- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Why Might Remitly Remittances Be Reviewed? Understand the Reasons and Handling of Transactions Being Placed on Hold

Image Source: unsplash

Discovering that your Remitly transfer is on hold may cause concern. But rest assured, this is typically a standard security measure. In fact, a Remitly transfer being reviewed is part of its protection system and does not mean you did anything wrong.

Remitly conducts these reviews to comply with financial regulations and ensure your funds are secure, effectively preventing unauthorized transactions.

This process aims to add an extra layer of security to every transaction.

Key Points

- Remitly reviews remittances to comply with regulations and protect your funds.

- If your transfer is under review, check Remitly’s notifications and provide requested information.

- You can contact Remitly support for help or cancel the transaction if necessary.

- Updating your profile, carefully verifying information, and clearly stating the transfer purpose can prevent delays.

- Responding quickly to Remitly’s requests is the best way to speed up the review process.

Common Reasons Why a Remitly Transfer Might Be on Hold

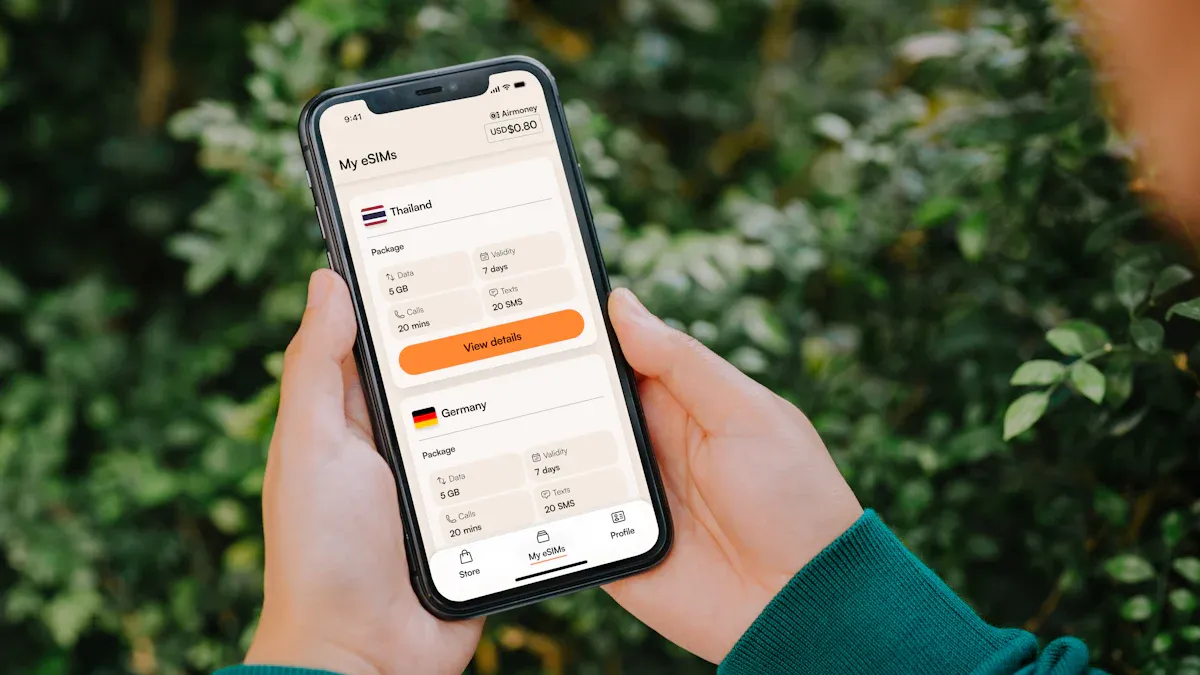

Image Source: pexels

Understanding the specific reasons that cause a transaction to be held can help you better respond and prevent issues. A Remitly transfer might be on hold typically due to the following four aspects.

Compliance and Security Reviews

This is the most primary and common reason. As a regulated financial services company, Remitly must comply with strict international and local regulations to safeguard your funds and combat financial crime.

Remitly’s top priority is protecting your funds. Its security system continuously improves through machine learning technology, reducing fraud intervention rates by over 25% in 2023, proving the effectiveness of its review measures.

To achieve this, Remitly conducts the following reviews:

- Anti-Money Laundering (AML) and Counter-Terrorism Financing (CFT) Reviews: All financial institutions must comply with these regulations. When you initiate a transaction, especially a large one, the system automatically screens to ensure the source of funds is legitimate and the transaction does not involve illegal activities.

- Sanctions List Screening: Remitly is regulated by agencies such as the U.S. Treasury’s Office of Foreign Assets Control (OFAC). The system compares sender and recipient information against global sanctions lists to prevent funds from flowing to restricted individuals or entities.

- Regulatory Compliance: Remitly is registered with the U.S. Financial Crimes Enforcement Network (FinCEN) and complies with regulations in all operating regions. This means your transactions must meet “Know Your Customer (KYC)” and other protocol requirements.

These reviews are mandatory and aim to build a secure remittance environment.

Account Information Verification

Remitly needs to ensure your account information is complete, accurate, and up-to-date. If the system detects any discrepancies in your information, it will pause the transaction for verification.

A common trigger is unclear transfer purpose. For example:

| Vague Transfer Purpose (May Trigger Review) | Clear Transfer Purpose (Recommended) |

|---|---|

| Daily | For paying family living expenses in mainland China |

| Payment | Payment to Zhang San for services (Invoice #123) |

| Gift | Birthday gift for my sister |

When the transfer purpose you provide is too simple or inconsistent with your transaction pattern, the system may require a more detailed explanation or supporting documents.

Unusual Transaction Patterns

If your transaction behavior suddenly deviates from your usual habits, it may trigger the system’s security alerts. In such cases, a Remitly transfer might be on hold to confirm that these operations are indeed initiated by you.

Common unusual patterns include:

- Sudden Large Transactions: If you usually send a few hundred dollars but suddenly initiate a transaction of several thousand dollars.

- Spike in Transaction Frequency: Initiating transfers to multiple different recipients in a short period.

- Unusual Login Location: Your account suddenly logs in and initiates a transfer from an uncommon country or region.

Some users report that even long-used accounts may be flagged due to such changes in transaction patterns, causing transfers to be temporarily held for review.

Recipient Information Issues

Recipient information is also a key focus of review. Any inaccurate or suspicious information may cause transfer delays.

Be sure to carefully verify the following information:

- Name Spelling: Ensure the recipient’s name exactly matches the name on their bank account.

- Bank Account Information: For example, when transferring to a licensed bank in Hong Kong, any small error in the account number or bank code may cause failure or delay.

- Address and Contact Details: Provide complete and accurate recipient address and phone number.

If the recipient’s information resembles known high-risk lists, or if the receiving bank is in a region with strict scrutiny, your transaction may also be held until Remitly completes additional due diligence.

Steps to Take After a Transaction Is Held

When you discover a transfer is on hold, staying calm and taking the right actions is key. The following four steps will guide you to efficiently handle the situation.

Check Official Notifications

This is the first and most important step you need to take. Remitly will proactively communicate with you.

As soon as Remitly places your transaction under review, it will immediately send a reminder via your registered email or in-app notification in the Remitly App.

Carefully check your inbox (including the spam folder) and the App’s notification center. The notification email usually explains the reason for the hold and clearly states what you need to do next.

- Stay Updated on Progress: Any developments during the review, including requests for additional information or final release of the transaction, will be notified again through the same channels. You don’t need to guess repeatedly; just monitor official channels.

- Verify Notification Source: Ensure all notifications come from Remitly’s official channels to prevent phishing scams.

Provide Information as Requested

If Remitly requests additional information, responding promptly and accurately is the fastest way to resolve the issue. Your cooperation directly affects the time required for the review.

Remitly may ask you to provide the following types of supporting documents:

| Possible Required Document Types | Preparation Tips |

|---|---|

| Proof of Source of Funds | Provide recent payslips, bank statements, or tax documents clearly showing the source of funds. |

| Identity Verification Documents | Ensure passports, driver’s licenses, and other IDs are valid, with clear photos and information. |

| Proof of Transfer Purpose | Provide invoices, contracts, or family relationship proofs related to the transfer purpose. |

Tip: When submitting documents, ensure they are complete, unaltered, and all key information (such as name, date, amount) is clearly visible. Blurry or incomplete documents may extend the review time.

Contact Customer Support

If you have questions about the notification or haven’t received updates long after submitting information, proactively contacting support is a good option. Remitly offers multiple contact methods; choose the most convenient one for you.

- OnlineHelp CenterCallback Request: You can submit an issue through Remitly’s online help center and request a callback. This saves international long-distance fees and wait time.

- Phone Support: For urgent transaction issues, call directly at

+1 (888) 736-4859. Before calling, have your transaction receipt number, sender, and recipient information ready to help support locate your issue faster. - WhatsApp: You can also contact Remitly via WhatsApp at

+1 (217) 802-0009. On first contact, a chatbot will try to answer your question. If unresolved, live support will step in to assist.

Alternative Option: Cancel the Transaction

In some cases, if your funds are urgently needed or you don’t want to wait for the review to complete, canceling the transaction may be an option. However, note that cancellation has prerequisites.

You can only cancel a transaction before funds are delivered to the recipient. Once completed, funds cannot be recovered through Remitly.

If you decide to cancel, the refund will be processed automatically. Refund times depend on your payment method:

- Bank Card Payment: Refunds typically take 3-5 business days to reach your account.

- Bank Account Payment: Refunds may take up to 10 business days.

To cancel a Remitly transaction, follow these steps:

- Log in to your Remitly account (via website or App).

- Find the transaction you want to cancel in “Transfer History”.

- Click and select the “Cancel Transfer” option.

- Follow the prompts to select a cancellation reason and submit the request.

Although a Remitly transfer being on hold may cause some inconvenience, following the clear steps above allows you to handle it calmly and ensure the issue is properly resolved.

How to Effectively Prevent Transfer Delays

Image Source: unsplash

Instead of passively handling issues after they occur, proactively taking measures to avoid holds from the source is better. Developing good remittance habits can make your transaction process smoother.

Keep Your Profile Updated

Ensure your personal profile registered with Remitly is complete and up-to-date. This includes your name, address, and contact information. Outdated or incomplete information is a common cause of account reviews.

To comply with “Know Your Customer (KYC)” regulations, Remitly may request updated identity documents at any time, such as passports, driver’s licenses, or proof of address (e.g., utility bills). Preparing these in advance speeds up any potential verification.

Carefully Verify Recipient Information

A small spelling or numerical error can cause delays or even failure. Before clicking “Send”, double-check the following key information:

- Recipient Full Name: Ensure it exactly matches the official name on their bank account.

- Bank Account Details: When transferring to licensed banks in Hong Kong or similar, carefully check bank codes and account numbers.

- Contact Information: Provide accurate phone number and address.

This simple step can save you significant time and effort.

Avoid Sudden Large Transactions

Your transaction behavior should maintain consistency. If you’re a new user or usually send small amounts, suddenly initiating a large transaction easily triggers security alerts.

Remitly sets initial limits for new users, such as Level 1 accounts allowing up to $2,999 per day. Building a reliable transaction history is key to increasing limits.

| Not Recommended (High Risk) | Recommended (Safer) |

|---|---|

| Attempting to send a large amount on first use. | Start with small transfers and gradually build your transaction history. |

| Transaction amount far exceeds your usual pattern. | If you need to send a large amount, contact support in advance to request a limit increase. |

When you need to send higher amounts, proactively submit a limit increase request to Remitly and provide proof of source of funds as required.

Clearly State the Transfer Purpose

Always describe your transfer purpose in clear, specific language. Vague descriptions (like “payment” or “fees”) raise system alerts. Provide enough information for the review team to quickly understand the transaction context. For example, changing “to family” to “for monthly family living expenses in Shanghai” effectively reduces the chance of review.

In summary, a Remitly transfer being on hold is a normal security and compliance procedure, not an operational error on your part.

The most effective approach is: stay calm, closely monitor official emails or app notifications, and quickly provide accurate information.

Developing good habits of carefully verifying information and keeping data updated is the best way to avoid future transaction delays.

FAQ

How long does a review usually take?

There is no fixed timeline for reviews. Simple verifications may take just a few hours. If the situation is complex or requires additional documents from you, it may take several days. Please be patient and monitor official notifications.

If the transaction is canceled, will I get my money back?

Yes, you will receive a refund. As long as funds have not been delivered to the recipient, you can cancel the transaction. Remitly will automatically process the refund, and funds will be returned to your original payment account.

What can I do to speed up the review process?

The most effective method is to respond quickly.

As soon as you receive a notification from Remitly, immediately provide clear and accurate documents as requested. Timely cooperation is the only way to expedite the review.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.