- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Use MUFG Bank ATMs? Guide and Precautions for ATM Transfers in Japan

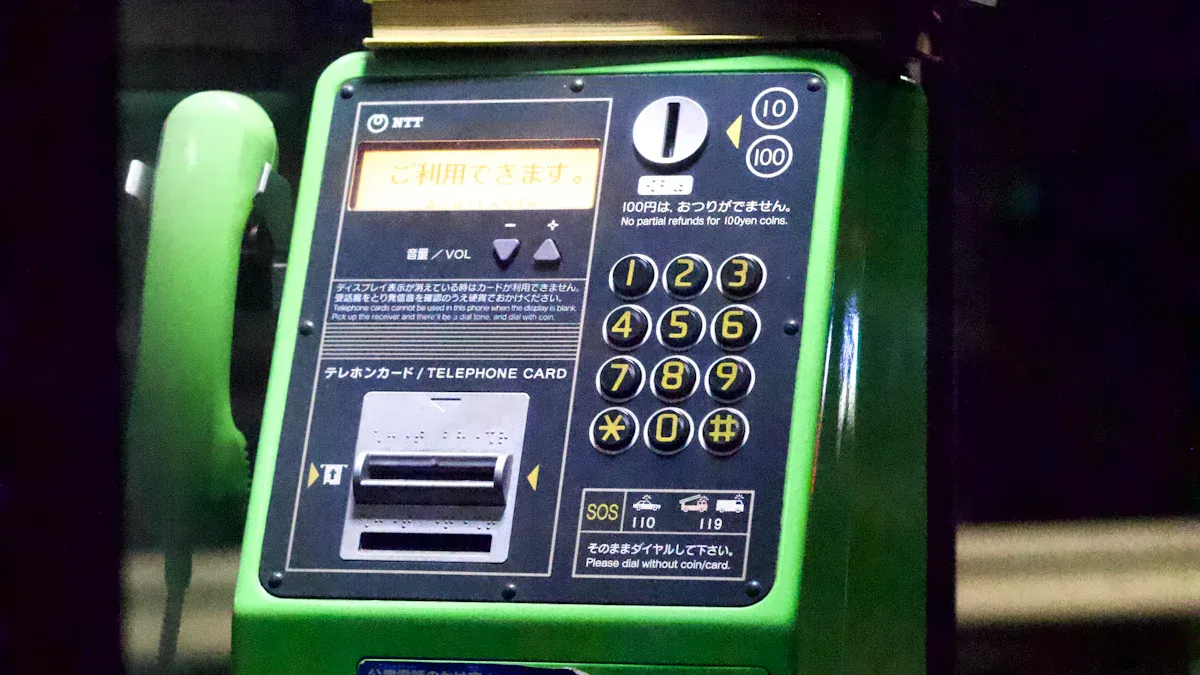

Image Source: unsplash

You can easily complete transfers using Mitsubishi UFJ Bank ATMs. You only need to prepare your bank card, recipient information, and cash. The machine supports multilingual operations, making each step easy to understand. Before transferring, confirm the fees and safety tips to ensure fund security.

Key Points

- Select a familiar language to operate the ATM, reducing the risk of errors.

- When entering recipient information, carefully verify each detail to ensure accuracy.

- After completing the transfer, keep the transaction receipt safe for future reference or issue resolution.

Mitsubishi UFJ Bank ATM Transfer Process

Image Source: pexels

Language Selection

After accessing a Mitsubishi UFJ Bank ATM, you will first see the language selection interface. You can choose from languages such as Japanese, English, or Chinese. The multilingual interface helps you easily understand each step. It’s recommended to select the language you’re most familiar with to reduce the risk of operational errors.

Tip: If you’re unsure about a button’s meaning, check the on-screen icons or select the English interface for clearer instructions.

Card Insertion and Authentication

You need to insert your bank card into the Mitsubishi UFJ Bank ATM’s card slot. The screen will prompt you to enter your password. After entering the password, the system will automatically verify your identity. You can only proceed to the next step after passing authentication. If you choose cash remittance, you don’t need to insert a card but must place cash in the designated slot.

Cash Remittance Operation

Mitsubishi UFJ Bank ATMs support both cash remittances and bank card transfers. You can select cash remittance directly on the ATM, following prompts to insert USD cash into the machine. The machine will automatically recognize the amount and display it on the screen. You need to confirm the amount is correct before proceeding. If using a bank card transfer, the system will automatically retrieve your account information.

Select “振込” Function

You will find the “ご送金” or “振込” function in the main menu. After clicking, select “他行口座へのご送金” and click “次へ” (Next). This step is critical to initiating the transfer. You need to follow prompts to select the recipient bank and branch name. Mitsubishi UFJ Bank ATMs provide a detailed bank list for easy lookup.

Enter Recipient Information

You need to enter the recipient’s detailed information, including the bank name (branch name), account type (ordinary deposit), account number (typically seven digits), and your contact phone number. Ensure the recipient’s information is spelled correctly in Japanese. You can refer to the following for filling in details:

- Enter the recipient’s bank name and branch name.

- Select “普通” (ordinary) as the account type.

- Enter the recipient’s account number.

- Enter your phone number for bank contact purposes.

Note: Incorrect recipient information can lead to transfer failure. Confirm all details in advance to avoid common errors.

Enter Amount and Confirm

You need to enter the transfer amount on the Mitsubishi UFJ Bank ATM. The system will prompt you to input the amount after entering the recipient’s account number. You can directly input the USD amount. After entering, the screen will display all details, including the recipient, amount, and contact phone number. You must carefully verify all information to ensure accuracy. Common errors include exceeding ATM limits or incorrect recipient details. You can return to revise at any time.

- When entering the amount, the system automatically checks if it exceeds the limit.

- Before submission, double-check all information for accuracy.

Obtain Receipt

After completing all operations, the Mitsubishi UFJ Bank ATM will automatically print a transaction receipt. The receipt includes key details such as the transfer amount, recipient information, and transaction time. You need to keep the receipt safe for future reference or issue resolution. Whether using cash remittance or bank card transfer, the receipt is a critical safeguard for your funds.

Reminder: Losing the receipt may complicate future inquiries. Take a photo or store it securely.

Notes

Fee Details

When transferring via a Mitsubishi UFJ Bank ATM, the system charges fees based on the transfer method. Typically, cash remittances and bank card transfers have different fees. You can view the specific fees on the operation interface in advance. Fees are displayed in USD, and you should carefully review the details before confirming. In some cases, fees vary based on the transfer amount and recipient bank. Refer to the ATM screen prompts to understand all costs.

Limits and Timing

Mitsubishi UFJ Bank ATMs impose limits on single transfer amounts. You need to ensure each transfer does not exceed the ATM’s maximum limit. Processing speeds may vary by time period. The table below shows common transfer delivery times:

| Source | Processing Time |

|---|---|

| Panda Remit | 99% of transfers complete within 1 business day after payment receipt, as fast as 10 minutes. Processing time may vary by destination country and recipient bank hours. |

| Tokai Tokyo Securities | Withdrawals processed via ATM or bank transfer typically arrive in local bank accounts within 1-3 business days, though delays may occur due to cut-off times and bank hours. |

You can choose the appropriate time for operations based on your needs.

Information Verification

When entering recipient information, you must carefully verify each detail. The following are common verification steps:

- Select the recipient bank name.

- Select the recipient bank branch name.

- Choose “ordinary” as the account type.

- Enter and confirm the recipient’s account number.

- Verify all information is correct before making the payment.

Verifying information before confirmation can effectively prevent transfer failures or fund losses.

Mitsubishi UFJ Bank ATM Safety Tips

When using a Mitsubishi UFJ Bank ATM, choose a secure environment. Avoid allowing strangers to approach or assist with operations. Cover your view when entering passwords and personal information to prevent leaks. Keep the receipt safe after completing the transfer to avoid loss. In case of anomalies, promptly contact bank customer service or seek help from on-site staff. Protecting your personal information reduces transfer risks.

What to Do If Issues Arise

ATM Help Button

If you encounter issues like interface freezes, unresponsive buttons, or error prompts while operating a Mitsubishi UFJ Bank ATM, you can press the “Help” or “Call” button, typically located near the screen and marked with “ヘルプ” or “HELP.” After pressing, bank staff will communicate with you via the intercom system to guide you through resolving the issue. You can describe the situation in Chinese, English, or Japanese. For system failures, technical issues, or network interruptions, the ATM screen may display error messages. The table below lists common issue types and impacts:

| Issue Type | Impact Description |

|---|---|

| System Failure | ATM withdrawals and other bank services are disrupted |

| Technical Issue | Unable to withdraw from other financial institutions’ ATMs |

| Transfer Delay | Transfers between MUFG and other banks face delays |

| Network Service Interruption | Certain internet banking services are currently inaccessible |

When encountering these issues, stay calm and prioritize using the help button for assistance.

Bank Counter Assistance

If you cannot resolve issues at the ATM, you can visit a Mitsubishi UFJ Bank counter. Bring valid identification and your bank card, and explain the specific issue to the counter staff. They will assist you in completing the transfer or resolving anomalies based on your description. Visiting the counter during business hours typically provides more detailed guidance. For issues like cash remittances, incorrect account information, or lost receipts, counter staff can assist with verification and reprocessing. You can also inquire about fees, limits, or delivery times.

Customer Service Hotline

You can also call Mitsubishi UFJ Bank’s customer service hotline for assistance. The hotline number is usually printed on the ATM, receipt, or bank website. Explain your issue over the phone, and customer service staff will assist in Chinese, English, or Japanese. You can inquire about transfer progress, account status, or technical issues. For urgent situations, prioritize calling the hotline for prompt advice. Keeping your transaction receipt and relevant information helps customer service quickly locate your issue.

When transferring via a Mitsubishi UFJ Bank ATM, always keep the receipt. Carefully verify the recipient’s name, account number, and bank address to ensure accuracy. Pay attention to fees and delivery times. Seeking help promptly during issues ensures fund safety.

FAQ

How to check transfer progress?

You can keep the ATM receipt and call the bank’s customer service hotline. Staff will check the transfer progress using the receipt information.

What to do if a transfer fails?

You can first check if the recipient information is correct. If the issue persists, bring the receipt to a bank counter for assistance.

Can I use a Chinese Mainland bank card for transfers at a Japan ATM?

You can try using a Chinese Mainland bank card, but some ATMs may not support it. Check with bank customer service in advance to confirm compatibility.

When navigating Mitsubishi UFJ Bank ATM transfers, frustrations like intricate language interfaces, strict Japanese spelling for recipient details, opaque fees, and per-transaction caps can arise, particularly from abroad, where cash remittances promise 10-minute arrivals but risk delays from verification slips. BiyaPay, a streamlined global finance platform, counters these with a user-friendly alternative for seamless cross-border sends to Japan and beyond. Our remittance fees begin at 0.5%, surpassing typical ATM variables, and enable instant exchanges across 30+ fiat currencies and 200+ cryptos via clear real-time rates, guaranteeing full recipient value without surprise deductions on yen or other conversions.

A swift signup unlocks same-day deliveries to Japan and 150+ countries—ideal for small daily aids or large supports, flowing directly to bank accounts , dodging ATM’s local and limit hurdles. With end-to-end encryption and multi-factor authentication upholding global standards, BiyaPay actively thwarts data breaches, exceeding ATM on-site alerts. Additionally, trade US and Hong Kong stocks on the unified platform—no offshore account required—with zero-fee contract orders for effortless fund synergy. Note that BiyaPay does not support remittances from mainland China or RMB-related services, catering to users in other global regions.

Launch into BiyaPay now! Tap Real-Time Exchange Rate Query to forecast precise yen receipts, refining your transfer strategy. Engage Stocks for blended payment and investment gains. Sign up for BiyaPay (for non-mainland China users) today, eclipsing ATM complexities with secure, rapid, and economical global remittances!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.