- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

The Best Ways to Send Money from the UK to India: Wire Transfer, Online Services, and Remittance Companies

Image Source: unsplash

If you’re planning to send money from the UK to India via remittance, online remittance services are typically your best option. Platforms like Wise and Remitly excel in fees, speed, and convenience.

Understanding the fees, exchange rates, and delivery times of different remittance channels can help you make the most informed choice based on the transfer amount and urgency.

Key Points

- Online remittance services are usually the best choice. They offer low fees, fast delivery, and ease of use.

- When choosing a remittance method, you need to consider four aspects: fees, exchange rates, speed, and security.

- Traditional bank wire transfers have high fees and are slow. They’re not suitable for personal small transfers.

- Traditional remittance companies are ideal for cash pickups. They have many locations but may have less favorable fees and rates.

- Before sending, check the remittance company on the UK Financial Conduct Authority (FCA) website to ensure your funds’ safety.

Evaluating Remittance Methods: Four Core Factors

Before deciding on a remittance method, understanding the evaluation criteria is crucial. You need to focus on four core factors: fees, exchange rates, speed, and security. This helps you avoid unnecessary losses and ensures funds arrive smoothly.

Fee Structure: Transparent and Hidden Costs

Remittance fees consist of two parts: explicit transaction fees and hidden additional costs. Online services typically charge a transparent service fee. In contrast, traditional banks’ fee structures can be more complex.

Many seemingly low fees hide additional costs you may not notice. These costs directly reduce the final amount received by the recipient.

Common hidden costs include:

- Exchange Rate Markup: Banks and providers add a margin to the real rate for profit.

- Intermediary Bank Fees: When funds pass through one or more intermediary banks, each may charge a processing fee.

- Recipient Bank Fees: Local banks in India may charge fees for receiving funds.

Exchange Rate Quality: Mid-Market Rate vs. Bank Rates

The exchange rate is key to determining your remittance’s cost-effectiveness. You need to focus on the Mid-Market Rate, the real rate used between banks and large institutions, which you can check on Google or Reuters.

Many online platforms (e.g., Wise) use this rate directly, charging only a service fee for full transparency. For example, when the market rate is 1 GBP = 116.899 INR, they calculate based on this.

Traditional banks and some providers offer their own “posted rates,” which include a markup over the mid-market rate. Even if they advertise “zero handling fees,” they profit through less favorable rates.

Delivery Speed: Instant vs. Business Day Wait

Transfer speed varies by channel. If you need funds urgently, speed is the top priority.

- Online Services: Typically very fast. Some services (e.g., Remitly, Western Union) offer instant delivery options, especially for cash pickups, with funds ready in minutes.

- Traditional Banks: Slower, typically requiring a wait.

| Transfer Method | Average Delivery Time (UK to India) |

|---|---|

| Traditional Bank Wire Transfer | 1-5 business days |

| Wise | 1-2 business days |

| Western Union | Minutes to 1 business day |

Security and FCA Regulation

Fund security is the baseline for remittances. In the UK, all legitimate remittance services must be authorized and regulated by the Financial Conduct Authority (FCA).

FCA-regulated companies must comply with:

- Fund Segregation: Your money must be held in separate accounts from the company’s own funds, ensuring safety even if the company fails.

- Fee Transparency: Must clearly display all fees, including any rate markups, before the transaction as required.

- Public Disclosure: You can check a company’s authorization and business scope on the FCA’s Financial Services Register.

Spending a minute to verify a company’s credentials on the FCA website is the simplest and most effective way to ensure your funds’ safety.

In-Depth Analysis of Mainstream Remittance Channels

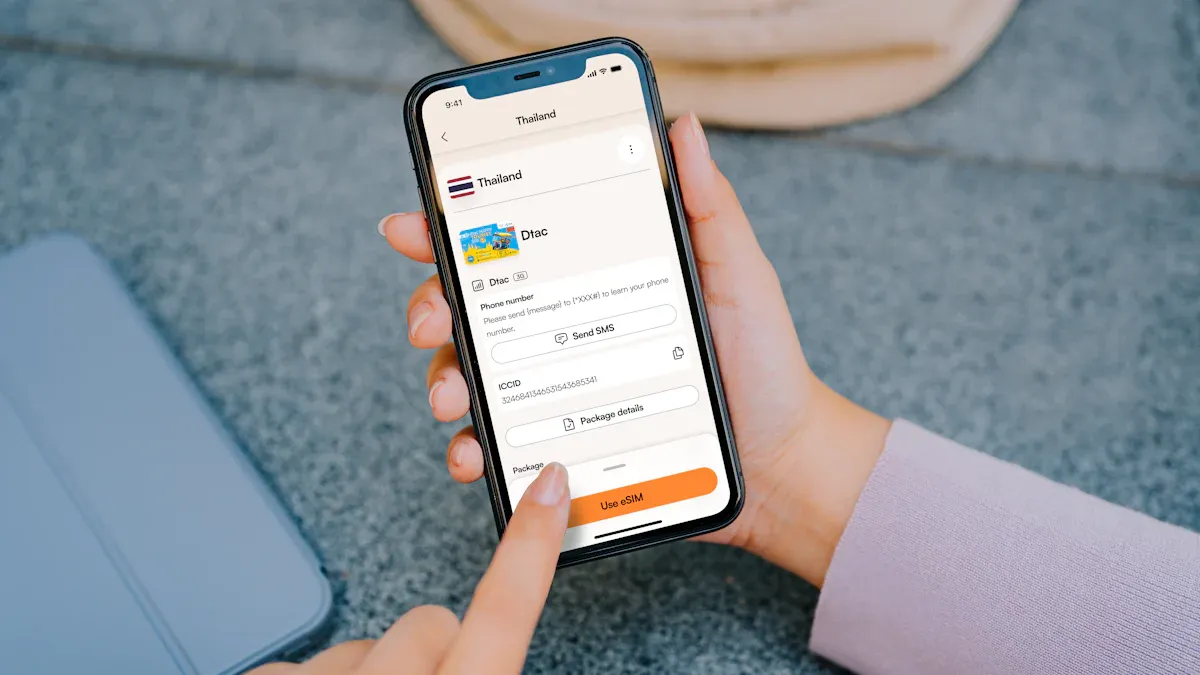

Image Source: unsplash

Having understood the evaluation criteria, let’s dive into the three main remittance channels from the UK to India. Each has unique pros and cons, and you’ll need to weigh them based on your needs.

Online Remittance Services

For most personal remittance scenarios, online services offer the best combination of speed, cost, and convenience. These platforms are designed for international transfers, with simple processes often completed in minutes.

Their core advantage lies in transparency and cost-effectiveness. Many use the mid-market rate directly, charging only a clear service fee, ensuring you don’t lose money to poor rates.

Tip: These platforms typically have high user ratings. Before choosing, check independent review sites like Trustpilot for real user experiences.

| Platform | Trustpilot Rating | Number/Type of Reviews | Key User Feedback |

|---|---|---|---|

| Wise | 4.2/5 | Over 155,400 five-star reviews | User-friendly, transparent fees |

| Remitly | 4.6/5 | Over 85,000 reviews | Reliable transfer service, multiple delivery options |

Here are some popular online services for sending money from the UK to India:

- Wise (formerly TransferWise): Known for using the mid-market rate and transparent fees. It has a large user base and strong reputation, making it a reliable choice.

- Remitly: Offers multiple receiving methods, including bank deposits and cash pickups. Its “Express” service delivers in minutes, ideal for emergencies.

- Paysend: Attracts users with a simple fee structure, typically charging a fixed £1 fee for transfers to India.

- Panda Remit: Supports transfers to major Indian banks (e.g., ICICI, HDFC), with a user-friendly interface for Chinese users.

- XE Money Transfer: A well-established currency information site with reliable remittance services, ideal for checking real-time rates.

- LemFi: Focuses on financial services for immigrants, with a convenient transfer process.

Overall, transparent fees, favorable rates, and fast delivery make online services one of the best ways to send money to India.

Traditional Bank Wire Transfers

Using your UK bank (e.g., HSBC, Barclays) for international wire transfers is another traditional option. It feels secure and authoritative, as you’re dealing with a familiar institution.

However, this security comes at a high cost and slow process. Banks’ remittance services aren’t their core profit driver, so fee structures are often complex.

Bank transfer costs go beyond a single fee. Watch out for three potential fees:

- Upfront Transfer Fee: Especially expensive at branches; for example, Barclays charges £25 for international payments at a branch.

- Exchange Rate Markup: Banks offer rates worse than the mid-market rate, their primary profit source.

- Third-Party Fees: Funds may pass through intermediary banks before reaching India, each charging a processing fee.

Additionally, bank wire transfers require extensive, precise details, and any error can cause delays or failures.

Required information typically includes:

- Recipient’s full name and address

- Recipient bank’s name, branch address, and SWIFT code (e.g.,

AXISINBBXXX) - Recipient’s full bank account number

- Purpose of transfer code

In summary, unless you have specific reasons to use a bank (e.g., company policy or specific requirements for large transactions), bank wire transfers are neither cost-effective nor efficient for personal small or medium transfers.

Traditional Remittance Companies

Traditional remittance companies like Western Union and MoneyGram excel due to their extensive global physical networks.

If your recipient in India lacks a bank account or urgently needs cash, these companies are unmatched. You can pay with cash or a card at a UK agent location, and the recipient can collect cash minutes later at any partner location in India with ID and a pickup code.

This convenience comes at a cost. Their fees and exchange rates are typically less competitive than online platforms. While they also offer online transfers to bank accounts, they often can’t match the pricing of specialized services like Wise or Remitly.

Choosing these companies means paying for “cash” and “speed.” If cost is your primary concern, they may not be the top choice.

How to Choose the Best Method Based on Your Needs?

Image Source: pexels

Having explored the characteristics of different channels, you might ask, “Which method is best for me?” The answer depends on your specific needs. Below, we outline four common scenarios to help you quickly find the most suitable remittance solution.

Scenario 1: Prioritizing “Cost”

If your primary goal is to save money, you need to carefully compare total costs, not just service fees. Total cost = service fee + exchange rate loss.

Online remittance services are typically the most cost-effective. They save you money with better rates and transparent fees.

- Wise: Known for using the mid-market rate. It charges a small, transparent fee, but with no rate markup, the final received amount is often higher.

- Remitly: Often offers promotions for new customers, such as waived fees on the first transfer and attractive promotional rates for the first £2,000.

Money-Saving Tip: Many platforms offer new customer promotions. Remitly provides first-transfer deals without needing a promo code, but each order can use only one offer. Choose the most advantageous deal to maximize savings.

To clarify the truth behind “zero fees,” see this comparison:

| Provider | Fee | Exchange Rate Info |

|---|---|---|

| Remitly | Free for first transfer | Promotional rate for first £2,000 |

| Western Union | Possibly £0.00 | Profit embedded in rate, e.g., 1 GBP = 106.24 INR |

This table shows that even with zero fees, the exchange rate matters. Small rate differences can accumulate into significant losses for larger transfers. Thus, for cost-conscious users, comparing both rates and fees is key to finding the best method.

Scenario 2: Prioritizing “Speed”

When you need to send money urgently, speed is everything. Delivery times vary greatly, from minutes to several business days.

Online services and traditional remittance companies excel in speed:

- Remitly: Offers an “Express” service, where funds paid by card can reach the recipient’s bank account or cash pickup point in minutes.

- Western Union / MoneyGram: Also provide near-instant cash pickup services, ideal for emergencies.

- Wise: Not the fastest, but its transfer tracking is robust. You can see every step of the process on Wise’s dashboard, from “Received” to “Sent” to “Delivered.”

You can monitor transfer status in real time using the provider’s tracking number (also called a “reference number”). Remitly allows you to log in or enter the number directly on its website to track. This gives you full visibility of your funds’ journey, reducing waiting anxiety.

Banks have specific processing cutoffs. Transfers submitted after the cutoff may be delayed until the next business day.

Overall, for maximum speed, Remitly’s Express service or Western Union’s cash transfers are the best options.

Scenario 3: Sending “Large Amounts”

When sending a large sum from the UK to India (e.g., for home purchases, investments, or significant family expenses), security and compliance become as important as cost.

First, consider the provider’s transfer limits.

- Wise: Allows online transfers from the UK to India up to 100 million INR (approximately £854,833).

- XE: Caps transfers from the UK at £350,000.

For large transfers, exchange rate impacts are amplified. Even a 0.5% rate difference can mean thousands of pounds in losses. Some providers advertise “zero fees” but profit through worse rates.

| Provider | USD to GBP Rate for $200,000 | Transfer Fee for $200,000 | Recipient Receives (GBP) |

|---|---|---|---|

| Wise | 1 USD = 0.792424 GBP | 926.04 USD | 157,750.98 GBP |

| OFX | 1 USD = 0.785400 GBP | 0 USD | 157,080.00 GBP |

This comparison shows that despite Wise charging a fee, its better rate results in more money received.

Important Note: Under Indian regulations, large transfers may require additional documentation. Per the Liberalised Remittance Scheme (LRS), Indian residents can send up to $250,000 abroad annually. While this applies to outbound transfers from India, receiving large sums may require a purpose code or documents to comply with anti-money laundering rules. For payments over 500,000 INR, the Reserve Bank of India may require Form 15CA and 15CB. Confirm these requirements with your recipient before large transfers.

Thus, the best method for large transfers is a transparent, high-limit, reputable platform like Wise.

Scenario 4: Recipient Needs “Cash Pickup”

If your recipient in India lacks a bank account, lives in a remote area, or urgently needs cash, services supporting cash pickups are the only option.

Traditional remittance companies have an unmatched advantage here.

- Western Union: Has over 111,000 agent locations in India, with widespread coverage across towns.

- MoneyGram: Also boasts a vast physical network, another reliable choice.

- Remitly: Offers cash pickup services, a strong competitor to traditional giants.

The cash pickup process is straightforward:

- You pay at a UK agent location or online platform.

- You receive a unique transaction code (e.g., MTCN).

- You share this code with the recipient in India.

- The recipient presents valid ID (e.g., Aadhaar card or passport) and the code at any partner location to collect cash.

This convenience comes with higher costs. Cash pickups have higher fees and less favorable rates than bank account transfers due to additional logistics and operational costs. You’ll need to weigh convenience against cost.

In summary, for most routine transfers, online services are the best in terms of cost and efficiency, far surpassing traditional banks.

Action Advice: Before each transfer, spend a minute using comparison tools like Wise (with over 203,000 reviews on Trustpilot, rated 4.4/5) to check the latest fees and rates. This ensures you get the best deal.

You can pre-register accounts with one or two reputable platforms. This allows you to send money quickly and cost-effectively when needed.

FAQ

Which method has the lowest fees?

Online services (e.g., Wise) typically have the lowest costs due to better exchange rates. Don’t focus solely on fees. The best practice is to use comparison tools to evaluate the total cost of “fees + exchange rate” for maximum savings.

What information do I need from the recipient?

For bank account transfers, you need the recipient’s full name, bank name, account number, and IFSC code. For cash pickups, you only need the recipient’s name. They collect funds with ID and a pickup code, making it simpler.

How do I confirm a remittance platform is safe?

Visit the UK Financial Conduct Authority (FCA) website and use its Financial Services Register to check the company’s name. Ensure it’s authorized and regulated. This is the most direct way to ensure your funds’ safety.

Do I need to pay taxes for sending money from the UK to India?

For small personal gift transfers, taxes are typically not required in the UK or India. However, tax rules for large transfers or commercial payments are complex. If unsure, consult a tax professional for accurate advice.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.