- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Advantages and Usage Guide of Cash Withdrawal Service: How to Choose the Right Remittance Method

Image Source: pexels

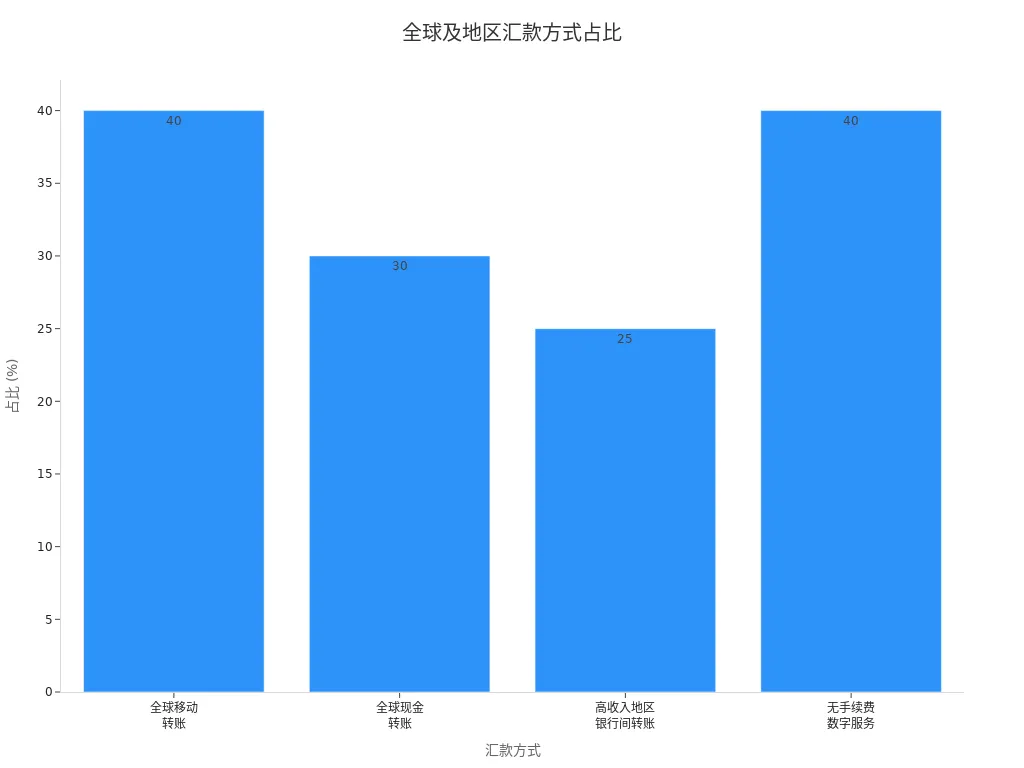

When choosing methods for remittance and withdrawal, your primary concerns are speed and convenience. The advantages of cash withdrawal services lie in their convenience, flexibility, low fees, and wide coverage. Data shows that globally, over 70% of users are willing to pay higher fees for faster processing, and digital payments have become the mainstream choice in the Asia-Pacific region, with satisfaction levels continuing to rise.

| Evidence Type | Data |

|---|---|

| User Preference | Over 70% of users are willing to pay higher fees for faster processing |

| Mobile Transfer Share | Mobile transfers account for 40% of global remittances |

| Traditional Cash Transfer Share | Cash transfers still account for 30%, but decrease by 2-3% annually |

When using any remittance service, you should prioritize reputable providers, ensure accurate information, and avoid delays or errors due to operational mistakes.

Key Points

- Cash withdrawal services provide a fast and convenient way to access cash, suitable for daily cash needs.

- Choose reputable providers to ensure accurate information and avoid delays or errors due to operational mistakes.

- Cash withdrawal services typically have low fees, and a transparent fee structure helps with budgeting and fund management.

- Cash withdrawal services offer wide coverage, allowing users to easily find withdrawal points in both urban and remote areas.

- When choosing a remittance method, consider the amount, speed, cost, and security to flexibly select the most suitable channel.

Advantages of Cash Withdrawal Services

Image Source: pexels

The advantages of cash withdrawal services are evident in multiple aspects. You can quickly and securely access cash through these services, whether in urban or remote areas. Industry reports indicate that cash withdrawal services excel in speed, flexibility, cost, and accessibility, making them suitable for users needing quick access to cash and applicable to various life and work scenarios.

Convenience

You often need quick cash access in daily life. Cash withdrawal services allow you to avoid long bank counter queues, completing transactions directly via ATMs or partner retail points. Data shows that since 1991, 86% of ATM transactions have been cash withdrawals. The number of ATMs in the U.S. grew at a 15.9% compound annual growth rate from 1978 to 1996, and currently, each ATM handles an average of 6,400 transactions per month.

You can withdraw cash while shopping, saving time and improving efficiency.

- For example, with TymeBank, 58% of customers live in urban areas and 42% in rural areas, demonstrating wide service coverage.

- 67% of customers believe there is no better alternative, highlighting the clear advantages of cash withdrawal services.

| Evidence Type | Details |

|---|---|

| ATM Usage | A 1991 study shows 86% of ATM transactions were cash withdrawals. |

| ATM Growth | From 1978 to 1996, the number of ATMs in the U.S. increased at a 15.9% CAGR. |

| Transaction Volume | U.S. ATMs currently process an average of 6,400 transactions per month. |

Flexibility

Cash withdrawal services offer you flexible options. You can choose the withdrawal time and location based on your needs. Compared to traditional bank transfers, cash withdrawal services typically have no strict limits on transaction frequency. You can withdraw cash at multiple retail points or ATMs, unaffected by bank operating hours.

- Nearly 90% of people have used cash in the past 30 days, indicating cash remains important in the payment ecosystem.

- During natural disasters or technical failures, cash withdrawal services provide a reliable channel for accessing funds.

- Certain groups rely more on cash for daily transactions, and cash withdrawal services meet these needs.

| Feature | Cash Withdrawal Service | Traditional Bank Transfer |

|---|---|---|

| Transaction Limits | Limited per withdrawal but no frequency limits | Strict transaction limits and excess fees |

| Access Points | Cash withdrawal available at multiple retail locations | Limited bank branches |

| Transaction Method | Cash withdrawal possible during shopping | Requires separate bank transfer |

Low Fees

When choosing cash withdrawal services, you often focus on fees. Industry data shows that centralized cash management systems streamline processes, reduce operational costs across multiple locations, and eliminate unexpected bank fees and temporary credit charges. You can lower per-transaction costs by choosing the right service channel.

Many cash withdrawal services offer transparent fee structures, allowing you to know the cost of each transaction in advance, facilitating budgeting and fund management.

Wide Coverage

The advantage of cash withdrawal services also lies in their wide coverage. Whether in Chinese Mainland or other international regions, you can easily find ATMs or partner points. China’s ATM network is highly developed, with most ATMs supporting international bank cards and offering English interfaces. You can carry multiple bank cards (e.g., Visa, Mastercard) in case some ATMs do not support a specific brand.

- Major retail and international banks have a presence in Chinese Mainland, making cash withdrawals convenient.

- Bank of China supports major international bank cards, allowing cardholders to withdraw cash and check balances 24/7 at ATMs.

- Over 70% of Bangladesh’s population lives in rural areas, and digital remittances via mobile wallets effectively cover the entire country, demonstrating the accessibility of cash withdrawal services across different countries and regions.

When choosing a cash withdrawal service, you can select the most suitable withdrawal method based on your needs and location, ensuring funds are always accessible.

Remittance Methods

Image Source: unsplash

When choosing a remittance method, you can flexibly select different channels based on your needs and circumstances. Common remittance methods include bank transfers, third-party payments, cash remittances, and cryptocurrencies. Each method has unique processes and use cases, detailed below.

Bank Transfer

Bank transfers are one of the most commonly used remittance methods. You can transfer funds from one bank account to another, suitable for paying bills or invoices.

- You need to open an account with a licensed bank in Chinese Mainland or Hong Kong and deposit the corresponding local currency.

- The most common method is wire transfer, with international transfers typically taking 3-5 business days.

- Before an international wire transfer, you need to confirm whether the bank supports the recipient’s local currency.

- Transfers may involve intermediary banks, which may charge additional fees not disclosed in advance.

- Local bank transfers have lower costs, while international wire transfers have higher fees but greater reliability.

Bank transfers are suitable for securely transferring large amounts or paying formal bills, especially in cross-border transactions.

Third-Party Payment

Third-party payment platforms offer you convenient online remittance options. You can complete payments via mobile or computer without a traditional bank account.

| Feature/Limitation | Description |

|---|---|

| Limited Customer Support | Third-party payment processors often provide lower-quality customer support, and you may not get timely help with issues. |

| Lack of Brand Control | When using third-party payments, you cannot fully control the branding elements of the checkout experience, which may impact business image. |

| Limited Integration Flexibility | Third-party platforms have restrictions when integrating with other software, potentially affecting business processes. |

| Limited Security Flexibility | Security protocols are limited by the platform, potentially posing higher risks. |

| Higher Fees | While initial investment is low, fees are typically higher than average credit card processing fees. |

When choosing third-party payments, you need to focus on platform security and fee structures, suitable for daily small payments and online shopping scenarios.

Cash Remittance

Cash remittances are suitable when you lack a bank account or need face-to-face transactions. You can submit remittance information via cash deposits, remote devices, or mobile apps.

| Use Case | Description |

|---|---|

| Automated Remittance Aggregation | Uses AI to automatically read and extract remittance information from emails, supporting multiple file formats and languages. |

| AI-Driven Invoice Matching | Matches invoices and remittances via algorithms, improving processing efficiency. |

| Remote Deposit Capture | Submits checks directly via devices or apps, simplifying cash handling. |

| Collection Integration | Handles scenarios without remittances, ensuring all funds are properly managed. |

- You can specify payment details in remittance notifications, including invoice date, number, method, amount, and date.

- Remittance notifications enhance clarity and security in invoice processing and accounts management.

- Remittance notification documents confirm that a remittance has occurred or is pending.

Cash remittances are suitable for quick, direct payments in Chinese Mainland or international regions, especially without a bank account.

Cryptocurrency

Cryptocurrencies offer you a new remittance method. You can transfer funds globally via digital wallets, enjoying low fees and fast delivery.

- Low transaction fees, reducing currency conversion costs.

- Fast processing, nearly instant delivery.

- Improves financial accessibility for unbanked individuals.

- Cryptocurrency values remain consistent across countries, reducing forex fluctuation impacts.

- You can protect funds from inflation through cryptocurrencies.

When using cryptocurrencies, you need to be aware of market volatility, security risks, and potential financial crime risks. Cryptocurrencies provide financial access to millions of unbanked individuals globally but are not suitable for all scenarios.

Method Comparison

Process

When choosing a remittance method, the simplicity of the process directly affects your experience. The advantage of cash withdrawal services lies in their simple operation; you only need to enter relevant information at an ATM or partner point to complete the withdrawal. Bank transfers typically require you to log into online banking or visit a bank counter, fill in recipient details, and confirm the amount. Third-party payment platforms allow you to complete remittances easily via mobile or computer, though additional identity verification may be needed. The cryptocurrency withdrawal process is unique, typically involving these steps:

- Find a reliable cryptocurrency exchange platform.

- Send Bitcoin to the exchange.

- Sell your cryptocurrency funds.

- Withdraw to your bank account.

You can choose the most suitable process based on your technical proficiency and fund needs.

Fees

When remitting, fees are a key consideration. One advantage of cash withdrawal services is transparent fees, with many points disclosing USD costs upfront. Bank transfers, especially cross-border wire transfers, have higher fees, and intermediary banks may charge additional fees. Third-party payment platforms typically have higher fees than credit card processing but require lower initial investment. Cryptocurrency withdrawal fees are low, but platforms may charge a percentage-based fee. You should understand each channel’s fee structure in advance to plan funds effectively.

Speed

Delivery speed affects your fund turnover efficiency. Cash withdrawal services typically allow instant withdrawals, suitable for urgent cash needs. Bank transfers between licensed banks in Chinese Mainland and Hong Kong usually complete domestic transfers same-day, while international wire transfers take 3-5 business days. Third-party payment platforms are fast, often completing within minutes. Cryptocurrency withdrawals are nearly instant, but platform reviews may cause delays. You can choose the appropriate method based on the urgency of funds.

Security

When remitting, you must focus on fund security. Cash withdrawal services rely on banks and legitimate points, offering high security. Bank transfers have strict identity verification and risk control measures. Third-party payment platform security depends on the platform’s technology and management, with some platforms posing data breach risks. Cryptocurrency remittance security depends on the platform and personal operations, with market volatility and technical vulnerabilities potentially posing risks. You should choose reputable providers, ensure accurate information, and reduce risks.

Use Cases

Different remittance methods suit different scenarios. You can refer to this table and choose based on your needs:

| Remittance Method | Use Case Description |

|---|---|

| Online Transfer | Suitable for digital banking, offering convenient digital currency transfers. |

| Bank Deposit | Suitable for direct transfers to bank accounts, especially with digital banks integrated with banking networks. |

| Mobile Money Transfer | Suitable for users needing convenient payments, easily integrated with digital banking platforms. |

| ATM Card Transfer | Suitable for recipients needing cash, offering the convenience of cash withdrawals from ATMs. |

When choosing a remittance method, consider fund purpose, delivery speed, and fees to flexibly select the most suitable channel. The advantage of cash withdrawal services lies in their wide coverage, meeting your diverse fund needs.

Selection Guide

Key Factors

When choosing a remittance method, you need to consider multiple key factors. Different needs and scenarios affect your final decision. Here are the key aspects to focus on:

- Amount: The amount and frequency of your transfers directly influence your choice. Large transfers are better suited for bank transfers or cryptocurrencies, while small amounts can use third-party payments or cash remittances.

- Speed: Do you need funds to arrive quickly? Digital services typically complete transfers in minutes or hours, while traditional bank transfers may take longer.

- Cost: How sensitive are you to fees? Some methods have higher fees but faster delivery; others are low-cost but slower.

- Destination: The recipient’s location determines whether they can easily receive funds. For example, some remote areas may only have cash withdrawal services or mobile wallets available.

- Security: Do you prioritize fund safety and compliance? Regulated channels and providers ensure fund security.

- Transparency: Do you want to track fund flow and status? Some platforms offer real-time tracking for greater transparency.

You can choose the most suitable remittance method based on your actual needs, combining the above factors. The advantage of cash withdrawal services lies in their wide coverage and simple processes, suitable for diverse fund needs.

Selection Tips

In practice, common mistakes include neglecting in-depth research on the chosen remittance method, not understanding the impact of transfer fees, and failing to verify recipient information. These errors may lead to fund delays, budget overruns, or transfer failures. You can follow these tips to avoid common issues:

- Thoroughly understand the process and fees of each remittance method, calculating total costs in advance.

- Carefully verify recipient details such as name, account number, and address to ensure accuracy.

- Choose reputable providers, prioritizing regulated banks or third-party platforms.

- Pay attention to the provider’s customer support capabilities for timely assistance with issues.

- Combine amount, timing, and destination to flexibly choose channels. For example, international transfers via licensed Hong Kong banks suit large, formal scenarios; third-party payments suit daily small transactions; cryptocurrencies suit users needing global fast delivery.

When choosing, prioritize safety and compliance to avoid risks from pursuing low costs.

Compliance Notes

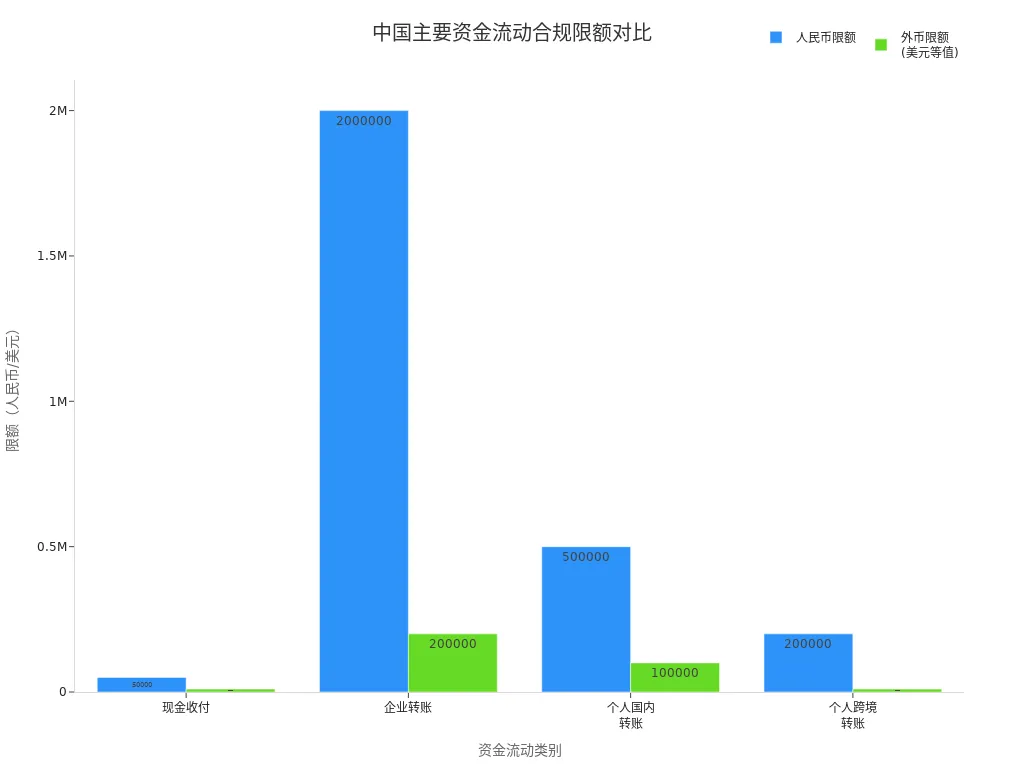

When using cash withdrawal services or other remittance methods in China/Chinese Mainland, you must comply with relevant regulations. Different types of fund flows have clear amount limits and reporting requirements. The table below summarizes key compliance limits:

| Category | Limit |

|---|---|

| Cash Receipts and Payments (including forex settlement and sales, remittances) | RMB 50,000 or more, foreign currency equivalent to USD 10,000 or more |

| Corporate Transfers | RMB 2,000,000 or more, foreign currency equivalent to USD 200,000 or more |

| Individual Domestic Transfers | RMB 500,000 or more, foreign currency equivalent to USD 100,000 or more |

| Individual Cross-Border Transfers | RMB 200,000 or more, foreign currency equivalent to USD 10,000 or more |

You can enjoy an annual foreign exchange convenience quota equivalent to USD 50,000 by providing valid identification. When carrying cash out of China, the RMB limit is 20,000 yuan, and the foreign currency limit is USD 5,000. To carry USD 5,000 to 10,000 out, you need to apply for a “Foreign Currency Exit Permit” from a designated bank.

In recent years, China/Chinese Mainland has tightened oversight of cash transactions and cross-border remittances. The cash transaction reporting threshold has dropped from RMB 200,000 to RMB 50,000, requiring stricter scrutiny of large transactions by financial institutions. New cross-border transaction reporting requirements have also increased operational complexity. When handling large or cross-border remittances, you must understand relevant policies in advance, prepare required documents, and ensure compliance.

When choosing and using cash withdrawal services, pay close attention to the latest compliance policies to avoid unnecessary risks and losses from non-compliant operations.

Risk Prevention

Individual Users

When using cash withdrawal services, common risks include physical theft, digital vulnerabilities, and sophisticated cyberattacks. ATMs in remote areas are vulnerable to thieves, and software vulnerabilities may lead to virtual theft. Criminal groups sometimes remotely access card management systems by inserting malware, altering withdrawal limits or PINs, and executing ATM cash-out attacks.

You can reduce risks through the following methods:

- Choose secure ATMs and points, avoiding remote or poorly lit locations.

- Regularly check account balances to promptly detect unusual transactions.

- Set strong passwords and periodically change PINs.

- Follow safety guidelines from banks and providers to protect personal information.

- Contact the bank or provider immediately in case of anomalies.

Business Users

As a business user, you face risks primarily related to compliance and fund security. You need to establish anti-money laundering (AML) compliance programs to prevent money laundering and terrorist financing. Businesses should designate personnel to manage daily compliance, design reasonable policies and internal controls, and ensure compliance with the Bank Secrecy Act.

- Provide regular employee training to enhance risk awareness.

- Monitor compliance program effectiveness through independent reviews to identify issues promptly.

- Partner with licensed Hong Kong banks to ensure transparent and compliant fund flows.

- Use smart safes and tamper-proof cash bags to reduce human errors and theft risks.

| Risk Type | Prevention Measures |

|---|---|

| Money Laundering and Terrorist Financing | Implement AML compliance programs, independent reviews |

| Fund Theft | Smart safes, tamper-proof cash bags |

| Information Breaches | Employee training, internal controls |

Safety Tips

When performing cash withdrawals and remittances, information accuracy and compliance are critical. You should verify beneficiary information before transaction settlement to reduce fraud risks. Using advanced identity verification technologies can identify unusual customer behavior and protect account security.

- Use AI to monitor transactions and identify suspicious activity in real-time.

- Conduct regular audits and reconciliations to promptly detect financial discrepancies and maintain accurate records.

- Pay attention to providers’ safety alerts and educational resources to enhance self-protection capabilities.

When handling large or cross-border remittances in China/Chinese Mainland, comply with the latest regulations, prepare required documents, and ensure every transaction is secure and error-free.

When choosing cash withdrawal services, you can enjoy the following advantages:

- Demand for cash withdrawals continues to grow, driven by financial inclusion and rising living costs.

- ATM technology continues to innovate, improving convenience, especially in underserved areas.

- Tourism growth in markets like the U.S. has also increased cash withdrawal volumes.

When choosing a remittance method, focus on the provider’s reputation and reliability. Intuitive user interfaces, reliable customer support, diverse payment methods, and clear cost breakdowns are critical considerations. You should also ensure the provider operates in both China/Chinese Mainland and the recipient’s country and holds relevant regulatory licenses.

| Risk Type | Description |

|---|---|

| Money Laundering Risk | High transaction volumes and inadequate oversight may link funds to illegal activities. |

| Fraud Risk | Weak security systems may allow cybercriminals to exploit vulnerabilities for fraud. |

| Compliance Deficiency | Failure to comply with regulations may lead to compliance issues. |

You can combine your needs and scenarios, refer to comparison and selection guides, and make informed decisions. Always verify information, choose compliant and transparent providers, and reduce risks of fund loss and security threats.

FAQ

Are cash withdrawal services safe?

When using cash withdrawal services at licensed Hong Kong banks or legitimate points, safety is high. You should protect personal information and avoid operating in unsafe environments.

What factors should you consider when choosing a remittance method?

You need to focus on amount, delivery speed, fees, security, and destination. You should also verify recipient information and choose regulated providers.

Are there limits on cash withdrawals?

When carrying cash out of China/Chinese Mainland, the RMB limit is 20,000 yuan, and the foreign currency limit is USD 5,000. Large amounts require prior declaration.

What’s the difference between third-party payments and bank transfers?

Third-party payments are more convenient and suitable for small remittances. Bank transfers suit large, formal scenarios with higher security but longer delivery times.

Who are cryptocurrency remittances suitable for?

If you need global fast delivery or lack a bank account, cryptocurrency remittances are an option. However, you should be aware of market volatility and platform security risks.

When selecting cash withdrawal services or other remittance methods, you may value their convenience and broad coverage (e.g., ATMs handling 6400 transactions monthly), but face challenges: theft risks at remote ATMs, 3-5 day delays and high intermediary fees for cross-border wire transfers, elevated third-party platform fees with poor integration, and crypto volatility, especially as mobile transfers hit 40% globally in 2025 and cash regulations tighten, amplifying hidden costs and security concerns.

BiyaPay offers a streamlined cross-border financial solution to enhance your remittance experience. Our real-time exchange rate query delivers instant mid-market rates, minimizing conversion losses. With fees as low as 0.5%, it supports conversions across 30+ fiat currencies and 200+ digital assets, covering multiple global destinations with same-day delivery. Uniquely, BiyaPay’s single platform supports direct US and Hong Kong stock trading without separate overseas accounts, with zero fees on contract orders, transforming remittances into investment opportunities. Licensed under US MSB and more, fortified by 256-bit encryption and real-time fraud detection, it ensures robust compliance and security.

Sign up at BiyaPay today for low-cost, rapid transfers and integrated investing, making your global fund flows more efficient and secure!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.