- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

A Practical Guide to Renting in Australia: Rental Websites, Prices and Precautions

Image Source: unsplash

When renting in Australia, you will find that weekly rents vary significantly across different cities. Sydney has the highest rents, averaging around AUD 796 per week, while Hobart is lower. In June 2025, Australia’s median rent was AUD 665, up 3.4% over the past year. Many tenants worry that requesting repairs may lead to rent increases, with half living in homes needing repairs. This practical rental guide will help you understand prices, prepare documents, and avoid risks in advance.

Key Points

- When renting in Australia, choose reputable rental websites like Realestate.com.au and Domain to ensure reliable property information.

- Preparing rental application documents in advance, including identification and proof of income, can increase your application success rate.

- Before signing a lease, carefully review every clause to understand your rights and obligations.

- Inspecting the property in person is a crucial step to ensure the condition meets expectations and avoid future disputes.

- Stay vigilant to avoid rental scams, never pay deposits or rent in advance, and ensure you sign a legitimate contract.

Rental Guide: Websites and Platforms

Image Source: pexels

Popular Rental Websites

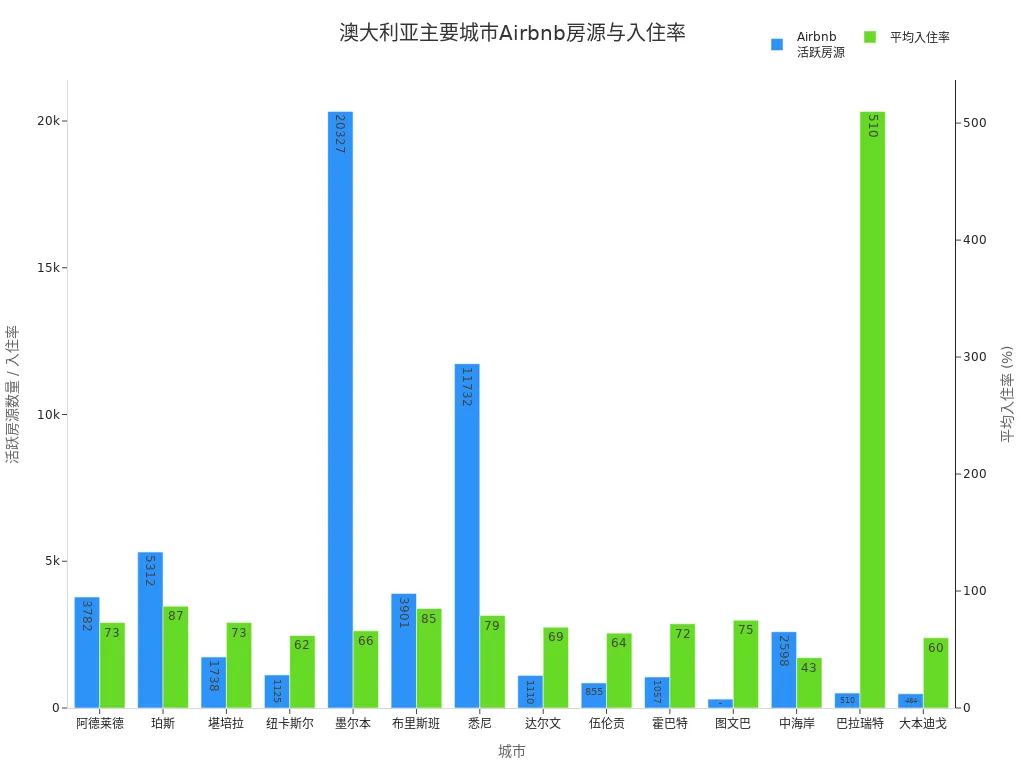

When searching for a rental in Australia, you can prioritize Realestate.com.au and Domain. These platforms offer extensive listings and support online applications, making it easy to filter and submit documents quickly. Domain is more popular with younger, affluent users, focusing on lifestyle and community information. Realestate.com.au caters to a broader buyer audience, offering features like price guides and Property 360 to help you understand market trends. You can also use Flatmates.com.au, which receives about 2.5 million visits monthly, ideal for finding shared housing. Airbnb is suitable for short-term stays and unique property experiences. Australia’s vacation rental market is projected to generate USD 1.62 billion in revenue by 2025, with a growing user base.

Platform Safety Certification

When choosing a rental platform, you must pay attention to its safety certifications. Reputable platforms like Realestate.com.au and Domain have strict verification processes for listings and landlords. You can cross-check properties on multiple platforms and directly contact real estate agents to confirm authenticity. SCAMwatch advises against simply driving by a property; you must inspect it in person or have a trusted person do so. Avoid paying deposits or rent before signing a legitimate lease agreement.

Property Filtering Tips

You can use the following methods to filter properties efficiently and avoid scams:

- Verify property information to ensure prices are reasonable. If prices seem too good to be true, it’s often a scam.

- Be cautious of landlords claiming to be overseas, as this is often a red flag.

- Refuse to pay any fees before meeting the landlord or property manager.

- Use reputable platforms and prioritize listings with safety certifications.

- If you can’t inspect in person, arrange for a trusted person to view the property to confirm its existence.

This rental guide advises you to stay vigilant and use platform filtering features wisely to protect your interests.

Rental Process

The rental process in Australia involves several key steps. You need to plan ahead to find a suitable property smoothly. This guide recommends starting with property searches, scheduling viewings, inspecting properties, applying, undergoing review, signing, and moving in, with careful preparation at each step. Below is a detailed breakdown of each stage.

Property Search and Scheduling

You can start searching for properties on mainstream platforms like Realestate.com.au and Domain. It’s recommended to begin your search 8-12 weeks in advance to have more options. Peak seasons (like April and July) see high competition, especially in cities like Sydney, Melbourne, and Brisbane. You should monitor listing release dates and avoid peak periods to improve success rates.

| Step | Timeframe |

|---|---|

| Start property search | 8-12 weeks before |

| Prepare rental documents | 4-6 weeks before |

| Attend property inspections | 2-3 weeks before |

| Arrange key pickup | 1 week before |

| Move-in | Move-in day |

When scheduling viewings, you typically need to submit basic information online. Some listings may require you to upload identification and proof of income in advance to streamline the application process.

Property Inspections

You must inspect the property in person or have a trusted person do so. Australia’s rental market places high importance on in-person inspections. Many landlords and agents schedule open houses during peak periods. You should book inspections 2-3 weeks in advance to allow time to compare properties. During inspections, focus on the property’s structure, lighting, amenities, and surrounding environment.

Tip: During peak seasons (e.g., April and July), competition is fierce. Book inspections early and prepare all documents in advance.

The table below shows peak rental seasons in major Australian cities:

| City | Peak Season |

|---|---|

| Sydney | April |

| Melbourne | April |

| Brisbane | July |

| Adelaide | April |

| Perth | April |

| Darwin | August |

| Newcastle | January |

| Wollongong | January |

Application and Review

After inspecting a property, if interested, you can submit a rental application immediately. Applications typically require the following documents:

| Required Document | Purpose | Verification Examples |

|---|---|---|

| Proof of Income | Confirms financial stability and payment ability | Pay stubs, bank statements, employer letters |

| Rental History | Assesses past rental behavior and property maintenance | Previous lease condition report |

| Previous Landlord Reference | Verifies reliability in paying rent and adhering to lease terms | Contact previous landlord |

| Employment Verification | Confirms current employment and income | Contact employer |

| Identification Documents | Verifies identity | Driver’s license, passport |

| Personal Information | Confirms identity and contact details | Full name, address, date of birth, phone |

| Additional Information | Special requirements (e.g., pets, dependents) | Pet information, accessibility needs |

After submitting your application, the agent or landlord will review your documents. Common reasons for rejection include:

- Poor payment history or insufficient income

- Negative records in rental databases

- Inaccurate or unreliable references

- Incomplete or incorrect application information

- Property already leased or pending approval

- Too many occupants or non-compliance with pet policies

You can improve your chances by preparing complete documents, maintaining good credit and rental history, and ensuring references are reliable.

Signing and Moving In

Once approved, you will receive a lease agreement. Australian law offers several protections for tenants. When signing, landlords cannot request sensitive information like litigation history. You must use the standard lease form prescribed by local law. At least one payment method for rent must be fee-free (e.g., bank transfer). Advance rent and bonds typically cannot exceed one month’s rent (exceptions apply if weekly rent exceeds USD 900). Before signing, landlords must disclose if the property is for sale or under a mortgage.

| Tenant Rights and Obligations | Description |

|---|---|

| Prohibited Information Requests | Landlords cannot ask for litigation history, bond history, etc. |

| Use of Standard Form | Must use legally prescribed lease forms |

| Rent Payment Methods | At least one fee-free payment method (e.g., bank transfer) |

| Advance Rent Limits | Cannot require more than one month’s rent in advance (exceptions for weekly rent over USD 900) |

| Bond Limits | Bond cannot exceed one month’s rent |

| Disclosure Requirements | Must disclose if the property is for sale or under a mortgage before signing |

After signing, you can arrange key pickup with the agent or landlord, typically one week before moving in. On move-in day, inspect the property and take photos to document its condition to protect your rights.

This rental guide reminds you: Prepare thoroughly and review documents and contracts carefully at every step to move into your ideal property smoothly.

Rental Documents

Image Source: unsplash

When applying to rent in Australia, you need to prepare a complete set of documents. Having all documents ready can significantly boost your application success rate. These primarily include personal information, proof of income, and rental history.

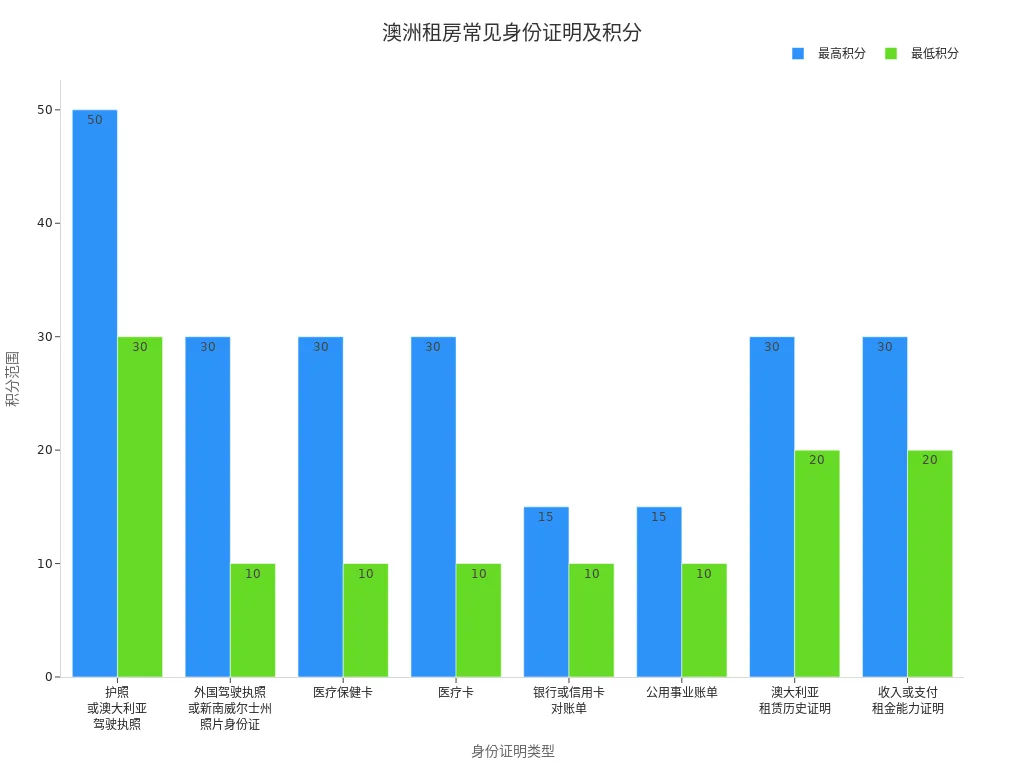

Personal Information

You need to submit various identification documents. Australian rental applications often use a points system, requiring documents to total 100 points. Common IDs and their point values are shown below:

| ID Type | Point Range |

|---|---|

| Passport or Australian Driver’s License (only one) | 30 - 50 points |

| Foreign Driver’s License or NSW Photo ID | 10 - 30 points |

| Visa Proof | No points (must prove visa covers lease term) |

| Healthcare Card/Medicare Card | 10 - 30 points |

| Bank or Credit Card Statement | 10 - 15 points |

| Utility Bill | 10 - 15 points |

| Australian Rental History Proof | 20 - 30 points |

| Proof of Income or Rent Payment Ability | 20 - 30 points |

Tip: Combine documents like a passport, driver’s license, and bank statements to meet the point requirement. Visa proof must show you’re not on a tourist visa and covers the entire lease term.

Proof of Income

Landlords and agents require proof of income to confirm your ability to pay rent on time. Common income verification methods include:

| Income Verification Method | Description |

|---|---|

| Employment Verification | Proves you have a stable, legal income source. |

| Pay Stubs and Tax Returns | Provide recent two months’ pay stubs or last year’s tax return showing income. |

| Bank Statements | Show deposits, withdrawals, and account balance to reflect financial status. |

| Self-Employment Verification | Includes tax returns, bank statements, profit/loss statements for self-employed individuals. |

| Investment Income | Provide investment account statements or tax returns proving investment earnings. |

| Government Benefits and Assistance | Prove government subsidies or welfare income to meet rental requirements. |

It’s recommended to prepare relevant documents in advance, especially pay stubs and bank statements. Bank statements can be from a licensed Hong Kong bank or other international banks, ensuring the information is accurate and valid.

Rental History

A strong rental history can significantly increase your application approval chances. Landlords and agents assess your reliability through past rental records. You can prepare the following:

- Previous lease agreements or rent payment records

- Reference letters from previous landlords or agents

- Property condition reports (showing no breaches or damage)

- Any relevant bills or notices

These documents help landlords gauge your compliance and responsibility. Maintaining a good rental history will make future rentals smoother.

Rental Price Comparison

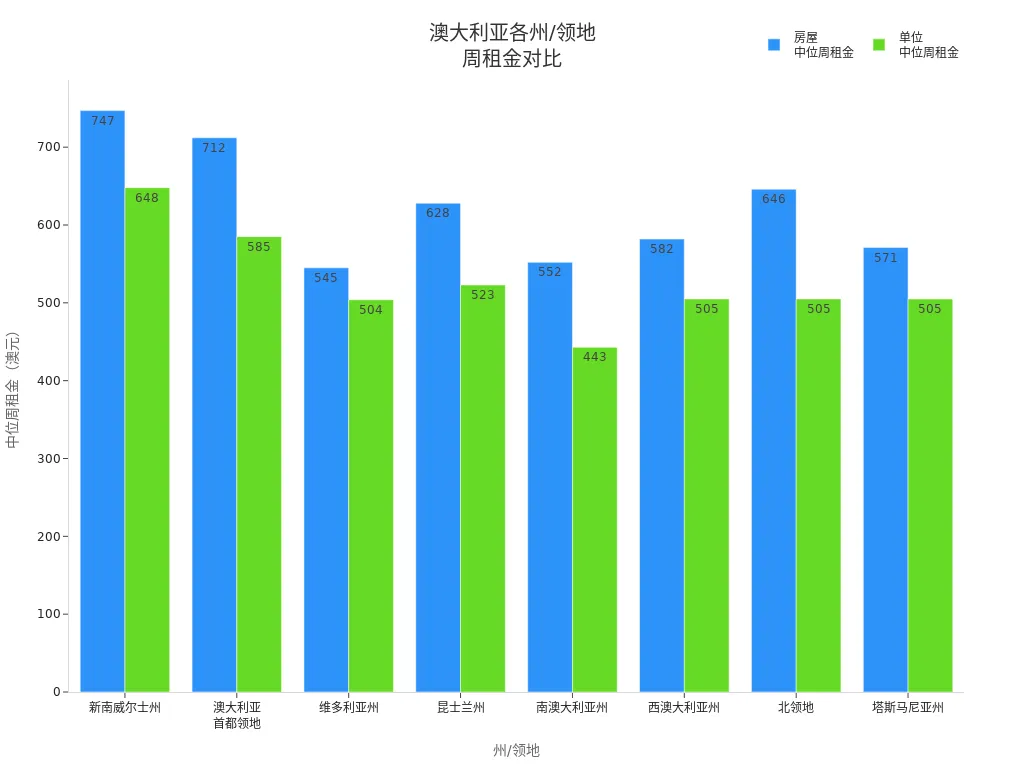

State Rents

When renting in Australia, you first need to understand rent levels across states and cities. The table below shows median weekly rents for houses and units in major Australian states and cities (in USD):

| State/City | Median Weekly House Rent | Median Weekly Unit Rent |

|---|---|---|

| New South Wales (NSW) | $747 | $648 |

| Australian Capital Territory (ACT) | $712 | $585 |

| Victoria (Vic) | $545 | $504 |

| Queensland (QLD) | $628 | $523 |

| South Australia (SA) | $552 | $443 |

| Western Australia (WA) | $582 | $505 |

| Northern Territory (NT) | $646 | $505 |

| Tasmania (Tas) | $571 | $505 |

Over the past three years, national rents have risen by 34%. Adelaide has seen an 81% increase over a decade. Capital cities have risen by 57% since 2015. Consider these changes when planning your budget.

Additional Fees

When renting in Australia, besides rent, you need to account for various additional fees. Common fees include:

| Fee Type | Description |

|---|---|

| Bond | Typically 4-6 weeks’ rent, held by a state government agency as a security deposit. |

| Advance Rent | Usually 2-4 weeks’ rent paid in advance. |

| Utilities | Electricity, water, gas, and internet are typically not included in rent and must be set up independently. |

| Utility Connection Fees | Small activation fees may apply when setting up accounts. |

| Application Fees | Generally not charged in Australia. |

You can use a licensed Hong Kong bank or other international banks to pay bonds and rent, ensuring secure transactions.

Budgeting Tips

When renting in high-rent cities, you can use these strategies to optimize your budget:

- Explore government assistance programs to apply for housing subsidies.

- Negotiate rent, as long-term tenants are more likely to receive discounts.

- Opt for shared housing or co-renting to split rent and fees.

- Downsize living space to reduce overall expenses.

- Consider moving to regional cities with more affordable rents.

- House-sitting or short-term rentals are also cost-saving options.

This rental guide advises you to plan your budget in advance, allocate monthly expenses wisely, and avoid financial strain.

Rental Precautions

Avoiding Scams

When renting in Australia, preventing scams is critical. In recent years, fake rental ads and impostor agents have become common. You need to learn to identify common rental scam types. The table below summarizes common scams and how to spot them:

| Rental Scam Type | Identification Method |

|---|---|

| Fake Rental Ads | Posted on real estate or classified sites, requesting advance deposits or personal information. |

| Impersonating Real Estate Agents | Posing as legitimate agents, organizing fake property inspections. |

| Requesting Personal Information | Asking for passports, bank statements, or pay stubs. |

| Virtual Inspections | Offering virtual tours and requesting deposits, often claiming in-person visits are unavailable due to the pandemic. |

You can protect yourself by:

- Using only certified, reputable platforms to search for properties.

- Avoiding advance deposits or rent payments, especially before signing a formal contract.

- Not sharing sensitive personal information like passports or bank statements.

- Inspecting the property in person or having a trusted person do so, avoiding decisions based solely on virtual tours.

If you encounter a rental scam, take these steps:

- Report rental fraud to law enforcement.

- File a complaint with consumer protection agencies.

- Seek legal advice if necessary.

- Report cyber scams via ReportCyber.

- If real estate agents or agencies are involved, complain to state fair trading offices.

Staying vigilant and verifying suspicious information promptly can significantly reduce scam risks during renting.

Contract Terms

When signing a lease, you must carefully review every clause. Australian standard lease agreements include key provisions that directly affect your rights. Focus on the following clauses:

- Property Definition: The contract must clearly describe the leased property’s details.

- Party Identification: Clearly state the tenant’s and landlord’s identities.

- Lease Term, Renewal Options, and Payment Terms: Include lease start date, duration, and renewal methods.

- Permitted Uses and Restrictions: Specify how the property can be used and any limitations.

- Restoration Clause: Requires you to restore the property to its original condition at lease end.

- Subletting Clause: Clarifies whether you can sublet parts of the property.

- Maintenance and Repair Clauses: Define your and the landlord’s repair responsibilities.

- Early Termination Clause: Specifies conditions for early lease termination.

- Rent Review Clause: Outlines how and when rent adjustments occur.

- Option Clause: Grants you priority to renew the lease at its end.

Before signing, ensure the contract is accurate, especially regarding bonds, payment methods, and repair responsibilities. Avoid signing blank or incomplete contracts. If unclear about terms, consult professionals or legal services.

Carefully reviewing contract terms can help you avoid bond disputes and legal risks, protecting your interests.

Move-In Inspection

Before moving into a new property, you must conduct a thorough move-in inspection to avoid future bond disputes over damages or cleaning issues. In Australia’s rental market, common bond disputes involve cleaning fees, repair costs, and unpaid bills. Follow this checklist for inspections:

- Check the overall cleanliness of the property, including floors, walls, kitchen, and bathroom.

- Inspect doors, windows, cabinets, lights, and appliances for functionality.

- Take photos to document existing damage or wear, keeping both photos and written notes.

- Complete a move-in inspection checklist with the landlord or agent, signed by both parties.

Common urgent repair issues for new tenants include burst pipes, gas leaks, hot water system failures, sewage leaks, and hazardous electrical faults. The table below lists common urgent repair issues:

| Urgent Repair Issue | Example |

|---|---|

| Burst Pipes | Yes |

| Gas Leaks | Yes |

| Hot Water System Failure | Yes |

| Sewage Leaks | Yes |

| Hazardous Electrical Faults | Yes |

You should also note non-urgent repairs, such as minor leaks, non-critical electrical issues, or damaged cabinet doors. Report issues to the landlord or agent promptly and keep communication records.

Conducting thorough inspections and keeping records before moving in can protect your bond and reduce future disputes.

When renting in Australia, choosing certified platforms and rationally filtering properties is crucial. You should prepare all application documents in advance, including identification, proof of income, and rental history. Pay attention to these key points:

- Organize documents to ensure a complete application, with references ready to respond promptly.

- Stay informed about rental market trends, noting rent increases and reduced property supply.

- Choose an appropriate lease term to enhance rental security and belonging.

- Carefully review contract terms before signing to avoid risks from misunderstanding rights and obligations.

- Stay honest and flexible during the rental process, communicating actively with agents and minimizing unnecessary requests.

- Use official channels like the Victorian Consumer Affairs Bureau and National Tenancy Database to verify property authenticity.

By preparing thoroughly and reviewing contracts and documents carefully, you can reduce rental risks and secure your ideal home smoothly.

FAQ

Can I use a mainland China bank account to pay the rental bond in Australia?

You can use a licensed Hong Kong bank or other international bank accounts to pay the bond. Australia’s rental market generally accepts international transfers. Confirm the payment method with the landlord or agent in advance.

Can lease terms be changed after signing?

Once signed, lease terms typically cannot be changed unilaterally. If you have special needs, negotiate with the landlord and sign a supplementary agreement.

How long does it take to get a rental bond refunded?

After moving out, the landlord will refund the bond after confirming no property damage, typically within 2-4 weeks. Keep photos from move-in and move-out for evidence.

Does lacking an Australian rental history affect my application?

You can still apply without an Australian rental history. Providing proof of income, reference letters, and other documents can increase your approval chances.

What should I do for urgent repairs during the lease?

For urgent issues like burst pipes or gas leaks, contact the landlord or agent immediately. Australian law requires landlords to address urgent repairs promptly.

You have thoroughly mastered the Australia Rental Guide, from selecting mainstream websites like Realestate.com.au to preparing the points-based application materials and understanding the high rent in Sydney (up to A$796/week). However, as you secure a property and prepare to move in, you face a significant upfront cost: typically 4-6 weeks of rent for the Bond plus 2-4 weeks of advance rent. For new international students or workers in Australia, this large cross-border transfer, as well as subsequent monthly rent payments, can be hampered by traditional banks’ high international transfer fees, non-transparent exchange rate losses, and transfer times that take several days.

You need a low-cost, high-efficiency solution that also allows for global asset management to ensure your rent and living expenses can reach your Australian account economically and seamlessly, precisely when needed.

BiyaPay is your ideal platform for managing both cross-border payments and investment needs. We offer real-time exchange rate inquiry and conversion services for fiat currencies, with remittance fees as low as 0.5% and zero commission on contract limit orders, effectively lowering your living expenses. BiyaPay supports most countries and regions globally and enables same-day fund arrival, ensuring your bond and rent arrive on time to prevent any move-in issues. Most importantly, you can use one platform to participate in global asset allocation, including US and Hong Kong stocks, without needing a complex overseas account. Register quickly with BiyaPay now, and use ultimate financial efficiency to ensure your rental and living experience in Australia is secure and smooth!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.