- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Discover the Limits of Sending Money with Western Union

Image Source: pexels

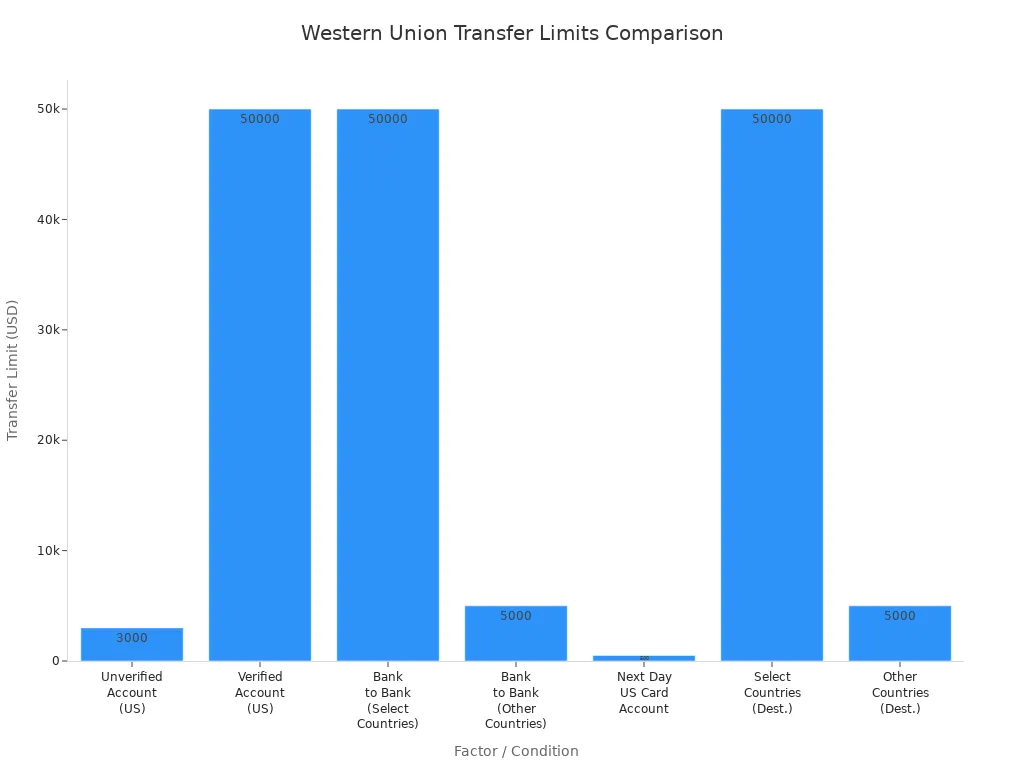

If you plan on sending money with Western Union, you need to know the current western union transfer limits. The maximum amount you can send online with an unverified account in the US is $3,000, but a verified account can send up to $50,000. Online and in-person transfer limits depend on your verification status, method, and where you send money. Western Union sets different limits for each country. The table below shows common transfer limits:

| Factor | Condition/Detail | Transfer Limit |

|---|---|---|

| Account Verification Status | Unverified (US) | Up to $3,000 |

| Verified (US) | Up to $50,000 | |

| Sending Method | Bank Account to Bank Account (UK, France, Germany, Australia, Hong Kong, US) | Up to $50,000 USD/EURO or local equivalent |

| Bank Account to Bank Account (Most other countries) | Up to $5,000 USD/EURO or local equivalent | |

| Sending Method | Next Day delivery within continental US (per card account) | $500 per day |

| Destination Country | Select countries (UK, France, Germany, Australia, Hong Kong, US) | Higher limits (up to $50,000) |

| Most other countries | Lower limits (around $5,000) |

Transfer limits may change because of identification, bank rules, or country regulations. Always check your own maximum amount before you send money online or at an agent location.

Key Takeaways

- Western Union sets different transfer limits based on your account verification, sending method, and destination country.

- Verifying your identity increases your transfer limit from $3,000 to up to $50,000, allowing you to send larger amounts safely.

- Always check your current transfer limits online, in the app, or at an agent location before sending money to avoid delays or declined transactions.

- Transfer fees and delivery times vary by method; online transfers usually cost less and can be faster than in-person transfers.

- If you need to send more than Western Union’s limits, consider other providers like MoneyGram, Wise, or Remitly to find the best speed, cost, and delivery options.

Transfer Limits Overview

Image Source: unsplash

Western Union Transfer Limits

You need to understand western union transfer limits before sending money. These limits depend on your account status, the method you use, and the country where you send funds. Western Union sets different maximum amounts for unverified and verified accounts. If you have not verified your account, you can send up to $3,000. Once you complete verification, your transfer limit increases to $50,000. Verification requires you to provide identification and address documents, either online or at an agent location.

| Account Type | Transfer Limit (USD) |

|---|---|

| Unverified Account | Up to 3,000 |

| Verified Account | Up to 50,000 |

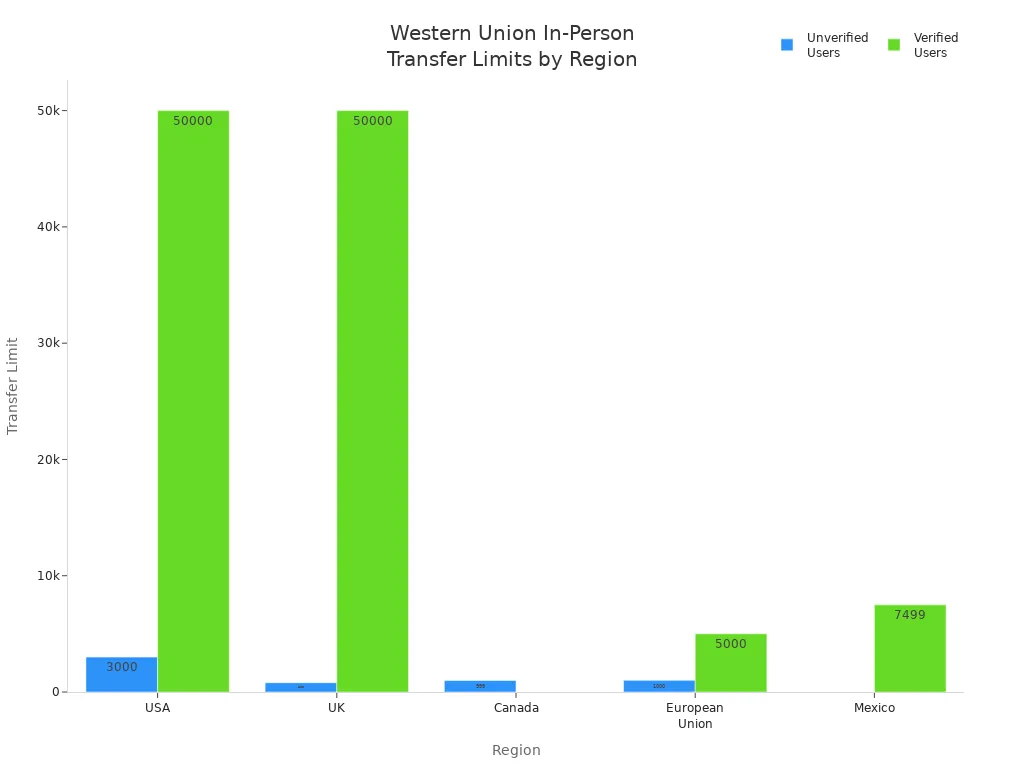

You should know that western union transfer limits also change based on the country. For example, in the United States, you can send up to $3,000 with an unverified account and up to $50,000 with a verified account. In the United Kingdom, the limit for unverified users is £800, while verified users can send up to £50,000. In Canada, unverified users can send up to $999 CAD. In the European Union, unverified users have a limit of €1,000, and verified users can send up to €5,000. Mexico allows verified users to send up to $7,499 USD or the equivalent in Mexican pesos.

| Region | Transfer Limit for Unverified Users | Transfer Limit for Verified Users | Currency |

|---|---|---|---|

| USA | Up to 3,000 | Up to 50,000 | USD |

| UK | Up to 800 | Up to 50,000 | GBP |

| Canada | Up to 999 | N/A | CAD |

| Mexico | N/A | Up to 7,499 | USD/MXN |

| European Union | Up to 1,000 | Up to 5,000 | EUR |

You should always check your own transfer limits before you start sending money. Western union transfer limits can change due to your transaction history, the destination country, and the payment method you choose.

Sending Money Online

When you transfer money online, western union sets specific limits based on your account status and where you send funds. If you have an unverified account in the United States, your online transfer limit is $3,000. After you verify your identity, you can send up to $50,000 online. Some countries have different daily limits. For example, in the United States, you can send up to $10,000 per day, while in the European Union, the daily limit can reach €15,000. Western union does not set fixed monthly or yearly caps for online transfers. However, if you want to send more than the daily limit, you must provide extra identification.

Note: Online transfer limits may be lower if you use certain services. For example, the Home Delivery Prepaid Card service has a daily cap of $500 per card account.

You should also know that western union monitors large international payments. If you send more than $10,000 in a single transfer, the company may report your transaction to government authorities. This reporting does not stop you from sending money, but you may need to provide more documents.

If you want to transfer money online, always check the online transfer limits for your country and payment method. This helps you avoid delays or declined transactions.

Sending Money In Person

You can also send money in person at a western union agent location. The transfer limits for in-person transactions depend on your account status and the country where you send funds. If you have not verified your account, you can send up to $3,000 in the United States. After verification, your maximum amount increases to $50,000. In the United Kingdom, unverified users can send up to £800, and verified users can send up to £50,000. In Canada, the limit for unverified users is $999 CAD. In Mexico, verified users can send up to $7,499 USD or the equivalent in pesos.

You should also know about other restrictions when you send money in person. Western union sets a $1,000 limit for each money order. You can only complete up to 30 transactions per year. If you try to send more than the allowed amount or exceed the transaction frequency, western union may delay or deny your transfer. The company may also report large international transfers to authorities if they exceed $10,000.

Tip: Always bring valid identification when you send money in person. This helps you complete your transfer quickly and avoid problems with limits.

Some services, such as FedEx delivery, have lower daily limits. If you use these services, check the maximum amount before you start your transfer.

You may face restrictions or declines for several reasons. These include insufficient funds, exceeding the transfer limit for your country, or security checks to prevent fraud. Western union sets these rules to keep your international transfers safe and legal.

If you plan to send money in person, always ask the agent about current transfer limits and requirements. This helps you avoid delays and ensures your international bank transfer goes smoothly.

Check Limits

Website

You can check your western union transfer limits easily on the website. First, log in to your western union account. Go to your profile or account settings. Look for the section labeled “Limits” or “Transfer Limits.” Here, you will see the maximum amount you can send. If you want to increase your transfer limit, you need to verify your identity. You can send up to $1,000 USD (or the equivalent in your local currency) within five days before verification. After you complete identity verification, your sending limit increases automatically. In some countries, you can send up to $50,000 USD after verification. This process helps you unlock higher limits and makes your transfers smoother.

Tip: Always keep your personal information up to date on your western union account. This helps you avoid problems when you check your western union transfer limits.

App

You can also check your limits using the western union app. Open the app and sign in to your account. Tap on the menu icon and select “Profile” or “Account Settings.” Find the section that shows your current transfer limits. The app displays your available limit for online transfers. If you want to send more money, the app will guide you through the steps to verify your identity. Follow the instructions to upload your documents. Once verified, your transfer limit will increase, and you can send larger amounts online.

Agent

If you prefer to check your limits in person, visit a western union agent location. Bring your identification and ask the agent to check your transfer limits. The agent can tell you your current limit and explain how to increase it. If you need a higher transfer limit, the agent will help you with the verification process. You may need to show your ID and proof of address. After verification, you can send larger amounts from your western union account at the agent location.

Note: Verifying your identity is the best way to increase your limits and make sure your transfers go through without delays.

Increase Limits

Verification Steps

If you want to increase your transfer limits with western union, you need to complete a few important steps. The process helps keep your transfers safe and follows legal rules. Here is what you should do:

- Log in to your western union account online or use the app.

- Start the identity verification process. You must provide a government-issued photo ID, such as a passport or driver’s license.

- Make sure your document is clear, unexpired, and shows all details like your name, birthdate, and photo.

- For transfers over $15,000, western union may ask for extra documents to show the source of your funds. You do not need to send these in advance. Western union will contact you by phone or email within 30 minutes after you start a large transfer.

- Upload your documents in PDF or JPG format. Good lighting and focus help make your documents easy to read.

- Wait for western union to review your documents. Most checks finish within 30 minutes.

Note: If your documents are not accepted, western union will email you with instructions on how to send new ones.

Completing these steps will help you increase your transfer limits and learn how to transfer large amounts of money safely.

Required Documents

To verify your identity and increase your transfer limits, you must provide one of the following documents:

- Passport

- Driver’s license

- EU/EEA-issued ID

- Temporary travel passport

- Travel document

- Diplomatic passport

Your document must be undamaged, legible, and not expired. All details, such as your picture, signature, and expiration date, should be visible. You can upload your document during an online transfer or through a video chat. Sometimes, western union may also ask for proof of funds, like a credit card statement, if you want to know how to transfer large amounts of money.

| Document Type | Details Needed | Format Accepted |

|---|---|---|

| Passport | Photo, signature, expiration | PDF, JPG |

| Driver’s license | Photo, signature, expiration | PDF, JPG |

| National ID | Photo, signature, expiration | PDF, JPG |

After successful verification, your limits can increase from $1,000 to $5,000 or more per transfer, depending on your location and the method you use. This process makes it easier to send higher amounts and helps you follow all rules.

Fees and Requirements

Fees by Method

You will notice that Western Union charges different fees depending on how you send money. If you use the website or mobile app, you often pay lower transfer fees than at an agent location. New customers can send their first online transfer with a $0 fee, but you still need to check the fees and exchange rates because exchange rate margins can add to your total cost. Here are some key points about fees:

- Fees change based on your sending method, payment type, and where the money goes.

- Online and app transfers usually have promotional or lower fees.

- In-person agent locations may charge higher fees.

- Extra fees can apply for cancellations, intermediary banks, or currency exchange markups.

- The Western Union website and app let you see fee estimates before you send money.

- Fees and exchange rates both affect the final amount your recipient gets.

If you exceed your western union transfer limit, you may face extra fees associated with exceeding transfer limits. Always check the maximum amount you can send and compare transfer fees before you complete your transaction.

Delivery Times

Delivery times for Western Union transfers depend on the method and destination. You can use the table below to see how long it usually takes for your money to arrive:

| Transfer Type | Typical Delivery Time | Notes |

|---|---|---|

| Bank Account Transfer | 1 or more banking days | Time depends on the banks involved and the country where you send money |

| International Transfers | 1 to 5 business days | Factors include banking rules, currency conversion, time zones, and holidays |

| Cash Pickup | Often within minutes | Recipients can pick up cash quickly at agent locations or after online transfers |

| Same-day International | Within 24 hours (expedited) | Available for some countries with extra fees and faster processing |

You should remember that transfer times can change because of local banking hours, holidays, and fraud checks. If you want to know how to transfer large amounts of money quickly, choose cash pickup or expedited services, but expect higher fees and exchange rates.

Large Transfer Regulations

When you send a large amount, Western Union must follow strict rules. If your transfer is over $10,000, Western Union reports it to authorities like FinCEN in the United States. This rule helps prevent money laundering and keeps your transfer legal. You will need to verify your identity and may need to show where your funds come from. Western Union does not block or tax these transfers, but you must follow local tax laws if you receive a large gift or payment. Trying to split transfers to avoid reporting can lead to serious penalties. These regulations apply to both local and international transfers. If you want to know how to transfer large amounts of money safely, always provide accurate information and keep your documents ready.

Alternatives to Western Union

Image Source: pexels

Other Providers

You have many options when you want to transfer money overseas. MoneyGram stands out as a strong competitor. It offers a wide network with over 350,000 agent locations in more than 200 countries. MoneyGram sets a $10,000 limit for most online international transfers, but you can send higher amounts through agents if local rules allow. Both Western Union and MoneyGram support fast cash pickups, often within minutes, and both have strong security for international payments. However, you may notice that MoneyGram’s fees can be high, especially for credit card payments or urgent transfers.

Other money transfer services like Wise, Remitly, and TransferGo focus on digital convenience. Wise uses real mid-market exchange rates and shows you all fees up front. Remitly offers flexible delivery speeds and low fees, but it may limit the size of your international transfers. These providers often let you send money to bank accounts or mobile wallets, but they may not support cash pickup in every country.

| Provider | Transfer Limit (USD) | Delivery Speed | Fees & Exchange Rates | Payout Options |

|---|---|---|---|---|

| Western Union | Up to $50,000 | Minutes to 7 days | Higher, less transparent | Cash, bank, mobile |

| MoneyGram | Up to $10,000 online | Minutes to 1-2 days | High for urgent transfers | Cash, bank, mobile |

| Wise | Varies | 1-2 days | Low, transparent | Bank, mobile |

| Remitly | Varies | Minutes to 3 days | Low, transparent | Cash, bank, mobile |

Note: Always check the latest transfer limits and fees before you choose a provider for international money transfers.

Choosing the Right Option

You should think about your needs before you pick the best way to send money internationally. If you need to send cash quickly, Western Union and MoneyGram both offer fast cash pickups. These services work well in places where digital banking is not common. If you want lower fees and more transparency, Wise and Remitly may suit you better. They show you the real exchange rate and all costs before you send money.

When you compare international bank transfer options, look at these factors:

- Transfer speed: Some providers deliver money in minutes, while others take a few days.

- Total cost: Check both the fees and the exchange rate margin. Some services add hidden costs to the exchange rate.

- Transfer limits: Make sure the provider supports the amount you want to send for international transfers.

- Delivery method: Decide if you need cash pickup, a bank deposit, or a mobile wallet.

- Destination coverage: Some services cover more countries than others.

You may find that international bank transfer services like Wise work best for sending money to Hong Kong banks. If you need to send large amounts, check the provider’s transfer limits and how long international transfers take. Always review the requirements for international payments and compare the total cost. This helps you choose the best way to transfer money overseas for your needs.

You should remember that western union transfer limits change based on where you send money and the method you choose.

- Western union offers higher limits than many other services, but these limits are not fixed.

- Always check your limits before sending money.

- Fees and exchange rates can affect your total cost.

If your needs go beyond western union’s limits, compare other options. Look at speed, cost, and how your recipient wants to receive the funds. Choose the method that fits your needs best.

FAQ

What happens if you try to send more than your Western Union limit?

Western Union will not process your transfer. You may see an error message. You can increase your limit by verifying your identity. Always check your current limit before you send money.

Can you send money to a Hong Kong bank account with Western Union?

Yes, you can send money to many Hong Kong banks. You need the recipient’s bank details. Western Union sets limits for these transfers. Check the latest USD limits and exchange rates before you start.

Does Western Union charge extra fees for large transfers?

Western Union does not charge special fees for large transfers. You pay standard transfer fees and exchange rate margins. If you send over $10,000 USD, you must provide extra documents for verification.

How many transfers can you make each year with Western Union?

You can complete up to 30 transfers per year. Western Union tracks your transactions. If you reach this limit, you must wait until the next year to send more money.

Western Union’s limits can slow you down, especially if you need to send more than $3,000 unverified or $50,000 verified. With BiyaPay, you don’t just get flexibility—you get real-time FX rate checks and instant conversion, remittance fees as low as 0.5%, and support for both fiat and digital currencies. Even better, BiyaPay offers same-day transfers with same-day arrival, so your funds reach their destination faster and at lower cost. Registration is quick, and you always see the exact amount that will arrive before confirming. Discover a more transparent way to send money with BiyaPay.

Send beyond limits—start today with BiyaPay.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.