Stop Getting Confused: SWIFT Code vs IBAN vs ABA – Differences and When to Use Each

Image Source: unsplash

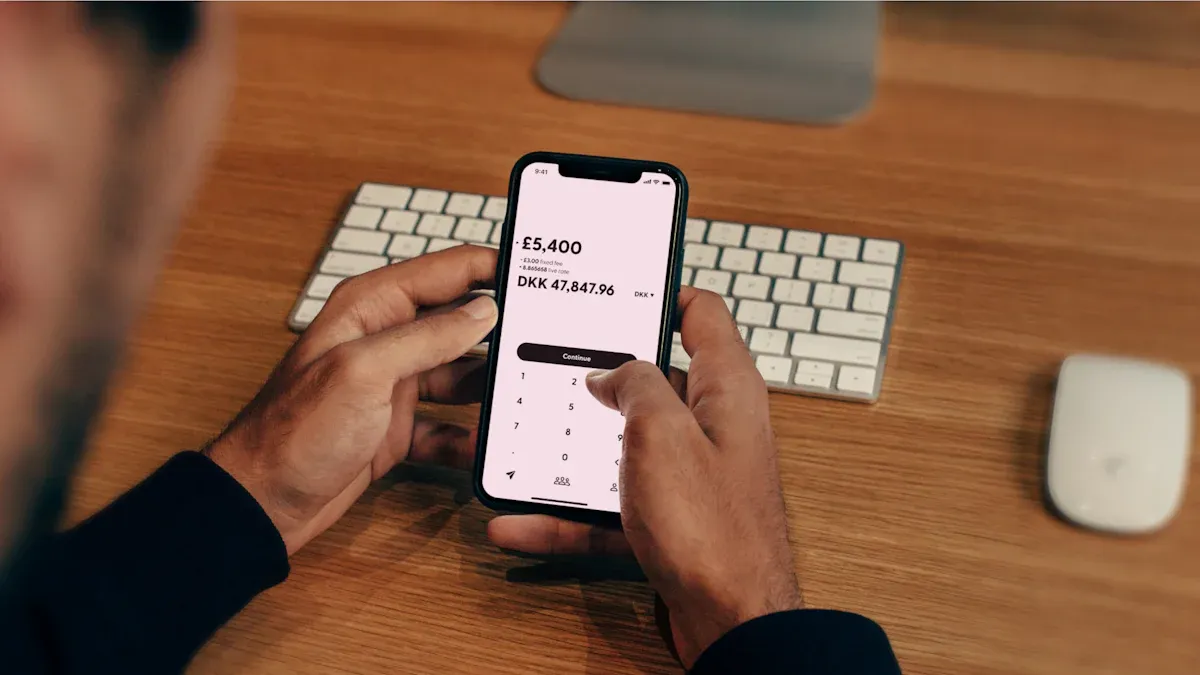

Preparing an international transfer and getting a headache from seeing SWIFT, IBAN, and ABA on the form? Are you worried that one wrong digit could make your money disappear and the fees non-refundable?

Actually, the biggest difference between these three codes is simply “they are used in different countries and regions.” This article will clear up all the confusion once and for all, so next time you make an overseas transfer, you’ll never hesitate again.

Key Takeaways

- SWIFT Code is the bank’s international ID, used for transfers between banks worldwide.

- IBAN is the standard European bank account number that ensures money reaches the exact account in Europe.

- ABA Number (Routing Number) is the U.S.-only code that directs money inside the American banking system.

- Transfers to the U.S. need both SWIFT Code and ABA Number; transfers to Europe need SWIFT Code and IBAN.

- Always double-check all details with the recipient before sending to avoid delays or extra charges.

Understand the Three Codes in Seconds: Find the Bank, Find the Account, Find the Path

Image Source: pexels

You can think of these three codes as a complete mailing address. The SWIFT Code is like the city name — it finds the right bank; IBAN is the full street address and house number — it pinpoints the exact recipient account; and the ABA Number is the U.S. domestic ZIP code that guides the money through the American banking network.

SWIFT Code: Find the Correct Bank

The SWIFT Code is the code you’ll use most often for international transfers. It acts like every bank’s global passport, letting financial institutions around the world recognize each other.

SWIFT is a huge financial messaging network that connects over 200 countries and more than 11,000 banks. As long as you provide the correct SWIFT Code, your money can safely travel between banks in different countries.

| Item | Details |

|---|---|

| Bank | UniCredit Banca |

| Country | Italy |

| City | Milan |

| SWIFT Code | UNCRITMMXXX |

| Purpose | Identifies UniCredit’s head office in Milan |

IBAN: Lock Onto a European Bank Account

If you’re sending money to Europe, besides the SWIFT Code, the bank will usually ask you to provide an IBAN. IBAN stands for “International Bank Account Number” — it doesn’t just identify the bank, it directly identifies the individual’s bank account.

Currently, more than 80 countries have adopted the IBAN system, and it has simplified cross-border payments, becoming the cornerstone of European finance.

Quick tip: Think of IBAN as a super-long combination of “country code + bank code + branch code + personal account number.” It packs everything into one string, ensuring the money is delivered precisely to the recipient’s account with far fewer errors.

ABA Number: Direct the Money Inside the U.S.

The ABA Number is a U.S.-exclusive system, also called a Routing Number. It was created by the American Bankers Association in 1910 to solve bank identification issues.

- It is a fixed 9-digit code.

- Mainly used for domestic U.S. transfers, wire transfers, or check clearing.

When your international transfer needs to pass through or end at a U.S. bank, providing the correct ABA Number ensures the money finds the fastest, most accurate path inside the complex U.S. banking system.

Detailed Definition and Format of the Three Transfer Codes

Now that you know the basic functions, let’s look deeper at how each code is structured. You’ll see that every code is designed around two goals: accuracy and efficiency.

SWIFT Code (Bank Identifier Code): The Global Bank Passport

SWIFT stands for “Society for Worldwide Interbank Financial Telecommunication”. It created a global financial messaging network, and the SWIFT Code is each bank’s address in that network. You may also hear it called Bank Identifier Code (BIC) — it’s exactly the same thing.

A SWIFT Code is usually 8 or 11 characters made of letters and numbers, and each part has a specific meaning:

| Part | Length | Example (ICBCTWTP011) | Meaning |

|---|---|---|---|

| Bank Code | 4 letters | ICBC | Abbreviation of the financial institution |

| Country Code | 2 letters | TW | Country where the bank is located |

| Location Code | 2 characters | TP | City or region of the head office |

| Branch Code | 3 characters | 011 | Specific branch; XXX or blank = head office |

Quick tip: When you provide only an 8-character SWIFT Code, the system assumes the money goes to that bank’s head office.

IBAN: Europe’s Standardized International Bank Account Number

IBAN stands for “International Bank Account Number”. It not only identifies the bank but directly targets the individual’s account — it’s the standard format for financial transactions in Europe.

The IBAN design is very strict: it always starts with a two-letter country code followed by two check digits to prevent typing errors. Each country’s IBAN has a different length, but the format is fixed.

| Country | IBAN Length | Example (format only) |

|---|---|---|

| United Kingdom | 22 characters | GBxx AAAA xxxx xxxx xxxx xx |

| Germany | 22 characters | DExx xxxx xxxx xxxx xxxx xx |

| France | 27 characters | FRxx xxxx xxxx xxxx xxxx xxx |

This standardized format dramatically reduces errors in cross-border transfers.

ABA Number: U.S.-Only Bank Routing Code

The full name is ABA Routing Transit Number, created by the American Bankers Association. Think of it as the dedicated routing code for banks inside the United States.

It is a fixed 9-digit code used primarily for domestic U.S. transfers and clearing. When your international transfer ends in the U.S., providing the correct ABA Number alongside the SWIFT Code ensures the money quickly finds the right path inside the U.S. banking system.

These 9 digits include the bank’s region, Federal Reserve Bank, etc., and the last digit is a checksum that verifies the first 8 digits for security.

Real-World International Transfer Scenarios: Which Code Do I Use?

Image Source: unsplash

You understand the theory, but still hesitate in practice? Don’t worry — here are the most common transfer scenarios so you’ll know exactly what to do next time.

Scenario 1: From Taiwan to the United States

When sending money from Taiwan to a U.S. bank account, you’ll usually be asked for two codes: SWIFT Code and ABA Number.

Why two? Think of it as a connecting flight:

- SWIFT Code: This is the international flight ticket. It safely brings your money from Taiwan to the recipient bank’s “international airport” in the U.S.

- ABA Number: This is the domestic flight ticket. Once the money lands, the ABA Number guides it through the U.S. banking system to the final bank — just like catching a connecting domestic flight.

Key reminder: Some U.S. banks may accept only the SWIFT Code, but providing the ABA Number as well is the safest approach. It ensures faster, more accurate processing once the money enters the U.S. and avoids delays or returns due to missing information.

Scenario 2: From Taiwan to Germany or the United Kingdom

If the destination is a European country like Germany or the UK, the main codes change to IBAN and SWIFT Code.

- IBAN: This is your primary information. IBAN acts like a “super address” that directly targets the recipient’s specific account in Europe.

- SWIFT Code (BIC): Still important as a supporting code that facilitates communication between banks.

Even though IBAN already contains most details, providing the SWIFT Code is still standard procedure. Together they let your money flow smoothly through Europe’s automated payment systems with minimal error risk. Therefore, when sending to countries that use IBAN (like Germany or the UK), always ask the recipient for both complete codes.

Scenario 3: From Taiwan to Japan, Australia, etc.

What if the destination isn’t the U.S. or Europe — for example, Japan, Australia, Singapore, or Canada? It’s much simpler.

In these countries, you usually only need to provide:

- Recipient bank’s SWIFT Code

- Recipient’s bank account number

- Recipient name and address

These countries do not use the IBAN system or the U.S. ABA Number. Therefore, the SWIFT Code becomes the most important international identifier — it directs the money to the correct bank, which then credits the account you provided. This is the classic and most widely used method for international transfers worldwide.

How to Look Up and Verify Your Transfer Codes?

After receiving the recipient’s details, how do you confirm they’re correct? Or when someone wants to send you money, where do you find your own bank codes?

1. The most reliable method: Ask the recipient directly

This is the safest and most recommended way. Ask the recipient to confirm the complete transfer details with their bank, including:

- Full bank name and address

- SWIFT Code / BIC

- IBAN (if in Europe)

- ABA Number (if in the U.S.)

- Account number and account holder name

2. Find your own bank codes

When you need to give your account details to someone else, you can find them through:

- Online banking: Log in — usually under account overview or personal settings.

- Bank statements: Some physical or electronic statements list the SWIFT Code.

- Bank’s official website: Look under “FAQ” or “Overseas transfers” sections.

3. Use online validation tools

Many free online tools can help you verify that the format is correct. They can’t confirm the account exists, but they catch simple typing mistakes.

| Tool Type | Example Sites (for reference only) | Main Function |

|---|---|---|

| SWIFT/BIC Lookup | IBAN.com, AspireApp | Search SWIFT by bank name/country and validate |

| IBAN Validation | SwiftRef, IBAN.com | Check country code, length, and checksum |

Final safety net before sending

Before any international transfer, triple-check everything!

- Avoid typing errors: IBAN or account numbers are long — copy-paste whenever possible.

- Remove spaces/special characters when entering codes online as required.

- Final confirmation: Double-check everything with the recipient before hitting send — the best protection against lost funds or extra fees.

Congratulations! You’ve now mastered the three major codes. Just remember one golden rule: for the U.S. use ABA, for Europe focus on IBAN, and for most other countries the universal SWIFT Code is enough.

Best habit before any transfer

Always get written details directly from the recipient and double-check recipient name, account number, and all codes. This is the ultimate guarantee your money arrives safely.

Once you understand the rules, international transfers are no longer scary.

FAQ

What happens if I enter the wrong transfer code?

Your transfer may be delayed or returned. Banks usually charge extra fees to handle the issue, and the original transfer fee is often non-refundable. Always triple-check before sending.

Why do some banks require both SWIFT and IBAN/ABA?

Think of SWIFT Code as the international flight that gets the money to the right country and bank. IBAN or ABA is the domestic connection or detailed address that guides the money to the final account inside that country. Using both makes the transfer faster and more accurate.

Do Taiwanese bank accounts have an IBAN?

No. Taiwan does not currently use the IBAN system. When receiving money from abroad to your Taiwanese account, you only need to provide the bank’s SWIFT Code, your account number, account holder name, and bank address.

Do these codes ever expire or change?

Yes. Banks may change their SWIFT Code or ABA Number due to mergers, acquisitions, or restructuring. Even if you’ve sent money there before, always confirm the latest details with the recipient before a new transfer.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

CUDA Ecosystem vs MI350: Who’s Winning the Nvidia vs AMD AI Tech War?

What Is the Dow Jones Industrial Average? Investment Differences vs. S&P 500 and Nasdaq

Master Dow Jones Futures Margin Rules: Risk Management Techniques to Avoid Margin Calls

When the US Stock Market Sneezes, Does Taiwan’s Market Catch a Cold? Data Reveals the Real Correlation Between Major Indices

Choose Country or Region to Read Local Blog

Contact Us

Company and Team

BiyaPay Products

Customer Services

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.