneyGram set a daily withdrawal limit of $500. If you need to withdraw more than $500, you must make several transactions. Each transaction comes with its own fees, so costs can rise fast. This limit helps keep your funds safe, but it can be a problem if you need a large amount of cash at once. Some alternative methods for withdrawing money, like bank transfers, may offer higher limits.

How Long It Takes

You want your funds fast, and PayPal with MoneyGram makes that possible. After you start the transfer, your funds are usually ready for pickup at MoneyGram within minutes. Sometimes, you may wait up to an hour if there are delays. This speed is much faster than some alternative methods for withdrawing money, such as standard bank transfers, which can take several days. If you need your funds right away, PayPal and MoneyGram give you quick access.

PayPal Account Requirements and Troubleshooting

Required Identification

When you withdraw money from your PayPal account at MoneyGram, you need to show the right identification. MoneyGram accepts several types of government-issued photo IDs. The name on your ID must match the name on your PayPal account and the transfer record. If you try to pick up funds with an ID that does not match, MoneyGram will not release your cash.

Here are some IDs you can use when withdrawing money from PayPal:

- US driver’s license

- Passport

- State ID card

- US military card

- Native American tribal ID

- Welfare ID

- Inmate (exit prison) ID

- Resident alien card

- Seafarer ID

- Border crossing card

- Temporary resident card

- Employment authorization card

- Mexican electoral card

- Mexican consular identification card

If you want a quick look, check this table for accepted IDs:

| Accepted US IDs for MoneyGram PayPal Cash Withdrawals |

|---|

| US driver’s license |

| Passport |

| State ID |

| US military card |

| Native American tribal ID |

| Welfare ID |

| Inmate (exit prison) ID |

| Resident alien card |

| Seafarer ID |

| Border crossing card |

| Temporary resident card |

| Employment authorization card |

| Mexican electoral card |

| Mexican consular identification card |

Note: If you withdraw more than $15,000, MoneyGram will ask for extra information besides your ID.

Always check with your local MoneyGram agent before you go. Some locations may have special rules or ask for more documents.

Common Issues

Sometimes, you might run into problems when withdrawing money from PayPal at MoneyGram. Here are some common issues and how you can fix them:

- Name Mismatch

If the name on your PayPal account does not match your ID, MoneyGram will not give you the funds. Double-check your details before you start the transfer. - Missing Reference Number

You need the 8-digit reference number to pick up your cash. If you lose it, log in to your PayPal account or check your email for the number. - Expired or Unaccepted ID

MoneyGram will not accept expired IDs or IDs not on their list. Bring a valid, accepted ID every time. - Exceeded Daily Limit

You can only withdraw up to $500 per day. If you need more, you must make another transaction on a different day. This rule also applies if you want to withdraw money from a PayPal business account. - Account Not Enrolled

If you have not enrolled your PayPal account with MoneyGram, you cannot start the withdrawal. Make sure you finish the enrollment steps online. - Business Account Issues

When you withdraw money from a PayPal business account, make sure your business name matches your ID or business documents. If not, MoneyGram may reject your withdrawal.

Tip: If you have trouble, contact PayPal or MoneyGram customer service. Keep your transaction details handy so they can help you faster.

You can avoid most problems by checking your information, bringing the right ID, and following the steps for withdrawing money from PayPal. This way, you get your funds without stress.

Withdrawing your funds from paypal using moneygram is easy when you follow the right steps. First, check if you qualify for the paypal and moneygram service. Next, enroll online and link your paypal account. Bring your ID and reference number to moneygram. Watch out for fees and daily limits on paypal withdrawals.

Always double-check your paypal details before you visit moneygram. This helps you avoid problems and get your cash fast.

FAQ

How do you enroll in the PayPal-to-MoneyGram withdrawal service?

You need to visit the MoneyGram-PayPal website. Create a MoneyGram account and link your PayPal account. Follow the steps to enroll. After you finish, you can start withdrawing funds and pick up cash at any MoneyGram location.

What should you do if your PayPal account name does not match your ID?

If your name does not match, you cannot withdraw money from PayPal at MoneyGram. Update your PayPal account details before you try to transfer funds from PayPal. Always check your information before starting the withdrawal process.

Can you withdraw money from a PayPal business account using MoneyGram?

Yes, you can withdraw money from a PayPal business account. Make sure your business name matches your identification. If you have problems, contact PayPal or MoneyGram customer service for help with the withdrawal process.

Are there alternative methods for withdrawing money from PayPal?

You can use other ways to access your funds. Some people choose bank transfers, ATM withdrawals, or send money online to another account. Compare fees and limits before you decide which method works best for you.

While PayPal and MoneyGram offer a quick way to turn digital funds into cash, the reality is that fees add up fast and the $500 daily limit can be restrictive if you need more flexibility. That’s where BiyaPay offers a smarter alternative.

With remittance fees as low as 0.5%, real-time exchange rate checks, and seamless support for both fiat and digital currencies, BiyaPay ensures you get the best value for your money. Unlike PayPal + MoneyGram, BiyaPay allows you to move funds across borders with fewer restrictions—fast, transparent, and cost-effective.

If you’re looking for more control over your international transfers, avoid high withdrawal fees and daily caps. Try BiyaPay today—register here and start sending smarter.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.