- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Unlocking International Transactions: A Complete Guide to Using Venmo with International Cards

Image Source: pexels

When you sign up for Venmo, you will find that Venmo’s official policy states its service is only for U.S. local payments. You cannot conduct international transactions through Venmo, nor can you use it for cross-border transfers. Even if you have an international card, Venmo does not explicitly support such conditions. For many Chinese users, this becomes a major barrier to using Venmo. You need to pay special attention to these restrictions to avoid financial losses due to improper operations.

Key Takeaways

- Venmo only supports U.S. local registration and USD transactions, and cannot directly bind Chinese or Hong Kong bank accounts.

- The bank card you bind must be a U.S.-issued credit or debit card, and you need a U.S. phone number and bank account.

- Credit card payments incur a 3% transaction fee, so it’s recommended to prioritize using a bank account or debit card to save on fees.

- International transactions are restricted with strict identity verification and limits, making it difficult for non-U.S. users to use.

- It’s recommended to choose tools like PayPal or Panda Remit, which are better suited for international remittances, ensuring fund security and convenient receipt.

Supported Regions

Venmo Service Regions

When you use Venmo, you first need to understand its service scope. Venmo is a U.S.-based third-party payment platform primarily supporting USD transactions. You can only register and use a Venmo account in the U.S.. Although some descriptions mention “applicable regions are local and global,” in reality, Venmo does not explicitly support registration and use outside the U.S. If you are in China or other countries, you cannot directly conduct international transactions through Venmo.

Note: Venmo has strict requirements for the IP address and phone number used during registration. You cannot register an account with virtual U.S. numbers like Google Voice. The platform requires you to bind a U.S. local phone number and typically a U.S. local IP address. Even if you try using a VPN and virtual number, registration remains highly challenging.

Additionally, Venmo requires you to bind a U.S. bank account separate from a regular bank account. This account is not protected by FDIC or NCUA insurance, further emphasizing the platform’s strict requirements for account binding. These restrictions make it difficult for non-U.S. users to successfully register and use Venmo.

International Card Binding Conditions

If you want to bind a bank card to Venmo, you must meet the following conditions:

- You can only bind U.S.-issued bank accounts, debit cards, or credit cards.

- For debit cards, the Venmo Mastercard, issued by The Bancorp Bank, supports the Mastercard network with automatic cashback and free withdrawals.

- For credit cards, the Visa credit card issued by Synchrony Bank offers cashback and comes with a QR code for convenient scan-to-pay.

- You must have a U.S. local bank account and a U.S. phone number to complete the binding.

- Although virtual credit cards meet Visa or Mastercard international standards, they still need to meet U.S. account and phone number requirements. You cannot directly bind international bank cards issued by banks in China, Hong Kong, or other regions to Venmo.

When binding an international card, common reasons for failure include:

- The debit card fails verification, or the bank account requires additional verification.

- Not binding a Social Security Number (SSN), which restricts account functionality.

- Platform risk control measures may block binding or transfers, requiring additional verification or customer service contact.

- Insufficient card balance, leading to payment failure.

- Entering incorrect recipient information, resulting in transfer failure.

You also need to pay attention to daily and monthly limits, network connection stability, and whether the app version is up to date, as these factors affect the success rate of binding and using international cards.

If you hope to conduct international transactions through Venmo, you will face significant restrictions. The platform only supports U.S. local accounts and bank cards, unable to meet the international transaction needs of Chinese users. You need to consider other payment tools better suited for international transactions.

Usage Process

Image Source: pexels

Adding an International Card

When you want to add a bank card to Venmo, you need to first download and install the Venmo mobile app. During account registration, enter your phone number and password, or set up a new account. When adding a bank account, Venmo will ask you to enter the bank account number, routing number, and name. If you choose to add a credit card, the system will prompt you to enter the card number, expiration date, and security code. Please note that only U.S.-issued bank cards and credit cards can be bound. You cannot directly use international cards issued by banks in China or Hong Kong. Credit card payments incur a transaction fee, typically 3% of the transaction amount. You need to prepare the relevant information in advance and ensure it is entered correctly.

- Download and install the Venmo app.

- Register an account, entering your phone number and password.

- Select “Add Bank Account” or “Add Credit Card.”

- Enter the bank account number, routing number, and name, or input credit card information.

- Submit after confirming the information.

Verification Steps

After you submit your bank account information, Venmo will send two small deposits to your account. You need to enter the exact amounts received in the app to complete the verification. If you add a credit card, the system will automatically verify the card information. The verification process typically completes within 1-3 business days. You need to ensure the bank account or credit card is in good standing with sufficient balance. If verification fails, it’s recommended to check if the information is correct or contact bank customer service.

Tip: During verification, closely monitor your bank account activity to avoid verification failure due to incorrect information.

Payment and Receipt Methods

After completing account verification, you can make payments and receive funds through Venmo. You can choose to pay using a bound bank account or credit card. Credit card payments incur a 3% fee, while bank account payments are free. You can transfer funds by scanning a QR code, entering the recipient’s username, or using their phone number. When receiving funds, the transferred amount goes directly to your Venmo balance. You can withdraw the balance to a bound U.S. bank account at any time. Please note that Venmo does not support direct transfers to bank accounts in China or Hong Kong. During use, you need to pay attention to transaction fees and exchange rate changes to manage funds effectively.

International Transaction Restrictions

Image Source: pexels

Fee Structure

When using Venmo for international transactions, you must understand the fee structure for different payment methods. The platform is friendly for most transfer methods, but some operations incur additional fees. You can refer to the following:

- If you use your Venmo balance, U.S. bank account, debit card, or prepaid card for transfers, the platform does not charge a fee.

- If you choose to pay with a credit card, Venmo charges a 3% fee. For example, if you pay $100 with a credit card, the actual received amount is $97.

- Venmo currently does not charge additional fees for international cards, but you can only bind U.S.-issued bank cards. International cards issued by banks in China or Hong Kong cannot be directly bound.

Tip: When choosing a payment method, it’s recommended to prioritize a bank account or debit card to effectively save on fees.

Limit Rules

When conducting international transactions, you also need to pay attention to the platform’s limit rules. Venmo sets single-transaction and periodic limits for each account. You can refer to the table below for common scenarios regarding limits and fees:

| Scenario | Single Transaction Limit (USD) | Weekly Cumulative Limit (USD) | Fee |

|---|---|---|---|

| Bank Account/Debit Card Transfer | 4,999.99 | 6,999.99 | Free |

| Credit Card Payment | 2,000.00 | 4,999.99 | 3% |

| Withdrawal to U.S. Bank Account | 19,999.99 | 19,999.99 | 1.75% (Instant) / Free (1-3 days) |

If you attempt to exceed the limit, the system will automatically reject the transaction. You need to plan fund transfers carefully to avoid delays in international transactions due to limits.

Exchange Rates and Settlement

When using Venmo for international transactions, all funds are settled in USD. The platform does not automatically convert USD to RMB or HKD. If you need to transfer funds to a bank account in China or Hong Kong, you must complete the conversion through other channels. During the conversion process, you will encounter exchange rate differences. Banks or third-party platforms will charge a conversion fee based on the daily exchange rate. For example, $100 converted at a rate of 1 USD to 7.2 RMB will result in a slightly reduced amount due to exchange rate fluctuations and fees.

When withdrawing, you can choose instant or standard transfers. Instant transfers incur a 1.75% fee and complete in minutes. Standard transfers are free but take 1-3 business days. You should choose the appropriate settlement method based on your needs.

When planning international transactions, you must pay attention to fees, limits, and exchange rate changes. This can effectively reduce costs and ensure fund security.

Risks and Precautions

Compliance and Risk Control

When using Venmo, you must strictly adhere to the platform’s compliance requirements. Venmo only allows U.S. local users to register and use the service. You need to meet the following conditions:

- You must be a U.S. resident with a U.S. phone number and U.S. bank account.

- You can only bind U.S.-issued credit or debit cards, not international cards issued by banks in China or Hong Kong.

- During registration, the platform requires you to submit the last four digits of your Social Security Number (SSN), valid ID, date of birth, and registration address.

- You need to connect a U.S. bank account via the Plaid platform or add a U.S. local bank card and complete small-amount verification.

- If you are a Chinese merchant wanting to accept Venmo payments, you must access it indirectly through the PayPal ecosystem, register a business account on PayPal’s China website, submit a business license and legal representative information, and complete KYB verification.

Venmo has strict identity verification and payment method binding requirements for international card users. You cannot directly register or pay with an international card, and cross-border use is restricted. The platform monitors abnormal transactions through its risk control system to prevent money laundering and fraud.

Common Failure Reasons

When attempting to bind a bank card or conduct international transactions, you may encounter various failures. Common reasons include:

- You do not have a U.S. local phone number or U.S. bank account, leading to registration failure.

- The information you submitted is incomplete, failing real-name authentication.

- The bound bank card is not U.S.-issued, and the system automatically rejects it.

- You did not complete the small-amount verification, so the account cannot be activated.

- The platform detects abnormal logins or transactions, triggering risk control restrictions.

- You attempt to exceed single-transaction or periodic limits, and the system rejects the transaction.

If you encounter a failure, you can check if the information was entered correctly and ensure the bank card and account are in good standing. If the issue persists, it’s recommended to contact Venmo customer service or your bank for assistance.

Account Security

When using Venmo, account security is crucial. You should pay attention to the following:

- Set a strong password and change it regularly to prevent account theft.

- Avoid logging into Venmo on public networks to prevent information leaks.

- Enable two-factor authentication to enhance account security.

- Regularly check account transaction records and address anomalies promptly.

- Do not disclose personal information or verification codes to prevent fraud.

If you notice abnormal logins or fund changes, immediately freeze your account and contact customer service. The platform will protect your funds based on compliance requirements, but you must also proactively mitigate risks.

Alternatives

PayPal

If you need to make international remittances, PayPal is a widely accessible option. PayPal supports 202 countries and regions globally, with 25 currencies. You can use PayPal for international remittances in the following regions:

- Africa: Algeria, Angola, Kenya, South Africa, etc.

- Americas: United States, Canada, Mexico, Brazil, etc.

- Asia-Pacific: Mainland China, Hong Kong, India, Japan, Australia, etc.

- Europe: United Kingdom, Germany, France, Italy, Spain, etc.

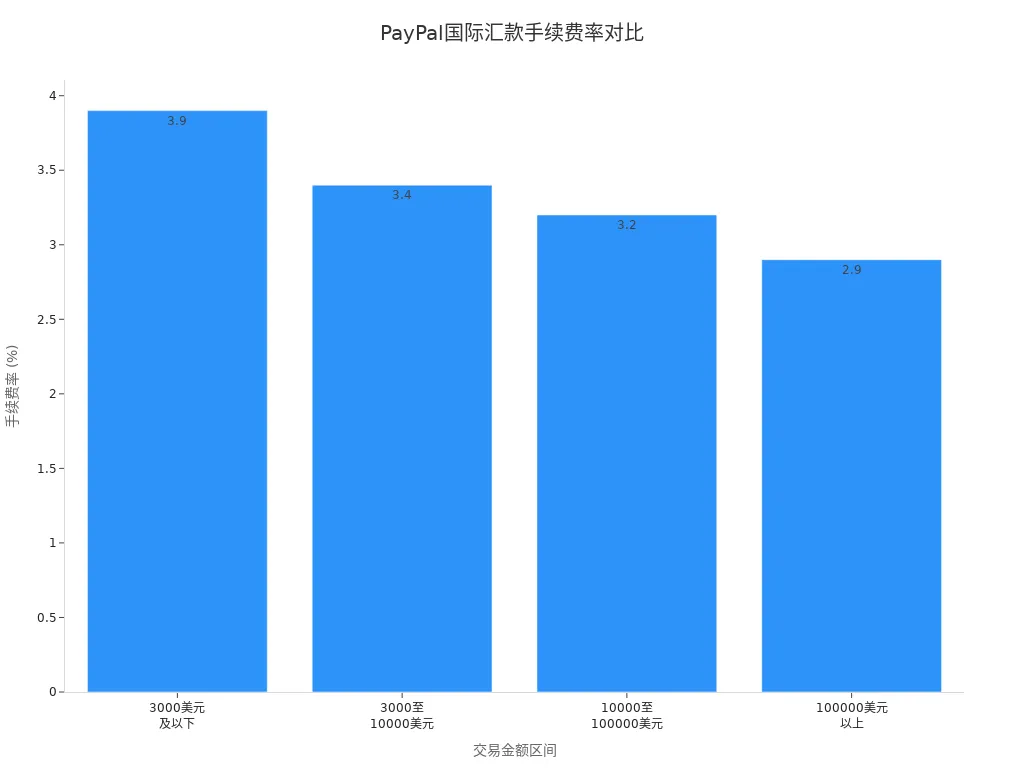

PayPal’s fee structure is as follows:

| Transaction Amount Range (USD) | Fee Rate | Currency Conversion Fee | Withdrawal to Hong Kong Bank | Processing Time |

|---|---|---|---|---|

| 3,000 and below | 3.9% + 0.3 | 2.5% markup | Low fee | Minutes (balance/bank account) |

| 3,000–10,000 | 3.4% + 0.3 | 2.5% markup | Low fee | 3–4 days (eCheck) |

| 10,000–100,000 | 3.2% + 0.3 | 2.5% markup | Low fee | |

| Above 100,000 | 2.9% + 0.3 | 2.5% markup | Low fee |

When using PayPal, you can choose to pay with a balance, bank account, or credit card. Withdrawals to Hong Kong bank accounts have relatively low fees and fast processing. PayPal is suitable for users needing multi-currency, global remittances.

Panda Remit

Panda Remit offers another convenient option for international remittances. You can use Panda Remit to send money to over 40 countries and regions in Asia, Europe, the Americas, and Oceania. The platform supports major currencies like AUD, USD, EUR, GBP, and JPY. You can send money from overseas to China, with receipt options including Alipay, WeChat Wallet, and major Chinese bank accounts. You can also send money from China to overseas, mainly for overseas tuition payments.

Panda Remit’s fees and processing times are as follows:

| Remittance Tool | International Transfer Fee (USD) | Exchange Rate Policy | Processing Time |

|---|---|---|---|

| Panda Remit | Approx. 11 (based on 80 RMB/7.2 rate) | 0.125% higher than bank rates | 15–30 minutes |

You simply transfer USD or other currencies to the platform’s designated account, and Panda Remit converts and sends the funds based on its exchange rate. Processing is fast, typically completing in 15–30 minutes. The platform holds an MSO license, ensuring security.

Comparison of Options

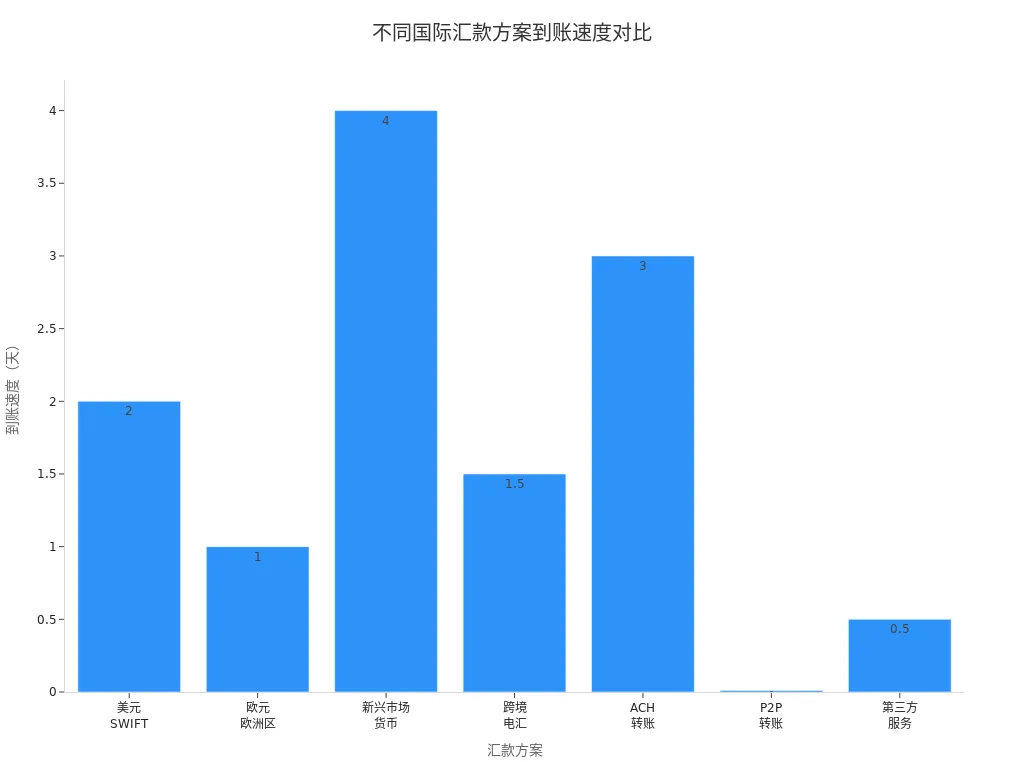

When choosing an international remittance option, you need to consider processing time, security, and fees. The table below compares the main features of common options:

| Remittance Option | Processing Time | Security | Fee Structure | Applicable Scenarios |

|---|---|---|---|---|

| PayPal | Minutes–3 days | Strictly regulated, high security | 2.9%–3.9% + 0.3, 2.5% exchange rate markup | Global multi-currency remittances, flexible withdrawals |

| Panda Remit | 15–30 minutes | Licensed institution, high security | Approx. $11/transfer, slightly high exchange rate | Remittances to China, tuition payments |

| SWIFT Wire Transfer | 1–3 days | Bank-regulated, high security | High fees, dual charges | Large amounts, formal transactions |

| Peer-to-Peer | Minutes | Lower security | Low fees, high risk | Small amounts, between acquaintances |

If you prioritize processing speed and convenience, Panda Remit is a good choice. If you need global, multi-currency support, PayPal is more suitable. For large or formal transactions, you can consider SWIFT wire transfers. When choosing, balance speed, fees, and security based on your needs.

When choosing Venmo for international transactions, you will face many restrictions. Venmo only supports U.S. local payments, with limitations in fund security and privacy protection. You need to pay special attention to the following:

- Choose regulated financial institutions to avoid low-fee temptations.

- Verify the recipient’s identity to prevent impersonation and fraud.

- Enable two-factor authentication to protect account security.

- Carefully check exchange rates, fees, and recipient information, and keep transaction records.

Official advice is to use Venmo cautiously, especially noting its lack of support for international transfers and fund security risks. You can choose PayPal, Panda Remit, or other methods better suited for international transactions based on your needs. If you have questions, it’s recommended to consult professional institutions or official customer service.

FAQ

Can Venmo directly bind Chinese or Hong Kong bank accounts?

You cannot directly bind Chinese or Hong Kong bank accounts. Venmo only supports U.S. local bank accounts. You need a U.S. bank account to complete binding and withdrawals.

Can I use a Chinese phone number to register for Venmo?

You cannot use a Chinese phone number to register for Venmo. The platform requires a U.S. local phone number. Virtual numbers and non-U.S. numbers cannot pass verification.

Which currencies does Venmo support?

Venmo only supports USD transactions. You cannot directly pay with RMB or HKD. All fund settlements are in USD.

How much is the fee for paying with a credit card on Venmo?

When you pay with a credit card, Venmo charges a 3% fee. For example, paying $100 results in $97 received. It’s recommended to prioritize a bank account or debit card.

If I’m in China, how can I safely receive payments from U.S. friends?

You can ask friends to send money via PayPal or Panda Remit. PayPal supports multi-currency, and Panda Remit offers fast processing. You need to provide a Hong Kong bank account or Alipay as a receiving method.

Venmo’s restrictions on non-US users often mean high fees, slow transfers, and unnecessary hurdles. With BiyaPay, you have a smarter choice: real-time FX conversion across multiple fiats and crypto, remittance fees starting at just 0.5%, and same-day settlement when you transfer on the day. Whether it’s tuition, rent, or family support, you can send money securely, quickly, and with full transparency. Fast sign-up puts global payments at your fingertips.

Experience stress-free cross-border transfers today with BiyaPay.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.