支持哪些汇款方式?(Web端)

BiyaPay

发布于 2025-01-08 更新于

2025-01-08

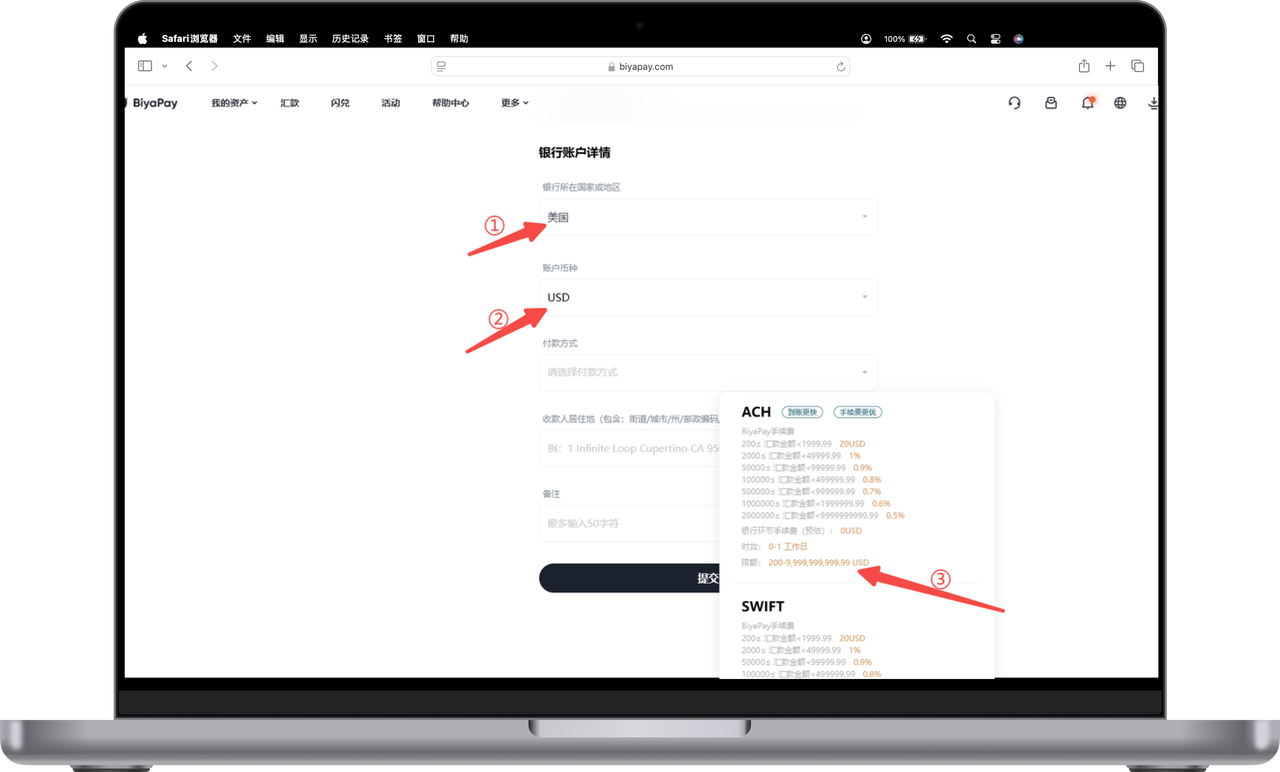

BiyaPay支持本地和国际汇款。当您绑定收款银行账户时,选择国家、币种,可选择付款方式。

本地汇款

- Local Transfer(本地转账)

- 适用范围:同一国家或地区内的银行账户之间进行资金转移。

- 特点:

- 低费用:通常费用较低,有些银行甚至提供免费服务。

- 快速:资金通常在几分钟到几个小时内到账,有时可能需要1-2个工作日。

- 汇款方式:通过电汇方式进行汇款。

- 安全性:由银行的安全系统保护,确保交易安全。

- 新加坡FAST汇款

- 适用范围:新加坡银行账户之间的即时资金转移。

- 特点:

- 即时转账:资金通常在几秒钟内到账。

- 全天候服务:24小时全年无休运行。

- 低费用或免费:具体费用视银行政策而定。

- 安全性:采用先进的安全技术和协议,确保资金和信息安全。

- 香港FPS汇款

- 适用范围:香港银行账户和储值支付工具之间的即时资金转移。

- 特点:

- 即时转账:通常在几秒钟内完成。

- 全天候服务:24小时全年无休运行。

- 币种支持:支持港币。

- 安全性:采用先进的安全技术和协议,确保资金和信息安全。

- 美国ACH汇款

- 适用范围:美国国内银行账户之间的电子资金转移。

- 特点:

- 低成本:相比电汇,成本更低。

- 广泛应用:用于工资发放、账单支付、个人间转账等。

- 交易时间:通常需要1-2个工作日完成。

- 美国ABA汇款

- 适用范围:使用ABA号码进行的美国国内银行转账。

- 特点:

- ABA号码:用于标识特定的美国银行或金融机构。

- 主要应用:用于支票处理、ACH汇款和电汇等。

- 识别功能:确保资金转移的准确性和高效性。

国际汇款

- SWIFT汇款

- 适用范围:全球超过200个国家和地区的银行账户之间的国际汇款。

- 特点:

- 全球覆盖:连接了全球上万家金融机构。

- 安全性高:采用高度加密技术和严格的安全协议。

- 效率高:通常在1-5个工作日内完成,具体时间取决于银行处理速度。

- 费用:可能包括发汇行、收汇行及中间行的费用。

- SEPA汇款

- 适用范围:欧元区国家之间的欧元支付。

- 特点:

- 覆盖区域:适用于欧洲经济区中的所有成员国及一些其他欧洲国家。

- 统一标准:使用统一的支付标准和流程。

- 快速高效:通常在1-2个工作日内完成。

- 低费用:费用透明,通常较低,有时甚至免费。