- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

A Comprehensive Guide to Sending Money to the Dominican Republic: Legal Restrictions, Fees, and Service Selection

Image Source: unsplash

Did you know that choosing different remittance methods can result in a final received amount that differs by up to 10%? Sending money to the Dominican Republic is not just a simple transfer. According to World Bank data, remittances account for nearly 9% of the country’s GDP, making every cent you send critical. This comprehensive guide will help you understand the key aspects of legal restrictions, fees, and services, teaching you how to avoid “hidden” losses and make the most informed and cost-effective decisions.

Key Takeaways

- Before sending money, you need to understand legal regulations, including restrictions on remittance amounts and recipient identity verification.

- The true cost of remittance includes fees and exchange rate differences. You should use a formula to calculate the total cost.

- Online remittance platforms are generally fast and low-cost. Traditional bank transfers are suitable for large amounts but are slower and more expensive.

- Cash remittance agents are ideal for recipients without bank accounts. This method is fast but has the highest fees.

- Choose the remittance method that best suits your needs, considering speed, cost, and recipient convenience.

Comprehensive Guide Before Sending Money: Legal and Tax Considerations

Before clicking the “send” button, understanding the relevant legal and tax regulations is crucial. This not only ensures your funds arrive smoothly but also helps avoid unnecessary legal issues. This section of the comprehensive guide will walk you through the three key legal points you must know before sending money.

Remittance Amount Restrictions

You need to pay attention to the regulations in both the sending and receiving countries.

- Dominican Republic Regulations: The country has no strict foreign exchange controls. However, when the received amount exceeds $10,000 or its equivalent in foreign currency, the recipient may need to declare the source of funds to local authorities.

- Remittance Service Provider Regulations: Different services have significantly varying limits. Traditional bank transfers typically allow higher single-transaction amounts. In contrast, many online platforms have lower single-transaction limits for security reasons, but platforms like Xe support higher online transfer limits, making it convenient for handling large sums.

Recipient Identity Verification (KYC)

“Know Your Customer” (KYC) is a global anti-money laundering regulation that all legitimate financial institutions must follow. This means both you and the recipient need to provide proof of identity. Prepare the following documents in advance to streamline the remittance process:

- Sender: You need to provide a government-issued photo ID (such as a passport or driver’s license) and proof of address.

- Recipient: Your family or friends will also need to present a valid ID (Cédula) when collecting funds.

Tax Implications of Remittance

Remittances themselves are generally not considered taxable income for the recipient. However, as a sender, you need to be aware of U.S. tax reporting requirements, particularly regarding foreign financial accounts.

Important Note: FBAR Reporting Requirements The U.S. Foreign Bank and Financial Accounts Report (FBAR) requires that if a U.S. resident’s total value of overseas financial accounts (including bank accounts, investment accounts, etc.) exceeds $10,000 at any point during the year, they must file Form 114 with the Financial Crimes Enforcement Network (FinCEN). Note that this applies to the total value of your overseas accounts, not the amount of a single remittance.

For large gift remittances, you may also need to understand U.S. gift tax regulations. If your remittance situation is complex, consulting a professional tax advisor is a wise choice. Following the legal advice in this comprehensive guide will make your act of giving more secure.

Comprehensive Cost Analysis: Fees and Exchange Rates

Image Source: unsplash

After understanding the legal framework, the next step is to calculate your true remittance cost. The good news is that, according to World Bank data, the global average remittance cost has significantly dropped from 4.5% a few years ago. However, you still need to be cautious, as the total cost consists of “visible” fees and “invisible” exchange rate differences.

Fixed Fees

Fixed fees are the explicit costs you pay for each remittance. These fees typically come in two forms:

- Fixed Amount: Regardless of the remittance amount, the service provider charges a flat fee, such as $5 per transaction.

- Percentage-Based Fee: The fee is a percentage of the remittance amount, such as 1%.

Fee structures vary greatly across services. Some online platforms may offer zero-fee promotions under specific conditions, while traditional bank transfer fees are generally higher.

Expert Clarification You may have heard of the International Monetary Fund’s (IMF) 0.5% service fee, but this applies to transactions between countries using IMF resources. This is unrelated to your personal remittances, so don’t confuse the two.

Hidden Costs of Exchange Rate Differences

This is the most easily overlooked cost. The USD to DOP exchange rate you find online is usually the “mid-market rate,” which is the benchmark rate used for transactions between banks and large financial institutions.

However, most remittance service providers offer a rate lower than this. The difference is the provider’s “hidden” profit and often constitutes the largest portion of your total cost. Fortunately, checking this information is now easy. Some providers (like XTransfer) offer currency converters that let you view real-time and historical exchange rates, helping you determine if the current rate is cost-effective. Other platforms (like Instarem) clearly state they use the mid-market rate, making costs more transparent.

Practical Total Cost Calculation Formula

To accurately compare different services, you need to calculate the total cost. Use this simple formula:

Total Cost = Fixed Fee + (Mid-Market Rate - Provider’s Rate) × Remittance Amount

- Fixed Fee: The fee clearly listed on the service provider’s website.

- Exchange Rate Difference Cost: Subtract the provider’s rate from the mid-market rate and multiply by your remittance amount.

Before sending money, spend a few minutes using this formula to calculate the total cost for two or three service providers. You’ll be surprised to find that the option with the lowest fees isn’t always the cheapest overall.

Comparison and Selection of Mainstream Remittance Services

Image Source: pexels

Now that you understand the legal regulations and cost components, it’s time to choose the remittance service that best suits your needs. There are three main options on the market: online remittance platforms, traditional bank transfers, and cash remittance agents. Each method has its unique advantages and disadvantages, and this section will break them down for you.

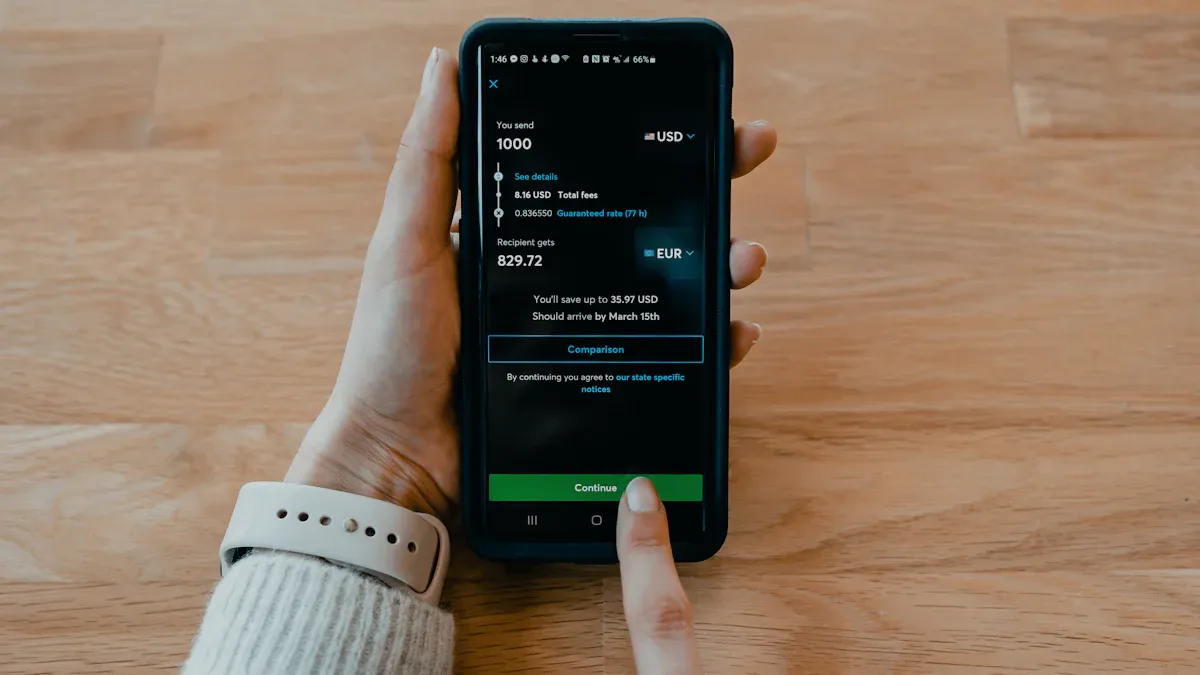

Online Remittance Platforms

Online platforms are currently the most popular remittance method, typically operated through websites or mobile apps. These services are known for their convenience, efficiency, and relatively low costs. You can complete the entire remittance process with just a few taps on your phone.

- Remitly: This is a highly flexible platform, especially suitable for users who need multiple options.

- Advantages: You can choose between two different delivery speeds. The “Express” service typically delivers within minutes but has slightly higher fees, while the “Economy” service is cheaper but takes 1-5 business days. It also supports bank deposits, cash pickups, and even home delivery in the Dominican Republic, which is extremely convenient for recipients.

- Disadvantages: Remitly’s main cost comes from its exchange rate markup. Although it advertises no hidden fees, its offered rate is often lower than the mid-market rate. This difference is the hidden cost you pay.

- Xoom (a PayPal service): If you’re a PayPal user, Xoom offers a seamless remittance experience.

- Advantages: Fast transaction speeds and a user-friendly interface. A unique feature is that you can use it to directly pay utility bills or top up mobile phone credit for family in the Dominican Republic.

- Disadvantages: Xoom’s fees and exchange rate markups are relatively high compared to the market. While its security verification is necessary, some users report that the process can be cumbersome.

- WorldRemit: Another widely popular online provider, known for its extensive global network. Its service model is similar to Remitly’s, offering multiple payment and receipt options. Before deciding, compare its real-time exchange rates and fees with other platforms.

Selection Tip When using online platforms, always use the total cost formula mentioned earlier. Don’t be swayed by “zero fee” advertisements, as exchange rate differences are often the key factor in determining the final cost.

Traditional Bank Transfers

International bank transfers through your bank are the most traditional method. If you need to send large amounts and don’t prioritize speed, this remains a highly reliable option.

To process a bank transfer, you typically need to provide the following information to your bank:

- Recipient’s full name and address

- Recipient bank’s name and address

- Recipient’s bank account number

- Recipient bank’s SWIFT code

What is a SWIFT Code? A SWIFT code is an international standard code of 8 to 11 characters used to identify banks globally. It acts like an international ID number for banks, ensuring your funds are sent accurately to the correct bank and branch. Before sending money, verify the correct SWIFT code with the recipient to avoid misdirected funds.

The main drawbacks of bank transfers are higher costs (typically including a fixed transfer fee, which can be as high as $25-$50) and slower processing times (usually 3-5 business days).

Cash Remittance Agents

For recipients in the Dominican Republic without bank accounts, cash remittance agents are a lifeline. Studies show that even among recipients with bank accounts, nearly half prefer to collect cash through agents, especially in rural areas.

- Western Union and MoneyGram are the two giants in this field.

- Advantages: They have extensive global physical networks, making them easily accessible in cities and towns across the Dominican Republic. Recipients don’t need a bank account and can collect cash within minutes using a valid ID and transaction reference number.

- Disadvantages: Their vast networks mean high operating costs, so their fees and exchange rate markups are typically the highest among all options.

This method is best suited for scenarios where the recipient urgently needs cash, has no bank account, or lives in an area with limited financial services.

Best Option Selection Matrix

To help you quickly make an informed decision based on your needs, we’ve created the following selection matrix, visually comparing the features of different remittance methods.

| Remittance Method | Speed | Cost | Sender Convenience | Applicable Scenarios |

|---|---|---|---|---|

| Online Remittance Platforms | Fast (minutes to days) | Low to Medium | Very High (Mobile App/Website) | Balancing speed and cost, small to medium remittances |

| Traditional Bank Transfers | Slow (3-5 business days) | High | Medium (Requires bank visit or online banking) | Large, non-urgent, high-security remittances |

| Cash Remittance Agents | Very Fast (usually minutes) | High | Medium (Requires visit to agent location) | Recipients without bank accounts, urgent cash needs, or preference for cash transactions |

Ultimately, there’s no “best” option, only the one that best fits your needs. Combine your specific requirements for speed, cost, and recipient convenience with this matrix to make an informed choice.

We hope this comprehensive guide helps you gain clarity. To send money to the Dominican Republic, follow a clear three-step process: first, check legal regulations to avoid unintentional “structuring” operations; second, use the total cost formula to compare options; and finally, choose a service based on your needs for speed, cost, and convenience.

The core of this comprehensive guide is to help you understand that there’s no “one-size-fits-all” option—only the one best suited to your current needs.

Call to Action 💡 Before making your final decision, take a few minutes to visit the websites of potential service providers. Use real-time comparison tools like Xe to quickly calculate and confirm the final received amount, ensuring every cent is well spent.

FAQ

Which is the fastest remittance method?

If speed is your priority, cash remittance agents (like Western Union) and certain online platforms’ “Express” services are the best choices. These methods can typically deliver cash or funds to the recipient within minutes.

How do I find the lowest-cost remittance option?

You need to calculate the total cost using the formula provided. Don’t focus solely on fees. Compare the exchange rate differences across services, as this hidden cost is often higher. Online platforms are generally more cost-effective than traditional banks.

Does the recipient in the Dominican Republic need a bank account?

No, it’s not necessary. If your recipient doesn’t have a bank account, you can use cash remittance agent services. Recipients can collect cash directly at local agent locations with a valid ID and transaction reference number.

What is a SWIFT code, and why do I need it?

A SWIFT code is a bank’s international ID number. When sending money via bank transfer, you need this code to ensure your funds are accurately sent to the recipient’s bank branch.

How can I ensure I get the best exchange rate?

Before sending money, use independent exchange rate tools (like Xe) to check the day’s mid-market rate. Then, compare this rate with those offered by various providers. Choosing a service with a rate closest to the mid-market rate will help you save more money.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.