2025 Latest Guide: How to Transfer Money from Taiwan to Mainland China – Complete Alipay & Bank Wire Tutorial

Image Source: unsplash

With increasingly frequent cross-strait exchanges, you may need to transfer money from Taiwan to mainland China. This article focuses on two mainstream methods: online platform transfers and traditional bank wire transfers.

Whether you need to send small living expenses or handle large commercial payments, you will find the most suitable cross-border remittance solution here and smoothly complete the fund transfer.

Key Takeaways

- There are two main ways to transfer money from Taiwan to China: online platforms and traditional bank wires.

- Online platforms are ideal for small-amount remittances — fast and convenient, though with certain restrictions.

- Traditional bank wires are best for large amounts — highly secure but with higher fees and more complex procedures.

- Always double-check the recipient’s full information and prepare all required documents before remitting.

- It is recommended to first convert TWD to USD before remitting to avoid double exchange rate losses.

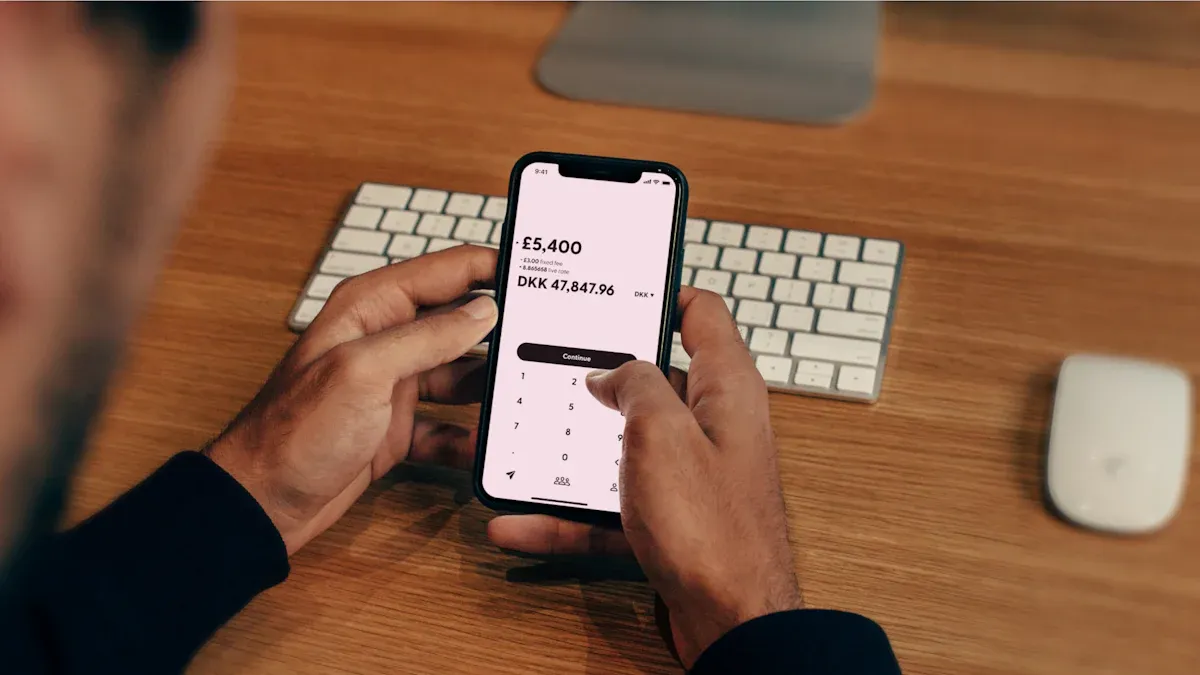

Method 1: Online Platform Cross-Border Transfer (Best for Small Amounts)

Image Source: pexels

If you need to pay living expenses, send red envelopes, or make small shopping payments, online platforms are your fastest and most convenient choice. This method allows you to complete transfers from Taiwan to mainland China without visiting a bank — just using your phone or computer. Many platforms support direct transfers to the recipient’s Alipay, greatly simplifying the process.

Choosing the Right Online Remittance Platform

There are many international remittance services on the market, with Wise and Remitly being globally renowned. They are favored by many users for transparent fees and user-friendly interfaces. You can refer to their public ratings on review sites as one of the selection criteria.

| Company | Trustpilot Score | Number of Reviews |

|---|---|---|

| Remitly | 4.6/5 | 85,000+ |

| Wise | 4.3/5 | 200,000+ |

When choosing a platform, consider the following user feedback:

- Wise: Users generally praise its fast service and competitive fees. However, some users have reported temporary account freezes due to strict security measures.

- Remitly: Many users find its diverse receiving options and fast speed particularly suitable for urgent needs.

Important Reminder: Due to regulatory restrictions, platforms like Wise and Remitly may not directly support the route from Taiwan TWD to mainland China personal accounts. Before proceeding, please confirm the latest supported routes on the platform’s official website or app.

Registration and Identity Verification Steps

No matter which platform you choose, the first step is to create a personal account and complete identity verification. This is required to comply with Anti-Money Laundering (AML) regulations and ensure transaction security.

You need to prepare one or two of the following identity documents:

- National ID card

- Passport

- Driver’s license

It is recommended to prepare clear photos or scans of these documents in advance. Complete identity verification is the foundation for successful cross-border remittances; preparing early makes the entire process smoother.

Detailed Remittance Operation Process

The remittance process on online platforms is usually very intuitive. It can generally be divided into “sender operations” and “recipient preparations.”

1. Sender Operation Steps

Using Remitly’s process as an example, most platforms follow similar steps:

- Log in to your platform account.

- Select the amount and currency you want to send.

- Choose the receiving method, such as “Alipay.”

- Enter the recipient’s name and Alipay account (usually the mobile number).

- Select your payment method (e.g., credit card or bank transfer), confirm the handling fee and exchange rate, then submit.

2. Recipient Preparations (Alipay Example)

To receive the money smoothly, the recipient must first enable the “Flash Receive” feature in the Alipay app. This step is crucial — please remind your friends or family in China to complete the setup.

The recipient can follow these steps:

- Open the Alipay app and search “跨境汇款” (cross-border remittance) in the top search bar.

- Tap into the “跨境汇款” service.

- Select “我要收款” (I want to receive money) or “Flash Receive.”

- Agree to the service agreement and select the bank card for receiving funds.

Note that Alipay’s cross-border receiving function usually requires the recipient to complete real-name authentication with a mainland China ID card.

Handling Fees, Exchange Rates, and Arrival Time Analysis

Online platforms generally have more transparent fee structures than traditional banks, mainly consisting of the following parts:

- Handling Fee: Usually a fixed fee or a percentage of the remittance amount.

- Exchange Rate: The platform provides its transaction exchange rate, which differs from the “mid-market rate” you see on Google. Platforms earn a small spread on the rate.

- Arrival Time: Depends on the selected service (economy or express), ranging from minutes to several business days.

- Remittance Limit: According to Taiwan regulations, the daily limit for personal remittances to mainland China is RMB 80,000. Online platforms also have their own per-transaction limits that you need to note.

The exchange rates shown on many currency converter websites are for reference only. To know the exact rate you will receive, you must log into the remittance platform and check the final quote after entering the amount.

In summary, online platforms provide a highly efficient solution for small-amount cross-border needs. Although there may be some route limitations, their convenience and speed are unmatched by traditional methods.

Method 2: Traditional Bank Wire Transfer (Suitable for Large Amounts)

Image Source: unsplash

If your remittance amount is large — such as paying commercial invoices, large fund turnover, or property purchases — traditional bank wire transfer (Telegraphic Transfer, TT) is the safer choice. Although the process is more complicated than online platforms, bank wires have higher single-transaction limits and clear bank records, offering greater security.

Required Documents and Recipient Information Before Remittance

Full preparation before visiting the bank can ensure you complete the process in one visit. You need to prepare complete information for both yourself and the recipient.

1. Documents the Sender (You) Needs to Prepare

Please bring the following to the bank:

- Valid ID document: Original ID card, passport, or ARC.

- Authorized seal: If you have a registered seal with the bank, remember to bring it.

2. Necessary Information to Obtain from the Recipient

This is the most error-prone part of the entire process. Be sure to confirm every item with the recipient in mainland China and preferably communicate via text (messaging app or email) to avoid verbal errors.

- Recipient’s English name: Must exactly match the bank account name.

- Recipient’s address and phone number: Complete contact information.

- Recipient’s bank account number: A string of digits — double-check carefully.

- Recipient bank’s English name and address: Full branch name and address.

- SWIFT/BIC code: The bank’s international standard code, 8 or 11 alphanumeric characters. Required for foreign currency (especially USD) remittances.

- CNAPS code (China National Advanced Payment System): A 12-digit code used for clearing between mainland China banks. Providing this code speeds up RMB remittances.

- Purpose of remittance: You need to provide a clear purpose code, e.g., payment for goods, tuition, etc.

Important Reminder: Ask the recipient to confirm with their bank whether the account can receive overseas funds (e.g., a full-function “Category I” account) and obtain the most complete information required for receiving foreign currency.

Detailed Bank Counter Wire Transfer Process

After preparing all information, you can visit the bank to process the remittance. Most banks also offer online application channels; choose according to your convenience.

1. Counter Process

- Visit the bank during business hours (usually Monday–Friday 09:00–15:30).

- Fill out the application form: Request an “Outward Remittance Application” from the teller and fill it out.

- Identity verification: Submit your ID and completed form for verification.

- Purchase foreign currency: If you don’t have enough foreign currency in your account, purchase the required amount with TWD.

- Confirm and pay: The teller will confirm all details including exchange rate and fees; sign and pay after verification.

- Receive remittance slip: Keep the receipt as proof of remittance.

2. Online Process

If you have enabled online foreign currency transfer in internet banking, many banks support completing the wire online. Log in, find “International Remittance,” and follow the prompts. The advantage is no need to visit during banking hours, and you can preset frequent recipients for faster future transfers.

Regulatory Note: According to Taiwan’s Central Bank rules, if your single or same-day foreign exchange purchase (TWD to foreign currency) exceeds NT$500,000, you must fill out a “Foreign Exchange Receipt/Payment or Transaction Declaration” and truthfully declare the purpose.

Smart Remittance Tip: Convert to USD First

You might wonder why not directly remit TWD to an RMB account. This is a great question. In practice, “convert to USD first, then remit” is usually more cost-effective.

- Reason: Most Taiwanese banks do not offer a direct TWD–RMB spot rate. Direct RMB remittance may involve two conversions (TWD → USD → RMB), causing double spread losses.

- Method: Convert TWD to USD in batches via online banking when rates are favorable and hold in your foreign currency account. Remit USD when needed.

- Advantages: This gives you control over timing, avoids opaque double conversion costs, and ensures the recipient receives closer to the expected amount.

Fee Structure and Total Cost Estimation

Bank wire fees are relatively complex. Your total cost usually consists of:

- Sending bank fee: Fixed cable charge + percentage-based handling fee.

- Correspondent bank fee: The most common hidden cost. If there is no direct relationship between the Taiwanese and Chinese bank, funds pass through one or more correspondent banks, each deducting $15–$50 USD.

- Receiving bank fee: The mainland China bank may also charge an incoming fee.

You can choose different fee-bearing options (international standard codes):

| Fee Code | Who Pays | Explanation |

|---|---|---|

| OUR (Sender pays all) | Sender | You pay all fees; recipient receives full amount — highest total cost to you. |

| SHA (Shared) | Shared | You pay sending bank fee; recipient pays correspondent & receiving bank fees — most common. |

| BEN (Recipient pays all) | Recipient | All fees deducted from principal — recipient receives least. |

For large remittances, ask the teller in advance for the total cost under OUR to ensure the recipient receives the full intended amount.

Which Method Should I Choose? Full Comparison

After understanding both methods, you may ask: “Which one should I pick?” The decision depends on your amount, speed requirement, and convenience. The following comparison and scenario analysis will help you quickly find the best fit.

Comparison Table: Speed, Fees, Limits, Convenience

| Item | Online Platforms (e.g., Wise, Remitly) | Traditional Bank Wire |

|---|---|---|

| Speed | Fast — minutes to hours | 1–5 business days |

| Fees | Lower & transparent | Higher + hidden correspondent fees |

| Single Transaction Limit | Lower (platform & regulatory limits) | Much higher |

| Convenience | Very high — mobile app anytime | Lower — counter or online banking setup |

Scenario 1: Sending Living Expenses or Red Envelopes to Mainland Relatives

For small living expenses or red envelopes of a few thousand NTD, online platforms are undoubtedly the best choice.

For small amounts, reputable online platforms are usually more cost-effective than banks — better rates and lower fees.

- Many offer fee-free or low-fee promotions.

- They route through global banking networks, reducing correspondent fees → recipient receives more.

- Compare fees and rates directly in the app before sending.

Scenario 2: Paying Large Commercial Invoices or Major Fund Transfers

When paying large commercial invoices or moving hundreds of thousands or more, security and compliance become top priorities. Bank wire is the safer choice.

Although more expensive and complicated, bank wires provide complete transaction records (remittance slip) essential for business accounting or proof of funds. Bank limits are also far higher than online platforms.

In summary:

Online platforms → small amounts & speed

Bank wire → large amounts & security

Important Reminder: Exchange rates and fees change constantly. Always reconfirm the latest information before remitting and stay aware of mainland China’s foreign exchange controls. Use online tools to track real-time rates and set alerts for better timing.

TWD CNY 100 TWD 22.563 CNY 1,000 TWD 225.63 CNY 10,000 TWD 2,256.3 CNY

FAQ

Is there a remittance limit to mainland China?

Yes. According to regulations, the daily limit per person to mainland China is RMB 80,000. Online platforms and banks may have their own per-transaction limits — check before sending.

What does the recipient need to prepare?

Yes. For online platform transfers, remind the recipient to enable Alipay’s “Flash Receive” feature. For bank wires, the recipient should confirm their account can receive overseas funds and provide complete English banking details.

Can I remit TWD directly?

Not recommended. Most banks lack a direct TWD–RMB spot rate. Converting to USD first usually avoids double spread losses and gives better overall cost.

This method also lets you control conversion timing and makes the received amount clearer.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

CUDA Ecosystem vs MI350: Who’s Winning the Nvidia vs AMD AI Tech War?

2025 Latest Edition: Nasdaq 100 Index Constituents List and Weight Analysis

Master Dow Jones Futures Margin Rules: Risk Management Techniques to Avoid Margin Calls

Complete Guide to China's Six Core A-Share Indexes: Everything You Need to Know

Choose Country or Region to Read Local Blog

Contact Us

Company and Team

BiyaPay Products

Customer Services

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.