- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

All you need to know about Chase money market accounts

Image Source: pexels

Chase gives you access to money market accounts with features that help you manage your savings. You can open a chase money market account if you want more flexibility than a chase savings account. Many people choose chase money market accounts for higher interest rates compared to regular savings. You may find that chase offers different options for money market accounts, each with its own requirements. Some customers compare chase money market accounts to other banks or look at how chase bank stands out. When you explore these accounts, you learn how money market account rules and benefits can fit your needs.

Key Takeaways

- Chase does not offer traditional money market accounts but provides savings accounts, checking accounts, and CDs.

- Money market accounts from other banks often offer higher interest rates, check-writing, and debit card access with low fees.

- Money market accounts usually require higher minimum balances and limit withdrawals to six per month.

- Chase savings accounts are simpler, with lower minimums and no check-writing, suitable for smaller balances.

- Before opening any account, compare interest rates, fees, minimum deposits, and access features to find the best fit.

Chase Money Market Accounts

Image Source: pexels

Features and Benefits

You may expect to find a variety of features when you look for money market accounts at major banks. Many banks offer high-yield money market accounts with competitive rates, low minimum deposits, and easy access. However, Chase does not currently offer money market accounts. Instead, Chase provides other deposit products such as checking accounts, savings accounts, and certificates of deposit (CDs). If you want a high-yield money market account, you will need to look at other banks. Some banks, like Brilliant Bank, Vio Bank, and UFB Direct, offer high-yield money market accounts with APYs up to 4.85%. These accounts often include check-writing privileges and no monthly maintenance fees. When you compare account features and requirements, you will see that Chase does not have a money market account to match these benefits. You should consider these differences if you want to maximize your savings with high-yield options.

Fees and Requirements

You will not find specific fees or requirements for Chase money market accounts because Chase does not offer this product. Other banks that provide high-yield money market accounts often have low or no monthly fees and low minimum deposit requirements. For example, some banks let you open a high-yield money market account with as little as $100. You may also find that these accounts do not charge monthly maintenance fees if you meet certain balance requirements. Chase bank, on the other hand, focuses on savings accounts and CDs, which have their own fee structures and minimums. If you want a money market account with low fees and easy requirements, you should compare several banks to find the best fit for your needs.

Access and Flexibility

You may want to know how you can access your money in a money market account. Many banks allow you to use online banking, ATMs, and even check-writing with their money market accounts. You can usually make up to six withdrawals or transfers per month, including checks, electronic, and phone withdrawals. This limit is common across banks and helps you manage your savings while still giving you flexibility. At Chase, you can access savings accounts through branches, online, and ATMs, but you will not find a money market account with these features. The table below shows how savings accounts and money market accounts compare in terms of access and flexibility:

| Feature | Savings Account | Money Market Account |

|---|---|---|

| Earns interest | Yes | Yes |

| ATM withdrawals | Yes | Yes |

| Unlimited withdrawals without excessive fees* | No | No |

| Check-writing | No | Sometimes |

| Debit card | No | Sometimes |

| Automated deposits possible | Yes | Yes |

| FDIC/NCUA-insured | Yes | Yes |

*Most banks limit you to six withdrawals per month for both account types.

If you want more flexibility, you may prefer a high-yield money market account from another bank. These accounts often allow check-writing and easy online transfers. Chase bank savings accounts have similar withdrawal limits, but they do not offer check-writing. You should review account features and requirements before choosing the best option for your savings.

Money Market Account vs Savings Account

Image Source: pexels

Key Differences

You may wonder how a money market account compares to a savings account. Both help you grow your savings, but they work in different ways. A money market account often gives you a higher interest rate, especially if you keep a large balance. You can sometimes write checks or use a debit card with a money market account, which adds flexibility. In contrast, a savings account usually has fewer features. You cannot write checks, and you may only access your money through online transfers or ATMs.

The table below shows how these accounts differ at Chase:

| Feature/Scenario | Money Market Account | Chase Savings Account |

|---|---|---|

| Minimum Balance | Higher minimum balance; fees if not met | Lower minimum; often no or low fees |

| Interest Rates | Higher rates for large balances | Competitive, but usually lower for large balances |

| Access to Funds | Check-writing, debit card, electronic transfers | No check-writing; online transfers or ATM |

| Ideal User Scenario | Larger balances, need for flexibility | Smaller balances, want low fees and easy management |

| Withdrawal Limits | Limits on withdrawals or checks | Limits on withdrawals; penalties possible |

| Fees | Possible monthly fees | Fewer fees, easier to maintain |

A money market account can give you more ways to use your money, but you may need to keep a higher balance to avoid fees. A chase savings account keeps things simple and works well for smaller balances.

When to Choose Each

You should choose a money market account if you plan to keep a large amount of money in your account. This type of account rewards you with higher interest and gives you more ways to access your funds. If you want to write checks or use a debit card, a money market account can help you do that.

A chase savings account fits your needs if you want to avoid fees and do not plan to keep a high balance. You may prefer this account if you want to save money for a goal and do not need to write checks. This account makes it easy to manage your savings with fewer requirements.

Tip: Always check the minimum balance and fee rules before you open any account. This helps you avoid surprises and pick the best option for your savings.

Alternatives to Chase Money Market Accounts

Chase Money Market Funds

You may want to explore Chase money market funds if you seek higher yields than a typical savings account. These funds invest in low-risk securities and offer liquidity. You can see the main features in the table below:

| Aspect | Details |

|---|---|

| Current Yields | 7-day annualized SEC yields, which change often and do not include fees. Yields reflect weekly income projected over a year. Fee waivers can affect yields. |

| Investment Risks | Not FDIC insured. You face market risks, including possible loss of principal. No guarantee from Chase or its affiliates. |

| SIPC Protection | The funds themselves are not SIPC protected. J.P. Morgan Securities LLC, the broker-dealer, is a SIPC member. SIPC covers brokerage failure, not investment losses. |

| FDIC Insurance | Bank deposit sweep options are FDIC insured up to $250,000 per depositor. Money market funds are not FDIC insured. |

You should know that a money market fund differs from a money market account. The fund does not guarantee your principal, but it may offer higher returns. You can access your money quickly, but you accept some risk.

Chase Premium Deposit

If you have a large balance, you might consider a Chase Premium Deposit account. You need at least $100,000 to open this account. The interest rate can be up to seven times higher than the national average savings rate. The exact rate changes based on market conditions. This account works well for people who want to earn more on large deposits and keep their money safe with Chase Bank.

Note: You should compare the rates and requirements of a Premium Deposit account to those of a high-yield money market account. Premium Deposit accounts need a much higher minimum deposit.

Other Bank Money Market Accounts

Many banks offer high-yield money market accounts with strong features. You can see common details in the table below:

| Feature / Requirement | Common Details |

|---|---|

| Minimum Opening Deposit | $0 to $5,000 |

| Minimum Ongoing Balance | Often any amount |

| Monthly Maintenance Fees | Usually none |

| ATM/Debit Card Availability | Often available |

| Check-Writing Privileges | Commonly offered |

| Withdrawal Limits | 6 withdrawals per month allowed; extra fees may apply |

| FDIC Insurance | Up to $250,000 per depositor, per insured bank |

| Interest Rates | Variable, often competitive with high-yield savings accounts; tiered rates for higher balances |

| Application Process | Online application, identity check, funding by ACH or other methods |

| Account Providers | Many online-only banks or smaller banks, all federally insured |

You may find that high-yield money market accounts from other banks offer better rates and more flexibility than Chase savings. These accounts often have no monthly fees and let you access your money with checks or a debit card. You can open an account online and start earning a high-yield rate right away.

Choosing the Best Money Market Account

Rates and APYs

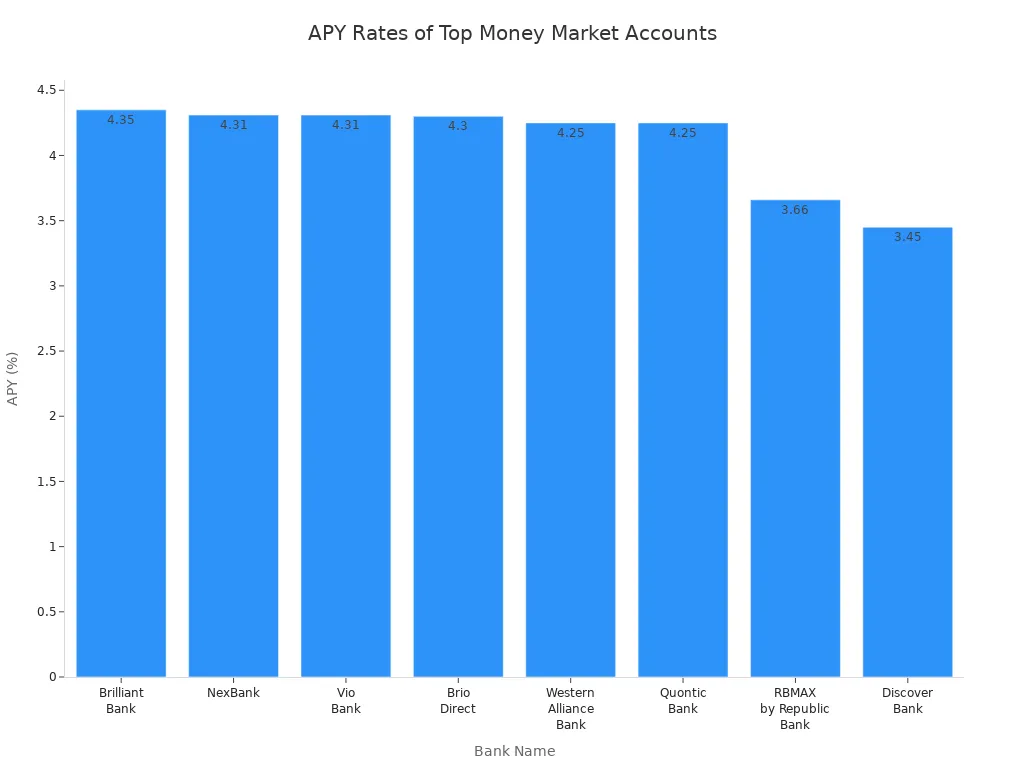

When you compare money market accounts, you should look at the rates and APYs first. High-yield accounts offer some of the best rates for your savings. These rates can change often, sometimes even daily, because banks adjust them based on the economy and Federal Reserve decisions. Chase does not offer money market accounts, so you will not find rates from Chase in this category. Other banks, especially online banks, provide high-yield money market accounts with strong APYs. The table below shows the current range of APYs from leading banks:

| Bank Name | APY | Minimum Deposit | FDIC Insured | Notes |

|---|---|---|---|---|

| Brilliant Bank | 4.35% | $1,000 | Yes | Online-only bank |

| NexBank | 4.31% | $1 | Yes | Bonus up to $500 for new customers |

| Vio Bank | 4.31% | $100 | Yes | No monthly fees |

| Brio Direct | 4.30% | $5,000 | Yes | Online sub-brand of Webster Bank |

| Western Alliance Bank | 4.25% | $500 | Yes | Top 50 US bank by deposits |

| Quontic Bank | 4.25% | $100 | Yes | Brick-and-mortar and online presence |

| RBMAX by Republic Bank | 3.66% | $1 | Yes | Digital bank account |

| Discover Bank | 3.45% | None (for < $100k) | Yes | Higher rate for balances > $100,000 |

You should focus on high-yield options if you want your money to grow faster. Always check how often the rates change, since high-yield accounts can adjust their APYs without notice.

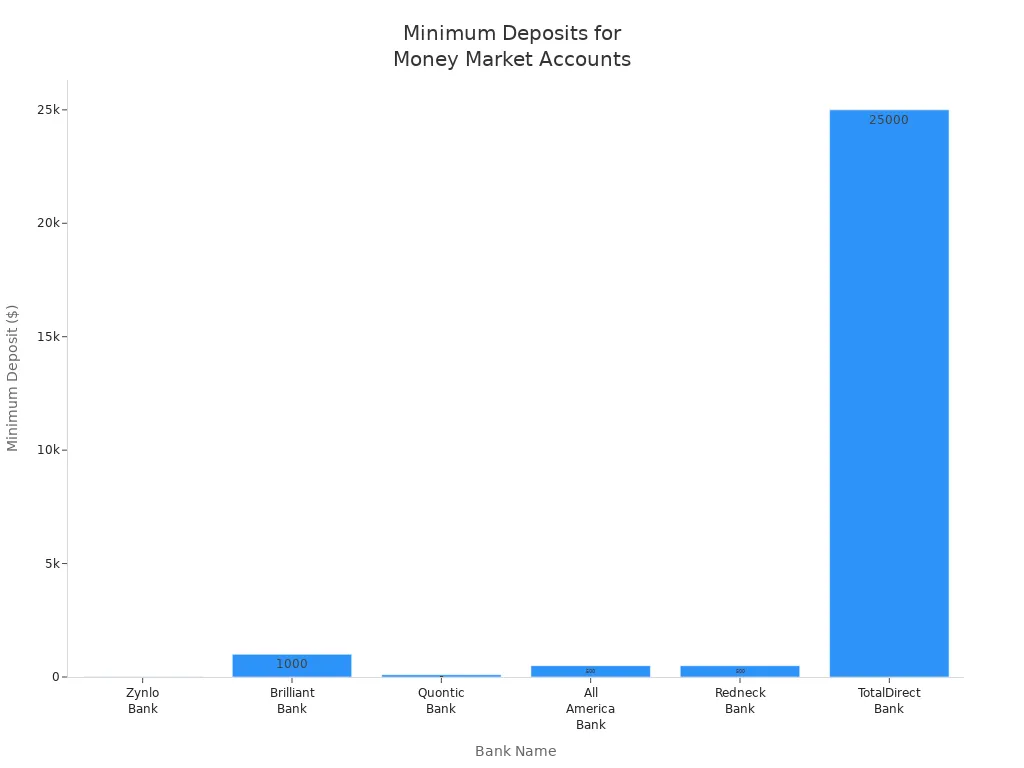

Fees and Minimums

You need to pay attention to fees and minimum balance requirements. High-yield money market accounts usually require higher minimum balances than regular savings accounts. If you do not keep enough money in your account, you might pay monthly fees or lose out on the best rates. Here are some common features:

- High-yield accounts often have more complex interest rate structures.

- You may need to keep a certain balance to avoid fees.

- Withdrawals may be limited each month.

- Minimum opening deposits can range from $1 to $25,000.

The table below shows how minimum deposits compare at different banks:

| Bank Name | Minimum Opening Deposit Requirement | Notes |

|---|---|---|

| Chase | N/A | Does not offer money market accounts |

| Zynlo Bank | $10 | No minimum balance required |

| Brilliant Bank | $1,000 | No balance cap for high APY |

| Quontic Bank | $100 | No monthly fee, debit card included |

| All America Bank | $500 | No minimum balance requirement |

| Redneck Bank | $500 | No minimum balance requirement |

| UFB Direct | N/A | $5,000 balance needed to avoid fees |

| TotalDirectBank | $25,000 | High minimum deposit |

You should always read the account terms before opening a high-yield money market account. This helps you avoid unexpected fees and makes sure you meet the minimums.

Account Access

Access to your money is another key factor. High-yield money market accounts often let you use checks, debit cards, and ATMs. You can make withdrawals, deposits, and balance inquiries easily. Most banks limit you to six withdrawals or transfers per month. If you go over this limit, you may pay extra fees. Some online banks, like Quontic and All America Bank, give you debit cards and check-writing privileges. These features make it easy to use your high-yield account for both saving and spending.

Tip: When you review considerations when choosing a money market account, always check how you can access your funds and if there are any limits or fees for transactions.

Chase does not offer money market accounts, so you will need to look at other banks for these features. Online banks often provide more flexible access and lower fees, making them a strong choice for high-yield savings.

Chase does not offer money market accounts, so you need to look at other banks or credit unions for this product. Money market accounts can give you higher yields and flexible access, but you may face higher minimums and fees.

| Aspect | Advantages | Disadvantages |

|---|---|---|

| Interest Earnings | Competitive yields, up to 4%+ APY | High minimum balances may be required |

| Access to Funds | Check-writing, debit card access | Six withdrawals per month limit |

| Federal Insurance | FDIC or NCUA insured up to $250,000 | — |

| Fees | Some accounts have no monthly fees | Fees can offset interest if conditions not met |

Before you open an account, compare APYs, check minimums, review fees, and make sure the account fits your needs.

FAQ

Does Chase offer a traditional money market account?

You cannot open a traditional money market account at Chase. Chase only provides savings accounts, checking accounts, and certificates of deposit. If you want a money market account, you need to look at other banks or financial institutions.

What is the difference between a money market account and a money market fund at Chase?

A money market account is a deposit account insured by the FDIC. A money market fund is an investment product. The table below shows the main differences:

| Feature | Money Market Account | Money Market Fund |

|---|---|---|

| FDIC Insurance | Yes | No |

| Investment Risk | Low | Moderate |

| Access to Funds | Easy | Easy |

Can you write checks from a Chase savings account?

You cannot write checks from a Chase savings account. Only some money market accounts at other banks allow check-writing. Chase savings accounts let you transfer money or withdraw cash, but they do not offer check-writing features.

Are Chase money market funds safe?

Chase money market funds carry some risk. They are not FDIC insured. You may lose money if the fund’s value drops. These funds invest in low-risk securities, but you should always review the risks before investing.

While Chase does not currently offer a true money market account—and its savings products may not deliver the yields or flexibility you’re looking for—you still have alternatives to grow and move your money more effectively. That’s where BiyaPay stands out.

With remittance fees as low as 0.5%, real-time exchange rate checks, and seamless support for both fiat and digital currencies, BiyaPay gives you more control over your funds. Whether you want to diversify beyond low-yield savings or need fast, borderless access to your money, BiyaPay provides the flexibility that traditional banks often lack.

Ready to move beyond limited savings options? Explore smarter, faster ways to manage your funds with BiyaPay—register here today.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.