- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Use American Express Points and Transfer Services? The Most Comprehensive Guide!

Image Source: unsplash

You can enjoy a more efficient card usage experience through American Express points. You earn points when spending on categories like dining, travel, and groceries. You can also take advantage of welcome offers, referral bonuses, and Amex Offers to earn additional points. When redeeming points, pay attention to the latest benefits and tax policies to avoid common pitfalls. Flexible use of transfer services helps you save more USD.

Key Takeaways

- Applying for an American Express credit card can yield generous sign-up bonuses; choose a card that suits you to maximize point earnings.

- During daily spending, prioritize high-earning categories like flights and hotel bookings to improve point accumulation efficiency.

- Participating in limited-time events and partner merchant promotions can earn extra points; stay alert for holiday promotions to gain more rewards.

- When redeeming points, travel rewards typically offer the highest value; prioritize transferring points to airline or hotel loyalty programs.

- Use the Send & Split feature to easily manage group payments, ensuring accurate information entry to avoid transfer errors.

How to Earn American Express Points

Image Source: unsplash

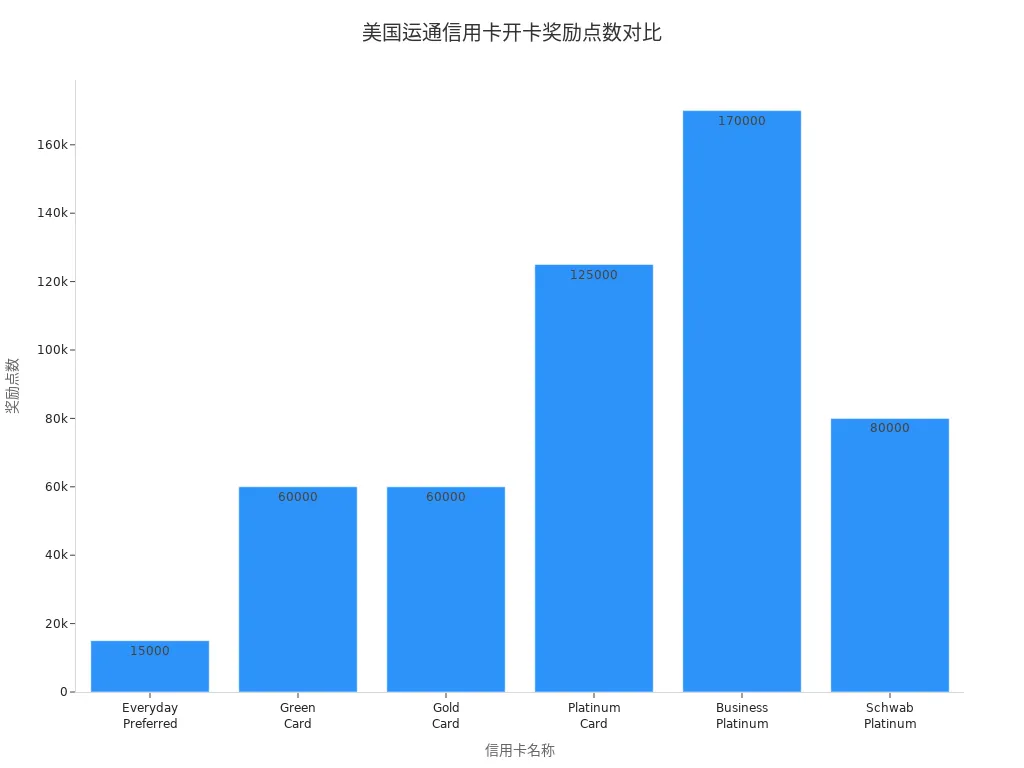

Sign-Up Bonuses

You can earn generous sign-up bonuses by applying for different American Express credit cards. Each card has different bonus conditions and point amounts. After meeting the specified spending threshold, you can earn a large number of American Express points at once. The table below shows the sign-up bonuses for some popular credit cards:

| Credit Card | Introductory Bonus |

|---|---|

| American Express Everyday Preferred card | 15,000 points if you spend $2,000 in the first 6 months (terms apply) |

| American Express® Green Card | 60,000 points if you spend $3,000 in the first 3 months (terms apply) |

| American Express® Gold Card | 60,000 points if you spend $6,000 in the first 6 months (terms apply) |

| The Platinum Card® from American Express | 125,000 points if you spend $8,000 in the first 6 months (terms apply) |

| The Business Platinum Card® from American Express | 170,000 points if you spend $15,000 in the first 3 months (terms apply) |

| American Express Platinum Card® for Schwab | 80,000 points if you spend $6,000 in the first 6 months (terms apply) |

You can view the differences in sign-up bonus points for various credit cards through the bar chart below:

When choosing a credit card, you can select the sign-up bonus plan that best suits your spending ability and needs. Pay attention to each card’s terms and time restrictions to avoid missing the optimal earning opportunity.

Daily Spending Accumulation

When you use an American Express credit card for daily spending, you can continuously accumulate points. Different types of spending yield different point ratios. You can refer to the table below to understand the number of points earned per $1 spent:

| Spending Type | Points Earned per $1 Spent |

|---|---|

| Flights (booked directly) | 5 |

| Hotels (booked through Amex Travel) | 5 |

| Other spending | 1 |

When booking flights and hotels, using an American Express credit card earns more points. You can also steadily accumulate American Express points in other spending scenarios like groceries and dining. By aligning with your spending habits, you can choose high-earning categories to boost point accumulation efficiency.

Tip: You can focus large spending on high-earning categories, such as travel bookings or partner hotels, to earn a large number of American Express points faster.

Events and Partner Merchants

You can also earn extra points by participating in American Express’s limited-time events and partner merchant promotions. On the American Express website or app, you can view the latest Amex Offers and partner merchant lists. After activating relevant offers, spending at designated merchants can earn you double points or cash back.

You can pay attention to major shopping festivals, holiday promotions, and partner brand events. Spending during these periods often earns more American Express points than usual. You can also earn referral bonus points by referring friends to apply for an American Express credit card.

Staying Updated

You should stay informed about the latest American Express points policies and event updates. You can subscribe to American Express’s official emails or enable push notifications in the app. You can also join American Express points-related communities to get firsthand information.

When using an American Express credit card in China/Mainland China, pay attention to changes in international spending policies and point redemption rules. You can regularly check the American Express website to learn about the latest point-earning channels and efficient accumulation techniques. Staying updated allows you to better plan your points strategy and avoid missing important benefits.

American Express Points Redemption and Transfer

Image Source: pexels

Travel Redemption

You can use American Express points for travel redemption, which is typically the most cost-effective option. You can transfer points to airline or hotel loyalty programs to redeem high-value flights or accommodations. For example, you can transfer points to Qatar Airways, where booking a Qsuite business class requires 70,000 points; transfer to Air France-KLM, where a round-trip business class to Europe requires only 60,000 points; or use Virgin Atlantic points to fly from JFK to London for just 6,000 points. The table below shows several popular travel redemption options and required points:

| Travel Reward Option | Required Points |

|---|---|

| Transfer to Qatar Airways for Qsuite business class | 70,000 |

| Transfer to Air France-KLM for round-trip Europe business class | 60,000 |

| Use Virgin Atlantic points to fly from JFK to London | 6,000 |

Before redeeming, confirm the availability of flights or hotels to avoid being unable to book after transferring points. You should also choose the most suitable transfer partner to enhance redemption efficiency.

Cash Back

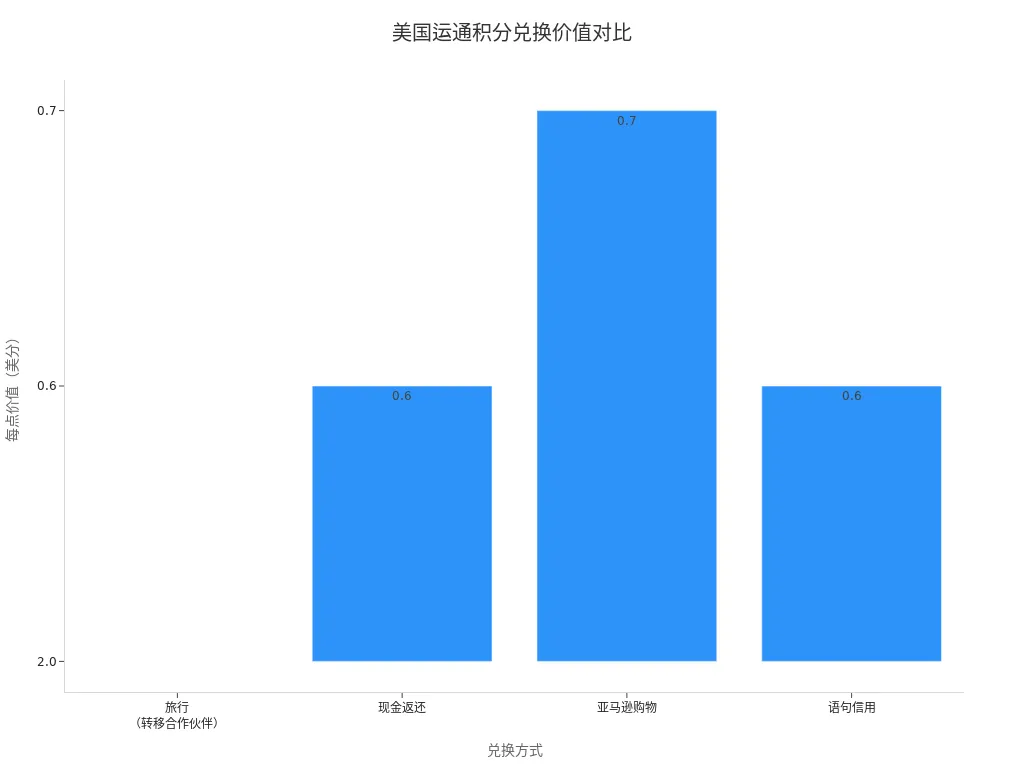

You can choose to redeem American Express points for cash back or statement credit. While this method is simple, the value per point is lower. The table below compares the value per point for different redemption methods:

| Redemption Method | Value per Point |

|---|---|

| Travel (transfer partners) | Over 2 cents |

| Cash back | 0.6 cents |

| Amazon shopping | 0.7 cents |

| Statement credit | 0.6 cents |

You can view the value differences of American Express points across redemption methods through the bar chart below:

If you aim to maximize point value, prioritize travel redemptions. If you need flexible funds, you can opt for cash back or statement credit.

Bank Transfer Process

You can transfer American Express points to partner bank loyalty accounts, especially common in China/Mainland China or Hong Kong licensed bank scenarios. You need to follow these steps to complete a bank transfer:

- Log in to your American Express account.

- If your default card is a co-branded card, switch to a Membership Rewards card.

- Click the “Explore Rewards” button to access the Membership Rewards dashboard.

- Find the “Transfer Points” option in the “Redeem Rewards” section.

- View all transfer partners and link your airline or hotel loyalty account.

- Enter your loyalty account number and complete security verification.

- Select the number of points to transfer and confirm the transfer request.

When operating, carefully verify the loyalty account number to avoid point loss due to input errors. You should also confirm the partner bank or hotel’s point redemption rules in advance to ensure a smooth transfer.

Tip: Before transferring, confirm the redemption requirements and availability of the target account to avoid unusable points after transfer.

Payment Platform Transfers

You can use the American Express platform to apply points for payments or transfers, but not all third-party payment platforms support point transfers. The table below shows the transfer restrictions for major payment platforms:

| Payment Platform | Transfer Restriction Range |

|---|---|

| American Express | $5,000 to $50,000 |

| PayPal | N/A |

| Xoom | N/A |

| MoneyGram | N/A |

When using the American Express platform for transfers, you can flexibly choose the amount range. When using in China/Mainland China or Hong Kong, pay attention to local policies and platform compatibility. Ensure accurate transfer information to avoid delays due to errors.

Taxes and Considerations

When redeeming American Express points, you need to be aware of relevant tax policies. The IRS stated in a 2002 announcement that frequent flyer miles related to business travel used by individuals are not considered income. However, in practical cases like the Shankar case, the Tax Court ruled that taxpayers must include the fair market value of airline tickets obtained through point redemption as income. If point redemption is considered interest payment, non-resident aliens may face reporting obligations under the Foreign Account Tax Compliance Act (FATCA).

In the Shankar case, the Tax Court confirmed the tax treatment of reward point redemptions, stating that redeeming points for rewards is a taxable event. You need to report the fair market value of the rewards in the tax year of redemption. This case set a precedent for the tax treatment of reward programs.

When operating, be aware of the following common pitfalls:

- Transferring points before confirming the availability of required flights or hotels.

- Failing to select the optimal transfer partner.

- Entering incorrect airline or hotel loyalty program numbers.

Plan your redemption strategy in advance to avoid point loss or tax risks due to operational errors or policy changes.

Transfer Services Explained

Send & Split Feature

You can use American Express’s Send & Split feature to easily manage group payments and transfer needs. This feature allows you to quickly split expenses when spending with friends or family. You can choose to split evenly or customize each person’s amount. Send & Split is not only suitable for repaying debts but also for sending gifts or splitting group purchase expenses. In Hong Kong licensed bank scenarios, you can also experience efficient fund allocation and management.

- Send money to friends or family, such as repaying debts or sending gifts.

- Split group purchase expenses, like gifts or shared costs.

- Through the Amex Split feature, you can flexibly split any card purchase expenses, choosing to split evenly or adjust each person’s amount.

Operation Steps

When using the Send & Split feature, you can follow these steps to complete splitting and transfers:

- Register: Download and log in to the Amex app, click “Send & Split: Venmo/PayPal,” and follow the prompts to link your Venmo or PayPal account.

- Select “Split It”: In the app, select a transaction, and you’ll see the “Split It” option.

- Choose Payment App and Amount: Select additional expenses to split, add contacts, and set each person’s payment amount.

- Choose Repayment Option: Choose to deposit the money into your Venmo account or directly credit your Amex account.

- Track Payments: View split transactions and details in the “Split Purchases” section of the Amex app.

- Complete: After sending the request, you can easily track payment progress.

Tip: Before splitting, confirm each participant’s account information to ensure funds arrive smoothly.

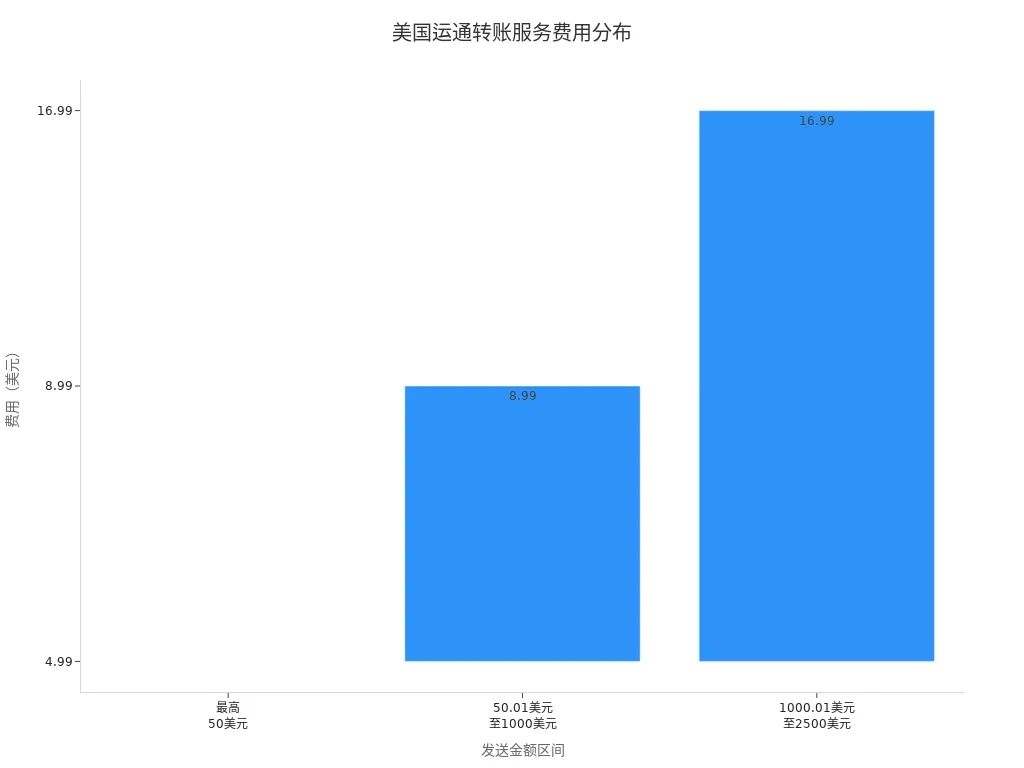

Fees and Scenarios

When using American Express transfer services, you need to be aware of fees for different amount ranges. The table below shows the main fee structure:

| Sending Amount Range | Fee |

|---|---|

| Up to $50 | $4.99 |

| $50.01 to $1,000 | $8.99 |

| $1,000.01 to $2,500 | $16.99 |

You can choose the appropriate amount range based on your needs to plan transfer costs reasonably. The Send & Split feature is most useful in the following scenarios:

- You need to split dining or travel expenses with friends.

- You want to repay a loan to family members.

- You want to quickly recover individual shares after purchasing group gifts.

Common Questions

When using American Express transfer services, you may encounter some common questions. The table below organizes the main questions and official answers:

| Question | Answer |

|---|---|

| How long does an American Express transfer take? | Typically, transfers take 1 to 3 business days. |

| Can I send money to someone without an American Express account? | Yes, modern remittance services allow recipients to receive money without a specific financial institution account. |

| Does American Express allow balance transfers? | No, American Express currently does not support balance transfers. |

When operating, also note the following:

- American Express transfers typically take 1 to 3 business days.

- You can send money to someone without an American Express account.

- American Express currently does not allow balance transfers.

If you encounter issues, you can always check the American Express official help center or contact customer service for timely support.

Practical Tips and Pitfalls to Avoid

Latest Policies

When using American Express points, you need to stay updated on the latest policy changes. Since December 15, 2023, American Express adjusted point calculations and airline transfer ratios. You can refer to the table below:

| Policy Change | Impact |

|---|---|

| Point calculation adjustment | Points will be calculated based on rounded amounts, and frequent small transactions may earn more points. |

| Airline point transfer ratio adjustment | Transfer ratio to Emirates changed from 2:1 to 4:1; six other airlines adjusted to 3:1. |

When redeeming points, note that American Express charges a transfer fee of $0.06 per point for certain airlines (e.g., Delta Air Lines, JetBlue). Recently, transferring 50,000 points incurs a $30 fee, 125,000 points incurs a $75 fee, with a maximum fee of $99. For international transfers, incoming transfers are free, while outgoing fees vary by amount. The daily minimum limit is $50, and the maximum is $10,000 or 70% of the approved credit limit, whichever is lower.

Common Pitfalls

When using American Express points and transfer services, you may encounter the following pitfalls:

- Ignoring changes in point transfer ratios, leading to reduced redemption value.

- Failing to check flight or hotel availability before transferring points, rendering points unusable.

- Not paying attention to new point calculation rules during frequent small purchases, missing extra points.

- Overlooking transfer fees and limits, resulting in reduced actual received amounts.

It’s recommended to carefully read the latest policies and fee details before operating to avoid losses due to outdated information.

User Experiences

Many experienced American Express users adopt the following strategies to enhance point value:

- On flights booked through airlines or American Express Travel, you can earn 5 points per $1 spent.

- For prepaid hotels booked through American Express Travel, you can also earn 5 points per $1 spent.

- You can utilize up to $200 in annual Uber cash and other credits to enhance card benefits.

- Pay attention to market conditions to understand the current value and demand for points.

- Before transferring points, confirm that points can be transferred to other users or frequent flyer programs.

- Choose reputable platforms (e.g., MileageSpot.com) for point transactions.

- When selling points, follow platform guidelines to ensure accurate information.

Flexible Choice Suggestions

When choosing point redemption and transfer methods, consider your needs and market conditions. The table below compares the point value of different credit cards:

| Credit Card Type | Point Value |

|---|---|

| Amex Membership Rewards | 2 cents/point |

| Chase Ultimate Rewards | 2.05 cents/point |

If you aim for high-value redemptions, prioritize travel-related point transfers. If you need flexible funds, opt for cash back or statement credit. When using American Express services in China/Mainland China, pay attention to international policies and local rules, and adjust your card usage strategy flexibly to maximize point benefits.

To efficiently use American Express points, consider the following:

- Choose a credit card with high point rates, reasonable annual fees, and generous welcome offers.

- Fully utilize 1:1 transfer ratios and 20 partners for flexible travel reward redemptions.

- Regularly check Amex Platinum card updates, subscribe to official newsletters, and stay informed about policy and benefit changes.

- If you have questions, proactively contact American Express for help.

By flexibly planning your redemption strategy based on your needs, you can maximize point value and enhance your card usage experience.

FAQ

How long does it take for American Express points to be credited?

After completing a purchase, points typically arrive within 1-3 business days. You can check point changes anytime on the American Express app or website.

Can I transfer points to family or friends?

You cannot directly transfer points to others. You can only transfer points to airline or hotel accounts under your own name.

Can I refund points after redeeming for travel rewards?

If the airline or hotel allows ticket refunds or cancellations, points will be returned to your account. Check the partner’s refund and cancellation policies in advance.

What restrictions apply to using an American Express card in China/Mainland China?

When using an American Express card in China/Mainland China, some merchants may not accept it. Confirm in advance whether the merchant accepts American Express payments.

Is there a minimum requirement for redeeming points for cash back?

There is usually a minimum point requirement for cash back redemption. Check the specific redemption threshold on the American Express website or app.

When transferring funds to Canada, you must weigh the high security of traditional banks against the convenience of transfer operators and the cost advantages of new digital platforms. While careful comparison helps you save money, modern global investors often require a single platform that combines efficient remittance with flexible asset management.

BiyaPay provides this advanced financial solution. You can achieve zero-barrier global investment with our quick registration, completed in just 3 minutes without needing an overseas bank account. We offer the significant advantage of remittance fees as low as 0.5%, providing savings of up to 90% versus conventional banks. Moreover, with our real-time exchange rate inquiry service, you can continuously monitor rate dynamics and effectively safeguard against hidden losses. A single account allows you to trade both US and Hong Kong stocks, enabling unified, quicker asset management without platform switching. We also support the conversion between fiat and digital currencies (like USDT), ensuring quick funding by bypassing complex channels. For tuition or investment, all transfers support same-day sending and arrival, meaning funds reach their destination the same day, so you never miss a critical trading window. Start exploring today to make your transfers to Canada and global investments more efficient and secure.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.