- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

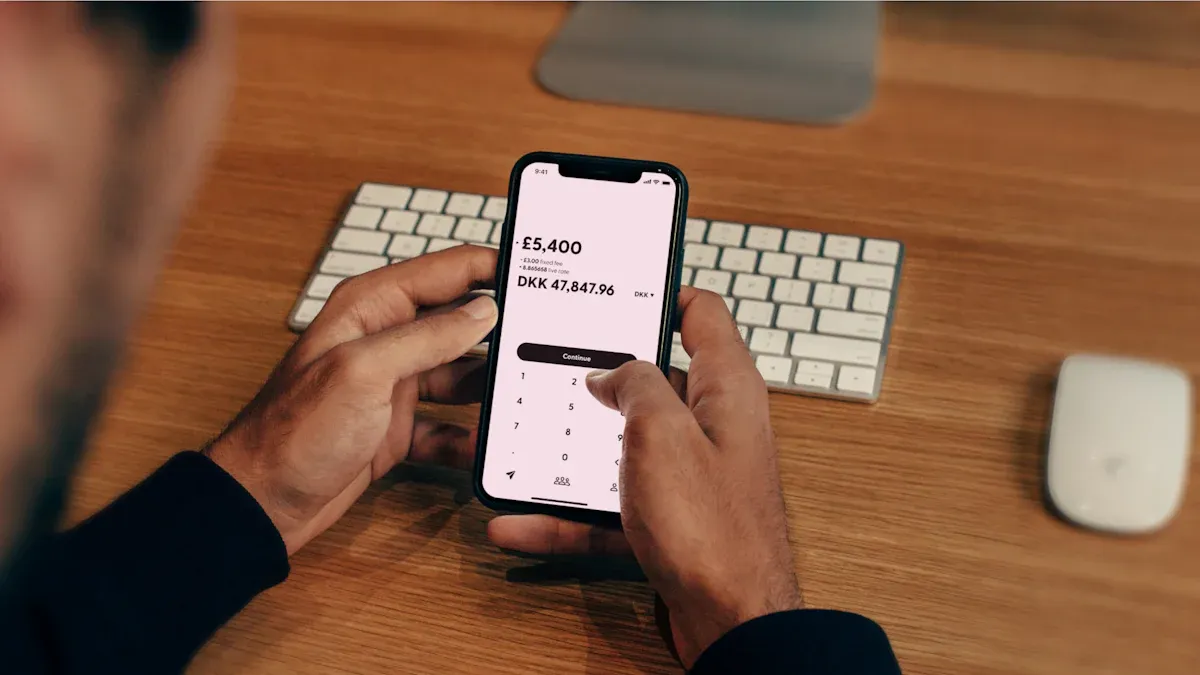

How to Use Interac e - Transfer in Canada

Image Source: unsplash

If you want to transfer money anytime, anywhere, choosing Canada Interac e-Transfer makes the process simple and efficient. Many Canadian businesses are using this method, with over 1.4 billion transactions processed by the platform in 2024. Compared to other transfer methods, you can enjoy the advantages of convenience, speed, real-time arrival, and high security. The latest policy will also introduce uniform fixed fee pricing in 2025, helping to enhance the competitiveness of financial services.

Key Points

- Logging into online banking is the first step in using Interac e-Transfer. Ensure you have activated online banking services and enter the correct user ID and password.

- Before transferring, carefully verify the recipient’s information. Ensure the name, email, or phone number is correct to avoid sending funds to the wrong account.

- When setting a security question, choose one that is not easily guessed. Communicate the security answer with the recipient in advance to ensure fund safety.

- Enabling the auto-deposit function allows funds to be deposited directly into your account, eliminating the need to enter a security answer each time, improving receiving efficiency.

- Pay attention to transfer limits and fees. Understand your bank’s specific regulations and plan fund flows reasonably to avoid unnecessary losses.

Canada Interac e-Transfer Process

Image Source: unsplash

Canada Interac e-Transfer provides a convenient way to transfer funds. You can complete the entire transfer process by following these steps:

Log into Online Banking

- First, you need to log into your online banking account or mobile banking app. Most Canadian banks support Canada Interac e-Transfer services, available for both individual and business customers.

- If you haven’t set up online banking, you can call your bank’s customer service or visit a local branch to obtain a Personal Access Code (PAC).

- When logging in, you need to enter your user ID and password for authentication. Some banks may also require you to verify your identity through an email address or phone number to ensure account security.

Tip: Ensure your bank account has online banking enabled, and you must be at least 18 years old (19 in some provinces); minors require parental consent.

| Requirement | Details |

|---|---|

| Age Requirement | Must be of legal age (18 or 19, depending on the province) |

| Parental Consent | Minors require parental consent |

| Bank Account | Must have a valid account with a participating bank |

Select Transfer Function

- After logging in, locate the “Transfer” option in the left menu bar.

- Navigate to the “INTERAC e-Transfer” page and select “Send Money.”

- Follow the prompts to fill in your personal information, ensuring accuracy.

Note: Canada Interac e-Transfer typically completes within 30 minutes, faster than traditional wire transfers (1-5 business days).

| Payment Method | Transaction Time |

|---|---|

| Canada Interac e-Transfer | Up to 30 minutes |

| Wire Transfer | 1-5 business days |

Enter Recipient Information

- Click “Add New Contact” and enter the recipient’s name and email address or phone number.

- Once added, the recipient’s information will be automatically saved to your contact list, eliminating the need to re-enter it for future transfers.

- You should only transfer to people you know and trust, carefully verifying the recipient’s email or phone number to avoid fund loss due to incorrect information.

- The recipient must have a valid account with a participating Canadian bank and be able to receive transfer notifications via email or phone number.

Tip: Avoid sharing the security answer directly via text or email to ensure information security.

Set Security Question

- Create a security question and answer known only to you and the recipient. The recipient must enter the correct answer to receive the funds.

- Choose a question that is not easily guessed, such as “What is my mother’s middle name?” or “What is the secret password I gave you?”

- Avoid using questions that can be easily guessed through social media or common knowledge, such as “What city do I live in?” or “What is my name?”

- It’s best to agree on the security question with the recipient in advance and share the answer via phone or another secure method.

- A strong security question effectively prevents unauthorized access to funds.

Confirm and Complete the Transfer

- On the “Send via INTERAC e-Transfer” page, select the recipient and enter the amount you wish to send (in USD).

- Click “Continue” and carefully review all transfer details, including the recipient’s name, email or phone number, amount, and security question.

- Once confirmed, click “Confirm,” and the amount will be deducted from your account immediately, with the system automatically notifying the recipient to claim the funds.

- The recipient must enter the correct security answer to complete the fund collection.

- You can share the security answer with the recipient via phone or in person to ensure fund safety.

Friendly Reminder: The Canada Interac e-Transfer process is simple and highly secure. By following the steps above, you can easily complete fund transfers.

Receiving Process

Image Source: pexels

Receive Notification

After you complete the transfer, the recipient will receive a notification immediately. The Canada Interac e-Transfer system will notify the recipient of incoming funds via email or text message. You can refer to the table below to understand common notification methods:

| Notification Method | Description |

|---|---|

| The recipient will receive an email notification informing them of a new transfer. | |

| Text Message | The recipient can also receive transfer notifications via text message. |

You can choose the recipient’s preferred contact method to ensure they receive the notification promptly. After receiving the notification, the recipient typically checks the email or text within minutes to confirm the fund source and amount.

Claim Funds

After receiving the notification, you need to follow the prompts to claim the funds. The process involves a few simple steps:

- Open the email or text message and view the transfer details.

- If you have set up Interac e-Transfer auto-deposit, the system will automatically deposit the funds into your designated account, and you only need to wait for the deposit notification.

- If auto-deposit is not enabled, you need to click the link in the notification to access your bank’s online service page.

- Follow the prompts to select the account type for the deposit.

- Before claiming the funds, you need to answer the security question set by the sender.

- After completing all steps, the system will confirm that the funds have been successfully deposited into your account, and the sender will receive a transaction completion notification.

You can check the deposit status in online banking at any time to ensure fund safety.

Enter Security Answer

In the Canada Interac e-Transfer process, the security question is a critical step in protecting funds. You need to enter the correct security answer to successfully claim the funds:

- The sender will set a security question in advance and share the answer with you.

- You must enter the correct answer when claiming the funds for the system to deposit the money into your account.

- This process prevents unauthorized access to funds, even if someone intercepts the notification.

You should communicate with the sender in advance about the security question to avoid fund claim failures due to incorrect answers.

Auto-Transfer

Enable Auto-Transfer

You can enable the Interac e-Transfer auto-deposit function to have funds deposited directly into your bank account without needing to enter a security answer each time. This significantly improves receiving efficiency and reduces errors. Simply follow these steps:

- Register using your email address and preferred CAD bank account.

- During registration, ensure the email address matches the one provided by the sender.

- Select the account you want to receive funds into.

- Once set up, all Interac e-Transfer funds received via that email will be automatically deposited into your designated account without requiring a security answer.

- You need to confirm that your bank supports the auto-deposit function. Most major Canadian banks and some Hong Kong licensed banks support this service.

Tip: The auto-deposit function helps avoid claim failures due to forgotten security answers and speeds up fund deposits.

Set Up Recurring Transfers

You can also use the Interac e-Transfer scheduling function to set up recurring or future-dated automatic transfers. This is very useful for users who need to regularly pay rent, tuition, or family living expenses. The setup process is as follows:

- Go to the transfer page in online banking and select the “Recurring Transfer” or “Scheduled Transfer” function.

- Enter the recipient’s information and transfer amount (in USD).

- Choose the transfer frequency, such as one-time, weekly, bi-weekly, quarterly, semi-annually, or annually.

- Confirm that the recipient has enabled auto-deposit; otherwise, recurring transfers cannot be completed automatically.

- The system will automatically deduct and send funds according to your set schedule.

You need to be aware of transfer limits. The total transfer amount within 24 hours must not exceed 3,000 USD, 10,000 USD within 7 days, and 30,000 USD within 30 days. Properly planning your transfer schedule can help you manage personal or family finances more effectively.

Friendly Reminder: The recurring transfer function is ideal for users with long-term, fixed payment needs. You can modify or cancel recurring transfer plans in online banking at any time, offering flexibility in managing funds.

Canada Interac e-Transfer Limits

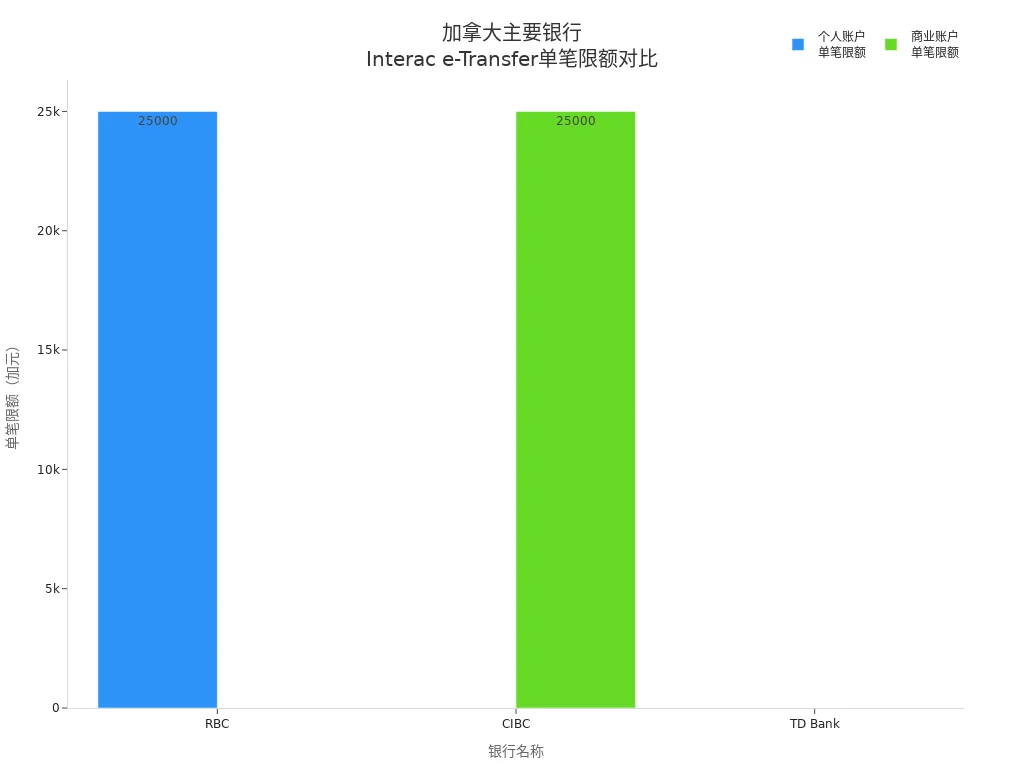

Single Transaction Limit

When using Canada Interac e-Transfer, each transaction has a maximum amount limit. Limits vary depending on the bank and account type. Generally, single transaction limits for personal accounts range from 2,500 to 25,000 USD. Business accounts typically have higher limits. You can refer to the table below for single transaction limits at some major banks:

| Bank Name | Personal Account Single Transaction Limit | Business Account Single Transaction Limit |

|---|---|---|

| BMO | 2,500-3,000 USD | 2,500-3,000 USD |

| Scotiabank | User-defined | 10,000 USD |

| Desjardins | 5,000 USD | 10,000 USD |

| Vancity | 3,000 USD | 6,000 USD |

| RBC | 25,000 USD | N/A |

| CIBC | 3,000 USD | 25,000 USD |

| TD Bank | 3,000 USD | 3,000 USD |

You can check your specific limit on your bank’s online service page. Some banks may dynamically adjust limits based on your account history and risk assessment.

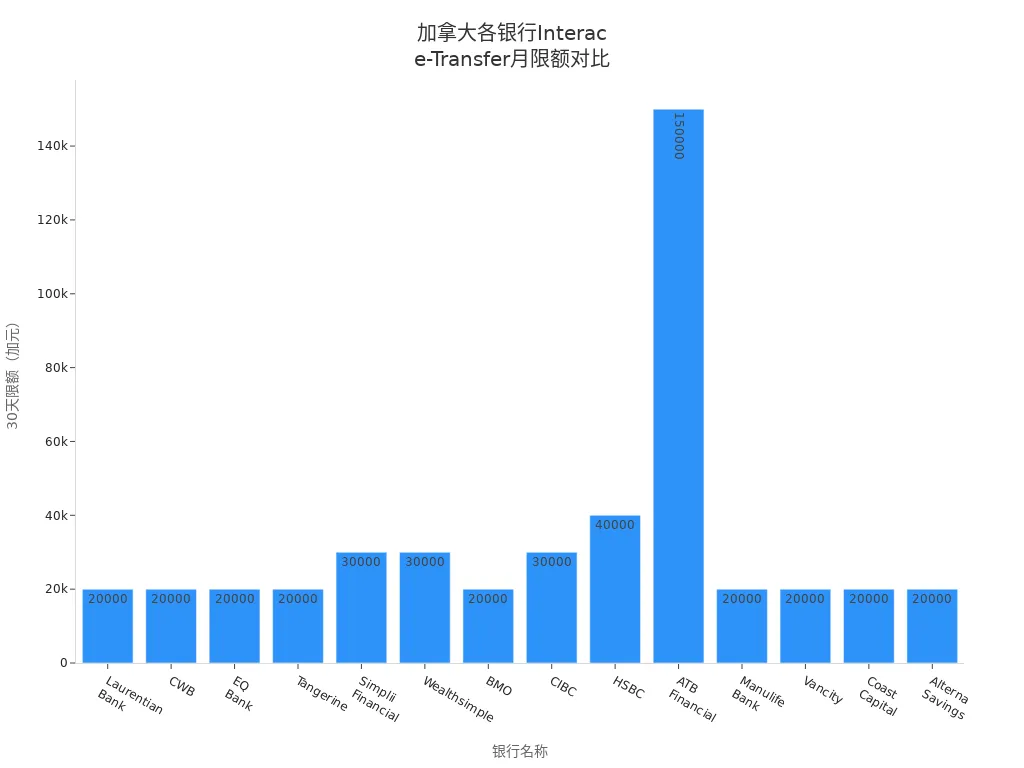

Daily/Monthly Limits

In addition to single transaction limits, you need to be aware of cumulative transfer limits for daily, weekly, and monthly periods. Most banks set limits for 24 hours, 7 days, and 30 days. For example, CIBC’s personal account limits are 3,000 USD per day, 10,000 USD per 7 days, and 30,000 USD per 30 days. Other banks like BMO, EQ Bank, and Tangerine have similar limit structures. You can refer to the table below for cumulative limits at different banks:

| Bank Name | 24-Hour Limit | 7-Day Limit | 30-Day Limit |

|---|---|---|---|

| CIBC | 3,000 USD | 10,000 USD | 30,000 USD |

| BMO | 3,000 USD | 10,000 USD | 20,000 USD |

| EQ Bank | 3,000 USD | 10,000 USD | 20,000 USD |

| HSBC | 7,000 USD | 10,000 USD | 40,000 USD |

| Vancity | 10,000 USD | 10,000 USD | 20,000 USD |

When planning large or frequent transfers, it’s recommended to check your account limits in advance to avoid transfer failures due to exceeding limits.

Fees

Fees for Canada Interac e-Transfer vary depending on the bank and account type. Some banks offer free transfers for personal accounts, while others charge between 0.04-1.50 USD per transaction. Business accounts typically incur higher fees. You can refer to the table below for common fee types:

| Fee Type | Fee Amount (USD) |

|---|---|

| Non-Bank Transaction | 0.08/transaction |

| Bank Transaction | 0.04/transaction |

| Request Money Fulfillment Fee | 0.10/request |

| Business Request Money Fee | Up to 3.50/transaction |

| Text Notification Fee | 0.015/message |

| Bulk Payment Processing Fee | 0.05/transaction |

When choosing a bank and account type, you can select the most suitable option based on your transfer frequency and amount. Some Hong Kong licensed banks also support similar services; refer to the bank’s official announcements for specific fees and limits.

Friendly Reminder: When using Canada Interac e-Transfer, be sure to monitor your account limits and fees, and plan fund flows to avoid unnecessary losses.

Safety and Precautions

Information Security

When using Canada Interac e-Transfer, protecting your account information is critical. Banks typically employ multiple security measures to ensure your funds are safe. The table below summarizes common security measures:

| Security Measure | Description |

|---|---|

| Multi-Factor Authentication | Enable multi-factor authentication on all online accounts to enhance security. |

| Auto-Deposit | Enable auto-deposit to reduce the risk of entering security questions each time. |

| Strong Security Questions | Set questions that are difficult to guess, avoiding publicly available information. |

| Secure Network Connection | Avoid logging into your bank account on public Wi-Fi to prevent information leaks. |

| Strong Password | Use complex passwords and change them regularly to protect your account. |

You should only transfer funds to trusted individuals or businesses. It’s recommended to open an account with a reputable financial institution, such as a Hong Kong licensed bank, and use mobile data or secure Wi-Fi for operations. Avoid transferring funds on shared computers. Before each transfer, carefully verify recipient information. Enabling auto-deposit further enhances security.

Tip: Funds are transferred through the banking system, and emails or text messages are used only for notifications and guidance, not for direct fund transmission.

Common Mistakes

When using Interac e-Transfer, you may encounter some common mistakes. Understanding these issues can help you avoid losses:

- Entering incorrect recipient names, emails, or phone numbers, leading to failed transfers or funds sent to the wrong account.

- Using simple or easily guessed security questions, increasing the risk of unauthorized fund access.

- Transferring funds to unverified recipients, making you vulnerable to scams.

- Forgetting to enable auto-deposit, resulting in delayed fund receipt.

- Failing to verify the recipient’s identity when buying or selling online, increasing scam risks.

- Not accepting transfers promptly, causing funds to expire and be returned.

You can take the following measures to reduce errors:

- Verify recipient information carefully before each transfer.

- Choose unique and hard-to-guess security questions and share answers through separate channels.

- Transact only with trusted contacts or merchants.

- Accept transfers promptly to avoid funds lingering in your inbox.

Handling Failures

If your Interac e-Transfer fails, don’t panic. You can follow these steps to address the issue:

- Log into online banking, locate the transfer record, and select to cancel the transaction. Some banks may charge a cancellation fee.

- Check if the recipient information is correct and ensure sufficient account balance.

- If you encounter technical issues or the transfer is delayed, contact your bank’s customer service or credit union for assistance.

- If funds are sent incorrectly or you suspect fraud, contact your bank immediately to initiate an investigation and report to the authorities. Change all related passwords to secure your account.

- In some cases, banks may assist in recovering funds, but success is not guaranteed.

Friendly Reminder: If you encounter any unusual or suspicious notifications, verify the transaction’s authenticity immediately to protect your personal information and funds.

You now understand the Canada Interac e-Transfer process, receiving methods, limits, and safety precautions. You can transfer funds quickly via email or phone number, enjoying high convenience and security. Refer to the table below for the main advantages and disadvantages:

| Advantages | Disadvantages |

|---|---|

| High convenience and accessibility | Transaction limits |

| Advanced security features | Fees for some users |

| Widely accepted | Limited to Canadian banks |

| Cost-effective | Prone to errors |

Interac e-Transfer is fast, typically arriving within 30 minutes, making it suitable for both daily and business use. You should choose this service based on your needs and verify information carefully to ensure fund safety.

FAQ

Can Canada Interac e-Transfer be used internationally?

You can only use Interac e-Transfer within Canada. Mainland China and Hong Kong licensed banks do not currently support this service. Funds must be transferred between Canadian bank accounts.

How long does it take for a transfer to arrive?

You typically receive funds within 30 minutes. Some banks may experience slight delays. You can check the deposit status in online banking at any time.

What should I do if I enter incorrect recipient information?

You can cancel the transfer in online banking. The funds will be returned to your account. Verify the recipient’s information and resend the transfer.

Is using Interac e-Transfer safe?

You can use it with confidence. Banks employ multiple security measures, including multi-factor authentication and auto-deposit. Avoid operating in public network environments.

Is there a minimum transfer amount?

The minimum transfer amount is typically 1 USD. Specific amounts depend on your bank’s regulations. Some Hong Kong licensed banks have similar restrictions.

While Interac e-Transfer is a convenient option for domestic transfers in Canada, its restriction to Canadian banks only, reliance on email/phone and security questions, and lack of cross-border functionality make it unsuitable for international needs or investment goals. When you need to send money to China, Hong Kong, or beyond, or want your funds to start earning immediately, Interac falls short.

BiyaPay breaks geographical barriers: fees as low as 0.5%, with same-day sending and same-day receipt across multiple regions, including Canada-US routes. No complex bank account linking—just a fully digital process to register and send in minutes. Use the real-time exchange rate tool to lock in optimal CAD-to-CNY/USD rates and avoid hidden spreads from traditional banks and remittance services.

Beyond sending, BiyaPay turns remittance into investment—trade US and HK stocks directly without a Canadian brokerage account, with zero fees on contract orders. Let your money grow as it moves. Whether supporting family, managing overseas income, or micro-investing, BiyaPay offers a more flexible, efficient, and rewarding solution than Interac. Sign up today and experience the next generation of global finance.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.