- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Analysis of Italian Currency: The Euro System, Exchange Methods, and Payment Habits

Image Source: unsplash

Italy’s official currency is the euro. Since January 1, 1999, Italy became a member of the Eurozone and began adopting the euro. On January 1, 2002, euro banknotes and coins officially entered circulation, and the Italian lira ceased to be used on February 28, 2002. The table below shows key dates in the adoption and circulation of the euro in Italy:

| Event | Date | Description |

|---|---|---|

| Euro Adoption | January 1, 1999 | Italy became a Eurozone member, using the euro as its official currency. |

| Euro Banknotes and Coins Introduced | January 1, 2002 | Euro banknotes and coins officially circulated in Italy. |

| Lira Ceased Circulation | February 28, 2002 | The euro became the sole legal tender. |

| Lira Exchange Deadline | February 29, 2012 | The central bank stopped exchanging old lira banknotes and coins. |

This Italy currency analysis helps understand the euro’s official status and circulation history.

Key Points

- Italy has used the euro since 2002 as its sole legal tender, facilitating daily transactions for residents and tourists.

- In Italy, cash payments remain dominant, and travelers should carry cash for small transactions.

- Banks, airports, and ATMs are the main channels for exchanging euros, and choosing the right channel can reduce transaction fees and improve exchange rates.

- When using credit cards, note foreign transaction fees; choosing a card with no foreign transaction fees can save costs.

- Travelers should stay vigilant, ensuring the safety of their belongings and avoiding large cash exchanges in unsafe locations.

Italy Currency Analysis: Euro System

Image Source: pexels

Euro Circulation

Since joining the Eurozone, Italy has used the euro as its sole legal tender. The euro symbol is “€,” and its subunit is the “cent,” with 1 euro equaling 100 cents. Shops, restaurants, transportation, and service providers across Italy accept euro payments. Residents and tourists use euros for shopping, bill payments, and transfers in daily life.

This Italy currency analysis shows that the euro’s circulation is widespread, covering all cities and rural areas in Italy. Banks, ATMs, and exchange offices provide euro cash services. The euro’s circulation not only benefits Italian residents but also offers convenience for travelers from other Eurozone countries.

Tip: In Italy, using euros for payments eliminates the need for exchange rate conversions, reducing transaction costs and uncertainties.

Euro Denominations

The euro has a wide range of banknotes and coins to meet various payment needs. This Italy currency analysis indicates that the most commonly used banknote denominations include USD 5, 10, 20, 50, and 100. Coin denominations include USD 1, 2, and 1, 2, 5, 10, 20, and 50 cents.

The table below shows common euro banknote and coin denominations in Italy:

| Banknote Denominations | Coin Denominations |

|---|---|

| 5€ | 1€ |

| 10€ | 2€ |

| 20€ | 5¢ |

| 50€ | 10¢ |

| 100€ | 20¢ |

| 200€ | 50¢ |

| 500€ |

In daily life, residents and tourists prefer using banknotes of USD 50 or below and coins of USD 1 and 2. Larger denominations like USD 200 and 500 are less common in circulation.

Italy’s euro denominations are consistent with other Eurozone countries. All Eurozone member states use uniform banknote and coin denominations. The obverse of coins reflects each country’s cultural characteristics. Italian coins often feature the Colosseum or historical figures like Dante Alighieri, showcasing the country’s cultural heritage.

Eurozone Relationship

As a Eurozone member, Italy follows the Eurozone’s monetary policies alongside other countries. The Eurozone’s monetary policy is set by the European Central Bank, and member states must comply with these regulations. This Italy currency analysis shows that Italy’s economic conditions are closely tied to the broader Eurozone.

Italy’s public debt exceeds 120% of its GDP, making it the second-largest debtor in the Eurozone. This impacts the euro’s stability and raises concerns about the Eurozone’s economic security. The Eurozone’s centralized monetary policy contrasts with decentralized fiscal policies, leading to asymmetries in policy implementation.

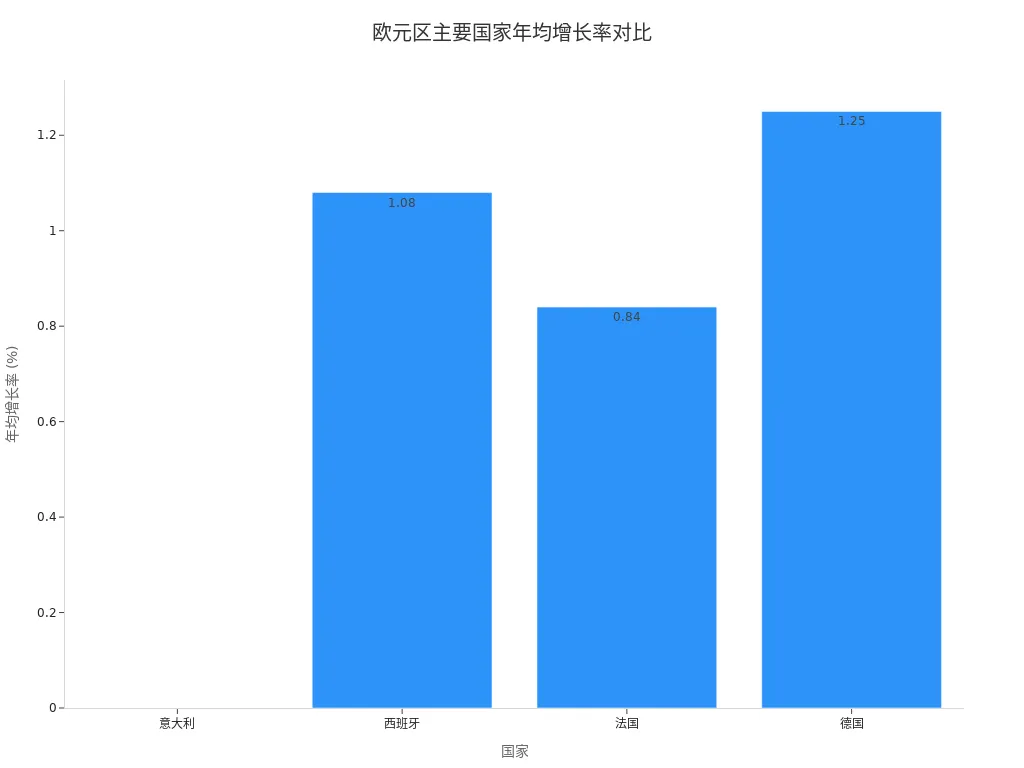

If Italy faces a debt default, it could affect the European integration process, impacting trade, finance, and political relations. The chart below shows a comparison of annual growth rates for Italy and other major Eurozone countries:

This Italy currency analysis not only focuses on the country’s currency system but also requires consideration of the broader Eurozone context. The euro’s stability is closely tied to the economic performance of Italy and other member states.

Italy Currency Analysis: Exchange Methods

Bank Exchange

In Italy, banks are one of the main channels for exchanging foreign currency into euros. Most banks only provide cash exchange services for account holders. Tourists needing to exchange foreign currency at banks typically need to open an account in advance. Some international partner banks may offer exchange services for clients with accounts at partner banks.

The table below shows exchange requirements for different bank types:

| Bank Type | Exchange Requirements |

|---|---|

| General Banks | Typically do not accept foreign currency cash for euros unless the client has an account with the bank. |

| International Partner Banks | Cash exchange is possible if the client’s home bank has a partnership with an Italian bank. |

When exchanging cash, clients must provide clean, undamaged banknotes. Banks have strict requirements for note condition, and any stained or damaged notes may be rejected. Bank exchanges generally offer reasonable rates but involve more complex procedures and longer processing times.

Tip: If exchanging at a bank, check operating hours and required documents in advance to avoid delays in your itinerary.

Airport Exchange

Airports are a common place for tourists to exchange currency. Major Italian airports have multiple currency exchange counters, allowing travelers to obtain euros immediately upon arrival. Airport exchange services typically do not charge additional fees and support credit card transactions. Some airports offer online booking services, allowing travelers to lock in exchange rates in advance and collect cash upon arrival.

The table below summarizes the features of airport exchange services:

| Service Type | Fee Information | Notes |

|---|---|---|

| Currency Exchange Service | No additional fees | Supports credit card transactions |

| Online Booking | Fixed exchange rate | Collect cash upon arrival at the airport |

| Other Travel Services | Offers insurance, train tickets | One-stop service |

Airport exchange counters also provide travel insurance, transportation tickets, and other one-stop services, making it convenient for travelers to handle multiple tasks.

Airport exchange rates are generally less favorable than banks or independent exchange offices, and fees are higher. Many travelers exchange a small amount of cash at airports for emergencies and obtain more euros through other channels later.

- Airport currency exchange services have higher fees.

- Airport exchange rates are typically less favorable than banks or independent exchange offices.

- It’s recommended to prioritize bank ATMs or independent exchange offices for better rates.

ATM Withdrawals

Italy has widespread automated teller machines (ATMs), providing convenient euro withdrawal services for tourists. Travelers with international bank cards can withdraw euros directly from ATMs. The ATM withdrawal process is simple and supports multiple language interfaces.

Banks charge a fixed fee for withdrawals, typically around USD 5 per transaction. Per-transaction limits range from USD 250 to USD 1,000, with a daily withdrawal limit of USD 250.

The table below shows ATM withdrawal fees and limits:

| Fee Type | Amount Range |

|---|---|

| Withdrawal Fee | Up to USD 5 |

| Per Transaction Limit | USD 250–USD 1,000 |

| Daily Withdrawal Limit | USD 250 |

Some banks may charge additional fees for foreign currency withdrawals. Travelers should check their home bank’s policies before withdrawing to avoid high fees increasing travel costs.

Tip: Prioritize ATMs at major banks or airports and avoid those in remote areas to ensure fund security.

Exchange Considerations

This Italy currency analysis shows that when exchanging euros, you need to consider exchange rate fluctuations and fees. Rates and fees vary significantly across channels, and travelers should compare options in advance to choose the best method.

- Using digital remittance services (e.g., Wise, Revolut) can offer lower conversion fees and rates close to the market rate.

- Check if the provider offers multi-currency accounts or credit cards with no foreign transaction fees.

- Before sending money, compare fees and rates across services to ensure the best deal.

- Understand foreign transaction fees for credit or debit cards; some credit card companies charge up to 3%.

- Choose credit cards with no foreign transaction fees, such as the Chase Sapphire Preferred Card, common in the U.S. market.

- Pay in the local currency to avoid additional losses from exchange rate conversions.

Travelers should avoid exchanging large amounts of cash at unfavorable rates or high-fee locations. It’s advisable to exchange in small batches and keep some reserve funds. If issues arise, consult bank staff or airport service desks for professional advice.

Payment Methods and Habits

Image Source: pexels

Cash Payments

Cash remains dominant in Italy. Data shows that cash accounts for 86% of in-person transactions. At point-of-sale payment scenarios, cash represents 25%. This Italy currency analysis finds that residents prefer cash for daily shopping, dining, and transportation. According to the 2023 Budget Law, the cash payment limit is USD 5,499.99, and amounts exceeding this must use traceable payment methods. Violating this incurs fines of USD 5,500 to USD 16,500. The table below summarizes cash payment regulations:

| Item | Content |

|---|---|

| Cash Payment Limit | USD 5,499.99 |

| Payments Exceeding Limit | Must use traceable methods |

| Violation Penalty | USD 5,500–USD 16,500 |

Card Payments

Bank cards are widely accepted in cities and tourist areas. Visa and Mastercard debit cards are commonly accepted in retail and hospitality sectors. As long as the bank permits overseas spending, users can use all Visa and Mastercard debit cards in Italy. The table below shows the advantages and disadvantages of card payments:

| Advantages | Disadvantages |

|---|---|

| Widely accepted by merchants | May lead to overspending |

| Offers fraud protection tools | Credit cards charge foreign transaction and currency conversion fees |

| Travel rewards cards earn points | Requires monitoring accounts for unauthorized charges |

| Credit card statements help track spending | Some purchases still require cash |

| Credit cards are compact and easy to carry | Daily fluctuating rates increase budgeting difficulty |

In rural areas or small shops, cash payments are more popular. Some merchants may charge DCC fees, and users should opt for local currency settlement.

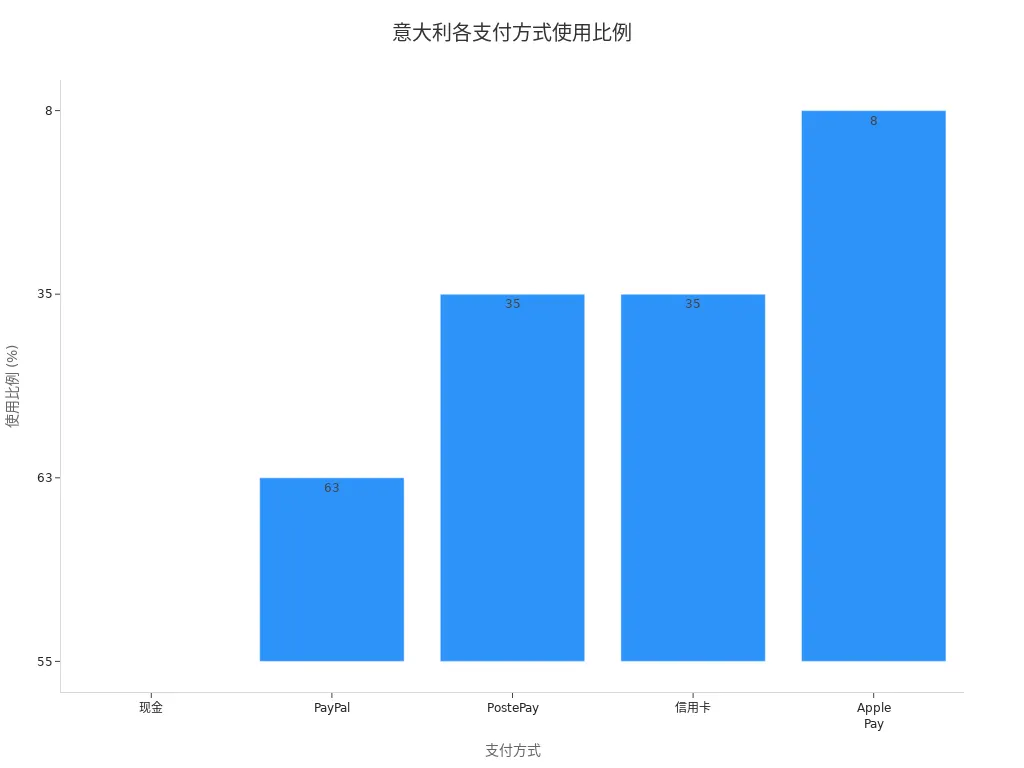

Mobile Payments

Mobile payment platforms are gaining popularity in Italy. PayPal and Google Pay have high adoption rates, while Apple Pay has lower usage. This Italy currency analysis shows that PayPal is widely popular in e-commerce and some offline scenarios. The table below shows the adoption rates of major mobile payment platforms:

| Payment Platform | Adoption Rate |

|---|---|

| PayPal | High |

| Google Pay | High |

| Apple Pay | Low |

Some younger demographics prefer mobile payments, especially in cities and large shopping centers. In rural areas, mobile payment adoption is lower, and cash remains dominant.

Payment Habits

Italian residents’ payment habits vary significantly by region and age. Urban residents frequently use bank cards and mobile payments, while rural residents prefer cash. In 2022, 67% of consumers chose cash payments. The chart below shows the usage proportions of different payment methods:

Younger groups like Gen Z and Millennials are more open to electronic payments, while older individuals rely more on cash. This Italy currency analysis indicates that payment method choices are closely tied to region, age, and consumption scenarios.

Traveler Recommendations

Payment Method Selection

When choosing payment methods in Italy, tourists should consider the local cash culture, fees, and payment tool availability. Italian society has a strong preference for cash, and many small shops and restaurants only accept cash.

- Travelers should carry some cash for small payments.

- Use debit cards at ATMs to withdraw euros, prioritizing Visa or Mastercard for hotels and large purchases.

- Note foreign transaction and currency conversion fees, and check policies of licensed Hong Kong banks in advance.

- Pay attention to contactless payment options; some urban merchants support mobile payments, but rural areas rely on cash.

- Carry a backup credit or debit card to prepare for card swallowing or account freezes.

Travelers can exchange a small amount of cash at airports for emergencies, and it’s more convenient to obtain more euros via ATMs after leaving the airport.

Avoiding Losses

In recent years, Italy’s popular cities and coastal destinations have seen a decline in tourist numbers due to economic and geopolitical factors. The luxury travel market faces challenges, with some travelers cutting budgets. To reduce financial losses and theft risks, tourists should take the following measures:

- Avoid displaying wealth, such as wearing expensive jewelry or watches.

- Stay vigilant, especially in unfamiliar settings, busy markets, or public transportation.

- Use crossbody bags or money belts, keeping wallets in front pockets rather than back pockets.

- Use bag hooks in restaurants or public places, avoiding hanging bags on chair backs.

- Choose small bags to reduce theft risks.

Many pickpockets target tourist areas and public transportation, so tourists should always monitor their surroundings to ensure the safety of their belongings.

Emergency Measures

In case of lost funds or unusable cards, Italy’s major cities offer various emergency financial services. The table below lists some common service points and contact information:

| Service Type | Location | Contact Phone | Operating Hours |

|---|---|---|---|

| FOREXCHANGE – TERMINI FORUM BRANCH | Rome | +39 800 305357 | Daily 8:30am – 8:30pm |

| AHMED GROUP | Rome | +39-06-4890-2016 | Daily 8:00am – 1:00pm |

| FININT S.p.A. | Milan | 02-676-261 | N/A |

| MAIL BOXES Etc. | Milan | 02-2900-2245 | Mon-Fri 8:30am-7:30pm, Sat 8:30am-1:00pm |

| BANCA ANTONVENETA | Naples | 081-204-964 | N/A |

If facing emergencies, tourists can contact the U.S. Embassy in Italy or credit card company customer service. Major credit card companies like Visa, Mastercard, and American Express offer 24-hour services. Consulates can assist in contacting family, banks, or employers to arrange fund transfers.

When facing financial issues, stay calm and prioritize official channels for assistance to ensure a smooth trip.

Italy uses the euro system with a wide range of banknotes and coins. Banks, airports, and ATMs offer euro exchange services with varying fees and processes. Cash, cards, and mobile payments each have advantages in different scenarios. Travelers should focus on exchange rates, fees, and safety concerns. Choosing the right payment method based on personal needs enhances the travel experience and fund security.

FAQ

Can mainland China bank cards be used for withdrawals in Italy?

With Visa or Mastercard debit cards issued by mainland China or licensed Hong Kong banks, you can withdraw euros at Italian ATMs. Banks may charge around USD 5 in fees.

Is exchanging euros at airports safe?

Airport exchange counters are operated by legitimate institutions. They provide secure euro exchange services for travelers. Travelers should note exchange rates and fees and avoid exchanging large amounts.

Do small shops in Italy accept credit cards?

Many small shops and restaurants only accept cash. Large malls and hotels in cities generally support credit card payments. Travelers should carry some cash.

How can I avoid high fees when exchanging euros?

Travelers can compare rates and fees across channels. Using no-foreign-transaction-fee credit cards from licensed Hong Kong banks or digital remittance services often provides better rates.

What should I do if I lose my bank card?

Travelers should immediately contact their card issuer’s customer service. Major credit card companies, common in the U.S. market, offer 24-hour loss reporting and emergency services. Consulates can also assist with fund transfers.

Navigating Italy’s euro-based payments or currency exchanges can be challenging, with high fees, unclear exchange rates, cumbersome processes, and security concerns often complicating matters for travelers or those sending money abroad. What if a platform offered a total fee as low as 0.5% , real-time rate checks, seamless swaps between 30+ fiat currencies and 200+ digital assets, global coverage, and same-day delivery?

BiyaPay is crafted to eliminate these hurdles. As a top digital finance platform, we enable effortless euro conversions and international transfers via mobile, ensuring ease and efficiency. Check real-time exchange rates to secure the best rates and avoid hidden charges. With multi-layer encryption and global compliance, BiyaPay guarantees secure, instant transactions. Sign up in minutes to streamline your financial needs, whether for travel spending or cross-border support.

Make your money work smarter now! Visit BiyaPay to plan your euro exchange or transfer. Sign up for a BiyaPay account today and unlock low-cost, instant, and secure financial solutions for Italy and beyond, ensuring a seamless payment experience.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.