- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Essential Strategies for Saving Money on Money Gram Transfers

Image Source: unsplash

You want to save money on money gram transfers, right? You can do this by picking smart strategies. First, always check the transfer fees before you send money. MoneyGram’s costs change based on where your money goes, how much you send, and which delivery method you pick. Sometimes, MoneyGram charges higher fees than other money transfer services like Wise or Western Union. If you compare fees and exchange rates, you might keep more money in your pocket.

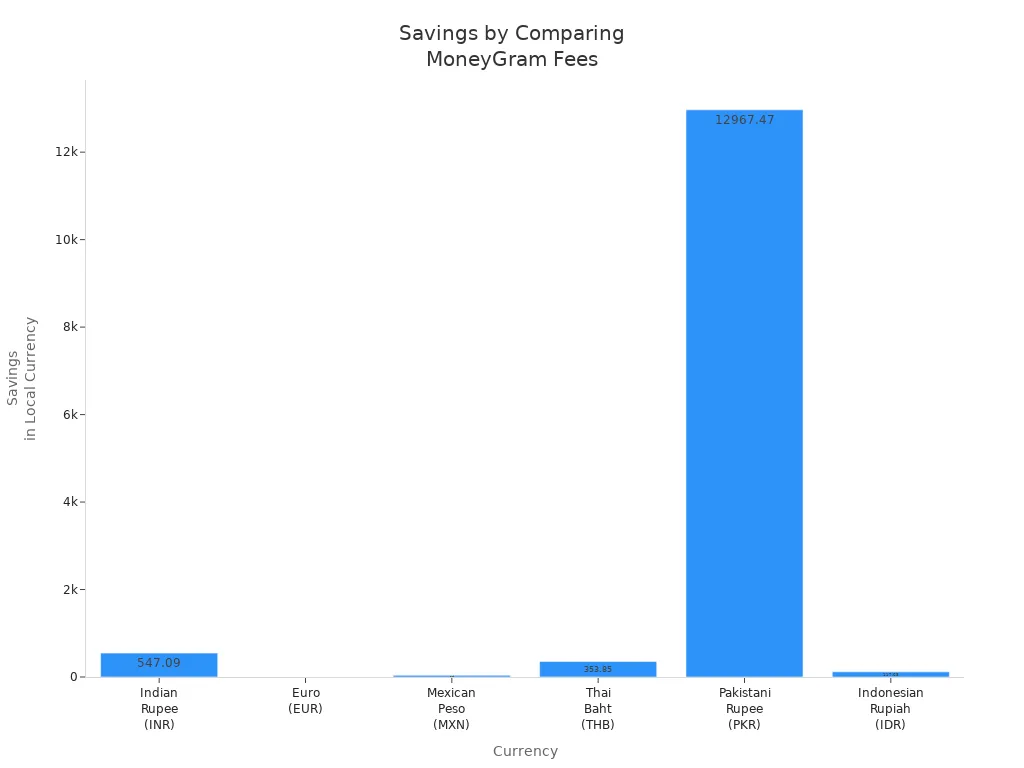

For example, if you send 1,000 USD, you could save a lot just by choosing a better rate. Take a look at this table to see how much you can save when you compare:

| Currency | Example Transfer Amount | Savings by Comparing Fees and Exchange Rates |

|---|---|---|

| Indian Rupee (INR) | Sending 1,000 USD | Wise yields 547.09 INR more than MoneyGram |

| Euro (EUR) | Sending 1,000 USD | Save approximately 2.03 EUR by choosing cheaper provider |

| Mexican Peso (MXN) | Sending 1,000 USD | Save 37.69 MXN by selecting cheaper option |

| Thai Baht (THB) | Sending 1,000 USD | Save 353.85 THB by comparing providers |

| Pakistani Rupee (PKR) | Sending 1,000 USD | Save 12,967.47 PKR by choosing better rates |

| Indonesian Rupiah (IDR) | Sending 1,000 USD | Save 117.63 IDR by comparing fees and rates |

You can also save by choosing cost-effective payment and delivery methods, consolidating your transfer, and using online options. MoneyGram offers tools that let you track a transfer, so you always know where your money goes. These strategies help you make the most of your money transfers.

Key Takeaways

- Always compare MoneyGram’s fees and exchange rates with other services to find the best deal and keep more money.

- Choose cost-effective payment methods like bank account transfers or debit cards to lower your transfer fees.

- Consolidate small transfers into one larger transfer to reduce total fees and get better rates.

- Use MoneyGram’s online tools and rewards programs to track transfers, access discounts, and save on fees.

- Send money during weekdays and watch exchange rates to avoid high fees and get the best value for your transfer.

MoneyGram Transfer Fees

Types of Transfer Fees

When you send money transfers with MoneyGram, you face different types of money transfer fees. These fees depend on how you pay, how much you send, and where your money goes. MoneyGram uses flat fees, percentage-based fees, and payment method-based fees. You might see a flat fee for small transfers, but larger amounts can bring higher percentage-based fees. The provider also adds a margin to the exchange rate, especially for international transfers.

Here’s a table to help you see how fees work for different payment methods when you send $500:

| Method of Receipt | Fee for Debit Payment | Fee for Credit Payment |

|---|---|---|

| Bank account | $8.99 | $20.49 |

| Debit card deposit | $10.99 | N/A |

| Cash pickup | $68.99 | $83.49 |

You can use a debit card, credit card, bank account, or even Apple Pay for online money transfers. Credit card payments usually cost more. The provider may also charge extra if you use a credit card, like cash advance fees or interest.

How Fees Vary

MoneyGram transfer fees change based on several things. The amount you send, the country you send to, and the payment method all affect the total cost. If you send money to a country with higher operational costs, you pay more. If you use a credit card, you pay higher fees than with a debit card or bank account. The provider also changes the exchange rate, which can make international transfers more expensive.

Tip: Always check the MoneyGram fee estimator tool before you send money. This tool helps you see the exact money transfer fees and exchange rate for your transfer.

Transfer fees can change without notice. The provider may update rates and fees based on market changes, regulations, or competition. You should compare the total cost, not just the upfront fee, before you choose a provider for your money transfers.

Hidden Costs

Some costs are not easy to spot. MoneyGram adds a margin to the exchange rate, so you might get less money in the end. Cash pickup fees are higher than bank deposits or mobile wallets. If you need to send money fast, you pay extra for express services. If you cancel or change a transfer, you may pay a fee. International transfers can also include extra charges for currency exchange or regulatory reasons.

- Cash pickup usually costs the most.

- Exchange rate margins add hidden costs.

- Express transfers cost more than standard ones.

- Changing or canceling a transfer brings extra fees.

MoneyGram must follow rules that require transparent pricing. The provider must show you all fees, the exchange rate, and the amount your recipient will get before you pay. This helps you avoid surprises and pick the best option for your types of money transfers.

Payment Methods for MoneyGram

Image Source: pexels

When you send money with MoneyGram, your choice of payment method can make a big difference in how much you pay in fees. Some options help you save, while others can cost you more. Let’s break down the impact of payment methods on rates and see how you can keep more money in your pocket.

Debit Card vs. Credit Card

You might think using a debit card or credit card is the same, but MoneyGram treats them very differently. Debit cards usually come with moderate fees. Credit cards, on the other hand, have the highest fees. You might even get hit with extra charges from your credit card company, like cash advance fees or interest. Here’s a quick look at how the fees stack up:

| Payment Method | Fee Range (USD) | Additional Notes |

|---|---|---|

| Debit Card | $0.39 - $0.99 | Moderate fees |

| Credit Card | $2.99 - $4.49 | Highest fees; may include cash advance fees and interest from credit card issuer |

| Bank Account | Starting at $1.89 | Lowest fees; most cost-effective option |

If you want fast money transfers, debit cards can be a good choice. They cost less than credit cards and still move your money quickly. Credit cards might seem convenient, but the fees add up fast.

Tip: Always check the total fees before you choose your payment method. Even a small difference can save you money over time.

Bank Account Transfers

Bank account transfers with MoneyGram usually have the lowest fees. You start at just $1.89, which makes this option the most cost-effective. If you don’t need instant delivery, using your bank account can help you save the most. Many people use this method for larger money transfers because the fees stay low, even as the amount goes up. Bank account transfers may take a bit longer, but you get more value for your money.

In-Person vs. Online

MoneyGram lets you send money in person at agent locations or through online payment services. Online payment services often offer lower fees than in-person transfers. When you go to a MoneyGram agent, you might pay extra for the same transfer. Online options are not just cheaper—they’re also faster and more convenient. You can send fast money transfers from your phone or computer, track your transfer, and avoid waiting in line.

If you want to save, choose online payment services whenever possible. The provider gives you more control and better rates. Always compare the total cost before you send money. The right payment method can help you avoid high fees and get your money where it needs to go.

Delivery Options and Money Transfer Fees

When you send money with MoneyGram, you get to pick how your recipient receives the funds. Each delivery option affects the total cost of your transfer. You want to make sure you choose the best method for your needs and budget. Let’s look at the main delivery options and how they impact your fees.

Cash Pickup

Cash pickup is a popular choice with MoneyGram. Your recipient can collect the money in person at a MoneyGram location. This method works well if your recipient does not have a bank account. However, cash pickup usually comes with higher fees. You might pay more for this convenience, especially if you need the transfer to arrive quickly. MoneyGram sets different fees for cash pickup based on the amount you send and where your recipient picks up the money. Always check the total fees before you confirm your transfer. If you want to save, compare cash pickup with other delivery options.

Bank Deposit

Bank deposit lets you send money straight to your recipient’s bank account. This option often has lower fees than cash pickup. MoneyGram makes it easy to send a transfer directly to a bank, which can help you avoid extra costs. You may also get a better exchange rate with a bank deposit. If your recipient uses a Hong Kong bank, this method can be fast and secure. You should always compare the fees and exchange rates for bank deposit before you send your transfer. MoneyGram’s fee estimator tool can help you find the best deal.

Mobile Wallets

Mobile wallets are another way to receive a MoneyGram transfer. Your recipient gets the money on their phone, which makes it easy to access and use. Fees for mobile wallets can vary, so you need to check them before you send. Sometimes, mobile wallets offer lower fees than cash pickup, but it depends on the country and the payment method you use. MoneyGram updates its fees and exchange rates often, so always review them before you complete your transfer.

- Delivery options such as cash pickup, bank deposit, and mobile wallets influence the total cost of a MoneyGram transfer.

- Fees change based on transfer amount, payment type, delivery method, and pickup location.

- You should compare both transfer fees and exchange rates when choosing a delivery method.

- MoneyGram can change fees and rates without notice, so check before every transfer.

MoneyGram transfer fees depend on many factors. Paying with a credit card usually means higher fees. The best way to save is to use MoneyGram’s estimator tool and compare all your options. You want to keep more of your money in every transfer.

Reducing Transfer Fees

Image Source: unsplash

You want to keep more of your money when you send large transfers with MoneyGram. Reducing transfer fees is one of the best strategies you can use. Let’s look at three ways you can save more on every transfer.

Consolidating Transfers

If you send money often, you might think it’s easier to send small amounts each time. But this can cost you more in fees. MoneyGram, like many financial services, charges a fee for every transfer. When you add up the fees from many small transfers, you pay much more than if you send one large transfer.

- Sending one large transfer usually means you pay a lower fee per dollar sent.

- Many financial institutions, including MoneyGram, offer better rates for large transfers.

- You can save a lot by combining several small transfers into one big transfer.

- This strategy works best if your recipient can wait and does not need the money right away.

You can also explore fee-free options by checking if MoneyGram offers any special deals for large transfers. Timing your transfer can help you get the best value. If you want to save, always compare the total fees for small versus large transfers before you send money.

Using Rewards Programs

MoneyGram rewards you for being a loyal customer. If you send large transfers often, you should join the MoneyGram Plus Rewards program. This program gives you special benefits and helps you save on fees.

- You get faster transactions and access to exclusive promotions.

- MoneyGram gives you a dedicated hotline for help with your transfers.

- You qualify for the program after you complete three transfers in six months.

- Once you join, you get discounts on every transfer you send.

- The more large transfers you make, the more rewards you earn.

After you enroll, you unlock a variety of discounts and benefits. MoneyGram designed this program for people who send money often. You get value back every time you use their service. If you want to save on fees, joining this program is a smart move.

Checking Promotions

MoneyGram often runs promotions that help you save on fees. These deals can make a big difference, especially if you send large transfers. You should always check for new offers before you send money.

- MoneyGram offers promotional fee discounts and $0 fee transfers during holidays, special events, or certain seasons. New deals appear every few weeks.

- If you are a new user, you may get a $0 fee on your first online transfer.

- Joining MoneyGram Plus Rewards gives you 20% off your next transfer fee right away. After five transfers in a year, you can get up to 40% off every fifth transfer.

- If you refer a friend, both you and your friend can get a zero-fee transfer when your friend sends their first transfer within 30 days.

- Promo codes and rewards usually apply only to transfer fees, not to exchange rates.

- You can only use one promo code per transfer.

- Some promotions are only for certain countries or require a minimum transfer amount.

- Most rewards and welcome gifts expire 90 days after you get them.

You can find promo codes and discounts on the MoneyGram website, social media, email, coupon sites, and the mobile app. Always read the terms and conditions for each offer. Some deals last only a short time or have special rules.

Tip: Set a reminder to check for new promotions before every transfer. This habit can help you save on fees and get the most out of your large transfers.

By using these strategies—consolidating transfers, joining rewards programs, and checking for promotions—you can lower your MoneyGram fees. You keep more of your money and make every transfer count.

Timing and Exchange Rates

Monitoring Rates

You want to get the most value when you send international money transfers. Timing plays a big role in how much your recipient gets. MoneyGram updates its rate several times each day. The rate you see can change in just a few minutes. Sometimes, the rate is only guaranteed for 10 minutes. If you wait too long, you might get a different rate and pay more for your international transfer.

MoneyGram does not use the mid-market rate. Instead, it adds a markup. This means you pay more than the real market value. By watching the rate, you can choose the best time to send money. Here are some ways you can save:

- Check the rate before you send. If the rate looks low, wait for a better one.

- Use MoneyGram’s cost estimator and real-time tracking tools. These help you see the current rate and fees.

- Compare MoneyGram’s rate with other services. Some, like Wise, use the mid-market rate and offer more competitive rates for international money transfers.

- Remember, international money transfer rates change based on the amount, payment type, and delivery method.

If you want the best exchange rates, keep an eye on the rate and act when it looks good. This simple habit can help you save money on international transfers.

Avoiding Peak Periods

You might not know this, but the time you send money can affect your costs. Weekends and holidays are peak periods for international money transfers. During these times, MoneyGram often raises fees because more people send money and processing costs go up. The rate can also change more often, making it harder to get competitive rates.

Here are some tips to help you avoid extra costs:

- Try to send money on weekdays. Fees are usually lower, and you might get a better rate.

- Avoid sending money during holidays or busy weekends. These are peak periods for international transfers.

- Check MoneyGram’s website or talk to customer service for the latest fee and rate information.

- If you need to send money fast, remember that expedited transfers cost more. The fee depends on the country, amount, and delivery method.

By planning your international money transfers and watching the rate, you can avoid high fees and get more value. Always check for the most competitive rates before you send money. This way, you make sure your recipient gets the most from your transfer.

Comparing MoneyGram with Other Services

Rate and Fee Comparison

When you look at international money transfers, you want to know how MoneyGram stacks up against other money transfer services. Comparing rates and fees is the best way to see which provider gives you more value. MoneyGram often charges higher fees, especially for fast money transfers or cash pickups. The exchange rate you get from MoneyGram usually includes a markup, so you might not get the most competitive rates. Wise, for example, uses the real exchange rate and shows you all costs upfront. This means you pay less in hidden fees.

Here’s a table to help you compare MoneyGram with other popular services:

| Factor | MoneyGram | Alternatives (e.g., Wise, Remitly) |

|---|---|---|

| Speed | Fast money transfers, instant cash pickup | Fast for bank transfers, slower cash pickup |

| Fees | Higher for small or urgent transfers | Lower upfront fees, transparent pricing |

| Exchange Rate | Markup added, less competitive | Real rate, low or no markup |

| Withdrawal Options | Cash pickup, bank, mobile wallet | Bank, debit card, home delivery |

| Countries Covered | Over 200, strong global reach | Fewer countries, focus on key corridors |

| App Usability | Feature-rich, can be complex | Simple, user-friendly |

Note: MoneyGram’s exchange rates are more transparent than Western Union’s, but still less favorable than brokers like Wise.

Choosing the Best Option

You should think about what matters most for your international money transfers. If you need fast money transfers and your recipient wants cash pickup, MoneyGram is a strong choice. Its large network covers over 200 countries, so you can send money almost anywhere. If you care more about low fees and getting the best rate, alternatives like Wise or Remitly might work better. They offer competitive rates and clear pricing, especially for bank-to-bank transfers.

When comparing rates and fees, always check the total cost before you send. Look at the exchange rate, the fees, and how your recipient will get the money. Some services have better apps, while others offer more withdrawal options. You can save money by picking the provider that matches your needs for international money transfers.

Tip: Comparing rates and fees each time you send money helps you keep more of your money. Make this a habit for every international transfer.

Planning Your MoneyGram Transfers

Transfer Limits

You want to send money across borders, but you need to know how much you can send at once. MoneyGram sets transfer limits for international money transfers. For most countries, you can send up to $10,000 every 30 calendar days if you use online services in the USA, UK, or Canada. If you need to send more, you can visit a Walmart location partnered with MoneyGram for a high-value transfer.

Here’s a quick look at how these limits and fees work:

| Aspect | Details |

|---|---|

| Transfer Limit | Up to $10,000 every 30 days for most countries. More possible in person at Walmart. |

| Fee Structure | Fees jump between $500 and $1,000. Higher tiers mean higher costs. |

| Payment Method Impact | Debit card transfers cost less than cash pickups. |

| Fee Estimation Tool | Use MoneyGram’s online tool to check your costs. |

| Effect on Transfer Costs | Limits may force you to split large transfers, which can raise your total fees. |

If you plan to send large transfers, always check the current limits. Sending multiple international transfers to get around the limit can cost you more because of tiered fees. You want to avoid paying double fees just because you hit a cap.

Estimating Costs

You need to know the real cost before you send international money transfers. MoneyGram makes this easier with their online calculator. You enter the destination, amount, and delivery method. The tool shows you the transfer fee, the exchange rate, and any extra charges for your payment method. This helps you see the total cost for international transfers, including the exchange rate margin.

Tip: Always look at both the transfer fee and the exchange rate margin. Some providers show low fees but use a less favorable exchange rate, so your recipient gets less money.

MoneyGram locks in the exchange rate at the start of your transaction. You see exactly how much your recipient will get. This transparency helps you plan large transfers and avoid surprises. You can also ask for a real-time quote at an agent location or by calling customer service.

Many people make mistakes when planning international money transfers. Here are the most common ones:

- Not checking for hidden fees, like currency conversion markups or bank charges.

- Ignoring the exchange rate before sending money.

- Sending small amounts too often, which increases total fees.

- Not comparing international money transfer services.

- Entering the wrong recipient information, causing delays and extra costs.

If you want to save money on international transfers, avoid these mistakes. Always compare your options, use the fee estimator, and plan your high-value transfer ahead of time. This way, you keep more of your money and make your international transfers work for you.

You can save a lot on money gram transfers by making smart choices. Start by understanding how MoneyGram sets its fees. Always compare MoneyGram with other services before you send money. Try these steps to keep more of your money:

- Combine small money gram transfers into one larger transfer to cut down on fees.

- Use MoneyGram’s online tools and ACH transfers for better rates.

- Watch exchange rates and send money when MoneyGram offers a good deal.

- Join MoneyGram’s rewards program and look for fee-free promotions.

- Check the full fee structure every time you use MoneyGram.

Stay alert and plan your money gram transfers. Even small changes in how you use MoneyGram can help you save more over time.

FAQ

How can you track a transfer with MoneyGram?

You can track a transfer by using the MoneyGram website or mobile app. Enter your reference number and last name. You will see the status of your money right away. This helps you know when your recipient gets the funds.

What payment methods can you use for MoneyGram transfers?

You can pay with a debit card, credit card, or bank account. Some online wallets also work. Bank account payments usually have the lowest fees. Always check which options are available for your country and the recipient’s location.

How does MoneyGram protect your privacy and security?

MoneyGram uses strong encryption and security checks. Your personal details and money stay safe. The company follows strict rules to protect your privacy and security. Never share your reference number or account details with anyone you do not trust.

Can you cancel or change a MoneyGram transfer?

You can cancel or change a transfer if it has not been picked up or deposited. Log in to your MoneyGram account or call customer service. You may pay a small fee for changes or cancellations.

What should you do if your recipient does not get the money?

First, track a transfer using your reference number. If you see a problem, contact MoneyGram support. They can help you fix the issue or start a refund. Always double-check the recipient’s details before sending money.

Saving money on transfers means more of your funds reach your family, friends, or business partners. While MoneyGram can be convenient, its fees and exchange rate margins often add up quickly. With BiyaPay, you gain control: real-time FX rate checks and instant conversion, remittance fees as low as 0.5%, and support for multiple fiat and digital currencies. Best of all, BiyaPay enables same-day transfers with same-day arrival, giving you speed and security without hidden costs. Registration is simple, and you always see the exact delivered amount before confirming. Discover a smarter way to save on every transfer with BiyaPay.

Cut fees and boost speed—start today with BiyaPay.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.