- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Is Revolut safe to use in the UK?

Image Source: unsplash

You might wonder, is revolut safe to use in the UK? Revolut safety stands out because the company follows strict rules set by the FCA. When you open a revolut account, your money goes into safeguarded accounts with trusted partner banks. However, your funds do not have FSCS protection. Many people now choose digital banks like Revolut for their features and easy access. Revolut safety depends on strong security features and regular checks. If you ask, how does revolut work to keep you safe, the answer lies in its advanced security tools and clear protection steps. You can feel safe using your revolut account, but always stay alert.

Key Takeaways

- Revolut follows strict FCA rules and keeps your money in separate accounts with trusted banks to protect your funds.

- Most Revolut accounts do not have FSCS protection yet, but accounts under its new UK banking license will offer this safety.

- The app uses strong security tools like two-factor authentication, real-time alerts, and instant card freezing to keep your account safe.

- Scams and fraud can happen, so always stay alert, use security features, and never share your PIN or password.

- Revolut offers easy, fast money transfers and good digital features, but customer support and fraud reimbursement can sometimes be slow.

Revolut Safety in the UK

Image Source: unsplash

Is Revolut Safe?

You may ask, is revolut safe for your money and personal information? Revolut safety stands out because the company follows strict rules and uses advanced security tools. You can trust that your account uses strong security, such as two-factor authentication and instant spending alerts. These features help you keep your money safe and spot any unusual activity quickly.

When you look at revolut safety compared to other fintech companies, you see that Revolut uses ring-fenced accounts with large partner banks like Barclays, JP Morgan, Citibank, and Goldman Sachs. This means your money stays separate from Revolut’s own funds. If you want to limit your risk, you can top up your card only when needed. This practice helps you keep your exposure low and your funds safe.

Here is a table that compares Revolut’s safety record with another major fintech provider:

| Aspect | Revolut | Payoneer |

|---|---|---|

| UK Banking License | Granted July 25, 2024 (mobilisation period, not fully recognized) | Not a UK bank |

| Regulatory Status | Electronic Money Institution regulated by FCA | FCA regulated |

| Client Money Protection | Ring-fenced in licensed banks (Barclays, JP Morgan, Citibank, Goldman Sachs) | Works with large, trusted partner banks |

| FSCS Protection | Not protected under FSCS (no $108,000 guarantee, based on $1 = £0.78 exchange rate) | Not protected under FSCS |

| Safety Reliance | Depends on proper ring-fencing of client funds | Relies on partner bank security and certifications |

| Operational Advice | Top up card as needed to limit exposure | Use security features and fraud monitoring |

You can see that revolut safety depends on both regulation and the way your money is stored. While Revolut does not offer FSCS protection, it uses strong security and trusted banks to keep your funds safe. You should always stay alert and use the app’s security features to protect your account.

Note: Revolut is a safe and registered provider, but you should always check your account for any suspicious activity.

FCA Regulation

Revolut operates as an FCA-authorized e-money institution in the UK. The Financial Conduct Authority (FCA) regulates Revolut and checks that it follows the rules for handling your money. You can feel confident that Revolut must keep your funds separate from its own business accounts. This rule helps protect your money if Revolut faces financial problems.

Revolut has also received full registration from the FCA as a crypto asset firm. This means you can use Revolut for crypto asset exchange and custodial services in the UK. The company is in the mobilisation stage of its UK banking license, which was granted on July 25, 2024. During this period, Revolut can accept deposits up to $64,000 (based on $1 = £0.78 exchange rate) while it builds its banking systems.

Here is a summary of Revolut’s FCA authorizations:

| Authorization Type | Description |

|---|---|

| UK E-money Institution Regulation | Regulated by FCA, must safeguard customer funds under Electronic Money Regulations 2011 |

| Crypto Asset Firm Registration | Full FCA registration for crypto asset exchange and custodial services |

| UK Banking License (Mobilisation) | In mobilisation stage, can accept deposits up to $64,000 while building banking infrastructure |

| Consumer Credit Licence | Applied for, not yet granted by FCA |

FCA regulation gives you extra protection, but it does not guarantee that Revolut is immune to fraud or operational issues. The UK Payment Systems Regulator will soon require all payment service providers, including Revolut, to reimburse customers who fall victim to Authorised Push Payment (APP) fraud. This rule, starting October 7, 2024, will provide up to $108,000 in compensation and split liability between sending and receiving providers. This new rule adds another layer of safety for your money.

You should remember that, even with FCA regulation, Revolut does not offer FSCS protection for your funds. You must rely on the company’s ring-fencing of funds and its security measures. Always use the app’s security features and keep your account details private to stay safe.

Money in Revolut Protected

Safeguarding Funds

You want to know how Revolut keeps your money safe. Revolut follows strict rules set by the Financial Conduct Authority (FCA). The company acts as an e-money institution, not a traditional bank. This means Revolut must keep your funds separate from its own business money. You benefit from this rule because your money goes into special safeguarding accounts with licensed banks. These banks include trusted names like Barclays, JP Morgan, Citibank, and Goldman Sachs.

Revolut does not mix your money with its own. The company works with partner banks and payment networks to make sure your funds stay protected. If you use Revolut for investment services, third-party brokers hold your assets in separate accounts. This setup helps protect your money if Revolut faces financial trouble.

Here is a table that shows how Revolut safeguards your funds:

| Safeguard Aspect | Description |

|---|---|

| Regulatory Status | Revolut is an e-money institution (EMI) authorized under the UK Electronic Money Regulations 2011 and regulated by the FCA (FRN: 900562). |

| Safeguarding Requirement | Customer funds must be kept separate from Revolut’s own funds, either in dedicated safeguarding accounts with authorized banks or low-risk assets. |

| Insolvency Protection | If Revolut becomes insolvent, customer funds in safeguarding accounts are protected from other creditors and paid back to customers first. |

| FSCS Protection | Revolut’s customer funds are not covered by the FSCS, which guarantees up to $108,000 per customer per institution (based on $1 = £0.78). |

| Scope of Safeguarding | Safeguarding applies only to e-money and payment services, not to funds in Savings Vaults, cryptocurrencies, commodities, or stocks. |

| Additional Protections | Revolut must follow Payment Services Regulations and FCA’s Consumer Duty to protect you from fraud and ensure strong authentication. |

| Regulatory Oversight | The FCA checks that Revolut follows all safeguarding requirements and protects customer funds. |

You can feel safe using Revolut for money transfers and payments. The company’s safeguarding process helps keep your money safe, even if Revolut faces financial problems.

FSCS Protection

You may wonder if your money in Revolut protected by the Financial Services Compensation Scheme (FSCS). The FSCS protects customer deposits up to $108,000 (based on $1 = £0.78) if a bank fails. However, Revolut accounts do not have FSCS protection because Revolut operates as an e-money institution, not a traditional bank. Instead, Revolut uses safeguarding accounts to protect your funds.

If you use Revolut’s Savings Vaults, your money may have FSCS protection because third-party banks hold those funds. For regular Revolut accounts, you do not get the same guarantee as with a traditional bank. The company’s new UK banking license means some accounts will soon have FSCS protection, but most accounts still rely on safeguarding rules.

Note: Always check if your Revolut account falls under the new banking license. Only those accounts will have FSCS protection for deposits up to $108,000.

You should use Revolut’s security features and stay alert when making money transfers. This helps you keep your money safe, even without FSCS coverage.

What Happens if Revolut Fails?

You might worry about what happens to your money if Revolut fails. If Revolut becomes insolvent, the company’s safeguarding process protects your funds. The FCA requires Revolut to keep your money in separate accounts with partner banks. If Revolut fails, administrators will return your safeguarded funds before paying other creditors. However, you may not get your money back right away.

Recent cases show that customers often wait about 2.3 years to recover safeguarded funds after an e-money institution fails. Delays happen because of complex rules and poor record-keeping. You may also lose some money to administrative costs during the process.

If your account falls under Revolut’s new UK banking license, you get FSCS protection. This means you can claim up to $108,000 if Revolut fails. Until Revolut completes its transition to a full bank, most accounts still rely on safeguarding, not FSCS.

You should always keep track of your account status and use Revolut’s security tools. When you make money transfers or receive payments, check your account for any issues. This helps you stay safe and protect your funds.

Revolut Safety Features

Account Security

You want your revolut account to stay safe. Revolut uses several security features to protect your personal data and money. When you log in, you use two-factor authentication. This means you need your password and a code from your phone. You can also use fingerprint or face recognition for quick access. These revolut key features help keep your personal data safe and stop others from getting into your account.

Revolut uses end-to-end encryption. This keeps your information private when you use the banking app. The app sends you real-time alerts for every spending or exchange. You can spot any strange activity right away. If you see something odd, you can freeze your card in the app. This stops anyone from using your card until you unfreeze it.

Here are some revolut safety measures you get with your account:

- Two-factor authentication for login and spending

- Biometric login options

- End-to-end encryption for all data

- Real-time spending and exchange alerts

- Instant card freezing

These features work together to keep your revolut account safe and your personal data safe.

Card Protection

Revolut gives you strong card protection features. You can use disposable virtual cards for online spending. These cards work only once, so no one can reuse your details. If you lose your card or see a strange charge, you can freeze your card in seconds. The app lets you control spending limits and turn off features like contactless payments or ATM withdrawals.

Revolut uses AI to spot scams and block bad transactions. If the system sees a risky payment, it may stop it and ask you for more details. You get tips in the app about common fraud tricks. You can also talk to fraud experts if you need help. These features help keep your spending and exchange safe.

Fraud Prevention

Revolut uses advanced anti-fraud processes to protect your money. The company works with partners to check your digital footprint and device details. Machine learning models look for strange spending or exchange patterns. If the system finds something odd, it blocks the transaction and sends you an alert.

Revolut updates its security features often. The team uses global standards to keep your revolut account safe from new threats. You get real-time alerts for every spending and exchange. If you spot a problem, you can act fast. These features help reduce fraud and keep your money safe.

Bank Comparison

Is Revolut Safe Compared to Banks?

You may wonder if Revolut is as safe as traditional banks for your spending, exchange, and money transfers. Both Revolut and high street banks follow strict rules, but there are some key differences. High street banks in the UK protect your deposits up to $108,000 under the Financial Services Compensation Scheme (FSCS). Revolut, until recently, did not offer this protection. Instead, Revolut kept your money separate from its own funds in trusted partner banks. Now, Revolut has a UK banking license with restrictions. Once fully operational, Revolut plans to offer FSCS protection for your deposits, just like traditional banks.

Here is a table comparing Revolut and traditional UK banks:

| Aspect | Revolut | Traditional UK Banks |

|---|---|---|

| Regulatory License | Holds a European banking license, subject to strict financial audits | Governed by long-established regulatory frameworks with strict capital reserve requirements |

| Deposit Protection | Protects client deposits up to a certain amount per EU regulations | Deposit insurance often up to $108,000 providing strong savings security |

| Security Measures | Two-factor authentication, instant card blocking/unblocking via app, customizable payment limits | Robust authentication systems, fraud alerts, transaction monitoring, dedicated compliance departments |

| Data Protection & Compliance | Complies with GDPR and anti-money laundering regulations | Entire departments dedicated to compliance and combating financial crime |

| Customer Support | 24/7 live chat support | More accessible support including in-branch and telephone options |

| Security Focus | Modern, digitally focused, appealing to tech-savvy users | Broader, more established security infrastructure with personal advisory services |

Revolut stands out for its digital features and user-controlled security. You can freeze your card instantly, set spending limits, and manage your account from your phone. These features make Revolut a strong choice for safe spending, exchange, and money transfers, especially if you want the best way to take money abroad. However, high street banks offer in-person support and a longer history of safe banking.

Note: Revolut is still in a transition phase. Some accounts may not yet have full FSCS protection, so always check your account type before making large deposits.

Security Standards

Revolut follows strict security standards to keep your spending, exchange, and transfers safe. The company complies with major data protection laws, including GDPR. Revolut uses encryption for all data, secure data centers, and multi-factor authentication. You get features like fingerprint identification, disposable virtual cards, and 3D secure protection for online spending and exchange.

Here are some key security features Revolut offers:

- Encryption for all data transfers and storage

- Multi-factor authentication and biometric checks for account access

- Real-time fraud detection using the Sherlock system

- Instant notifications for logins from new devices

- User-set transaction limits and biometric verification for large transfers

- Quick restriction of access if your device is lost or stolen

Traditional banks also use strong security, but Revolut’s digital-first approach gives you more control over your account. You can manage spending, exchange, and money transfers directly from the app. Revolut’s fee-free account and advanced features help you stay safe while handling your finances online or abroad.

Risks and Staying Safe

Image Source: unsplash

Common Scams

You need to know about the risks when using revolut for spending, exchange, and transfers. Scammers often target revolut users with fake text messages that look like they come from the app. These messages may tell you to verify your details or risk account freezing. If you enter your PIN on a fake page, scammers can steal your money and move it to crypto accounts that are hard to trace.

Here are some common scams that affect revolut users:

- Authorised push payment (APP) fraud, including investment, charity, romance, and impersonation scams.

- Card fraud, such as remote purchase fraud, lost or stolen card fraud, and account takeover.

- Remote support scams, where criminals ask you to install software so they can control your device.

- Delivery fee scams, where scammers pretend to be from a delivery company and ask for your personal information.

- CEO fraud, which targets businesses by pretending to be a senior leader and asking for money transfers.

Regulators have noticed that revolut accounts are often used by fraudsters for APP fraud. The rate of these scams is higher than in many traditional banks. In 2023, revolut received about 3,500 complaints to the ombudsman, more than any other bank or e-money firm in the UK. Some users say revolut does not always reimburse victims of fraud quickly. You should stay alert and watch for these risks when using revolut for exchange or spending.

How to Protect Your Account

You can take steps to avoid falling victim to fraud when using revolut for exchange, spending, or transfers. Always check the sender before clicking on links in messages. Revolut will never ask for your PIN or password by text or email. If you get a message that seems suspicious, contact revolut support through the app.

Follow these tips to keep your revolut account safe:

- Use two-factor authentication and set strong passwords.

- Never share your PIN or password with anyone.

- Freeze your card in the app if you notice strange spending or exchange activity.

- Use disposable virtual cards for online spending.

- Update your app and device to the latest version.

Revolut experienced a data breach that affected about 0.16% of its users, including over 20,000 in Europe. No funds or passwords were stolen, but affected users face a higher risk of fraud. Revolut contacted those users and set up a team to monitor their accounts. If you received an alert, stay extra careful with your spending and exchange.

Regulators have also found problems with revolut’s internal controls and anti-money laundering checks, especially for exchange and crypto services. You should review your account often and report any issues right away. By following these steps, you can help keep your revolut account safe while enjoying easy spending and exchange.

Revolut Review: User Experiences

Customer Feedback

When you look at revolut customer reviews, you see a mix of positive and negative experiences. Many users like the app’s easy design and fast money transfers. You can manage your account, freeze your card, and set spending limits with just a few taps. People often say that revolut makes it simple to send money abroad and track spending. If you ask, how does revolut work for daily banking, most users find it quick and convenient.

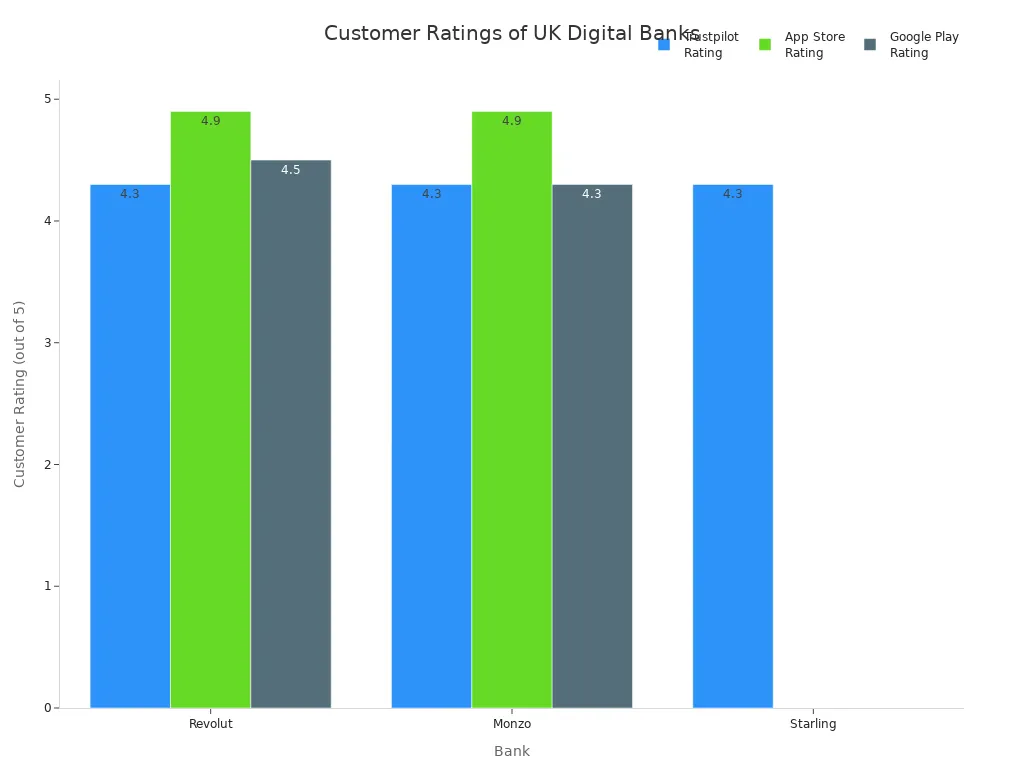

You can compare revolut reviews with other digital banks in the UK. The table below shows how revolut stands next to Monzo and Starling based on customer satisfaction:

| Bank | Trustpilot Rating (Reviews) | App Store Rating (Reviews) | Google Play Rating (Reviews) | Number of Users |

|---|---|---|---|---|

| Revolut | 4.3/5 (129,508) | 4.9/5 (569,120) | 4.5/5 (2,225,875) | 25 million+ |

| Monzo | 4.3/5 (26,083) | 4.9/5 (140,415) | 4.3/5 (104,000) | 7.2 million |

| Starling | 4.3/5 (34,479) | N/A | N/A | N/A |

You can see that revolut has a high number of reviews and a strong rating, especially on the App Store and Google Play. This shows that many people trust revolut for their banking needs. The chart below gives a visual comparison of customer satisfaction ratings:

Complaints and Issues

You should also know about the main problems users report in revolut customer reviews. Many complaints focus on customer service and fraud protection. Here are some of the most common issues:

- Revolut’s customer service has become weaker, making it hard to get help during fraud cases.

- Some users feel that revolut does not reimburse scam victims fairly.

- The lack of phone support and reliance on chatbots frustrates customers in urgent situations.

- Some people think revolut cares more about profits than service quality.

You can see more details in the list below:

- Revolut saw a 35% rise in fraud complaints in the UK, more than other lenders.

- Thousands of users affected by authorized push payment (APP) fraud did not get reimbursed.

- Many cases went to the UK’s Financial Ombudsman Service, which ordered compensation in almost half of the cases.

- Customers lost large sums and felt emotional stress because of scams and slow support.

- The increase in APP fraud shows a need for better fraud prevention.

Some revolut reviews mention that criminals bypassed facial recognition, and over 100 fraudulent transactions happened quickly without alerts. Users also faced delays when contacting support, which is mostly a chatbot. Revolut received 9,793 fraud complaints, more than any peer, including a case where a customer lost $211,500 (using $1 = £0.78). The company’s status as an e-money firm, not a full bank, adds to customer concerns.

When you read a revolut review, you should weigh both the positive feedback and the complaints. This helps you decide if revolut fits your needs.

You can use revolut in the UK with confidence if you stay alert and follow safety tips. Revolut now holds a UK banking license, but you should know that regulators expect stronger fraud controls. The company uses advanced technology for identity checks and fraud detection. You get easy tools to freeze your card and set limits. Revolut faces more scrutiny than before, so you may see more updates to its app and policies. You should check your account often, use two-factor login, and watch for scams. Revolut works well for spending and travel, but you must stay aware of fees and customer support limits. If you want extra safety, always use the app’s security features and keep your details private.

FAQ

What makes Revolut safe for your money?

You get strong security features like two-factor authentication and instant alerts. Revolut keeps your funds in separate accounts with trusted banks. You can freeze your card anytime. These steps help protect your money from fraud and theft.

Does Revolut offer FSCS protection for all accounts?

No, most Revolut accounts do not have FSCS protection. Only accounts under the new UK banking license will get this coverage. You should check your account type before making large deposits.

How quickly can you access your money if Revolut fails?

You may wait several months or even years to get your money back if Revolut fails. Administrators must return safeguarded funds first, but delays can happen. FSCS-protected accounts usually pay out faster.

Can you use Revolut for international transfers safely?

Yes, you can use Revolut for international transfers. The app uses encryption and secure networks. You get real-time alerts for every transaction. Always double-check recipient details before sending money.

Where can you find more revolut safety faqs?

You can visit the official Revolut website or check the app’s help section. These resources provide answers to common questions about account security, fraud prevention, and money protection.

While Revolut offers strong digital security, many UK users still worry about the lack of FSCS coverage, hidden fees, and slow fraud reimbursements. If you want safer, cheaper, and more transparent cross-border transfers, consider BiyaPay instead:

- Remittance fees from as low as 0.5%, far below most banks and fintech rivals

- Real-time FX rates so you always know exactly how much arrives

- Support for both fiat and crypto, adding flexibility for global payments

- Same-day delivery, with clear tracking and no hidden costs

Don’t let safety gaps or high charges drain your money — switch to smarter international transfers with BiyaPay.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.