- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Send Money to the Dominican Republic? A Safe and Convenient Transfer Guide

Image Source: unsplash

Sending money to the Dominican Republic for remittance is easier than ever. You can use a variety of modern, secure methods, including online services, bank wire transfers, and mobile apps.

Expert Tip: For most users, online platforms like Remitly or Paysend are the preferred choice. They are typically faster and have lower fees.

Your transfer matters significantly. International remittances account for a substantial portion of the country’s economy, reaching 9% of its GDP in 2022.

Key Takeaways

- Online remittance services are usually the best choice for sending money to the Dominican Republic. They are fast, have low fees, and offer good exchange rates.

- When choosing a remittance method, compare total costs, delivery speed, and transfer limits. Don’t just look at handling fees; consider how much the recipient will ultimately receive.

- You can choose from multiple receiving methods, including bank deposits, cash pickups, and home delivery. Select the most convenient option based on the recipient’s situation.

- Online remittances are simple to operate—just create an account, enter the amount, provide recipient details, and choose a payment method.

- To ensure transfer security, select a reputable remittance provider and carefully verify all recipient information.

Comparison of Dominican Republic Remittance Methods

Image Source: unsplash

Choosing the right remittance method can save you time and money. Below, we compare three mainstream Dominican Republic remittance methods to help you make the best decision.

Online Remittance Services

Online remittance services are currently the most popular choice. They typically offer the best exchange rates, lower fees, and faster transfer speeds. You can complete all operations in minutes through a website or mobile app.

These platforms provide great flexibility.

- Main Providers: Companies like Remitly, Paysend, Ria Money Transfer, and Wells Fargo ExpressSend offer remittance services to the Dominican Republic.

- Payment Methods: You can typically pay using a debit or credit card. Using a debit card is recommended, as credit card payments may be treated as cash advances, incurring additional fees.

- Diverse Receiving Options: Funds can be deposited directly into the recipient’s bank account, picked up at thousands of cash pickup locations, or even delivered to their door through services like Remitly.

Operation Example: Using Remitly You simply create an account, enter the remittance amount, and provide the recipient’s name and contact information. Then, choose a receiving method (e.g., bank deposit or cash pickup) and complete the payment. For returning users, transfers can be nearly instant, especially for cash pickups. The recipient can collect funds with a valid ID and the remittance reference number (MTN).

Bank Wire Transfers

Bank wire transfers are a highly traditional and secure method. If you and the recipient prefer using banks and have the highest security requirements, this could be a good choice. Many people trust their banks, feeling more reassured by bank transfers.

However, this traditional method has clear disadvantages.

- Higher Fees: Bank wire transfers typically have the highest total costs. Fees are complex and may include:

- A fixed remittance fee charged by your bank

- A receiving fee charged by the recipient’s bank

- Additional fees from intermediary correspondent banks

- Less favorable currency exchange rates

- Slower Speed: An international wire transfer usually takes 1-5 business days to arrive. While banks may process your request before a cutoff time, this doesn’t guarantee same-day delivery.

- Complex Process: You need to accurately provide the recipient’s bank details, including the bank name, address, and International Bank Account Number (IBAN). Any errors could lead to delays or transfer failure.

Major banks in the Dominican Republic, such as Banco Popular, Banco BHD, and Banco de Reservas, accept international wire transfers.

Fee Calculation Example Suppose you want to send $1,000 USD. If your bank charges a $20 USD handling fee, the recipient’s bank charges $15 USD, and there’s a 2% exchange rate margin (i.e., $20 USD), your total cost could be as high as $55 USD.

Cash Pickup Locations

If your recipient in the Dominican Republic doesn’t have a bank account or urgently needs cash, sending money through cash pickup locations is a highly practical option. Companies like Western Union and Ria Money Transfer have extensive global agent networks.

The core advantage of this method is convenience and accessibility.

| Company Name | Number of Agent Locations in the Dominican Republic |

|---|---|

| Ria Money Transfer | 2,300+ |

| Western Union | 300+ |

Sending cash is typically straightforward. After completing the remittance, you receive a unique reference number. The recipient needs to present identification and this number to collect cash at the nearest agent location.

However, fees require attention. For example, the average fee for sending cash for pickup may be $3.99 USD plus an additional 1% of the transaction amount. While convenient, the total cost may be higher than some online services.

Key Considerations: Fees, Speed, and Limits

When choosing the best Dominican Republic remittance method, three key factors need careful consideration: total cost, delivery speed, and transfer limits. Understanding these factors will help you make the most informed decision, ensuring funds are delivered efficiently and economically.

Comparing Total Costs

The total cost of a remittance is not just the “handling fee.” It consists of two parts:

- Transfer Fee: This is the fixed or percentage-based fee charged by the service provider for processing your transaction.

- Exchange Rate Margin: The exchange rate offered by the provider is typically slightly below the mid-market rate. This difference is the provider’s hidden profit and affects the amount the recipient ultimately receives.

Expert Tip: Don’t focus solely on the handling fee. Always pay attention to the “total amount received by the recipient.” A service with a lower fee but a poor exchange rate may end up being more expensive than one with a slightly higher fee but a better rate.

Some modern online platforms prioritize fee transparency. For example, Paysend charges a fixed fee of $1.99 USD per transfer to the Dominican Republic, ensuring clear and low costs, making it easy to estimate the total expense.

Focusing on Delivery Time

The speed of fund delivery varies depending on the remittance method chosen. If you or your recipient urgently need the funds, speed is a critical factor.

Online remittance services are typically the fastest, with funds arriving in minutes to one or two business days. In contrast, traditional bank wire transfers may take 3-5 business days or longer.

Here are typical delivery times for online services depositing funds into Dominican Republic bank accounts:

- Bank Deposits: Funds are typically deposited into all Dominican Republic bank accounts by the next business day.

- Special Cases: If you initiate a transfer after 5 p.m. Dominican Republic time, on weekends, or public holidays, delivery times may be extended accordingly.

Understanding Transfer Limits

Due to financial regulations and security considerations, all remittance services impose sending limits. These limits may be calculated daily, monthly, or over longer periods. Before choosing a service, confirm that its limits meet your remittance needs.

For example, online services like Remitly typically offer a tiered limit system:

- Initial Limits: New users typically have an initial sending limit of £5,000 within 24 hours and £15,000 within 30 days.

- Raising Limits: If you need to send larger amounts, you can submit additional identity verification documents (e.g., government-issued photo ID) and proof of funds to request higher limits.

- Higher Limits: After approval, your limit can increase to £25,000 within 30 days or even higher.

Note: In addition to the provider’s rules, the recipient country’s laws may impose additional restrictions. Platforms typically inform you of all applicable limits when confirming the transaction.

Choosing Flexible Receiving Methods

When sending money to the Dominican Republic, selecting a convenient receiving method for the recipient is crucial. Modern remittance services offer multiple flexible options, allowing you to choose based on the recipient’s situation (e.g., whether they have a bank account or their location).

Bank Account Deposits

Depositing funds directly into the recipient’s bank account is one of the safest and most common methods. If your recipient has a bank account, this is an excellent choice. The funds are automatically deposited, and the recipient doesn’t need to visit any location.

Many online services support deposits to major banks in the Dominican Republic.

| Provider | Supported Banks |

|---|---|

| Sharemoney | BANCO POPULAR DOMINICANO, C. POR A. |

| Sharemoney | BANESCO BANCO MULTIPLE, S.A. |

Additionally, innovative services like Felixpago allow you to send money directly to Banco Popular via WhatsApp.

Cash Pickup Locations

If your recipient doesn’t have a bank account or urgently needs cash, cash pickup is an ideal solution. This is a very fast method, with funds typically available for collection within minutes.

The Dominican Republic has an extensive cash pickup network, such as Caribe Express with numerous branches in major cities like Santo Domingo. To collect cash, the recipient needs to provide:

- A valid national identification document

- The remittance transaction reference number

Important Reminder: Acceptable ID types must comply with Dominican Republic banking laws and regulations.

Home Delivery Service

Home delivery is a highly user-friendly feature, especially for recipients with limited mobility or those living in remote areas. Platforms like Remitly offer this service, delivering cash directly to the recipient’s home address.

This service has broad coverage, including the following major cities:

- Santo Domingo (Greater Santo Domingo area)

- Santiago de los Caballeros

- La Romana

- San Cristóbal

- Concepción de la Vega

Direct Transfers to Bank Cards

Direct transfers to the recipient’s bank card are one of the fastest and most convenient methods. Through services like Paysend, you can send funds directly to a Visa or Mastercard debit card issued in the Dominican Republic.

This method leverages advanced platforms like Mastercard Send, enabling near-instant delivery.

Fees and Speed

- Speed: Funds typically reach the recipient’s bank card within minutes.

- Fees: When paying with a debit card, fees may be as low as $0.00 USD. If using a credit card, fees may start at $4.99 USD.

Step-by-Step Guide to Online Remittance

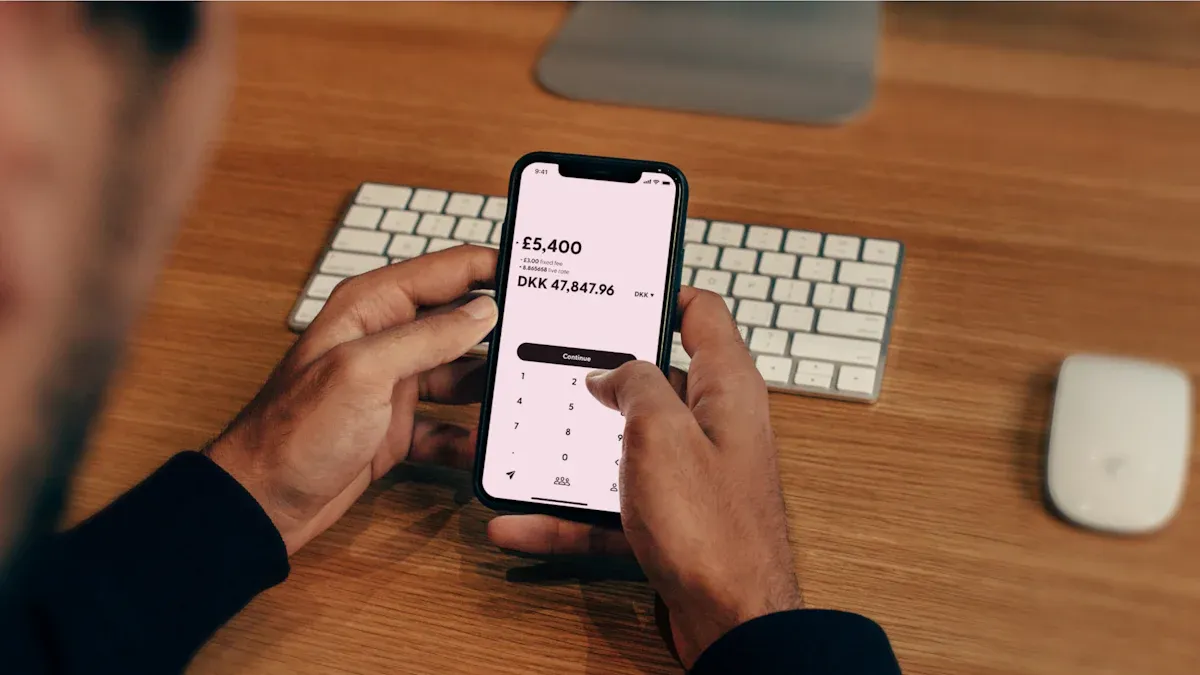

Image Source: unsplash

Sending money through online platforms is straightforward. Follow these four steps to easily complete a transfer, ensuring funds reach your loved ones in the Dominican Republic safely and quickly.

Step 1: Create and Verify an Account

First, you need to create a free account on your chosen online remittance platform (e.g., Remitly, Paysend). This process typically takes just a few minutes. You’ll need to provide basic information, such as your name, email, and phone number. To ensure transaction security and comply with financial regulations, the platform may require identity verification, usually by uploading a valid government-issued ID.

Step 2: Enter Transfer Amount and Receiving Method

Once your account is set up, you can start the remittance process. On the platform’s interface, enter the amount you wish to send (in USD). The system will automatically display the current exchange rate and the total Dominican Pesos (DOP) the recipient will receive.

- Exchange Rate Example: The platform may show a real-time exchange rate like

1 USD = 63.7855 DOP.

Next, choose the most convenient receiving method for the recipient, such as bank deposit, cash pickup, or home delivery.

Step 3: Provide Recipient Details

You need to accurately enter the recipient’s information. The required details depend on the chosen receiving method. Ensure all information, especially the name, matches the recipient’s ID exactly to avoid delays.

| Information Type | Required for Bank Deposit | Required for Cash Pickup |

|---|---|---|

| Recipient Name | Must match bank account and ID | Must match ID exactly |

| Bank Information | Bank name, account number | Not applicable |

| Address and Phone | Recipient’s address and phone number | Not applicable |

| Tracking Number | Not applicable | Transaction tracking number (MTCN) |

| Identification | Used to verify name | Valid government-issued photo ID |

Step 4: Choose Payment Method and Confirm

The final step is to select your payment method to fund the transfer. Most platforms support multiple payment options:

- Bank account transfer (ACH)

- Debit card

- Credit card

- Digital wallet

Important Reminder: Using a credit card may be treated as a “cash advance,” incurring additional fees and higher interest rates. To save costs, prioritize paying with a bank account or debit card.

Before confirming payment, carefully review all details, including the transfer amount, recipient name, and receiving method. Once everything is correct, submit your remittance request.

Choosing a reputable online platform for your Dominican Republic remittance is the best strategy for balancing safety, speed, and cost. Select a receiving method based on the recipient’s situation, whether it’s a convenient bank deposit, fast cash pickup, or thoughtful home delivery service.

Final Tip: Before confirming the transfer, double-check all information to ensure your funds reach your loved ones without any issues.

FAQ

What’s the cheapest way to send money to the Dominican Republic?

The cheapest method depends on the total cost. Compare the “handling fee” and “exchange rate margin” across services.

Tip: Focus on the total amount the recipient receives, not just the handling fee.

How can I ensure my remittance is secure?

Choosing a reputable, licensed remittance provider is key to safety. Use regulated platforms like Remitly or Paysend. Also, ensure the accuracy of recipient information to avoid errors.

What if the recipient doesn’t have a bank account?

You have multiple options. Many online services support cash pickups, where recipients can collect funds at local outlets with a valid ID and reference number. Some services also offer convenient home delivery.

What documents do I need to send money?

You typically need to provide a valid government-issued ID (e.g., passport or driver’s license) to verify your account. This complies with financial regulations and ensures transaction security. Having these documents ready will streamline the process.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.