- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Remit Money from Bangladesh to the United States? Understand the Remittance Process, Security, and Techniques

Image Source: unsplash

Are you planning to send money from Bangladesh to the USA through remittance? You need to understand that this process is subject to strict local financial regulations. According to the latest data from the American Community Survey, over 280,000 Bangladeshis live in the USA, making financial transactions between families a common need.

Key Tip: Choosing a regulated cross-border remittance service provider (MSB) like WorldRemit is a critical step to ensure the safety and efficiency of your funds.

Key Takeaways

- Choosing a regulated online remittance service provider, such as WorldRemit, can ensure the safety of your funds and improve remittance efficiency.

- Before sending money, you need to prepare your identification documents and the recipient’s detailed bank information, and carefully verify them to avoid errors.

- Comparing fees and exchange rates of different remittance services, opting for larger remittances, and prioritizing bank transfers can help you save on costs.

- Be sure to send money through authorized banks in Bangladesh and comply with Bangladesh Bank’s regulations, such as annual personal remittance limits.

- Stay vigilant against scams and protect your personal account information to ensure the safety of your funds.

Comparison of Three Major Remittance Channels

When sending money from Bangladesh to the USA, you can choose from multiple channels. Understanding their key differences can help you find the most suitable method for your needs. Below, we compare three mainstream remittance channels.

Online Remittance Service Providers (MSB)

Online remittance service providers, or Money Service Businesses (MSB), are the modern mainstream choice for remittances. These companies are legitimate platforms regulated by financial institutions, specializing in international money transfers.

Key Advantage: These services typically have lower fees, more competitive exchange rates, and very fast processing times.

Take WorldRemit as an example: you can easily initiate a transfer through its website or mobile app. Funds can be deposited directly into the recipient’s U.S. bank account or offered as cash pickup in various flexible ways. The entire process is transparent and efficient, making it ideal for handling small, frequent family living expenses or educational costs.

Traditional Bank Wire Transfers

Wire transfers through banks are the most traditional method. If you prioritize maximum security and don’t mind higher costs, this could be an option. You need to visit a bank branch, fill out complex forms, and provide detailed documentation.

The security of bank wire transfers is unquestionable, but the disadvantages are also clear:

- High Fees: Transaction fees and intermediary bank fees can add up to a significant expense.

- Poor Exchange Rates: Banks typically offer less favorable exchange rates compared to professional remittance companies.

- Slower Speed: Funds usually take 3-5 business days to arrive.

Cash Remittance Companies

If your recipient in the USA does not have a bank account or urgently needs cash, cash remittance companies are an ideal choice. Western Union and Ria are leading players in this field.

These companies have extensive agent networks in Bangladesh. For example, Western Union provides services through Dutch-Bangla Bank PLC, while Ria has approximately 29,000 cash pickup locations in Bangladesh. Additionally, mobile financial services like bKash have over 240,000 agent locations, greatly facilitating cash remittances. After the sender makes the payment, the recipient can collect cash within minutes using identification and a transaction code. However, this convenience often comes with higher fees.

| Remittance Channel | Fees | Speed | Convenience |

|---|---|---|---|

| Online Remittance Service Providers (MSB) | Low | Fast (minutes to 1 day) | High, online operation |

| Traditional Bank Wire Transfers | High | Slow (3-5 business days) | Low, requires bank visit |

| Cash Remittance Companies | Higher | Very Fast (minutes) | Moderate, requires visit to agent location |

Sending Money from Bangladesh to the USA: Step-by-Step Guide

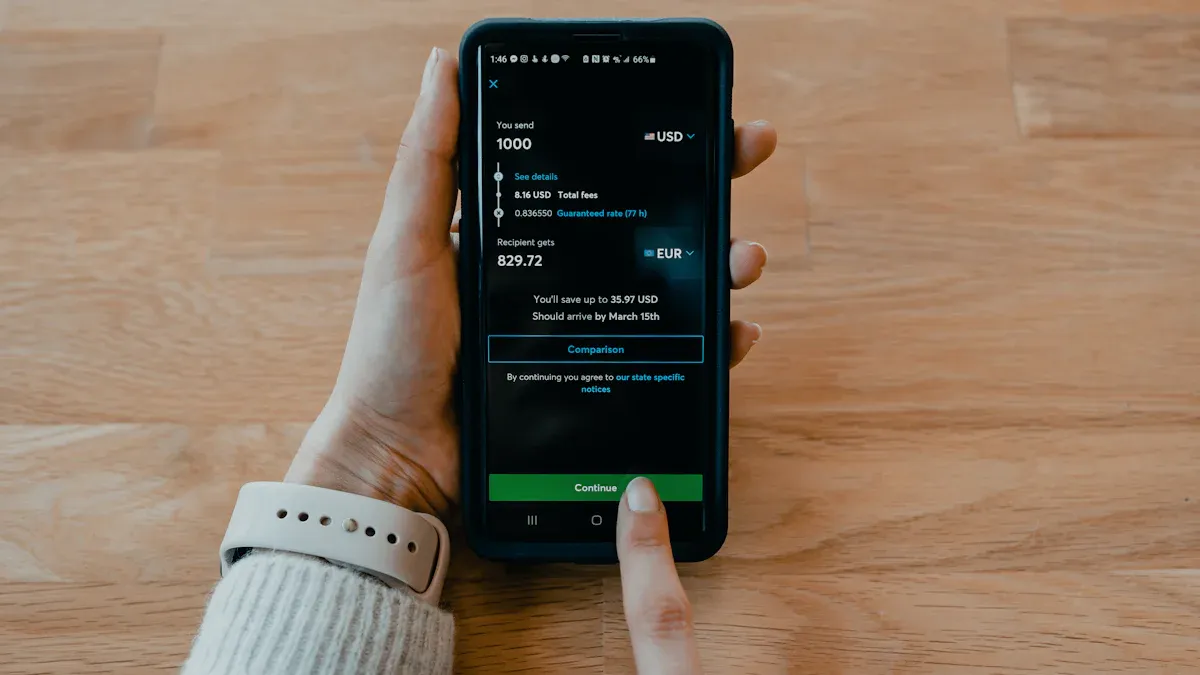

Image Source: unsplash

Once you understand the different remittance channels, the actual process becomes straightforward. Follow these three steps to complete the entire remittance process clearly and smoothly.

Prepare Documents and Information

Before starting the remittance, thorough preparation can save you significant time and avoid unnecessary issues. You need to prepare both your own and the recipient’s information.

Personal Documents You Need to Prepare:

- Valid identification (e.g., national ID card, passport)

- Proof of address

- Proof of fund source (depending on the remittance amount and platform requirements)

Recipient Information You Need: To ensure funds arrive accurately, you need to obtain the following detailed information from the recipient.

- Recipient’s full legal name (must match the bank account name)

- Recipient’s detailed residential address in the USA

- Recipient’s bank name and address

- Recipient’s bank account number

- Bank’s SWIFT/BIC code (an 8-11 character code used to identify banks globally)

Important Tip: Double-checking the recipient’s name spelling and bank account number is critical. Even a minor error could lead to a failed transfer or loss of funds.

Select Service and Execute

With all the information prepared, you can start the process. Whether you choose an online platform or a traditional bank, the steps are largely similar.

- Choose and Register for a Service: Based on the comparison in the previous section, select the remittance service provider that best suits your needs. If it’s your first time, you’ll need to create an account and complete identity verification.

- Enter Remittance Details: Input the amount you wish to send. The system will automatically display the exchange rate, fees, and the final amount the recipient will receive.

- Fill in Recipient Information: Accurately enter the recipient’s bank account details you prepared.

- Fund the Transfer: Choose a payment method to fund your transfer. In Bangladesh, a common online payment method is transferring funds to a designated local bank account. For example, some services require you to deposit funds into their account at Social Islami Bank (SIBL) to complete the payment.

After completing these steps, your Bangladesh to USA remittance process is essentially done.

Track Funds and Confirm

Submitting the remittance request doesn’t mean you can completely relax. Tracking the status of the funds is the final step to ensure a successful transaction.

- Obtain a Tracking Number: After successful payment, the service provider will give you a unique transaction reference number, order number, or PIN. Be sure to keep this number safe.

- Track Status Online: Visit the service provider’s website or app, enter your tracking number and last name on the “track transfer” page to view the real-time status of your funds, such as “processing,” “sent,” or “available for pickup.”

- Notify the Recipient: Once the system shows the funds have arrived or are available for pickup, immediately notify your recipient. Ask them to check their bank account or visit the designated location to collect cash.

With this final confirmation step, the entire Bangladesh to USA remittance process is successfully completed.

Key Tips: Saving Money and Ensuring Security

Image Source: pexels

A successful remittance doesn’t just mean the funds arrive—it also means you’ve saved on costs and ensured security throughout the process. Mastering the following tips can make every remittance more cost-effective and secure.

Five Tips to Reduce Costs

The cost of international remittances is determined by fees and exchange rates. Follow these five tips to effectively lower your total expenses.

- Compare Service Providers: Don’t stick to just one provider. Spend a few minutes comparing fees and exchange rates across different online platforms and banks before sending money.

- Monitor Exchange Rate Fluctuations: Exchange rates vary due to global economic factors, and there’s no fixed “best time to send”. You can use rate alert features provided by online services to get notified when the rate reaches your desired level.

- Opt for Larger Remittances: If possible, sending a larger amount at once is usually more economical than multiple small transfers, as it reduces the frequency of paying fixed fees.

- Choose Cost-Effective Receipt Methods: Typically, direct transfers to the recipient’s bank account are cheaper than cash pickups.

- Avoid Peak Periods: During weekends or holidays, bank processing speeds may slow down, and some providers may charge additional fees. Planning your transfer in advance can avoid unnecessary costs.

Five Key Points to Ensure Fund Security

Fund security is the top priority in remittances. Bangladesh has experienced attacks exploiting banking system vulnerabilities, so individual users must remain highly vigilant.

- Choose Regulated Platforms: Always use remittance service providers that are officially authorized and regulated. These platforms typically employ high-level security technologies.

- Check Website Security Measures: Ensure the provider’s website uses HTTPS encryption (indicated by a padlock in the browser’s address bar) and enable two-factor authentication (2FA) to protect your account.

- Double-Check Recipient Information: This is the most critical step. Errors in name spelling or bank account numbers can lead to delays, failures, or even permanent loss of funds.

- Beware of Scams: Fraudsters use a variety of tactics, so you need to stay vigilant.

Common Scam Warnings:

- Visa Fee Scams: Fraudsters posing as U.S. government officials may contact you via phone or non-official emails (not ending in “.gov”) to demand “visa fees” through mobile payment tools like bKash. Remember, the U.S. Embassy will never request payments this way.

- Fake Loan Scams: Some fraud groups misuse the names of reputable institutions like the World Bank, posting fake loan offers on social media to trick you into paying fees.

- Protect Personal Credentials: Never share your account password, security question answers, or transaction PIN with anyone. Legitimate providers will never ask for this information.

Key Regulations and Remittance Restrictions

Sending money abroad from Bangladesh is the part of the process that requires the most attention. You must strictly comply with the foreign exchange regulations set by Bangladesh Bank. Understanding these rules is essential to ensure your funds can legally and smoothly leave the country.

Bangladesh Bank Regulations

Bangladesh Bank imposes strict capital controls on foreign exchange outflows. This means you cannot freely transfer funds abroad. All remittance transactions must go through licensed “Authorized Dealers” (AD), typically major commercial banks.

To monitor fund flows, the central bank has established an “Online TM Form Monitoring System”. When processing a remittance through a bank, you need to fill out a “TM Form” application, detailing the purpose and specifics of the transfer.

Key Point: Any private currency exchange or remittance bypassing official bank channels is illegal. You must complete all Bangladesh to USA remittances through authorized banks to ensure compliance and safety.

Remittance Amount Limits

Bangladesh sets clear annual limits on personal outbound remittances. These limits are closely tied to the purpose of your remittance.

- Annual Travel Quota: As a Bangladeshi citizen, your annual foreign exchange quota for international travel is up to $12,000.

- For travel to non-SAARC countries like the USA, the annual limit is $7,000.

- For travel to SAARC countries like India, the annual limit is $5,000.

Important Distinction: Small vs. Large Remittances Small remittances within the annual quota (e.g., under $7,000 for family support or travel expenses) can be processed directly through authorized banks with relatively simple procedures. However, for large remittances exceeding the personal quota or for special purposes like investments, the process is much more complex. Your bank must submit an application to Bangladesh Bank’s Foreign Exchange Investment Department (FEID) and await approval.

For businesses or large-scale investment-related transfers, the approval process is even stricter, as shown in the table below:

| Transaction Amount (BDT) | Central Bank Approval Requirement | Main Actor |

|---|---|---|

| Below 10 million | No prior approval required | Authorized Dealer Bank |

| 10 million to 100 million | Post-transaction reporting required | Authorized Dealer Bank |

| Above 100 million | Prior approval required | Authorized Dealer Bank |

Legitimate Remittance Purposes

Every remittance must have a clear and legitimate purpose. Banks will require supporting documents to verify the authenticity of the transfer. Below are some common legitimate remittance purposes and their required documents:

- Family Maintenance: You can provide living expenses for immediate family members in the USA within the annual travel quota. Banks will process this based on your quota.

- Educational Expenses: Paying tuition and living expenses for children studying in the USA is fully legitimate and typically not subject to the annual travel quota. You need to provide:

- Admission letter from the U.S. school.

- Detailed list or invoice of tuition and living expenses.

- Your income proof or family bank statements to verify the source of funds.

- Scholarship letter (if applicable).

- Medical Expenses: If you or your family need to travel to the USA for medical treatment, you can apply to remit medical expenses. Beyond the annual $12,000 quota, you can typically apply for up to an additional $10,000 without prior central bank approval. You need to prepare:

- Treatment recommendation from a professional medical board or doctor.

- Estimated medical cost or invoice from a U.S. hospital.

- Proof of your relationship with the patient (if sending on their behalf).

- Other Personal Remittances: Within the specified limits, you can also apply for remittances to pay for overseas membership fees, exam fees, or professional course fees.

Preparing complete documentation that aligns with your remittance purpose is a critical step to ensure your application passes bank review smoothly.

Successfully completing a Bangladesh to USA remittance hinges on understanding and complying with the strict regulations of the central bank, particularly regarding remittance limits. For small family support or educational expenses, choosing a compliant online remittance service provider (MSB) like WorldRemit is a smart choice that balances efficiency and cost.

Final Reminder: Regardless of the method you choose, safety always comes first. Always operate through legitimate, regulated channels to ensure the security of your funds.

FAQ

Are there limits on sending money from Bangladesh to the USA?

Yes, you must comply with regulations. The annual foreign exchange quota for personal use to non-SAARC countries like the USA is $7,000. Remittances for specific purposes like education or medical expenses can apply for higher limits with supporting documents.

Which remittance method is the fastest?

Wondering about the fastest option? Cash remittance companies (like Western Union) are typically the fastest, with funds available within minutes. However, their fees are relatively high. Online service providers usually take a few hours to a day.

What should I do if my remittance fails?

You should immediately contact the remittance service provider you used. Have your transaction tracking number ready. Customer service will help you check the status of your funds and guide you through next steps, such as correcting information or requesting a refund.

Can I use bKash to send money directly to a U.S. bank account?

Currently, you cannot directly use bKash to send money to a U.S. bank account. bKash is primarily used for domestic payments in Bangladesh or as a cash remittance receipt method. You need to use a bank or online platforms like WorldRemit for cross-border transfers.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.