- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Unveiling the Secrets of Cash App: Answers to Your Top Five Questions About Adding Funds from a Credit Card!

Image Source: pexels

Are you most concerned about how quickly funds from a credit card reach your Cash App? In fact, in most cases, you’ll find that funds arrive almost instantly. Unveiling the secrets of Cash App, you’ll also discover many small details hidden in fees, limits, and operational steps. If you want to avoid spending unnecessary money or encountering restrictions, make sure to pay attention to the prompts at each step.

Key Takeaways

- Adding funds to Cash App via credit card typically arrives within minutes, and choosing the “Instant Deposit” service can make it even faster, though it may incur a fee.

- After completing identity verification, Cash App’s funding and payment limits increase significantly, while unverified accounts have lower limits that require attention to restrictions.

- You can customize the funding amount during the process, which is simple, but ensure the amount is within the limit range and verify credit card information to avoid funding failures.

- Credit card funding incurs a 3% platform fee, and banks may treat it as a cash advance, charging additional fees, so it’s advisable to understand the costs in advance.

- Using a non-USD credit card for funding will incur foreign currency conversion fees, so choosing a USD credit card or debit card can effectively reduce additional costs.

Unveiling Cash App’s Secrets: Funding Speed

Image Source: unsplash

How Fast Funds Arrive

Are you often worried about whether adding funds to Cash App with a credit card will take too long? In fact, unveiling Cash App’s secrets, you’ll find that in most cases, credit card funding arrives almost instantly. Based on payment industry experience, such as the Payline platform, credit card funding takes an average of 3 minutes to arrive. When you use Cash App, you can usually experience similar speeds. As long as the operation is correct, funds will quickly appear in your account. If you choose Cash App’s “Instant Deposit” service, there’s almost no wait, and you’ll see your balance increase within minutes. However, if you use the standard transfer method, it may take 1-3 business days, especially during holidays or when the banking system is undergoing maintenance.

You may wonder how Cash App’s funding speed compares to other similar apps. The table below can help you see it clearly:

| App Name | Funding Speed | Fee Details | Other Restrictions or Features |

|---|---|---|---|

| Cash App | P2P transfers arrive instantly | Some transfer methods are fee-free | Transfers require only a phone number, email, or username, making it simple |

| Venmo | Funds arrive within 30 minutes | Instant transfers incur a 1% fee | Supports instant transfers to debit cards and bank accounts |

| Apple Cash | Arrival time not specified | Transfer fee of 1.5% | Relies on iMessage platform, recipient needs compatible device |

Factors Affecting Funding Speed

Unveiling Cash App’s secrets, you’ll find that funding speed is influenced by many factors. Sometimes when it feels slow, these reasons may be at play:

- The funding channel you choose varies, such as using a credit card, a Hong Kong bank debit card, or a third-party payment, which affects the arrival speed.

- Network delays can affect information transmission. If you’re using unstable Wi-Fi, it may cause slower funding.

- The speed of information transfer between the bank and Cash App’s system is also critical. Funding will only arrive after the bank confirms the transfer’s success.

- The stability of your network connection is also important. When the network is unstable, funding requests may be delayed.

- Different channels have noticeable differences in arrival times; for example, funding via Alipay may take up to 24 hours, while some bank apps allow real-time arrivals.

Tip: If you want funds to arrive faster, prioritize the “Instant Deposit” service, which, despite a 1.5% fee, may save you valuable time.

Unveiling Cash App’s secrets means understanding that funding speed depends not only on the platform but also on your operational habits, chosen channels, and network environment. Next time you fund your account, pay attention to these details for a smoother funding experience.

Limits and Frequency Restrictions

Daily/Weekly Caps

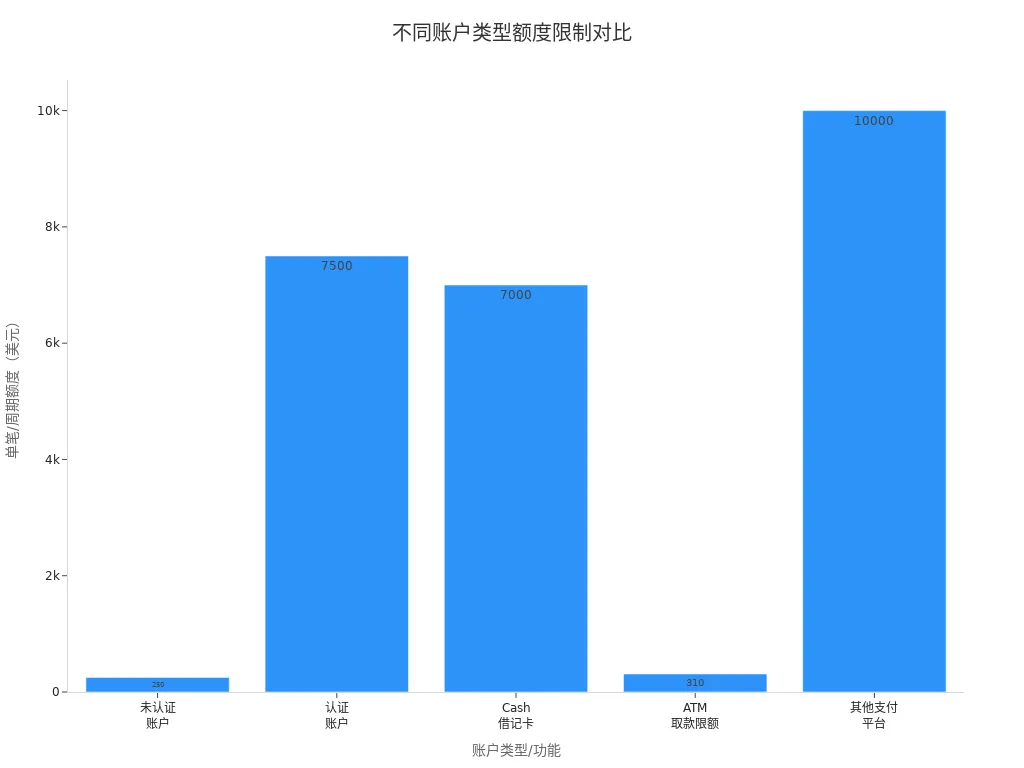

When funding Cash App, you’re likely concerned about how much you can add daily and weekly. In fact, Cash App has clear limits for different account types. If your account is unverified, you can only send up to $250 within 7 days, with a receiving limit of $1,000 within 30 days. Once you complete identity verification, limits increase significantly, with a weekly sending cap of $7,500 and no limit on receiving. If you also link a Cash debit card, single transactions and daily spending limits can reach $7,000, with a 7-day spending cap of $10,000 and a 30-day cap of up to $25,000. You can refer to the table below for a quick overview of limits for different accounts and features:

| Account Type/Feature | Funding and Payment Limits | Notes |

|---|---|---|

| Unverified Account | $250 sending limit within 7 days, $1,000 receiving limit within 30 days | Lower limits, strict restrictions |

| Verified Account | $7,500 weekly sending limit, no receiving limit | Limits significantly increase after verification |

| Cash Debit Card | $7,000 per transaction, $7,000 daily spending, $10,000 within 7 days, $25,000 within 30 days | Higher limits with debit card, supports cashback offers |

| ATM Withdrawal Limit | $310 per transaction, $1,000 daily, $1,000 within 7 days, with a $2 fee | Lower withdrawal limits with fees |

| Other Payment Platforms (e.g., Square Debit Card) | $10,000 per transaction, $25,000 daily, etc. | Higher limits but lacks tiered verification management |

You can also check the chart below for a more visual comparison of Cash App and other platforms’ limit settings:

Handling Over-Limit Issues

If you get a prompt that you’ve exceeded your limit while funding, don’t panic. First, check your account’s verification status. Unverified accounts have low limits, so it’s recommended to complete identity verification promptly to increase your weekly funding and payment limits. If you’re already verified but still hit the limit, you can wait until the next cycle to proceed. In some cases, contacting customer service can help with temporary limit adjustments. Plan your funding amounts reasonably to avoid frequently triggering restrictions, making your experience smoother.

Tip: You can check your current and remaining limits in Cash App’s “Account Settings” at any time to plan your funds and avoid disruptions due to exceeding limits.

Partial Balance Funding

Operation Process

You may not want to transfer your entire credit card balance to Cash App every time. In fact, you can completely customize the funding amount based on your needs. The process is also very simple. The checklist below can help you complete it quickly:

- Open Cash App and log into your account.

- Find the “Add Cash” option on the main interface and click to enter.

- You can choose system-recommended amounts or directly input the specific amount you want to fund, such as $50, $120, or even smaller amounts.

- Enter your phone number or other identification information to ensure account security.

- Confirm payment details and select your credit card as the payment method.

- Double-check and click confirm. The system will process your request immediately.

- After successful funding, you’ll receive a notification, and your balance will update instantly.

You’ll find the entire process quite smooth. As long as you follow the prompts step by step, errors are unlikely.

Notes to Consider

While custom funding amounts are flexible, you should pay attention to a few details during the process. First, Cash App has requirements for minimum and maximum funding amounts per transaction. For example, the minimum might be $1, while the maximum depends on your account verification level. It’s best to check your limits in advance to avoid entering amounts outside the allowed range.

Additionally, double-check the amount entered to avoid inputting too much or too little. When selecting credit card payment, ensure the card information is correct to prevent funding failures due to expired cards or incorrect details. If you’re using a Hong Kong-issued credit card, check the related fees and exchange rates in advance to avoid unnecessary losses.

Tip: Before each funding, consider your actual needs and plan the amount wisely to avoid frequent operations and better manage your funds.

Additional Fees

Image Source: pexels

Cash Advance Fees

When you fund Cash App with a credit card, besides the platform’s fees, be aware that the credit card issuer may treat the transaction as a “cash advance.” What does this mean? The bank may consider this funding as equivalent to an ATM cash withdrawal. As a result, the bank will charge an additional cash advance fee. For example, if you use a Hong Kong bank’s credit card, you’ll typically incur a 1% to 5% cash advance fee, with a minimum of around $5. Many banks also start charging interest from the funding date, with annual interest rates typically around 20%. Each time you fund, the fees and interest add up. If you don’t repay promptly, the costs will keep rising.

Tip: Before funding, it’s best to call your issuing bank to confirm whether the transaction will be treated as a cash advance. This helps you budget and avoid being surprised by high fees.

3% Transaction Fee

When funding Cash App with a credit card, the platform itself also charges a fee. According to the latest 2025 Cash App usage guide, credit card funding incurs a 3% transaction fee. For example, if you fund $100, Cash App will charge an additional $3. Funding with a debit card, however, incurs no such fee. This 3% rate is consistently mentioned in Cash App’s official documentation, with no other fee rates found.

| Funding Method | Cash App Fee | Potential Fees from Credit Card Issuer |

|---|---|---|

| Credit Card | 3% | Cash advance fee + interest |

| Debit Card | 0 | Usually no additional fees |

Before funding, it’s best to calculate the total cost. This helps avoid affecting your financial plans due to high fees. If you want to save money, prioritize debit card funding or direct bank transfers.

Note: Understand all related fees before each funding to manage your funds better and avoid unnecessary expenses.

Foreign Transaction Fees

Non-US Credit Cards

When you use a non-US credit card (e.g., one issued by a Hong Kong bank) to fund Cash App, you often face foreign currency conversion fees. Since Cash App settles in USD, if your credit card account isn’t in USD, the bank will automatically convert your local currency to USD. During this process, the bank charges a foreign transaction fee, typically 1% to 3% for Hong Kong bank credit cards. For example, if you use a HKD credit card to fund $100 at an exchange rate of 1 USD to 7.8 HKD, the bank will convert HKD to USD and charge about $1 to $3 in fees.

Note: Some banks list a separate “foreign transaction service fee” on the statement, so check your bill details carefully to avoid duplicate charges.

You may also notice that, besides the foreign transaction fee, banks use their own exchange rates for conversions, which are often slightly higher than market rates, meaning you pay a bit more than expected.

Ways to Avoid Fees

Want to save on foreign transaction fees? Here are some simple ways to reduce losses:

- Choose a credit card that supports USD settlement. Many Hong Kong banks offer USD credit cards, and using one avoids foreign transaction fees when funding Cash App.

- Look out for credit card foreign transaction promotions. Some banks periodically offer “foreign transaction cashback” or “fee-free” promotions, which you can take advantage of for funding.

- Before funding, check your bank’s real-time exchange rate and fee policy to calculate costs in advance and avoid being caught out by high rates.

- If you have friends or family in the US, consider having them fund your Cash App with a local credit card and transfer the funds to you, bypassing foreign transaction fees.

| Method | Foreign Transaction Fee | Applicable Scenarios |

|---|---|---|

| USD Credit Card Funding | No | When you have a USD credit card |

| HKD Credit Card Funding | Yes (1%-3%) | When you only have a HKD credit card |

| Debit Card (USD Account) | No | When you have a USD debit card |

| Friend/Family Proxy Funding | No | When US-based friends assist |

Tip: Confirm fee policies with your bank in advance and choose the most cost-effective funding method to make every transaction more efficient and economical.

When choosing a funding method, don’t forget to consider fees, convenience, and security. Unveiling Cash App’s secrets, you’ll find that direct funding through third-party payment platforms or business accounts can make fund management more efficient. Combine your credit card and account situation to flexibly choose the best method. Understanding all fees and restrictions in advance can save you significant money. With careful planning, every transaction can be more secure and cost-effective.

FAQ

What to Do If Credit Card Funding Fails?

You can first check if the credit card information was entered correctly. If the details are correct, contact the issuing bank (e.g., a Hong Kong bank) to confirm if there are transaction restrictions. You can also try using a different credit card.

Why Does Funding Sometimes Take Longer?

Bank system maintenance or unstable networks can cause delays. You can operate during periods of good network connectivity or use the “Instant Deposit” service to speed things up.

How to Avoid High Fees?

Prioritize debit card funding, which typically has no 3% fee. Using a USD credit card can also reduce foreign transaction fees. Consult your bank’s customer service before funding to understand all fees.

Are There Limits on Funding Amounts?

You can fund up to $7,500 weekly, with lower limits for unverified accounts. Check your remaining limits in Cash App’s account settings to plan funding wisely.

Is Funding with a Hong Kong Bank Credit Card Safe?

When funding Cash App, the platform encrypts your payment information. As long as you protect your account password and verification code, your funds are generally secure. If you notice anything unusual, contact customer service immediately.

While Cash App credit card top-ups come with a 3% fee and hidden foreign exchange charges, BiyaPay offers a smarter global solution. Covering most countries and regions worldwide, BiyaPay provides real-time FX conversion, remittance fees starting at just 0.5%, and same-day delivery when you send funds on the day. Whether it’s tuition, rent, or family support, BiyaPay makes international transfers faster, cheaper, and more transparent — across both fiat and crypto.

Sign up with BiyaPay today and unlock a seamless way to move money globally.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.