- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

American Express Expedited Transfer: How to Transfer Money to a Bank Account Quickly

Image Source: unsplash

American Express offers a convenient feature that allows you to transfer your credit line directly to your linked bank account via its “Send & Split” service. Using the American Express expedited transfer option, these funds typically arrive within 30 minutes, meeting your urgent needs.

Core Tip: This transfer is often treated in the Amex system as a regular purchase (Purchase), not a cash advance (Cash Advance), providing you with significant financial flexibility.

Key Takeaways

- The American Express expedited transfer service enables you to quickly move credit line funds to your bank account.

- This service routes through Venmo or PayPal, usually arriving within 30 minutes, but incurs a 1.75% service fee.

- This transfer is treated as a regular purchase and does not trigger high cash advance fees.

- You can view your personal transfer limits in the Amex App and choose between expedited or free standard transfers.

- This feature is only available for American Express personal credit cards; business cards are not supported.

Prerequisites for Expedited Transfer

Before starting the American Express expedited transfer, ensure you meet the following basic conditions. These preparations are the foundation of the entire process and will help you complete the transfer smoothly and quickly.

Required Account Types

First, you need to have the correct accounts ready. Missing any one of them will prevent you from using this feature.

- A valid American Express personal credit card: This feature is primarily for holders of U.S.-issued Amex personal cards.

- A valid Venmo or PayPal account: Funds will be routed through one of these third-party platforms.

Important Tip: To ensure a smooth linking process, confirm that the name and email used on your American Express, Venmo, or PayPal accounts are consistent. Mismatched information may cause linking to fail.

Linking Venmo or PayPal Account

American Express funds are not sent directly to your bank but first go to your linked Venmo or PayPal wallet. Therefore, you must complete the account linking in advance.

You can complete the linking directly in the official Amex app, which is the most recommended method:

- Download and log in to the Amex App.

- On the main interface, find and tap the “Account” tab.

- Select the “Send & Split: Venmo/PayPal” feature.

- Follow the on-screen prompts to log in and authorize linking your Venmo or PayPal account.

Alternatively, you can initiate linking from within the Venmo app:

-

Open your Venmo application.

-

Go to the “Me” profile page.

-

In the “Wallet” section, tap “Add a bank or card”.

-

Select “Amex Send Account” as the card type.

-

The system will guide you to log in to your American Express account to complete the association.

Once linking is complete, your preparations are ready, and you can start the transfer operation at any time.

American Express Expedited Transfer Operation Guide

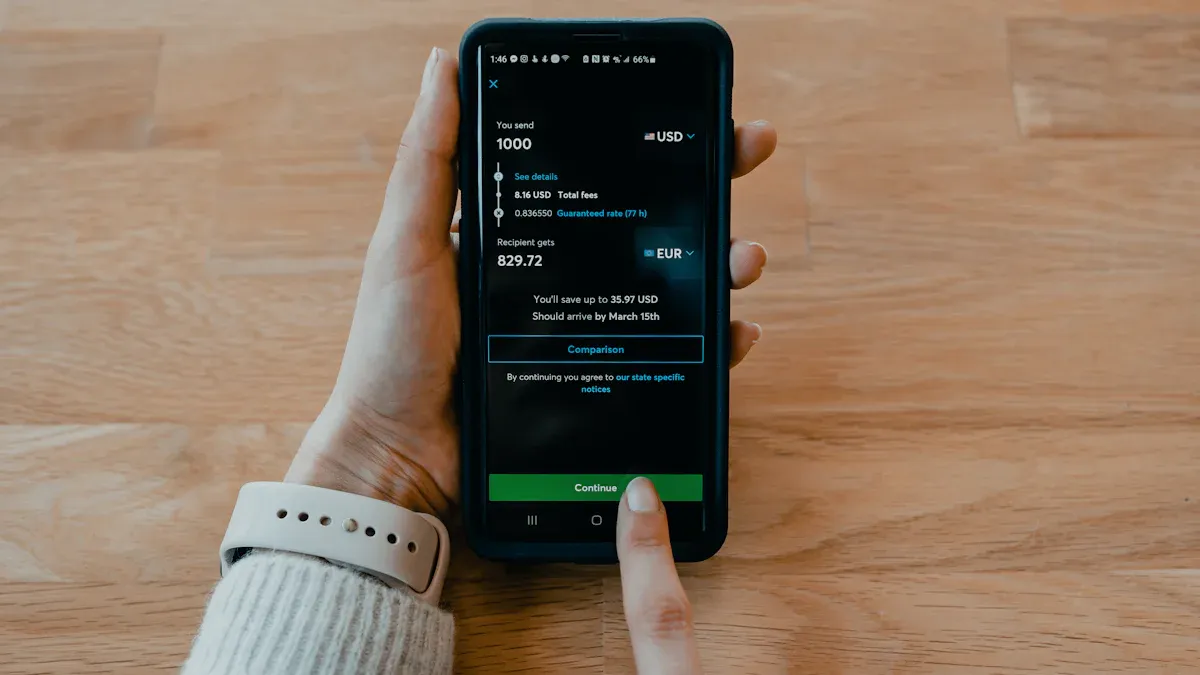

Image Source: unsplash

After completing all preparations, you can begin the actual transfer operation. The entire process is very intuitive; simply follow the five steps below to move funds from your American Express card to your bank account.

Locate the “Send & Split” Feature

First, you need to find the entry point in your official American Express app. The Amex Send & Split™ feature is located within the American Express® App.

- Open and log in to your Amex App.

- On the bottom navigation bar of the main interface, tap “Account”.

- On the account page, scroll down to find and select “Send & Split: Venmo/PayPal”.

Select “Send Money”

After entering “Send & Split,” you’ll see two main options: “Send Money” (send funds) and “Split Purchases” (split expenses). To convert credit line to cash, select “Send Money”.

These two features have fundamentally different purposes:

| Feature | Send Money | Split Purchases |

|---|---|---|

| Purpose | Pay directly to your Venmo or PayPal account. | Split an existing purchase on your card with friends. |

| Fund Source | Directly allocated from your credit line. | Splits an existing transaction record on your card. |

| Operation | You initiate a new transfer. | You select a completed transaction to initiate splitting. |

Therefore, clearly select “Send Money” to proceed with our transfer process.

Enter Amount and Select Expedited

Next, enter the amount you wish to transfer. Below the amount input field, you’ll see two key arrival speed options:

- Expedited Transfer: Funds typically arrive in your Venmo or PayPal account within 30 minutes. This option incurs a small service fee.

- Standard Transfer: Funds take 1-3 business days to arrive. This option is usually free.

Speed vs. Cost: If you have urgent fund needs, selecting “Expedited Transfer” is the best option. Though it has a fee, it allows quick cash access. If time is not urgent, choosing “Standard Transfer” saves costs.

To achieve fast arrival, be sure to select the “Expedited” option in this step. This is the core step for completing an American Express expedited transfer.

Review Information and Confirm

Before clicking the final confirmation button, the system will display a summary page with all transfer details. Carefully review the following:

- Transfer Amount: Confirm the amount is correct.

- Recipient Account: Confirm funds will be sent to your own Venmo or PayPal account.

- Fees and Speed: Confirm you selected “Expedited Transfer” and the corresponding service fee.

Once all information is verified, swipe or click the button to authorize and complete the transfer. Funds will be sent from your American Express account.

Withdraw from Third-Party Platform

Remember, funds first arrive in your Venmo or PayPal wallet, not directly into your bank account. You need to complete the final step: withdraw from these platforms.

If using Venmo:

- Open the Venmo app and go to the “Me” page.

- In the “Wallet” section, tap “Manage” or “Add or transfer”.

- Enter the amount you wish to withdraw from your Venmo balance.

- Choose withdrawal method: “Instant” (usually arrives within 30 minutes, incurs a fee) or “1-3 business days” (usually free).

- Confirm your bank account details, then tap “Transfer”.

If using PayPal:

PayPal withdrawal also offers standard and instant options. Fees and times are shown in the table below:

| Withdrawal Method | Fee | Processing Time |

|---|---|---|

| Standard Bank Transfer | Free | 1-3 business days |

| Instant Transfer | Typically 1.75% of withdrawal amount (with minimum and maximum fees) | Usually within 30 minutes |

Simply log in to PayPal, select “Transfer,” and follow the prompts to choose your preferred withdrawal method. After this step, funds will finally be deposited into your designated bank account.

Fees, Limits, and Arrival Times

Image Source: pexels

Before using American Express’s transfer feature, you need to understand the associated fees, limits, and arrival times. Clearly grasping this information will help you make the best choice based on your situation and manage your funds more efficiently.

Expedited Transfer Fee Structure

Choosing expedited transfer allows quick fund access but incurs a service fee.

- Fee Rate: American Express typically charges a 1.75% service fee for expedited transfers. For example, transferring $1,000 incurs a $17.50 fee.

- Fee Nature: This fee is for accelerated processing.

Important Distinction: This 1.75% fee is treated as a service fee, not a cash advance (Cash Advance) fee. This means it does not trigger high cash advance interest rates or handling fees, making it friendlier to your account.

Per-Transaction and Monthly Limits

American Express sets transfer amount caps for the “Send & Split” feature. These limits vary by individual.

Typical reference limits include:

- Per-Transaction Limit: Up to $2,000.

- Monthly Transfer Limit: Up to $5,000.

However, your personal limits depend on multiple factors. American Express sets specific limits based on your card type and account history. For example, Centurion or Platinum cardholders may have higher transfer limits. Some users report that even with a high total credit line (e.g., $15,000), their “Send & Split” available limit may only be $2,000. Thus, your transfer limit is not directly tied to your total credit line.

Operation Suggestion: You can directly view your account’s exclusive limits within the “Send & Split” feature in the Amex App.

Expected Arrival Time Comparison

Your fund arrival speed entirely depends on your choice during transfer. American Express expedited transfer offers a significant speed advantage.

The table below clearly compares the core differences between the two options:

| Transfer Method | Expected Arrival Time | Fee |

|---|---|---|

| Expedited Transfer | Usually within 30 minutes | Service fee (e.g., 1.75%) |

| Standard Transfer | 1-3 business days | Free |

If you urgently need funds, the expedited option is undoubtedly the best choice. If your fund needs are not pressing, standard transfer saves you a fee.

Now you’ve mastered the entire process. To complete a successful transfer, remember these five core steps:

- Link your Venmo or PayPal account.

- Enter the “Send & Split” feature.

- Select “Send Money”.

- Enter the amount and choose “Expedited”.

- Review information and confirm.

American Express expedited transfer provides an efficient fund solution. It quickly converts your credit line into available cash, with the core advantage of fast arrival, and the operation is typically treated as a regular purchase.

When you have urgent fund needs, refer to this guide to complete the operation safely and efficiently.

FAQ

Will this transfer be treated as a cash advance?

You can rest assured. American Express typically treats this operation as a regular purchase, not a cash advance (Cash Advance). Therefore, you won’t pay high cash advance fees or interest.

How do I check my personal transfer limit?

You can view your limits directly in the Amex App. After entering the “Send & Split” feature, the system will display your per-transaction and monthly available limits. Everyone’s limits may differ.

Can business cards use this feature?

Currently, this feature is limited to American Express personal credit cardholders. Your business or corporate card cannot use the “Send & Split” service for transfers.

Can I complete the transfer completely free?

Yes. If you choose “Standard Transfer,” American Express does not charge a fee. Then, when withdrawing from Venmo or PayPal, selecting standard withdrawal (1-3 business days) is also free.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.