支持哪些汇款方式?

BiyaPay

发布于 2024-09-12 更新于

2025-05-20

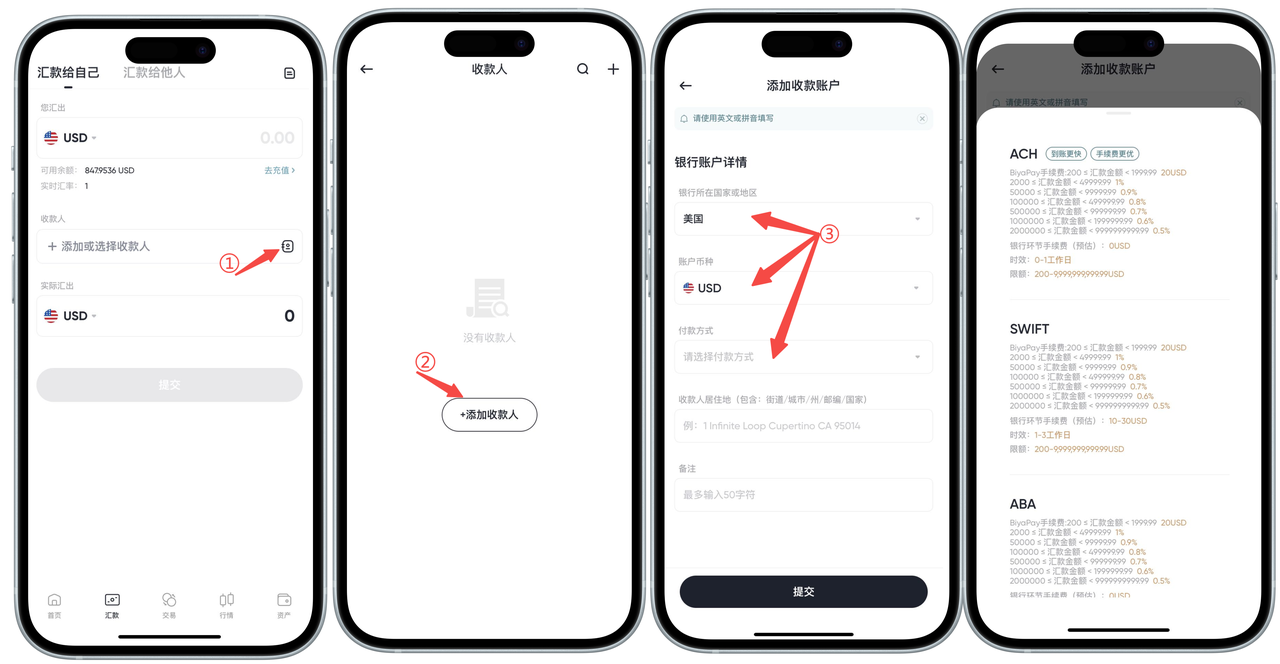

BiyaPay支持本地和国际汇款。当您绑定收款银行账户时,可以查看具体支持的汇款方式,具体信息以绑定时显示的为准。

本地汇款

1.Local Transfer(本地转账)

适用范围: 同一国家或地区内的银行账户之间进行资金转移。

特点:

- 低费用: 通常费用较低,有些银行甚至提供免费服务。

- 快速: 资金通常在几分钟到几个小时内到账,有时可能需要1-2个工作日。

- 汇款方式: 通过电汇方式进行汇款。

- 安全性: 由银行的安全系统保护,确保交易安全。

2.新加坡FAST汇款

适用范围: 新加坡银行账户之间的即时资金转移。

特点:

- 即时转账: 资金通常在几秒钟内到账。

- 全天候服务: 24小时全年无休运行。

- 低费用或免费: 具体费用视银行政策而定。

- 安全性: 采用先进的安全技术和协议,确保资金和信息安全。

3.香港FPS汇款

适用范围: 香港银行账户和储值支付工具之间的即时资金转移。

特点:

- 即时转账: 通常在几秒钟内完成。

- 全天候服务: 24小时全年无休运行。

- 币种支持: 支持港币。

- 安全性: 采用先进的安全技术和协议,确保资金和信息安全。

4.美国ACH汇款

适用范围: 美国国内银行账户之间的电子资金转移。

特点:

- 低成本: 相比电汇,成本更低。

- 广泛应用: 用于工资发放、账单支付、个人间转账等。

- 交易时间: 通常需要1-2个工作日完成。

5.美国ABA汇款

适用范围: 使用ABA号码进行的美国国内银行转账。

特点:

- ABA号码: 用于标识特定的美国银行或金融机构。

- 主要应用: 用于支票处理、ACH汇款和电汇等。

- 识别功能: 确保资金转移的准确性和高效性。

国际汇款

1.SWIFT汇款

适用范围: 全球超过200个国家和地区的银行账户之间的国际汇款。

特点:

- 全球覆盖: 连接了全球上万家金融机构。

- 安全性高: 采用高度加密技术和严格的安全协议。

- 效率高: 通常在1-5个工作日内完成,具体时间取决于银行处理速度。

- 费用: 可能包括发汇行、收汇行及中间行的费用。

2.SEPA汇款

适用范围: 欧元区国家之间的欧元支付。

特点:

- 覆盖区域: 适用于欧洲经济区中的所有成员国及一些其他欧洲国家。

- 统一标准: 使用统一的支付标准和流程。

- 快速高效: 通常在1-2个工作日内完成。

- 低费用: 费用透明,通常较低,有时甚至免费。