- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Everything You Need to Know About Zelle: Payments, Fees, and Support

Image Source: pexels

You can easily make instant transfers between U.S. bank accounts through the Zelle introduction. Zelle is suitable for splitting dinner bills with friends or family or making urgent payments in daily life. You only need the recipient’s phone number or email, and the transfer can be completed in minutes without fees. Zelle has covered over 2,200 banks, with 17.7 million users in Q3 2022 and 44% more transactions than checks. According to a Morning Consult survey, Zelle enjoys a good reputation and high user recognition in the U.S. market.

Key Takeaways

- Zelle is an instant bank-to-bank transfer tool in the U.S., requiring only the recipient’s phone number or email, completing transfers in minutes, easy to use, and without fees.

- Most major U.S. banks support Zelle, and users can activate and use it through their bank’s app or the Zelle app, suitable for daily payment needs of individuals and small businesses.

- Zelle transfers have daily and monthly limits, typically below $2,500 for single and daily transactions, with fast delivery, and funds generally arrive in minutes.

- When using Zelle, you should carefully verify recipient information to avoid transferring to the wrong account and only send payments to trusted individuals to prevent fraud and financial loss.

- If you encounter issues, you can contact your bank or Zelle’s official customer service for assistance, with Zelle providing 24/7 customer support to protect user rights.

Zelle Introduction

Image Source: unsplash

Definition and Uses

Through the Zelle introduction, you can learn that it is an instant bank-to-bank transfer system in the U.S.. Since June 2017, Zelle has been operated by Early Warning Services, a company jointly owned by several major U.S. banks. You only need to enter the recipient’s U.S. phone number or email address to complete a transfer in minutes. The main uses of Zelle introduction include:

- Fast transfers between individuals, such as splitting dining costs, rent, or emergency loans.

- Businesses and government agencies often use Zelle to disburse salaries, insurance payouts, and rebates.

- You can operate through your bank’s app or the Zelle app, supporting cross-bank transfers.

You don’t need to fill in complex bank account information; just a phone number or email is enough to complete the operation.

Main Advantages

The advantages of the Zelle introduction are very clear. You can experience the following benefits:

- Fast transfer speed, with funds typically arriving in minutes.

- No fees, suitable for large or frequent transfers.

- Simple operation, completed in just a few steps.

- Zelle collaborates with most major U.S. banks, usually integrated into bank apps, requiring no additional downloads.

- Funds transfer directly from your bank account to the recipient’s account, with high security.

You will find that, compared to tools like Venmo or PayPal, the Zelle introduction offers faster transfers and no additional fees for credit card transactions.

Scope of Application

The scope of the Zelle introduction is very broad. You can use Zelle in most banks and credit unions in the U.S. As of the end of 2020, Zelle had covered over 1,000 banks and credit unions, serving more than 140 million individual users. You only need a U.S. bank account and a phone number or email to register and use Zelle. Zelle does not support international transfers, and both the sender and recipient must be registered in the U.S. Each bank sets different transfer limits, typically ranging from $600 to $5,000 daily, suitable for daily transfer needs of individuals and small businesses.

Zelle Payments

Activation Methods

You can activate Zelle services through two main methods: your bank’s app or the Zelle app. Most major U.S. banks have integrated Zelle functionality. You only need to meet the following conditions to activate smoothly:

| Condition/Process Item | Description | Differences Among Banks |

|---|---|---|

| Registration Method | Register through the bank’s website or mobile app that supports Zelle, linking a Mastercard or Visa debit card associated with a U.S. bank account. | Registration processes are generally similar across banks via online banking or apps. |

| Linked Information | Register with a phone number or email; each phone number or email can only be linked to one bank account. | Multiple accounts require different phone numbers or emails. |

| Adding Recipients | You need to add recipients who have registered with Zelle and linked their phone number or email to make transfers. | Uniform rule. |

| Transfer Operation | Operate directly through the bank’s app, entering the amount to transfer. | Uniform operation method. |

| Transfer Limits | Subject to bank restrictions, with varying limits and frequencies. | Wells Fargo: $2,500 daily, $4,000 in 30 days; Chase: $2,000 daily, $16,000 monthly. |

| Application Platform | No desktop app; mainly used via bank apps or the Zelle mobile app. | Uniform platform restriction. |

You can follow these steps to activate Zelle:

- Activate via Bank App

- First, confirm if your bank supports Zelle (check the list of partner banks on Zelle’s official website).

- Log in to your bank’s app or online banking and locate the Zelle transfer function.

- On first use, the system will ask you to accept the terms of service and enter your email or U.S. phone number.

- After completing a one-time verification code, you can use Zelle for sending and receiving payments directly in the bank app.

- Activate via Zelle App

- If your bank hasn’t integrated Zelle, you can download the Zelle app (available on App Store or Google Play).

- Register by entering your personal contact information, email, or U.S. phone number, and link a Visa or Mastercard debit card.

- After verification, you can send and receive payments through the Zelle app.

You only need a U.S. bank account and a valid phone number or email, without filling in complex bank information. The process is simple and fast, suitable for individuals and small business users.

Adding Recipients

You need to add a recipient before making a Zelle transfer. The operation is very simple:

- In the bank app or Zelle app, select “Add Recipient.”

- Enter the recipient’s U.S. phone number or email address.

- The system will prompt you to confirm the recipient’s name and contact information to ensure accuracy.

- On first adding, Zelle will require you to verify your identity with a one-time code to ensure account security.

You should carefully verify recipient information to avoid transferring funds to the wrong account. Zelle does not require the recipient’s bank or account name, greatly simplifying the process, but you need to stay vigilant to prevent fraud.

You don’t need to provide the recipient’s bank account information when adding a recipient; just a phone number or email is enough. Each phone number or email can only be linked to one bank account. If you have multiple accounts, you need to register them with different phone numbers or emails.

Initiating a Transfer

You can complete a Zelle transfer by following these steps:

- In the bank app or Zelle app, select “Transfer” or “Send Money.”

- Choose an added recipient and enter their phone number or email.

- Enter the transfer amount (in USD) and optionally add a note explaining the purpose.

- Confirm the information is correct and click “Send.”

- Funds typically arrive in minutes. If the recipient hasn’t registered with Zelle, the system will notify them to complete registration, and funds will arrive after they register.

Zelle transfers are free of charge. You can initiate transfers anytime, anywhere, suitable for daily bill splitting, rent payments, emergency loans, and more. For small businesses and freelancers, Zelle is also very practical. Compared to PayPal or Venmo, Zelle does not require reporting transactions over $600 to the IRS, reducing tax reporting complexity. However, you still need to declare taxable income to ensure compliance.

You don’t need to enter the recipient’s name or bank when using Zelle, and transfers are generally irreversible once completed. While Zelle has some anti-fraud mechanisms, it carries certain security risks due to the lack of strict real-name authentication and identity verification. You should only transfer to trusted individuals and stop immediately if you encounter suspicious situations, contacting your bank or Zelle customer service.

Summary: You can complete Zelle transfers with just a phone number or email, without complex operations, suitable for individuals and small businesses. While enjoying convenience, you should also pay attention to information security to prevent fraud risks.

Fee Details

Are There Fees?

You don’t need to pay any fees when transferring with Zelle. Zelle is a peer-to-peer payment tool launched by multiple U.S. banks. As long as you transfer using an email or phone number, funds can arrive instantly. As long as both you and the recipient use Zelle partner banks, cross-bank transfers incur no fees. Zelle’s design goal is to let you complete bank-to-bank transfers as easily and securely as using cash, without worrying about hidden fees or calculating extra costs for each transfer. Compared to platforms like PayPal and Venmo, Zelle focuses on instant, fee-free bank-to-bank transfers, suitable for various payment needs in daily life.

Tip: Although Zelle itself doesn’t charge fees, you should still check your bank’s policies to avoid additional fees for special services.

Bank Policies

Most major U.S. banks offer free Zelle transfer services. You can refer to the table below to understand specific policies of some banks:

| Bank Name | Zelle Transfer Fees | Notes |

|---|---|---|

| JPMorgan Chase | Free | Small fees may apply for transfers exceeding regular limits |

| East West Bank | Free | Other international transfers have fees, not affecting Zelle use |

| U.S. Bank | Free | Other types of transfers have corresponding fees |

You typically won’t encounter additional charges when using Zelle. Some banks charge fees for expedited or overnight transfers, but these are not part of Zelle’s standard services. If you have large transfer needs, it’s recommended to check your bank’s limits and policies in advance. The IRS has reporting requirements for electronic transfers exceeding $600 (USD), but this doesn’t affect Zelle’s fee-free policy. You can confidently use Zelle for daily transfers, just stay aware of your bank’s specific regulations.

Limits and Arrival Time

Transfer Limits

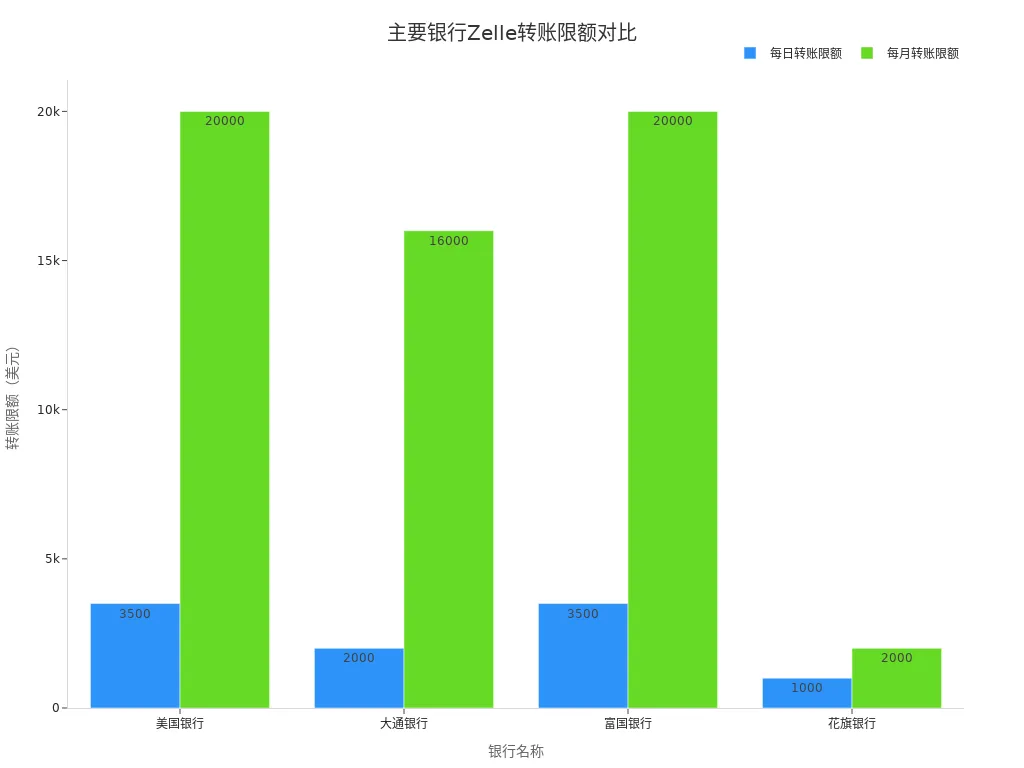

When using Zelle for transfers, you need to be aware that each bank imposes different limits on transfer amounts. Zelle is designed for small, fast transfers, suitable for various payment scenarios in daily life. Different banks set single, daily, and monthly transfer limits based on their policies. Below is a comparison of limits for common banks:

| Bank Name | Single Transfer Limit (USD) | Daily Limit (USD) | Monthly Limit (USD) |

|---|---|---|---|

| Chase | 2,000 | 2,000 | 16,000 |

| Bank of America | 3,500 | 3,500 | 20,000 |

| Wells Fargo | 2,500 | 2,500 | 20,000 |

| Cathay Bank | 2,500 | 2,500 | Not disclosed |

You can see that most banks’ single and daily limits are below $2,500. Some banks adjust limits based on your account type or usage history. You can check your specific limits in your bank’s app or website before transferring.

Ordered list summarizing Zelle limit features:

- Zelle is suitable for small, fast payments, with single and daily limits generally below $2,500.

- Limits vary by bank and account type, so it’s recommended to check in advance.

- Monthly limit information is not disclosed by some banks, and actual limits may be adjusted.

Arrival Time

When you transfer via Zelle, funds typically arrive in minutes in real time. Zelle’s system is designed to allow fast fund transfers between U.S. banks. In most cases, the recipient receives the transfer notification and funds immediately.

Ordered list explaining arrival time details:

- After you initiate a transfer, funds generally arrive in minutes, suitable for urgent payments.

- If the recipient hasn’t registered with Zelle, the system will notify them to register, and funds will arrive after they complete registration.

- In certain cases, such as bank risk control reviews, account anomalies, holidays, or system maintenance, transfers may show as “pending,” delaying arrival time.

- You can confirm information with the recipient in advance to ensure smooth delivery.

Tip: You should carefully verify recipient information before transferring to avoid delays or failures due to errors. Zelle’s delivery is fast, but special cases may require patience for bank processing.

Support and Security

Image Source: pexels

Common Issues

You may encounter issues like transfer failures, operational errors, or the need to update personal information when using Zelle. Below are solutions for common issues:

- If a transfer fails or you make an error, you can apply for a refund through your bank. You need to fill out a refund request form and submit transaction details. The bank will expedite your request.

- You can directly call Zelle’s customer service at 844-428-8542 for 24/7 support.

- If you change your phone number or email, you need to re-register and link the new information in the Zelle system. Each phone number or email can only be linked to one bank account.

- Before transferring, carefully verify the recipient’s phone number or email to ensure accuracy. Once a transfer is completed, it cannot be canceled unless the recipient hasn’t registered with Zelle.

- If the recipient hasn’t registered with Zelle, you can find the transfer in your bank app or Zelle app and choose to cancel it.

Tip: You must verify all information before operating to avoid financial loss due to errors.

Customer Service and Help

You can get help through the following methods if you encounter any issues:

- Call Zelle’s official customer service at 844-428-8542 for 24-hour support.

- Submit issues or feedback through the help center in your bank app or Zelle app.

- Visit Zelle’s official website to find FAQs and user guides.

When applying for a refund or dealing with account anomalies, your bank and Zelle customer service will assist you. You only need to provide detailed transaction information, and the support team will process your request promptly.

Security Tips

The Zelle platform places great emphasis on user fund security. You can protect your account with the following methods:

- Only send payments to family, friends, and trusted individuals, avoiding transfers to strangers.

- Always verify the recipient’s identity and account information before transferring to prevent scams.

- Never disclose sensitive information like bank account details, passwords, or verification codes.

- If you suspect fraud or account anomalies, promptly report it on the Zelle website or contact your bank for help.

- Since Zelle transactions are irreversible, funds cannot be recovered once sent, so you must be especially careful when verifying information.

Maintaining good security habits can effectively reduce risks. While Zelle offers some fraud protection, your own vigilance and proper operation are most important.

Through the Zelle introduction, you can discover that this payment tool offers several advantages:

- Fast transfers, arriving in minutes, greatly improving fund transfer efficiency.

- Simple operation, requiring only the recipient’s phone number or email to complete a transfer.

- No fees in most cases, reducing daily payment costs.

- Collaboration with major banks, with many banks integrating Zelle into their mobile banking apps for greater convenience.

While enjoying these benefits, you should also pay attention to security. Protect personal information, verify recipient identity, and avoid operating on public networks. In case of bank policy changes or payment anomalies, promptly contact your bank or Zelle customer service to ensure fund security. You can decide whether to use Zelle based on your needs, plan your transfer activities wisely, prevent fraud risks, and ensure every transaction is completed smoothly.

FAQ

How do I change the phone number or email linked to Zelle?

You can modify linked information in the settings of your bank app or Zelle app. The system will require you to verify the new phone number or email to ensure account security.

What should I do if a Zelle transfer fails?

If you encounter a transfer failure, first check your network and account balance. If the issue persists, contact your bank’s customer service or Zelle’s official support for assistance.

Which banks does Zelle support?

Zelle covers most major U.S. banks, including Chase, Bank of America, Wells Fargo, and more. You can check the full list of banks on Zelle’s official website.

Can I reverse or cancel a transfer after sending?

You can only cancel a transfer if the recipient hasn’t registered with Zelle. Once the recipient has registered and received the funds, they cannot be reversed. Always verify information carefully.

Are there amount limits for using Zelle?

Each bank sets different transfer limits. For example, Chase has a daily limit of $2,000 (USD), approximately 14,400 RMB (based on real-time exchange rates). You can check specific limits in your bank’s app.

Zelle is perfect for fast, fee-free transfers within the US, but it stops at the border. For tuition, rent, or family support abroad, traditional bank wires mean high costs and long waits. BiyaPay changes that: with coverage across most countries and regions worldwide, remittance fees starting from just 0.5%, real-time FX conversion, and same-day delivery, your money arrives securely and on time. Supporting both fiat and crypto, BiyaPay gives you the flexibility Zelle simply can’t.

Sign up with BiyaPay today and make global transfers simple, transparent, and fast.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.