- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Why Venmo Doesn’t Support International Transfers and What to Use Instead

Image Source: pexels

Venmo does not support international transfers. You can use Venmo only if you have a US bank account and a US phone number. Venmo international transfer is not possible, even if you want to send money to friends or family outside the United States. If you try to make international transfers, Venmo will block the action. Many users search for a venmo international transfer option, but venmo remains focused on users within the United States. When you need to send money abroad, you must look for other choices because venmo does not handle international transfers.

Key Takeaways

- Venmo only works within the United States and requires both sender and receiver to have US bank accounts and phone numbers.

- Venmo does not allow international transfers due to strict financial rules and security challenges in other countries.

- To send money abroad, use trusted services like Wise, PayPal, or Xoom that support international transfers with clear fees and strong security.

- Compare fees, exchange rates, transfer speed, and delivery options before choosing a money transfer service.

- Always double-check recipient details and use secure platforms to keep your international money transfers safe.

Venmo International Transfer Limits

US-Only Access

You can use Venmo only if you live in the United States or certain US territories. Venmo requires both you and the person you want to pay to have US bank accounts. You also need a US phone number to sign up. If you try to log in from outside the US, you will see errors or get blocked. Venmo does not work in other countries, including Canada. This means you cannot use venmo international transfer features to send money to friends or family abroad.

Venmo is different from some other payment apps. For example, PayPal lets you send money to people in other countries. Venmo only works inside the US. This makes venmo less flexible if you want to make international transfers.

Note: Venmo does not support international transfers. Both the sender and receiver must have US accounts and be located in the US or certain US territories.

Terms and Restrictions

Venmo has strict rules that stop you from using the app for international transfers. Here are some important restrictions:

- You cannot sign in to Venmo from outside the US.

- Venmo only works with US bank accounts, US phone numbers, and US social security numbers.

- The app must follow US financial rules, such as anti-money laundering (AML) and know your customer (KYC) laws.

- Venmo blocks access if you try to use a VPN or log in from another country.

- The platform does not have the network or partnerships to support international transfers.

- Venmo’s terms and conditions clearly say you cannot use the service from outside the US.

Venmo sets transfer limits for users, but these only apply to payments within the US. After you verify your identity, you can send up to $5,000 per transfer and up to $19,999.99 per week to your bank. There are no limits for venmo international transfer because the service does not allow international transfers at all.

Why Venmo Doesn’t Work Abroad

Image Source: unsplash

Regulatory Barriers

You may wonder why venmo does not let you send money outside the United States. The main reason is that venmo faces strict regulatory barriers. Venmo is not a bank, so your balance is not insured by the government. This makes it hard for venmo to build trust with users in other countries. Each country has its own financial rules and laws. Venmo would need to follow many different anti-money laundering rules and customer identification laws if it wanted to offer services abroad. These rules are complex and can change often.

Venmo is only available to users in the United States. If you try to use venmo from another country, you cannot log in. You also cannot get customer support if you are outside the US. Venmo does not support foreign currencies, so you cannot send money in other types of money, like the currency used in Trinidad and Tobago.

These barriers make it very hard for venmo to offer international transfers. Venmo would need to spend a lot of time and money to meet all the rules in each country. For now, venmo chooses to focus on the US market.

Security Concerns

Venmo also cares about keeping your money safe. The company uses tools like encryption, multi-factor authentication, and device management to protect your account. Venmo warns you to watch out for scams and to keep your information private. However, venmo does not talk about security risks for international transfers because it does not offer them. If you want to send money to someone in another country, you should look for services that have strong security features for international payments. Some companies, like Wise, are known for their secure systems when sending money abroad.

Best Venmo Alternatives

Image Source: unsplash

When you want to send money outside the United States, you need to choose a reliable money transfer tool. Many people look for the best venmo alternatives because venmo does not support international transfers. Here are some of the most popular options you can use instead.

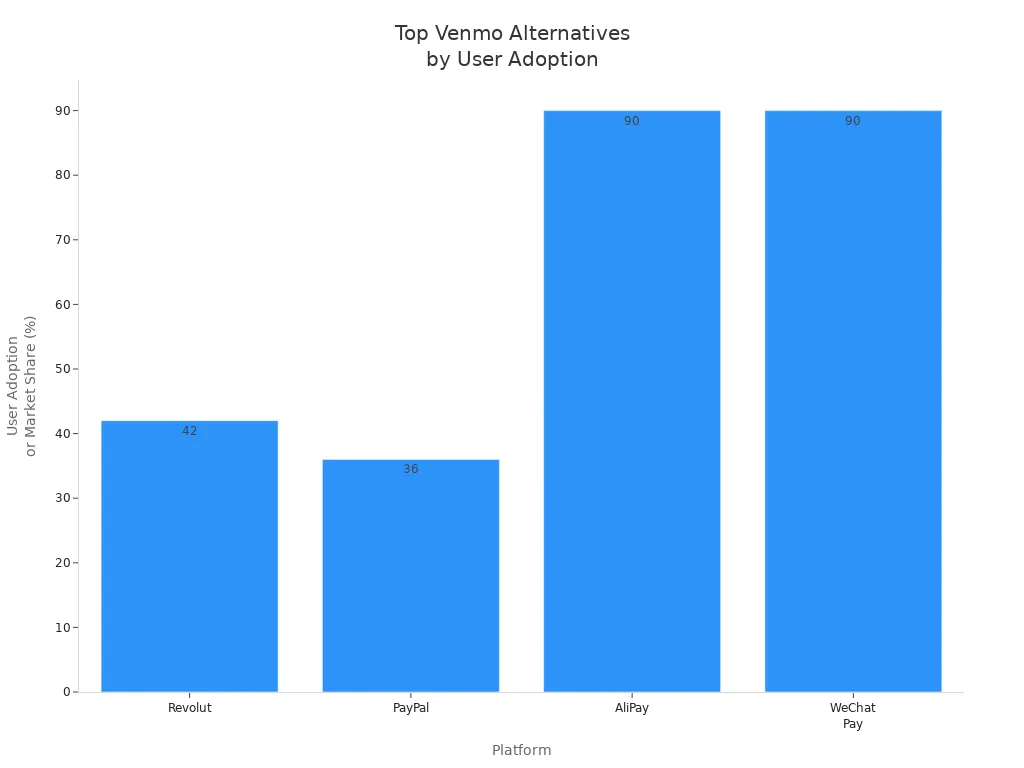

The chart below shows how many people use different payment platforms around the world. This helps you see which services are trusted by many users.

| Platform | User Adoption / Market Share / Transaction Volume Details | Region / Notes |

|---|---|---|

| Venmo & Cash App | Processed over $750 billion in P2P payments (U.S.) | U.S. peer-to-peer payments |

| Revolut | 42 million global users, 22% year-over-year growth | Global, international transfers |

| PayPal | 36% of U.S. digital wallet users; 46% of U.S. population uses it for online transactions | U.S., global reach |

| AliPay | Commands ~90% of China’s payment market; default for Alibaba platforms | China |

| WeChat Pay | Commands ~90% of China’s payment market; default for WeChat app | China |

| PhonePe | Major player in India, early adopter of UPI system | India |

| Google Pay | One of the two largest global NFC mobile payment solutions | Global |

| Apple Pay | One of the two largest global NFC mobile payment solutions | Global |

| Zelle | Most popular non-NFC mobile payment service in the U.S. | U.S. |

Wise

Wise helps you send money to over 140 countries. You can use it to pay friends, family, or businesses in many parts of the world. Wise shows you the real exchange rate and tells you the fee before you send money. This makes it easy to know how much your recipient will get.

Main Features:

- Supports transfers to more than 140 countries.

- Uses the mid-market exchange rate with no hidden markups.

- Shows all fees upfront.

- Connects to local bank accounts worldwide.

Pros:

- Transparent pricing.

- Low fees compared to banks.

- Fast transfers to many countries.

- Easy to use online or with the app.

Cons:

- Not all countries are supported.

- Some transfers may take a few days.

Ideal Use Cases:

- You want to send money to family or friends abroad.

- You need to pay for services in another country.

- You want to avoid high bank fees.

Wise is more cost-effective and widely supported for international transfers compared to venmo, which does not support such transfers at all.

PayPal

PayPal is one of the most well-known payment platforms. You can use it in over 200 countries and send money in 25 different currencies. PayPal is easy to use and has a strong reputation for security.

| Feature Category | Details & Ratings |

|---|---|

| Maximum Send Limits | No maximum send limits. |

| Geographic Coverage | Available in over 200 countries, supports 25 national currencies. |

| Transfer Speed | Usually completed within one working day. |

| Ease of Use | Simple account setup and transfer process; user-friendly website and app. |

| Mobile App | Highly rated (Apple Store 4.8, Google Play 4.4). |

| Fees and Exchange Rates | Fees are reasonable but not the lowest; exchange rates include a margin. |

| Customer Service | Mixed reviews; support available via email, phone, and forums. |

| User Satisfaction Ratings | Scores around 3.8 to 3.9 out of 5 for help and feedback. |

| Security Features | Advanced security including encryption and fraud monitoring. |

| Business Products | Special plans and monthly options for business users. |

Pros:

- Trusted by millions of users.

- Wide global coverage.

- Strong security features.

- No maximum send limits.

Cons:

- Fees can be high, especially for currency conversion.

- Customer support can be slow.

Ideal Use Cases:

- You already have a PayPal account.

- You want to send money to someone who uses PayPal.

- You need to pay for goods or services online.

WorldRemit

WorldRemit lets you send money to over 130 countries. You can choose how your recipient gets the money, such as bank deposit, cash pickup, or mobile wallet. The platform is easy to use, even if you are not tech-savvy.

| Pros | Cons |

|---|---|

| Multiple transfer options including bank deposits, cash pickups, and mobile money | Occasional transaction delays reported by customers |

| Supports transfers to many countries, offering convenience | Fees vary significantly by destination and amount |

| User-friendly platform suitable for non-tech-savvy users | Exchange rates include a margin, making them less competitive |

| 24/7 customer support via phone, email, and chat | Supports fewer countries than some competitors |

Main Features:

- Many ways to send and receive money.

- Transparent fees and exchange rates shown upfront.

- 24/7 customer support.

Ideal Use Cases:

- You want to send money for cash pickup.

- Your recipient does not have a bank account.

- You need to send money to a country with limited banking options.

Remitly

Remitly gives you two ways to send money: Express and Economy. Express is fast but costs more. Economy is slower but cheaper. You can send money to over 100 countries.

| Aspect | Details |

|---|---|

| Transfer Speeds | - Express: Often instant transfers, faster delivery but higher fees |

| - Economy: Slower, can take up to 3-5 days, but usually cheaper | |

| Transfer Fees | - Example: $3.99 fee for sending $1,000 to India or the UK |

| - Lower fees for some countries (e.g., $1.99 to Mexico, $1.49 for Euro transfers) | |

| Exchange Rates | - Markup over mid-market rates applied |

| - Promotional rates available only for first-time customers and limited transfer amounts | |

| Additional Fees | - Credit card payments may incur extra fees (e.g., 3% credit card fee in the US) |

Pros:

- Fast delivery with Express option.

- Lower fees with Economy option.

- Many payout methods, including cash pickup.

Cons:

- Exchange rates include a markup.

- Extra fees for credit card payments.

- Promotional rates only for first transfers.

Ideal Use Cases:

- You need to send money quickly.

- Your recipient needs cash pickup.

- You want to save money with slower transfers.

Xoom

Xoom, a service from PayPal, lets you send money to over 160 countries. You can send money for bank deposit, cash pickup, or even home delivery in some places.

| Feature | Venmo | Xoom |

|---|---|---|

| Accessibility | Limited to U.S. use only; app access barred outside U.S.; relies on U.S. banking system | Supports transfers to 160+ countries worldwide; multiple delivery options including bank deposit, cash pickup, mobile wallet, home delivery |

| Geographic Restriction | Only U.S. residents with U.S. bank accounts; geolocation blocks access outside U.S. | Internationally accessible; designed for global transfers |

| Transfer Types | Peer-to-peer transfers only | International money transfers, bill payments, prepaid credit reloads |

| Fees | Free for transfers funded by balance, bank account, or debit card; 3% fee on credit card payments | Fees vary by transaction; higher fees for debit/credit card payments; includes currency conversion markup |

| Transfer Speed | Instant or same-day within U.S. | Fast transfers, but speed varies by destination and method |

| Currency Conversion | Not applicable (no international transfers) | Includes exchange rate markup |

Main Features:

- Transfers to over 160 countries.

- Multiple delivery options.

- Fast transfer speeds.

Pros:

- Many payout choices.

- Fast delivery to many countries.

- Backed by PayPal’s security.

Cons:

- Fees can be high, especially for card payments.

- Exchange rates include a markup.

Ideal Use Cases:

- You want to send money for cash pickup or home delivery.

- Your recipient lives in a country with limited banking options.

- You need a trusted service with global reach.

Tip: Always check the total cost, including fees and exchange rates, before you send money with any service.

Other Notable Alternative Services

You can also consider other alternative services for international transfers. Revolut offers multi-currency accounts and works well for people who travel or do business in different countries. OFX supports large transfers and gives you 24/7 phone support. Western Union and MoneyGram have thousands of locations worldwide, making them good for cash pickups. Payoneer is popular with businesses and freelancers who work with clients in other countries. Ria Money Transfer and XE are part of the same company and provide reliable options for sending money abroad.

You have many choices when you need a money transfer tool for sending funds internationally. Each service has its own strengths, so you can pick the one that fits your needs best.

Comparing Alternatives

Fees and Exchange Rates

When you compare money transfer services, you should look at both fees and exchange rates. Some services charge high fees or add extra costs to the exchange rate. Others show you the real cost up front. The table below helps you see how major services compare:

| Service | International Transfer Fees and Exchange Rates | Notes |

|---|---|---|

| Wise | Low fees with transparent pricing; uses mid-market exchange rate with no hidden markups | Cost-effective for international transfers; supports 140+ countries; 24/7 digital support |

| PayPal | Up to 4% currency conversion markup; 5% transaction fee on foreign payments | Higher cost for international transfers; widely used but expensive |

| Zelle | Does not support international transfers | Limited to US payments only |

| Cash App | 2% international use fee on card payments; 3% fee for credit card transfers | Allows international spending but with additional fees |

| Apple Cash | Does not support international transfers; US only | Limited to US use |

You can see that Wise offers the most transparent and cost-effective option for international transfers. PayPal is easy to use but can cost more. Zelle and Apple Cash do not support sending money outside the US.

Speed and Delivery Options

Speed and delivery options matter when you send money. Some services let you send money to a bank account, while others offer cash pickup or mobile wallet delivery. The table below shows what each app can do:

| App | Bank Deposit/Transfer | Cash Pickup | Mobile Wallet |

|---|---|---|---|

| Ria | Yes | Yes | Yes |

| Xoom | Yes | Yes | Yes |

| Wise | Yes | N/A | N/A |

| Revolut | Yes (multi-currency) | N/A | N/A |

| PayPal | Yes | N/A | N/A |

| Zelle | Yes (bank-to-bank) | N/A | N/A |

| Remitly | Yes | Yes | N/A |

| Western Union | Yes | Yes | Yes |

| WorldRemit | Yes | Yes | Yes |

If you want fast delivery or cash pickup, you should choose services like Xoom, Ria, Western Union, or WorldRemit. Wise and PayPal work best for bank transfers.

Accessibility

You may not have a US bank account or want to send money to someone who does not use banks. Some services make this easy. Western Union lets you send money without a US bank account. You can pay with a credit card, debit card, Apple Pay, or cash at a location. The receiver can get money in a bank account, at a cash pickup spot, or in a mobile wallet. WorldRemit also works for people without US bank accounts. You can register with your personal details and pay with a card or bank account. The receiver does not need a WorldRemit account. These options help you send money even if you or the receiver do not use banks.

How to Send Money Internationally

Choosing the Right Service

When you want to send money internationally, you need to think about several important factors. Each service has different costs, speeds, and ways for your recipient to get the money. You should compare these features before you decide.

Always check the total cost, not just the transfer fee. Some services add extra charges through poor exchange rates.

Here is a table to help you compare what matters most:

| Factor | What to Look For |

|---|---|

| Cost Components | Sending fees, transfer fees, receiving fees, and exchange rates. Watch for hidden costs. |

| Safety and Security | Strong encryption and compliance with financial laws protect your money. |

| Transfer Speed | Some services send money in minutes, others take days. Choose what fits your needs. |

| Customer Support & UX | Good support helps if you have problems. Easy-to-use apps or websites make transfers simple. |

| Accessibility | Make sure your recipient can get the money, whether by bank, cash pickup, or mobile wallet. |

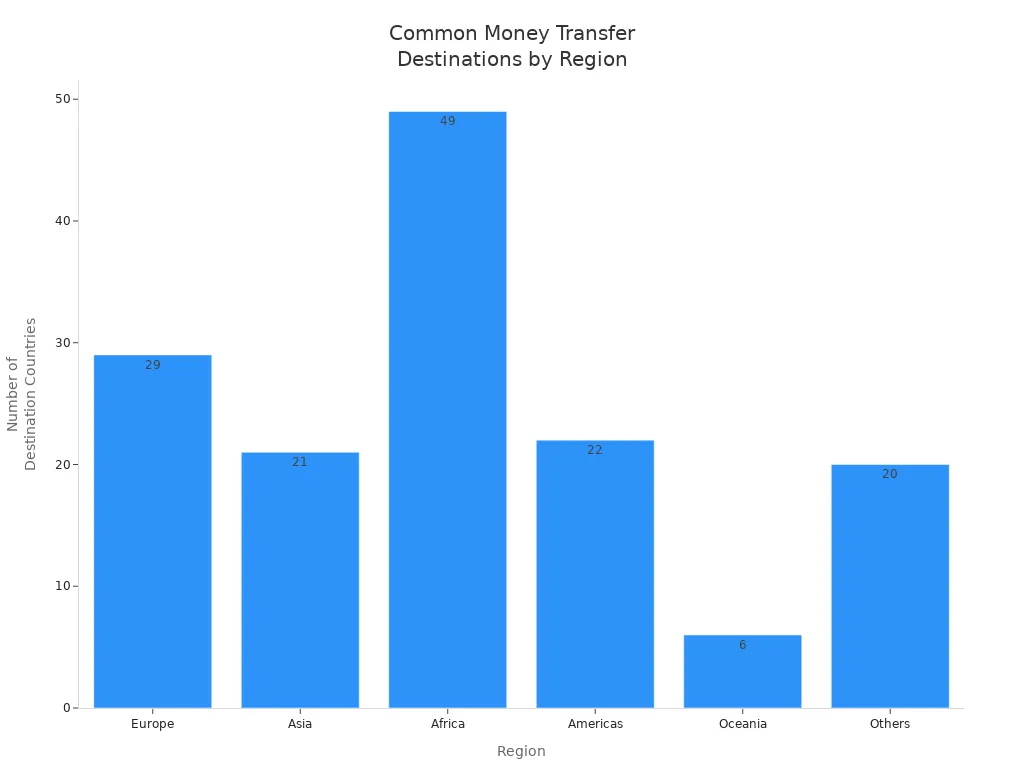

You should also think about where your recipient lives. Many people in the United States send money to countries like India, Mexico, Pakistan, and China.

Tips for Safe Transfers

You want your money to arrive safely. Here are some tips to help you avoid mistakes and scams:

- Use trusted services with strong security, such as two-factor authentication and encryption.

- Double-check all recipient details before you send money. Mistakes can cause delays or lost funds.

- Compare both fees and exchange rates. A low fee does not always mean a better deal if the exchange rate is poor.

- Watch out for scams. Never send money to someone you do not know or trust. Be careful with requests that seem urgent or unusual.

- Keep your personal information private. Do not share passwords or sensitive details.

- Save your transfer receipts. These help if you need to solve a problem later.

- If you send large amounts, check if there are tax rules in the country where your recipient lives.

Tip: If you need to send money internationally, do not use venmo. Choose a service that supports global transfers and meets your needs for safety, speed, and cost.

Venmo does not let you send money outside the United States, but you have many reliable alternatives. You should compare your options to find the best fit for your needs. Leading services offer strong customer support, often with 24/7 and multilingual help. To choose the right provider, follow these steps:

1. Compare several providers for fees and exchange rates.

2. Review all costs to avoid hidden charges.

3. Pick a transfer method that matches your needs.

4. Check how fast the money will arrive.

5. Make sure the provider uses strong security.

6. Confirm rates and fees before sending.

7. Use comparison platforms for real-time advice.

8. Double-check recipient details and local rules.

9. Track your transfer until it arrives.

With the right service, you can send money internationally with confidence and ease.

FAQ

Can you use Venmo to send money from the United States to another country?

You cannot use Venmo to send money outside the United States. Venmo only supports transfers between users with US bank accounts and US phone numbers. You need to choose another service for international transfers.

What is the best way to send money to someone in China?

You can use services like Wise, PayPal, or Xoom to send money to China. These platforms support transfers to Chinese bank accounts, including Hong Kong banks. Always check the current USD to CNY exchange rate before sending money.

Are there extra fees for international money transfers?

Yes, most services charge fees for international transfers. You may pay a sending fee, a receiving fee, and a currency exchange fee. The table below shows common fees:

| Service | Sending Fee | Exchange Rate Markup |

|---|---|---|

| Wise | Low | None |

| PayPal | Medium | Up to 4% |

| Xoom | Varies | Yes |

How can you keep your international money transfer safe?

Always use trusted services with strong security. Double-check the recipient’s details before sending money. Never share your passwords or sensitive information. Save your transfer receipt in case you need help later.

While Venmo offers a convenient way to handle transactions within the United States, this article makes it clear that its service is limited by strict regulatory barriers, preventing it from supporting international transfers.1 These limitations can be a major pain point for users who need to send money abroad. This is where a truly global financial solution like BiyaPay can fill the gap. Our platform simplifies your global transactions, providing real-time exchange rate queries and conversions for various fiat and digital currencies with remittance fees as low as 0.5%.

Whether you’re sending money to family, paying international suppliers, or managing a global investment portfolio, BiyaPay makes it secure and cost-effective. Our platform supports money transfers to most countries and regions worldwide, ensuring your funds get where they need to go quickly—often on the same day. Don’t let confusing regulations and hidden fees stand in the way of your financial freedom. Open a new account with BiyaPay in minutes to simplify your international financial life. You can start your journey with BiyaPay and enjoy seamless transactions globally.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.