- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Remit Money to Bangladesh Easily and Safely? A Comprehensive Guide Analysis

Image Source: unsplash

In the 2024-25 fiscal year, Bangladesh received a record-breaking $30.04 billion in remittances. For you, the easiest and safest way to send money to Bangladesh via remittance is by using regulated online platforms. This trend is evident.

Did you know? Data from a major Bangladeshi bank shows that the proportion of remittance transactions processed through digital channels has surged from 37% to 75%.

Even better, sending money through these legitimate channels also qualifies you for government cash incentives.

Key Takeaways

- Using online platforms to send money to Bangladesh is the most convenient and cost-effective, such as Wise.

- The Bangladeshi government offers a 2.5% cash incentive for remittances sent through legitimate channels.

- Before sending, carefully verify the recipient’s bank account or mobile wallet information to ensure accuracy.

- When choosing a remittance platform, confirm it’s regulated and enable two-factor authentication to secure your account.

- Avoid sending money on weekends, as weekdays typically offer better exchange rates.

Sending Money to Bangladesh: Comparing Methods

Image Source: pexels

Choosing the right remittance method depends on your priorities: lowest cost, fastest speed, or the convenience of cash pickup. Below, we compare three mainstream methods to help you make the best decision.

Online Remittance Platforms

For most people, online platforms are the ideal choice for sending money to Bangladesh. They typically offer the best exchange rates and lower fees, with highly convenient operations.

Wise (formerly TransferWise) is a leader in this field. Its biggest advantage is transparency. Wise uses the real, mid-market exchange rate for USD to Bangladeshi Taka (BDT) conversions, charging only a clear, low service fee. Many banks and other providers hide markups in the exchange rate, making you pay more. Wise consistently offers the true rate you see on Google.

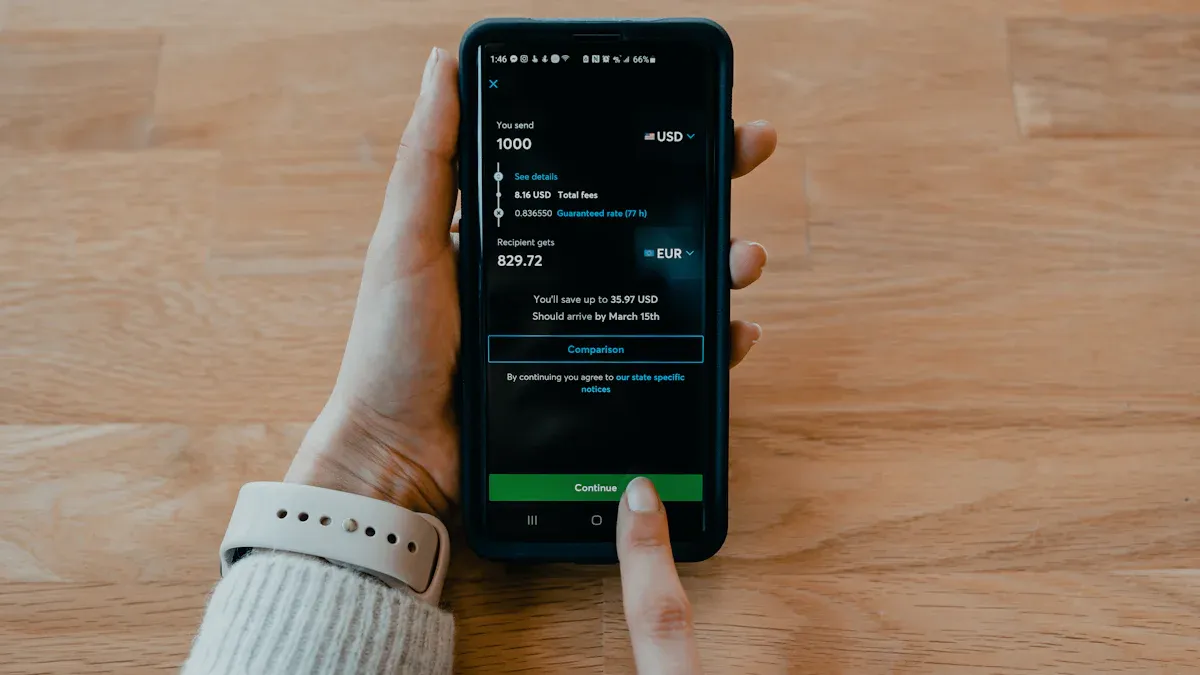

To give you a clearer picture, here’s an example of sending 1,000 USD:

| Provider | Exchange Rate (USD to BDT) | Transfer Fee (USD) | Recipient Receives (BDT) |

|---|---|---|---|

| Wise | 122.300 (mid-market rate) | 15.17 | 120,444.71 |

| Remitly | Rate and fees vary by payment method | Check during order creation | Check during order creation |

| WorldRemit | Rate and fees vary by payment method | Check during order creation | Check during order creation |

Core Advantages:

- Cost-Effectiveness: Typically offers the best exchange rates and lowest fees.

- Fast Speed: With debit or credit card payments, transfers usually arrive in minutes to hours. Bank account payments take 1-3 business days.

- Convenience: You can complete all operations from home via computer or phone.

Other excellent platforms like Remitly and WorldRemit are also good choices, potentially more advantageous in certain cases (e.g., cash pickup or mobile wallet top-ups).

Traditional Bank Wire Transfers

If you need to transfer a very large amount or have high security requirements, traditional bank wire transfers remain a reliable option. You can initiate an international wire transfer through your usual bank, such as licensed banks in Hong Kong.

However, this reliability comes at a cost.

- High Fees: Banks typically charge a high fixed fee (usually between 25-50 USD).

- Unfavorable Rates: Banks’ exchange rates often include markups, meaning your recipient receives fewer Taka than with online platforms.

- Slower Speed: An international wire transfer usually takes 3 to 5 business days to complete.

For bank wire transfers, you must prepare accurate recipient information, with the most critical being the SWIFT/BIC code. This code is the bank’s unique identifier in the global financial network.

For example, the main SWIFT code for NATIONAL BANK LIMITED in Bangladesh is: NBLBBDDHXXX

This code tells the global banking system to send the money to this specific bank in Bangladesh. If the recipient doesn’t provide a specific branch code, using the head office code is usually a safe choice.

Offline Remittance Agencies

If you or your recipient prefer cash transactions, agencies like Western Union and MoneyGram are designed for you. Their biggest advantage is their vast global network of agent locations, allowing recipients to conveniently pick up cash at nearby points without a bank account.

This convenience comes at a cost. Offline agencies’ fees and exchange rates are typically the least cost-effective of all methods.

Note: These companies’ rates and fees vary in real-time based on payment and pickup methods. Their primary profit comes from the exchange rate spread in currency conversion.

However, they sometimes offer promotions for new customers, such as zero fees on the first transfer. These typically don’t apply to credit card payments, and you’ll still pay for less favorable rates. If cash pickup convenience is your priority, this may be an acceptable trade-off.

Online Remittance Operation Guide

Image Source: unsplash

You’ve learned the pros and cons of different remittance methods; now let’s get practical. Follow these three simple steps to complete an online transfer easily and securely.

Choose a Platform and Register

Selecting a trustworthy platform is the first step to a successful transfer. Wise, Remitly, and WorldRemit are excellent choices, and you can decide based on their reputation and user reviews.

The Power of User Reviews Wise has earned over 155,400 five-star reviews on Trustpilot, proving its reliability. Over 16 million satisfied customers globally trust Wise, handling over $10 billion monthly. Meanwhile, some users found WorldRemit offered better exchange rates after comparison and chose to use it long-term. This shows that taking time to compare platforms is worthwhile.

After choosing a platform, you need to create an account. This involves a critical security step called “Know Your Customer” (KYC). This is a legal obligation for all regulated financial institutions to prevent money laundering and fraud, ensuring your funds’ safety.

The good news is that for direct transactions like remittances, many platforms streamline the registration process. You typically only need to complete a basic identity verification (limited KYC) to start sending money.

To make registration smoother, prepare the following information in advance:

- Your full name

- Date of birth

- Residential address

- ID number

In some cases, the platform may require you to upload documents to verify your identity. Common documents include:

- Government-issued photo ID (e.g., passport or driver’s license)

- A utility bill or bank statement showing your name and address

Prepare Recipient Information

Accurate information is key to a successful transfer. Before creating a transfer order, ensure you obtain complete and correct details from your recipient. Required information varies by receiving method.

1. If Sending to a Bank Account

This is the most common remittance method. You need to obtain the following bank details from the recipient:

| Required Information | Description |

|---|---|

| Recipient’s Full Name | Must match the name on the bank account exactly. |

| Bank Account Number | The recipient’s account number at a Bangladeshi bank. |

| Branch Name | The specific branch of the bank where the account is held. |

| Region | The region where the bank branch is located. |

2. If Sending to a Mobile Wallet (bKash, Nagad, Rocket)

Mobile wallets are highly popular in Bangladesh, offering a very convenient receiving method. You need to prepare:

Important Note: Ensure the recipient’s mobile wallet account is fully verified and enabled for receiving international transfers. Otherwise, the transfer may fail. Also, mobile wallets have transaction limits, so check that your transfer amount is within the allowed range.

Create Order and Payment

With all information ready, you can start creating your first transfer order.

Step 1: Check Exchange Rates Before entering the amount, make a smart check. Use an independent exchange rate tool like Xe to view the current “mid-market exchange rate”. This rate is the midpoint between global buy and sell prices, the fairest benchmark available. While you can’t transact at this rate, it helps you judge whether the platform’s offered rate is cost-effective.

Step 2: Create the Transfer Order Log into your remittance platform account, then:

- Enter the amount you wish to send (e.g., 1,000 USD).

- The platform will automatically display the Bangladeshi Taka (BDT) amount the recipient will receive, along with all fees.

- Select the receiving method (bank transfer or mobile wallet).

- Fill in the recipient information you prepared.

Step 3: Payment and Confirmation The final step is payment. You can choose to pay with a debit card, credit card, or bank transfer. Card payments are typically the fastest but may have slightly higher fees. After completing the payment, you’ll receive a confirmation email with a tracking number, which you can use to check the status of your transfer to Bangladesh at any time.

Money-Saving and Safety Tips

You’ve learned how to execute a transfer; now let’s master advanced tips. These strategies will help you save more money and ensure every transfer is secure.

Money-Saving Tips

Savvy remitters know how to leverage timing and promotions to reduce costs.

- Choose the Best Transfer Time: You should avoid sending money on weekends. Most currency markets close on weekends, and platforms may use fixed rates with more profit margin. Operating during weekday market hours typically secures more competitive rates.

- Take Advantage of New Customer Promotions: Many platforms offer first-transfer promotions to attract new users. For example, WorldRemit and Remitly often provide zero fees or rate discounts for new customers. Spend a few minutes checking for applicable promotions before signing up.

- Focus on Large Transfer Fee Structures: For larger amounts, online platforms’ fee advantages become more pronounced. Traditional banks’ fixed fees (up to 50 USD) are costly, while platforms like Wise charge proportional fees, keeping overall costs lower.

Claiming Government Cash Incentives

This is one of the most attractive benefits of sending money to Bangladesh.

Good News! The Bangladeshi government offers a 2.5% cash incentive for wage-earner remittances sent through legitimate channels. This means if your family receives 1,000 USD equivalent in Taka, they can also get an additional ~25 USD equivalent cash incentive.

To qualify for this incentive, you need to meet a few simple conditions:

- Remittance Nature: The funds must be “wage-earner” personal remittances, not commercial payments or investments.

- Account Type: You should send from your personal account to the recipient’s personal bank account or mobile wallet.

- Recipient Eligibility: Only the recipient (a Bangladeshi citizen) can claim this incentive.

As long as you use a legitimate platform like Wise, this incentive is typically automatically credited to the recipient’s account without additional steps.

Core Safety Tips

Ensuring fund security is always the top priority. Be sure to follow these points:

| Safety Measure | Specific Action |

|---|---|

| Verify Platform Legitimacy | Ensure your chosen platform is regulated by financial authorities. Legitimate companies display their licensing information on their websites and comply with KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations. |

| Enable Two-Factor Authentication (2FA) | This is one of the most effective ways to protect your account. Once enabled, even if your password is compromised, no one can access your funds without your phone verification code or fingerprint confirmation. |

| Beware of Remittance Scams | Be cautious of any unsolicited requests for urgent transfers, such as claims of “winning a prize” or “family emergencies.” Never send money to unknown or untrusted individuals. |

Following these core tips ensures your transfers are both cost-effective and secure.

You now understand that choosing a regulated online platform like Wise is the best strategy for sending money to Bangladesh. This not only offers better exchange rates but also allows you to easily claim government cash incentives.

Recap of key steps:

- Compare and select the best platform

- Prepare accurate recipient information

- Securely create the order and pay

- Sit back and let the recipient enjoy the extra incentive

You’ve mastered all the core knowledge. Start your first safe and cost-effective remittance journey now!

FAQ

Which Remittance Method Is the Fastest?

Using an online platform with debit or credit card payments offers the fastest speed. Funds typically reach the recipient’s account in minutes to hours.

Do I Need to Apply for the 2.5% Government Incentive?

You don’t need to apply separately. As long as you use a legitimate platform like Wise to send to a personal account, the incentive is usually automatically calculated and added to the received amount.

What If My Transfer Fails?

You should immediately contact the customer service of the remittance platform you used.

- Provide your transfer tracking number.

- They will help investigate the reason and resolve the issue.

Are There Limits on Transfers to Mobile Wallets?

Yes, mobile wallets have daily and monthly receiving limits. Confirm with the recipient before sending to ensure your transfer amount is within the allowed range to avoid transaction failure.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.