- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Guide to Currency Exchange in Italy: How Tourists Can Handle Remittance and Currency Exchange Challenges

Image Source: unsplash

When you arrive in Italy, you may worry about the security, convenience, and costs of currency exchange and remittance. You need to understand how to choose legitimate channels to avoid exchange rate losses and potential risks. This Italy currency exchange guide will help you master practical methods to easily handle currency conversion and fund transfer challenges during your trip.

Key Points

- In Italy, the only circulating currency is the euro; prepare some cash in advance for immediate expenses.

- Choose legitimate channels for currency exchange, such as banks and licensed exchange offices, to avoid high fees and unfavorable exchange rates.

- Using ATMs for cash withdrawals typically offers better exchange rates; prioritize bank-owned ATMs.

- Exchange offices at airports and tourist areas have poor exchange rates; try to avoid exchanging money there.

- When carrying cash, be aware of legal restrictions; amounts exceeding 10,000 USD must be declared to customs.

Currency and Payment Methods

Image Source: unsplash

Euro Introduction

When traveling in Italy, the only circulating currency is the euro (€). Italy no longer uses the lira. You need to prepare some euro cash to cover immediate expenses like transportation and dining upon arrival. Many tourists are concerned about the exchange rates between the euro and other major currencies. Below are the current exchange rates for major currencies (based on USD):

| Currency Pair | Current Exchange Rate |

|---|---|

| 1 USD to EUR | 0.85 |

| 1 USD to CNY | 7.112 |

You can exchange some euros in mainland China before departure or obtain euros through banks or ATMs after arriving in Italy.

Common Payment Methods

In Italy, payment methods are diverse. You can choose the following methods for daily expenses:

- Credit and debit cards (such as VISA, MasterCard, Maestro, American Express) are accepted in most shops and restaurants.

- Digital wallets (such as PayPal, Apple Pay, Google Pay) are increasingly popular, especially among younger people and online shoppers.

- Cash is still widely accepted for small transactions, particularly in small shops and markets.

- Buy Now, Pay Later (BNPL) services are gaining popularity, with some merchants supporting this payment method.

| Payment Method | Description |

|---|---|

| Cash | Usage is gradually decreasing |

| Credit Cards | Market share is declining, especially compared to digital wallets |

| Digital Wallets | Increasingly popular, becoming a primary payment method |

| Buy Now, Pay Later (BNPL) | Gaining popularity, attracting many consumers |

When shopping online, VISA or MasterCard credit cards are the most popular. Cards like CartaSi and PostePay are also common in Italy.

Cash and Card Usage Scenarios

In Italy, the frequency of cash and card usage varies by scenario. The table below summarizes common payment scenarios:

| Payment Item | Bank Card | Cash |

|---|---|---|

| Taxi | Usually accepted, confirm in advance | Accepted |

| Convenience Store | Usually accepted, small amounts may not be | Accepted |

| Coffee Shop | Usually accepted, small amounts may not be | Accepted |

| Public Transportation | Accepted | Accepted |

| Restaurant | Usually accepted, small amounts may not be | Accepted |

| Vespa Rental | Accepted | Accepted |

In large cities and tourist areas, bank cards and digital payments are more prevalent. In small towns, markets, or certain small shops, cash is more popular. You can prepare a mix of cash and cards based on your needs to ensure smooth payments. Financial institutions recommend prioritizing secure bank cards and digital wallets to reduce the risk of carrying large amounts of cash. If you encounter payment issues, contact your issuing bank promptly or use payment tools with buyer protection.

Italy Currency Exchange Guide: Exchange Channels

Image Source: pexels

When traveling in Italy, your choice of currency exchange channels directly impacts the security and convenience of your funds. This Italy currency exchange guide recommends selecting banks, currency exchange offices, ATMs, or online remittance and mobile apps based on your needs. Below are the features and precautions for each channel.

Banks and Exchange Offices

You can handle foreign currency exchange and international remittances at major Italian banks. Major banks like BNL, Intesa Sanpaolo, UBI Banca, BancoPosta, UniCredit, and CheBanca! have numerous branches nationwide, making it convenient for you to access services. Banks generally offer a secure service environment, suitable for exchanging large amounts or handling international remittances.

| Bank Name | Service Type | Convenience Description |

|---|---|---|

| BNL | Foreign Exchange Services | Numerous branches nationwide, convenient for customers |

| Intesa Sanpaolo | Foreign Exchange and Cashless Payment Solutions | Hundreds of branches, facilitating currency exchange |

| UBI Banca | International Remittances and Currency Exchange | Branches across Italy, easily accessible |

| BancoPosta | Foreign Exchange Services | Numerous branches and post offices offering exchange services |

| UniCredit | Retail and Corporate Banking Services | Branches in nearly all countries, suitable for currency exchange |

| CheBanca! | Modern Banking Services | Offers online transactions and premium customer service, suitable for currency exchange |

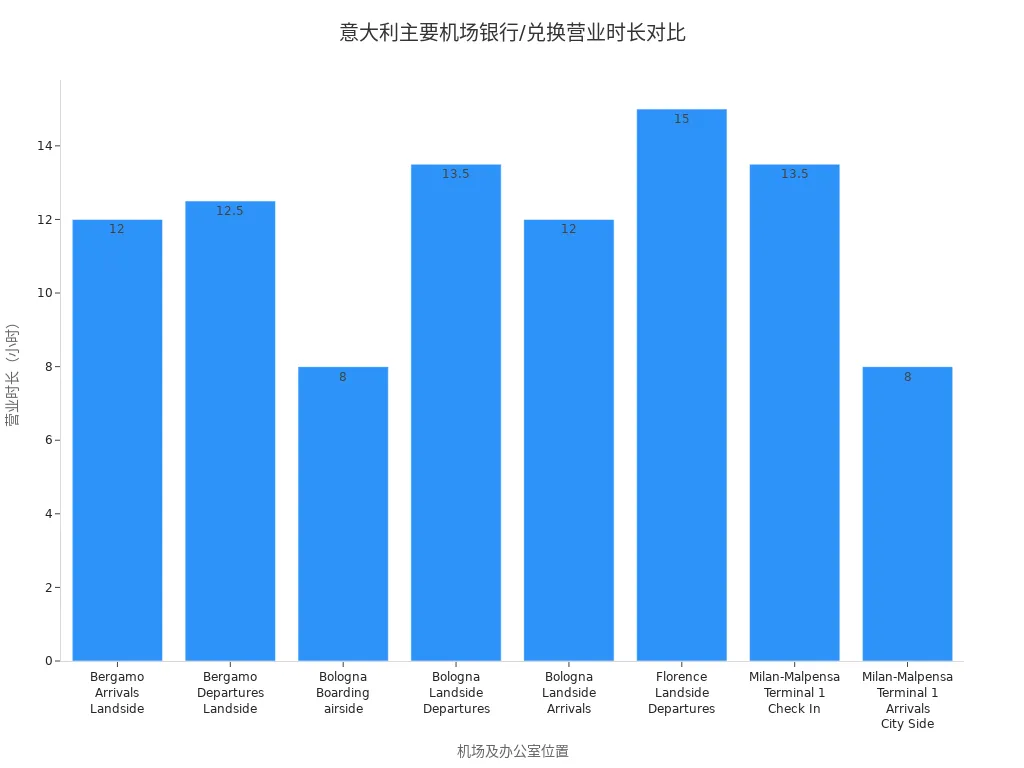

You can also find currency exchange offices at airports, train stations, and popular tourist attractions. These offices have flexible hours and cover major transportation hubs. The table below shows the operating hours of some airport exchange offices:

| Airport Name | Office Location | Operating Hours |

|---|---|---|

| Bergamo Airport | Arrivals Landside | 07:00 - 19:00, daily |

| Departures Landside | 07:00 - 19:30, daily | |

| Bologna Airport | Boarding Airside | 10:00 - 18:00, daily |

| Landside Departures | 06:30 - 20:00, daily | |

| Landside Arrivals | 08:30 - 20:30, daily | |

| Florence Airport | Landside Departures | 05:00 - 20:00, daily |

| Milan-Malpensa Airport | Terminal 1 Check In | 06:30 - 20:00, daily |

| Terminal 1 Arrivals City Side | 08:30 - 16:30, daily |

When using exchange offices, note that those in popular tourist areas often have poor exchange rates and may charge high hidden fees. This Italy currency exchange guide suggests exchanging some euros in mainland China beforehand to reduce the need for local exchanges.

Tip: Bring your passport when exchanging at banks, as some may require an appointment. Exchange offices have simpler procedures but higher fees, suitable for small emergency exchanges.

ATM Withdrawals

Using ATMs to withdraw cash in Italy is one of the most convenient ways to obtain cash. Most ATMs accept international cards like Visa and Mastercard, and withdrawal rates are typically better than bank counters or exchange offices. This Italy currency exchange guide recommends prioritizing ATM withdrawals, especially in city centers and transportation hubs.

- You can find ATMs at banks, metro stations, and airports.

- Visa or Mastercard exchange rates are generally more cost-effective.

- Most ATMs support foreign cards, but some may not recognize mainland China bank cards.

When using ATMs, pay attention to withdrawal limits and fees. The table below summarizes common withdrawal limits and fees:

| Single Withdrawal Limit | Foreign Card Fee Description |

|---|---|

| $250 - $1,000 | Most ATMs charge no fees; some charge $6 per transaction; UK cardholders pay $1.5 or $6 |

| Up to $2,000 | No specific details |

| Depends on Card Limit | No specific details |

When withdrawing, prioritize bank-owned ATMs and avoid standalone street machines. Some ATMs support multilingual operations for quick withdrawals.

Note: Withdraw larger amounts per transaction to reduce fee expenses. Keep cash secure after withdrawal and avoid exposing large amounts in public.

Online Remittance and Mobile Apps

You can transfer funds in Italy using online remittance platforms and mobile apps. Many international remittance companies, such as Xoom and Wise, offer rate-locking services. You can lock exchange rates during fluctuations to ensure fees remain unchanged for 24 hours. This method is suitable for remittances to the US or other countries or for transfers within Italy.

- You can download remittance apps on your phone and link them to a bank or credit card.

- Online remittances are fast, with some platforms supporting instant transfers.

- When using online remittances, prioritize platforms with international licenses for security.

This Italy currency exchange guide reminds you that online remittances are ideal for small transfers and emergencies. Verify exchange rates and fees to avoid losses from hidden charges.

Reminder: Provide accurate identity information when registering for remittance apps to ensure account security. Some platforms support multi-currency exchanges for flexible fund management.

Comparison of Exchange Channel Convenience

When choosing exchange channels, refer to the table below to compare convenience and applicable scenarios:

| Exchange Channel | Convenience | Applicable Scenarios | Precautions |

|---|---|---|---|

| Banks | Secure, numerous branches | Large exchanges, international remittances | Bring passport, some require appointments |

| Exchange Offices | Flexible, wide coverage | Small emergency exchanges | Poor rates, high fees |

| ATMs | Convenient, good rates | Daily withdrawals | Check fees and limits |

| Online Remittance/Apps | Fast, instant transfers | Cross-border transfers, small remittances | Verify platform security and rates |

When exchanging currency in Italy, combine your needs and circumstances to choose the most suitable channel. This Italy currency exchange guide helps you avoid common pitfalls, ensuring secure and convenient fund management.

Fees and Exchange Rates

Fee Comparison

When exchanging currency in Italy, fees and hidden charges directly affect your actual costs. Different channels have significant fee variations:

- When exchanging at airports and hotels, you typically face higher fees and unfavorable exchange rates. These locations are suitable for emergency exchanges but not for large amounts.

- Exchange offices near tourist attractions often advertise “zero commission” but profit through exchange rate spreads. You may find that, despite no explicit fees, the amount received is reduced.

- When withdrawing from ATMs, you generally get better exchange rates. Some ATMs charge $6 per transaction, and some banks add foreign transaction fees. Prioritize bank-owned ATMs to avoid standalone machines.

- Using online platforms or apps (like Wise) for exchanges incurs lower, transparent fees. Some platforms have fees as low as 0.41%, suitable for frequent small exchanges.

Tip: When withdrawing from ATMs, always choose to settle in the local currency to avoid extra fees from dynamic currency conversion.

Exchange Rate Differences

When exchanging currency in Italy, the actual rates you receive are often lower than official interbank rates. Exchange rate differences across channels include:

- When exchanging at airports, hotels, or tourist areas, rates are typically 7 to 10 cents lower than official rates. For example, the official rate may be 1 EUR = 1.18 USD, but some banks or exchange offices may offer only 1 EUR = 1.2473 USD, a significant difference.

- ATM withdrawals generally offer rates closer to the mid-market rate, but beware of direct currency conversion fees charged by banks.

- Online platforms like Wise use mid-market exchange rates with transparent fees, allowing you to understand actual costs clearly.

| Source | Description |

|---|---|

| Banca d’Italia | Provides historical and current Italian official exchange rate data, suitable for those needing official rates |

| Wise | Offers real-time currency conversion with mid-market rates and fees as low as 0.41% |

Before exchanging, check official rates and platform real-time rates to avoid overpaying due to information asymmetry.

Exchange Amounts and Restrictions

When exchanging currency in Italy, be aware of amount restrictions and regulations:

- When withdrawing from ATMs, single transaction limits are typically $250–$1,000, with some banks allowing higher daily cumulative limits. Check your card’s withdrawal limits in advance and plan withdrawal frequency.

- Online platform exchanges may have single-transaction and daily limits, suitable for frequent small transactions.

- When exchanging at exchange offices or bank counters, some institutions require identity verification and declarations for large amounts. Bring a passport or other valid ID, and some banks may require appointments.

Reminder: Avoid exchanging large amounts of cash at once to reduce fees and risks of carrying cash.

How to Save on Exchange Costs

You can adopt the following strategies to reduce exchange and remittance costs:

- Avoid exchanging currency at airports and tourist areas, as they have the highest fees.

- Prioritize bank-owned ATMs for better rates and lower fees.

- Use low-fee, transparent-rate platforms like Wise for frequent small exchanges.

- Minimize cash exchanges to avoid 5%–10% losses.

- Compare real-time rates and fees across channels to choose the best option.

By following the suggestions in this Italy currency exchange guide, you can avoid high fees and unfavorable rates, making your travel fund management more efficient and secure.

Italy Currency Exchange Guide: Safety Tips

Identifying Legitimate Channels

When exchanging currency in Italy, choosing legitimate channels is crucial. You can prioritize banks, licensed currency exchange offices, and official ATMs. Legitimate banks typically display their licenses at the entrance or in the lobby. When choosing ATMs, prioritize bank-owned machines. Standalone street ATMs or unmarked exchange points carry higher risks. Exchange offices at airports and train stations, while convenient, charge higher fees. Before departing from mainland China, you can exchange some euros through Hong Kong-licensed banks to reduce the need for local exchanges in Italy.

Tip: When exchanging, verify the institution’s legal operating credentials. Legitimate channels require a passport or valid ID to ensure fund security.

Fraud Prevention and Safety

When exchanging or withdrawing cash in Italy, stay vigilant against fraud risks. Some fake ATMs may steal card information or have cameras installed during withdrawals. Cover the keypad with your hand when entering your PIN to prevent information theft. If strangers offer exchange services, firmly decline. Street exchanges often involve counterfeit currency or high fees. When using online remittances or mobile apps, choose platforms with international licenses to avoid personal information leaks.

To protect your funds, follow these suggestions:

- Keep bank cards and cash secure, and avoid carrying large amounts of cash.

- Regularly check account balances and contact your issuing bank immediately if you notice anomalies.

- Avoid sharing personal information, especially in public places or on unknown websites.

Reminder: If you encounter suspicious situations, stop the transaction immediately and seek help from local police or banks. This Italy currency exchange guide advises staying vigilant and choosing legitimate channels to ensure travel fund safety.

Cash Carrying Regulations

Carrying Limits

When traveling to Italy, you need to understand legal restrictions on carrying cash. In 2024, Italy has clear regulations on cash transactions and carrying amounts. You must not carry cash exceeding 10,000 USD when entering or leaving Italy. If you carry cash exceeding 4,999.99 USD, it’s recommended to use traceable methods like bank transfers for large payments. Cash transactions exceeding the limit may attract customs attention and could lead to high fines.

- The maximum cash transaction limit in 2024 is 4,999.99 USD.

- Cash payments exceeding this amount must be made through traceable methods like banks.

- You must declare cash exceeding 10,000 USD when entering or leaving Italy.

- Failure to declare or violating cash-carrying rules may result in fines up to 50% of the carried amount.

The table below summarizes cash-carrying restrictions and related fines:

| Cash Carrying Limit | Fine Description |

|---|---|

| Over 4,999.99 USD | Minimum fine of 5,000.00 USD |

| Over 10,000 USD | Must be declared; undeclared cash may incur fines up to 50% |

Reminder: Before departing from mainland China, exchange some foreign currency through Hong Kong-licensed banks to reduce the need to carry large amounts of cash in Italy.

Declaration Requirements

When carrying large amounts of cash into or out of Italy, you must comply with customs declaration regulations. If you carry cash equivalent to or exceeding 10,000 USD, whether in euros, USD, or other currencies, you must proactively declare it to customs. The declaration process is typically completed upon entry or exit, with customs requiring you to fill out forms detailing the source and purpose of the funds.

| Cash Amount | Declaration Requirement | Potential Consequences |

|---|---|---|

| ≥ 10,000 USD | Must declare to customs | Cash may be confiscated, with fines imposed |

If you fail to declare as required, customs may confiscate excess cash and impose high fines. Prepare relevant documentation in advance to ensure a smooth declaration process. It’s recommended to carry minimal cash and prioritize bank cards or online payment tools for safety and convenience.

Practical Tips

Exchange Preparation

Preparing for currency exchange before traveling to Italy can make your trip smoother. You can contact your bank in advance to confirm whether your debit card can be used in Italy. You also need to inquire about the 24-hour withdrawal limit and international transaction fees for your debit card. When exchanging currency, you must carry your passport, as some banks or exchange offices require it for identity verification. If you plan to apply for Value Added Tax (VAT) refunds after shopping, familiarize yourself with the requirements in advance. Keep special receipts and tax exemption forms, as these are essential for refunds.

- Contact your bank to confirm international debit card usage

- Check withdrawal limits and international transaction fees

- Prepare your passport for exchange and identity verification

- Understand VAT refund procedures and keep relevant receipts and forms

Preparing these materials in advance can reduce hassles during exchange and payment processes.

Money-Saving Tips

When exchanging currency in Italy, choosing the right channels and methods can save significant costs. You can prioritize bank-owned ATMs for withdrawals, which typically offer better exchange rates and lower fees. Avoid exchanging at airports, hotels, or tourist attraction exchange offices, as their rates are often unfavorable and fees are high. Compare real-time rates and fees across channels to choose the best option. When exchanging, withdraw larger amounts per transaction to reduce fee expenses. Consider using online remittance platforms, which offer transparent fees and are suitable for frequent small exchanges.

Reminder: When shopping in Italy, request receipts with VAT information. You can use these receipts to apply for refunds upon departure, further saving on travel costs.

By planning strategically and choosing wisely, you can ensure every exchange is cost-effective, keeping your travel funds secure and efficient.

When exchanging currency in Italy, keep these points in mind:

- Choose bank-affiliated ATMs for lower fees and higher security.

- Settle in euros to avoid hidden fees from dynamic currency conversion.

- Avoid exchange points at airports and hotels due to high fees.

- Carry minimal cash and use bank cards for daily expenses.

| Aspect | Italy Practice | Common Practices in Other European Countries |

|---|---|---|

| Cash Usage | Common for small transactions | Credit cards more prevalent |

| Credit Card Acceptance | Visa, Mastercard dominant | AMEX more widely accepted |

| Exchange Advice | Avoid airports, train stations | Use banks or legitimate exchange offices |

By preparing in advance and choosing channels flexibly, you can manage your travel funds safely, conveniently, and economically.

FAQ

How Much Cash Can You Exchange at Italian Airports?

There is no strict limit on cash exchanges at Italian airports, but for larger amounts, staff may require you to show your passport and register information.

Can You Use Mainland China Bank Cards for ATM Withdrawals in Italy?

You can use mainland China bank cards for ATM withdrawals in Italy. Confirm international withdrawal permissions with your issuing bank in advance and understand daily withdrawal limits and fees.

How Can You Avoid High Fees When Exchanging Currency in Italy?

Prioritize bank-owned ATMs or legitimate online platforms for exchanges. Avoid large exchanges at airports, hotels, or tourist attraction exchange offices to reduce fee expenses.

Do You Need to Declare Cash Exceeding 10,000 USD When Entering Italy?

You must proactively declare cash equivalent to or exceeding 10,000 USD when entering Italy. Failure to declare may result in cash confiscation and high fines.

What Should You Do If You Encounter Counterfeit Currency or Fake ATMs in Italy?

If you encounter counterfeit currency or fake ATMs, stop the transaction immediately and retain evidence. Seek help from local police or banks to ensure fund safety.

While this guide offers practical advice on using banks, ATMs, and traditional exchange services in Italy, frequent withdrawals, high fees, dynamic currency conversion (DCC), and complex VAT refund processes still lead to inefficient and costly money management for many travelers. When you need to quickly use euros for spending or investing in China, traditional methods become slow and cumbersome.

BiyaPay provides a seamless cross-border financial solution: with fees as low as 0.5% and support for same-day sending and receipt. Say goodbye to airport exchange losses and hidden ATM fees. Use the real-time exchange rate tool to lock in optimal EUR/CNY or EUR/USD rates, ensuring every euro retains maximum value.

Beyond remittance, BiyaPay lets you invest directly in US and HK stocks without a mainland Chinese bank account—zero fees on contract trades. Whether managing travel leftovers, student funds, or overseas income, BiyaPay turns remittance into investment. Sign up today and experience smarter, faster global money management.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.