- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Send Money from the US to Canada: Analysis of Remittance Methods, Fees, and Steps

Image Source: unsplash

When you need to send money from the USA to Canada through remittance, there are typically three mainstream methods to choose from:

- Online remittance platforms (e.g., Wise, Remitly)

- Traditional bank wire transfers

- PayPal

For most daily remittance needs, online remittance platforms are your best choice. They generally outperform other methods in terms of fees, speed, and ease of use. Choosing the right USA to Canada remittance service can save you time and money.

Key Takeaways

- Online remittance platforms are usually the best choice. They have low fees, fast processing, and are easy to use.

- The total cost of remittance includes transaction fees and exchange rate losses. Choosing a platform that uses the mid-market exchange rate can save you money.

- Remittance speed and amount influence your choice. Small remittances are ideal for online platforms, while large remittances require consideration of security and costs.

- All legitimate remittance services are strictly regulated. Your funds are secure.

- Online remittances are simple to process. You need to create an account, enter details, choose a payment method, and confirm.

USA to Canada Remittance: Comparison of Mainstream Methods

Image Source: unsplash

Choosing a remittance method depends on how much you prioritize fees, speed, and convenience. Below, we compare the advantages and disadvantages of these three mainstream methods to help you make the best decision.

Online Remittance Platforms

Online Remittance Platforms are currently the most popular choice for sending money from the USA to Canada. They typically offer better exchange rates and lower fees than traditional banks.

-

Wise (formerly TransferWise) Wise is known for its transparent fee structure and use of the mid-market exchange rate. This means you won’t incur hidden losses from exchange rates.

What is the mid-market exchange rate? This is the “true” exchange rate used for currency transactions between banks and large financial institutions, without any added profit margin. Wise uses this rate directly, charging only a clear service fee.

When sending money through Wise, fees vary depending on your payment method. For example, sending $1,000 USD to Canada has the following fee structure:Payment Method Fees Direct Debit (ACH) and Debit Card $1.00 + 0.75% Wire Transfer $1.00 + 0.60% Credit Card $1.00 + 2.45% -

Paysend Paysend’s feature is a small fixed fee, regardless of the remittance amount. This can be very cost-effective for small transfers.

- Fixed Fee: Sending from the USA typically costs 1.99 USD.

- Exchange Rate: The platform adds a small markup to the standard exchange rate, but you’ll clearly see the final rate and received amount before confirming the transaction.

-

Remitly Remitly offers flexible speed and fee options. You can choose the higher-fee “Express” service for quick delivery or the lower-fee “Economy” service. Additionally, it supports multiple receipt methods, including Canada’s popular Interac e-Transfer, allowing recipients to deposit funds directly into their bank accounts, which is very convenient.

Traditional Bank Wire Transfers

Performing an international wire transfer through your U.S. bank (e.g., Chase, Bank of America) is a very traditional and secure method, especially suitable for large remittances.

The main advantage of bank wire transfers is their security and reliability, with funds transferred directly from your bank account to the recipient’s. However, the drawbacks are equally clear:

- High Fees: Banks typically charge high fixed transaction fees.

- Poor Exchange Rates: Banks often include significant markups in their exchange rates.

- Hidden Fees: In addition to the fees you pay, intermediary banks in the transfer process may deduct additional charges.

For example, here are the international wire transfer fees for some major U.S. banks:

| Bank | Incoming International Transfer | Outgoing International Transfer |

|---|---|---|

| Bank of America | $16 per transfer | $35 per transfer (foreign currency) |

| Chase | Up to $15 per transfer | $5 per online transfer (foreign currency), $40 per online transfer (USD) |

Beware of Intermediary Bank Fees! This is one of the most easily overlooked costs. When your funds move from a U.S. bank to a Canadian bank, if the two banks don’t have a direct relationship, one or more “intermediary” banks may be involved. These banks deduct a service fee from your remittance.

| Fee Type | Typical Range (USD or equivalent) | Paid By/Occurrence |

|---|---|---|

| Intermediary Bank Fees | $10–$50+ per intermediary bank | Deducted by banks in the payment chain before funds reach the recipient |

Additionally, banks impose daily transfer limits; for example, TD Bank’s online international transfer limit may be $6,500 per day.

PayPal and Money Orders

PayPal is widely known for its convenience, but it’s not the most economical choice for USA to Canada remittances.

-

PayPal If both you and the recipient have PayPal accounts, the transfer process is very straightforward. However, you need to pay special attention to its costs, primarily from its currency conversion fees. When PayPal converts currencies, it adds up to a 4.0% spread on top of the wholesale exchange rate.

Here’s a real-world comparison:Provider Exchange Rate (1 USD to CAD) Transfer Fee (USD) Recipient Receives (Sending $1,000 USD) Wise 1.40050 (mid-market rate) $10.15 1,386.28 CAD PayPal 1.34420 $4.99 1,337.49 CAD As shown in the table, although PayPal’s fees appear lower, the exchange rate difference results in the recipient receiving nearly 50 CAD less. -

Money Order A money order is a more traditional paper-based payment method. You can purchase one at a post office or certain banks and mail it to the recipient in Canada. While this method is very secure, it’s extremely slow and cumbersome, making it rarely used as a mainstream international remittance method today.

How to Choose the Best Remittance Method

Now that you understand the different remittance methods, you might ask, “Which one is best for me?” The answer depends on your specific needs. To choose the best method, consider four key factors: total cost, speed, amount, and security.

Factor 1: Total Cost

The total cost of a remittance isn’t just the fixed transaction fee you pay. An often-overlooked cost is the “exchange rate loss.” Therefore, you need to use a simple formula to evaluate the total cost:

Total Cost = Transaction Fee + Exchange Rate Loss

- Transaction Fee: This is the explicit fee charged by the service provider, which may be a fixed amount or a percentage.

- Exchange Rate Loss: This comes from the difference between the exchange rate offered by the provider and the true mid-market rate. Banks and PayPal typically add significant markups to the exchange rate to earn profits.

What is the “Mid-Market Exchange Rate”? This is the exchange rate you find on Google, the “true” rate used for transactions between banks and large financial institutions. Platforms like Wise use this rate directly, allowing you to see the true value of your funds.

To avoid losses on exchange rates, you can use a currency calculator to check the real-time mid-market rate before sending money.

The table below shows the CAD value of different USD amounts at the mid-market rate. Use it as a reference to compare the final amount received across platforms.

| USD | CAD (Reference Mid-Market Rate) |

|---|---|

| 100 | 140.06 |

| 500 | 700.28 |

| 1000 | 1,400.55 |

| 5000 | 7,002.75 |

Before confirming a transfer, always pay attention to the exact amount the recipient will receive, not just the superficial transaction fee.

Factor 2: Remittance Speed

Remittance speed varies by provider and payment method, ranging from minutes to several business days.

- Instant or Within Minutes: Certain online services (e.g., Xoom’s cash pickup) or specific bank partnerships (e.g., RBC Bank’s USA-Canada account transfers) can achieve near-instant delivery.

- 1-2 Business Days: This is the typical speed for most online remittance platforms (e.g., Wise, Remitly) and some bank wire transfers.

- 3-5 Business Days or Longer: Traditional bank international wire transfers may take longer, especially when intermediary banks are involved.

Note! These factors may cause remittance delays

- Holidays and Weekends: Bank holidays in the USA or Canada can delay processing times.

- Payment Method: Paying with a credit card is usually the fastest, while direct bank account debits (ACH) may require additional time to clear.

- Information Errors: Any minor errors in the recipient’s name, bank account, or address can lead to transaction delays or failures.

- Compliance Checks: To comply with anti-money laundering regulations, providers may conduct additional verification for certain transactions, especially large ones.

Factor 3: Remittance Amount

The amount you’re sending is a key factor in choosing the right method.

- Small to Medium Remittances (Hundreds to Thousands of Dollars) For these daily remittances, online remittance platforms are the top choice. They typically have much lower total costs than banks and are more convenient to operate. You can easily complete all steps on your phone or computer.

- Large Remittances (Typically Over $10,000) When sending large amounts from the USA to Canada, security and costs become particularly important. You have two main options:

- Online Platforms Specializing in Large Transfers: Platforms like Wise offer specialized services for large remittances. They maintain transparent fees and favorable exchange rates, can handle single wire transfers up to $1,000,000, and provide dedicated customer support.

- Traditional Bank Wire Transfers: Although banks charge higher fixed fees (typically $40–$50), and intermediary bank fees may apply, this remains a reliable choice for users who highly value the security of traditional banks. Note that, under U.S. law, transactions exceeding $10,000 must be reported to the Financial Crimes Enforcement Network (FinCEN).

Factor 4: Security

Whether using a traditional bank or an online platform, fund security is the top priority. Fortunately, all legitimate remittance services are strictly regulated.

- Banks: They are tightly regulated by the government, and your deposits are typically insured by the FDIC (Federal Deposit Insurance Corporation).

- Online Remittance Platforms: Companies like Wise and Remitly are also subject to strict financial oversight. For example, they must register with FinCEN in the USA and comply with state regulations.

How do online platforms ensure your fund security? They use a mechanism called “Safeguarding.” This means your money is held in a bank account completely separate from the company’s operational funds (e.g., Wise stores customer funds in top-tier banks like Goldman Sachs and JPMorgan). Even if the company faces issues, your funds are protected and accessible at all times. Additionally, they offer technologies like two-factor authentication (2FA) to secure your account.

In summary, as long as you choose a reputable, officially regulated platform—whether a bank or an online service—your funds are secure.

Step-by-Step Guide: Completing an Online Remittance

Image Source: unsplash

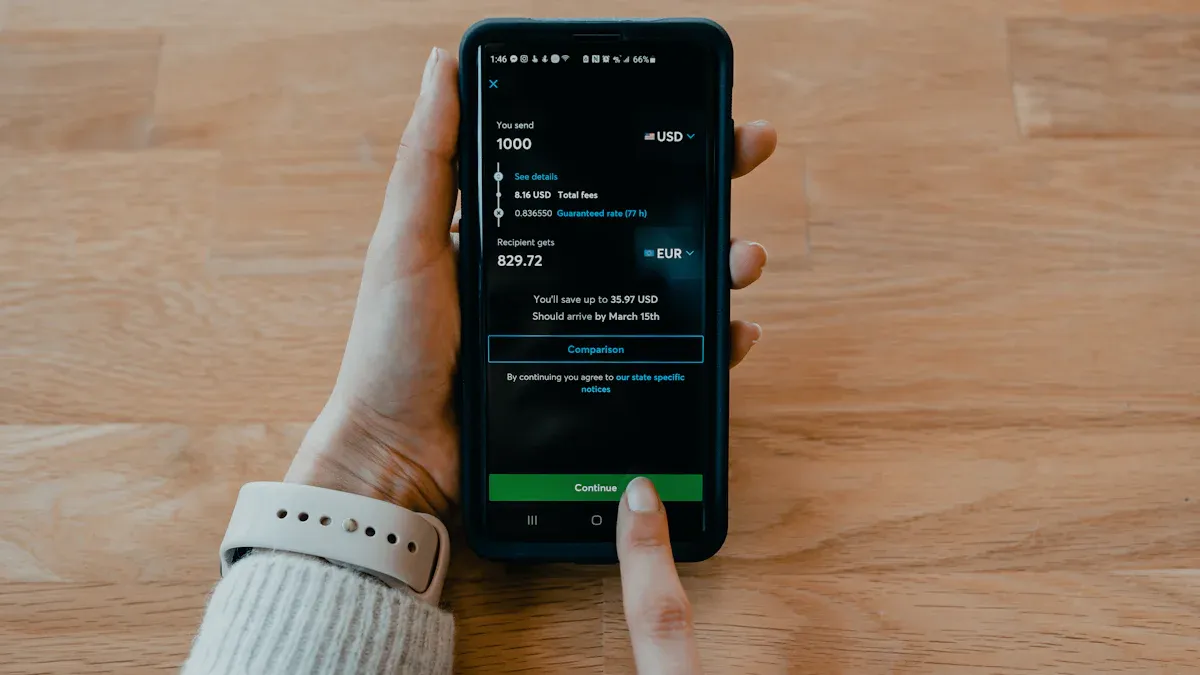

Using an online platform to send money is very straightforward. Below, we use Wise as an example to show the five typical steps for completing a remittance from the USA to Canada.

Step 1: Create an Account

First, you need to create a free account on your chosen remittance platform (e.g., Wise or Remitly). The process is similar to signing up for other online services but includes an identity verification step to ensure fund security.

You’ll need to provide some basic personal information. The platform may require:

- Your full name and date of birth

- Documents for identity verification, such as a passport or U.S. driver’s license

- Proof of address, such as a utility bill or bank statement

If you’re a U.S. resident, platforms like Wise may also require your Social Security Number (SSN) for USD remittances.

Step 2: Enter Remittance Details

After creating and verifying your account, you can start setting up the remittance.

On the platform’s interface, enter the USD amount you want to send (e.g., $1,000 USD). The platform will automatically calculate the CAD amount the recipient will receive based on the real-time exchange rate. At this step, you’ll clearly see the exchange rate used, the fees, and the final amount received.

Step 3: Provide Recipient Details

To ensure funds arrive accurately, you need to provide the recipient’s Canadian bank account information. This is the most critical step, so double-check carefully. The required information includes:

| Number Type | Digits | Description |

|---|---|---|

| Institution Number | 3 digits | Identifies the recipient’s bank |

| Transit Number | 5 digits | Identifies the specific bank branch |

| Account Number | 7-12 digits | The recipient’s personal account number |

💡 How to find these numbers? Your Canadian recipient can easily find this information through:

- Checking a cheque: All details are printed at the bottom of a personal cheque.

- Logging into online banking: Usually listed on the account details page.

- Contacting the bank: Call or visit the bank branch to inquire.

Step 4: Choose a Payment Method

Next, you need to select how to fund the remittance. Common payment methods include:

- Direct Bank Account Debit (ACH): Lower fees but may take 1-3 business days to process.

- Debit or Credit Card: Typically the fastest, enabling quick delivery.

⚠️ Note Credit Card Fees! While paying with a credit card is convenient and fast, most credit card companies treat it as a “cash advance”. This means you may incur additional cash advance fees and higher interest rates, often starting from the transaction date.

Step 5: Confirm and Track

In the final step, carefully review all information—including the remittance amount, recipient details, and fees. Once confirmed, submit your transfer request.

After sending the remittance, you can track the status of your funds in real-time on the platform’s website or mobile app. Platforms like Wise also provide a tracking link that you can share with the recipient, allowing them to monitor updates, such as when funds leave your bank, arrive at the platform, and are expected to deposit into their account.

Choosing the best USA to Canada remittance method involves balancing fees, speed, and amount.

- Daily Small Remittances: Online platforms (e.g., Wise) are the top choice due to low costs and fast processing.

- Large or Traditional Remittances: If you highly value the security of traditional banks, consider bank wire transfers.

Final Reminder 💡 Regardless of the method you choose, double-check the recipient’s bank information before confirming the transfer. A simple error could lead to delays or even loss of funds.

FAQ

What is the cheapest way to send money to Canada?

For small remittances, online platforms are usually the most cost-effective option. You need to compare the total cost of “transaction fees + exchange rate losses.” Choosing a service that offers the true mid-market rate can maximize your savings.

Do I need to provide the recipient’s SWIFT/BIC code?

Typically, no. To send money to a Canadian bank account, you need to provide the following three pieces of information:

- 3-digit Institution Number

- 5-digit Transit Number

- 7-12-digit Account Number

Can I cancel a transfer if I entered incorrect information?

It depends on the processing status of the remittance. If the funds haven’t been sent, you can usually cancel. Once the transfer is complete, it cannot be reversed. If you spot an error, contact your remittance provider immediately for assistance.

How can I ensure my remittance isn’t delayed?

The most critical step is to double-check that the recipient’s name and bank details are completely accurate. A minor error can lead to a failed or delayed transaction. Additionally, try to process transfers on business days to avoid non-processing times during bank weekends.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.